Global Gas Turbine Market Size by Technology (Open Cycle and Combined Cycle), Rating Capacity (?200 MW and >200 MW), Design Type (Heavy Duty and Aeroderivative), Application (Power Generation, Oil & Gas, Marine, Process Plants, Aerospace, and Others), Regions, Segmentation and Projection till 2028

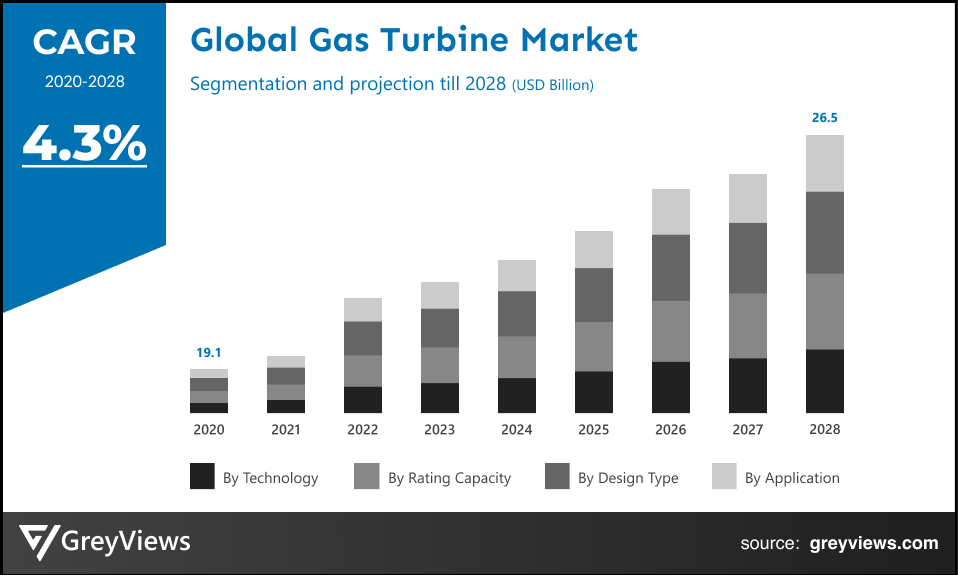

CAGR: 4.3%Current Market Size: USD 19.1 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Gas Turbine Market- Market Overview

The global Gas Turbine market is expected to grow from USD 19.1 Billion in 2020 to USD 26.5 Billion by 2028, at a CAGR of 4.3% during the Projection period 2021-2028. This growth of the gas turbine market is significantly driven by the increasing population along with an upsurge in demand for electricity.

The gas turbine is a type of internal combustion (IC) engine that helps in converting natural gas or other fuels in liquid form to mechanical energy. The mechanical energy created is used for fueling the generator producing electrical energy. The gas turbine heats a mixture of fuel and air at high temperatures leading to the spin of turbine blades to generate electricity. This type of IC engine reduces carbon emissions when compared to the other combustion-based power generation applications. It offers several advantages such as high power to weight ratio, low operation pressures, and is smaller compared to the several reciprocating engines of the same power rating.

Further, the factors such as rising demand for power plants fired by natural gas, decreasing carbon dioxide emission, the emergence of efficient power generation technology, and the growth in the aviation industry boost the growth of the gas turbine market.

Request Sample:- Global Gas Turbine Market

Market Dynamics

Drivers:

- Increasing population along with an upsurge in demand for electricity

Demand for electricity increasing rapidly at the global level as a result of growing household incomes and growing demand for air conditioning and digitally connected devices. For instance, in 2020, the U.S. primary energy consumption was equal to about 93 quadrillion Btu. This has led to the emergence of advanced technologies in electricity generation, fueling demand for gas turbines.

- Supportive government regulations for power generation technologies to reduce carbon dioxide (CO2) emissions

Significant growth in electricity demand has led to the rise of CO2 emissions from the power sector. For instance, electric power generation is mainly responsible for 28% of U.S. greenhouse gas emissions. Hence, governments across the globe are introducing regulations associated with power generation technologies to reduce carbon dioxide (CO2) emissions. In the U.S., power plant greenhouse gas emission regulations are being reviewed by Environmental Protection Agency (EPA). While, gas turbine operates more efficiently and uses less fuel, enabling carbon capture technologies to effectively reduce greenhouse gas emissions.

Restraints:

- The volatile price of natural gas

The prices of basic energy including electricity, natural gas, and heating oil are generally volatile than prices of other commodities. While supply and demand across the globe are major factors that cause the prices of such fuels to fluctuate. This volatility in pricing hampers the growth of the gas turbine market.

Opportunities:

- Increasing focus on research and development (R&D) activities

Manufacturers in the gas turbine industry are significantly focusing on research and development (R&D) activities to develop turbines that operate at elevated temperatures, offer the flexibility of fuel usage, and eliminate turbine failures. In addition, research and development in the gas turbine sector are driven by demand from future systems in power generation which needs to work toward zero emissions or integrate carbon capture, utilization, and storage (CCUS) solutions. Such a factor creates lucrative growth opportunities for the gas turbine market growth.

Challenges:

- Problems associated with the gas turbine engines

Gas turbine engines may be affected by increased amounts of fatigue damage due to more frequent starts and load fluctuations; increased deterioration of seals and bearings, and increased operation under low load conditions which may lead to the risk of blade flutter and fatigue damage. Such problems pertaining to gas turbine engines may pose challenges to the global gas turbine market.

Segmentation Analysis

The global Gas Turbine market has been segmented based on technology, rating capacity, design type, application, and regions.

By Technology

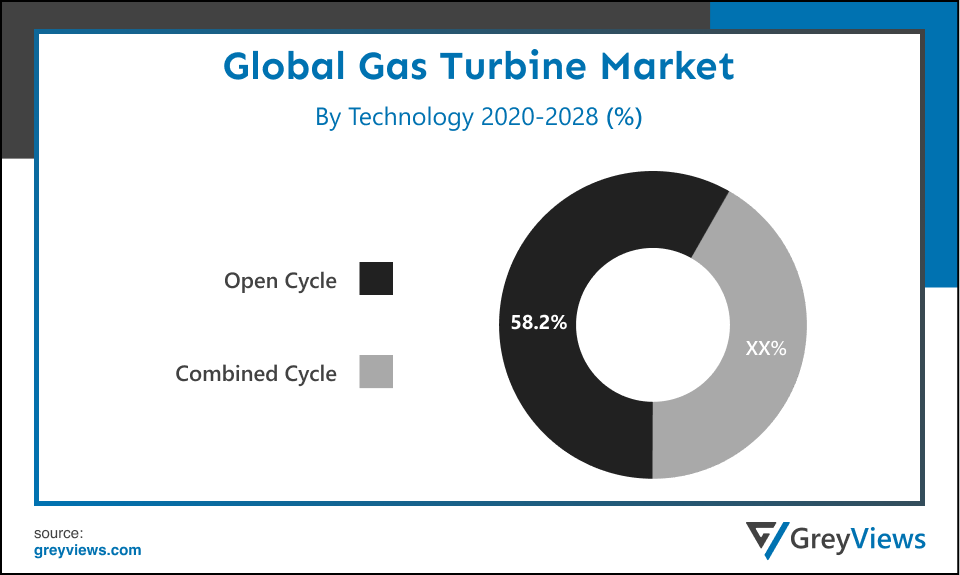

- The Technology segment includes an open cycle and a combined cycle. The open cycle segment led the gas turbine market with a market share of around 58.2% in 2020. The growth of this segment is mainly attributed to a number of favorable factors such as lower warm-up time, quick start, operational versatility, lightweight, quick start, compact size, and less dependency on cooling water. However, the combined cycle segment is expected to witness the highest growth rate during the Projection period. This is attributed to the fact that the combined cycle power plants can achieve electrical efficiencies of about 60%.

By Rating Capacity

- The rating capacity segment includes ≤200 MW and >200 MW. The ≤200 MW segment led the gas turbine market with a market share of around 53.2% in 2020. Growth of the segment is driven by the proliferation of large single-cycle gas turbine which produces ≤200 megawatts of electric power with 35–40% thermodynamic efficiency. However, >200 MW capacity of the gas turbine segment is expected to witness the highest growth rate during the Projection period. This is due to the emergence of advanced >200 MW capacity gas turbines.

By Design Type

- The design type segment includes heavy-duty and aero-derivative. The heavy-duty segment held the largest market share of 64.5% in 2020. The growth of this segment is driven by an increasing number of large-gas fired power plants coupled with the need for heavy-duty gas turbines for powering them. Such types of turbines used in combined cycle operations can provide over300 MW of output.

By Application

- The application segment includes power generation, oil & gas, marine, process plants, aerospace, and others. The power generation segment held the largest market share of 42.1% in 2020. The growth of this segment is mainly driven by increasing energy demand coupled with the positive regulations towards the integration of sustainable energy infrastructure.

By Regional Analysis

The regions analyzed for the Gas Turbine market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The Asia-Pacific region dominated the Gas Turbine market and held the 33.30% share of the market revenue in 2020.

- The growth of the Asia-Pacific Gas Turbine market is mainly driven by rising populations along with the rapid urbanization across the developing countries. The market in this region is dominated by China, India, Japan, Thailand, and Indonesia. In addition to this, the region is attracting global players to expand their business operations due to the availability of low-cost raw materials and labor.

- The North American region is likely to register significant growth during the Projection period due to the development trend of new technologies in mining and extraction technology to reduce costs of gas extraction.

Key Industry Players Analysis

Key market players are concentrating on implementing new strategies to improve their market position in the market

The key players are now concentrating on implementing strategies such as adopting new technology, product innovations, mergers & acquisitions, joint venture, alliances, and partnerships to improve their market position in the global gas turbine industry.

For instance, Siemens Gas and Power launched the SGT5-9000 HL turbine, in May 2020 which will provide the opportunity for a test run of the equipment for the 50-Hertz (Hz) market. This is the 593-MW capacity turbine and is projected to be installed at the Keadby 2 power plant for SSE Thermal.

In October 2019, GE launched the 7HA.03, the latest evolution of its HA gas turbine, which will power Florida Power & Light Company’s (FPL) Dania Beach Clean Energy Center near Fort Lauderdale, Florida.

In March 2019, Siemens, the German industrial group partnered with China's State Power Investment Corp. (SPIC) to develop heavy-duty gas turbines for power plants.

- Bharat Heavy Electricals Limited

- Caterpillar Inc.

- Harbin Electric Company Limited

- General Electric Company (GE)

- Mitsubishi Hitachi Power Systems, Ltd. (MHPS)

- Volkswagen Group

- Kawasaki Heavy Industries Ltd.

- Rolls-Royce Holdings Plc

- Siemens AG

- Capstone Green Energy

- Centrax

- Zorya

- Solar Turbines

- Ansaldo

- OPRA

- Man Diesel

- Vericor Power

Latest Development

- September 2021- Chevron U.S.A. Inc., which is a subsidiary of Chevron Corporation and Caterpillar Inc. collaborated to develop hydrogen demonstration projects in stationary power and transportation applications.

- February 2021- Caterpillar Inc. acquired Weir Oil & Gas, the Oil & Gas Division of the Weir Group PLC, a Scotland-based global engineering business.

- July 2020- Uniper signed an agreement with General Electric aiming at collaboration on the decarbonization of Uniper's gas-fired power plants as well as natural gas storage facilities.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

4.3% |

|

Market Size |

19.1 Billion |

|

Projection unit |

Value (USD) |

|

Segments covered |

Technology, Rating Capacity, Application, and Region |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Bharat Heavy Electricals Limited, Caterpillar Inc., General Electric Company, Harbin Electric Company Limited, Mitsubishi Hitachi Power Systems, Ltd., Volkswagen Group, Kawasaki Heavy Industries Ltd., Siemens AG, and Rolls-Royce Holdings Plc among others |

|

By Technology |

|

|

By Rating Capacity |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Gas Turbine Market by Technology:

- Open Cycle

- Combined Cycle

Global Gas Turbine Market by Rating Capacity:

- ≤200 MW

- >200 MW

Global Gas Turbine Market by Design Type:

- Heavy Duty

- Aeroderivative

Global Gas Turbine Market by Application:

- Power Generation

- Oil & Gas

- Marine

- Process Plants

- Aerospace

- Others

Global Gas Turbine Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Gas Turbine Market?

Global Gas Turbine market is expected to reach USD19.1 Billion by 2028, at a CAGR of 4.3% from 2021 to 2028.

What is the segmentation considered for the analysis of the global Gas Turbine market?

The global Gas Turbine market has been segmented based on technology, rating capacity, application, and regions

Which regions have been studied for the regional analysis of the global Gas Turbine market?

The regions analyzed for the Gas Turbine market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

Which are the leading market players active in the Gas Turbine market?

leading market players active in the global gas turbine market are Bharat Heavy Electricals Limited, Caterpillar Inc., General Electric Company, Harbin Electric Company Limited, Mitsubishi Hitachi Power Systems, Ltd., Volkswagen Group, Kawasaki Heavy Industries Ltd., Siemens AG, Rolls-Royce Holdings Plc among others.

What is the key driver of the Gas Turbine market?

Increasing population along with an upsurge in demand for electricity primarily drives the growth of the Gas Turbine market.

What are the ongoing trends that are projected to influence the market in the upcoming years?

Increasing population along with an upsurge in demand for electricity. In addition, rise in demand for natural gas-fired power plants.

What are the detailed impacts of the COVID-19 pandemic on the global market?

The pandemic has significantly affected several industries and has caused a worldwide economic slowdown. This has resulted in the reduction of oil & gas demand across the world, declining growth of the market.

How the company profile has been selected?

Based on the sales revenue, product offering, and regional presence, the companies are selected.

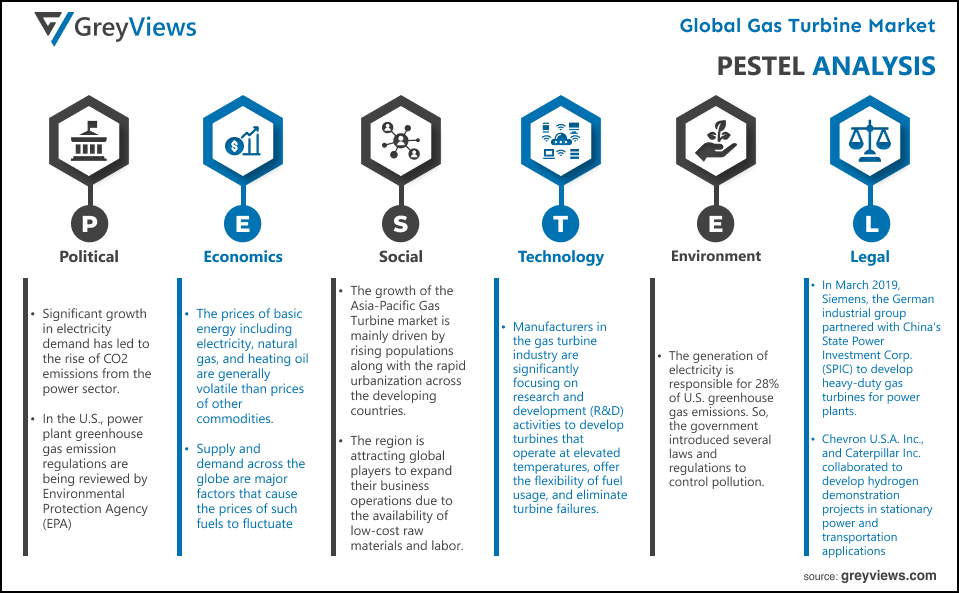

Political- Significant growth in electricity demand has led to the rise of CO2 emissions from the power sector. For instance, electric power generation is mainly responsible for 28% of U.S. greenhouse gas emissions. Hence, governments across the globe are introducing regulations associated with power generation technologies to reduce carbon dioxide (CO2) emissions. In the U.S., power plant greenhouse gas emission regulations are being reviewed by Environmental Protection Agency (EPA). While, gas turbine operates more efficiently and uses less fuel, enabling carbon capture technologies to effectively reduce greenhouse gas emissions.

Economic- The prices of basic energy including electricity, natural gas, and heating oil are generally volatile than prices of other commodities. While supply and demand across the globe are major factors that cause the prices of such fuels to fluctuate. This volatility in pricing hampers the growth of the gas turbine market.

Social- The growth of the Asia-Pacific Gas Turbine market is mainly driven by rising populations along with the rapid urbanization across the developing countries. The market in this region is dominated by China, India, Japan, Thailand, and Indonesia. In addition to this, the region is attracting global players to expand their business operations due to the availability of low-cost raw materials and labor. The North American region is likely to register significant growth during the Projection period due to the development trend of new technologies in mining and extraction technology to reduce costs of gas extraction.

Technological- Manufacturers in the gas turbine industry are significantly focusing on research and development (R&D) activities to develop turbines that operate at elevated temperatures, offer the flexibility of fuel usage, and eliminate turbine failures. In addition, research and development in the gas turbine sector are driven by demand from future systems in power generation which needs to work toward zero emissions or integrate carbon capture, utilization, and storage (CCUS) solutions. Such a factor creates lucrative growth opportunities for the gas turbine market growth.

Environmental- Because of the increase in the high demand for electricity, there is a rise in CO2 emissions from the power sector. For example, the generation of electricity is responsible for 28% of U.S. greenhouse gas emissions. So, the government introduced several laws and regulations to control pollution.

Legal- In March 2019, Siemens, the German industrial group partnered with China's State Power Investment Corp. (SPIC) to develop heavy-duty gas turbines for power plants. Chevron U.S.A. Inc., which is a subsidiary of Chevron Corporation, and Caterpillar Inc. collaborated to develop hydrogen demonstration projects in stationary power and transportation applications.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By Rating Capacity

- Market Attractiveness Analysis By Design Type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing population along with an upsurge in demand for electricity

- Supportive government regulations for power generation technologies to reduce carbon dioxide (CO2) emissions

- Restrains

- Volatile price of natural gas

- Opportunities

- Increasing focus on research and development (R&D) activities

- Challenges

- Problems associated with the gas turbine engines

- Global Gas Turbine Market Analysis and Projection, By Technology

- Segment Overview

- Open Cycle

- Combined Cycle

- Global Gas Turbine Market Analysis and Projection, By Rating Capacity

- Segment Overview

- ≤200 MW

- >200 MW

- Global Gas Turbine Market Analysis and Projection, By Design Type

- Segment Overview

- Heavy Duty

- Aeroderivative

- Global Gas Turbine Market Analysis and Projection, By Application

- Segment Overview

- Power Generation

- Oil & Gas

- Marine

- Process Plants

- Aerospace

- Others

- Global Gas Turbine Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Gas Turbine Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Gas Turbine Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Technology Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Kawasaki Heavy Industries

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Siemens

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- General Electric Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Harbin Electric Company Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Ansaldo

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- OPRA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- MAN Diesel

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Solar Turbines

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Vericor Power

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- BHEL

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Centrax

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Zorya

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technology Portfolio

- Recent Developments

- SWOT Analysis

- Kawasaki Heavy Industries

List of Table

- Global Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Global Open Cycle Market, By Region, 2020–2028(USD Billion)

- Global Combined Cycle Market, By Region, 2020–2028(USD Billion)

- Global Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Global ≤200 MW Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global >200 MW Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Global Heavy Duty Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Aeroderivative Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Global Power Generation Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Oil & Gas Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Marine Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Process Plants Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Aerospace Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Others Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Gas Turbine Market, By Region, 2020–2028(USD Billion)

- Global Gas Turbine Market, By North America, 2020–2028(USD Billion)

- North America Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- North America Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- North America Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- North America Gas Turbine Market, By Application, 2020–2028(USD Billion)

- US Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- US Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- US Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- US Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Canada Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Canada Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Canada Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Canada Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Mexico Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Mexico Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Mexico Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Mexico Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Europe Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Europe Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Europe Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Europe Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Germany Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Germany Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Germany Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Germany Gas Turbine Market, By Application, 2020–2028(USD Billion)

- France Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- France Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- France Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- France Gas Turbine Market, By Application, 2020–2028(USD Billion)

- UK Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- UK Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- UK Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- UK Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Italy Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Italy Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Italy Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Italy Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Spain Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Spain Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Spain Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Spain Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Asia Pacific Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Asia Pacific Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Asia Pacific Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Asia Pacific Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Japan Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Japan Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Japan Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Japan Gas Turbine Market, By Application, 2020–2028(USD Billion)

- China Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- China Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- China Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- China Gas Turbine Market, By Application, 2020–2028(USD Billion)

- India Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- India Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- India Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- India Gas Turbine Market, By Application, 2020–2028(USD Billion)

- South America Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- South America Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- South America Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- South America Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Brazil Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Brazil Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Brazil Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Brazil Gas Turbine Market, By Application, 2020–2028(USD Billion)

- Middle East and Africa Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- Middle East and Africa Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- Middle East and Africa Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- Middle East and Africa Gas Turbine Market, By Application, 2020–2028(USD Billion)

- UAE Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- UAE Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- UAE Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- UAE Gas Turbine Market, By Application, 2020–2028(USD Billion)

- South Africa Gas Turbine Market, By Technology, 2020–2028(USD Billion)

- South Africa Gas Turbine Market, By Rating Capacity, 2020–2028(USD Billion)

- South Africa Gas Turbine Market, By Design Type, 2020–2028(USD Billion)

- South Africa Gas Turbine Market, By Application, 2020–2028(USD Billion)

List of Figures

- Global Gas Turbine Market Segmentation

- Gas Turbine Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Gas Turbine Market Attractiveness Analysis By Technology

- Global Gas Turbine Market Attractiveness Analysis By Rating Capacity

- Global Gas Turbine Market Attractiveness Analysis By Design Type

- Global Gas Turbine Market Attractiveness Analysis By Application

- Global Gas Turbine Market Attractiveness Analysis By Region

- Global Gas Turbine Market: Dynamics

- Global Gas Turbine Market Share By Technology(2021 & 2028)

- Global Gas Turbine Market Share By Rating Capacity(2021 & 2028)

- Global Gas Turbine Market Share By Design Type(2021 & 2028)

- Global Gas Turbine Market Share By Application(2021 & 2028)

- Global Gas Turbine Market Share by Regions (2021 & 2028)

- Global Gas Turbine Market Share by Company (2020)