Global Hybrid Vehicle Market Size by Electric Powertrain type (Parallel Hybrid and Series Hybrid), Component type (Battery, Electric Motor, and Transmission), Propulsion (HEV, PHEV, and NGV, Hybridization (Full Hybrid, Micro-Hybrid, and Mild Hybrid), and Vehicle Type (Passenger Car and Commercial Vehicle), Regions, Segmentation and Projection till 2028

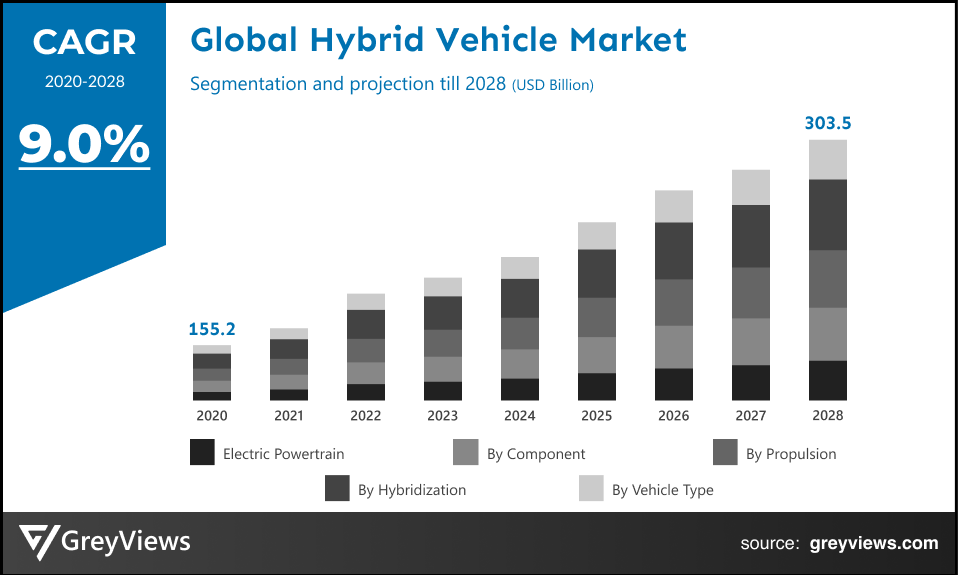

CAGR: 9.0%Current Market Size: USD 155.2 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2021-2028Base Year: 2020

Market Overview

The global hybrid vehicle market is expected to grow from USD 155.2 Billion in 2020 to USD 303.5 Billion by 2028, at a CAGR of 9.0% during the Projection period 2021-2028. This growth of the hybrid vehicle market is significantly driven by an upsurge in concerns associated with vehicular emissions and demand for vehicles with more power and enhanced fuel efficiency.

Hybrid vehicles are powered by an electric motor and a conventional internal combustion engine (either petrol or diesel). It cannot be plugged in to charge the battery; however, it utilizes energy stored in batteries where the battery is charged by the internal combustion engine and via regenerative braking. This type of vehicle features a small fuel-efficient engine coupled with an electric motor for assisting the engine while accelerating. As compared with conventional vehicles, hybrid vehicles offer better power and fuel efficiency along with low emissions.

Further, such a type of vehicle ensures reduced operational and maintenance costs. However, with the ongoing technological breakthroughs, the portfolio of hybrid vehicles is expanding at a rapid pace around the globe with a number of consumers in varied regions preferring hybrid vehicles.

Request Sample:- Global hybrid vehicle market

Market Dynamics

Drivers:

- Upsurge in concerns associated with the vehicular emissions

Vehicular emissions can lead to numerous bad effects on human health as well as the ecosystem. For instance, transportation has become one of the major sources of air pollution in different countries across the globe owing to the high number of IC engine-powered vehicles. However, usage of the hybrid electric vehicles can cut emissions and reduce smog-forming pollutants significantly. In addition, hybrid vehicles are one of the major solutions for preserving air quality for the future. This factor prominently boosts demand for hybrid vehicles.

- Rising demand for fuel-efficient vehicles

According to the December 2020 survey by nationally representative Consumer Reports survey, 89% of the Americans agreed that automakers should improve fuel economy in their upcoming models. In addition, most of them think fuel economy is either very important or extremely important while purchasing a new vehicle. However, one of the major benefits of a hybrid car is its greater fuel economy, with about 30% less fuel per mile as compared with conventional fuel-powered vehicles. Hence, demand for fuel-efficient vehicles is projected to boost the growth of the market.

Restraints:

- Ongoing demand for BEVs and FCEVs

Rising fuel prices along with the various government initiatives have created a demand for battery electric vehicles (BEVs). In addition to this, a number of electric vehicle companies such as Tesla (US), BYD (China), BMW Group (Germany), Volkswagen AG (Germany), and Nissan Motors (Japan) are introducing battery electric vehicles (BEVs) and Fuel cell electric vehicles (FCEVs), hampering the growth of the hybrid vehicles.

Opportunities:

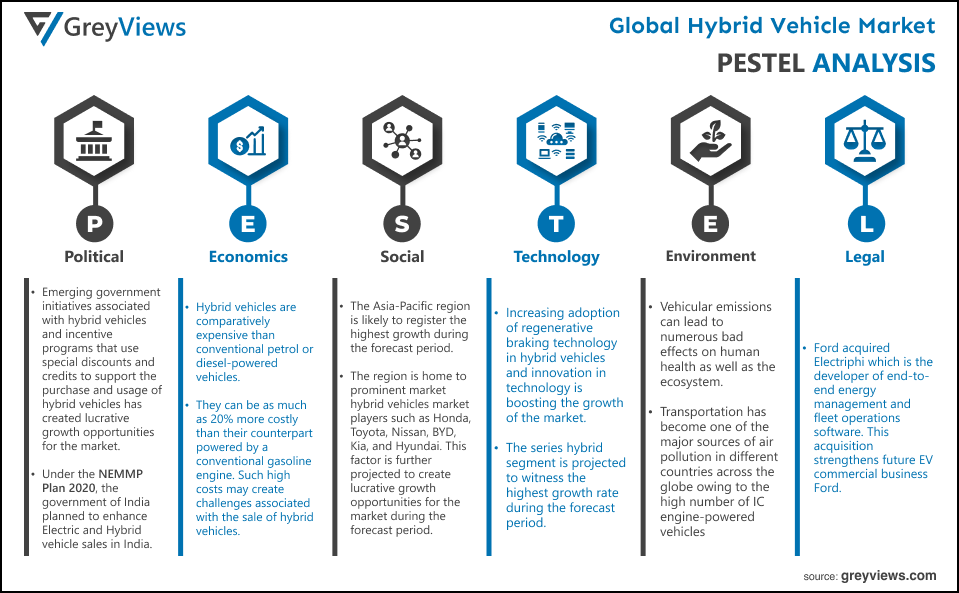

- Government initiatives associated with the hybrid vehicles

Emerging government initiatives associated with hybrid vehicles and incentive programs that use special discounts and credits to support the purchase and usage of hybrid vehicles has created lucrative growth opportunities for the market. Such government initiatives have led to the rising shift towards hybrid cars and buses in the public transportation and service vehicles sector as a part of government programs for becoming more environmentally responsible. For instance, under the National Electric Mobility Mission Plan 2020 (NEMMP), the government of India planned to enhance Electric and Hybrid vehicle sales in India.

Challenges:

- High cost of hybrid vehicle

Hybrid vehicles are comparatively expensive than conventional petrol or diesel-powered vehicles. They can be as much as 20% more costly than its counterpart powered by a conventional gasoline engine. Such high costs may create challenges associated with the sale of hybrid vehicles.

Segmentation Analysis

The global hybrid vehicle market has been segmented based on electric powertrain type, component type, propulsion, hybridization, vehicle type, and regions.

By Electric Powertrain type

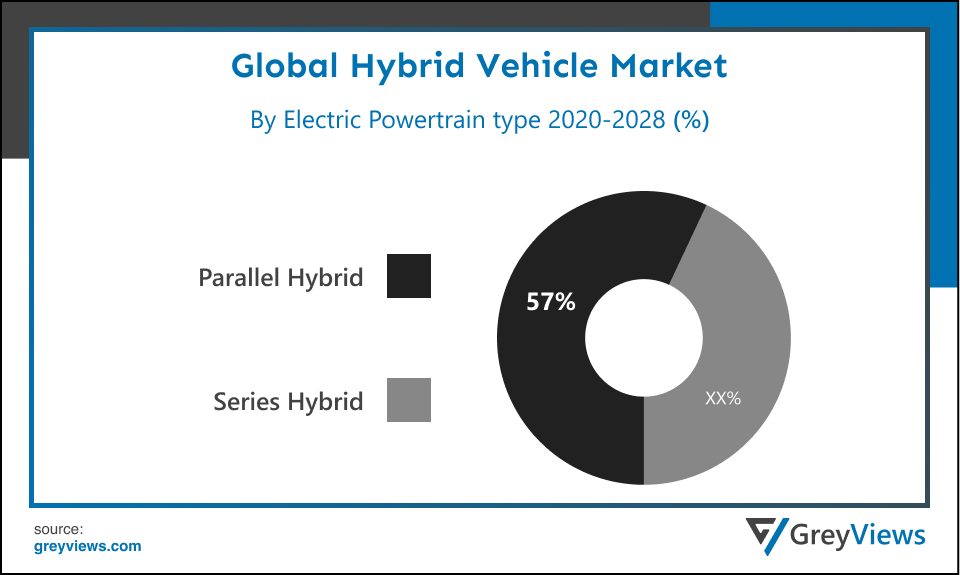

- The electric powertrain type segment includes parallel hybrid and series hybrid. The parallel hybrid segment led the hybrid vehicle market with a market share of around 57% in 2020. This is due to the increasing adoption of regenerative braking technology in hybrid vehicles. In addition, it reduces the need for external electric infrastructure; thus, fueling the growth of the segment. However, the series hybrid segment is projected to witness the highest growth rate during the Projection period.

By Component Type

- The component type segment includes the battery, electric motor, and transmission. The battery segment held the largest market share of 45% in 2020. The need for batteries in hybrid vehicles to store a large amount of power for an extended period of time drives the growth of the segment. However, the electric motor segment is expected to witness the highest growth rate during the Projection period.

By Propulsion

- The propulsion segment includes HEV, PHEV, and NGV. The HEV segment held the largest market share of 52.3% in 2020. The growth of this segment is mainly driven by a significant rise in sales volume of HEV in the US, Japan, and China. In addition to this, the emergence of stringent emission standards in developing countries fuels demands for HEVs. However, the PHEV segment is expected to grow at the highest growth rate during the Projection period.

By Hybridization

- The hybridization segment includes full hybrid, micro-hybrid, and mild hybrid. The full hybrid segment held the largest market share of 49.1% in 2020. The growth of this segment is mainly driven by the need for more power, better fuel efficiency, and minimum emissions in vehicles. However, the mild-hybrid segment is projected to experience the highest CAGR during the Projection period.

By Vehicle Type

- The vehicle type segment includes passenger cars and commercial vehicles. The passenger car segment held the largest market share of 65.2% in 2020. Increasing disposable income across the developing countries and need for passenger cars in conveyance in developed and developing countries. However, the commercial vehicle segment is expected to witness the highest growth rate during the Projection period. The growth of this segment is driven by advancements across irrigation projects, mining activities, and ongoing infrastructural developments.

By Regional Analysis

The regions analyzed for the Hybrid Vehicle market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The North American region dominated the Hybrid Vehicle market and held the 37.9% share of the market revenue in 2020.

- North America holds tremendous potential for hybrid vehicle production and demand. For instance, the proliferation of a hybrid type of vehicle has been observed in countries such as the U.S. with around 400,746 hybrid cars sold in the U.S. in 2019.

- The Asia-Pacific region is likely to register the highest growth during the Projection period. This is mainly due to the significant demand for hybrid vehicles across the countries including China, Japan, and South Korea. In addition to this, the region is home to prominent market hybrid vehicles market players such as Honda, Toyota, Nissan, BYD, Kia, and Hyundai. This factor is further projected to create lucrative growth opportunities for the market during the Projection period.

Key Industry Players Analysis

Key market players are focusing on new launches to improve market position

The key players are now concentrating on implementing strategies such as adopting new technology, product innovations, mergers & acquisitions, joint venture, alliances, and partnerships to improve their market position in the global hybrid vehicle industry.

For instance, in September 2020, Allison Transmission launched the eGen Flex, the new zero-emission vehicle (ZEV)-a capable electric hybrid system. This launch is aimed at providing an innovative solution for helping fleets of commercial vehicles to go electric.

In July 2019, Continental, one of the leading market players introduced a 48V high-power drive system for enabling electric-only driving in hybrid vehicles. This launch has enhanced the hybrid vehicle portfolio of the company.

- Delphi

- Continental

- BorgWarner

- ZF Friedrichshafen AG

- Ford

- Volvo

- Continental

- Toyota

- Daimler

- Honda

- Hyundai

- Schaeffler

- Allison Transmission

- Nissan

Latest Development

- September 2021- Allison Transmission which is a designer and manufacturer company of electric, hybrid, conventional, and fully electric vehicle propulsion solutions collaborated with SAIC Hongyan Automotive Co., Ltd. to integrate Allison’s eGen Power 130D into regional and long haul tractors.

- June 2021- Ford acquired Electriphi which is the developer of end-to-end energy management and fleet operations software. This acquisition strengthens future EV commercial business Ford.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

9.0% |

|

Market Size |

155.2 Billion in 2020 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Electric Powertrain type, Component type, Propulsion, Hybridization, Vehicle Type, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

ZF Friedrichshafen AG, Bharat Forge Limited, NTN Corporation, American Axle & Manufacturing, Inc., Meritor Inc., ThyssenKrupp AG, CIE Automotive, S.A., Dana Inc., Ramkrishna Forgings among others. |

|

By Electric Powertrain type |

|

|

By Component type |

|

|

By Propulsion

|

|

|

By Hybridization |

|

|

By Vehicle Type |

|

|

Regional scope |

|

Scope of the Report

Global Hybrid Vehicle Market by Electric Powertrain type:

- Parallel Hybrid

- Series Hybrid

Global Hybrid Vehicle Market by Component type:

- Battery

- Electric Motor

- Transmission

Global Hybrid Vehicle Market by Propulsion:

- HEV

- PHEV

- NGV

Global Hybrid Vehicle Market by Hybridization:

- Full Hybrid

- Micro-Hybrid

- Mild Hybrid

Global Hybrid Vehicle Market by Vehicle Type:

- Passenger Car

- Commercial Vehicle

Global Hybrid Vehicle Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market value of the hybrid vehicle Market in 2020?

The market value of the hybrid vehicle Market in 2020 is $155.2 Billion.

Which is the most influencing segment growing in the hybrid vehicle report?

Parallel Hybrid segment is the most influencing segment in the Hybrid Vehicle market.

Which region has the highest market share in the hybrid vehicle Market?

North America held the major share in the market over the Projection period 2021- 2028.

Which are the top players active in the hybrid vehicle market?

The leading market players active in the global Hybrid Vehicle market are Delphi, Continental, BorgWarner, ZF Friedrichshafen AG, Ford, Volvo, Continental, Toyota, Daimler, Honda, Hyundai, Schaeffler, Allison Transmission, Nissan, and among others.

What are the segment considered in the global hybrid vehicle market?

Electric Powertrain type, Component type, Propulsion, Hybridization, Vehicle Type, and regions are the six segments of the report.

Does this report include the impact of COVID-19 on the hybrid vehicle market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the hybrid vehicle market.

What is the study period of this market?

The Hybrid Vehicle market is studied from 2020 - 2028.

Political- Emerging government initiatives associated with hybrid vehicles and incentive programs that use special discounts and credits to support the purchase and usage of hybrid vehicles has created lucrative growth opportunities for the market. Such government initiatives have led to the rising shift towards hybrid cars and buses in the public transportation and service vehicles sector as a part of government programs for becoming more environmentally responsible. For instance, under the National Electric Mobility Mission Plan 2020 (NEMMP), the government of India planned to enhance Electric and Hybrid vehicle sales in India.

Economic- Hybrid vehicles are comparatively expensive than conventional petrol or diesel-powered vehicles. They can be as much as 20% more costly than their counterpart powered by a conventional gasoline engine. Such high costs may create challenges associated with the sale of hybrid vehicles.

Social- The Asia-Pacific region is likely to register the highest growth during the Projection period. This is mainly due to the significant demand for hybrid vehicles across the countries including China, Japan, and South Korea. In addition to this, the region is home to prominent market hybrid vehicles market players such as Honda, Toyota, Nissan, BYD, Kia, and Hyundai. This factor is further projected to create lucrative growth opportunities for the market during the Projection period.

Technological- Increasing adoption of regenerative braking technology in hybrid vehicles and innovation in technology is boosting the growth of the market. In addition, it reduces the need for external electric infrastructure; thus, fueling the growth of the segment. However, the series hybrid segment is projected to witness the highest growth rate during the Projection period.

Environmental- Vehicular emissions can lead to numerous bad effects on human health as well as the ecosystem. For instance, transportation has become one of the major sources of air pollution in different countries across the globe owing to the high number of IC engine-powered vehicles. However, usage of the hybrid electric vehicles can cut emissions and reduce smog-forming pollutants significantly. In addition, hybrid vehicles are one of the major solutions for preserving air quality for the future. This factor prominently boosts demand for hybrid vehicles.

Legal- Ford acquired Electriphi which is the developer of end-to-end energy management and fleet operations software. This acquisition strengthens future EV commercial business Ford.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Electric Powertrain type

- Market Attractiveness Analysis By Component type

- Market Attractiveness Analysis By Propulsion

- Market Attractiveness Analysis By Hybridization

- Market Attractiveness Analysis By Vehicle Type

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Upsurge in concerns associated with the vehicular emissions

- Rising demand for fuel efficient vehicles

- Restrains

- Ongoing demand for passenger cars and FCEVs

- Opportunities

- Government initiatives associated with the hybrid vehicles

- Challenges

- High cost of hybrid vehicle

- Global Hybrid Vehicle Market Analysis and Projection, By Electric Powertrain type

- Segment Overview

- Parallel Hybrid

- Series Hybrid

- Global Hybrid Vehicle Market Analysis and Projection, By Component type

- Segment Overview

- Battery

- Electric Motor

- Transmission

- Global Hybrid Vehicle Market Analysis and Projection, By Propulsion

- Segment Overview

- HEV

- PHEV

- NGV

- Global Hybrid Vehicle Market Analysis and Projection, By Hybridization

- Segment Overview

- Full Hybrid

- Micro-Hybrid

- Mild Hybrid

- Global Hybrid Vehicle Market Analysis and Projection, By Vehicle Type

- Segment Overview

- Passenger car

- Commercial vehicle

- Global Hybrid Vehicle Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Hybrid Vehicle Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Hybrid Vehicle Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Electric Powertrain type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Delphi

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Continental

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- BorgWarner

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- ZF Friedrichshafen AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Ford

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Volvo

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Continental

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Toyota

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Daimler

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Honda

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Hyundai

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Schaeffler

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Allison Transmission

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Nissan

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Electric Powertrain type Portfolio

- Recent Developments

- SWOT Analysis

- Delphi

List of Table

- Global Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Global Parallel Hybrid Market, By Region, 2020–2028(USD Billion)

- Global Series Hybrid Market, By Region, 2020–2028(USD Billion)

- Global Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Global Battery Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Electric Motor Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Transmission Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Global HEV Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global PHEV Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global NGV Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Global Full Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Micro-Hybrid Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Mild Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Global Passenger Car Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Commercial Vehicle Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Hybrid Vehicle Market, By Region, 2020–2028(USD Billion)

- Global Hybrid Vehicle Market, By North America, 2020–2028(USD Billion)

- North America Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- North America Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- North America Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- North America Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- North America Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- USA Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- USA Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- USA Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- USA Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- USA Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Canada Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Canada Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Canada Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Canada Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Canada Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Mexico Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Mexico Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Mexico Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Mexico Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Mexico Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Europe Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Europe Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Europe Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Europe Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Europe Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Germany Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Germany Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Germany Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Germany Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Germany Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- France Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- France Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- France Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- France Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- France Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- UK Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- UK Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- UK Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- UK Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- UK Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Italy Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Italy Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Italy Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Italy Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Italy Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Spain Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Spain Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Spain Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Spain Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Spain Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Asia Pacific Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Asia Pacific Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Asia Pacific Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Asia Pacific Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Asia Pacific Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Japan Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Japan Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Japan Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Japan Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Japan Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- China Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- China Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- China Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- China Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- China Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- India Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- India Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- India Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- India Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- India Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- South America Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- South America Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- South America Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- South America Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- South America Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Brazil Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Brazil Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Brazil Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Brazil Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Brazil Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- Middle East and Africa Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- Middle East and Africa Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- Middle East and Africa Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- Middle East and Africa Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- Middle East and Africa Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- UAE Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- UAE Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- UAE Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- UAE Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- UAE Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

- South Africa Hybrid Vehicle Market, By Electric Powertrain type, 2020–2028(USD Billion)

- South Africa Hybrid Vehicle Market, By Component type, 2020–2028(USD Billion)

- South Africa Hybrid Vehicle Market, By Propulsion, 2020–2028(USD Billion)

- South Africa Hybrid Vehicle Market, By Hybridization, 2020–2028(USD Billion)

- South Africa Hybrid Vehicle Market, By Vehicle Type, 2020–2028(USD Billion)

List of Figures

- Global Hybrid Vehicle Market Segmentation

- Hybrid Vehicle Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Hybrid Vehicle Market Attractiveness Analysis By Electric Powertrain type

- Global Hybrid Vehicle Market Attractiveness Analysis By Component type

- Global Hybrid Vehicle Market Attractiveness Analysis By Propulsion

- Global Hybrid Vehicle Market Attractiveness Analysis By Hybridization

- Global Hybrid Vehicle Market Attractiveness Analysis By Vehicle Type

- Global Hybrid Vehicle Market Attractiveness Analysis By Region

- Global Hybrid Vehicle Market: Dynamics

- Global Hybrid Vehicle Market Share By Electric Powertrain type(2021 & 2028)

- Global Hybrid Vehicle Market Share By Component type(2021 & 2028)

- Global Hybrid Vehicle Market Share By Propulsion(2021 & 2028)

- Global Hybrid Vehicle Market Share By Hybridization(2021 & 2028)

- Global Hybrid Vehicle Market Share By Vehicle Type (2021 & 2028)

- Global Hybrid Vehicle Market Share by Regions (2021 & 2028)

- Global Hybrid Vehicle Market Share by Company (2020)