Global Medical Tubing Market Size by Material (Plastics, Rubbers, and Specialty Polymers), Structure (Single-lumen, Co-extruded, Multi-lumen, Tapered or Bump tubing, and Braided tubing), Application (Bulk disposable tubing, Catheters & cannulas, Drug delivery system, and Special applications), Regions, Segmentation and Projection till 2028

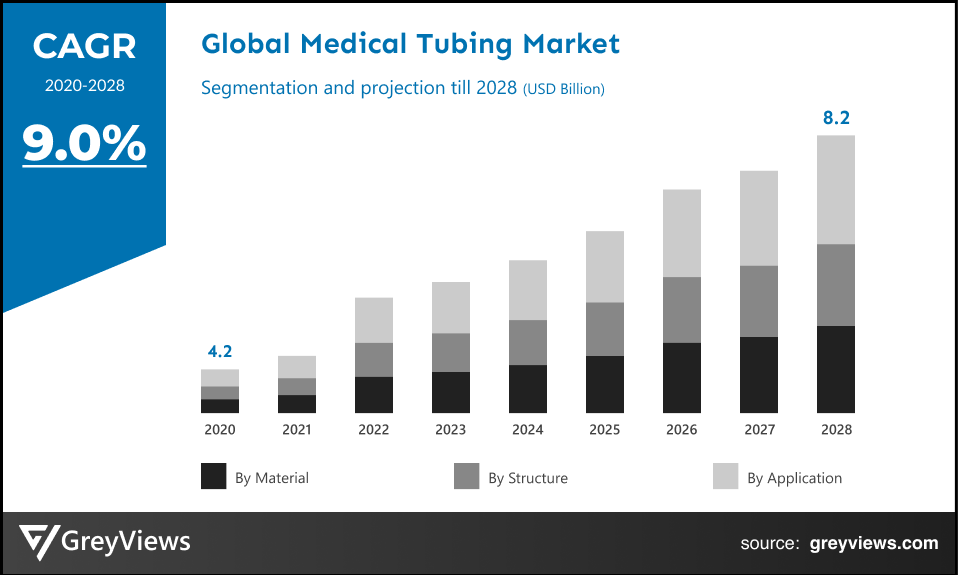

CAGR: 9.0% Current Market Size: USD 4.2 Billion Fastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2021-2028Base Year: 2020

Global Medical Tubing Market- Market Overview

The global medical tubing market is expected to grow from USD 4.2 Billion in 2020 to USD 8.2 Billion by 2028, at a CAGR of 9.0% during the Projection period 2021-2028. This growth of the medical tubing market is significantly driven by growing health concerns among geriatric populations and rising demand for medical tubing from a number of applications in the pharmaceutical and medical industries.

Medical tubing is an important component for both the medical and pharmaceutical industries. It can be made out of different types of plastic, such as polyvinyl chloride (PVC), thermoplastic elastomers (TPE), nylon, polyethylene, and silicone. It is mainly designed for several applications that enables clinicians to administer fluid or allow for gas flow. In addition to this, it is used with anesthesiology and respiratory equipment, catheters, peristaltic pumps, IVs, and biopharmaceutical laboratory equipment.

Increase in cardiac catheterization along with the rise in interventional cardiology encourages sales of the medical tubing. For instance, tubing is rapidly being used to drive catheters in cardiac catheterizations for testing heart disease as well as to locate narrowing blood vessels, check pump functions, diagnose congenital heart defects, and identify heart valve issues by using catheterizations.

Request Sample:- Global medical tubing market

Market Dynamics

Drivers:

- Significant rise in cases of respiratory diseases

There is significant rise in respiratory diseases including lung cancer, asthma, and pulmonary fibrosis across the globe. Out of all the respiratory diseases, asthma and chronic lung disease (COPD) are the most common conditions; however, others such as interstitial lung disease; pneumoconiosis (a lung disease owing to dust inhalation), and pulmonary sarcoidosis (causes by lung scarring and inflammation) also have become public health concerns globally. Hence, the requirement for a respiratory tube while curing such diseases boosts the growth of the medical tubing market.

- Growth in the elderly population

The world’s geriatric or elderly population is continuing to grow at an unprecedented rate. However, an aging population leads to growth in demand for healthcare services creating the need for medical devices that incorporate tubing. For instance, as per the United Nations (UN) World Populations Ageing report 2020, there were about 727 million people aged 65 years or above around the globe, and this number is projected to double by 2050. This growth in the aging population is projected to fuel the need for tubing related to respiratory and cardiovascular diseases.

Restraints:

- Need for huge investment and time for product development

The decline is being observed in investments for medical product development technology owing to the delays in regulatory approvals. In addition to this, the selection of ideal polymer for a specific medical application in medical tubing is essential, which requires intense technical expertise and research and development. The different polymers and devices require to go through varying approval processes. This factor is may hamper the growth of the market to some extent during the Projection period.

Opportunities:

- Rapid growth in investment across the healthcare sector in developing countries

The number of factors such as greater access to healthcare facilities coupled with increased private and government investments as well as government initiatives promoting medical insurance and foreign investment is boosting the healthcare sector in developing counties. For instance, the government of China has planned to boost its investment in healthcare via public reforms such as the Healthy China 2030 policy and 14th Five-Year Plan from 2021-2025. Such reforms or government investments are projected to create lucrative growth opportunities for the medical tubing market.

Challenges:

- Stringent government regulations

Stringent regulations and policies associated with the approval process may impede the commercialization of medical tubing products. For instance, the production of medical tubing needs to meet requirements set by regulating agencies including the Food and Drug Administration (FDA), Drug Administration (DA), National Science Foundation (NSF), and Center for Devices and Radiological Health (CDRH). Such regulations pose challenges to the market players.

Segmentation Analysis

The global Medical Tubing market has been segmented based on material, structure, application, and regions.

By Material

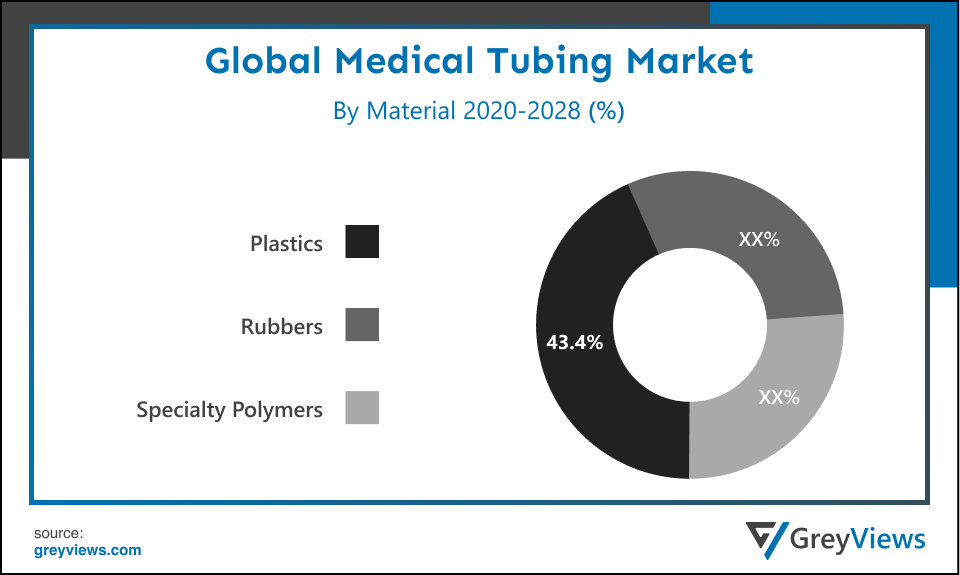

- The Mineral type segment includes plastics, rubbers, and specialty polymers. The plastics segment led the medical tubing market with a market share of around 43.4% in 2020. This is due to the fact that plastics play an essential role in the production of medical tubes, such as conduits for acquiring biopsy samples, vascular catheters, and stent holders, owing to their features including inertness to tissues and body fluids, higher optical properties, resistance to sterilization conditions, and low cost for high volume applications. However, specialty polymers are anticipated to witness the highest growth rate during the Projection period.

By Structure

- The structure segment includes single-lumen, co-extruded, multi-lumen, tapered or bump tubing, and braided tubing. The single-lumen segment led the Medical tubing market with a market share of around 34.3% in 2020. Single-lumen tubing is mainly being used for transporting liquids, gases, or surgical devices. Wide applications of the single-lumen structure of medical tubing in urological, IV, and drainage catheters boost the growth of this segment. However, multi-lumen is expected to witness the highest growth rate during the Projection period.

By Application

- The application segment includes bulk disposable tubing, Catheters & cannulas, Drug delivery system, and Special applications. The bulk disposable tubing segment held the largest market share of 36.1% in 2020. Bulk disposable devices comprise tubes used for blood transfusion, IV infusion tubing, drug delivery disposables, laboratory disposables, respiratory disposables, and wound management disposables. The growth of this segment is driven by increasing focus on the prevention of infection from one patient to another. However, drug delivery systems segment is expected to witness the highest growth rate during the Projection period.

By Regional Analysis:

The regions analyzed for the medical tubing market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The North American region dominated the Medical tubing market and held the 36.7% share of the market revenue in 2020.

- The growth of the North American medical tubing market is mainly driven by well-established medical infrastructure as well as increasing healthcare expenditures activities across the region. In addition to this, the emergence of governments initiatives to improve health care infrastructure, coupled with the focus on research and development (R&D) activities boosts the North American medical tubing market.

- The Asia-Pacific region is likely to register the highest growth during the Projection period due to a number of factors such as rising demand for minimally invasive surgeries, increased healthcare accessibility, and an upsurge in the geriatric population.

Key Industry Players Analysis

Key market players are focusing on expansion to improve their market position

The key players are now concentrating on implementing strategies such as adopting new mineral types, product innovations, mergers & acquisitions, joint ventures, alliances, and partnerships to improve their market position in the global Medical tubing industry.

For instance, in June 2021, Freudenberg Medical which is a contract designing and manufacturing unit for the medical device industry expanded its manufacturing operations in Alajuela, Costa Rica. This expansion project has added 8,600 square feet to the existing facility.

In September 2020, Freudenberg Medical, a contract manufacturing, and design provider acquired the Merit Medical Hypotube manufacturing business. The acquisition strengthens the medical tubing portfolio of the company.

In July 2019, the Lubrizol Corporation acquired Bavaria Medizin Technologie GmbH (BMT), an innovative designer & manufacturer of both intravascular (peripheral, coronary, and cranial) and nonvascular devices.

- Saint-Gobain

- Freudenberg Medical LLC

- Raumedic AG

- Lubrizol Corporation

- Elkem ASA

- L. Gore and Associates Inc.

- Avient Corporation

- Dow Corning Corporation

- Nordson Corporation

- Teknor Apex

- Optinova

Latest Development

- November 2021- Freudenberg Medical, one of the leading market players introduced two new biopharma tubing products in India. This includes PharmaFocus Premium and HelixMark Tubing.

- August 2021- Raumedic, a polymer specialist announced the expansion of its silicone business with two new facilities. These facilities are scheduled to be erected at the company’s headquarters by 2025.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

9.0% |

|

Market Size |

4.2 Billion in 2020 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Material, Structure, Application, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Stepan Company, BASF SE, Emery Oleochemicals, Cargill Inc., Biobased Technologies, Vertellus, IFS Chemicals Group, Huntsman Corporation, Dow Chemical Company, Emery Oleochemicals among others. |

|

By Material |

|

|

Structure |

|

|

Applications |

|

|

Regional scope |

|

Scope of the Report

Global Medical Tubing Market by Material:

- Plastics

- Rubbers

- Specialty Polymers

Global Medical Tubing Market by Structure:

- Single-lumen

- Co-extruded

- Multi-lumen

- Tapered or Bump tubing

- Braided tubing

Global Medical Tubing Market by Application:

- Bulk disposable tubing

- Catheters & cannulas

- Drug delivery system

- Special applications

Global Medical Tubing Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market value of the medical tubing market in 2020?

The market value of the medical tubing market in 2020 is $4.2 Billion.

Which region has the highest market share in the medical tubing Market?

North America held the major share in the market over the Projection period 2021- 2028.

Which is the most influencing segment growing in the medical tubing report?

Plastics segment is the most influencing segment in the medical tubing market.

Which are the Top players active in the medical tubing market?

The leading market players active in the global medical tubing market are Saint-Gobain, Freudenberg Medical LLC, Raumedic AG, Lubrizol Corporation, Elkem ASA, W.L. Gore and Associates Inc., Avient Corporation, Dow Corning Corporation, Nordson Corporation, Teknor Apex, Optinova among others.

What are the segment considered in the global medical tubing market?

Material, Structure, Application, and regions are the three segments of the report.

Does this report include the impact of COVID-19 on the medical tubing market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the medical tubing market.

What is the study period of this market?

The medical tubing market is studied from 2020 - 2028.

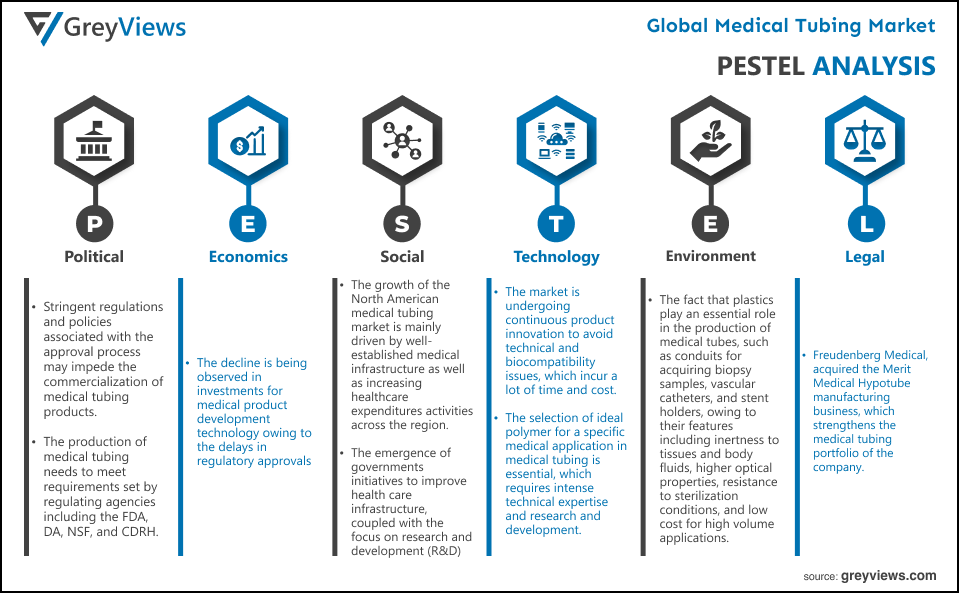

Political- Stringent regulations and policies associated with the approval process may impede the commercialization of medical tubing products. For instance, the production of medical tubing needs to meet requirements set by regulating agencies including the Food and Drug Administration (FDA), Drug Administration (DA), National Science Foundation (NSF), and Center for Devices and Radiological Health (CDRH). Such regulations pose challenges to the market players.

Economic- The decline is being observed in investments for medical product development technology owing to the delays in regulatory approvals. In addition to this, the selection of ideal polymer for a specific medical application in medical tubing is essential, which requires intense technical expertise and research and development. The different polymers and devices require to go through varying approval processes. This factor is may hamper the growth of the market to some extent during the Projection period.

Social- The growth of the North American medical tubing market is mainly driven by well-established medical infrastructure as well as increasing healthcare expenditures activities across the region. In addition to this, the emergence of governments initiatives to improve health care infrastructure, coupled with the focus on research and development (R&D) activities boosts the North American medical tubing market.

Technological- The market is undergoing continuous product innovation to avoid technical and biocompatibility issues, which incur a lot of time and cost. For example, selecting the ideal polymer for a particular medical application and scrutinizing the application areas for each polymer in medical tubing is essential, which requires intense R&D and technical expertise.

Environmental- The fact that plastics play an essential role in the production of medical tubes, such as conduits for acquiring biopsy samples, vascular catheters, and stent holders, owing to their features including inertness to tissues and body fluids, higher optical properties, resistance to sterilization conditions, and low cost for high volume applications. This leads to increased pollution and causes environmental damage.

Legal- Freudenberg Medical, a contract manufacturing, and design provider acquired the Merit Medical Hypotube manufacturing business. The acquisition strengthens the medical tubing portfolio of the company. Nordson Corporation acquired the medicals advanced technologies business of Vention (US), which is a manufacturer, designer, and developer of catheters, medical tubing, and medical devices

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Material

- Market Attractiveness Analysis By Structure

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Significant rise in cases of respiratory diseases

- Growth in elderly population

- Restrains

- Need for huge investment and time for product development

- Opportunities

- Rapid growth in investment across the healthcare sector in developing countries

- Challenges

- Rapid growth in investment across the healthcare sector in developing countries

- Global Medical Tubing Market Analysis and Projection, By Material

- Segment Overview

- Plastics

- Rubbers

- Specialty Polymers

- Global Medical Tubing Market Analysis and Projection, By Structure

- Segment Overview

- Single-lumen

- Co-extruded

- Multi-lumen

- Tapered or Bump tubing

- Braided tubing

- Global Medical Tubing Market Analysis and Projection, By Application

- Segment Overview

- Bulk disposable tubing

- Catheters & cannulas

- Drug delivery system

- Special applications

- Global Medical Tubing Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- K.

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Medical Tubing Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Medical Tubing Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Material Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Saint-Gobai

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Freudenberg Medical LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Raumedic AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Lubrizol Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Elkem ASA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- L. Gore and Associates Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Avient Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Dow Corning Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Nordson Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Teknor Apex

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Optinova

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Saint-Gobai

List of Table

- Global Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Global Plastics Market, By Region, 2020–2028(USD Billion)

- Global Rubbers Market, By Region, 2020–2028(USD Billion)

- Global Specialty Polymers Market, By Region, 2020–2028(USD Billion)

- Global Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Global Single-lumen Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Co-extruded Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Multi-lumen Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Tapered or Bump tubing Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Braided Tubing Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Global Bulk disposable tubing Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Catheters & Cannulas Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Drug delivery system Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Special applications Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Medical Tubing Market, By Region, 2020–2028(USD Billion)

- Global Medical Tubing Market, By North America, 2020–2028(USD Billion)

- North America Medical Tubing Market, By Material, 2020–2028(USD Billion)

- North America Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- North America Medical Tubing Market, By Application, 2020–2028(USD Billion)

- USA Medical Tubing Market, By Material, 2020–2028(USD Billion)

- USA Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- USA Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Canada Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Canada Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Canada Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Mexico Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Mexico Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Mexico Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Europe Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Europe Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Europe Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Germany Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Germany Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Germany Medical Tubing Market, By Application, 2020–2028(USD Billion)

- France Medical Tubing Market, By Material, 2020–2028(USD Billion)

- France Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- France Medical Tubing Market, By Application, 2020–2028(USD Billion)

- UK Medical Tubing Market, By Material, 2020–2028(USD Billion)

- UK Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- UK Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Italy Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Italy Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Italy Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Spain Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Spain Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Spain Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Asia Pacific Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Asia Pacific Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Asia Pacific Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Japan Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Japan Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Japan Medical Tubing Market, By Application, 2020–2028(USD Billion)

- China Medical Tubing Market, By Material, 2020–2028(USD Billion)

- China Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- China Medical Tubing Market, By Application, 2020–2028(USD Billion)

- India Medical Tubing Market, By Material, 2020–2028(USD Billion)

- India Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- India Medical Tubing Market, By Application, 2020–2028(USD Billion)

- South America Medical Tubing Market, By Material, 2020–2028(USD Billion)

- South America Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- South America Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Brazil Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Brazil Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Brazil Medical Tubing Market, By Application, 2020–2028(USD Billion)

- Middle East and Africa Medical Tubing Market, By Material, 2020–2028(USD Billion)

- Middle East and Africa Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- Middle East and Africa Medical Tubing Market, By Application, 2020–2028(USD Billion)

- UAE Medical Tubing Market, By Material, 2020–2028(USD Billion)

- UAE Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- UAE Medical Tubing Market, By Application, 2020–2028(USD Billion)

- South Africa Medical Tubing Market, By Material, 2020–2028(USD Billion)

- South Africa Medical Tubing Market, By Structure, 2020–2028(USD Billion)

- South Africa Medical Tubing Market, By Application, 2020–2028(USD Billion)

List of Figures

- Global Medical Tubing Market Segmentation

- Medical Tubing Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Medical Tubing Market Attractiveness Analysis By Material

- Global Medical Tubing Market Attractiveness Analysis By Structure

- Global Medical Tubing Market Attractiveness Analysis By Application

- Global Medical Tubing Market Attractiveness Analysis By Region

- Global Medical Tubing Market: Dynamics

- Global Medical Tubing Market Share By Material(2021 & 2028)

- Global Medical Tubing Market Share By Structure(2021 & 2028)

- Global Medical Tubing Market Share By Application(2021 & 2028)

- Global Medical Tubing Market Share by Regions (2021 & 2028)

- Global Medical Tubing Market Share by Company (2020)