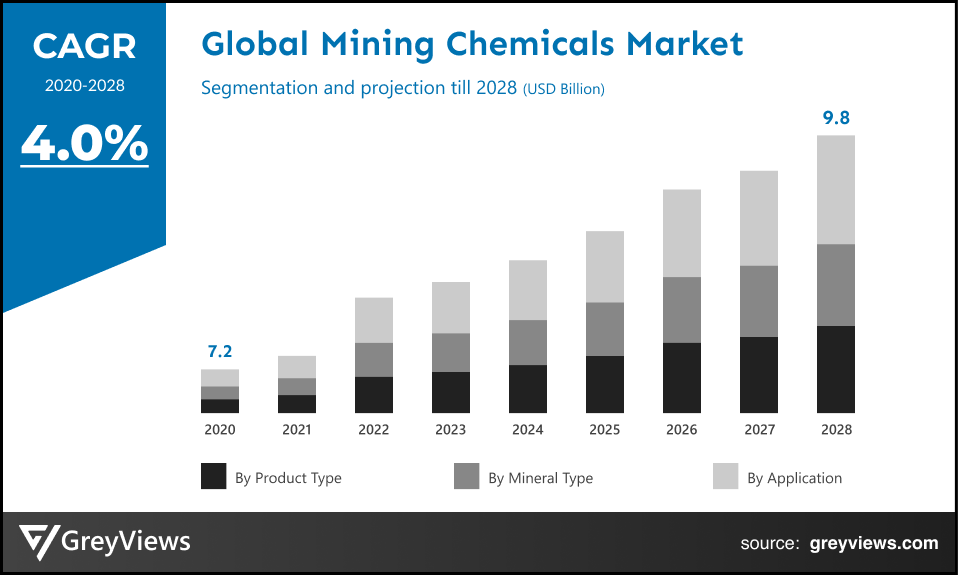

Global Mining Chemicals Market Size by Product type (Frothers, Flocculants, Collectors, Solvent Extractants, and Grinding aids), Mineral Type (Base metals, Non-metallic minerals, Precious metals, and Rare earth metals), Application (Mineral Processing, Explosives & Drilling, Water & Wastewater Treatment, and Others), Regions, Segmentation, and Projection till 2028

CAGR: 4.0%Current Market Size: USD 7.2 BillionFastest Growing Region: MEA

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Mining Chemicals Market- Market Overview

The global mining chemicals market is expected to grow from USD 7.2 Billion in 2020 to USD 9.8 Billion by 2028, at a CAGR of 4.0% during the Projection period 2021-2028. This growth of the market is significantly driven by extensive adoption of this product across a number of sectors such as mineral processing, water treatment, underground mining, stockpiles, mine haul roads, explosives & drilling, and surface mining among others.

Mining chemicals are the aggressive as well as high-cost compounds used during mineral processing. Such chemicals need precise metering for ensuring sound recovery rates and providing optimum froth and bubble size along with the depression specificity. These chemicals help infiltration and de-watering, offering efficiency, improving grade & recovery, and handling slurry and pumping, and lowering collector dose and cost per ton. Frothers, flocculants, collectors, solvent extractants, and grinding aids are the most commonly utilized mining chemicals.

The mining chemicals play an important role in enhancing the efficiency and productivity of processes such as the recovery and extraction of target materials and minerals from ore.

Request Sample:- Global mining chemicals market

Market Dynamics

Drivers:

- Significant rise in the mining of coal, chalk, oil shale, limestone, and gemstones

There is a significant rise in the mining of coal due to growing demand for low-cost energy and iron and steel, as well as cement. Also, increased infrastructural developments around the globe are projected to fuel demand for the mining of limestone. While on the other hand, rapid usage of gemstones in making jewelry and other ornaments, as well as for decoration purposes boosts demand for the mining of gemstones. The aforementioned factors are projected to boost growth in demand for mining chemicals.

- Growing investments across the mining projects in South America and Asia-Pacific

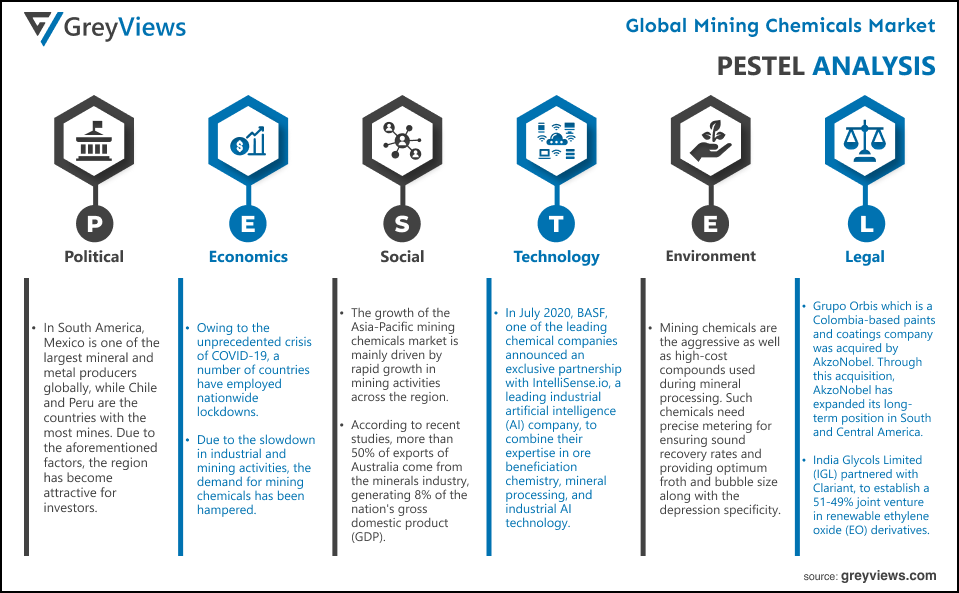

In South America, Mexico is one of the largest mineral and metal producers globally, while Chile and Peru are the countries with the most mines. Due to the aforementioned factors, the region has become attractive for investors. On the other hand, the huge presence of mineral, metal, and coal mines in countries such as China, Indonesia, and India, coupled with the favorable government initiatives pushes investment across the mining projects, fueling the growth of the global mining chemicals market.

Restraints:

- The slow growth of the mining industry in developed countries

A number of developed countries such as the U.S., the UK, and Japan are seeing a considerable decline in mining industry growth. For instance, by December 2020, the number of producing coal mines in the U.S. fell to 551 mines from 2019 with a total annual decline of 18% in the total number of producing coal mines. This factor primarily hampers the growth of the mining chemicals market due to declining demand for mining chemicals from such countries.

Opportunities:

- The rise in growth of mining industry across Africa and Eastern Europe

Africa is the prominent producer of key mineral commodities, with huge reserves of minerals and metals including gold, diamond, bauxite, iron ore, cobalt, coal, and copper across the continent. The countries such as South Africa, the Democratic Republic of Congo (DRC), Namibia, and Zimbabwe are fueling mining industry growth. Also, the mining & natural resources sector across Eastern Europe is playing an important role in national economies, creating lucrative growth opportunities for the growth of the global mining chemicals market.

Challenges:

- Disruptions due to COVID-19

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. However, as they are reopening, safety measures such as social distancing are still being applied. This has caused significant economic downturns across the globe. Due to the slowdown in industrial and mining activities, the demand for mining chemicals has been hampered. Hence, the emergence of the COVID-19 pandemic has posed challenges to the global mining chemicals market.

Segmentation Analysis

The global mining chemicals market has been segmented based on product type, mineral type, application, and regions.

By Product type

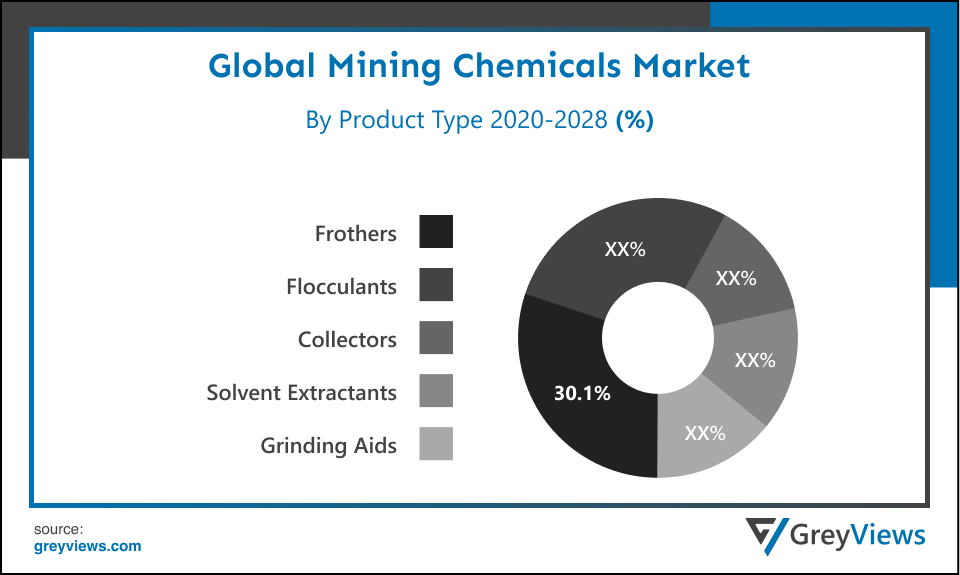

- The Mineral type segment includes frothers, flocculants, collectors, solvent extractants, and grinding aids. The frothers segment led the mining chemicals market with a market share of around 30.1% in 2020. This is due to the proliferation of froth flotation in the mining industry for recovering minerals from the slurry, purification of certain minerals, and separation of impurities. Frothers are essential reagents playing multiple roles in the flotation process. However, flocculants are projected to grow at the highest CAGR due to the wide usage of flocculants in water treatment to remove solids in water. Hence, application in processes of water and wastewater purification boosts the growth of this segment.

By Mineral type

- The mineral type segment includes base metals, non-metallic minerals, precious metals, and rare earth metals. The base metals segment led the mining chemicals market with a market share of around 32.3% in 2020. Base metals are common metals that oxidize, tarnish, or corrode rapidly when exposed to moisture or air. It includes lead, copper, aluminum, nickel, and zinc. The growth of this segment is driven by significant demand for base metals from the construction industry.

By Application

- The application segment includes mineral processing, explosives & drilling, water & wastewater treatment, and others. The explosives & drilling segment held the largest market share of 36.1% in 2020. Drilling & blasting are the most important operations in opencast mining. Thus, growth in opencast mining boosts the growth of this segment. However, the mineral processing segment is expected to witness the highest growth rate during the Projection period.

By Regional Analysis

The regions analyzed for the mining chemicals market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The Asia-Pacific region dominated the Mining Chemicals market and held the 45.2% share of the market revenue in 2020.

- The growth of the Asia-Pacific mining chemicals market is mainly driven by rapid growth in mining activities across the region. For instance, China is one of the leading producers of coal and gold among other earth minerals. On the other hand, according to recent studies, more than 50% of exports of Australia come from the minerals industry, generating 8% of the nation's gross domestic product (GDP). The aforementioned factors are significantly contributing to the growth of the Asia-Pacific mining chemicals market size.

- The Middle East and Africa region are likely to register the highest growth during the Projection period due to the proliferating mining sector in Africa region coupled with the promising Middle East mining industry.

Key Industry Players Analysis

Market players are developing new technologies to enhance the market

The key players are now concentrating on implementing strategies such as adopting new mineral types, product innovations, mergers & acquisitions, joint ventures, alliances, and partnerships to improve their market position in the global Mining Chemicals industry.

For instance, in July 2020, BASF, one of the leading chemical companies announced an exclusive partnership with IntelliSense.io, a leading industrial artificial intelligence (AI) company, to combine their expertise in ore beneficiation chemistry, mineral processing, and industrial AI technology.

In August 2019, Indorama Ventures entered into an agreement with Huntsman Corporation, an American multinational manufacturer and marketer of chemical products to sell its chemical intermediates businesses to.

In December 2018, Eastman Chemical Company which is an advanced material and specialty additives company entered into an exclusive cooperation agreement with Clariant, a specialty chemicals company, for the distribution of Tamisolve NxG solvent manufactured by Eastman, for the agrochemical industry.

- AkzoNobel N.V.

- BASF SE

- Clariant International Ltd.

- Cytec Industries Inc.

- Kemira OYJ

- The Dow Chemical Company

- Huntsman International LLC

- Orica Limited.

- ArrMaz Products, L.P.

- SNF Floreger

Latest Development

- June 2021- Grupo Orbis which is a Colombia-based paints and coatings company was acquired by AkzoNobel. Through this acquisition, AkzoNobel has expanded its long-term position in South and Central America.

- March 2021- India Glycols Limited (IGL) which manufactures green technology-based chemicals partnered with Clariant, a specialty chemical company, to establish a 51-49% joint venture in renewable ethylene oxide (EO) derivatives.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

4.0% |

|

Market Size |

7.2 Billion in 2020 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product Type, Mineral Type, Application, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

AkzoNobel N.V., BASF SE, Clariant International Ltd., Cytec Industries Inc., Kemira OYJ, The Dow Chemical Company, Huntsman International LLC, Orica Limited., ArrMaz Products, L.P., and SNF Floreger among others. |

|

By Product Type |

|

|

By Mineral type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Mining Chemicals Market by Product type:

- Frothers

- Flocculants

- Collectors

- Solvent Extractants

- Grinding aids

Global Mining Chemicals Market by Mineral type:

- Base metals

- Non-metallic minerals

- Precious metals

- Rare earth metals

Global Mining Chemicals Market by Application:

- Mineral Processing

- Explosives & Drilling

- Water & Wastewater Treatment

- Others

Global Mining Chemicals Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market value of the mining chemicals Market in 2020?

The market value of the mining chemicals Market in 2020 is $ 7.2 Billion.

Which is the most influencing segment growing in the mining chemicals report?

Frothers segment is the most influencing segment in the mining chemicals market.

Which region has highest market share in mining chemicals Market?

Asia Pacific held the major share in the market over the Projection period 2021- 2028

Which are the Top players active in the mining chemicals market?

The leading market players active in the global mining chemicals market are AkzoNobel N.V., BASF SE, Clariant International Ltd., Cytec Industries Inc., Kemira OYJ, The Dow Chemical Company, Huntsman International LLC, Orica Limited., ArrMaz Products, L.P., and SNF Floreger among others.

What are the segment considered in the global mining chemicals market?

Product type, mineral type, application, and regions are the three segments of the report.

Does this report include the impact of COVID-19 on the mining chemicals market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the mining chemicals market

What is the study period of this market

The mining chemicals market is studied from 2020 - 2028.

Political- In South America, Mexico is one of the largest mineral and metal producers globally, while Chile and Peru are the countries with the most mines. Due to the aforementioned factors, the region has become attractive for investors. On the other hand, the huge presence of mineral, metal, and coal mines in countries such as China, Indonesia, and India, coupled with the favorable government initiatives pushes investment across the mining projects, fueling the growth of the global mining chemicals market.

Economic- Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. However, as they are reopening, safety measures such as social distancing are still being applied. This has caused significant economic downturns across the globe. Due to the slowdown in industrial and mining activities, the demand for mining chemicals has been hampered. Hence, the emergence of the COVID-19 pandemic has posed challenges to the global mining chemicals market.

Social- The growth of the Asia-Pacific mining chemicals market is mainly driven by rapid growth in mining activities across the region. For instance, China is one of the leading producers of coal and gold among other earth minerals. On the other hand, according to recent studies, more than 50% of exports of Australia come from the minerals industry, generating 8% of the nation's gross domestic product (GDP). The aforementioned factors are significantly contributing to the growth of the Asia-Pacific mining chemicals market size.

Technological- in July 2020, BASF, one of the leading chemical companies announced an exclusive partnership with IntelliSense.io, a leading industrial artificial intelligence (AI) company, to combine their expertise in ore beneficiation chemistry, mineral processing, and industrial AI technology. India Glycols Limited (IGL) which manufactures green technology-based chemicals partnered with Clariant, a specialty chemical company, to establish a 51-49% joint venture in renewable ethylene oxide (EO) derivatives.

Environmental- Mining chemicals are the aggressive as well as high-cost compounds used during mineral processing. Such chemicals need precise metering for ensuring sound recovery rates and providing optimum froth and bubble size along with the depression specificity. These chemicals help infiltration and de-watering, offering efficiency, improving grade & recovery, and handling slurry and pumping, and lowering collector dose and cost per ton. Frothers, flocculants, collectors, solvent extractants, and grinding aids are the most commonly utilized mining chemicals. This affected the environment in many ways.

Legal- Grupo Orbis which is a Colombia-based paints and coatings company was acquired by AkzoNobel. Through this acquisition, AkzoNobel has expanded its long-term position in South and Central America. India Glycols Limited (IGL) which manufactures green technology-based chemicals partnered with Clariant, a specialty chemical company, to establish a 51-49% joint venture in renewable ethylene oxide (EO) derivatives. Indorama Ventures entered into an agreement with Huntsman Corporation, an American multinational manufacturer and marketer of chemical products to sell its chemical intermediates businesses to.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product type

- Market Attractiveness Analysis By Mineral type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Significant rise in mining of coal, chalk, oil shale, limestone, and gemstones

- Growing investments across the mining projects in South America and Asia-Pacific

- Restrains

- Slow growth of mining industry in developed countries

- Opportunities

- Rise in growth of mining industry across Africa and Eastern Europe

- Challenges

- Disruptions due to COVID-19

- Global Mining chemicals Market Analysis and Projection, By Product type

- Segment Overview

- Frothers

- Flocculants

- Collectors

- Solvent Extractants

- Grinding aids

- Global Mining chemicals Market Analysis and Projection, By Mineral type

- Segment Overview

- Base metals

- Non-metallic minerals

- Precious metals

- Rare earth metals

- Global Mining chemicals Market Analysis and Projection, By Application

- Segment Overview

- Mineral Processing

- Explosives & Drilling

- Water & Wastewater Treatment

- Others

- Global Mining chemicals Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Mining chemicals Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Mining chemicals Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- AkzoNobel N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- BASF SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- Clariant International Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- Cytec Industries Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- Kemira OYJ

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- The Dow Chemical Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- Huntsman International LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- Orica Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- ArrMaz Products, L.P.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- SNF Floreger

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product type Portfolio

- Recent Developments

- SWOT Analysis

- AkzoNobel N.V.

List of Table

- Global Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Global Frothers Market, By Region, 2020–2028(USD Billion)

- Global Flocculants Market, By Region, 2020–2028(USD Billion)

- Global Collectors Market, By Region, 2020–2028(USD Billion)

- Global Solvent Extractants Market, By Region, 2020–2028(USD Billion)

- Global Grinding aids Market, By Region, 2020–2028(USD Billion)

- Global Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Global Base metals Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Non-metallic minerals Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Precious metals Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Rare earth metals Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Global Mineral Processing Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Explosives & Drilling Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Water & Wastewater Treatment Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Others Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Mining chemicals Market, By Region, 2020–2028(USD Billion)

- Global Mining chemicals Market, By North America, 2020–2028(USD Billion)

- North America Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- North America Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- North America Mining chemicals Market, By Application, 2020–2028(USD Billion)

- US Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- US Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- US Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Canada Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Canada Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Canada Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Mexico Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Mexico Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Mexico Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Europe Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Europe Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Europe Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Germany Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Germany Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Germany Mining chemicals Market, By Application, 2020–2028(USD Billion)

- France Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- France Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- France Mining chemicals Market, By Application, 2020–2028(USD Billion)

- UK Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- UK Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- UK Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Italy Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Italy Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Italy Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Spain Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Spain Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Spain Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Asia Pacific Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Asia Pacific Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Asia Pacific Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Japan Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Japan Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Japan Mining chemicals Market, By Application, 2020–2028(USD Billion)

- China Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- China Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- China Mining chemicals Market, By Application, 2020–2028(USD Billion)

- India Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- India Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- India Mining chemicals Market, By Application, 2020–2028(USD Billion)

- South America Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- South America Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- South America Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Brazil Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Brazil Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Brazil Mining chemicals Market, By Application, 2020–2028(USD Billion)

- Middle East and Africa Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- Middle East and Africa Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- Middle East and Africa Mining chemicals Market, By Application, 2020–2028(USD Billion)

- UAE Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- UAE Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- UAE Mining chemicals Market, By Application, 2020–2028(USD Billion)

- South Africa Mining chemicals Market, By Product type, 2020–2028(USD Billion)

- South Africa Mining chemicals Market, By Mineral type, 2020–2028(USD Billion)

- South Africa Mining chemicals Market, By Application, 2020–2028(USD Billion)

List of Figures

- Global Mining chemicals Market Segmentation

- Mining chemicals Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Mining chemicals Market Attractiveness Analysis By Product type

- Global Mining chemicals Market Attractiveness Analysis By Mineral type

- Global Mining chemicals Market Attractiveness Analysis By Application

- Global Mining chemicals Market Attractiveness Analysis By Region

- Global Mining chemicals Market: Dynamics

- Global Mining chemicals Market Share By Product type(2021 & 2028)

- Global Mining chemicals Market Share By Mineral type(2021 & 2028)

- Global Mining chemicals Market Share By Application(2021 & 2028)

- Global Mining chemicals Market Share by Regions (2021 & 2028)

- Global Mining chemicals Market Share by Company (2020)