Global Natural Oil Polyols Market Size by Product (Soy Oil Polyols, Castor Oil Polyols, Canola Oil Polyols, Palm Oil Polyols, and Sunflower Oil Polyols), End-use (Furniture & Interiors, Construction, Electrical & Electronic Appliances, Footwear, Automotive, Packaging, and Others), Regions, Segmentation and Projection till 2028.

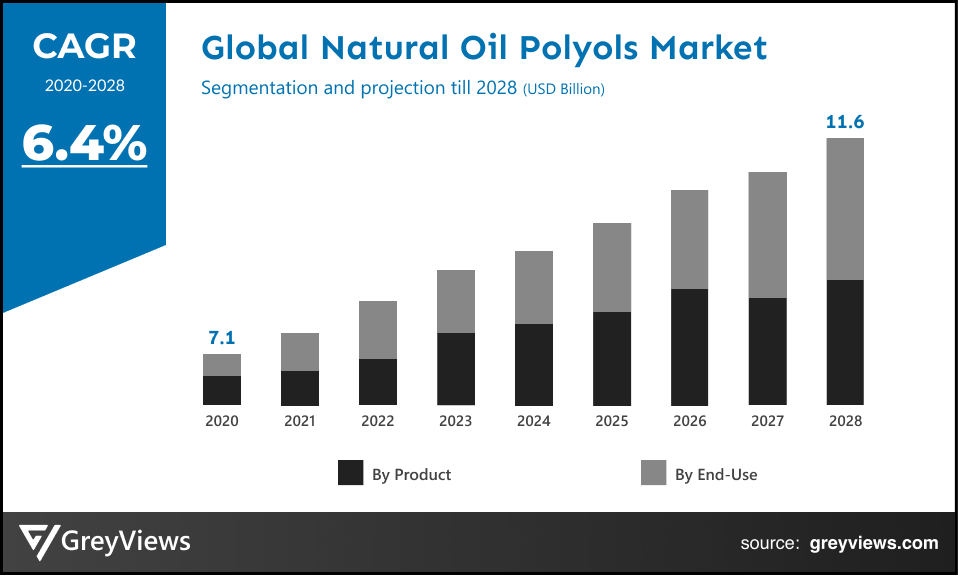

CAGR: 6.4%Current Market Size: USD 7.1 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Natural Oil Polyols Market- Market Overview

The global natural oil polyols market is expected to grow from USD 7.1 Billion in 2020 to USD 11.6 Billion by 2028, at a CAGR of 6.4% during the Projection period 2021-2028.This growth of the natural oil polyols market is mainly driven by the ongoing production trend of bio-based and eco-friendly products along with the rising usage of polyols industrial applications, such as lubricants, solvents, and additives.

Natural oil polyols (NOPs) or bio polyols are polyols that are derived from vegetable oils by various techniques. The major vegetable oil sources, including sunflower oil, castor oil, soy oil, and palm oil, are rapidly being used as natural oil polyols feedstock. Different processes are being developed for the production of natural oil polyols. For instance, Cargill Industrial BioProducts developed polyols made by ring-opening oligomerization of epoxidized soybean oil; Urethane Soy Systems Company produces polyols made by auto-oxidation; while on the other hand, Dow Chemical Company has developed soy-based polyols made in four steps from soybean oil: methanolysis, hydroformylation, hydrogenation, and polymerization.

Natural oil polyols are seeing an extensive range of applications in different industries including construction, food, electronic appliances, packaging, furniture & interiors, footwear, transportation, and automotive.

Market Dynamics

Drivers:

- Ongoing production trend of bio-based and eco-friendly products

There is rising demand for bio-based and eco-friendly materials that are derived from renewable sources and are less likely to be harmful and toxic to public health or the environment. This has led to the proliferation of bio-based plastics. For instance, according to the Berlin-based trade association European Bioplastics, demand for bioplastics is expanding, with global industrial output is expected to reach 2.62 million tons annually by 2023. This factor has led to the rising demand for natural oil polyols for the production of bio-based and eco-friendly plastics.

- Growing demand for polyols in various industrial applications

Polyols are mainly used for the manufacture of polyurethane resins which are extensively being used in durable elastomers, flexible & rigid foams, and high-performance adhesives and sealants, fibers, seals, gaskets, and carpet underlay. The automotive and construction industries are the major end-users with a constantly growing demand for polyurethane foams. In addition, the demand for polyurethane rigid foam is growing due to other applications such as insulation of walls, roofs, panels, and doors for effective temperature control within automotive. Such applications are fueling the growth of the global natural oil polyols market.

Restraints:

- Stringent government regulations

National Emission Standards for Hazardous Air Pollutants (NESHAP), are the emission standards set by the U.S. Environmental Protection Agency. These standards restrict the usage of polyurethane foam due to the emission of harmful gases. Such emissions are hazardous to humans, as it causes skin, throat, eye, nose, and lung irritation. Hence, a number of national and international environmental protection agencies are taking protective measures on the use or production of materials causing emission. This factor primarily hampers the growth of the market.

Opportunities:

- The rise in demand from furniture Industry

The rapid economic growth across the developed, as well as developing countries, has led to a positive impact on the corporate and realty sectors, creating significant demand for furniture. In addition to this, rising disposal incomes across developing countries have boosted spending on home furniture. However, the most common product used for the manufacture of furniture is foam made out of polyurethane. Hence, this demand for polyurethane across the furniture industry is anticipated to create lucrative growth opportunities for the natural oil polyols market.

Challenges:

- Decrease in demand for natural oil polyols during the COVID-19 pandemic

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. The pandemic has caused a considerable economic downturn across the globe with a huge influence on the growth of different industrial sectors. This has led to the reduction in demand for natural oil polyols in major end-user industries such as the automotive and furniture sectors. This is one of the major challenges faced by the natural oil polyols market.

Request Sample:- Global Natural oil polyols market

Segmentation Analysis

The global natural oil polyols market has been segmented based on product, application, and regions.

By Product

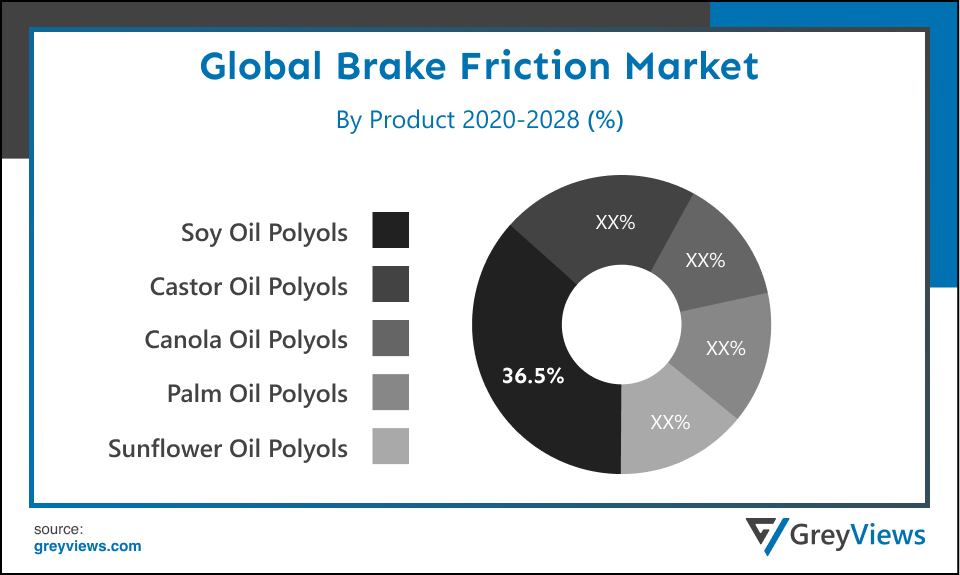

- The product segment includes soy oil polyols, castor oil polyols, canola oil polyols, palm oil polyols, and sunflower oil polyols. The soy oil polyols segment led the natural oil polyols market with a market share of around 36.5% in 2020. The growth of this segment is mainly driven by an upsurge in demand for soy oil polyols for use in food and animal feed along with alternative industrial applications including fuel additives and other polymers. However, the castor oil segment is expected to witness the highest growth rate during the Projection period. This is due to the rising usage of castor oil polyols in the production of semi-rigid or rigid polyurethane foams, composites, polyurethane adhesives & coatings, and elastomers across the different industrial applications.

By End-Use

- The end-user segment includes furniture & interiors, construction, electrical & electronic appliances, footwear, automotive, packaging, and others. The construction segment held the largest market share of 32.1% in 2020. This growth is mainly attributed to the huge adoption of polyurethanes in the construction of walls and roofs of buildings. Also, the surge in construction activities is projected to create lucrative growth opportunities for this segment. However, the furniture and interiors segment is projected to witness the highest growth rate during the Projection period.

By Regional Analysis

The regions analyzed for the natural oil polyols market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The North American region dominated the natural oil polyols market and held the 42% share of the market revenue in 2020.

- The number of factors such as the high availability of Soy in the U.S.; supportive government regulations; and surge in biofuel demand drives the growth of the North American natural oil polyols market. In addition to this, rising demand from end-use industries including electrical and electronic appliances, construction, and furniture & interiors in the region is likely to help market growth in the region.

- The Asia Pacific region is likely to register significant growth during the Projection period owing to the rising spending on infrastructure development across the countries such as India and China, coupled with the strong availability of raw materials, such as palm oil and castor oil.

Key Industry Players Analysis

Key market players are focusing on new launches to improve their market position

The key players are now concentrating on implementing strategies such as adopting new technology, product innovations, mergers & acquisitions, joint venture, alliances, and partnerships to improve their market position in the global natural oil polyols industry.

For instance, in November 2020, Stepan Company launched STEPANQUAT Soleil, the new high-performing, sustainable, and hair conditioning agent.

In January 2021, BASF, one of the leading natural oil polyols industry players acquired Solvay’s polyamide (PA 6.6) business. This acquisition expands BASF’s polyamide capabilities with well-known and innovative products such as Technol.

In January 2021, Stepan Company has acquired INVISTA's aromatic polyester polyol business and associated assets. This acquisition includes two manufacturing sites, one in Wilmington, NC (United States) and the other in Vlissingen (the Netherlands), along with the intellectual property, inventory, customer relationships, and working capital.

- Stepan Company

- BASF SE

- Emery Oleochemicals

- Cargill Inc.

- Biobased Technologies

- Vertellus

- IFS Chemicals Group

- Huntsman Corporation

- Dow Chemical Company

- Emery Oleochemicals

Latest Development

- October 2021- BASF, one of the leading natural oil polyols industry players has developed a polyurethane (PU) foam that relies on a renewable polyol for a sports helmet. This product development has expanded the portfolio of BASF.

- September 2021- Cargill acquired Arkema’s epoxides business which includes a facility located in Blooming Prairie, Minnesota. This acquisition is attributed to the rising demand for bio-based industrial solutions.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

6.4% |

|

Market Size |

7.1 Billion |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product Type, End Use, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Stepan Company, BASF SE, Emery Oleochemicals, Cargill Inc, Cargill Inc, Vertellus, IFS Chemicals Group, Huntsman Corporation, Dow Chemical Company, and Emery Oleochemicals |

|

By Product Type |

|

|

By End Use |

|

|

Regional scope |

|

Scope of the Report

Global Natural oil polyols Market by Product:

- Soy Oil Polyols

- Castor Oil Polyols

- Canola Oil Polyols

- Palm Oil Polyols

- Sunflower Oil Polyols

Global Natural Oil Polyols Market by End-use:

- Furniture & Interiors

- Construction

- Electrical & Electronic Appliances

- Footwear

- Automotive

- Packaging

- Others

Global Natural Oil Polyols Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market value of the Natural Oil Polyols Market in 2020?

The market value of the Natural Oil Polyols Market in 2020 is $ 7.1 Billion.

Which is the most influencing segment growing in the Natural Oil Polyols report?

Soy Oil Polyols segment is the most influencing segment in the Natural Oil Polyols market.

Which region has the highest market share in Natural Oil Polyols Market?

North America held the major share in the market over the Projection period 2021- 2028.

Which are the Top players active in the Natural Oil Polyols market?

The leading market players active in the global Natural Oil Polyols market are Stepan Company, BASF SE, Emery Oleochemicals, Cargill Inc., Biobased Technologies, Vertellus, IFS Chemicals Group, Huntsman Corporation, Dow Chemical Company, and Emery Oleochemicals among others.

What are the segment considered in the global Natural Oil Polyols market?

Product, End-use, and regions are the three segments of the report.

Does this report include the impact of COVID-19 on the Natural Oil Polyols market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the Natural Oil Polyols market.

What is the study period of this market?

The Natural Oil Polyols market is studied from 2020 - 2028.

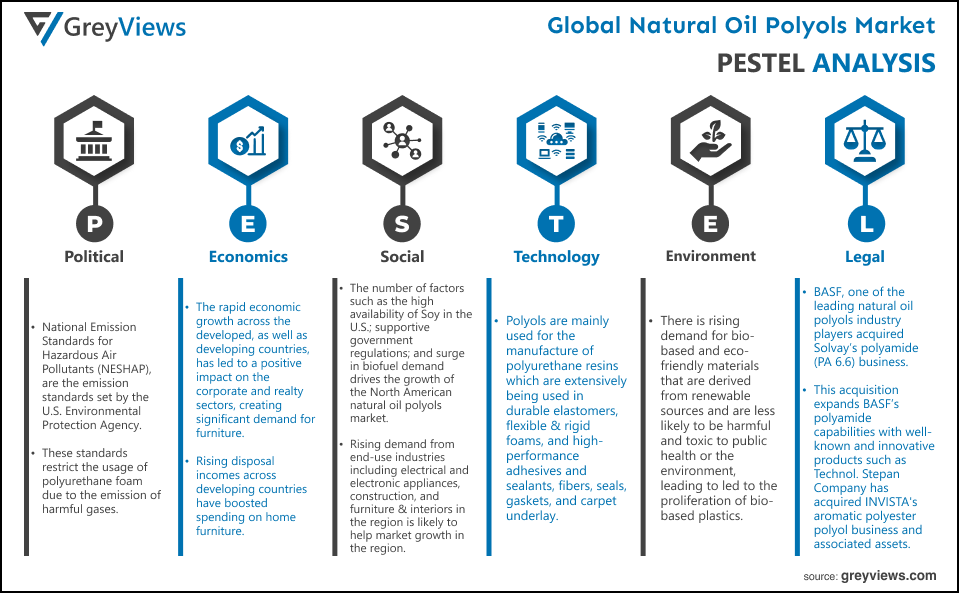

Political- National Emission Standards for Hazardous Air Pollutants (NESHAP), are the emission standards set by the U.S. Environmental Protection Agency. These standards restrict the usage of polyurethane foam due to the emission of harmful gases. Such emissions are hazardous to humans, as it causes skin, throat, eye, nose, and lung irritation. Hence, a number of national and international environmental protection agencies are taking protective measures on the use or production of materials causing emission. This factor primarily hampers the growth of the market.

Economic- The rapid economic growth across the developed, as well as developing countries, has led to a positive impact on the corporate and realty sectors, creating significant demand for furniture. In addition to this, rising disposal incomes across developing countries have boosted spending on home furniture. However, the most common product used for the manufacture of furniture is foam made out of polyurethane. Hence, this demand for polyurethane across the furniture industry is anticipated to create lucrative growth opportunities for the natural oil polyols market.

Social- The number of factors such as the high availability of Soy in the U.S.; supportive government regulations; and surge in biofuel demand drives the growth of the North American natural oil polyols market. In addition to this, rising demand from end-use industries including electrical and electronic appliances, construction, and furniture & interiors in the region is likely to help market growth in the region. The Asia Pacific region is likely to register significant growth during the Projection period owing to the rising spending on infrastructure development across the countries such as India and China, coupled with the strong availability of raw materials, such as palm oil and castor oil.

Technological- Polyols are mainly used for the manufacture of polyurethane resins which are extensively being used in durable elastomers, flexible & rigid foams, and high-performance adhesives and sealants, fibers, seals, gaskets, and carpet underlay. The automotive and construction industries are the major end-users with a constantly growing demand for polyurethane foams. In addition, the demand for polyurethane rigid foam is growing due to other applications such as insulation of walls, roofs, panels, and doors for effective temperature control within automotive. Such applications are fueling the growth of the global natural oil polyols market.

Environmental- There is rising demand for bio-based and eco-friendly materials that are derived from renewable sources and are less likely to be harmful and toxic to public health or the environment. This has led to the proliferation of bio-based plastics. For instance, according to the Berlin-based trade association European Bioplastics, demand for bioplastics is expanding, with global industrial output is expected to reach 2.62 million tons annually by 2023. This factor has led to the rising demand for natural oil polyols for the production of bio-based and eco-friendly plastics.

Legal- BASF, one of the leading natural oil polyols industry players acquired Solvay’s polyamide (PA 6.6) business. This acquisition expands BASF’s polyamide capabilities with well-known and innovative products such as Technol. Stepan Company has acquired INVISTA's aromatic polyester polyol business and associated assets. This acquisition includes two manufacturing sites, one in Wilmington, NC (United States) and the other in Vlissingen (the Netherlands), along with the intellectual property, inventory, customer relationships, and working capital.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product

- Market Attractiveness Analysis By End-use

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Ongoing production trend of bio-based and eco-friendly products

- Growing demand for polyols in various industrial applications

- Restrains

- Stringent government regulations

- Opportunities

- Rise in demand from furniture Industry

- Challenges

- Decrease in demand for natural oil polyols during the COVID-19 pandemic

- Global Natural Oil Polyols Market Analysis and Projection, By Product

- Segment Overview

- Soy Oil Polyols

- Castor Oil Polyols

- Canola Oil Polyols

- Palm Oil Polyols

- Sunflower Oil Polyols

- Global Natural Oil Polyols Market Analysis and Projection, By End-use

- Segment Overview

- Furniture & Interiors

- Construction

- Electrical & Electronic Appliances

- Footwear

- Automotive

- Packaging

- Others

- Global Natural Oil Polyols Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Natural Oil Polyols Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Natural Oil Polyols Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Stepan Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BASF SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Emery Oleochemicals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Cargill Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Biobased Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Vertellus

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- IFS Chemicals Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Huntsman Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Dow Chemical Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Emery Oleochemicals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Stepan Company

List of Table

- Global Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Global Soy Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Castor Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Canola Oil Polyolss Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Palm Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Sunflower Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Global Furniture & Interiors Natural Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Construction Natural Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Electrical & Electronic Appliances Natural Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Footwear Natural Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Automotive Natural Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Packaging Natural Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Others Natural Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Natural Oil Polyols Market, By Region, 2020–2028(USD Billion) (Kilotons)

- Global Natural Oil Polyols Market, By North America, 2020–2028(USD Billion) (Kilotons)

- North America Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- North America Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- US Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- US Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Canada Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Canada Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Mexico Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Mexico Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Europe Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Europe Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Germany Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Germany Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- France Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- France Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- UK. Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- UK Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Italy Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Italy Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Spain Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Spain Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Asia Pacific Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Asia Pacific Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Japan Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Japan Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- China Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- China Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- India Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- India Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- South America Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- South America Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Brazil Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Brazil Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- Middle East and Africa Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- Middle East and Africa Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- UAE Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- UAE Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

- South Africa Natural Oil Polyols Market, By Product, 2020–2028(USD Billion) (Kilotons)

- South Africa Natural Oil Polyols Market, By End-use, 2020–2028(USD Billion) (Kilotons)

List of Figures

- Global Natural Oil Polyols Market Segmentation

- Natural Oil Polyols Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Natural Oil Polyols Market Attractiveness Analysis By Product

- Global Natural Oil Polyols Market Attractiveness Analysis By End-use

- Global Natural Oil Polyols Market Attractiveness Analysis By Region

- Global Natural Oil Polyols Market: Dynamics

- Global Natural Oil Polyols Market Share By Product(2021 & 2028)

- Global Natural Oil Polyols Market Share By End-use(2021 & 2028)

- Global Natural Oil Polyols Market Share by Regions (2021 & 2028)

- Global Natural Oil Polyols Market Share by Company (2020)