Global Power Rental Systems Market Size by End-user (Government & Utilities, Oil & Gas, Construction, Industrial, Event Management, and Others), Application (Peak Shaving, Continuous Power, and Standby Power), Regions, Segmentation and Projection till 2028

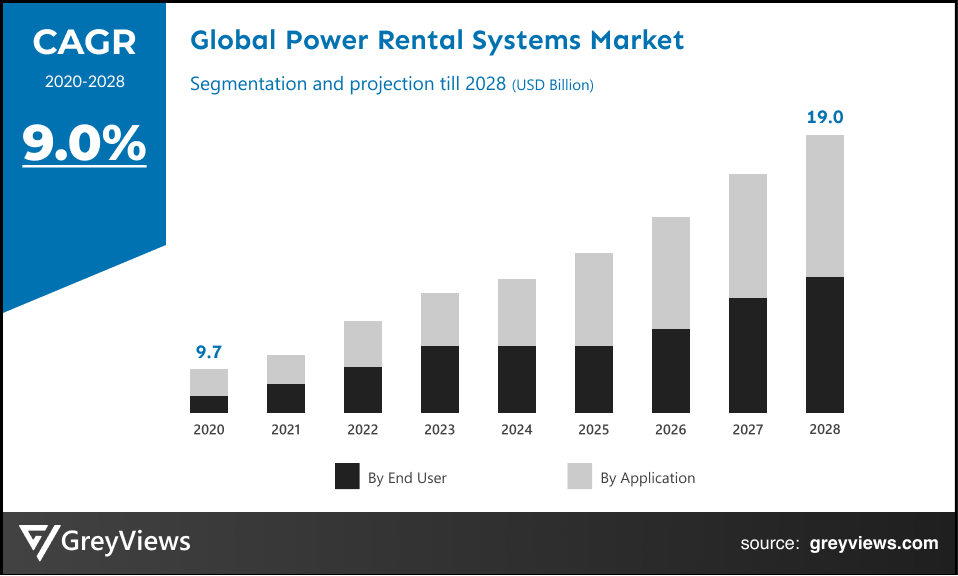

CAGR: 9.0%Current Market Size: USD 9.7 Billion Fastest Growing Region: MEA

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Power Rental Systems Market- Market Overview

The global power rental systems market is expected to grow from USD 9.7 Billion in 2020 to USD 19.0 Billion by 2028, at a CAGR of 9.0% during the Projection period 2021-2028. This growth of the power rental systems market is significantly driven by huge consumption of electricity for industrial and commercial applications. Supply-demand gap in the power market has led to the demand for power rental systems.

Power rental systems are the back-up systems that provides a number of industrial and commercial applications with a power supply during the times of power suspension to keep processes running. These systems generally comprise of load banks, transformers, and power generators that offers the feature of temporarily renting power to supply energy to industrial units. These systems are rapidly being implemented across a range of commercial and industrial uses to offer extra energy to industries to subsist with power shortages.

These systems provide lucrative properties including adaptability, high speed, dependability, and cost-efficiency to businesses. While implementing the power rental systems, flexibility, ease of use, power features, reporting capabilities, and reliability features are considered.

Request Sample:- Global Power Rental Systems market

Market Dynamics

Drivers:

- Constant power supply demand from oil & gas and mining industries

Industrial energy consumption is significantly growing across the mining and oil & gas industries. For instance, the industrial energy consumption of U.S. mining industry (excluding gas & oil) is about 1,246 (TBtu/yr) Trillion Btu/year . Also, the industrial energy consumption of an offshore oil & gas platforms is around 16 terawatt-hours a year to power their operations, while an uninterrupted power supply (UPS) has become crucial for the oil & gas sector. Hence, constant power supply demand from oil & gas and mining industries significantly boosts growth of power rental systems market.

- Emerging need for continuous power supply and electrification in developing countries

The need for expansion of power supply has led to various strategies by developing countries. For instance, the government of India has created corporations such as State Electricity Boards (SEB), NTPC Limited, and NHPC limited to meet power supply demands. Despite such strategies, the issue of shortage of electric power supply has not been solved in the country. Hence, such countries are heavily investing in infrastructural activities, fueling the adoption of power rental systems.

Restraints:

- Enforcement of strict regulations related to the reduction of emission in fossil fuel-powered equipment

The need for reducing greenhouse gas emissions from the industrial sector has led to enforcement of strict regulations related to the reduction of emissions in fossil fuel-powered equipment. For instance, the United States Environmental Protection Agency (EPA) has an authority under the Clean Air Act to regulate and monitor greenhouse gas emissions. Such Agencies poses regulations on fossil fuel-powered equipment in order to reduce greenhouse gas emissions.

Opportunities:

- Introduction of digital technology solutions for the operation enhancement

There is an emerging trend of smart grid technology that reduces the amount and duration of electricity outages owing to enhanced network monitoring. Moreover, a typical smart grid automatically redirects power, which enables faster electricity restoration after outages. Smart grid technology uses digital technology solutions for the operation enhancement in the energy and power sector. This has created lucrative growth opportunities for the power rental systems market.

Challenges:

- Fluctuations due to COVID-19

Owing to the unprecedented crisis of COVID-19, a number of countries have employed nationwide lockdowns. However, as they are reopening, safety measures such as social distancing are still being applied. This has caused a significant economic downturns across the globe. Due to a slowdown in industrial activities and consumer markets, the power rental systems industry has been impacted. Thus, the emergence of the COVID-19 pandemic has posed challenges to the global power rental systems market.

Segmentation Analysis

The global power rental systems market has been segmented based on End-user, Application, and regions.

By End-user

- The end-user segment includes government & utilities, oil & gas, construction, industrial, and event management, and others. The government & utility segment led the power rental systems market with a market share of around 26.5% in 2020. The usage of power rental systems is are rapidly being adopted in the government and utility sector as it helps these industries to distribute power loads between non-peak and peak hours; hence, reducing the electrical power cost significantly. On the other hand, the oil and gas sector is projected to witness the highest growth rate during the Projection period. The growth of this segment is mainly driven by the growing oil & gas industry in the Middle East and the Asia-Pacific, along with the supply-demand gap in the power sector.

By Application

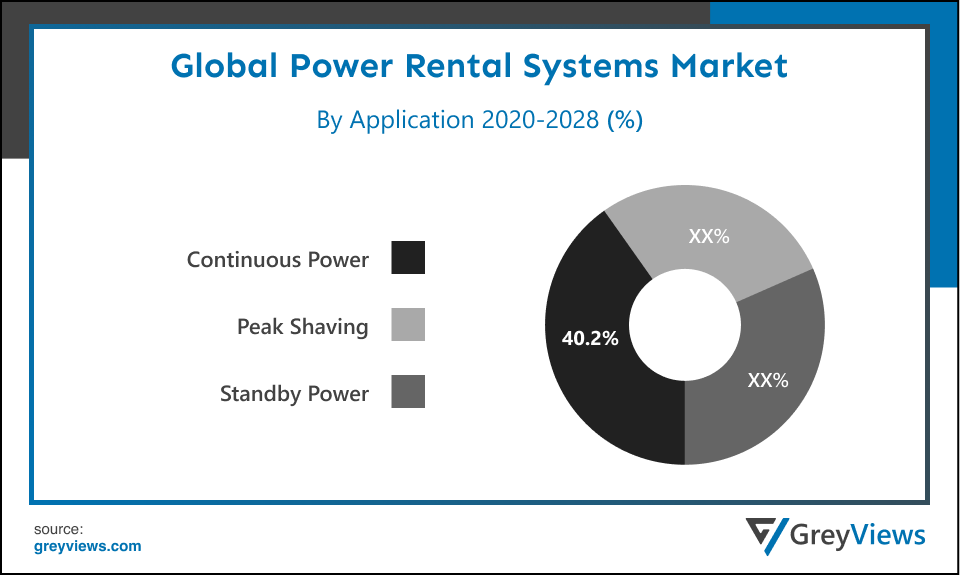

- The application segment includes peak shaving, continuous power, and standby power. The continuous power segment held the largest market share of 40.2% in 2020. The growth of this segment is mainly driven by the rapidly growing adoption of power rental systems in the construction, oil & gas, and mining sectors. The aforementioned sectors usually need a continuous electricity supply as they are distant from the power grid areas. In addition to this, the rise in demand for continuous power across the government offices, telecommunication centers, and hospitals fueling the growth of the continuous power segment.

By Regional Analysis

The regions analyzed for the power rental systems market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the power rental systems market and held the 37.40% share of the market revenue in 2020.

- In Asia-Pacific, growing electricity consumption in emerging countries such as China and India along with the emerging industrial applications of the power rental systems boosts the market. In addition to this, the region are experiencing the rapid proliferation of commercial spaces including hotels, malls, and retail stores, which, in turn, enhanced the demand for a stable power supply. The aforementioned factors drive the growth of the Asia-Pacific power rental systems market.

- The Middle East and Africa region are likely to register significant growth during the Projection period. The growth of this region is mainly driven by collective demand for power rental units in the construction, oil & gas, and industrial sectors among the countries, including Qatar, Iraq, Saudi Arabia, and UAE. On the other hand, North America is one of the pioneers in the global power rental systems market.

Key Industry Players Analysis

Key market players are focusing on partnership agreements for improving their position in the global power rental system market

The key players are concentrating on implementing new strategies to improve their market position in the global power rental systems industry such as adopting new technology, mergers & acquisitions, product innovations, alliances, joint venture, and partnerships.

For instance, In August 2020, Cumulus announced a partnership agreement with United Rentals, Inc., one of the leading equipment rental companies, with locations throughout the U.S. and Canada. Through this agreement, Cumulus is designated as United Rentals’ strategic supplier for flange management software.

In June 2018, Trackunit, Inc., a global innovator of telematics technology partnered with United Rentals, Inc., the largest equipment rental company to offer premium telematics solutions for the United Rentals fleet.

In March 2018, Caterpillar, one of the leading market players launched a National Accounts VIP Rental Program to meet the momentary power needs of larger businesses that are operating in different regions by providing customized services and resources quickly and conveniently.

- Atlas Copco AB

- Aggreko

- Caterpillar

- United Rentals

- Cummins, Inc.

- Generac Power Systems, Inc.

- Kohler Co.

- Wacker Neuson SE.

- Ashtead Group plc.

- HERC Rentals Inc.

Latest Development

- August 2021- A North American equipment rental supplier named Holdings Inc., acquired all the assets of Texas-based CBS Rentals (CBS) which strengthened the rental portfolio of the company.

- September 2021- A leading global designer & manufacturer of energy technology solutions named Generac Power Systems launched PWRmanager, which works as the load management system for Generac's renowned PWRcell Energy Storage System.

- May 2021- Kohler Power, one of the leaders in energy solutions and power generation, launched the KOHLER Power Reserve energy storage systems which is an expansion of its clean energy offering and part of its initiative to support sustainability innovations.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

9.0% |

|

Market Size |

9.7 Billion |

|

Projection unit |

Value (USD) |

|

Segments covered |

End-user, Application, Region |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Atlas Copco AB, Aggreko, Caterpillar, United Rentals, Cummins, Inc., Generac Power Systems, Inc., Kohler Co., Wacker Neuson SE., Ashtead Group plc., and HERC Rentals Inc. among others |

|

By End-user |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Power Rental Systems Market by End-user:

- Government & utilities

- Oil & gas

- Construction

- Industrial

- Event Management

- Others

Global Power Rental Systems Market by Application:

- Peak Shaving

- Continuous Power

- Standby Power

Global Power Rental Systems Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Power Rental Systems Market?

Global power rental systems market is expected to reach USD 19.0 Billion by 2028, at a CAGR of 9.0% from 2021 to 2028.

Which regions have been studied for the regional analysis of the global Power Rental Systems market?

The regions analyzed for the Power Rental Systems market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

What is the segmentation considered for the analysis of global Power Rental Systems market?

The global power rental systems market has been segmented based on end-user, application, and regions.

Which are the leading market players active in the Power Rental Systems market?

leading market players active in the global power rental systems market are Atlas Copco AB, Aggreko, Caterpillar, United Rentals, Cummins, Inc., Generac Power Systems, Inc., Kohler Co., Wacker Neuson SE., Ashtead Group plc., HERC Rentals Inc. among others.

What are the key drivers of the Power Rental Systems market?

Constant power supply-demand from the oil & gas and mining industries is one of the major factors driving the growth of the power rental systems market.

What are the ongoing trends that are projected to influence the market in the upcoming years?

Huge consumption of electricity for industrial and commercial applications, enforcement of strict regulations related to the reduction of emission in fossil fuel-powered equipment.

What are the detailed impacts of the COVID-19 pandemic on the global market?

Lockdowns imposed by the governments in various countries have temporarily suspended manufacturing activities, travel bans, and production shutdowns. The aforementioned factors have led to the reduced demand for power rental systems, hampering the growth of the market.

How the company profile has been selected?

Based on the sales revenue, product offering, and regional presence, the companies are selected.

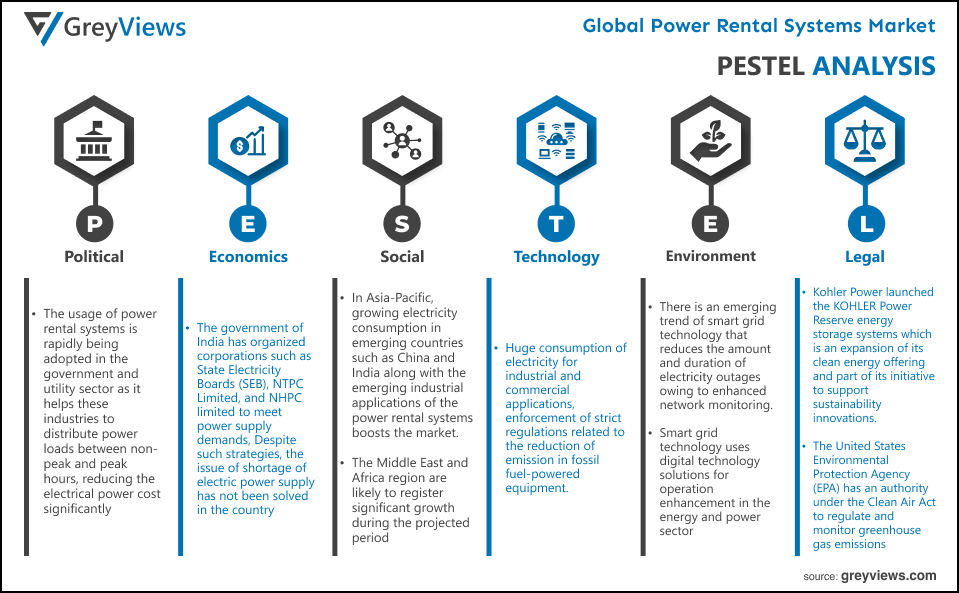

Political- The usage of power rental systems is rapidly being adopted in the government and utility sector as it helps these industries to distribute power loads between non-peak and peak hours; hence, reducing the electrical power cost significantly. This forced the government in several countries to shift to greenhouse gases to reduce the emission of harmful gases. The government and political parties enforced laws and regulations which will pressurise the companies in reducing the usage of harmful gases.

Economic- The need for expansion of power supply has led to various strategies by developing countries. For instance, the government of India has organized corporations such as State Electricity Boards (SEB), NTPC Limited, and NHPC limited to meet power supply demands. Despite such strategies, the issue of shortage of electric power supply has not been solved in the country. Hence, such countries are heavily investing in infrastructural activities, fueling the adoption of power rental systems.

Social- In Asia-Pacific, growing electricity consumption in emerging countries such as China and India along with the emerging industrial applications of the power rental systems boosts the market. In addition to this, the region is experiencing the rapid proliferation of commercial spaces including hotels, malls, and retail stores, which, in turn, enhanced the demand for a stable power supply. The aforementioned factors drive the growth of the Asia-Pacific power rental systems market. The Middle East and Africa region are likely to register significant growth during the Projection period. The growth of this region is mainly driven by collective demand for power rental units in the construction, oil & gas, and industrial sectors among the countries, including Qatar, Iraq, Saudi Arabia, and UAE. On the other hand, North America is one of the pioneers in the global power rental systems market.

Environmental- Huge consumption of electricity for industrial and commercial applications, enforcement of strict regulations related to the reduction of emission in fossil fuel-powered equipment. Kohler Power, one of the leaders in energy solutions and power generation, launched the KOHLER Power Reserve energy storage systems which is an expansion of its clean energy offering and part of its initiative to support sustainability innovations.

Technological- There is an emerging trend of smart grid technology that reduces the amount and duration of electricity outages owing to enhanced network monitoring. Moreover, a typical smart grid automatically redirects power, which enables faster electricity restoration after outages. Smart grid technology uses digital technology solutions for operation enhancement in the energy and power sector. This has created lucrative growth opportunities for the power rental systems market.

Legal- The need for reducing greenhouse gas emissions from the industrial sector has led to the enforcement of strict regulations related to the reduction of emissions in fossil fuel-powered equipment. For instance, the United States Environmental Protection Agency (EPA) has an authority under the Clean Air Act to regulate and monitor greenhouse gas emissions. When any industry is seen not abiding by the regulation, legal actions are taken against them. Such Agencies poses regulations on fossil fuel-powered equipment in order to reduce greenhouse gas emissions.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By End-user

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Constant power supply demand from oil & gas and mining industries

- Emerging need for continuous power supply and electrification in developing countries

- Restrains

- Enforcement of strict regulations related to the reduction of emission in fossil fuel-powered equipment

- Opportunities

- Emergence of cost-effective production techniques

- Challenges

- Introduction of digital technology solutions for the operation enhancement

- Global Power Rental Systems Market Analysis and Projection, By End-user

- Segment Overview

- Government & utilities

- Oil & Gas

- Construction

- Industrial

- Event Management

- Others

- Global Power Rental Systems Market Analysis and Projection, By Application

- Segment Overview

- Peak Shaving

- Continuous Power

- Standby Power

- Agricultural Chemicals

- Others

- Global Power Rental Systems Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Power Rental Systems Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Power Rental Systems Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- End-user Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Atlas Copco AB

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- Aggreko

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- Caterpillar

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- United Rentals

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- Cummins, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- Generac Power Systems, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- Kohler Co.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- Wacker Neuson SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- Ashtead Group plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- HERC Rentals Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company End-user Portfolio

- Recent Developments

- SWOT Analysis

- Atlas Copco AB

List of Table

- Global Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Global Government & utilities Market, By Region, 2020–2028(USD Billion)

- Global Oil & Gas Market, By Region, 2020–2028(USD Billion)

- Global Constructions Market, By Region, 2020–2028(USD Billion)

- Global Industrial Market, By Region, 2020–2028(USD Billion)

- Global Event Management Market, By Region, 2020–2028(USD Billion)

- Global Others Market, By Region, 2020–2028(USD Billion)

- Global Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Global Peak Shaving Power Rental Systems Market, By Region, 2020–2028(USD Billion)

- Global Continuous Power Power Rental Systems Market, By Region, 2020–2028(USD Billion)

- Global Standby Power Power Rental Systems Market, By Region, 2020–2028(USD Billion)

- Global Power Rental Systems Market, By Region, 2020–2028(USD Billion)

- Global Power Rental Systems Market, By North America, 2020–2028(USD Billion)

- North America Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- North America Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- USA Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- USA Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Canada Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Canada Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Mexico Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Mexico Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Europe Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Europe Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Germany Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Germany Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- France Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- France Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- UK Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- UK Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Italy Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Italy Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Spain Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Spain Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Asia Pacific Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Asia Pacific Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Japan Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Japan Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- China Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- China Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- India Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- India Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- South America Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- South America Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Brazil Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Brazil Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- Middle East and Africa Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- Middle East and Africa Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- UAE Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- UAE Power Rental Systems Market, By Application, 2020–2028(USD Billion)

- South Africa Power Rental Systems Market, By End-user, 2020–2028(USD Billion)

- South Africa Power Rental Systems Market, By Application, 2020–2028(USD Billion)

List of Figures

- Global Power Rental Systems Market Segmentation

- Power Rental Systems Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Power Rental Systems Market Attractiveness Analysis By End-user

- Global Power Rental Systems Market Attractiveness Analysis By Application

- Global Power Rental Systems Market Attractiveness Analysis By Region

- Global Power Rental Systems Market: Dynamics

- Global Power Rental Systems Market Share By End-user(2021 & 2028)

- Global Power Rental Systems Market Share By Application(2021 & 2028)

- Global Power Rental Systems Market Share by Regions (2021 & 2028)

- Global Power Rental Systems Market Share by Company (2020)