Global Video Surveillance Market Size by Offering (Hardware, Software, and Service), System (Analog Video Surveillance Systems and IP Video Surveillance Systems), Vertical (Commercial, Infrastructure, Military & Defense, Residential, Public Facility, and Industrial), Regions, Segmentation and Projection till 2028

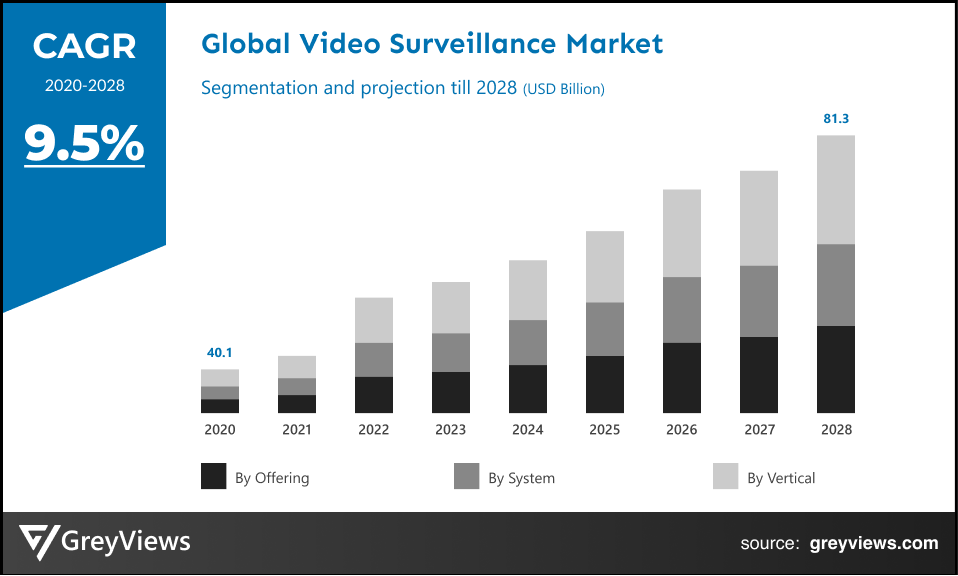

CAGR: 9.5%Current Market Size: USD 40.1 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Video Surveillance Market- Market Overview

The global Video Surveillance market is expected to grow from USD 40.1 Billion in 2020 to USD 81.3 Billion by 2028, at a CAGR of 9.5% during the Projection period 2021-2028. This growth of the Video Surveillance market is significantly driven by significant growth in concerns for security along with ongoing trend of smart city infrastructure development.

Video Surveillance is the system which monitors activity in building or an area using a television system. It comprises of a system of cameras, recorders, and monitors/display units. Such surveillance systems can both be applied to exterior and interior areas of an exterior or building. It can operate 24/7, set to record during particular times of the day, or can be designed for recording in response to movement. The footage from video surveillance systems can be monitored distantly by a monitoring company, monitored live by a security guard, or can simply be recorded and stored by a digital video recorder or network video recorder for review later should the need arise.

Such systems are rapidly being adopted by governments, financial institutions, enterprises, and healthcare organizations to meet security demands. For instance, video surveillance systems such as closed-circuit television (CCTV) are extensively being installed in a range of locations such as commercial buildings and public infrastructures among others.

Request Sample:- Global Video Surveillance Market

Market Dynamics

Drivers:

- Significant growth in adoption of IP/Network-based CCTV Cameras

IP/Network-based CCTV Camera is the type of digital security camera and a connected device which receives and sends video footage through an IP network. In addition to this, such cameras capture images in high resolution to enable automatic alerts and video analytics. The aforementioned technological features of IP/Network-based CCTV Camera have boosted its adoption across the globe, fueling the global video surveillance market. Moreover, the need for remote monitoring has fueled the adoption of such cameras in departmental stores, food chains, workshops, malls, and factory among other public places to keep a check on the activities.

- The surge in public safety and security concerns

Safety and security challenges have become the most pressing issues in the past few years, due to urbanization and increased population. Concerns such as terrorism and environmental disasters have impacted millions of lives across the globe. This has led to the proliferation of public video surveillance which meets demands generated by strict public safety policies. In addition to this, modern video surveillance systems are utilizing advanced technologies such as facial recognition to identify criminals and help authorities to track them down. Hence, the surge in public safety and security concerns coupled with the usage of video surveillance systems boosts the growth of the market.

Restraints:

- Lack of professional expertise and high investment cost

The installation, commissioning, maintenance, or operation of video surveillance systems needs professional expertise. In addition, the cost is a significant and determining factor while selecting a system and video surveillance systems. However, high-quality CCTV systems require a significantly high initial investment. These factors may hamper the growth of the market to some extent during the Projection period.

Opportunities:

- The rise in demand for AI-based video surveillance systems

IP cameras powered by Artificial Intelligence (AI) analytics have emerged as one of the newest technological advancements in the global video surveillance industry. In such systems, machine learning algorithms help to detect people and objects such as vehicles and more. The demand for such video surveillance systems is growing at a rapid pace across the globe. For instance, police in New Orleans, New York, and Atlanta use surveillance cameras that are equipped with video analytics to improve investigations.

Challenges:

- Need for high-capacity storage systems

Modern video surveillance systems offer capabilities such as higher image resolution, more active cameras, longer archival periods, and intelligent video recognition. However, such capabilities demand abundant storage capacity. This factor is expected to challenge the growth of the market as significant investment is needed for the high-capacity storage systems.

Segmentation Analysis

The global Video Surveillance market has been segmented based on offering, system, vertical, and regions.

By Offering

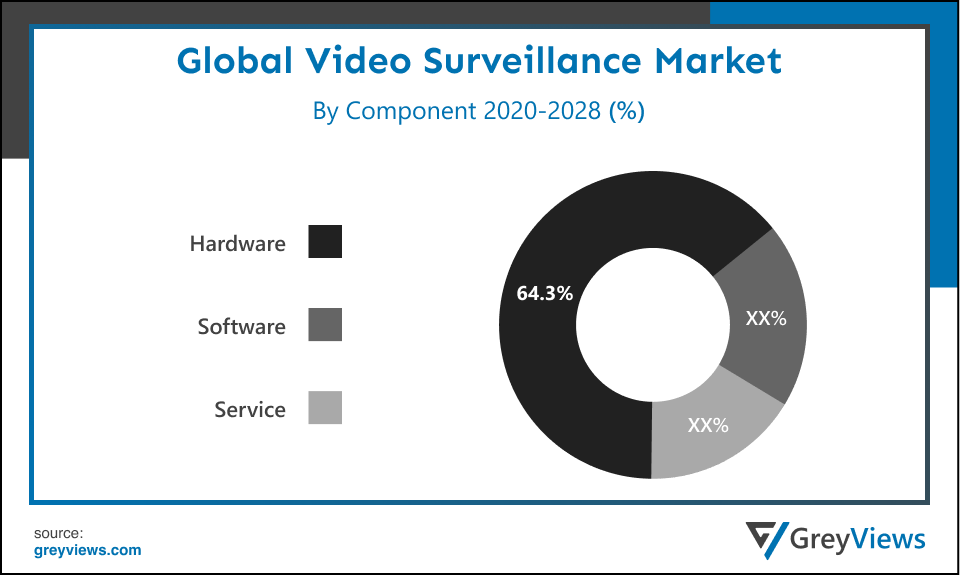

- The offering segment includes hardware, software, and service. The hardware segment led the video surveillance market with a market share of around 64.3% in 2020. This is due to the tremendous growth in the deployment of cameras across the globe as a result of rising security concerns. In addition to this, rising shift towards IP cameras has boosted innovations associated with the hardware to offer enhanced object tracking as well as low light performance. However, the services segment is expected to witness the highest growth rate during the Projection period.

By System

- The system segment includes analog video surveillance systems and IP video surveillance systems. The IP video surveillance systems segment led the video surveillance market with a market share of around 68.1% in 2020. IP video surveillance camera has enhanced capabilities as compared with the analog camera as it performs digital processing in the camera. In addition to this, such systems offer features such as product scalability and high resolution. Such features primarily boost the growth of the segment. Further, this segment is expected to witness the highest growth rate during the Projection period due to its futuristic capabilities such as detecting and preventing undesirable behaviors, such as shoplifting, vandalism, thefts, and even terror attacks.

By Vertical

- The application segment includes commercial, infrastructure, military & defense, residential, public facility, and industrial. The commercial segment held the largest market share of 36.6% in 2020. The growth of this segment is mainly driven by rising security concerns across applications, such as enterprises, retail, and banks & financial institutes among others. The commercial sector is adopting security surveillance systems to avoid security breaches such as inventory loss, unauthorized access, and robbery among other criminal activities. However, the infrastructure segment is expected to witness the highest growth rate during the Projection period.

By Regional Analysis

The regions analyzed for the Video Surveillance market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa. The Asia-Pacific region dominated the video surveillance market and held the 53.2% share of the market revenue in 2020.

- The growth of the Asia-Pacific video surveillance market is mainly driven by rapid growth in investment for smart cities development coupled with rising security threats among countries such as China, India, and Japan. In addition to this, the region is seeing tremendous growth in a number of retail chains, residential apartments, small businesses, and hospitality businesses, which demands advanced capability-enabled video surveillance systems. Further, the government initiatives for the installation of video surveillance systems in public places including airports, colleges, religious places, and schools are projected to boost the growth of the market.

- The North American region is likely to register significant growth during the Projection period due to the rise in threats of terror attacks, growth in incidences of officer brutality, and an upsurge in criminal activities.

Key Industry Players Analysis

Key market players are focusing on acquisition to improve their market position

The key players are now concentrating on implementing strategies such as adopting new mineral types, product innovations, mergers & acquisitions, joint ventures, alliances, and partnerships to improve their market position in the global Video Surveillance industry.

For instance, in June 2021, one of the largest security camera manufacturers company named Hangzhou Hikvision Digital Technology Co., Ltd., acquired a major stake in Mexico's largest security systems distributor named Syscom.

In August 2018, Avigilon Corporation which is a Motorola Solutions company launched a new Avigilon Artificial Intelligence Appliance (AI Appliance) which is integrated with self-learning video analytics and Avigilon Appearance Search technology to any of the IP cameras.

In February 2018, Dahua Technology Co., Ltd., one of the leading market players acquired Lorex Technology, the Flir Systems SME security subsidiary based in Canada.

- Avigilon (Motorola Solutions)

- Axis Communications AB

- Aventura Technologies, Inc.

- Bosch Security Systems Gmbh (Robert Bosch Gmbh)

- Cisco Systems, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Dahua Technology Co., Ltd.

- Eagle Eye Networks

- Flir Systems, Inc.

- Pelco (Schneider Electric)

- Honeywell Security (Honeywell International Inc.)

- Panasonic Corporation

- The Infinova Group

- Verkada Inc.

Latest Development

- February 2021- Hangzhou Hikvision Digital Technology Co., Ltd., an IoT solution provider introduced the All-Rounder ITS camera, the latest traffic product offering mainly designed for improving road safety and optimizing traffic flow.

- June 2019- Avigilon Corporation, a Motorola Solutions company launched the Avigilon Blue platform in the United Kingdom. For the partners of Avigilon, this Avigilon Blue cloud service platform offers an easy-to-install, cloud-based video security solution.

Report Metrics

| Report Attribute | Details |

| Forecast period | 2021-2028 |

| Base year considered | 2020 |

| CAGR (%) | 9.5% |

| Market Size | 40.1 Billion in 2020 |

| Forecast unit | Value (USD) |

| Segments covered | Offering, System, Vertical, And Regions |

| Report Scope | Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Avigilon (Motorola Solutions), Axis Communications AB, Aventura Technologies, Inc., Bosch Security Systems Gmbh (Robert Bosch Gmbh), Cisco Systems, Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Eagle Eye Networks, Flir Systems, Inc., Pelco (Schneider Electric), Honeywell Security (Honeywell International Inc.), Panasonic Corporation, The Infinova Group, and Verkada Inc. among others. |

| By Offering |

|

| By System |

|

| By Vertical |

|

| Regional scope |

|

Scope of the Report

Global Video Surveillance Market by Offering:

- Hardware

- Software

- Service

Global Video Surveillance Market by System:

- Analog Video Surveillance Systems

- IP Video Surveillance Systems

Global Video Surveillance Market by Vertical:

- Commercial

- Infrastructure

- Military & Defense

- Residential

- Public Facility

- Industrial

Global Video Surveillance Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market value of the video surveillance Market in 2020?

The market value of the video surveillance Market in 2020 is $40.1 Billion.

Which region has the highest market share in the video surveillance market?

The Asia Pacific held the major share in the market over the Projection period 2021- 2028.

Which is the most influencing segment growing in the video surveillance report?

The hardware segment is the most influencing segment in the video surveillance market.

Which are the Top players active in the video surveillance market?

The leading market players active in the global video surveillance market are Avigilon (Motorola Solutions), Axis Communications AB, Aventura Technologies, Inc., Bosch Security Systems Gmbh (Robert Bosch Gmbh), Cisco Systems, Inc., Hangzhou Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Eagle Eye Networks, Flir Systems, Inc., Pelco (Schneider Electric), Honeywell Security (Honeywell International Inc.), Panasonic Corporation, The Infinova Group, and Verkada Inc. among others.

What are the segment considered in the global video surveillance market?

Offering, system, vertical, and regions are the four segments of the report.

Does this report include the impact of COVID-19 on the video surveillance market?

Yes, the market includes qualitative and quantitative insights for COVID-19 impact on the video surveillance market.

What is the study period of this market?

The video surveillance market is studied from 2020 - 2028.

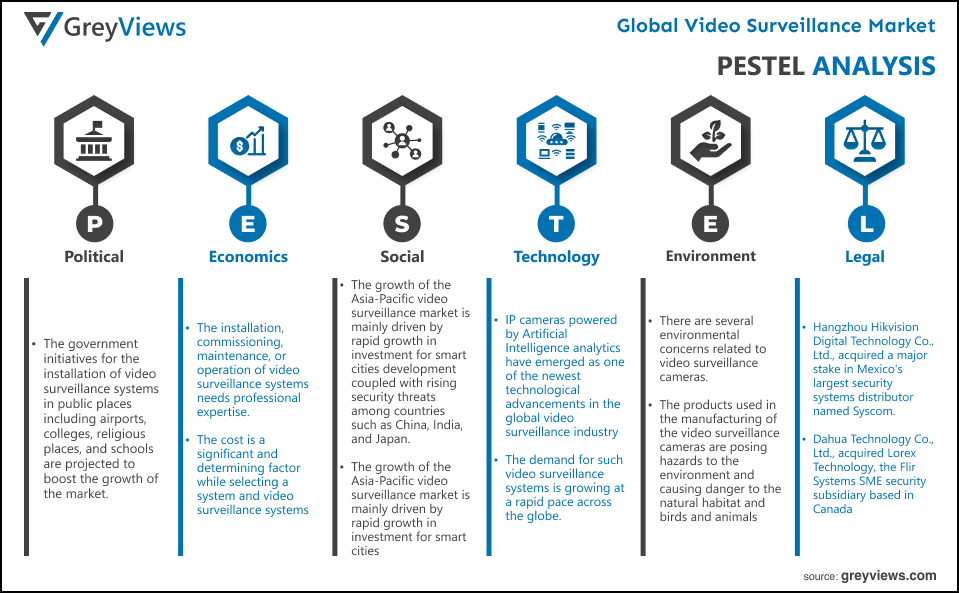

Political- The government initiatives for the installation of video surveillance systems in public places including airports, colleges, religious places, and schools are projected to boost the growth of the market.

Economic- The installation, commissioning, maintenance, or operation of video surveillance systems needs professional expertise. In addition, the cost is a significant and determining factor while selecting a system and video surveillance systems. However, high-quality CCTV systems require a significantly high initial investment. These factors may hamper the growth of the market to some extent during the Projection period.

Social- The growth of the Asia-Pacific video surveillance market is mainly driven by rapid growth in investment for smart cities development coupled with rising security threats among countries such as China, India, and Japan. In addition to this, the region is seeing tremendous growth in a number of retail chains, residential apartments, small businesses, and hospitality businesses, which demands advanced capability-enabled video surveillance systems. The growth of the Asia-Pacific video surveillance market is mainly driven by rapid growth in investment for smart cities development coupled with rising security threats among countries such as China, India, and Japan. In addition to this, the region is seeing tremendous growth in a number of retail chains, residential apartments, small businesses, and hospitality businesses, which demands advanced capability-enabled video surveillance systems.

Technological- IP cameras powered by Artificial Intelligence (AI) analytics have emerged as one of the newest technological advancements in the global video surveillance industry. In such systems, machine learning algorithms help to detect people and objects such as vehicles and more. The demand for such video surveillance systems is growing at a rapid pace across the globe. For instance, police in New Orleans, New York, and Atlanta use surveillance cameras that are equipped with video analytics to improve investigations.

Environmental- There are several environmental concerns related to video surveillance cameras. The products used in the manufacturing of the video surveillance cameras are posing hazards to the environment and causing danger to the natural habitat and birds and animals.

Legal- one of the largest security camera manufacturers company named Hangzhou Hikvision Digital Technology Co., Ltd., acquired a major stake in Mexico's largest security systems distributor named Syscom. Dahua Technology Co., Ltd., one of the leading market players acquired Lorex Technology, the Flir Systems SME security subsidiary based in Canada.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Offering

- Market Attractiveness Analysis By System

- Market Attractiveness Analysis By Vertical

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Significant growth in adoption of IP/Network-based CCTV Cameras

- Surge in public safety and security concerns

- Restrains

- Lack of professional expertise and high investment cost

- Opportunities

- Rise in demand for AI-based video surveillance systems

- Challenges

- Need for high-capacity storage systems

- Global Video Surveillance Market Analysis and Projection, By Offering

- Segment Overview

- Hardware

- Software

- Service

- Global Video Surveillance Market Analysis and Projection, By System

- Segment Overview

- Analog Video Surveillance Systems

- IP Video Surveillance Systems

- Global Video Surveillance Market Analysis and Projection, By Vertical

- Segment Overview

- Commercial

- Infrastructure

- Military & Defense

- Residential

- Public Facility

- Industrial

- Global Video Surveillance Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Video Surveillance Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Video Surveillance Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Offering Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Avigilon (Motorola Solutions)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Axis Communications AB

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Aventura Technologies, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Bosch Security Systems Gmbh (Robert Bosch Gmbh)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Cisco Systems, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Dahua Technology Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Eagle Eye Networks

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Flir Systems, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Pelco (Schneider Electric)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Honeywell Security (Honeywell International Inc.)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Panasonic Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- The Infinova Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Verkada Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Avigilon (Motorola Solutions)

List of Table

- Global Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Global Hardware Market, By Region, 2020–2028(USD Billion)

- Global Software Market, By Region, 2020–2028(USD Billion)

- Global Service Market, By Region, 2020–2028(USD Billion)

- Global Video Surveillance Market, By System, 2020–2028(USD Billion)

- Global Analog Video Surveillance Systems Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global IP Video Surveillance Systems Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Global Commercial Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global Infrastructure Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global Military & Defense Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global Residential Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global Public Facility Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global Industrial Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global Video Surveillance Market, By Region, 2020–2028(USD Billion)

- Global Video Surveillance Market, By North America, 2020–2028(USD Billion)

- North America Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- North America Video Surveillance Market, By System, 2020–2028(USD Billion)

- North America Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- US Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- US Video Surveillance Market, By System, 2020–2028(USD Billion)

- US Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Canada Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Canada Video Surveillance Market, By System, 2020–2028(USD Billion)

- Canada Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Mexico Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Mexico Video Surveillance Market, By System, 2020–2028(USD Billion)

- Mexico Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Europe Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Europe Video Surveillance Market, By System, 2020–2028(USD Billion)

- Europe Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Germany Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Germany Video Surveillance Market, By System, 2020–2028(USD Billion)

- Germany Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- France Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- France Video Surveillance Market, By System, 2020–2028(USD Billion)

- France Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- UK Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- UK Video Surveillance Market, By System, 2020–2028(USD Billion)

- UK Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Italy Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Italy Video Surveillance Market, By System, 2020–2028(USD Billion)

- Italy Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Spain Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Spain Video Surveillance Market, By System, 2020–2028(USD Billion)

- Spain Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Asia Pacific Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Asia Pacific Video Surveillance Market, By System, 2020–2028(USD Billion)

- Asia Pacific Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Japan Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Japan Video Surveillance Market, By System, 2020–2028(USD Billion)

- Japan Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- China Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- China Video Surveillance Market, By System, 2020–2028(USD Billion)

- China Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- India Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- India Video Surveillance Market, By System, 2020–2028(USD Billion)

- India Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- South America Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- South America Video Surveillance Market, By System, 2020–2028(USD Billion)

- South America Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Brazil Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Brazil Video Surveillance Market, By System, 2020–2028(USD Billion)

- Brazil Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- Middle East and Africa Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- Middle East and Africa Video Surveillance Market, By System, 2020–2028(USD Billion)

- Middle East and Africa Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- UAE Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- UAE Video Surveillance Market, By System, 2020–2028(USD Billion)

- UAE Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

- South Africa Video Surveillance Market, By Offering, 2020–2028(USD Billion)

- South Africa Video Surveillance Market, By System, 2020–2028(USD Billion)

- South Africa Video Surveillance Market, By Vertical, 2020–2028(USD Billion)

List of Figures

- Global Video Surveillance Market Segmentation

- Video Surveillance Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Video Surveillance Market Attractiveness Analysis By Offering

- Global Video Surveillance Market Attractiveness Analysis By System

- Global Video Surveillance Market Attractiveness Analysis By Vertical

- Global Video Surveillance Market Attractiveness Analysis By Region

- Global Video Surveillance Market: Dynamics

- Global Video Surveillance Market Share By Offering(2021 & 2028)

- Global Video Surveillance Market Share By System(2021 & 2028)

- Global Video Surveillance Market Share By Vertical(2021 & 2028)

- Global Video Surveillance Market Share by Regions (2021 & 2028)

- Global Video Surveillance Market Share by Company (2020)