Global Vinyl Flooring Market Size by Product (Luxury Vinyl Tile and Vinyl Sheets & Vinyl Composite Tile), End User (Residential, Healthcare, Hospitality, Retail, Education, Sport, Office, Industrial, and Automotive), Regions, Segmentation, and Projection till 2028.

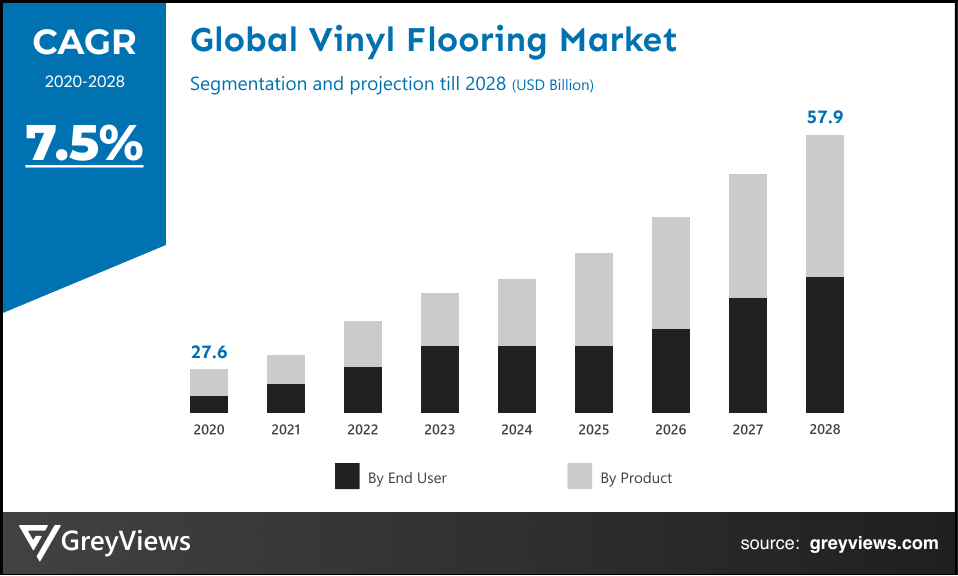

CAGR: 7.5%Current Market Size: USD 27.6 billionFastest Growing Region: North America

Largest Market: APACProjection Time: 2021-2028Base Year: 2020

Global Vinyl Flooring Market- Market Overview

The global vinyl flooring market is expected to grow from USD 27.6 billion in 2020 to USD 57.9 billion by 2028, at a CAGR of 7.5% during the Projection period 2021-2028. This growth of the vinyl flooring market is significantly driven by rising demand for low maintenance, lightweight, and cost-efficient construction materials across the residential construction sector.

Vinyl flooring is composed of multiple layers of materials that are sandwiched together to form a highly durable, affordable, and practical floor covering. It is composed of synthetic materials such as PVC vinyl, fiberglass, and a plasticizer, and is made in layers. It has mainly two types namely, sheet flooring and tile flooring. Both of them are made from the same materials; however, they're constructed differently to produce different effects. Vinyl flooring offers a number of benefits as compared with the other flooring types. For instance, vinyl flooring offers slightly softer floors in comparison to tile or wood and it has a nice appearance and easy maintenance also vinyl floors are not only resistant to water, but also are resistant to acids, alkalis, soaps, detergents, and petrol.

Furthermore, vinyl flooring installation is typically easier than the installation of other flooring materials. For instance, a floating vinyl sheet doesn’t require staples or glue. Also, the vinyl flooring can be installed over concrete, plywood, or hardwood. As the resilient floors are easier to maintain, durable, more moisture-resistant than many alternative materials; vinyl flooring is mainly being preferred to be used in bathrooms and residential kitchens, as well as in healthcare facilities, along with retail and commercial establishments.

Request Sample:- Global vinyl flooring market

Market Dynamics

Drivers:

- The increasing popularity of vinyl flooring in the hospital flooring sector will boost the market growth

The factors such as water-resistant nature, hardwearing, and ease of cleaning often make vinyl the product of choice for today's modern hospital, general practice surgeries, health centers, and care homes. In addition to this, the healthcare establishments deal with busy environments as well as they have different operational areas with flooring performance and quality requirements. This creates demand for vinyl flooring in the hospital flooring sector.

- Significant growth in construction of educational, healthcare, and industrial infrastructures across China and Indian economies

The enormous growth in population; changes in lifestyles; and rise in disposable income have boosted growth in the construction of educational, healthcare, and industrial infrastructures across China and India. For instance, as per the growth targets in China’s national development plans and the “Healthy China” initiative, medical infrastructure is anticipated to have expanded considerably from 2015 to 2020, with a 100% increase in private hospital beds and a 30% increase in public hospital beds.

Restraints:

- Impact of COVID-19 on the construction industry

The occurrence of COVID-19 has mainly led to disruption in the global residential construction sector. For instance, the contractors and builders are struggling to obtain government permissions for new as well as in-process construction projects. The decline in the growth rate of the construction industry has led to decreased demand for vinyl flooring in the residential construction sector, hampering the growth of the market.

Opportunities:

- The rise in investments across the global construction Industry

Rapid urbanization, a growing population base, and upcoming infrastructure projects have led to a significant rise in investments across the global construction Industry. In addition to this, the governments of developing countries are introducing infrastructure development projects, creating demand for the vinyl flooring market. For instance, the government of India has recently introduced flagship infrastructure development programs such as ‘Smart Cities’, ‘Make in India’, ‘Housing for All’, and ‘Atal Mission for Urban Rejuvenation and Transformation’ (AMRUT).

Challenges:

- Some of the disadvantages associated with vinyl flooring

Vinyl flooring is a cost-effective flooring option; however, it cannot be repaired and are difficult to replace. In addition to this, vinyl floorings is less eco-friendly than their non-resilient counterparts and are difficult to recycle. Such factors are anticipated to create several challenges for the growth of the vinyl flooring market.

Segmentation Analysis

The global vinyl flooring market has been segmented based on product, industry vertical, and regions.

Global Vinyl flooring - By Product

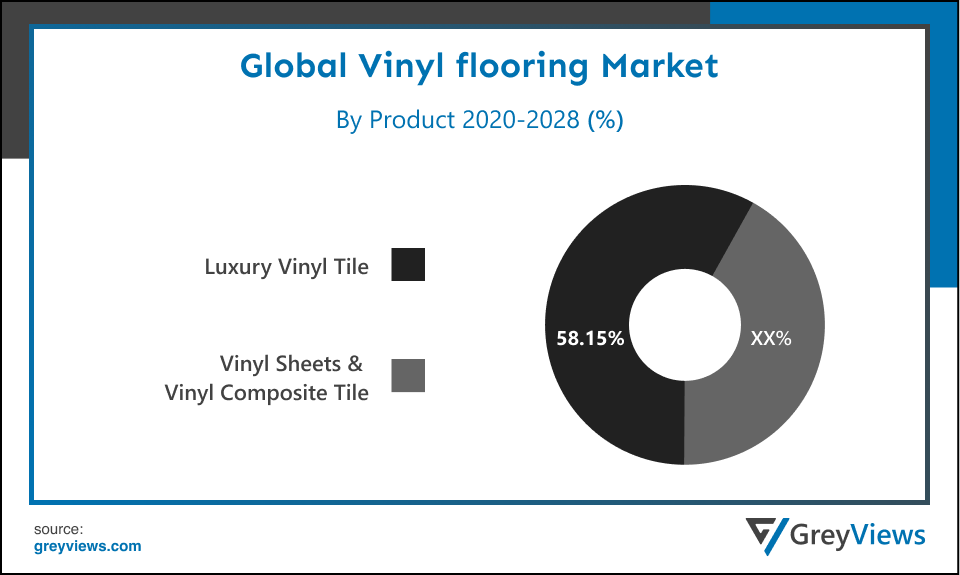

- The product segment includes luxury vinyl tile and vinyl sheets & vinyl composite tile. The luxury vinyl tile segment led the vinyl flooring market with a market share of around 58.15% in 2020. This segment's growth is mainly attributed to the fact that they are mainly being preferred in the construction industry due to more durable and better performance in comparison to standard vinyl tiles. Further, the emergence of digital printing technology in the flooring industry has created lucrative growth opportunities for the luxury vinyl tile segment.

By End User

- The end-user segment includes residential, health care, hospitality, retail, education, sport, office, industrial, and automotive. The residential segment held the largest market share of 25.22% in 2020. Construction and renovation applications of residential houses primarily boost demand for vinyl flooring which is available in the form of sheets, planks, and tiles with features including easy maintenance and impact resistance. In addition, factors such as low cost, the availability of an extensive range of sizes, patterns, colors, and texture have pushed demand for vinyl flooring to construct floors of various areas of residential areas such as bathrooms’ laundry area, kitchen, and others.

By Regional Analysis

The regions analyzed for the vinyl flooring market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia Pacific region dominated the vinyl flooring market and held the 42.15% share of the market revenue in 2020.

- The enormous growth in population; changes in lifestyles; and rise in disposable income have boosted growth in the construction of educational, healthcare, and industrial infrastructures across China and India. This growth in the construction industry boosts demand for vinyl flooring products. In addition to this, the Asia-Pacific region is experiencing an increasing number of maintenance and remodeling activities in the non-residential and residential construction sectors, fueling demand for vinyl flooring.

- The North American region is likely to register the highest growth during the Projection period due to rising demand for vinyl flooring due to growth in the construction of commercial buildings, such as educational institutes, commercial complexes, and offices. Also, advantages associated with vinyl floorings, such as cost-effectiveness, easy installation & maintenance, and moisture resistance has created a demand for vinyl flooring in North America. Moreover, the U.S. and Canada are some of the key countries for the vinyl flooring market in the North American region.

Key Industry Players Analysis

Advancement in technology have made the key players improve their position in the global vinyl market

The key market players are concentrating on implementing new strategies such as product innovations, joint venture, adopting new technology, alliances, mergers & acquisitions, and partnerships to improve their position in the global vinyl flooring industry.

In January 2019, Genflor Group, one of the leading manufacturer of flooring solutions and wall finishes introduced Creation 55 and Creation 30, a new range of LVT–Luxury Vinyl Tiles & Planks. The company offers a range of LVT available with high-quality designs.

In September 2018, M S International, Inc., the leading supplier of premium surfaces in the U.S. launched Everlife Luxury Vinyl Tile(LVT), the line of Luxury Vinyl Tile (LVT).

In December 2018, Beaulieu Flooring Solutions, the European leader in wall-to-wall floorcoverings for both the residential and commercial sectors, expanded its capacity at Juteks vinyl rolls plant in Russia. This development had offered better product service in the market in various European and Middle east countries.

Further, in December 2018, Congoleum signed a distribution agreement with Kraus Flooring, a division of Q.E.P. Co., Inc., to service major markets in the western region of the U.S.

In October 2018, Tarkett, the French multinational corporation specializing in the production of floor and wall coverings, acquired Lexmark Carpet Mills to expand its presence in North America.

In March 2018, Adore Floors, the global leader in the manufacturing of Luxury Vinyl tiles, introduced flooring products with recycled materials having the maximum amount of LEED credits.

- Armstrong Flooring, Inc.

- Berkshire Hathaway Inc. (Shaw Industries Group, Inc.)

- CBC Co., Ltd. (CBC AMERICA LLC.)

- Congoleum Corporation

- Mohawk Industries, Inc.

- Novalis Innovative Flooring

- Gerflor

- Mannington Mills, Inc.

- Tarkett S.A.

Latest Development

- January 2021- The leading global manufacturer of residential and commercial flooring products company in Carroll country named Mohawk industries announced expanding its production plant. The company will add 19,000 Sq. feet to its facility in Hillsville and install loom equipment and new extrusion to increase production speed.

- March 2021- Mohawk Group expanded Living Local, the domestically manufactured 2.5mm LVT platform. This expansion comprises four new designs of 12 X 24 size including stone, terrazzo, and abstract textile visuals complimenting the existing size of 6 X 48 wood design. These new styles are projected to offer designers the enhanced flexibility to create unique and vibrant spaces.

- December 2020- An international flooring manufacturer Mannington Mills, partnered with Microban, an antimicrobial consumer brand. Through this partnership, Mannington Mills will feature surface protection technology on its ADURA LVT products.

- April 2020- Armstrong Flooring Inc. launched a program to ship free flooring samples to consumers, along with the new enhancements to its online Design-aRoom tool. This strategy has made it easier for homeowners to plan their projects.

- August 2020- Novalis Innovative Flooring planned to open a plant in Georgia, Dalton, United States for manufacturing rigid core LVT (luxury vinyl tile) in the U.S. This strategy is expected to expand geographical presence and generate new revenue streams for the Novalis Innovative Flooring.

Report Metrics

|

Report Attribute |

Details |

|

Projection period |

2021-2028 |

|

Base year considered |

2020 |

|

CAGR (%) |

7.5% |

|

Market Size |

27.6 billion |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product, End User, Region |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Armstrong Flooring, Inc., Berkshire Hathaway Inc. (Shaw Industries Group, Inc.), CBC Co., Ltd. (CBC AMERICA LLC.), Congoleum Corporation, Mohawk Industries, Inc., Novalis Innovative Flooring, Gerflor, Mannington Mills, Inc., and Tarkett S.A. among others. |

|

By Product |

|

|

By End User |

|

|

Regional scope |

|

Scope of the Report

Global Vinyl Flooring Market by Product

- Luxury Vinyl Tile

- Vinyl Sheets & Vinyl Composite Tile

Global Vinyl Flooring Market by End User:

- Residential

- Health Care

- Hospitality

- Retail

- Education

- Sport

- Office

- Industrial

- Automotive

Global Vinyl Flooring Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Vinyl Flooring Market?

Global vinyl flooring market is expected to reach USD 57.9 billion by 2028, at a CAGR of 7.5% from 2021 to 2028.

What is the segmentation considered for the analysis of the global vinyl flooring market?

The global vinyl flooring market has been segmented based on product, industry vertical, and regions

Which regions have been studied for the regional analysis of the global vinyl flooring market?

The regions analyzed for the vinyl flooring market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa.

Which are the leading market players active in the vinyl flooring market?

leading market players active in the global vinyl flooring market are Armstrong Flooring, Inc., Berkshire Hathaway Inc. (Shaw Industries Group, Inc.), CBC Co., Ltd. (CBC AMERICA LLC.), Congoleum Corporation, Mohawk Industries, Inc., Novalis Innovative Flooring, Gerflor, Mannington Mills, Inc., and Tarkett S.A. among others.

What are the key drivers of the vinyl flooring market?

Rising demand for low maintenance, lightweight, and cost-efficient construction materials across the residential construction sector primarily drives the growth of the vinyl flooring market.

What are the ongoing trends that influence the market in the upcoming years?

Manufacturers in the vinyl flooring market are using advanced production technologies to incorporate better design, installation, and performance. In addition, smart cities will contribute to the demand for vinyl flooring.

What are the detailed impacts of the COVID-19 pandemic on the global market?

Lockdowns imposed by the governments temporarily suspended construction activities, delaying renovation of the houses as well as new construction projects. This hampered the growth of the vinyl flooring market. However, consumers are willing to spend on essential goods and services, creating demand for vinyl flooring.

How the company profile has been selected?

Based on the sales revenue, product offering, and regional presence, the companies are selected.

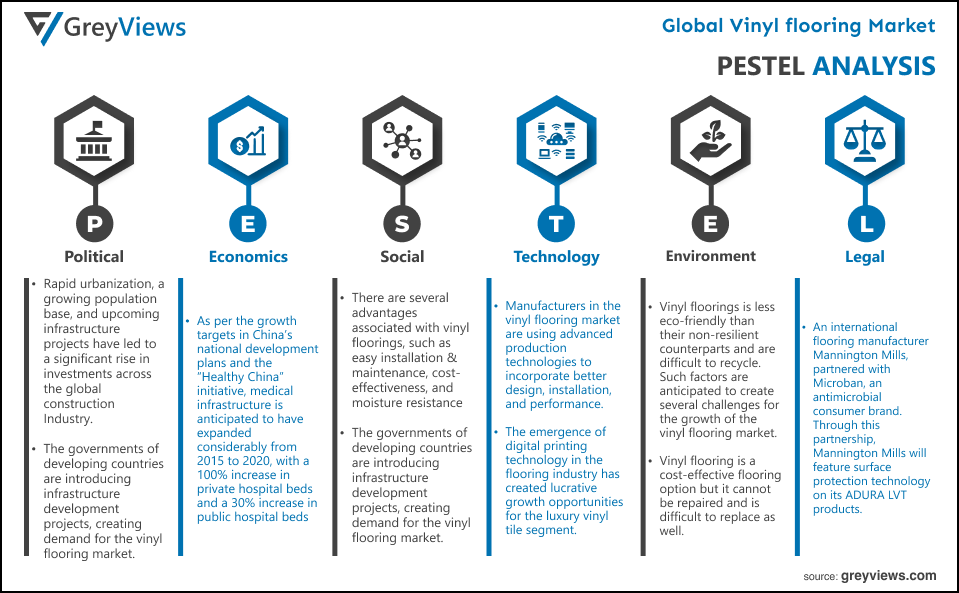

Political- Rapid urbanization, a growing population base, and upcoming infrastructure projects have led to a significant rise in investments across the global construction Industry. In addition to this, the governments of developing countries are introducing infrastructure development projects, creating demand for the vinyl flooring market. Fo example the government of India has recently introduced flagship infrastructure development programs such as ‘Smart Cities’, ‘Make in India’, ‘Housing for All’, and ‘Atal Mission for Urban Rejuvenation and Transformation’ (AMRUT). The Asia-Pacific region is experiencing an increasing number of maintenance and remodeling activities in the non-residential and residential construction sectors, fueling demand for vinyl flooring.

Economic- The enormous rise in population; changes in lifestyles; and rise in disposable income have boosted growth in the construction of educational, healthcare, and industrial infrastructures across China and India. The government is also focusing on investing more money in these sectors for the improvement of infrastructure. For instance, as per the growth targets in China’s national development plans and the “Healthy China” initiative, medical infrastructure is anticipated to have expanded considerably from 2015 to 2020, with a 100% increase in private hospital beds and a 30% increase in public hospital beds. So, the economical worldwide growth has given a boost to this sector as well.

Social- The North American region is likely to register the highest growth during the Projection period due to rising demand for vinyl flooring due to growth in the construction of commercial buildings, such as commercial complexes, educational institutes, and offices. Also, advantages associated with vinyl floorings, such as easy installation & maintenance, cost-effectiveness, and moisture resistance has created a demand for vinyl flooring in North America. In addition to this, the governments of developing countries are introducing infrastructure development projects, creating demand for the vinyl flooring market.

Technological- Manufacturers in the vinyl flooring market are using advanced production technologies to incorporate better design, installation, and performance. In addition, smart cities will contribute to the demand for vinyl flooring. Rising demand for low maintenance, lightweight, and cost-efficient construction materials across the residential construction sector primarily drives the growth of the vinyl flooring market. Further, the emergence of digital printing technology in the flooring industry has created lucrative growth opportunities for the luxury vinyl tile segment.

Environmental- Vinyl floorings is less eco-friendly than their non-resilient counterparts and are difficult to recycle. Such factors are anticipated to create several challenges for the growth of the vinyl flooring market. However, Vinyl flooring is a cost-effective flooring option but it cannot be repaired and is difficult to replace as well.

Legal- An international flooring manufacturer Mannington Mills, partnered with Microban, an antimicrobial consumer brand. Through this partnership, Mannington Mills will feature surface protection technology on its ADURA LVT products. The strategy of expansion and agreement between two companies is expected to expand geographical presence and generate new revenue streams for the global vinyl flooring market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product

- Market Attractiveness Analysis By End User

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rising demand for low maintenance, lightweight, and cost-efficient construction materials

- Increasing popularity of vinyl flooring in the hospital flooring sector

- Restrains

- Impact of COVID-19 on the construction industry

- Opportunities

- Rise in investments across the global construction Industry

- Challenges

- Some of the disadvantages associated with vinyl flooring

- Global Vinyl Flooring Market Analysis and Projection, By Product

- Segment Overview

- Luxury Vinyl Tile

- Vinyl Sheets & Vinyl Composite Tile

- Global Vinyl Flooring Market Analysis and Projection, By End User

- Segment Overview

- Residential

- Healthcare

- Hospitality

- Retail

- Education

- Sport

- Office

- Industrial

- Automotive

- Global Vinyl Flooring Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Vinyl Flooring Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Vinyl Flooring Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Armstrong Flooring, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Berkshire Hathaway Inc. (Shaw Industries Group, Inc.)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- CBC Co., Ltd. (CBC AMERICA LLC.)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Congoleum Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Mohawk Industries, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Novalis Innovative Flooring

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Gerflor

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Mannington Mills, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Tarkett S.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Armstrong Flooring, Inc.

List of Table

- Global Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Luxury Vinyl Tile Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Vinyl Sheets & Vinyl Composite Tile Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Residential Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Healthcare Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Hospitality Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Retail Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Education Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Sport Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Office Feed Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Industrial Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Automotive Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Vinyl Flooring Market, By Region, 2020–2028(USD Billion) (Million Sq. Meters)

- Global Vinyl Flooring Market, By North America, 2020–2028(USD Billion) (Million Sq. Meters)

- North America Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- North America Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- USA Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- USA Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Canada Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Canada Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Mexico Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Mexico Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Europe Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Europe Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Germany Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Germany Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- France Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- France Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- UK Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- UK Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Italy Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Italy Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Spain Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Spain Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Asia Pacific Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Asia Pacific Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Japan Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Japan Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- China Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- China Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- India Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- India Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- South America Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- South America Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Brazil Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Brazil Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- Middle East and Africa Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- Middle East and Africa Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- UAE Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- UAE Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

- South Africa Vinyl Flooring Market, By Product, 2020–2028(USD Billion) (Million Sq. Meters)

- South Africa Vinyl Flooring Market, By End User, 2020–2028(USD Billion) (Million Sq. Meters)

List of Figures

- Global Vinyl Flooring Market Segmentation

- Vinyl Flooring Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Vinyl Flooring Market Attractiveness Analysis By Product

- Global Vinyl Flooring Market Attractiveness Analysis By End User

- Global Vinyl Flooring Market Attractiveness Analysis By Region

- Global Vinyl Flooring Market: Dynamics

- Global Vinyl Flooring Market Share By Product(2021 & 2028)

- Global Vinyl Flooring Market Share By End User(2021 & 2028)

- Global Vinyl Flooring Market Share by Regions (2021 & 2028)

- Global Vinyl Flooring Market Share by Company (2020)