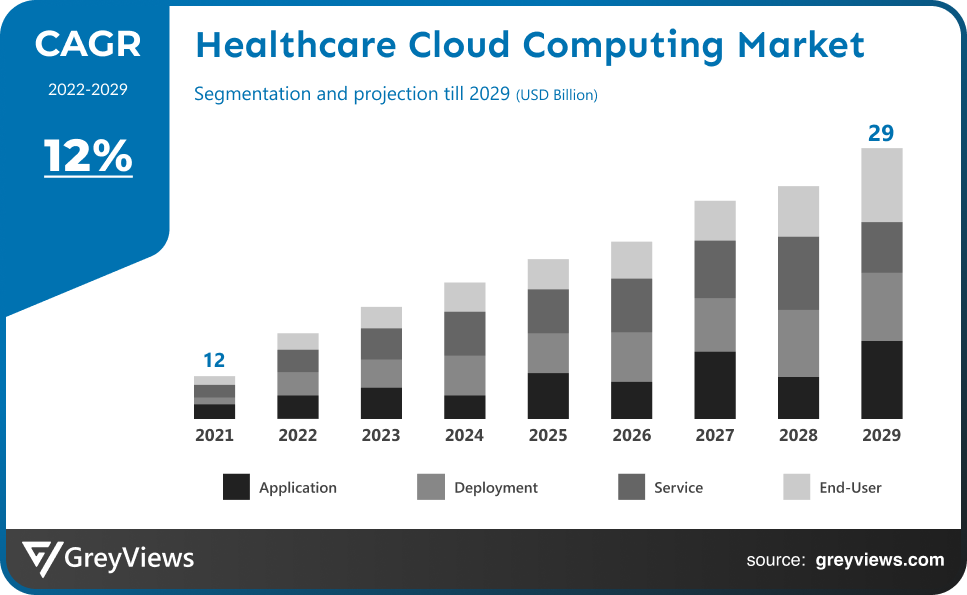

Healthcare Cloud Computing Market By Application (Clinical Information Systems (CIS) and Non-clinical Information Systems (NCIS)), By Deployment (Private Cloud and Public Cloud), By Service (Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS)), By End-User (Healthcare Providers and Healthcare Payers), Regions, Segmentation, and Projection till 2029

CAGR: Current Market Size: USD 12 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Healthcare Cloud Computing Market- Market Overview:

The Global healthcare cloud computing market is expected to grow from USD 12 billion in 2021 to USD 29 billion by 2029, at a CAGR of 12% during the Projection period 2022-2029. The growth of this market is mainly driven by the growing demand for integrated information systems majorly due to an increase in the prevalence of chronic diseases and the aging population

Healthcare providers use healthcare cloud computing to store, preserve, and back up patient health information (PHI). It delivers flexible resources, economies of scale, and instant access to data everywhere, all while lowering overall operational expenses. Remote conferencing, it assists in updating patient records, improving analysis, and tracking information on diagnosis, treatment, cost, and performance. Additionally, it helps in cost-saving and resilience-improving tailored care delivery, patient outcomes improvement, and compliance requirements fulfillment. As a result, it is becoming more popular across the globe due to its increased simplicity and improvement of healthcare organizations’ general efficiency. The healthcare sector's expanding demand-supply imbalance has raised the need for IT, which has accelerated the adoption of cloud computing in this sector. The market is anticipated to grow as a result of the increased demand for cloud-based information systems. Furthermore, one of the main drivers of market demand is healthcare infrastructure that is technologically advanced, particularly hospitals in developed economies. Integration of data and real-time access are now essential due to the growing population and volume of patient data. One of the elements anticipated to have a favorable impact on growth in the near term is a rise in expenditures made in healthcare IT infrastructure by a number of private and governmental entities. For instance, the University of Pittsburgh Medical Center (UPMC) invested USD 2.0 billion in its hospitals' digital transformation across all of its campuses in the final quarter of 2017. The UPMC Hillman Cancer Hospital, UPMC Vision and Rehabilitation Hospital, and UPMC Heart and Transplant Hospital are the organization's three digital speciality hospitals. Additionally, UPMC has declared that it would collaborate with Microsoft to improve digital hospitals. Telemedicine technology including teleradiology, video/audio conferencing, and telesurgery, are recent developments in the industry. These services assist medical experts to share thoughts & consult others on challenging issues, enabling patients to receive clinical therapy without visiting healthcare providers.

Sample Request: - Global Healthcare Cloud Computing Market

Market Dynamics:

Drivers:

- Machine Learning and Artificial Intelligence

The healthcare sector's expanding demand-supply imbalance has raised the need for IT, which has accelerated the adoption of cloud computing in this sector. The market is anticipated to grow due to the increased demand for cloud-based information systems. Furthermore, one of the main drivers of market demand is healthcare infrastructure that is technologically advanced, particularly hospitals in developed economies. Integration of data and real-time access is now essential due to the growing population and volume of patient data. One of the elements anticipated to have a favourable impact on growth in the near term is a rise in expenditures made in healthcare IT infrastructure by a number of private and governmental entities.

Restraints:

- Concern About Security

Cloud service provider data storage is less secure than on-premise data storage. To make sure that only people with permission can access patient information, a high level of privacy must be maintained. Patient data has been examined by several legal frameworks, including the US's HIPAA (Health Insurance Portability and Accountability Act). Similarly to this, the European Union has a variety of data protection directives. Transferring patient Protected Health Information (PHI) from one country to another is prohibited in many others. Personal information that is obtained, used, or disclosed is protected by Canada's Personal Information Protection and Electronic Documents Act (PIPEDA). Canadian organizations may face legal prosecution for failing to comply with the Act.

Opportunities:

- Increase in Telemedicine

Due to the convergence of wireless and cloud technology, patient care can now be provided in remote locations. The bulk of doctors and specialists work in big cities and metropolitan areas in various countries. Patients can only obtain the most advanced medical technology in urban areas as a result. To overcome this difficulty, medical professionals can employ a tele-cloud to diagnose and treat patients over vast distances in real-time and affordably.

Challenges:

- Cyber Attacks

The cloud has numerous benefits and takes many security measures, yet data stored there is still susceptible to hacker attacks. As the number of patient data increases and there are more initiatives to adopt digital transformation in healthcare, data security and privacy concerns are growing. Additionally, patients' worries about protecting their data raise the requirement for maintaining high-security standards for patient data. Public clouds are not advised because they have the same security issues as conventional IT systems.

Segmentation Analysis:

The global healthcare cloud computing market has been segmented based on application, deployment, service, end-user, and region.

By Application

The application segment is Clinical Information Systems (CIS) and Non-clinical Information Systems (NCIS). The non-clinical information systems (NCIS) segment led the largest share of the healthcare cloud computing market with a market share of around 6.6% in 2021. Due to the increased use of cloud computing services for a variety of applications, including billing & accounts management, revenue cycle management, healthcare information sharing, fraud management, supply chain management, and financial management.

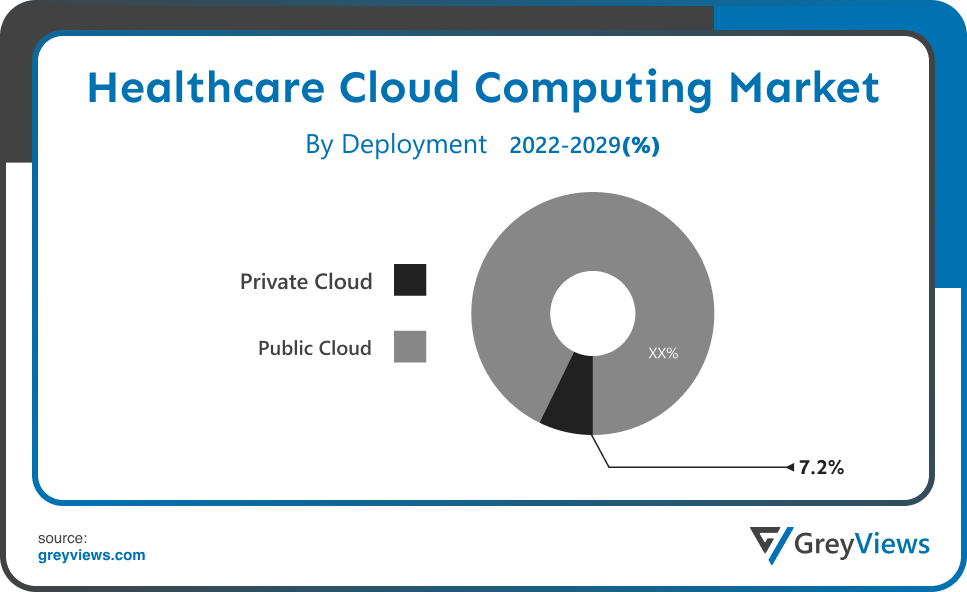

By Deployment

The deployment segment includes Private Cloud and Public Cloud. The private cloud segment led the healthcare cloud computing market with a market share of around 7.2% in 2021. The private model commonly referred to as the "Internal Cloud," is a protected platform to which only authorized users have access. This model is well-guarded and under organization control. As a result, as of 2018, this category accounted for the highest revenue share. A cloud hosting platform called the public model gives users access to various systems and services. These services are offered by businesses like Amazon, Microsoft, IBM, etc.

By Service

The service segment includes Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS). The software-as-a-service (SaaS) segment led the healthcare cloud computing market with a market share of around 4.56% in 2021. Because this paradigm is often used in clinical settings. SaaS services range from database processing and web-based email to inventory control. The user can utilize the service anywhere, at any time, because the service provider essentially owns both data and applications.

Global Healthcare Cloud Computing Market- Sales Analysis.

The sale of the healthcare cloud computing market has been segmented based on application, deployment, service, and end-user expanded at a CAGR of 9.7% from 2015 to 2021.

It is anticipated that the COVID-19 epidemic will largely benefit the market. The promise of cloud technologies, which offer data storage and computing resources managed by external service providers to aid in improving the security, caliber, and effectiveness of healthcare, is increasingly being recognized more and more. The research data that is being generated needs to be stored in a secure environment that can contain vast amounts of data due to the enormous number of research and clinical trials that are being conducted globally. Due to its ability to hold massive volumes of data on private and dedicated cloud channels, cloud computing addresses the issues of both security and space limitations.

For instance, the University of Pittsburgh Medical Center (UPMC) invested USD 2.0 billion in its hospitals' digital transformation across all campuses in the final quarter of 2017. The UPMC Hillman Cancer Hospital, UPMC Vision and Rehabilitation Hospital, and UPMC Heart and Transplant Hospital are the organization's three digital speciality hospitals. UPMC also declared that it would collaborate with Microsoft to improve digital hospitals. Telemedicine technology, including teleradiology, video/audio conferencing, and telesurgery, are recent developments in the industry. These services assist medical experts in sharing thoughts & consult others on challenging issues, enabling patients to receive clinical therapy without visiting healthcare providers.

Thus, owing to the aforementioned factors, the global healthcare cloud computing market is expected to grow at a CAGR of 12% during the Projection period from 2022 to 2029.

Global Healthcare Cloud Computing Market- By Regional Analysis:

The regions analyzed for the healthcare cloud computing market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the healthcare cloud computing market and held a 39% share of the market revenue in 2021.

- The North America region witnessed a major share. One of the main elements that may be ascribed to the high revenue share is the rising use of analytical IT solutions in health management to increase process efficiency and streamline workflow. Additionally, improvements in healthcare IT infrastructure and an increase in IT initiatives from both public and private companies are contributing to the market's expansion.

- Asia Pacific is anticipated to experience significant growth during the Projection period. With prosperous chances presented by developing nations like Japan, China, and India. A few reasons driving the market include the rise in the elderly population, the burden of chronic diseases, and the existence of initiatives encouraging the adoption of integrated health systems. The market is anticipated to be driven by the region's expanding use of IT medical solutions and improving healthcare infrastructure.

Global Healthcare Cloud Computing Market- Country Analysis:

- Germany

Germany's healthcare cloud computing market size was valued at USD 0.18 billion in 2021 and is expected to reach USD 0.28 billion by 2029, at a CAGR of 6% from 2022 to 2029. A favourable trend for cloud computing is anticipated due to consumer adoption of multi-cloud strategies. Since a few years ago, cloud computing technology has entered a golden age and is gaining popularity in all commercial sectors. Adopting cloud services by businesses in Germany is a top priority globally since it will reduce infrastructure costs and provide operational flexibility.

- China

China’s healthcare cloud computing market size was valued at USD 0.39 billion in 2021 and is expected to reach USD 0.83 billion by 2029, at a CAGR of 10% from 2022 to 2029. The growing adoption of innovative technological solutions by care facilities to enhance their procedures and workflows and appropriately address the growing patient population is predicted to fuel the market's expansion in China.

- India

India's healthcare cloud computing market size was valued at USD 0.31 billion in 2021 and is expected to reach USD 0.57 billion by 2029, at a CAGR of 8% from 2022 to 2029. The astonishing potential is being shown by the quickly growing information technology sector, which is attracting both public and private investors. In the years to come, it is projected that this will hasten the industry's overall development.

Key Industry Players Analysis:

To increase their market position in the global healthcare cloud computing business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- CareCloud Corporation

- ClearData Networks, Inc.

- Athenahealth

- Cerner Corporation

- Epic Systems Corporation

- NextGen Healthcare

- Carestream Corporation

- Dell, Inc.

- DICOM Grid, Inc.

- INFINITT Healthcare

- Sectra AB

- Merge Healthcare, Inc

- Siemens Healthineers

- iTelagen, Inc.

- NTT DATA Corporation

- Nuance Communications

- Ambra Health.

Latest Development:

- In December 2021, CVS Health and Microsoft began working together to advance digital healthcare using AI and cloud computing.

- In September 2021, MetaCell, a life sciences software business, unveiled a new product called "MetaCell Cloud Hosting," which offers cutting-edge cloud computing solutions especially created for life science and healthcare organizations to support research and innovation.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 12% |

| Market Size | 12 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | By Application, By Deployment, By Service, By End-User, and By Region. |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | CareCloud Corporation, ClearData Networks, Inc., Athenahealth, Cerner Corporation, Epic Systems Corporation, NextGen Healthcare, Carestream Corporation, Dell, Inc., DICOM Grid, Inc., INFINITT Healthcare, Sectra AB, Merge Healthcare, Inc, Siemens Healthineers, iTelagen, Inc., NTT DATA Corporation, Nuance Communications, and Ambra Health. |

| By Application |

|

| By Deployment |

|

| By Service |

|

| By End-User |

|

Regional scope |

|

Scope of the Report

Global Healthcare Cloud Computing Market By Application:

- Clinical Information Systems (CIS)

- Non-clinical Information Systems (NCIS)

Global Healthcare Cloud Computing Market By Deployment:

- Private Cloud

- Public Cloud

Global Healthcare Cloud Computing Market By Service:

- Software-as-a-Service (SaaS)

- Infrastructure-as-a-Service (IaaS)

- Platform-as-a-Service (PaaS)

Global Healthcare Cloud Computing Market By End User:

- Healthcare Providers

- Healthcare Payers

Global Healthcare Cloud Computing Market By Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the healthcare cloud computing market in 2029?

Global healthcare cloud computing market is expected to reach USD 29 billion by 2029, at a CAGR of 12% from 2022 to 2029.

What is the CAGR of the healthcare cloud computing market?

The healthcare cloud computing market is projected to have a CAGR of 12%.

What are the key factors for the growth of the healthcare cloud computing market?

The healthcare sector now has a greater need for IT, which has accelerated the adoption of cloud computing in this sector due to the widening demand-supply mismatch in that sector. The market is anticipated to grow as a result of the increased demand for cloud-based information systems.

Which are the leading market players active in the healthcare cloud computing market?

Leading market players active in the global healthcare cloud computing market are CareCloud Corporation; Athenahealth; ClearData Networks, Inc.; Cerner Corporation; Epic Systems Corporation; NextGen Healthcare; Carestream Corporation; Dell, Inc.; DICOM Grid, Inc.; INFINITT Healthcare; Sectra AB; Merge Healthcare, Inc.; Siemens Healthineers; iTelagen, Inc.; NTT DATA Corporation; Nuance Communications; and Ambra Health among others.

What is the end-user segment of the healthcare cloud computing market?

Based on end-user, the healthcare cloud computing market is segmented into Healthcare Providers and Healthcare Payers.

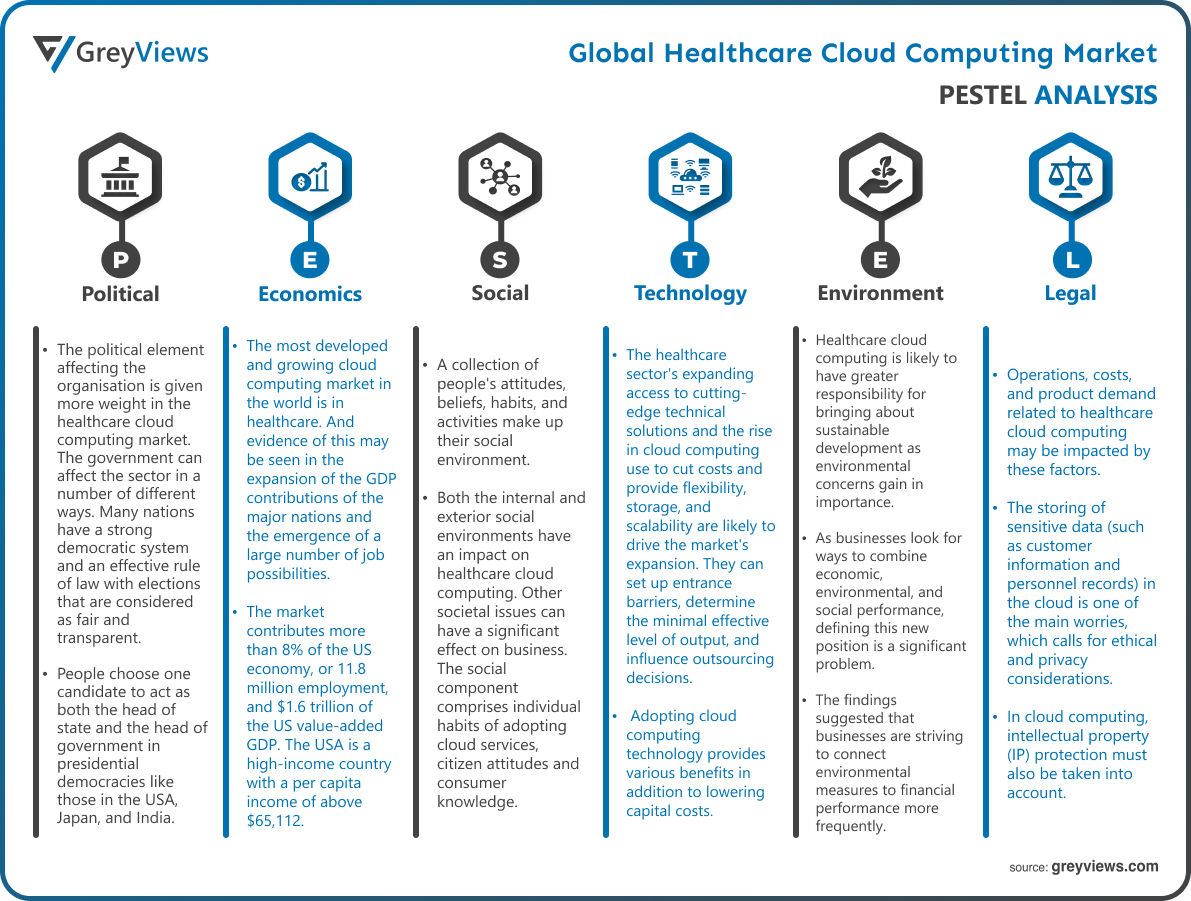

Political Factors- The political element affecting the organisation is given more weight in the healthcare cloud computing market. The government can affect the sector in a number of different ways. Many nations have a strong democratic system and an effective rule of law with elections that are considered as fair and transparent. People choose one candidate to act as both the head of state and the head of government in presidential democracies like those in the USA, Japan, and India. The USA is home to many tech behemoths, like Microsoft, Oracle, IBM, Salesforce, Amazon, and others, which contributes to a strong economy. As a result, the government attempts to create regulations that are more business-friendly. The political situation of the country raises a lot of issues. Risks might come in the form of trade restrictions, currency limitations, and monetary regulations. Healthcare cloud computing should take particular steps to lower political concerns. For instance, healthcare cloud computing can steer clear of investments where this kind of risk is higher. Political risk insurance may be able to mitigate significant potential losses. Therefore, the success and revenue of healthcare cloud computing are directly impacted by the political context.

Economical Factors- The most developed and growing cloud computing market in the world is in healthcare. And evidence of this may be seen in the expansion of the GDP contributions of the major nations and the emergence of a large number of job possibilities. For instance, the market contributes more than 8% of the US economy, or 11.8 million employment, and $1.6 trillion of the US value-added GDP. The USA is a high-income country with a per capita income of above $65,112. Businesses that use cloud computing for their operations should anticipate a decrease in capital expenditure from an economic standpoint. The tight budget of any firm may be eased by emerging technology like cloud computing, as corporate executives are accountable for maximising profits to their owners. The majority of empirical investigations have come to the conclusion that greater use of cloud computing in healthcare sector can boost GDP, productivity, and employment.

Social Factor- A collection of people's attitudes, beliefs, habits, and activities make up their social environment. Both the internal and exterior social environments have an impact on healthcare cloud computing. Other societal issues can have a significant effect on business. The social component comprises individual habits of adopting cloud services, citizen attitudes and consumer knowledge. Organizations and employees are required to abide by a set of guiding principles or an ethical code, as well as to be aware of the value of information stored in the cloud, including the value of personal information, disclosure of personal information, and uses of personal data. There are many different languages spoken there, making communication easy. Due to the high levels of knowledge in nations like India, China, Japan, France, and the United States, the task is relatively straightforward for multinational firms and businesses engaged in healthcare cloud computing. For cloud computing in healthcare, there are many capable individuals on hand.

Technological Factors- The healthcare sector's expanding access to cutting-edge technical solutions and the rise in cloud computing use to cut costs and provide flexibility, storage, and scalability are likely to drive the market's expansion. They can set up entrance barriers, determine the minimal effective level of output, and influence outsourcing decisions. Adopting cloud computing technology provides various benefits in addition to lowering capital costs. For instance, the cloud's accessibility, dependability, adaptability, and mobility offer limitless data resources and storage. Additionally, because cloud computing is a readily available online technology, users do not need to wait for the installation and implementation of their equipment and can purchase resources with optional cash rather than as a capital expense.

Environmental Factors- Healthcare cloud computing is likely to have greater responsibility for bringing about sustainable development as environmental concerns gain in importance. However, as businesses look for ways to combine economic, environmental, and social performance, defining this new position is a significant problem. Managers must quantify the connection between environmental actions and financial performance in order to incorporate sustainability principles into their business strategy and to help with resource allocation decisions. The findings suggested that businesses are striving to connect environmental measures to financial performance more frequently. While environmentally conscious businesses are aware of the buzz surrounding green energy, cloud computing, and related themes, many businesses have yet to make a firm commitment to a solid economic case for the larger question of sustainability.

Legal Factors- The legal aspects of discrimination, consumers, antitrust, employment, and health and safety legislation are among them. Operations, costs, and product demand related to healthcare cloud computing may be impacted by these factors. The storing of sensitive data (such as customer information and personnel records) in the cloud is one of the main worries, which calls for ethical and privacy considerations. Users worry about "critical data falling into the wrong hands." Today, regulations governing consumer protection, data privacy, intellectual property rights (IPR), health and safety, and employees and the workplace are required to be obeyed in almost every country. As a result, it becomes crucial for this market to operate legally and ethically in order to avoid facing legal action, fines, or other consequences from a court of law. In the cloud, best practises for computing such as data migration with robust authentication and guiding principles for IT use should still be followed. In cloud computing, intellectual property (IP) protection must also be taken into account.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Application

- 3.2. Market Attractiveness Analysis By Deployment

- 3.3. Market Attractiveness Analysis By Service

- 3.4. Market Attractiveness Analysis By End-User

- 3.5. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Machine Learning and Artificial Intelligence

- 3. Restraints

- 3.1. Concern About Security

- 4. Opportunities

- 4.1. Increase in Telemedicine

- 5. Challenges

- 5.1. Cyber Attacks

- Global Healthcare Cloud Computing Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Clinical Information Systems (CIS)

- 3. Non-clinical Information Systems (NCIS)

- Global Healthcare Cloud Computing Market Analysis and Projection, By Deployment

- 1. Segment Overview

- 2. Private Cloud

- 3. Public Cloud

- Global Healthcare Cloud Computing Market Analysis and Projection, By Service

- 1. Segment Overview

- 2. Software-as-a-Service (SaaS)

- 3. Infrastructure-as-a-Service (IaaS)

- 4. Platform-as-a-Service (PaaS)

- Global Healthcare Cloud Computing Market Analysis and Projection, By End-User

- 1. Segment Overview

- 2. Healthcare Providers

- 3. Healthcare Payers

- Global Healthcare Cloud Computing Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Healthcare Cloud Computing Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Healthcare Cloud Computing Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- CareCloud Corporation

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- ClearData Networks, Inc.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Athenahealth

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Cerner Corporation

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Epic Systems Corporation

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- NextGen Healthcare

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Carestream Corporation

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Dell, Inc.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- DICOM Grid, Inc.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- INFINITT Healthcare

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Sectra AB

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Merge Healthcare, Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Siemens Healthineers

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- iTelagen, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- NTT DATA Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Nuance Communications

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Ambra Health.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- CareCloud Corporation

List of Table

- Global Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Global Clinical Information Systems (CIS), Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Non-clinical Information Systems (NCIS), Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Global Private Cloud, Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Public Cloud, Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Global Software-as-a-Service (SaaS), Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Infrastructure-as-a-Service (IaaS), Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Platform-as-a-Service (PaaS), Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Global Healthcare Providers, Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Healthcare Payers, Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- Global Healthcare Cloud Computing Market, By Region, 2021–2029 (USD Billion)

- North America Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- North America Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- North America Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- North America Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- USA Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- USA Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- USA Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- USA Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Canada Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Canada Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Canada Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Canada Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Mexico Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Mexico Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Mexico Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Mexico Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Europe Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Europe Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Europe Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Europe Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Germany Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Germany Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Germany Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Germany Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- France Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- France Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- France Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- France Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- UK Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- UK Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- UK Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- UK Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Italy Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Italy Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Italy Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Italy Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Spain Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Spain Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Spain Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Spain Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Asia Pacific Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Asia Pacific Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Asia Pacific Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Japan Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Japan Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Japan Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Japan Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- China Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- China Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- China Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- China Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- India Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- India Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- India Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- India Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- South America Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- South America Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- South America Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- South America Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Brazil Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Brazil Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Brazil Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Brazil Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- Middle East and Africa Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- Middle East and Africa Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- Middle East and Africa Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- UAE Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- UAE Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- UAE Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- UAE Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

- South Africa Healthcare Cloud Computing Market, By Application, 2021–2029 (USD Billion)

- South Africa Healthcare Cloud Computing Market, By Deployment, 2021–2029 (USD Billion)

- South Africa Healthcare Cloud Computing Market, By Service, 2021–2029 (USD Billion)

- South Africa Healthcare Cloud Computing Market, By End-User, 2021–2029 (USD Billion)

List of Figures

- Global Healthcare Cloud Computing Market Segmentation

- Healthcare Cloud Computing Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Healthcare Cloud Computing Market Attractiveness Analysis By Application

- Global Healthcare Cloud Computing Market Attractiveness Analysis By Deployment

- Global Healthcare Cloud Computing Market Attractiveness Analysis By Service

- Global Healthcare Cloud Computing Market Attractiveness Analysis By End-User

- Global Healthcare Cloud Computing Market Attractiveness Analysis By Region

- Global Healthcare Cloud Computing Market: Dynamics

- Global Healthcare Cloud Computing Market Share By Application (2021 & 2029)

- Global Healthcare Cloud Computing Market Share By Deployment (2021 & 2029)

- Global Healthcare Cloud Computing Market Share By Service (2021 & 2029)

- Global Healthcare Cloud Computing Market Share By End-User (2021 & 2029)

- Global Healthcare Cloud Computing Market Share by Regions (2021 & 2029)

- Global Healthcare Cloud Computing Market Share by Company (2020)