Hydraulic Tools Market Size By Product Type (Cylinders, Motors, Pumps, Valves, Filters & Accumulators, and Transmission), By End-user (Material Handling, Aerospace & Defense, Construction, Agriculture, Machine Tools, Oil & Gas, and Others), Regions, Segmentation, and forecast till 2029

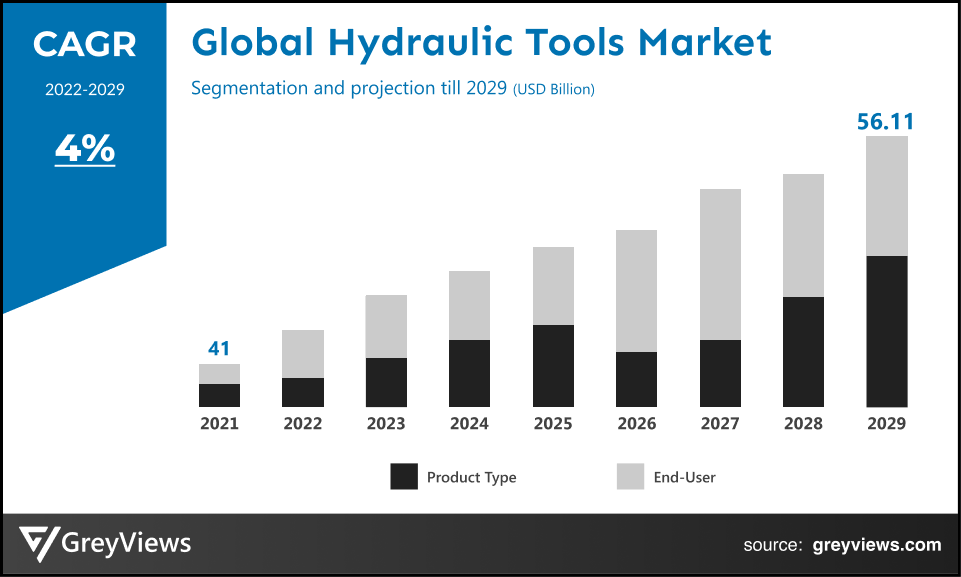

CAGR: 4%Current Market Size: USD 41 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Hydraulic Tools Market- Market Overview:

The Global Hydraulic Tools market is expected to grow from USD 41 billion in 2021 to USD 56.11 billion by 2029, at a CAGR of 4% during the forecast period 2022-2029. The growth of this market is mainly driven owing to increasing development in the construction industry around the world.

High-powered tools called hydraulic tools are used to drive hydraulic machinery with pressurized fluid. The fluid travels through hydraulic tubes to the actuator of the tool, where the pressure that has been built up in the fluid is transferred to the moving parts of the machine. The fluid is then pumped back through a pumping mechanism and pressured once more. Strong, transportable, and adaptable enough for use in a range of situations are hydraulic tools. A hydraulic power unit or the hydraulic system of a bigger piece of equipment can both be connected to many hydraulic tools. Jacks, cylinders, crimpers, spreaders, cutters, splitters, breakers, drivers, torque wrenches, punches, drills, saws, and other devices are examples of tools, but they are not the only ones. The daily operations in a variety of industrial settings are supported by hydraulic power tools, which are adaptable instruments. Hydraulic tools are used in a variety of industries, including construction, utilities, transportation, and railroads, for daily maintenance and other duties. By minimizing the time and physical effort personnel must use to complete a task, hydraulic tools improve the efficiency of various processes. Hydraulic tools are frequently used for tasks including building and maintaining roads and highways, erecting barriers and fences, fastening street signs to metal posts, driving construction cranes to help move big, heavy objects, tunneling, and mining.

Sample Request: - Global Hydraulic Tools Market

Market Dynamics:

Drivers:

- Growing need for material handling machinery

The rising cost of labour is causing issues for businesses everywhere. The relative productivity declines as labour expenses rise. Government rules, a mismatch between supply and demand, and a lack of trained workers are a few of the factors driving rising labour prices. Companies are finding it reasonable to invest in automated solutions due to the rise in labour prices. The market for material handling equipment is anticipated to be driven by the rising need for automated solutions across a number of industries, including automotive, metal, construction, and mining. The function, controllability, power, and safety of material handling equipment are all being improved through the use of hydraulics. As a result, the demand for hydraulics is being driven by the rising demand for material-handling equipment.

Restraints:

- Rising concerns about oil leaks

Oil is the primary hydraulic fluid used by hydraulic cylinders. Oil leakage in hydraulic cylinders is caused by a number of factors, including improper fittings and connections and environmental variables like vibrations, shocks, and temperature changes. The issue of leakage still exists to a great extent in sectors like mining and construction that demand extensive earthworks and the deployment of big fixed and mobile facilities in an environmentally sensitive site. This leak is risky for the environment and the workforce in addition to being expensive. Unexpected leakage also creates delays and prohibitive costs in the aerospace industry, especially when it happens on a job site. Additionally, it harms the environment since businesses in the marine, mining, and agricultural sectors often release this fluid (oil) into rivers or soil, resulting in significant government cleaning costs.

Opportunities:

- Hydraulic cylinders continue to undergo technological and research development

Increased investment in hydraulic cylinder research and development to provide upgraded variations to meet market demands is one of the primary methods used by industry players. Manufacturers like Parker-Hannifin Corporation, KYB Corporation, and Danfoss have been spending a lot of money on research and development to advance their hydraulic technology. As an illustration, KYB Corporation created hydraulic cylinders with strengthened chromium plating to offer higher wear resistance. In a similar vein, numerous large corporations, like SMC Corporation, Parker-Hannifin Corporation, and Bosch Rexroth, offer specifically designed hydraulic cylinders to satisfy customer needs. For example, Weber-Hydraulik has created unique hydraulic cylinders for use in Liebherr Telescopic Mobile cranes, the largest cranes in the world with a carrying capacity of up to 1,200 tonnes.

Challenges

- Substitutes are available

The environment becomes contaminated as a result of fluid leaks, primarily oil. One of the most significant issues with the use of hydraulics equipment is this. As a result, there is a rising need for alternatives such as pneumatic systems, which use the pressure of compressed gas to generate force in a reciprocating linear motion. Since a pneumatic system employs gases, it does not contaminate the environment even if there is a leak. Pneumatic systems are employed in material handling and agricultural applications where workers must be near to the equipment. Therefore, the availability of more environmentally friendly alternatives, including pneumatic systems, presents a challenge to the expansion of the hydraulics sector.

Segmentation Analysis:

The global hydraulic tools market has been segmented based on product type, end-user, and region.

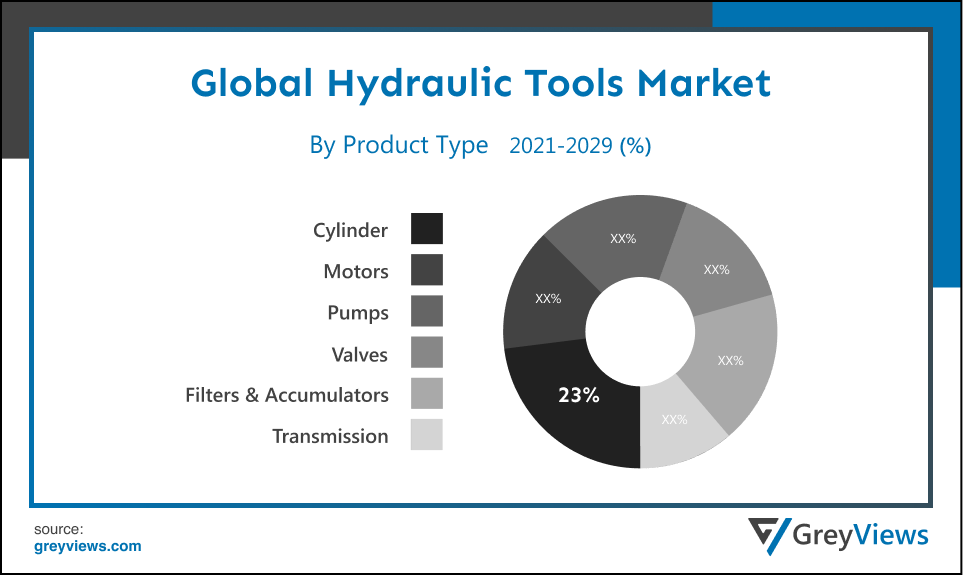

By Product Type

The product type segment is cylinders, motors, pumps, valves, filters & accumulators, and transmission. The cylinder segment led the hydraulic tools market with a market share of around 23% in 2021. The industry is expanding as a result of the widespread usage of hydraulic cylinders in a variety of sectors, including material handling, building and infrastructure, marine, and earthmoving. Large-scale engines like ship motors, steam engines, industrial furnaces, earthmoving equipment, and other construction machinery all use double-acting hydraulic cylinders. Over the projected period, the demand for double-acting hydraulic cylinders is anticipated to rise due to the rise in product demand in the aforementioned applications.

By End-User

The end-user includes material handling, aerospace & defense, construction, agriculture, machine tools, oil & gas, and others. The construction segment led the hydraulic tools market with a market share of around 34% in 2021. Hydraulics' introduction to the construction sector has considerably increased productivity, enabling more work to be completed in less time. The equipment was able to move in a range of directions and be precisely controlled thanks to the study of hydraulics. The use of hydraulic equipment is a crucial component of the contemporary construction industry, and as technology develops further, its significance will grow.

By Regional Analysis:

The regions analyzed for the hydraulic tools market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the hydraulic tools market and held a 36% share of the market revenue in 2021.

- North America region witnessed a major share. Tier 1 businesses with reliable hydraulic equipment, established alliances, and wide-ranging distribution networks predominate in the North American hydraulic equipment industry. However, with tailored offers for particular industry sectors, small, specialist competitors might increase their market share. Additionally, the region's oil and gas sector are expanding quickly, which increases the demand for hydraulic machinery. The US Energy Information Administration projects that by December 2022, dry natural gas production will have increased from a daily average of 95.1 billion cubic feet in October 2021 to 97.5 billion cubic feet.

- Asia Pacific is anticipated to experience significant growth during the predicted period. One of the main drivers of growth in the area is the enormous spending on construction. For instance, Asia accounted for around 4.5 trillion USD in 2020, or about half of all construction spending worldwide.

Global Hydraulic Tools Market- Country Analysis:

- Germany

Germany's Hydraulic Tools market size was valued at USD 2.62 billion in 2021 and is expected to reach USD 3.26 billion by 2029, at a CAGR of 2.8% from 2022 to 2029.

The enormous increase in the aerospace and military industries, as well as the country's high vehicle manufacturing, both considerably influence the hydraulic equipment market in Germany. The European aerospace and defense sector had a revenue of over $291.7 billion in 2019, according to the Aerospace and Defense Industries Association of Europe (ASD). The employment of hydraulic equipment, such as thrust reversers, primary flight controls, flap/slat drives, emergency hydraulic-driven electrical generators, rudders, landing gear, cargo doors, nose wheel steering, and spoilers, is being prompted by this.

- China

China Hydraulic Tools’ market size was valued at USD 4.98 billion in 2021 and is expected to reach USD 6.60 billion by 2029, at a CAGR of 3.6% from 2022 to 2029. China, the second-largest economy and top producer of hydraulic power machinery and parts accounts for 30.6% of the worldwide market in terms of scale, just less than the US (32%), and significantly more than other industrialized nations like Japan and Germany.

- India

India's Hydraulic Tools market size was valued at USD 3.73 billion in 2021 and is expected to reach USD 4.72 billion by 2029, at a CAGR of 3% from 2022 to 2029. The Indian economy depends heavily on the building industry. The government places a strong emphasis on the sector because it is crucial to driving India's overall growth and because it can help ensure that the nation develops world-class infrastructure on schedule. Despite the setbacks in India's construction industry, there is hope for the future because to the initiatives and procedures being developed to support major projects. For instance, Honey Group unveiled 33 projects in one day in April 2022, including nine projects in Telangana and 24 projects in Andhra Pradesh, setting a standard for the construction sector. The business has done this by employing a number of cutting-edge methods for building design, construction, and management.

Key Industry Players Analysis:

To increase their market position in the global hydraulic tools business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Taizhou Eternal Hydraulic Machine Co., Ltd.

- Poclain Hydraulics

- Bosch Rexroth Corporation

- Rotary Power

- VELJAN

- HYDRO LEDUC

- Eaton Corporation plc

- M+S Hydraulic Plc

- Italgroup S.r.l.

- SAI S.p.a

- Kawasaki Heavy Industries, Ltd.

- Maha Hydraulics

- Vivoil Oleodinamica Vivolo s.r.l.

- VBC Hydraulics

- Permco, Inc.

- Danfoss Group

- Bezares

- Maxma

- Parker Hannifin Corporation

Latest Development:

- In August 2022, The tiny hydraulic power pack type HICON, developed by HAWE for use in recreational boats but with a distinct advantage in many other applications, was released. As it is waterproof, it can operate when being splashed with water or briefly submerged in water.

- In July 2022, Bosch made an investment in BRUSA HyPower to round out its line of eLION products for off-road vehicle electrification. In the upcoming years, prominent corporations are likely to prioritize strategic acquisition and investments in up-and-coming businesses.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 4% |

| Market Size | 41 billion in 2021 |

| Forecast period | 2022-2029 |

| Forecast unit | Value (USD) |

| Segments covered | By Product Type, By End-User, and Region. |

| Report Scope | Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Taizhou Eternal Hydraulic Machine Co., Ltd., Poclain Hydraulics, Bosch Rexroth Corporation, Rotary Power, VELJAN, HYDRO LEDUC, Eaton Corporation plc, M+S Hydraulic Plc, Italgroup S.r.l., SAI S.p.a, Kawasaki Heavy Industries, Ltd., Maha Hydraulics, Vivoil Oleodinamica Vivolo s.r.l., VBC Hydraulics, Permco, Inc., Danfoss Group, Bezares, Maxma, and Parker Hannifin Corporation, among others |

| By Product Type |

|

| By End-User |

|

Regional scope |

|

Scope of the Report

Global Hydraulic Tools Market by Product Type:

- Cylinders

- Motors

- Pumps

- Valves

- Filters & Accumulators

- Transmission

Global Hydraulic Tools Market by By End-user:

- Material Handling

- Aerospace & Defense

- Construction

- Agriculture

- Machine Tools

- Oil & Gas

- Others

Global Hydraulic Tools Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the market size of the hydraulic tools market?

Global hydraulic tools market is expected to reach USD 56.11 billion by 2029, at a CAGR of 4% from 2022 to 2029.

Which region dominate the hydraulic tools market?

North America region dominated the hydraulic tools market and held a 36% share of the market revenue in 2021.

Which are the leading market players active in the hydraulic tools market?

Leading market players active in the global hydraulic tools market are Taizhou Eternal Hydraulic Machine Co., Ltd., Poclain Hydraulics, Bosch Rexroth Corporation, Rotary Power, VELJAN, HYDRO LEDUC, Eaton Corporation plc, M+S Hydraulic Plc, Italgroup S.r.l., SAI S.p.a, Kawasaki Heavy Industries, Ltd., Maha Hydraulics, Vivoil Oleodinamica Vivolo s.r.l., VBC Hydraulics, Permco, Inc., Danfoss Group, Bezares, Maxma, and Parker Hannifin Corporation.

What are the opportunities that are projected to influence the market in the upcoming years?

Development in the construction sector around the globe is projected to influence the market in the forecast years.

What is the key threats to the hydraulic tools market?

High cost of machine price is primarily impeding the growth of the hydraulic tools market.

Political Factors- The factors that can affect the long-term profitability of hydraulic tools in a given nation or market are heavily influenced by political issues. Industrial Equipment & Components, which includes hydraulic tools, are present in over a dozen nations and are under risk in a variety of political contexts. To succeed in such a fast-paced global Industrial Equipment & Components market, one must diversify their exposure to political environment systemic hazards. Before entering or making an investment in a certain market, the sector can carefully examine the following considerations. Political stability, the significance of the industrial equipment & components sector to the national economy, the threat of military invasion, the extent of corruption, particularly in industrial goods regulation, bureaucracy, and government meddling in the industrial equipment & components industry.

Economical Factors- The total supply and total investment in an economy are determined by macroenvironmental factors as the inflation rate, savings rate, interest rate, foreign exchange rate, and economic cycle. While microenvironmental elements like industry norms have an impact on the firm's competitive edge. Hydraulic tools can forecast the growth trajectory by using economic variables from the industry, such as the growth rate of the Industrial Equipment & Components industry and consumer spending. Additional economic factors that the hydraulic tool industry should take into account include: the type of economic system in the countries where it operates, its stability, government intervention in the free market and related industrial goods, exchange rates, and the stability of the host country's currency.

Social Factor- The manner of life and culture of the society have an effect on the organizational culture in a given setting. When developing a marketing message for consumers in the Industrial Equipment & Components industry, marketers in the Hydraulic tools sectors must take into account the shared views and attitudes of the general populace. Demographics and skill levels of the population, class structure, hierarchy, and power structures in society, educational attainment, as well as industry-specific educational standards, are social issues that need to be examined.

Technological Factors- Technological features including R&D effort, automation, technology incentives, and the pace of technological progress are examples of technological factors. They can establish entry barriers, and the minimum effective production level, and have an impact on outsourcing choices. Additionally, changes in technology can have an impact on prices, quality, and innovation. A company should analyze the industry's technological state as well as how quickly it is being disrupted by technology. Slow technological disruption will allow more time, whereas rapid disruption may give a firm little time to adapt and be profitable.

Environmental Factors- Environmental considerations include ecological and environmental elements including weather, climate, and climate change, which may have a particularly negative impact on some sectors of the economy like tourism, agriculture, and insurance. Additionally, as people become more aware of the possible effects of climate change, it is changing how businesses run and the products they offer, creating new markets but also eroding or eliminating existing ones. Climate changes such as climate change, greenhouse gas emissions, and growing pollution, are effectively by prominent market players. It should put more emphasis on waste management, recycling, renewable energy sources, and oil spillage. It should also be aware of how its resources and waste are being used up, as this could have a detrimental effect on its brand reputation and consumer loyalty.

Legal Factors- Legal considerations include those related to discrimination, consumers, antitrust, employment, and health and safety laws. These elements may have an impact on a company's operations, expenses, and product demand. The industry is subject to very strict legislative requirements. Market players to gain consumer loyalty and their faith in its brand products, it is crucial that it abide by all laws and binding rules and regulations. Nearly all nations now have laws that must be followed for consumer protection, data privacy, intellectual property rights (IPR), health and safety, employees and the workplace, and other topics. Therefore, it becomes essential for this business to conduct itself in a lawful and ethical manner in order to prevent any legal proceedings or penalties or punishments from a court of law.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Product Type

- 3.2. Market Attractiveness Analysis By End-User

- 3.3. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Construction industry in developing countries is expanding

- 3. Restraints

- 3.1. Rising concern about oil leaks

- 4. Opportunities

- 4.1. Hydraulic cylinders continue to undergo technological and research development

- 5. Challenges

- 5.1. Substitutes availability

- Global Hydraulic Tools Market Analysis and Projection, By Product Type

- 1. Segment Overview

- 2. Cylinders

- 3. Motors

- 4. Pumps

- 5. Valves

- 6. Filters & Accumulators

- 7. Transmission

- Global Hydraulic Tools Market Analysis and Projection, By End-User

- 1. Segment Overview

- 2. Material Handling

- 3. Aerospace & Defense

- 4. Construction

- 5. Agriculture

- 6. Machine Tools

- 7. Oil & Gas

- 8. Others

- Global Hydraulic Tools Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Hydraulic Tools Market-Competitive Landscape

- 1. Overview

- 2. Market Share of Key Players in the Hydraulic Tools Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- 3. Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Taizhou Eternal Hydraulic Machine Co., Ltd.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Poclain Hydraulics

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Bosch Rexroth Corporation

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Rotary Power

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- VELJAN

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- HYDRO LEDUC

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Eaton Corporation plc

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- M+S Hydraulic Plc

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Italgroup S.r.l.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- SAI S.p.a

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Taizhou Eternal Hydraulic Machine Co., Ltd.

List of Table

- Global Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Global Cylinders, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Motors, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Pumps, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Valves, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Filters & Accumulators, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Transmission, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Global Material Handling, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Aerospace & Defense, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Construction, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Agriculture, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Machine Tools, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Oil & Gas, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Others, Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- Global Hydraulic Tools Market, By Region, 2021–2029 (USD Billion)

- North America Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- North America Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- USA Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- USA Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Canada Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Canada Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Mexico Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Mexico Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Europe Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Europe Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Germany Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Germany Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- France Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- France Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- UK Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- UK Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Italy Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Italy Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Spain Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Spain Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Asia Pacific Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Asia Pacific Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Japan Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Japan Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- China Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- China Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- India Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- India Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- South America Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- South America Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Brazil Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Brazil Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- Middle East and Africa Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- Middle East and Africa Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- UAE Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- UAE Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

- South Africa Hydraulic Tools Market, By Product Type, 2021–2029 (USD Billion)

- South Africa Hydraulic Tools Market, By End-User, 2021–2029 (USD Billion)

List of Figures

- Global Hydraulic Tools Market Segmentation

- Hydraulic Tools Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Hydraulic Tools Market Attractiveness Analysis By Product Type

- Global Hydraulic Tools Market Attractiveness Analysis By End-User

- Global Hydraulic Tools Market Attractiveness Analysis By Region

- Global Hydraulic Tools Market: Dynamics

- Global Hydraulic Tools Market Share By Product Type (2021 & 2029)

- Global Hydraulic Tools Market Share By End-User (2021 & 2029)

- Global Hydraulic Tools Market Share by Regions (2021 & 2029)

- Global Hydraulic Tools Market Share by Company (2020)