In-vitro Diagnostics Market Size by Product and Service (Reagents & Kits, Instruments, Services, and Data Management Software), By Technology, By Application, End User (Hospital laboratories, Clinical laboratories, Point-of-care testing centers, Academic institutes, Patients, and other end users) Regions, Segmentation, and forecast till 2029.

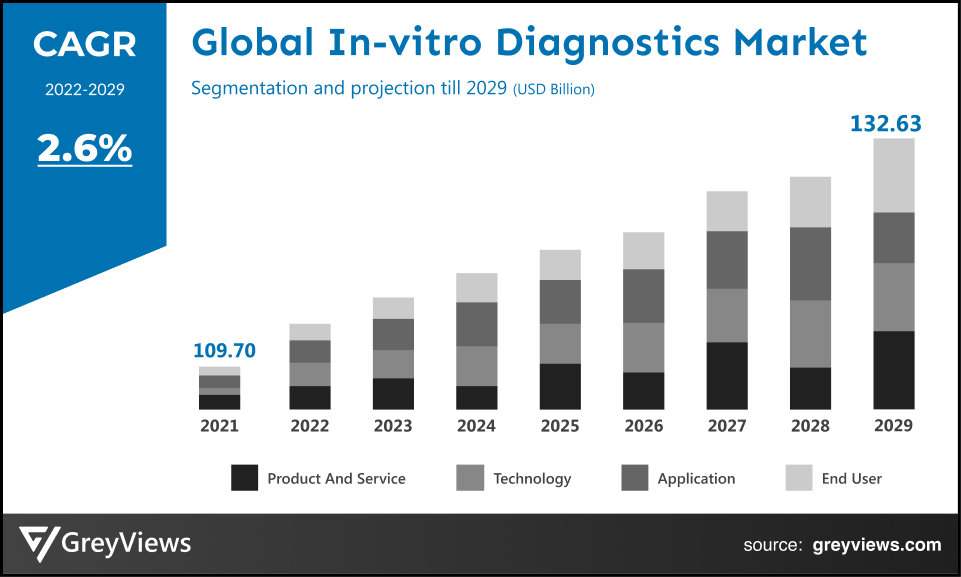

CAGR: 2.6% Current Market Size: USD 109.70 Billion Fastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global In-vitro Diagnostics Market- Market Overview:

Global In-vitro Diagnostics market is expected to grow from USD 109.70 billion in 2021 to USD 132.63 billion by 2029, at a CAGR of 2.6% during the forecast period 2022-2029. This market growth is mainly driven by the increasing geriatric population and the prevalence of infectious and chronic diseases.

In vitro Diagnostics (IVDs) are tests done on samples such as human blood or tissue to detect disease, infections, and conditions. These tests are usually conducted in test tubes or similar equipment. It is conducted on blood, stool, urine, and tissue samples to provide medical information used to diagnose conditions ranging from minor infections to life-threatening cancers. In addition to this, IVDs are used by patients to monitor chronic conditions such as diabetes. Hence, these tests enhance the patient's convenience through self-tests, including blood glucose monitors or pregnancy tests. Such tests can be conducted wherever the patient is, enabling them to record their condition.

The prominent IVD products include pregnancy tests, HIV tests, and COVID-19 tests, along with Cancer diagnostics, blood glucose monitoring systems, blood grouping devices, human genetic testing devices, immunoassays, and hepatitis tests. Furthermore, IVDs are also seeing significant applications in precision medicine for identifying patients who are projected to benefit from specific therapies or treatments.

Request Sample: - Global In-vitro Diagnostics Market

Market Dynamics:

Drivers:

- Rapid growth in geriatric population and prevalence of infectious and chronic diseases

Every country globally is witnessing rapid growth in both the proportion and the size of older persons in the population. For instance, according to the World Health Organization (WHO), 1 in 6 people around the globe will be aged more than 60 years by 2030. This growth in the geriatric population creates increased demand for healthcare services. Moreover, the incidence of chronic diseases such as diabetes, heart disease, and cancer among the aging population is comparatively higher than in the younger population. For instance, as per the World Health Organization (WHO), the prevalence of chronic diseases was expected to rise by 57% by December 2020. In addition, emerging markets such as China and India were expected to be hardest hit by chronic diseases due to population growth. These diseases include chronic respiratory diseases, cancer, cardiovascular diseases, and diabetes. The prevalence of such diseases has fuelled demand for in vitro diagnostics.

- Expansion of the precision medicine sector

Precision medicine is mainly aimed at targeting accurate treatments to the right patients at the right time. In vitro diagnostics are used in this sector to identify patients who are expected to benefit from specific therapies or treatments. Hence, an overall growth of the precision medicine sector drives the In Vitro Diagnostics market growth.

Restraints:

- Increasing healthcare costs

Due to related high costs, there is a major shortage of diagnostics solutions and equipment in low- and middle-income countries (LMICs). This has been the major restraint in the global in the vitro diagnostics market. In addition, sophisticated and expensive medical equipment is seeing comparatively less adoption in rural and semi-rural areas across the LMIC settings. For instance, according to the Centers for Medicare & Medicaid Services, the U.S. federal agency, healthcare costs will skyrocket to $4.3 trillion in 2021. This increase in healthcare costs is anticipated to hamper the growth of the market to some extent during the forecast period.

Opportunities:

- Increased significance of companion diagnostics

A companion diagnostic device provides information that is crucial for effective and safe usage of a corresponding therapeutic product. These devices are usually developed in collaboration with drug development companies to help doctors in excluding or select particular patients for treatment. Moreover, recently, the U.S. Food and Drug Administration (FDA) issued draft guidance that outlined considerations for the labeling and development of in vitro companion diagnostics to support indicated usage for several drug or biologic oncology products. Such regulations associated with in vitro companion diagnostics have further created lucrative growth opportunities for the market.

Challenges

- The new European regulations for medical devices (EU MDR) and In-vitro Diagnostic Devices (EU IVDR)

The European regulations for medical devices (EU MDR) and In-vitro Diagnostic Devices (EU IVDR) have replaced In-vitro Diagnostic Directive (IVDD), old legislation, in May 2022. These regulations require manufacturers in IVD market to make considerable changes in data reporting, product development, and quality assurance. This is expected to pose challenges such as higher costs and longer timelines for new product development in front of in vitro diagnostics device manufacturers.

Segmentation Analysis:

The global In-vitro Diagnostics market has been segmented based on product and service, technology, application, end-user, and regions.

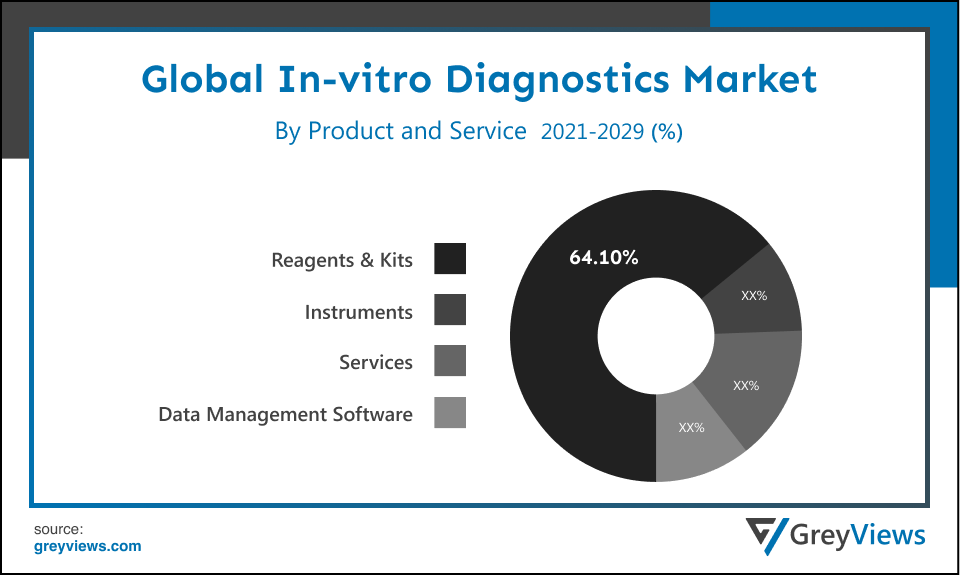

By Product and Service

The product and service segment includes reagents & kits, instruments, services, and data management software. The reagents & kits segment led the In-vitro Diagnostics market with a market share of around 64.10% in 2021. This is attributed to the upsurge in demand for COVID-19 test kits & reagents for the detecting proteins from the COVID-19 virus in respiratory or in serum or blood samples. In addition, rising product development trend in the market creates lucrative growth opportunities for the market. For instance, In June 2022, Agilent Technologies Inc., American analytical instrumentation development and manufacturing company, launched the In Vitro Diagnostic Regulation (IVDR) (EU) 2017/746 compliant Class A products, including kits, instruments, and reagents.

By Technology

The technology segment includes immunoassay/ immunochemistry, clinical chemistry, molecular diagnostics, hematology, microbiology, coagulation and hemostasis, urinalysis, and other technologies. The molecular diagnostics segment led the In-vitro Diagnostics market with a market share of around 35.1% in 2021. The growth of this segment is mainly driven by continuous technological evolution and the introduction of new technology. For instance, in February 2020, FIND, an international non-profit organization, introduced an expression of interest (EOI) for test developers of in vitro diagnostics (IVDs) for detection of SARS-CoV-2 nucleic acid (molecular tests).

By End User

The end users segment includes hospital laboratories, clinical laboratories, point-of-care testing centers, academic institutes, patients, and other end users. The hospital laboratories segment led the In-vitro Diagnostics market with a market share of around 36.10% in 2021. The ongoing development trend of automated IVD systems for hospitals and laboratories to provide accurate, efficient, and error-free diagnoses has driven the growth of this segment. Furthermore, in March 2022, Applied BioCode, an IVD manufacturer, signed an agreement with Hardy Diagnostics, a manufacturer of microbiology products in the U.S., for the distribution of the MDx-3000 System for the diagnosis of gastrointestinal infections and upper respiratory infections. This system is expected to be used by high-complexity laboratories. Such developments are expected to create lucrative growth opportunities for the growth of this segment.

By Regional Analysis:

The regions analyzed for the In-vitro Diagnostics market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The North American region dominated the In-vitro Diagnostics market and held the 38.02% share of the market revenue in 2021.

- North America region witnessed a major share. The growth of the market in this region is mainly driven by factors such as the growing geriatric population and associated diseases, favorable funding and reimbursement scenarios, and comparatively higher spending on healthcare in the region. In addition, U.S. healthcare spending increased by 9.7% in 2020, reaching $12,530 per person or $4.1 trillion. Also, health spending accounted for 19.7% share of the overall GDP. This spending on the healthcare sector is prominently boosting the growth of North America In-vitro Diagnostics market.

- Asia-Pacific is expected to witness the highest growth rate during the forecast period. Upsurge in the number of diagnostic centers and hospitals, improving national infrastructure, and rising healthcare spending have driven the growth of the Asia-Pacific In-Vitro Diagnostic Market

Global In-vitro Diagnostics Market- Country Analysis:

- Germany

In Europe, Germany is one of the largest market shareholders in the In-Vitro Diagnostic Market In addition, this country has a strong healthcare system, especially in regard to hospital beds, infrastructure, equipment, and trained staff.

Germany's In-vitro Diagnostics market size was valued at USD 10.97 billion in 2021 and is expected to reach USD 13.22 billion by 2029, at a CAGR of 2.5% from 2022 to 2029.

A number of factors, including the growing number of private hospitals, rising demand for personalized medicine & point-of-care testing, and an upsurge in the number of independent testing laboratories, have driven the growth of Germany In-vitro Diagnostics market. Moreover, according to the International Diabetes Federation, an umbrella organization of over 230 national diabetes associations, the prevalence rate of diabetes in adults across Germany was 15.3% in 2020. This has further created the demand for In-vitro Diagnostics in the country.

- China

China's In-vitro Diagnostics market size was valued at USD 21.94 billion in 2021 and is expected to reach USD 26.22 billion by 2029, at a CAGR of 2.4% from 2022 to 2029. China has become a prominent In-vitro Diagnostics markets due to economic growth, the aging population, and expanding basic health insurance sector. In addition, by 2030, the Chinese government has planned a broader healthcare ecosystem of about 16 trillion RMB with continuous optimization of healthcare management & services.

Furthermore, according to the National Health Commission of the People's Republic of China, about 1.71 million cases of infectious diseases were reported in December 2019 in the country. This prevalence of infectious diseases has boosted demand for In-vitro Diagnostics in the country.

- India

India's In-vitro Diagnostics market size was valued at USD 4.39 billion in 2021 and is expected to reach USD 5.38 billion by 2029, at a CAGR of 2.8% from 2022 to 2029. India is one of the strongest growing economies in Asia. This country is seeing increased government spending on the development of healthcare facilities. For instance, in December 2019, the ministry of health and family welfare of the Indian government introduced its plans to partner with private firms operating in diagnostic services to provide enhanced diagnostic services under the Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB-PMJAY).

Key Industry Players Analysis:

To increase their market position in the global In-vitro Diagnostics business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Roche Diagnostics

- Siemens Healthineers

- Danaher Corporation

- Abbott

- Thermo Fisher Scientific

- Johnson & Johnson

- Becton

- Dickinson and Company

- Bio-Rad Laboratories

- Sysmex Corporation

Latest Development:

- In March 2022, Roche Diagnostics, a Swiss multinational healthcare company, collaborated with Bristol Myers Squibb, an American multinational pharmaceutical company, to support the advancements in personalized healthcare with the help of digital pathology solutions.

- In February 2022, Siemens Healthineers AG, a German medical device company, partnered with United Nations Children's Fund UNICEF to optimize Point-of-Care diagnostics networks. The partnership is aimed at strengthening the fragile health systems across sub-Saharan Africa.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

2.6% |

|

Market Size |

109.70 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product and service, technology, application, end user, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Roche Diagnostics, Siemens Healthineers, Danaher Corporation, Abbott, Thermo Fisher Scientific, Johnson & Johnson, Becton, Dickinson and Company, Bio-Rad Laboratories, Sysmex Corporation, among others |

|

By Product and Service |

|

|

By Technology |

|

|

By Application |

|

|

By End User |

|

|

Regional scope |

|

Scope of the Report

Global In-vitro Diagnostics Market by Product and Service:

- Reagents & Kits

- Instruments

- Services

- Data Management Software

Global In-vitro Diagnostics Market by Technology:

- Immunoassay/ Immunochemistry

- Clinical chemistry

- Molecular diagnostics

- Hematology

- Microbiology

- Coagulation and Hemostasis

- Urinalysis

- Other Technologies

Global In-vitro Diagnostics Market by Application:

- Infectious diseases

- Diabetes

- Oncology

- Cardiology

- Drug Testing/ Pharmacogenomics

- Autoimmune diseases

- HIV/AIDS

- Nephrology

- Other applications

Global In-vitro Diagnostics Market by End User:

- Hospital laboratories

- Clinical laboratories

- Point-of-care testing centers

- Academic institutes

- Patients

- Other end users

Global In-vitro Diagnostics Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of Global In-Vitro Diagnostic Market?

Global In-Vitro Diagnostic Market size is USD 109.70 billion in 2021

What is the projected market size of Global In vitro Diagnostics market in 2029?

Global In vitro Diagnostics market will command to USD 132.63 billion by 2029, at a CAGR of 2.6% from 2022 to 2029

Which region is largest market for In vitro Diagnostics?

North American region dominated the In-vitro Diagnostics market and held the 38.02% share of the market revenue in 2021

Who are the leading market players in the In-vitro Diagnostics market?

Leading market players active in the global In vitro Diagnostics market are Roche Diagnostics, Siemens Healthineers, Danaher Corporation, Abbott, Thermo Fisher Scientific, Johnson & Johnson, Becton, Dickinson and Company, Bio-Rad Laboratories, and Sysmex Corporation among others.

What are the key driver of the In vitro Diagnostics market?

Increasing geriatric population and prevalence of infectious and chronic diseases is primarily driving the growth of the In vitro Diagnostics market.

What is latest event happened in In vitro Diagnostics Market?

In March 2022, Roche Diagnostics, a Swiss multinational healthcare company, collaborated with Bristol Myers Squibb, an American multinational pharmaceutical company, to support the advancements in personalized healthcare with the help of digital pathology solutions.

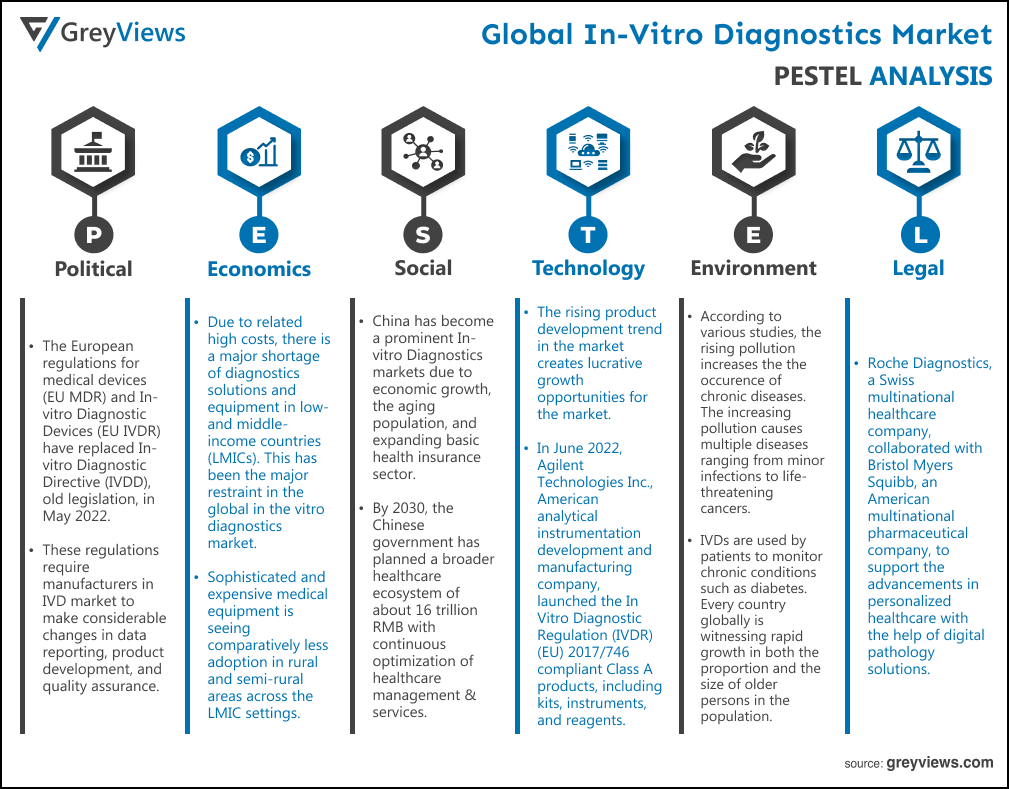

Political Factors- The European regulations for medical devices (EU MDR) and In-vitro Diagnostic Devices (EU IVDR) have replaced In-vitro Diagnostic Directive (IVDD), old legislation, in May 2022. These regulations require manufacturers in IVD market to make considerable changes in data reporting, product development, and quality assurance. This is expected to pose challenges such as higher costs and longer timelines for new product development in front of in vitro diagnostics device manufacturers. For instance, in December 2019, the ministry of health and family welfare of the Indian government introduced its plans to partner with private firms operating in diagnostic services to provide enhanced diagnostic services under the Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB-PMJAY).

Economical Factors- Due to related high costs, there is a major shortage of diagnostics solutions and equipment in low- and middle-income countries (LMICs). This has been the major restraint in the global in the vitro diagnostics market. In addition, sophisticated and expensive medical equipment is seeing comparatively less adoption in rural and semi-rural areas across the LMIC settings. For instance, according to the Centers for Medicare & Medicaid Services, the U.S. federal agency, healthcare costs will skyrocket to $4.3 trillion in 2021. This increase in healthcare costs is anticipated to hamper the growth of the market to some extent during the Projection period.

Social Factor- China has become a prominent In-vitro Diagnostics markets due to economic growth, the aging population, and expanding basic health insurance sector. In addition, by 2030, the Chinese government has planned a broader healthcare ecosystem of about 16 trillion RMB with continuous optimization of healthcare management & services. Furthermore, according to the National Health Commission of the People's Republic of China, about 1.71 million cases of infectious diseases were reported in December 2019 in the country. This prevalence of infectious diseases has boosted demand for In-vitro Diagnostics in the country.

Technological Factors- The rising product development trend in the market creates lucrative growth opportunities for the market. For instance, In June 2022, Agilent Technologies Inc., American analytical instrumentation development and manufacturing company, launched the In Vitro Diagnostic Regulation (IVDR) (EU) 2017/746 compliant Class A products, including kits, instruments, and reagents. FIND, an international non-profit organization, introduced an expression of interest (EOI) for test developers of in vitro diagnostics (IVDs) for detection of SARS-CoV-2 nucleic acid (molecular tests).

Environmental Factors- According to various studies, the rising pollution increases the the occurence of chronic diseases. The increasing pollution causes multiple diseases ranging from minor infections to life-threatening cancers. In addition to this, IVDs are used by patients to monitor chronic conditions such as diabetes. Every country globally is witnessing rapid growth in both the proportion and the size of older persons in the population. For instance, according to the World Health Organization (WHO), 1 in 6 people around the globe will be aged more than 60 years by 2030. This growth in the geriatric population creates increased demand for healthcare services.

Legal Factors- Roche Diagnostics, a Swiss multinational healthcare company, collaborated with Bristol Myers Squibb, an American multinational pharmaceutical company, to support the advancements in personalized healthcare with the help of digital pathology solutions. Siemens Healthineers AG, a German medical device company, partnered with United Nations Children's Fund UNICEF to optimize Point-of-Care diagnostics networks. The partnership is aimed at strengthening the fragile health systems across sub-Saharan Africa.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product and Service

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By End User

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Rapid growth in geriatric population and prevalence of infectious and chronic diseases

- Expansion of precision medicine sector

- Restrains

- Increasing healthcare costs

- Opportunities

- Increased significance of companion diagnostics

- Challenges

- The new European regulations for medical devices (EU MDR) and In-vitro Diagnostic Devices (EU IVDR)

- Global In vitro Diagnostics Market Analysis and Projection, By Product and Service

- Segment Overview

- Reagents & Kits

- Instruments

- Services

- Data Management Software

- Global In vitro Diagnostics Market Analysis and Projection, By Technology

- Segment Overview

- Immunoassay/ Immunochemistry

- Clinical chemistry

- Molecular diagnostics

- Hematology

- Microbiology

- Coagulation and Hemostasis

- Urinalysis

- Other Technologies

- Global In vitro Diagnostics Market Analysis and Projection, By Application

- Segment Overview

- Infectious diseases

- Diabetes

- Oncology

- Cardiology

- Drug Testing/ Pharmacogenomics

- Autoimmune diseases

- HIV/AIDS

- Nephrology

- Other applications

- Global In vitro Diagnostics Market Analysis and Projection, By End User

- Segment Overview

- Hospital laboratories

- Clinical laboratories

- Point-of-care testing centers

- Academic institutes

- Patients

- Other end users

- Global In vitro Diagnostics Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global In vitro Diagnostics Market-Competitive Landscape

- Overview

- Market Share of Key Players in the In vitro Diagnostics Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product and Service Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Roche Diagnostics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Siemens Healthineers

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Danaher Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Abbott

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Thermo Fisher Scientific

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Johnson & Johnson

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Becton, Dickinson and Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Bio-Rad Laboratories

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Sysmex Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- bioMérieux

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product and Service Portfolio

- Recent Developments

- SWOT Analysis

- Roche Diagnostics

List of Table

- Global In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Global Reagents & Kits In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Instruments In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Services Market, By Region, 2021–2029(USD Billion)

- Global Data Management Software Market, By Region, 2021–2029(USD Billion)

- Global In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Global Immunoassay/ Immunochemistry In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Clinical chemistry In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Molecular diagnostics In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Hematology In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Microbiology In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Coagulation and Hemostasis In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Urinalysis In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Others In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Global Infectious diseases In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Diabetes In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Oncology In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Cardiology In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Drug Testing/ Pharmacogenomics In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Autoimmune diseases In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global HIV/AIDS In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Nephrology In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Other applications In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Global Hospital laboratories In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Clinical laboratories In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Point-of-care testing centers In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Academic institutes In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Patients In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global Other end users In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global In vitro Diagnostics Market, By Region, 2021–2029(USD Billion)

- Global In vitro Diagnostics Market, By North America, 2021–2029(USD Billion)

- North America In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- North America In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- North America In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- North America In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- USA In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- USA In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- USA In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- USA In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Canada In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Canada In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Canada In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Canada In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Mexico In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Mexico In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Mexico In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Mexico In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Europe In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Europe In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Europe In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Europe In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Germany In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Germany In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Germany In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Germany In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- France In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- France In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- France In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- France In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- UK In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- UK In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- UK In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- UK In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Italy In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Italy In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Italy In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Italy In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Spain In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Spain In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Spain In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Spain In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Asia Pacific In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Asia Pacific In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Asia Pacific In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Asia Pacific In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Japan In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Japan In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Japan In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Japan In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- China In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- China In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- China In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- China In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- India In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- India In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- India In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- India In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- South America In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- South America In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- South America In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- South America In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Brazil In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Brazil In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Brazil In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Brazil In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- Middle East and Africa In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- Middle East and Africa In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- Middle East and Africa In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- UAE In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- UAE In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- UAE In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- UAE In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

- South Africa In vitro Diagnostics Market, By Product and Service, 2021–2029(USD Billion)

- South Africa In vitro Diagnostics Market, By Technology, 2021–2029(USD Billion)

- South Africa In vitro Diagnostics Market, By Application, 2021–2029(USD Billion)

- South Africa In vitro Diagnostics Market, By End User, 2021–2029(USD Billion)

List of Figures

- Global In vitro Diagnostics Market Segmentation

- In vitro Diagnostics Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global In vitro Diagnostics Market Attractiveness Analysis By Product and Service

- Global In vitro Diagnostics Market Attractiveness Analysis By Technology

- Global In vitro Diagnostics Market Attractiveness Analysis By Application

- Global In vitro Diagnostics Market Attractiveness Analysis By End User

- Global In vitro Diagnostics Market Attractiveness Analysis By Region

- Global In vitro Diagnostics Market: Dynamics

- Global In vitro Diagnostics Market Share By Product and Service(2021 & 2029)

- Global In vitro Diagnostics Market Share By Technology(2021 & 2029)

- Global In vitro Diagnostics Market Share By Application(2021 & 2029)

- Global In vitro Diagnostics Market Share By End User (2021 & 2029)

- Global In vitro Diagnostics Market Share by Regions (2021 & 2029)

- Global In vitro Diagnostics Market Share by Company (2020)