Industrial Water Service Market Size By Service Type (Water Resource Management, Water Supply Management, and Waste Water Management), By End-user (Pharmaceutical Industry, Power Generation Industry, Pulp & Paper Mills, Microelectronics, Food & Beverage Industry, Oil & Gas, Automotive, Mining & Metals, and Others) Regions, Segmentation, and Projection till 2029

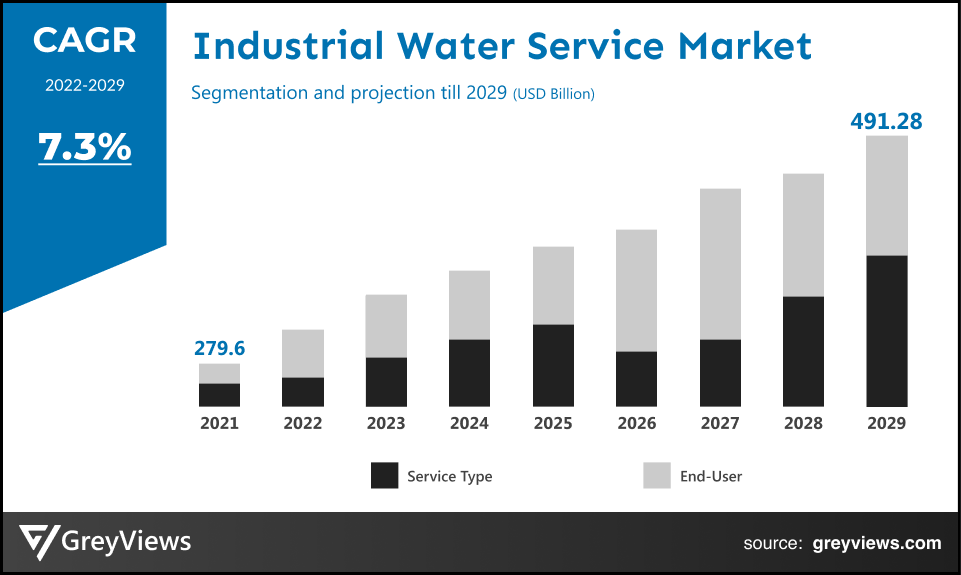

CAGR: 7.3%Current Market Size: USD 279.6 billionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Industrial Water Service Market- Market Overview:

Global Industrial Water Service market is expected to reach USD 491.28 billion by 2029, at a CAGR of 7.3% from 2022 to 2029 This growth of the Industrial water service market is significantly driven by the rising demand for water in the industries owing to their multiple functions. Industrial water services are the most crucial services as any organization requires water for each and every process for creating their products or cooling equipment used in creating their products. According to the United States Geological Survey (USGS), industrial water is used for processing, fabricating, washing, cooling, diluting, and transporting a product. Wastewater and industrial water are both a by-product of commercial and industrial water activities. Water is the most crucial resource on earth as it is used for several functions and across a multitude of industries. However, the wastewater generated must be managed carefully to help reduce environmental pollution. Several industries also use heavy water, including food, chemicals, paper, refined petroleum, or primary metals.

Sample Request: - Global Industrial Water Service Market

Market Dynamics:

Drivers:

- Increasing application of water in industries

Industries these days are becoming increasingly dependent on water as several processes of the industries cannot take place without water. Ultrapure water is used in semiconductor manufacturing, which drives the market’s growth. Besides, water is also used for cooling purposes in industries to remove heat from processes or equipment. Despite digitalization, there are several industries, such as the pulp and paper industry is one of the largest users of industrial process water, propelling the market’s growth.

Restraints:

- Wastewater generation

The wastewater generation from the industries is not managed properly, posing a great risk to the environment and hampering the market’s growth. Most industries do not treat wastewater, increasing water pollution and restraining the market’s growth. Moreover, the plants used for wastewater treatment require a steady and continuous power supply. Every year, the wastewater treatment process consumes between 3% and 15% of the country’s electrical power. High dependency on power for wastewater management negatively impacts the industrial water services market.

Opportunities:

- Rising industrialization

The increasing industrialization from various sectors increases the demand for the industrial water service market, providing an opportunity for growth. Industries such as brewery and carbonated beverage water, sugar mills and refineries, dairy industries, textile manufacturing, oil and gas, pulp and paper mills, the automotive and aircraft industries, and many others use the industrial water services in large numbers providing growth opportunities for the during the Projection period.

Challenges

- Stringent government regulations

Implementation of stringent norms and regulations by different governments for water use in industries from natural sources challenges the market’s growth. For instance, the Clean Water Act (CWA) defines the simple structure for controlling pollution discharges into U.S. waters and regulating surface water quality standards. The U.S government initiatives regarding wastewater disposal and treatment have successfully minimized the effects of wastewater on the ecosystem. Several other countries, such as Spain, China, the Netherlands, and others, also have stringent regulatory measures for wastewater management, which is expected to challenge the market’s growth during the Projection period.

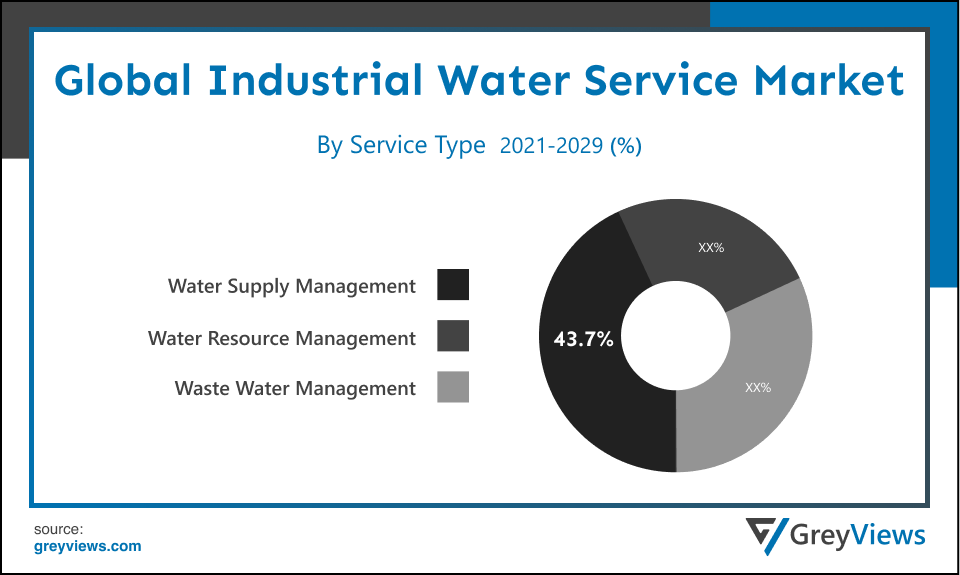

Segmentation Analysis:

The global Industrial Water Service market has been segmented based on service type, end-users, and regions.

By service type

The service type segment includes water resource management, water supply management, and waste water management. The water supply management segment led the Industrial Water Service market with a market share of around 43.7% in 2021. The supply management is one of the most crucial services as the proper and even distribution of water supply is needed by the different processes of the industries.

By End-users

The end-users segment includes pharmaceutical industry, power generation industry, pulp & paper mills, microelectronics, food & beverage industry, oil & gas, automotive, mining & metals, and others. The pulp & paper segment led the Industrial Water Service market with a market share of around 15.13% in 2021. Despite digitalization promoting the use of digital paper, the pulp and paper industry still remains one of the largest users of industrial water service. Water is increasingly being used at all three stages of paper production, namely, pulp making, pulp processing, and paper/paper board manufacturing, and their associated activities of cooking, bleaching, and washing. This propels the growth of the market in the segment.

By Regional Analysis:

The regions analyzed for the Industrial Water Service market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the Industrial Water Service market and held a 41.7% share of the market revenue in 2021.

- Asia-Pacific region has registered the highest value for the year 2021. The presence of well-established industries in countries such as China, Japan, India, and South Korea propels the market’s growth in the region. Furthermore, the rapid population growth and industrialization in the regions also add impetus to the market’s growth. China is one of the largest economies with high industrial growth, which increases the region's demand for industrial water services.

- North America is likely to register substantial growth during the Projection period due to the presence of prominent industries in the region, such as Xylem, Veolia, Dow, and others. Furthermore, the rising urbanization and rapid and increasing disposable income propel the market’s growth in the region. The region also has a proper innovative and smart wastewater pumping system from Xylem's Flygt brand, which propels the market’s growth.

Global Industrial Water Service Market- Country Analysis:

- China

China is the largest Industrial Water Service market globally, with an estimated market share of 25.4% across the Asia-Pacific region by 2022. The demand for Industrial Water services in the country has been rising as China is one of the largest economies with high industrial growth, substantially increasing the demand for industrial services. Furthermore, the increasing number of regional industries propels the market’s growth.

- Germany

In the Europe region, Germany is the largest market shareholder in the Industrial Water Service market, with an estimated market share of around 21.32% by the end of 2022. Germany is the leading consumer of industrial water services owing to significant industrial developments and high usage by several end-use industries such as chemicals and manufacturing, power, food & beverage, resulting in increased demand for industrial water services.

Key Industry Players Analysis:

To increase their market position in the global Industrial Water Service business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Salher

- Dober

- Veolia Environment

- American Water

- Ecolab

- PARKER HANNIFIN CORP

- Pentair

- Evoqua Water Technologies LLC

- Suez Environnement S.A

- United Utilities Group PLC

- Xylem, Inc.

- Danaher Corporation

- DuPont

- Toshiba Corporation, etc.

Latest Development:

- In April 2022, Suez’s Jiangsu Sino French Water Co Ltd was awarded a 30-year build-and-operate contract from Changshu Urban Construction Public Assets Management Co Ltd. for designing, constructing, and operating the industrial wastewater treatment plant in Changshu, China.

- In April 2021, Veolia North America acquired Suez North America, which specializes in wastewater treatment. The deal adds 6.7 million new water consumers to Veolia North America's portfolio, including over 700,000 drinking water users served through 67 new public-private partnerships and six new regulated utilities.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

7.3% |

|

Market Size |

USD 279.6 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Service Type, End-user, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Salher, Dober, Veolia Environment, American Water, Ecolab, PARKER HANNIFIN CORP, Pentair, Evoqua Water Technologies LLC, Suez Environnement S.A, United Utilities Group PLC, Xylem, Inc., Danaher Corporation, DuPont, Toshiba Corporation, etc., among others. |

|

By Service Type |

|

|

By End-User |

|

|

Regional scope |

|

Scope of the Report

Global Industrial Water Service Market by service type:

- Water Resource Management

- Water Supply Management

- Waste Water Management

Global Industrial Water Service Market by End-users:

- Pharmaceutical Industry

- Power Generation Industry

- Pulp & Paper Mills

- Microelectronics

- Food & Beverage Industry

- Oil & Gas

- Automotive

- Mining & Metals

- Others

Global Industrial Water Service Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the market size of the Industrial Water Service market in 2029?

Global Industrial Water Service market is expected to reach 491.28 billion by 2029, at a CAGR of 7.3% from 2022 to 2029.

Which are the leading market players active in the Industrial Water Service market?

Leading market players active in the global Industrial Water Service market are Salher, Dober, Veolia Environment, American Water, Ecolab, PARKER HANNIFIN CORP, Pentair, Evoqua Water Technologies LLC, Suez Environnement S.A, United Utilities Group PLC, Xylem, Inc., Danaher Corporation, DuPont, Toshiba Corporation, etc., among others.

What are the key drivers of the Industrial Water Service market?

Increasing application of industrial water service, is primarily driving the growth of the Industrial Water Service market.

What are the detailed impacts of the COVID-19 pandemic on the global market?

The pandemic has significantly affected several industries and has caused a worldwide economic slowdown. Many regions imposed various lockdowns during the fiscal year 2020. These lockdowns led to the closure of the regional industries and all types of manufacturing facilities, which has led to a shortage of supply in the market. Additionally, all the end-users industries were temporarily closed during this period, which in turn decreased the sales for Industrial Water Service.

What are the ongoing trends that are projected to influence the market in the upcoming years?

Manufacturers in the Industrial Water Service market are using advanced production technologies to incorporate better results, and capacity expansion of the storage systems. In addition, the rising number of investments will contribute to demand for the Industrial Water Service.

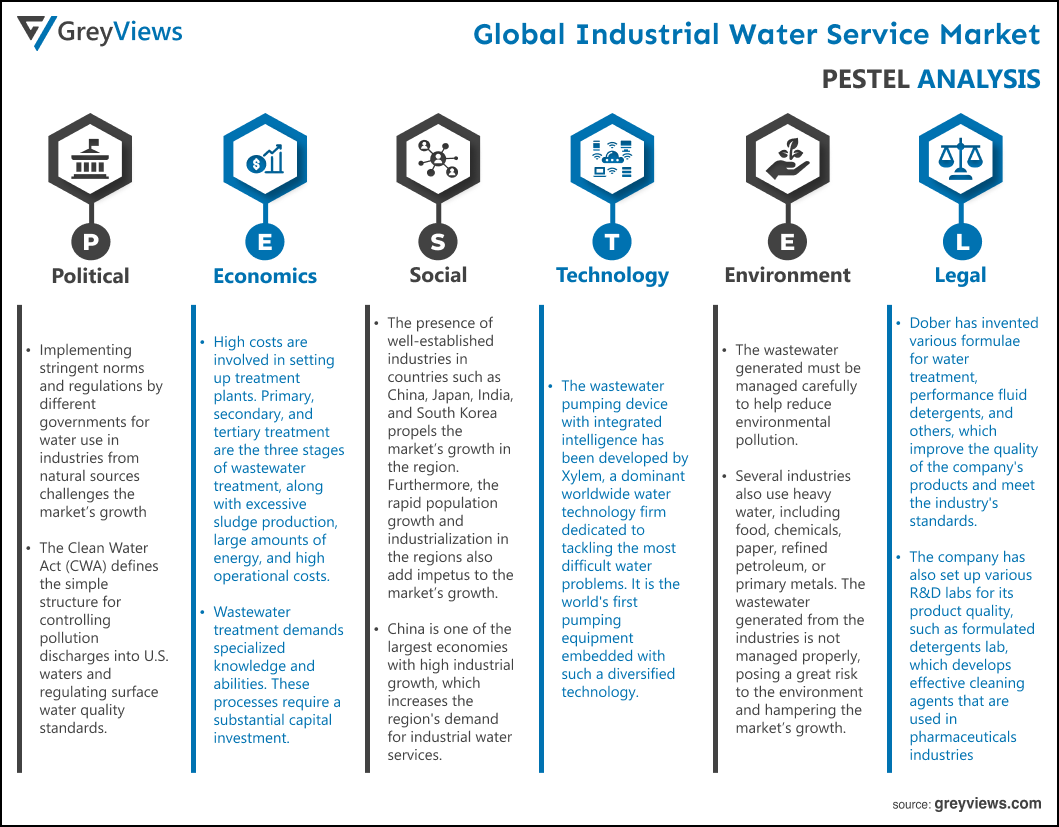

Political Factors- Implementing stringent norms and regulations by different governments for water use in industries from natural sources challenges the market’s growth. For instance, the Clean Water Act (CWA) defines the simple structure for controlling pollution discharges into U.S. waters and regulating surface water quality standards. The U.S government initiatives regarding wastewater disposal and treatment have successfully minimized the effects of wastewater on the ecosystem. Several other countries, such as Spain, China, the Netherlands, and others, also have stringent regulatory measures for wastewater management, which is expected to challenge the market’s growth during the Projection period.

Economical Factors- High costs are involved in setting up treatment plants. Primary, secondary, and tertiary treatment are the three stages of wastewater treatment, along with excessive sludge production, large amounts of energy, and high operational costs. Wastewater treatment demands specialized knowledge and abilities. These processes require a substantial capital investment. Flow rates of effluent, water quality, the needed degree of purity, and building materials are all factors that raise the cost of wastewater treatment.

Social Factor- The presence of well-established industries in countries such as China, Japan, India, and South Korea propels the market’s growth in the region. Furthermore, the rapid population growth and industrialization in the regions also add impetus to the market’s growth. China is one of the largest economies with high industrial growth, which increases the region's demand for industrial water services. The demand for Industrial Water services in the country has been rising as China is one of the largest economies with high industrial growth, substantially increasing the demand for industrial services. Furthermore, the increasing number of regional industries propels the market’s growth.

Technological Factors- The wastewater pumping device with integrated intelligence has been developed by Xylem, a dominant worldwide water technology firm dedicated to tackling the most difficult water problems. It is the world's first pumping equipment embedded with such a diversified technology. This innovative smart, linked wastewater pumping system from Xylem's Flygt brand senses its environment's operating circumstances, modifying its performance in real-time and providing feedback to pumping station operators. The Immersed Membrane Bioreactor (MBR) is proven to be a crucial developing technology for treating high-strength wastewater produced in food and beverage processing industries such as champagne and beer production, fish and meat processing plants, and plants and vegetables.

Environmental Factors- Water is the most crucial resource on earth as it is used for several functions across many industries. However, the wastewater generated must be managed carefully to help reduce environmental pollution. Several industries also use heavy water, including food, chemicals, paper, refined petroleum, or primary metals. The wastewater generated from the industries is not managed properly, posing a great risk to the environment and hampering the market’s growth. Most industries do not treat wastewater, increasing water pollution and restraining the market’s growth. Moreover, the plants used for wastewater treatment require a steady and continuous power supply. Every year, the wastewater treatment process consumes between 3% and 15% of the country’s electrical power. High dependency on power for wastewater management negatively impacts the industrial water services market.

Legal Factors- Dober has invented various formulae for water treatment, performance fluid detergents, and others, which improve the quality of the company's products and meet the industry's standards. The company has also set up various R&D labs for its product quality, such as formulated detergents lab, which develops effective cleaning agents that are used in pharmaceuticals industries, a water treatment lab to treat the wastewater coolant additive lab to resist corrosion, and a quality control lab to ensure the quality of the product. Suez’s Jiangsu Sino French Water Co Ltd was awarded a 30-year build-and-operate contract from Changshu Urban Construction Public Assets Management Co Ltd. for designing, constructing, and operating the industrial wastewater treatment plant in Changshu, China.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Service Type

- Market Attractiveness Analysis By End-User

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing application of water in industries

- Restraints

- Waste water generation

- Opportunities

- Rising industrialization

- Challenges

- Stringent government regulations

- Global Industrial Water Service Market Analysis and Projection, By Service Type

- Segment Overview

- Water Resource Management

- Water Supply Management

- Waste Water Management

- Global Industrial Water Service Market Analysis and Projection, By End-User

- Segment Overview

- Pharmaceutical Industry

- Power Generation Industry

- Pulp & Paper Mills

- Microelectronics

- Food & Beverage Industry

- Oil & Gas

- Automotive

- Mining & Metals

- Others

- Global Industrial Water Service Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Industrial Water Service Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Industrial Water Service Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Service Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Salher

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- Dober

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- Veolia Environment

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- American Water

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- Ecolab

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- PARKER HANNIFIN CORP

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- Pentair

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- Evoqua Water Technologies LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- Suez Environnement S.A

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- United Utilities Group PLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Service Type Portfolio

- Recent Developments

- SWOT Analysis

- Salher

List of Table

- Global Industrial Water Service Market, By Service Type, 2021–2029 (USD Billion)

- Global Water Resource Management Industrial Water Service Market, By Region, 2021–2029 (USD Billion)

- Global Water Supply Management Industrial Water Service Market, By Region, 2021–2029 (USD Billion)

- Global Waste Water Management Industrial Water Service Market, By Region, 2021–2029 (USD Billion)

- Global Industrial Water Service Market, By End-User, 2021–2029 (USD Billion)

- Global Pharmaceutical Industry Industrial Water Service Market, By Region, 2021–2029 (USD Billion)

- Global Power Generation Industry Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- Global Pulp & Paper Mills Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- Global Microelectronics Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- Global Food & Beverages Industry Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- Global Oil & Gas Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- Global Automotive Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- Global Mining & Metals Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- Global Others Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- Global Industrial Water Service Market, By Region, 2021–2029(USD Billion)

- North America Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- North America Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- USA Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- USA Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Canada Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Canada Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Mexico Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Mexico Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Europe Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Europe Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Germany Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Germany Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- France Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- France Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- UK Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- UK Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Italy Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Italy Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Spain Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Spain Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Asia Pacific Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Asia Pacific Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Japan Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Japan Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- China Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- China Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- India Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- India Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- South America Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- South America Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Brazil Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Brazil Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- Middle East and Africa Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- Middle East and Africa Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- UAE Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- UAE Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

- South Africa Industrial Water Service Market, By Service Type, 2021–2029(USD Billion)

- South Africa Industrial Water Service Market, By End-User, 2021–2029(USD Billion)

List of Figures

- Global Industrial Water Service Market Segmentation

- Industrial Water Service Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Industrial Water Service Market Attractiveness Analysis By Service Type

- Global Industrial Water Service Market Attractiveness Analysis By End-User

- Global Industrial Water Service Market Attractiveness Analysis By Region

- Global Industrial Water Service Market: Dynamics

- Global Industrial Water Service Market Share By Service Type (2021 & 2029)

- Global Industrial Water Service Market Share By End-User (2021 & 2029)

- Global Industrial Water Service Market Share by Regions (2021 & 2029)

- Global Industrial Water Service Market Share by Company (2020)