Inverter Market Size by Inverter Type (Solar inverter, Vehicle inverter, and Others), Output Power Rating (Below 10 kW, 10 to 50 kW, 50 to 100 kW, and Above 100 kW), Output Voltage (100 to 300 V, 300 to 500 V, and Above 500 V), Connection Type (Standalone and Grid-tied), End User (Residential, Automotive, Photovoltaic (PV) Plants, and Others) Regions, Segmentation, and Projection till 2029

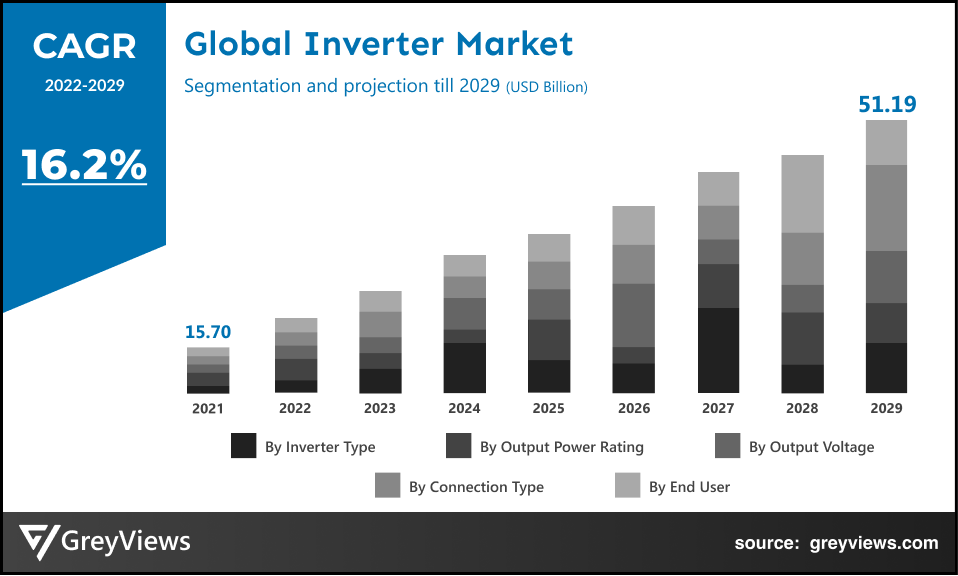

CAGR: 16.2%Current Market Size: USD 15.70 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Inverter Market- Market Overview:

The global inverter market is expected to grow from USD 15.70 billion in 2021 to USD 51.19 billion by 2029, at a CAGR of 16.2% during the Projection period 2022-2029. This growth of the market is mainly driven by increasing investment across the green infrastructure and renewable power generation sector.

The inverter is the power electronic device or electrical equipment used for converting the convert direct current (DC) voltage to alternating current (AC). The operation of DC-to-AC conversion includes rapid switching of the direction of a DC input back and forth. The filters along with other electronics are used to produce a clean voltage with a sine wave. DC is used in various small electrical equipment such as solar power systems, power sources, power batteries, and fuel cells. Hence, an inverter is used for converting the DC power from such equipment into AC power. This AC power can be supplied to homes, and industries using the public utility or power grid.

Furthermore, the inverters have become prominent equipment in the solar energy system as it converts DC power generated from solar panels to AC power.

Request Sample: - Global Inverter Market

Market Dynamics:

Drivers:

- Growth of the solar energy sector

There is substantial growth in the number of solar PV installations due to the growing solar energy sector across the globe. This is mainly attributed to the different schemes and initiatives by governments of developing countries such as India, China, and Brazil among others to encourage the usage of inverters in various applications. For instance, in March 2022, the government of China announced its plans to build a wind & solar power capacity of 450 gigawatts in the Gobi desert by 2030. This is more than twice the amount of wind & power installed in the U.S. This growth of the solar energy sector has led to increased PV power plant installations, fuelling demand for inverters.

- The ongoing trend of residential solar rooftop installations

Rapid urbanization, economic growth, and rising disposable incomes of individuals have led to increased spending on power inverters to meet the need for an uninterrupted power supply. Also, there is a rising investment trend in solar rooftop installation as it has become the safest investment that promises attractive paybacks. In addition, the governments are providing subsidies to homeowners for the installation of solar rooftop systems. These systems use inverters for the conversion of DC electricity, generated from a solar panel to AC electricity. Hence, the trend of residential solar rooftop installations has driven the growth of the global market.

Restraints:

- Hazards of high DC voltages

The DC voltages with currents above 25 mA at 50 V are considered significantly dangerous under normal conditions. In addition, high voltages can cause damage to components in the device such as Inverter Bridge if the voltage increases to a level more than that of the inverter rating. Also, there is a danger to life due to electric shock if any live cables or components of the high voltage capacity inverter are touched. Such hazards may hamper the growth of the market to some extent during the Projection period.

Opportunities:

- Emerging demand for inverters from electric vehicles (EV)

The inverter is one of the most essential components of EV coupled with the electric motor and battery systems. In addition, the EV inverter manufacturers such as Continental, Infineon Technologies AG, Delphi Technologies, Samlex Europe, Toyota Industries, Sensata Technologies, and BESTEK are introducing innovative inverter systems to enhance vehicle operations. For instance, in May 2021, Infineon Technologies AG launched an automotive power module with CoolSiC MOSFET technology. This is the full-bridge module with 1200 V blocking voltage augmented for traction inverters in electric vehicles (EVs). On the other hand, in May 2020, Equipmake developed an inverter that is lighter, smaller, and more efficient. Such product development trends in the EV inverter sector are expected to be opportunistic for the growth of the global market.

Challenges

- Availability of cheap and low-quality products

The global inverter market is considerably fragmented with the presence of several international and local players. Hence, the unorganized inverter sector creates cheaper alternatives as local manufacturers in various countries are competing strongly with global suppliers. This also makes international players develop low-cost equipment with reduced profit margins. Hence, the availability of cheap and low-quality products has created significant challenges for the global market players.

Segmentation Analysis:

The global inverter market has been segmented based on inverter type, output power rating, output voltage, connection type, end-user, and region.

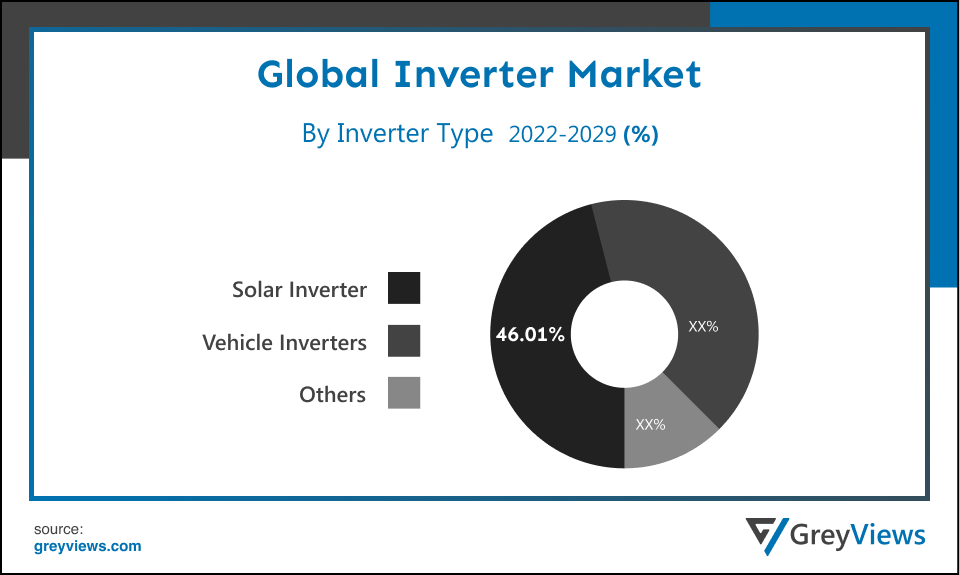

By Inverter Type

The inverter type segment includes solar inverters, vehicle inverters, and others. The solar inverter segment led the Inverter market with a market share of around 46.01% in 2021. This is attributed to the huge demand for Solar PV inverters which are one of the prominent components of the whole solar power system. These inverters are not only being used in residential or utility applications but also seeing wide adoption in industrial & commercial solar power projects around the globe. In addition, the emergence of innovative solar inverters is further projected to boost the growth of this segment. For instance, in March 2022, Delta, the Taiwanese solar inverter maker launched its new M100A Flex three-phase inverter series for the residential and commercial PV sectors.

By Output Power Rating

The output power rating segment includes Below 10 kW, 10–50 kW, 50–100 kW, and Above 100 kW. The Below 10 kW segment led the inverter market with a market share of around 38.1% in 2021. The growth of this segment is mainly driven by demand for inverters with a Below 10 kW rating in residential applications. In addition, huge growth in the number of solar rooftop installations across the various countries creates demand for inverters with a Below 10 kW rating. For instance, according to the Rystad Energy analysis, the global Rooftop Solar PV installations are expected to witness a significant surge in the next three years, with the total capacity reaching about 94.7 gigawatts (GW) by 2025.

By End User

The end-users segment includes residential, automotive, photovoltaic (PV) plants, and others. The residential segment led the inverter market with a market share of around 35.71% in 2021. The growth of this segment is mainly driven by an upsurge in the adoption of inverters in residential homes to ensure an uninterrupted power supply. In addition, rising awareness among individuals about the significance of renewable energy sources to reduce greenhouse emissions has boosted the adoption of Solar PV inverters. This has further driven the growth of this segment.

On the basis of connection type, a grid-tied segment is expected to witness the highest growth rate during the Projection period. A rise in demand for smart grid inverters has mainly driven the growth of this segment. In addition, rooftop solar applications are further creating demand for grid-tied inverters. For instance, in October 2020, BPE, the Indian organization engaged in the power solutions business launched the KSG-DM series of grid-tied solar rooftop inverters.

By Regional Analysis:

The regions analyzed for the inverter market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. Asia-Pacific region dominated the Inverter market and held the 36.1% share of the market revenue in 2021.

- The Asia-Pacific region has registered the highest value for the year 2021. The flourishing renewable energy sector in the region has primarily boosted demand for inverters. For instance, China, under its 14th five-year plan (2021 to 2025) aimed at enabling renewable energy to supply about 33% of national power consumption by 2025. This has created the demand for solar PV inverters. In addition, the factors such as the huge demand for inverters from the residential sector, growing investments in photovoltaic (PV) plants, and the ongoing shift towards electrical vehicles in the transportation sector contribute to the market growth.

- North America is expected to witness a considerable growth rate during the Projection period. Increasing demand for solar panels coupled with the government subsidies associated with solar panel installation has driven the growth of the market in North America. On the other hand, the Europe market is projected to contribute a considerable market share in 2021 due to supportive government regulations along with the subsidies such as residential feed-in tariffs (FITs) to encourage investment in the renewable energy sector.

Global Inverter Market- Country Analysis:

- Germany

Germany's inverter market size was valued at USD 1.57 billion in 2021 and is expected to reach USD 5.10 billion by 2029, at a CAGR of 16.1% from 2022 to 2029.

The rising demand for inverters from solar PV power plants in the country has driven the growth of the market. Also, the market players are actively adopting various strategies to enhance their portfolios and increase their capacities. For instance, in June 2022, SMA Solar Technology, the solar PV inverter supplier announces the construction of a GW factory in Germany to expand its production capacity from 21 GW to about 40 GW by 2024. This strategy is mainly aimed at serving large-scale solar PV power plants in the country.

- China

China's inverter market size was valued at USD 3.30 billion in 2021 and is expected to reach USD 10.46 billion by 2029, at a CAGR of 15.8% from 2022 to 2029. According to EnergyTrend, the Chinese-based newsletter, in January 2020, the total PV inverter export volume from China grew for the third year in a row, in spite of a 10% year-over-year decline in global inverter sales. In the first six months of 2019, Chinese manufacturers including Ginlong Technologies, Huawei, and Sungrow shipped inverters valued at about $1.3 billion during the first six months of 2019. This huge export value of inverters from china has mainly driven the growth of the market.

- India

India's inverter market size was valued at USD 0.94 billion in 2021 and is expected to reach USD 3.11 billion by 2029, at a CAGR of 16.4% from 2022 to 2029. Significant power shortages along with a strong push towards a national solar mission in the country have mainly driven the growth of the market. In addition, the country is the fourth-largest producer of electricity around the globe. This factor further boosts the growth of the Indian inverter market.

On the other hand, the expansion of global inverter industry players in India is opportunistic for the growth of the market. For instance, in June 2019, Fuji Electric Co. Ltd., the Japanese electric & thermal energy company acquired Consul Neowatt Power Solutions to expand its power electronics systems business in India.

Key Industry Players Analysis:

To increase their market position in the global Inverter business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Huawei Technologies

- Sungrow Power Supply

- SMA Solar Technology

- Power Electronics

- FIMER

- SolarEdge Technologies

- Fronius International

- Altenergy Power System

- Enphase Energy

- Darfon Electronics Corporation

- Schneider Electric

Latest Development:

- In March 2022, Sungrow, the inverter solution supplier signed an agreement with Ibitu Energia, a Brazilian company. Through this agreement, Sungrow is expected to supply its 1500Vdc central inverter solutions for the construction of Caldeirao Grande 2, the solar complex in Piaui state, Brazil.

- In June 2021, FIMER, one of the leading inverter suppliers launched innovative systems including PVS-260/PVS-300, a modular conversion solution, and PVS-350, a multi-MPPT string inverter. These systems are projected to serve the utility-scale solar sector.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 16.2% |

| Market Size | 15.70 billion in 2021 |

| Forecast period | 2022-2029 |

| Forecast unit | Value (USD) |

| Segments covered | Inverter type, output power rating, output voltage, connection type, end user, and Regions |

| Report Scope | Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Huawei Technologies, Sungrow Power Supply, SMA Solar Technology, Power Electronics, FIMER, SolarEdge Technologies, Fronius International, Altenergy Power System, Enphase Energy, Darfon Electronics Corporation, Schneider Electric, among others |

| By Output Power Rating |

|

| By Output Voltage |

|

| By Connection Type |

|

| By End User |

|

Regional scope |

|

Scope of the Report

Global Inverter Market by Inverter Type:

- Solar Inverter

- Vehicle Inverter

- Others

Global Inverter Market by Output Power Rating:

- Below 10 kW

- 10–50 kW

- 50–100 kW

- Above 100 kW

Global Inverter Market by Output Voltage:

- 100–300 V

- 300–500 V

- Above 500 V

Global Inverter Market by Connection Type:

- Standalone

- Grid-tied

Global Inverter Market by End User:

- Residential

- Automotive

- Photovoltaic (PV) Plants

- Others

Global Inverter Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

How big is Global Inverter market?

Global inverter market size is USD 15.70 billion in 2021.

How much Global Inverter Market Will Grow?

Global Inverter market will grow to USD 51.19 billion by 2029, at a CAGR of 16.2%.

Who are active players in Global Inverter market?

Leading market players active in the global inverter market are Huawei Technologies, Sungrow Power Supply, SMA Solar Technology, Power Electronics, FIMER, SolarEdge Technologies, Fronius International, Altenergy Power System, Enphase Energy, Darfon Electronics Corporation, and Schneider Electric among others.

What is the key reason for the growth of Inverter market?

The inverter is one of the most essential components of EV coupled with the electric motor and battery systems. In addition, the EV inverter manufacturers such as Continental, Infineon Technologies AG, Delphi Technologies, Samlex Europe, Toyota Industries, Sensata Technologies, and BESTEK are introducing innovative inverter systems to enhance vehicle operations.

Which region seems to growing in Global Inverter Market?

North America is expected to witness a considerable growth rate during the Projection period. Increasing demand for solar panels coupled with the government subsidies associated with solar panel installation has driven the growth of the market in North America.

How New Generation Inverter Will benefit the environment?

Rising awareness among individuals about the significance of renewable energy sources to reduce greenhouse emissions has boosted the adoption of Solar PV inverters. In addition, rooftop solar applications are further creating demand for grid-tied inverters. For instance, in October 2020, BPE, the Indian organization engaged in the power solutions business launched the KSG-DM series of grid-tied solar rooftop inverters

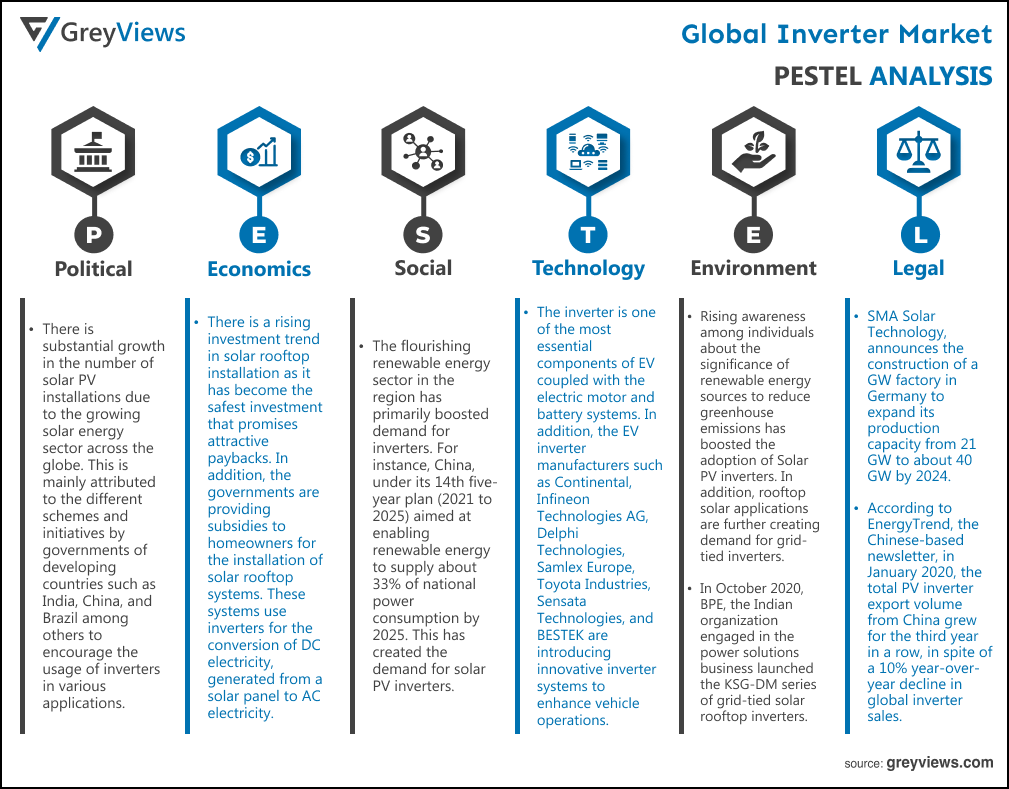

Political Factors- There is substantial growth in the number of solar PV installations due to the growing solar energy sector across the globe. This is mainly attributed to the different schemes and initiatives by governments of developing countries such as India, China, and Brazil among others to encourage the usage of inverters in various applications. For instance, in March 2022, the government of China announced its plans to build a wind & solar power capacity of 450 gigawatts in the Gobi desert by 2030. This is more than twice the amount of wind & power installed in the U.S. This growth of the solar energy sector has led to increased PV power plant installations, fuelling demand for inverters.

Economical Factors- There is a rising investment trend in solar rooftop installation as it has become the safest investment that promises attractive paybacks. In addition, the governments are providing subsidies to homeowners for the installation of solar rooftop systems. These systems use inverters for the conversion of DC electricity, generated from a solar panel to AC electricity. Hence, the trend of residential solar rooftop installations has driven the growth of the global market.

Social Factor- The flourishing renewable energy sector in the region has primarily boosted demand for inverters. For instance, China, under its 14th five-year plan (2021 to 2025) aimed at enabling renewable energy to supply about 33% of national power consumption by 2025. This has created the demand for solar PV inverters. In addition, the factors such as the huge demand for inverters from the residential sector, growing investments in photovoltaic (PV) plants, and the ongoing shift towards electrical vehicles in the transportation sector contribute to the market growth.

Technological Factors- The inverter is one of the most essential components of EV coupled with the electric motor and battery systems. In addition, the EV inverter manufacturers such as Continental, Infineon Technologies AG, Delphi Technologies, Samlex Europe, Toyota Industries, Sensata Technologies, and BESTEK are introducing innovative inverter systems to enhance vehicle operations. For instance, in May 2021, Infineon Technologies AG launched an automotive power module with CoolSiC MOSFET technology. This is the full-bridge module with 1200 V blocking voltage augmented for traction inverters in electric vehicles (EVs). On the other hand, in May 2020, Equipmake developed an inverter that is lighter, smaller, and more efficient. Such product development trends in the EV inverter sector are expected to be opportunistic for the growth of the global market.

Environmental Factors- Rising awareness among individuals about the significance of renewable energy sources to reduce greenhouse emissions has boosted the adoption of Solar PV inverters. In addition, rooftop solar applications are further creating demand for grid-tied inverters. For instance, in October 2020, BPE, the Indian organization engaged in the power solutions business launched the KSG-DM series of grid-tied solar rooftop inverters.

Legal Factors- SMA Solar Technology, the solar PV inverter supplier announces the construction of a GW factory in Germany to expand its production capacity from 21 GW to about 40 GW by 2024. This strategy is mainly aimed at serving large-scale solar PV power plants in the country. According to EnergyTrend, the Chinese-based newsletter, in January 2020, the total PV inverter export volume from China grew for the third year in a row, in spite of a 10% year-over-year decline in global inverter sales. In the first six months of 2019, Chinese manufacturers including Ginlong Technologies, Huawei, and Sungrow shipped inverters valued at about $1.3 billion during the first six months of 2019. This huge export value of inverters from china has mainly driven the growth of the market.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Inverter Type

- Market Attractiveness Analysis By Output Power Rating

- Market Attractiveness Analysis By Output Voltage

- Market Attractiveness Analysis By Connection Type

- Market Attractiveness Analysis By End User

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growth of the solar energy sector

- Ongoing trend of residential solar rooftop installations

- Restrains

- Hazards of high DC voltages

- Opportunities

- Emerging demand for inverters from electric vehicles (EV)

- Challenges

- Availability of cheap and low quality products

- Global Inverter Market Analysis and Projection, By Inverter Type

- Segment Overview

- Solar Inverter

- Vehicle Inverter

- Others

- Global Inverter Market Analysis and Projection, By Output Power Rating

- Segment Overview

- Below 10 kW

- 10–50 kW

- 50–100 kW

- Above 100 kW

- Global Inverter Market Analysis and Projection, By Output Voltage

- Segment Overview

- 100–300 V

- 300–500 V

- Above 500 V)

- Global Inverter Market Analysis and Projection, By Connection Type

- Segment Overview

- Standalone

- Grid-tied

- Global Inverter Market Analysis and Projection, By End User

- Segment Overview

- Residential

- Automotive

- Photovoltaic (PV) Plants

- Others

- Global Inverter Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Inverter Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Inverter Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Inverter Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Huawei Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- Sungrow Power Supply

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- SMA Solar Technology

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- Power Electronics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- FIMER

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- SolarEdge Technologies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- Fronius International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- Altenergy Power System

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- Enphase Energy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- Darfon Electronics Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Inverter Type Portfolio

- Recent Developments

- SWOT Analysis

- Huawei Technologies

List of Table

- Global Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Global Solar Inverter Market, By Region, 2021–2029(USD Billion)

- Global Vehicle Inverter Market, By Region, 2021–2029(USD Billion)

- Global Others Market, By Region, 2021–2029(USD Billion)

- Global Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Global Below 10 kW Inverter Market, By Region, 2021–2029(USD Billion)

- Global 10–50 kW Inverter Market, By Region, 2021–2029(USD Billion)

- Global 50–100 kW Inverter Market, By Region, 2021–2029(USD Billion)

- Global Above 100 kW Inverter Market, By Region, 2021–2029(USD Billion)

- Global Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Global 100–300 V Inverter Market, By Region, 2021–2029(USD Billion)

- Global 300–500 V Output Voltage Inverter Market, By Region, 2021–2029(USD Billion)

- Global Above 500 V Output Voltage Inverter Market, By Region, 2021–2029(USD Billion)

- Global Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Global Standalone Inverter Market, By Region, 2021–2029(USD Billion)

- Global Grid-tied Inverter Market, By Region, 2021–2029(USD Billion)

- Global Inverter Market, By End User, 2021–2029(USD Billion)

- Global Residential Inverter Market, By Region, 2021–2029(USD Billion)

- Global Automotive Inverter Market, By Region, 2021–2029(USD Billion)

- Global Photovoltaic (PV) Plants Inverter Market, By Region, 2021–2029(USD Billion)

- Global Others Inverter Market, By Region, 2021–2029(USD Billion)

- Global Inverter Market, By Region, 2021–2029(USD Billion)

- Global Inverter Market, By North America, 2021–2029(USD Billion)

- North America Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- North America Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- North America Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- North America Inverter Market, By Connection Type, 2021–2029(USD Billion)

- North America Inverter Market, By End User, 2021–2029(USD Billion)

- USA Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- USA Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- USA Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- USA Inverter Market, By Connection Type, 2021–2029(USD Billion)

- USA Inverter Market, By End User, 2021–2029(USD Billion)

- Canada Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Canada Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Canada Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Canada Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Canada Inverter Market, By End User, 2021–2029(USD Billion)

- Mexico Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Mexico Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Mexico Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Mexico Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Mexico Inverter Market, By End User, 2021–2029(USD Billion)

- Europe Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Europe Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Europe Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Europe Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Europe Inverter Market, By End User, 2021–2029(USD Billion)

- Germany Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Germany Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Germany Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Germany Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Germany Inverter Market, By End User, 2021–2029(USD Billion)

- France Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- France Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- France Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- France Inverter Market, By Connection Type, 2021–2029(USD Billion)

- France Inverter Market, By End User, 2021–2029(USD Billion)

- UK Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- UK Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- UK Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- UK Inverter Market, By Connection Type, 2021–2029(USD Billion)

- UK Inverter Market, By End User, 2021–2029(USD Billion)

- Italy Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Italy Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Italy Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Italy Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Italy Inverter Market, By End User, 2021–2029(USD Billion)

- Spain Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Spain Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Spain Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Spain Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Spain Inverter Market, By End User, 2021–2029(USD Billion)

- Asia Pacific Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Asia Pacific Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Asia Pacific Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Asia Pacific Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Asia Pacific Inverter Market, By End User, 2021–2029(USD Billion)

- Japan Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Japan Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Japan Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Japan Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Japan Inverter Market, By End User, 2021–2029(USD Billion)

- China Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- China Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- China Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- China Inverter Market, By Connection Type, 2021–2029(USD Billion)

- China Inverter Market, By End User, 2021–2029(USD Billion)

- India Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- India Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- India Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- India Inverter Market, By Connection Type, 2021–2029(USD Billion)

- India Inverter Market, By End User, 2021–2029(USD Billion)

- South America Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- South America Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- South America Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- South America Inverter Market, By Connection Type, 2021–2029(USD Billion)

- South America Inverter Market, By End User, 2021–2029(USD Billion)

- Brazil Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Brazil Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Brazil Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Brazil Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Brazil Inverter Market, By End User, 2021–2029(USD Billion)

- Middle East and Africa Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- Middle East and Africa Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- Middle East and Africa Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- Middle East and Africa Inverter Market, By Connection Type, 2021–2029(USD Billion)

- Middle East and Africa Inverter Market, By End User, 2021–2029(USD Billion)

- UAE Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- UAE Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- UAE Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- UAE Inverter Market, By Connection Type, 2021–2029(USD Billion)

- UAE Inverter Market, By End User, 2021–2029(USD Billion)

- South Africa Inverter Market, By Inverter Type, 2021–2029(USD Billion)

- South Africa Inverter Market, By Output Power Rating, 2021–2029(USD Billion)

- South Africa Inverter Market, By Output Voltage, 2021–2029(USD Billion)

- South Africa Inverter Market, By Connection Type, 2021–2029(USD Billion)

- South Africa Inverter Market, By End User, 2021–2029(USD Billion)

List of Figures

- Global Inverter Market Segmentation

- Inverter Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Inverter Market Attractiveness Analysis By Inverter Type

- Global Inverter Market Attractiveness Analysis By Output Power Rating

- Global Inverter Market Attractiveness Analysis By Output Voltage

- Global Inverter Market Attractiveness Analysis By Connection Type

- Global Inverter Market Attractiveness Analysis By End User

- Global Inverter Market Attractiveness Analysis By Region

- Global Inverter Market: Dynamics

- Global Inverter Market Share By Inverter Type(2021 & 2029)

- Global Inverter Market Share By Output Power Rating(2021 & 2029)

- Global Inverter Market Share By Output Voltage(2021 & 2029)

- Global Inverter Market Share By Connection Type(2021 & 2029)

- Global Inverter Market Share By End User (2021 & 2029)

- Global Inverter Market Share by Regions (2021 & 2029)

- Global Inverter Market Share by Company (2020)