Lactic Acid Market Size by Raw Material (Sugarcane, Corn, Cassava, Other Corps), Application (Industrial, Food & Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), and Others), Regions, Segmentation, and Projection till 2029

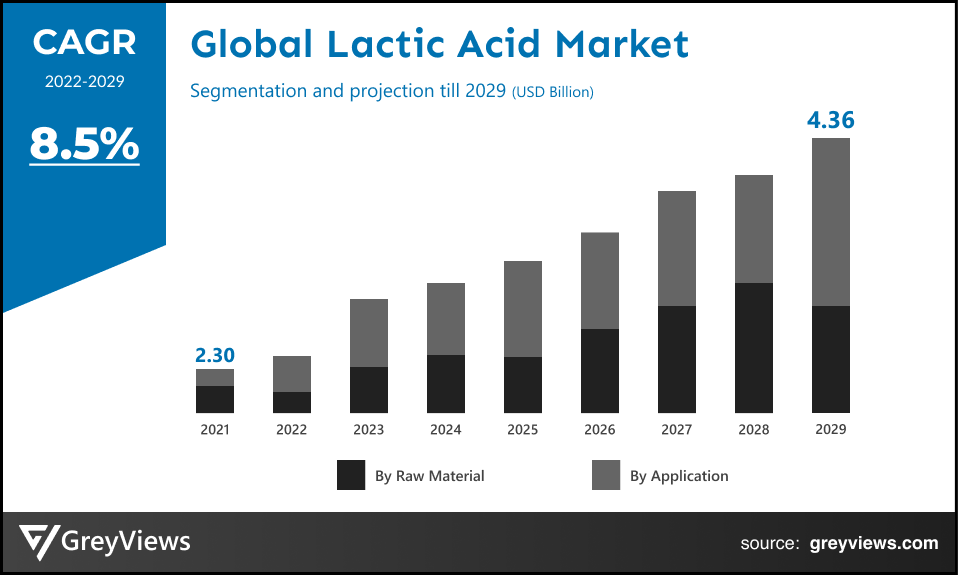

CAGR: 8.5%Current Market Size: USD 2.30 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Lactic Acid- Market Overview:

The global lactic acid market is expected to grow from USD 2.30 billion in 2021 to USD 4.36 billion by 2029, at a CAGR of 8.5% during the Projection period 2022-2029. This growth is mainly attributed to the increased demand for lactic acid from industries, such as pharmaceuticals and food & beverages.

Lactic acid is a well-known organic acid with various industrial applications. This type of acid is commercially produced on a large scale and is mainly used across different industries such as food, pharmaceutical, cosmetic, and chemical industries. Also, it is rapidly being used as a monomer to produce bio-degradable poly lactic acid (PLA). It is considered one of the most important hydroxycarboxylic acids due to its versatile applications as a flavoring, acidulant, and inhibitor of bacteria.

Industrially, lactic acid is produced by chemical synthesis from acetaldehyde or by bacterial fermentation of carbohydrates. Nowadays, lactic acid fermentation is considered an alternative for producing a biocompatible polymer, suitable for biomedical, food packaging, tissue repairing, bone fixation, and drug delivery applications.

Request Sample: - Global Lactic Acid Market

Market Dynamics:

Drivers:

- The functionalities of lactic and polylactic acids

The applications of lactic acids range from bulk production of products, such as Poly Lactic Acid (PLA), in industries to household applications such as food containers. It has some important functions, such as a mildly acidic taste, preserving foodstuffs, and being easily soluble in water. On the other hand, the bi-functionality (hydroxyl and carboxylic acid groups) enables lactic acid molecules to inter-esterify to form dimers, trimers, and longer lactic acid oligomers. Hence, the advantageous functionality of lactic and polylactic acids drives the growth of the lactic acid market.

- Rising demand for lactic acid and polylactic acid in various end-user applications

The commercially produced lactic acid is used in several industries, such as pharmaceutical, food, and textile industries. For instance, manufacturers use lactic acid in packaged food products such as bread, olives, desserts, and jams to enable longer shelf life. On the other hand, in the pharmaceutical industry, it is being used as a dispersing/dissolving excipient for various biological compounds without destroying the pharmacological activity of the active ingredient. Therefore, demand for lactic acid in various industries fuels the global market growth.

Restraints:

- Fluctuations in raw material prices

Lactic acid is obtained from renewable feedstocks, such as sugarcane, sugar beet, cassava, and corn. However, in the past few years, the raw material prices for lactic acid production have been volatile. The increasing costs of raw materials have led to increased production costs along with the higher costs of transportation, chemicals, and energy consumed, which causes a reduction in margins for manufacturers. Hence, fluctuations in raw materials are expected to hamper the market's growth to some extent.

Opportunities:

- Government initiatives pertaining to encourage the use of bioplastics

Currently, biodegradable polylactic acid (PLA) has attracted significant attention owing to the rising concerns associated with environmental pollution from petroleum-based plastics. PLA is a bioplastic made from lactic acid and is rapidly being used across the food industry to package sensitive food products. In addition, many governments across the globe are taking initiatives to provide subsidies and support for increasing the usage of bio-degradable products. Such government initiatives are expected to create lucrative growth opportunities for the market during the Projection period.

Challenges

- COVID-19 pandemic

The global COVID-19 pandemic has forced all industries to change the way of managing assets and workforces. In addition, the global food & beverages sector has disrupted supply chains and fluctuations in raw material prices. The number of consumer products food & beverage companies faced significantly reduced consumption and disrupted supply chains. This factor is expected to pose challenges to global market growth.

Segmentation Analysis:

The global lactic acid market has been segmented based on raw material, application, and regions.

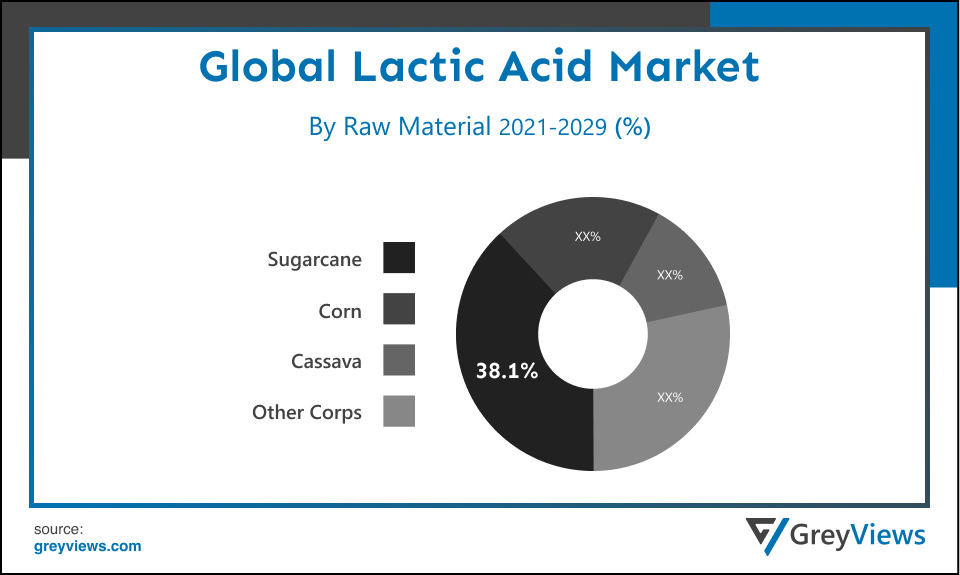

Global Lactic acid - By Raw Material

The raw material segment includes sugarcane, corn, cassava, and other crops. The sugarcane segment led the lactic acid market with a market share of around 38.1% in 2021. This is attributed to the fact that raw sugar extracted from the sugarcane or sugar beet is one of the major feedstocks used to manufacture lactic acid. Sugar cane molasses is available across various countries as a byproduct of sucrose production, which is used as the substrate for lactic acid fermentation.

Global Lactic acid - By Application

The application segment includes food & beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others. The polylactic acid (PLA) segment led the lactic acid market with a market share of around 25.02% in 2021. The growth of the PLA segment is mainly driven by significant demand for sustainable bioplastic materials in industrial applications. For instance, the need for lightweight components to reduce the vehicle's weight and enhance performance has led to the use of polylactic acid in the automotive industry.

Global Lactic acid Market- By Regional Analysis:

The regions analyzed for the lactic acid market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. North America region dominated the lactic acid market and held a 46.01% share of the market revenue in 2021.

- North America region witnessed a major share. The growth of this region is mainly driven by significant growth in the pharmaceutical, personal care, and food and beverages industries. In addition, the region is home to several personal care and cosmetic companies, including Maybelline New York, Avon, the Colgate-Palmolive Company, Procter and Gamble, Unilever, and Johnson and Johnson Private Limited. Therefore, the huge demand for lactic acid from the pharmaceutical industry in the region has driven the market's growth.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. The surge in expenditures on medicines coupled with the expansion of the pharmaceutical industry in this region is expected to create opportunities for growth of the lactic acid market.

Global Lactic acid Market- Country Analysis:

- Germany

Germany's lactic acid market size was valued at USD 0.18 billion in 2021 and is expected to reach USD 0.35 billion by 2029, at a CAGR of 8.4% from 2022 to 2029.

Germany is the largest market for food and beverages in the European Union. In addition, the country is a significant exporter of food products globally. For instance, the country has been the third-largest overall exporter of agricultural goods across the globe and the leading exporter of cheese, confectionery, pork, and agricultural technology for many years. Hence, demand for lactic acid from the food industry in the country is expected to boost the market's growth.

- China

China's lactic acid market size was valued at USD 0.30 billion in 2021 and is expected to reach USD 0.55 billion by 2029, at a CAGR of 8.2% from 2022 to 2029. The average food consumption per capita is continuously increasing in this country. Hence, this country's huge consumption of food products is projected to boost the growth of the lactic acid market. In addition, the rising focus of global lactic industry players on China is opportunistic for the market's growth. For instance, IFF launched YO-MIX® ViV, a new solution for ambient yogurt and other fermented drinks producers across the Asia Pacific, focusing on China.

- India

India's lactic acid market size was valued at USD 0.16 billion in 2021 and is expected to reach USD 0.31 billion by 2029, at a CAGR of 8.7% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the emerging popularity of lactic acid in this country is expected to create lucrative growth opportunities for the lactic acid market. On the other hand, huge demand for lactic acid from the cosmetics industry is projected to boost the growth of the Indian lactic acid market.

Key Industry Players Analysis:

To increase their market position in the global lactic acid business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- BASF SE

- Galactic

- Musashino Chemical (China) Co., Ltd.

- Futerro

- Corbion

- Dow

- TEIJIN LIMITED

- Henan Jindan Lactic Acid Technology

- Vigon International

- Danimer Scientific

Latest Development:

In September 2021, American agribusiness Archer Daniels Midland (ADM) signed an agreement with LG Chem, the chemical firm, for a new joint venture to construct and operate a lactic acid production facility in the United States.

In March 2021, Corbion launched a multi-faceted initiative to significantly increase its capacity for producing lactic acid and lactic-acid derivatives ahead of its formerly announced expansion in Thailand scheduled for 2023.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year considered |

2021 |

|

CAGR (%) |

8.5% |

|

Market Size |

2.30 billion in 2021 |

|

Projection period |

2021-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Raw Material, application, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

BASF SE, Galactic, Musashino Chemical (China) Co., Ltd., Futerro, Corbion, Dow, TEIJIN LIMITED, Henan Jindan Lacic Acid Technology, Vigon International, and Danimer Scientific among others |

|

By Raw Material |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Lactic acid Market By Raw Material:

- Sugarcane

- Corn

- Cassava

- Other Corps

Global Lactic acid Market By Application:

- Industrial

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

Global Lactic acid Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What Was the market size of the lactic acid?

Global lactic acid market was USD 2.30 billion in 2021.

What is the application of lactic acid?

Application segment includes food & beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others.

What Raw material use for making in Lactic Acid?

The raw material segment includes sugarcane, corn, cassava, and other crops

What is the technological advancement happening in lactic acid Market?

Key players in the lactic acid market are using advanced technologies to incorporate better results and performance of the whole process. For instance, the country has been the third-largest overall exporter of agricultural goods across the globe and the leading exporter of cheese, confectionery, pork, and agricultural technology for many years. The technological advancement in the market has been created opportunities for growth of the lactic acid market.

How environment get affected by Lactic Acid?

Biodegradable polylactic acid (PLA) are highly responsible for environmental pollution. It is responsible for carbon emission which harms the environment as well as people in the surrounding. However, the carbon emissions associated with biodegradable polylactic acid (PLA) production are 80% lower than that of traditional plastic. Many government initiatives are being taken to reduce carbon emission. For instance, in March 2021, Corbion launched a multi-faceted initiative to significantly increase its capacity for producing lactic acid and lactic-acid derivatives ahead of its formerly announced expansion in Thailand scheduled for 2023

Who are major players in Lactic Acid Market?

BASF SE, Galactic, Musashino Chemical (China) Co., Ltd., Futerro, Corbion, Dow, TEIJIN LIMITED, Henan Jindan Lactic Acid Technology, Vigon International, Danimer Scientific

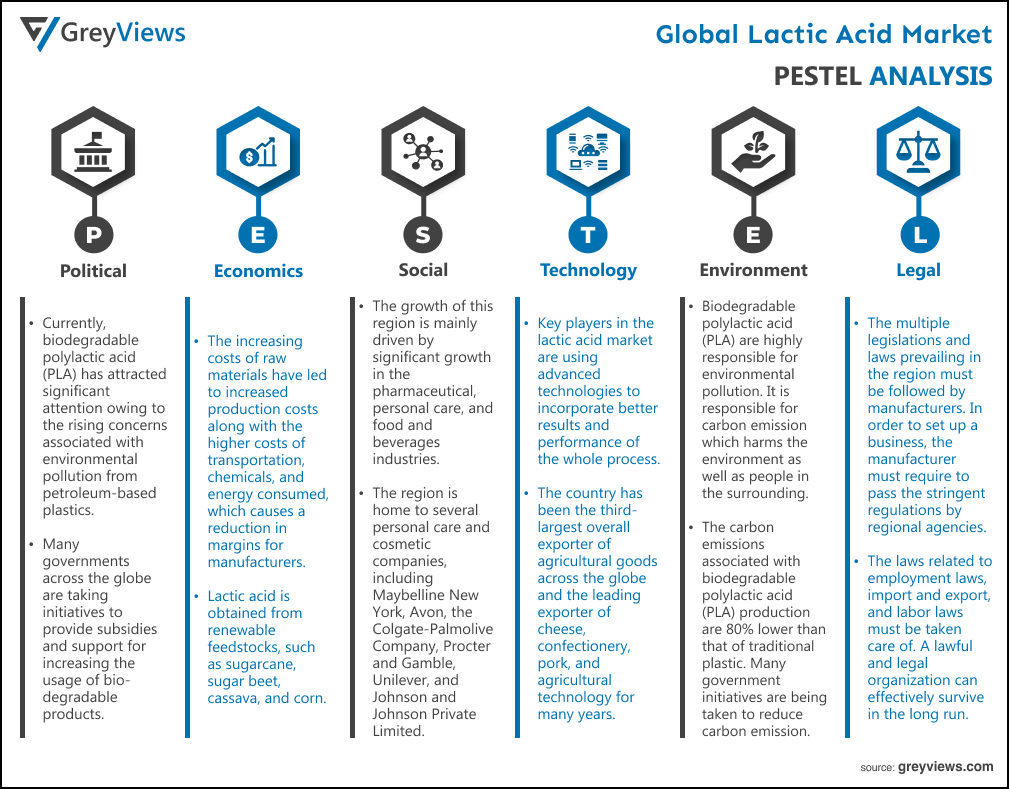

Political Factors- Currently, biodegradable polylactic acid (PLA) has attracted significant attention owing to the rising concerns associated with environmental pollution from petroleum-based plastics. PLA is a bioplastic made from lactic acid and is rapidly being used across the food industry to package sensitive food products. In addition, many governments across the globe are taking initiatives to provide subsidies and support for increasing the usage of bio-degradable products. Such government initiatives are expected to create lucrative growth opportunities for the market during the Projection period.

Economical Factors- The economic factor for any business includes recession, inflation, growth in GDP, population growth, etc. rise in raw material prices increases the cost of the final product, and to maintain profitability, the organization has to increase its prices. The organization can leverage this trend by expanding its product range and targeting new customers. For instance, Lactic acid is obtained from renewable feedstocks, such as sugarcane, sugar beet, cassava, and corn. However, in the past few years, the raw material prices for lactic acid production have been volatile. The increasing costs of raw materials have led to increased production costs along with the higher costs of transportation, chemicals, and energy consumed, which causes a reduction in margins for manufacturers. Hence, fluctuations in raw materials are expected to hamper the market's growth to some extent.

Social Factor- The growth of this region is mainly driven by significant growth in the pharmaceutical, personal care, and food and beverages industries. In addition, the region is home to several personal care and cosmetic companies, including Maybelline New York, Avon, the Colgate-Palmolive Company, Procter and Gamble, Unilever, and Johnson and Johnson Private Limited. Therefore, the huge demand for lactic acid from the pharmaceutical industry in the region has driven the market's growth. The manufacturers and suppliers should focus on the set of values, religions, cultures, attitudes, etc. present in the region; that governs the performance of the market in the region. Thus, the company has to maintain a balance to avoid any kind of discrimination in the organization. Thus, these factors should be identified well by the companies, and all other socially responsible factors should be taken into consideration before setting up or expanding the business in any regional market.

Technological Factors- Key players in the lactic acid market are using advanced technologies to incorporate better results and performance of the whole process. For instance, the country has been the third-largest overall exporter of agricultural goods across the globe and the leading exporter of cheese, confectionery, pork, and agricultural technology for many years. The technological advancement in the market has been created opportunities for growth of the lactic acid market.

Environmental Factors- Biodegradable polylactic acid (PLA) are highly responsible for environmental pollution. It is responsible for carbon emission which harms the environment as well as people in the surrounding. However, the carbon emissions associated with biodegradable polylactic acid (PLA) production are 80% lower than that of traditional plastic. Many government initiatives are being taken to reduce carbon emission. For instance, in March 2021, Corbion launched a multi-faceted initiative to significantly increase its capacity for producing lactic acid and lactic-acid derivatives ahead of its formerly announced expansion in Thailand scheduled for 2023.

Legal Factors- The multiple legislations and laws prevailing in the region must be followed by manufacturers. In order to set up a business, the manufacturer must require to pass the stringent regulations by regional agencies. Thus, companies should extensively focus on the legal factors of the country. Moreover, the laws related to employment laws, import and export, and labor laws must be taken care of. A lawful and legal organization can effectively survive in the long run. For instance, IFF launched YO-MIX® ViV, a new solution for ambient yogurt and other fermented drinks producers across the Asia Pacific, focusing on China. In September 2021, American agribusiness Archer Daniels Midland (ADM) signed an agreement with LG Chem, the chemical firm, for a new joint venture to construct and operate a lactic acid production facility in the United States.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Raw Material

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- The functionalities of lactic and polylactic acids

- Rising demand for lactic acid and polylactic acid in various end-user applications

- Restrains

- Fluctuations in raw material prices due to COVID-19 pandemic

- Opportunities

- Government initiatives pertaining to encourage the use of bioplastics

- Challenges

- Concerns associated with the quality of lactic acid in food & beverage

- Global Lactic acid Market Analysis and Projection, By Raw Material

- Segment Overview

- Sugarcane

- Corn

- Cassava

- Other Corps

- Global Lactic acid Market Analysis and Projection, By Application

- Segment Overview

- Industrial

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

- Global Lactic acid Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Lactic acid Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Lactic acid Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Raw Material Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- BASF SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- Galactic

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- Musashino Chemical (China) Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- Futerro

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- Corbion

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- Dow

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- TEIJIN LIMITED

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- Henan Jindan Lacic Acid Technology

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- Vigon International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- Danimer Scientific

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Raw Material Portfolio

- Recent Developments

- SWOT Analysis

- BASF SE

List of Table

- Global Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Global Sugarcane Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Corn Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Cassava Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Other Corps Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Lactic acid Market, By Application, 2021–2029(USD Billion)

- Global Industrial Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Food & Beverages Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Pharmaceuticals Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Personal Care Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Polylactic Acid (PLA) Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Others Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Lactic acid Market, By Region, 2021–2029(USD Billion)

- Global Lactic acid Market, By North America, 2021–2029(USD Billion)

- North America Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- North America Lactic acid Market, By Application, 2021–2029(USD Billion)

- USA Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- USA Lactic acid Market, By Application, 2021–2029(USD Billion)

- Canada Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Canada Lactic acid Market, By Application, 2021–2029(USD Billion)

- Mexico Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Mexico Lactic acid Market, By Application, 2021–2029(USD Billion)

- Europe Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Europe Lactic acid Market, By Application, 2021–2029(USD Billion)

- Germany Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Germany Lactic acid Market, By Application, 2021–2029(USD Billion)

- France Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- France Lactic acid Market, By Application, 2021–2029(USD Billion)

- UK Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- UK Lactic acid Market, By Application, 2021–2029(USD Billion)

- Italy Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Italy Lactic acid Market, By Application, 2021–2029(USD Billion)

- Spain Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Spain Lactic acid Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Asia Pacific Lactic acid Market, By Application, 2021–2029(USD Billion)

- Japan Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Japan Lactic acid Market, By Application, 2021–2029(USD Billion)

- China Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- China Lactic acid Market, By Application, 2021–2029(USD Billion)

- India Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- India Lactic acid Market, By Application, 2021–2029(USD Billion)

- South America Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- South America Lactic acid Market, By Application, 2021–2029(USD Billion)

- Brazil Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Brazil Lactic acid Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- Middle East and Africa Lactic acid Market, By Application, 2021–2029(USD Billion)

- UAE Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- UAE Lactic acid Market, By Application, 2021–2029(USD Billion)

- South Africa Lactic acid Market, By Raw Material, 2021–2029(USD Billion)

- South Africa Lactic acid Market, By Application, 2021–2029(USD Billion)

List of Figures

- Global Lactic acid Market Segmentation

- Lactic acid Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Lactic acid Market Attractiveness Analysis By Raw Material

- Global Lactic acid Market Attractiveness Analysis By Application

- Global Lactic acid Market Attractiveness Analysis By Region

- Global Lactic acid Market: Dynamics

- Global Lactic acid Market Share By Raw Material(2021 & 2029)

- Global Lactic acid Market Share By Application(2021 & 2029)

- Global Lactic acid Market Share by Regions (2021 & 2029)

- Global Lactic acid Market Share by Company (2020)