Laparoscopic Vision Systems Market Size by Product Type (Insufflator, Suction/Irrigation systems, Laparoscope, Access & Energy Devices), Application (General, Colorectal, Gynecology, Urology, Bariatric, Pediatric), End-User (Hospitals, Ambulatory Surgical Centers, and Others), Regions, Segmentation, and projection till 2029

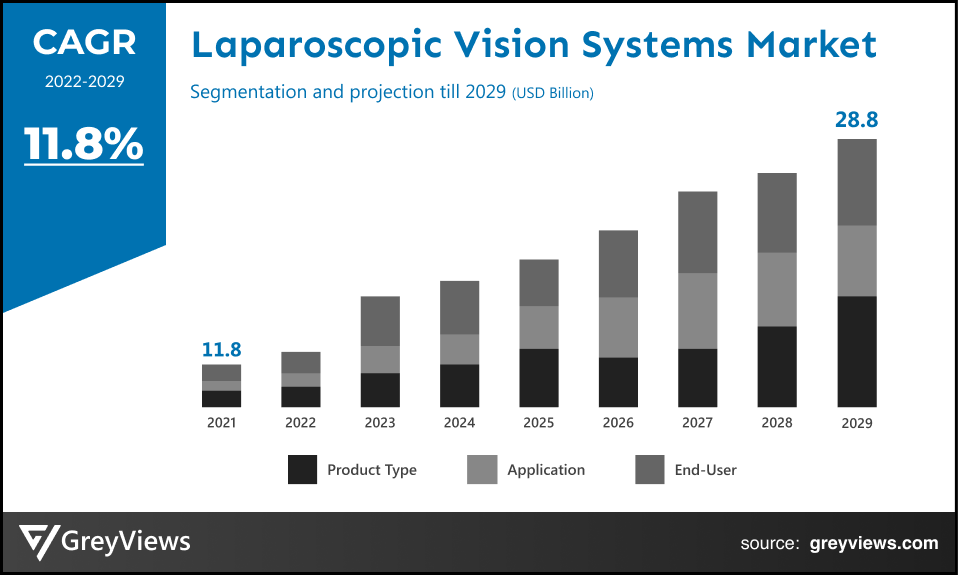

CAGR: 11.8%Current Market Size: USD 11.8 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Laparoscopic Vision Systems Market- Market Overview:

Global Laparoscopic Vision Systems market is expected to grow from USD 11.8 billion in 2021 to USD 28.8 billion by 2029, at a CAGR of 11.8% during the projection period 2022-2029. The increasing adoption of minimally invasive surgeries over open surgeries drives the market’s growth.

The laparoscopic vision system is a surgery that can be combined with a traditional laparoscope and provides the surgeon with a more detailed view of the abdominal cavity or any other part of the human organ. It helps surgeons get closer to the affected area and perform the surgery more accurately and with a precise result of the surgery. These days patients prefer minimally invasive surgeries, which increases the demand for laparoscopic vision systems. Minimally invasive surgeries reduce the visibility of scars, and there is also less blood loss, reduced pain, better recovery times, and shorter hospital stays. The demand for laparoscopic vision systems is increasing due to their better performance and lower error rates. The changing lifestyle and fooding style affects the health of humans leading to the cause of several diseases along with the increasing geriatric population. These factors are also expected to drive the market’s growth.

Request Sample:- Global Laparoscopic Vision Systems Market

Market Dynamics:

Drivers:

- Increased prevalence of chronic diseases

There is a significant prevalence of chronic diseases in the general population across different regions of the globe. The rapidly changing lifestyle of humans and increasing pollution affects people's health. This leads to increasing chronic diseases among a large population, such as diabetes, respiratory diseases, cancer, heart disease, etc. The world has been observing an upsurge of chronic diseases among the geriatric and common populations. This is expected to drive the market's growth as this disease can only be treated using laparoscopy surgeries. Overall, the increasing prevalence of minimally invasive surgery also adds to the market's growth.

Restraints:

- High treatment cost

A laparoscopic vision system is costly, which is restraining the market’s growth. The surgeries performed under a laparoscopic vision system are complicated and require a lot of costs. Some of the laparoscopic like ophthalmic and neurosurgery, cost around $41,000 to $145,000, a significant element restricting the use of the laparoscopic vision system. Additionally, recurring expenditures on the maintenance of these laparoscopic surgeries increased operational expenses. Therefore, the increased cost of a laparoscopic vision system hinders the development of the market during the forecast period.

Opportunities:

- Increasing demand for minimally invasive surgeries

The increasing demand for minimally invasive surgeries provides an opportunity for the market’s growth. Laparoscopic procedures help save costs and are less invasive in terms of pre- and post-operation care and the length of hospital stays. These surgeries have fewer postoperative complications, result in less blood loss, and a shorter recovery time for patients. Furthermore, health insurance providers also cover minimally invasive surgeries, which provides an opportunity for the market’s growth during the forecast period.

Challenges

- Lack of skilled professionals

The lack of reimbursement in emerging markets and the shortage of trained healthcare professionals challenges the market's growth during the forecast period. Developing countries face the challenge of bridging the gap regarding infrastructural support available for performing laparoscopic procedures and also lack fulfilling the requirements of skilled professionals challenging the market’s growth.

Segmentation Analysis:

The global Laparoscopic Vision Systems market has been segmented based on product, application, end-user, and regions.

By Product

The product segment includes insufflators, suction/Irrigation systems, laparoscopes, and access & energy devices. The access & energy devices segment led the Laparoscopic Vision Systems market with a market share of around 38.22% in 2021. The access and energy systems allow transection, rapid sequential tissue and vessel sealing, and coagulation during laparoscopic surgery, which drives the segment’s growth. This system is widely used in various applications of bariatric surgeries, such as adjustable gastric band, sleeve gastrectomy, gastric bypass, and biliopancreatic diversion with duodenal switch, propelling the segment’s growth.

By application

The application segment includes general, colorectal, gynecology, urology, bariatric, and pediatric. The general segment led the Laparoscopic Vision Systems market with a market share of around 16.8% in 2021. Cholecystectomy laparoscopy, thoracic laparoscopy, colon laparoscopy, appendectomy laparoscopy, and prostrate laparoscopy drive the segment’s growth. The increasing incidences of diseases such as cancer, obesity, and diabetes owing to changing lifestyles, supplements the segment's growth.

By end-user

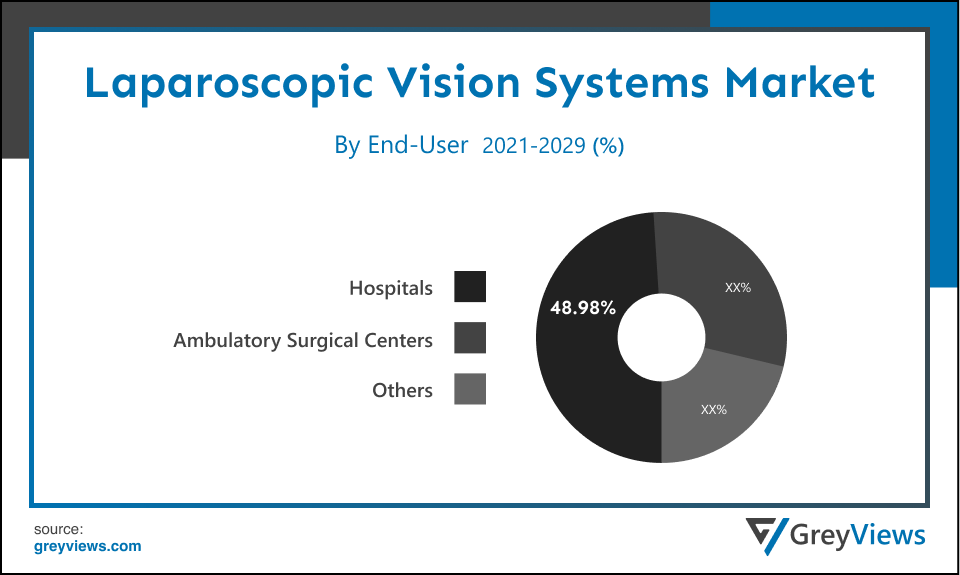

The end-user segment includes hospitals, ambulatory surgical centers, and others. The hospital's segment led the Laparoscopic Vision Systems market with a market share of around 48.98% in 2021. Most laparoscopic surgeries require a well-built infrastructure and heavy machinery, which can only be found in hospitals. The rising demand for laparoscopic surgeries boosts the segment’s growth as hospitals as they see a large of patients regularly. In addition, the cost-effective benefits of hospitals have boosted demand for Laparoscopic Vision Systems in hospitals. Moreover, several such settings have been boosted dramatically due to the emergence of the COVID-19 pandemic. This factor has further created lucrative growth opportunities for the segment.

By Regional Analysis:

The regions analyzed for the Laparoscopic Vision Systems market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. North American region dominated the Laparoscopic Vision Systems market and held a 36.22% share of the market revenue in 2021.

- North America region witnessed a major share. This is mainly attributed to an increased preference for minimally invasive surgeries and an upsurge in the geriatric population in the region. Furthermore, the region also witnessed an increase in the number of chronically ill population, which propels the market’s growth. In addition, the factors such as favorable regulations and technically innovative healthcare facilities across the U.S. and Canada boost the market growth.

- Asia-Pacific is expected to witness a considerable growth rate during the projection period. Growing demand from emerging markets such as India and China, coupled with an upsurge in the number of patients with chronic disease, has driven the growth of the Asia-Pacific Laparoscopic Vision Systems industry.

Global Laparoscopic Vision Systems Market- Country Analysis:

- Germany

Germany's Laparoscopic Vision Systems market size was valued at USD 1.24 billion in 2021 and is expected to reach USD 2.58 billion by 2029, at a CAGR of 9.6% from 2022 to 2029.

Germany is one of the leading shareholders in the Laparoscopic Vision Systems market in Europe. In addition, the huge healthcare spending by the government in this country has been a major contributor to market growth. Furthermore, the increased prevalence of chronic diseases and increasing demand for minimally invasive surgeries has driven the demand for Laparoscopic Vision Systems.

- China

China's Laparoscopic Vision Systems market size was valued at USD 1.20 billion in 2021 and is expected to reach USD 3.03 billion by 2029, at a CAGR of 12.3% from 2022 to 2029. The factors such as the aging population, increasing consumer income, and government initiatives have driven the growth of the China Laparoscopic Vision Systems market. In addition, China accounts for about 40% of all active pharmaceutical ingredients (APIs) used globally in the global pharmaceutical manufacturing supply chain. In addition, the number of Chinese facilities that produce APIs for the U.S. has increased significantly over the past decade. This factor has primarily contributed to this country's Laparoscopic Vision Systems industry revenue.

- India

India's Laparoscopic Vision Systems market size was valued at USD 0.93 billion in 2021 and is expected to reach USD 2.19 billion by 2029, at a CAGR of 11.3% from 2022 to 2029. India is one of the highest growing economies in Asia. The increasing geriatric population and rising prevalences of chronic diseases in the country have driven India's Laparoscopic Vision Systems market. Furthermore, the region has a huge population pool and well-built healthcare infrastructure, which propels the market’s growth.

Key Industry Players Analysis:

To increase their market position in the global Laparoscopic Vision Systems business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Intuitive Surgical

- Stryker Corporation

- Olympus Corporation

- Karl Storz GmbH & CO. KG

- Medtronic PLC

- Microline Surgical, Inc.

- Braun Melsungen AG

- SCHÖLLY Fiberoptic GmbH

- Optomic

- Victor Medical Instruments Co., Ltd

Latest Development:

- In 2021, the SIF-H190 single-balloon enteroscopy solution was launched by Olympus Corporation to reach deep into the small intestine.

- In 2019, Intuitive Surgical, Inc. received clearance from the US FDA for the da Vinc X Surgical System.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

11.8% |

|

Market Size |

11.8 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product Type, Application, End-User, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Intuitive Surgical, Stryker Corporation, Olympus Corporation, Karl Storz GmbH & CO. KG, Medtronic PLC, Microline Surgical, Inc., B. Braun Melsungen AG, SCHÖLLY Fiberoptic GmbH, Optomic, Victor Medical Instruments Co., Ltd among others |

|

By Product Type |

? Insufflator ? Suction/Irrigation systems, ? Laparoscope, ? Access ? Energy Devices |

|

By Application |

? General ? Colorectal ? Gynecology ? Urology ? Bariatric ? Pediatric |

|

By End-User |

? Hospitals ? Ambulatory Surgical Centers ? Others |

|

Regional scope |

? North America ? Europe ? Asia-Pacific ? South America ? Middle East and Africa |

Scope of the Report

Global Laparoscopic Vision Systems Market by Product Type:

- Insufflator

- Suction/Irrigation systems

- Laparoscope

- Access & Energy Devices

Global Laparoscopic Vision Systems Market by application:

- General

- Colorectal

- Gynecology

- Urology

- Bariatric

- Pediatric

Global Laparoscopic Vision Systems Market by end-user:

- Hospitals

- Ambulatory Surgical Centers

- Others

Global Laparoscopic Vision Systems Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of the Laparoscopic Vision Systems market in 2021

Global Laparoscopic Vision Systems market size was USD 11.8 billion in 2021.

What will be the market size of the Laparoscopic Vision Systems market in 2029?

Global Laparoscopic Vision Systems market is expected to reach USD 28.8 billion by 2029, at a CAGR of 11.8% from 2022 to 2029.

Who are the leading players in the Laparoscopic Vision Systems market?

Leading market players active in the global Laparoscopic Vision Systems market are Intuitive Surgical, Stryker Corporation, Olympus Corporation, Karl Storz GmbH & CO. KG, Medtronic PLC, Microline Surgical, Inc., B. Braun Melsungen AG, SCHÖLLY Fiberoptic GmbH, Optomic, Victor Medical Instruments Co., Ltd among others

What is the key driver of the Laparoscopic Vision Systems market?

Increased prevalence of chronic diseases is primarily driving the growth of the Laparoscopic Vision Systems market.

What is the most significant end-user of Laparoscopic Vision Systems?

The hospital segment led the Laparoscopic Vision Systems market with a market share of around 48.98% in 2021

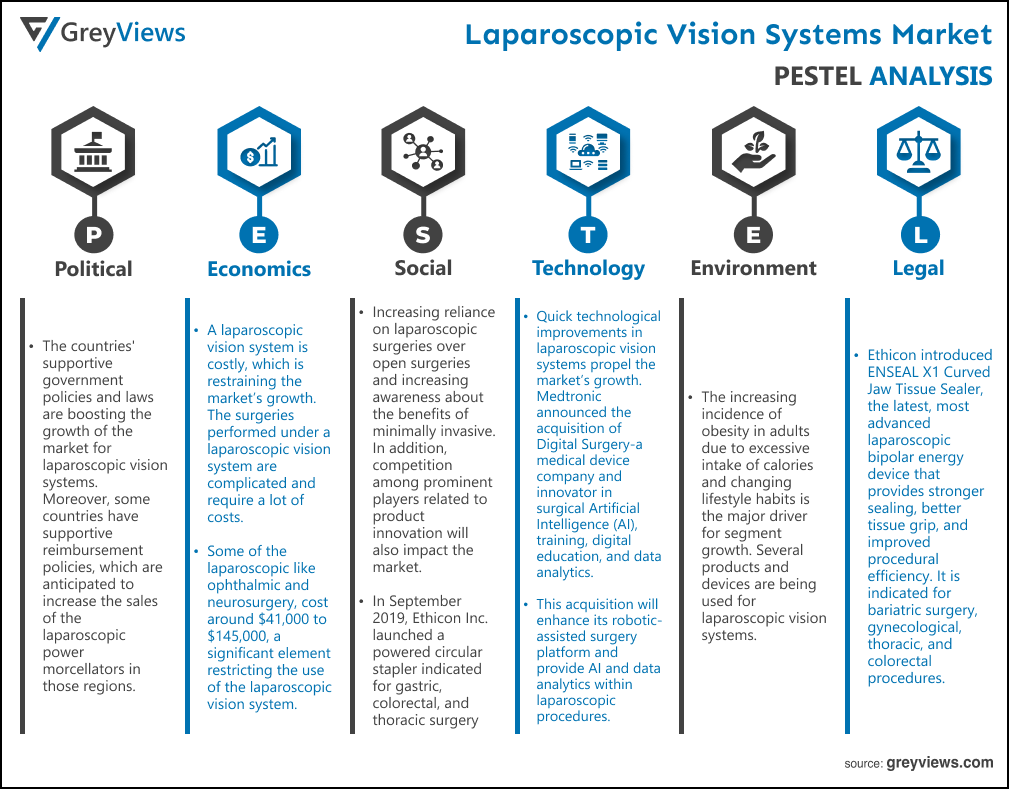

Political Factors- The countries' supportive government policies and laws are boosting the growth of the market for laparoscopic vision systems. Moreover, some countries have supportive reimbursement policies, which are anticipated to increase the sales of the laparoscopic power morcellators in those regions. Laparoscopic device systems are expanding due to a noteworthy increase in worldwide elderly demographics and the expansion of energy systems, which is increasing their availability and affordability. Laparoscopic vision systems incorporate energy systems and are expected to find lucrative uses in various applications in bariatric surgeries, such as adjustable gastric bands, sleeve gastrectomy, gastric bypass, and biliopancreatic diversion with duodenal switch.

Economical Factors- A laparoscopic vision system is costly, which is restraining the market’s growth. The surgeries performed under a laparoscopic vision system are complicated and require a lot of costs. Some of the laparoscopic like ophthalmic and neurosurgery, cost around $41,000 to $145,000, a significant element restricting the use of the laparoscopic vision system. Additionally, recurring expenditures on the maintenance of these laparoscopic surgeries increased operational expenses.

Social Factor- Increasing reliance on laparoscopic surgeries over open surgeries and increasing awareness about the benefits of minimally invasive. In addition, competition among prominent players related to product innovation will also impact the market. For instance, in September 2019, Ethicon Inc. launched a powered circular stapler indicated for gastric, colorectal, and thoracic surgery. This reduces leaks by 61% at the staple line without compromising perfusion. Thus, this, in turn, is anticipated to boost the growth of the market for laparoscopic vision systems.

Technological Factors- Quick technological improvements in laparoscopic vision systems propel the market’s growth. Medtronic announced the acquisition of Digital Surgery-a medical device company and innovator in surgical Artificial Intelligence (AI), training, digital education, and data analytics. This acquisition will enhance its robotic-assisted surgery platform and provide AI and data analytics within laparoscopic procedures. Olympus has announced the addition of 3D and infrared capabilities to their VISERA ELITE II surgical imaging platform for minimally invasive surgery. Adding such an imaging platform could help hospitals and operation centers improve efficiency and cut expenses. The product is useful in various applications, such as gynecology, general surgery, orthopedic surgery, endourology, and ENT.

Environmental Factors- The increasing incidence of obesity in adults due to excessive intake of calories and changing lifestyle habits is the major driver for segment growth. Several products and devices are being used for laparoscopic vision systems. The daily consumption of single-use products by the general population will increase non-recyclable plastic waste and have a detrimental impact on the environment, as currently, there is no infrastructure in place for safe and environmentally friendly disposal of potentially contaminated single-use face masks used by the general population.

Legal Factors- Ethicon introduced ENSEAL X1 Curved Jaw Tissue Sealer, the latest, most advanced laparoscopic bipolar energy device that provides stronger sealing, better tissue grip, and improved procedural efficiency. It is indicated for bariatric surgery, gynecological, thoracic, and colorectal procedures. In addition, the market for the laparoscopic device is consolidating due to the rising popularity of medical equipment and along with increased research collaboration and agreements between diverse manufacturers.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product Type

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By End-User

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increased prevalence of chronic diseases

- Restrains

- High treatment cost

- Opportunities

- Increasing demand for minimally invasive surgeries

- Challenges

- Lack of skilled professionals

- Global Laparoscopic Vision Systems Market Analysis and Projection, By Product Type

- Segment Overview

- Insufflator

- Suction/Irrigation systems

- Laparoscope

- Access & Energy Devices

- Global Laparoscopic Vision Systems Market Analysis and Projection, By Application

- Segment Overview

- General

- Colorectal

- Gynecology

- Urology

- Bariatric

- Pediatric

- Global Laparoscopic Vision Systems Market Analysis and Projection, By End-User

- Segment Overview

- Hospitals

- Ambulatory Surgical Centers

- Others

- Global Laparoscopic Vision Systems Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Laparoscopic Vision Systems Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Laparoscopic Vision Systems Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Intuitive Surgical

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Stryker Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Olympus Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Karl Storz GmbH & CO. KG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Medtronic PLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Microline Surgical, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Braun Melsungen AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- SCHÖLLY Fiberoptic GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Optomic

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Victor Medical Instruments Co., Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Type Portfolio

- Recent Developments

- SWOT Analysis

- Intuitive Surgical

List of Table

- Global Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Global Insufflator Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Suction/Irrigation systems Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Laparoscope Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Access & Energy Devices Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Global General Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Colorectal Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Gynecology Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Urology Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Bariatric Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Pediatric Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Global Hospitals Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Ambulatory Surgical Centers Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Others Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Laparoscopic Vision Systems Market, By Region, 2021–2029(USD Billion)

- Global Laparoscopic Vision Systems Market, By North America, 2021–2029(USD Billion)

- North America Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- North America Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- North America Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- USA Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- USA Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- USA Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Canada Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Canada Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Canada Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Mexico Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Mexico Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Mexico Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Europe Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Europe Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Europe Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Germany Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Germany Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Germany Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- France Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- France Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- France Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- UK Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- UK Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- UK Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Italy Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Italy Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Italy Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Spain Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Spain Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Spain Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Asia Pacific Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Asia Pacific Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Japan Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Japan Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Japan Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- China Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- China Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- China Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- India Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- India Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- India Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- South America Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- South America Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- South America Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Brazil Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Brazil Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Brazil Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- Middle East and Africa Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- Middle East and Africa Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- UAE Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- UAE Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- UAE Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

- South Africa Laparoscopic Vision Systems Market, By Product Type, 2021–2029(USD Billion)

- South Africa Laparoscopic Vision Systems Market, By Application, 2021–2029(USD Billion)

- South Africa Laparoscopic Vision Systems Market, By End-User, 2021–2029(USD Billion)

List of Figures

- Global Laparoscopic Vision Systems Market Segmentation

- Laparoscopic Vision Systems Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Laparoscopic Vision Systems Market Attractiveness Analysis By Product Type

- Global Laparoscopic Vision Systems Market Attractiveness Analysis By Application

- Global Laparoscopic Vision Systems Market Attractiveness Analysis By End-User

- Global Laparoscopic Vision Systems Market Attractiveness Analysis By Region

- Global Laparoscopic Vision Systems Market: Dynamics

- Global Laparoscopic Vision Systems Market Share By Product Type(2021 & 2029)

- Global Laparoscopic Vision Systems Market Share By Application(2021 & 2029)

- Global Laparoscopic Vision Systems Market Share By End-User(2021 & 2029)

- Global Laparoscopic Vision Systems Market Share by Regions (2021 & 2029)

- Global Laparoscopic Vision Systems Market Share by Company (2020)