Livestock Monitoring Market Size by Offering (Hardware, Software, and Services), Livestock Type (Cattle, Poultry, Swine, Equine, and Others), Application (Milk Harvesting Management, Heat Detection Monitoring, Feeding Management, Heat Stress Management, Health Monitoring Management, and Sorting and Weighing Management), Regions, Segmentation, and Projection till 2029.

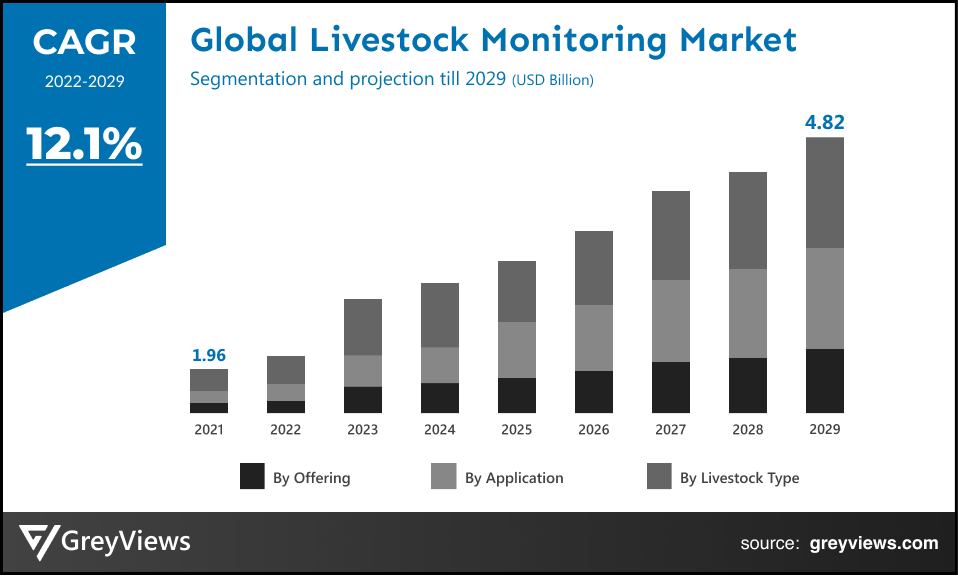

CAGR: 12.1%Current Market Size: USD 1.96 billionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Livestock Monitoring Market - Market Overview

Global livestock monitoring market is expected to grow from USD 1.96 billion in 2021 to USD 4.82 billion by 2029, at a CAGR of 12.1% during the Projection period 2022-2029.This growth is mainly attributed to the upsurge in demand for innovative livestock monitoring technology along with the continuous rise in the cattle population.

The traditional methods of livestock monitoring comprise individual inspection of animals for signs of injury or disease. However, this method is both highly unreliable and costly. For instance, recently, an Oklahoma University found lung lesions and scarring in 37% of cattle that had never been diagnosed as sick. Such instances have led to the emergence of IoT-enabled livestock management solutions. This has become one of the leading revolutionary solutions developed and architected using advanced technologies such as sensors, GPS, and other IoT-enabled devices and integrating them with a network protocol for communication. Such systems are helping farmers to keep a check on their farm animals and track & monitor the health of livestock remotely. By using a wearable tag or collar, battery-powered sensors monitor the location, blood pressure, temperature, and heart rate of animals and wirelessly send data to the devices of farmers.

Request Sample:- Global livestock monitoring market

Market Dynamics

Drivers:

- Demand for early disease detection and real-time monitoring

The advancement in sensor technologies has enabled livestock monitoring to detect diseases in animals at the earliest. For instance, the Tail Sensor is being used for the prediction of calving time as well as early detection of fever. In addition, the activity monitoring devices are useful for the early identification of bulls at risk of becoming sick. Therefore, if built precisely and used correctly, livestock monitoring solutions can provide an appropriate diagnosis of diseases in animals, eventually lessening the economic losses. Hence, demand for early disease detection has driven the growth of the market.

- Advantageous features associated with the livestock monitoring

The livestock monitoring solution enables farmers to check in on the health and location of each individual animal. In addition to health tracking, livestock monitoring solutions utilize GPS tracking to collect and store historical data about preferred grazing spots as well as use temperature tracking to understand the peak of the mating season. Such features associated with livestock monitoring as compared with traditional monitoring drives the growth of the market.

Restraints:

- The high implementation cost of livestock monitoring solutions

The livestock monitoring solutions including sensing and monitoring devices as well as herd management software have significantly high set-up and maintenance costs. In addition to this, the farmers need heavy investments in automation and control devices, robotic equipment, systems based on RFID or GPS technology, and distribution wagons. All of the aforementioned solutions incur high installation and maintenance costs, making them unaffordable for small farmers. Hence, the high cost of livestock monitoring solutions hampers the growth of the market to some extent.

Opportunities:

- Upsurge in the number of poultry, dairy, and swine farms

In the past few years, the demand for meat and dairy products has grown significantly, fueling the number of poultry, dairy, and swine farms. For instance, in 2020, there were more than 33 billion chickens across the globe, up from 14.3 billion chickens in 2000. In addition, according to the data from the U.S. Department of Agriculture's Agricultural Resource Management Survey (USDA ARMS), the larger dairy farms are growing at faster rates than smaller dairy farms. This surge in the number of poultry, dairy, and swine farms is expected to create lucrative growth opportunities for the livestock monitoring market.

Challenges

- Environmental concerns such as global warming

According to various studies, livestock farming leads to about 13 to 15% of the man-made greenhouse gas emissions causing global warming. In addition, this type of farming causes biodiversity loss, water & land degradation, acid rain, deforestation, and coral reef degeneration. For instance, the livestock industry uses about 8% of the total available freshwater and more than 10% of the global agricultural land. This may be further responsible for biodiversity loss and deforestation. Hence, the aforementioned environmental concerns triggered by livestock farming may pose significant challenges to market growth.

Segmentation Analysis:

The global livestock monitoring market has been segmented based on offering, livestock type, application, and regions.

Global Livestock monitoring - By Offering

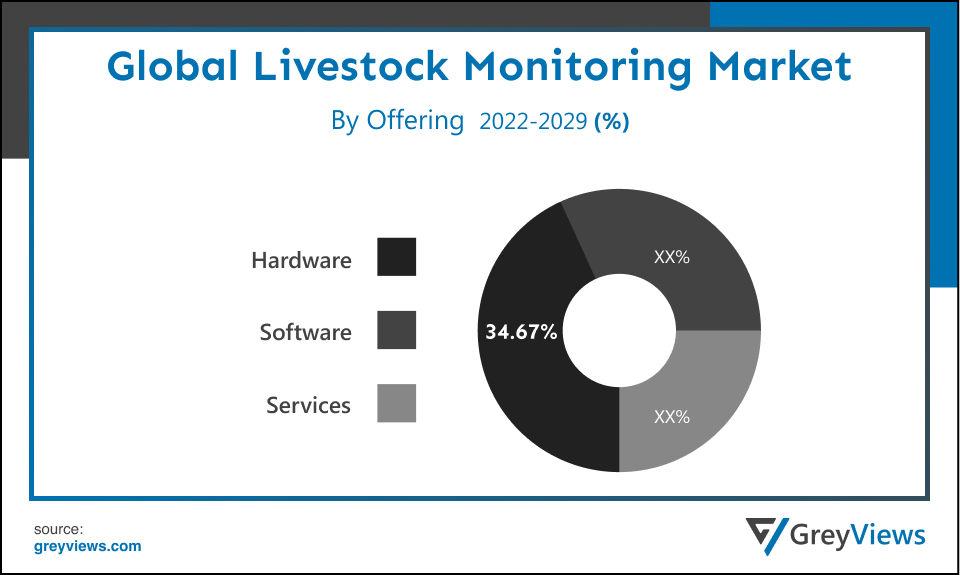

The offering segment includes hardware, software, and services. The hardware segment led the livestock monitoring market with a market share of around 34.67% in 2021. This is attributed to the fact that the use of livestock monitoring hardware enhances the productivity of the farming trade, thus boosting production. The increasing adoption of hardware such as smart tags, camera-based systems, sensors, and GPS devices in livestock farms has boosted the growth of this segment.

By Livestock Type

The livestock type segment includes cattle, poultry, swine, equine, and others. The cattle segment led the livestock monitoring market with a market share of around 46.12% in 2021. This is attributed to the increasing popularity of cattle livestock monitoring systems. Dairy products and beef are under continuous inspection by different public and private organizations to ensure the quality and safety of such products as well as the prevention of disease transmission. Hence, increasing consumption of dairy products and beef boosts the growth of the cattle segment.

By Application

The application segment includes milk harvesting management, heat detection monitoring, feeding management, heat stress management, health monitoring management, and sorting and weighing management. The feeding management segment led the livestock monitoring market with a market share of around 24.88% in 2021. The need to provide constant access to feed and water and to keep the living areas of animals clean has boosted the demand for feeding management solutions. The appropriate manure handling and feeding are vital for veterinary comfort, health, and well-being as well as for reducing disease, parasites, and illness.

The milk harvesting segment is expected to anticipate to witness the highest growth rate during the Projection period. Manual milking is very slow and time-consuming; hence, the implementation of auto milking has grown significantly, reducing costs and the need for manpower. In addition, there is rising usage of intelligent cooling tanks to automatically preserve the milk. Such factors have driven the growth of the Milk harvesting segment.

Global Livestock Monitoring Market- By Regional Analysis

The regions analyzed for the livestock monitoring market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The North American region dominated the livestock monitoring market and held the 32.28% share of the market revenue in 2021.

- North America region witnessed a major share. The growth of this region is mainly driven by the increased internet penetration along with the technological developments in the field of livestock monitoring. In addition, according to the Food and Agriculture Organization of the United Nations (UNFAO), a specialized agency of the United Nations, the U.S. is the largest producer of poultry meat in the world. The huge poultry industry in this region has driven growth of the livestock monitoring market.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. A number of factors such as growing population, changing dietary patterns, and rapid urbanization have driven the growth of the livestock monitoring market in this region. In addition, the region is seeing growing penetration of IoT in animal monitoring applications, further fueling the growth of the market.

Global Livestock Monitoring Market- Country Analysis:

- Germany

In Germany, the competitiveness of livestock production is limited owing to a high number of small farms. However, the country is the third-largest exporter of agricultural goods across the globe, and the agricultural industry in this country exports about one-third of its products.

Germany's livestock monitoring market size was valued at USD 0.23 billion in 2021 and is expected to reach USD 0.56 billion by 2029, at a CAGR of 11.8% from 2022 to 2029.

Further, according to The Federal Statistical Office (Destatis), about 13.0 billion eggs were produced in enterprises in Germany. Hence, a huge poultry sector in the country is projected to boost demand for livestock monitoring solutions.

- China

China's livestock monitoring market size was valued at USD 0.39 billion in 2021 and is expected to reach USD 0.82 billion by 2029, at a CAGR of 9.9% from 2022 to 2029. China has a large livestock population with fowls and pigs being the most common. In addition, the average milk, meat, and egg consumption per capita are continuously increasing in this country. Hence, the huge consumption of livestock products in this country is projected to boost the growth of the livestock monitoring market.

- India

India's livestock monitoring market size was valued at USD 0.17 billion in 2021 and is expected to reach USD 0.39 billion by 2029, at a CAGR of 11.0% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the emerging popularity of livestock monitoring in this country is expected to create lucrative growth opportunities for the livestock monitoring market. In August 2020, the government in this country launched the e-Gopala app to help farmers choose better quality livestock and improve dairy output. Such government initiatives are opportunistic for the growth of the Indian livestock monitoring market.

Key Industry Players Analysis:

To increase their market position in the global livestock monitoring business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Allflex Livestock Intelligence (Subsidiary of MSD Animal Health)

- DeLaval

- Afimilk Ltd.

- Nedap N.V.

- BouMatic

- ENGS Systems

- CowManager B.V.

- Dairymaster

- HerdInsights (Subsidiary of Datamars)

- Zoetis

Latest Development:

In June 2021, MSD Animal Health, a division of Merck & Co., Inc. announced to acquire of the assets of LIC Automation Ltd. LICA is one of the leaders in automation and technology for the dairy industry.

In June 2021, Nedap N.V., a Dutch multinational technology company partnered with Cogent Breeding (UK), a breeding technology and cattle genetics company, to launch PrecisionCOW. This solution monitors the fertility, health, and location of each cow throughout the day.

Report Scope

| Report Attribute | Details |

| Market size available for years | 2021-2029 |

| Base year considered | 2021 |

| CAGR (%) | 12.1% |

| Market Size | 1.96 billion in 2021 |

| Forecast period | 2022-2029 |

| Forecast unit | Value (USD) |

| Segments covered | Offering, livestock type, application, and Regions |

| Report Scope | Revenue forecast, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Allflex Livestock Intelligence (Subsidiary of MSD Animal Health), DeLaval, Afimilk Ltd., Nedap N.V. , BouMatic, ENGS Systems, CowManager B.V., Dairymaster, HerdInsights (Subsidiary of Datamars), and Zoetis among others |

| By Offering |

|

By Livestock Type |

|

| By Application |

|

Regional scope |

|

Scope of the Report

Global Livestock Monitoring Market by Offering:

- Hardware

- Software

- Services

Global Livestock Monitoring Market by Livestock Type:

- Cattle

- Poultry

- Swine

- Equine

- Others

Global Livestock Monitoring Market by Application:

- Milk Harvesting Management

- Heat Detection Monitoring

- Feeding Management

- Heat Stress Management

- Health Monitoring Management

- Sorting and Weighing Management

Global Livestock Monitoring Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the Current market size of livestock monitoring market?

Global livestock monitoring market size is USD 1.96 billion in 2021

Which segment is doing more contribution in livestock monitoring market?

The cattle segment led the livestock monitoring market with a market share of around 46.12% in 2021

What is the segmentation considered for the analysis of the global livestock monitoring market?

The global livestock monitoring market has been segmented based on offering, livestock type, application, and regions.

Which region dominate the global livestock monitoring market?

The North American region dominated the livestock monitoring market and held the 32.28% share of the market revenue in 2021

Who are the leading market players active in the livestock monitoring market?

Leading market players active in the global livestock monitoring market are Allflex Livestock Intelligence (Subsidiary of MSD Animal Health), DeLaval, Afimilk Ltd., Nedap N.V., BouMatic, ENGS Systems, CowManager B.V., Dairymaster, HerdInsights (Subsidiary of Datamars), and Zoetis among others

Which country Dominate the Livestock Monitoring Market

China's livestock monitoring market size was valued at USD 0.39 billion in 2021 and is expected to reach USD 0.82 billion by 2029, at a CAGR of 9.9% from 2022 to 2029.

What is the key driver of the livestock monitoring market?

The upsurge in demand for innovative livestock monitoring technology along with the continuous rise in cattle population is primarily driving the growth of the livestock monitoring market.

What are the ongoing trends that are projected to influence the market in the upcoming years?

Key players in the livestock monitoring market are using advanced technologies to incorporate better results and performance of the whole process. In addition, the rising number of investments will contribute to the demand for livestock monitoring.

What are the detailed impacts of the COVID-19 pandemic on the global market?

The pandemic has significantly affected several industries and has caused a worldwide economic slowdown. Many regions imposed various lockdowns during the fiscal year 2020. These lockdowns led to the closure of the regional industries and all types of manufacturing facilities, which has led to a shortage of supply in the market. Additionally, all the end-users industries were temporarily closed during this period, which in turn has decreased the sales for livestock monitoring.

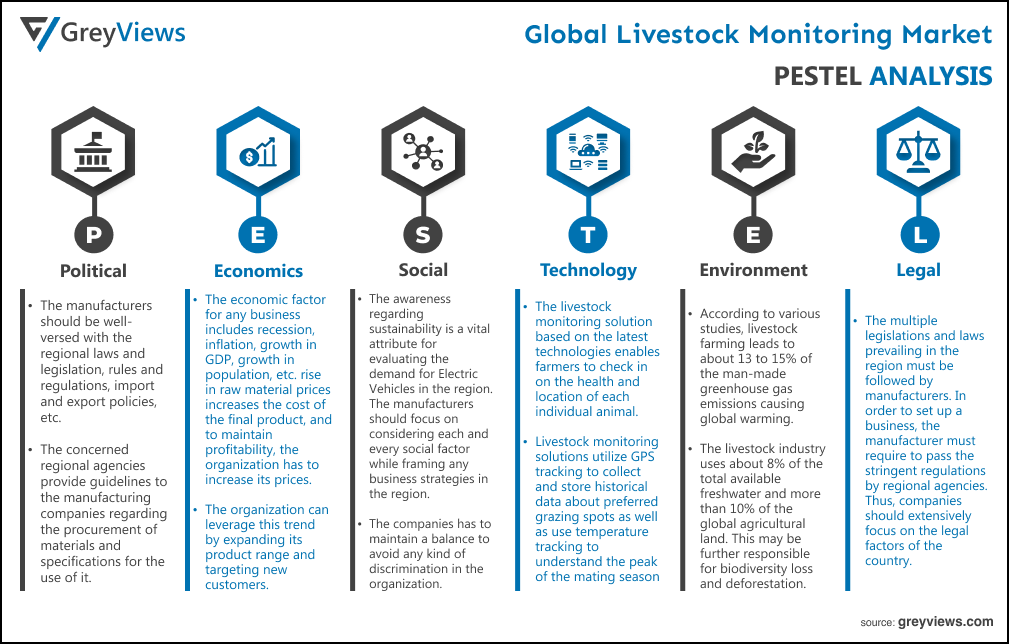

Political Factors- Political factors are one of the significant factors that largely affect the operations of the organization in the livestock monitoring market. The manufacturers should be well-versed with the regional laws and legislation, rules and regulations, import and export policies, etc. The concerned regional agencies provide guidelines to the manufacturing companies regarding the procurement of materials and specifications for the use of it. According to the Food and Agriculture Organization of the United Nations (UNFAO), a specialized agency of the United Nations, the U.S. is the largest producer of poultry meat in the world.

Economical Factors- The economic factor for any business includes recession, inflation, growth in GDP, growth in population, etc. rise in raw material prices increases the cost of the final product, and to maintain profitability, the organization has to increase its prices. The organization can leverage this trend by expanding its product range and targeting new customers. For instance, the farmers need heavy investments in automation and control devices, robotic equipment, systems based on RFID or GPS technology, and distribution wagons. All of the aforementioned solutions incur high installation and maintenance costs, making them unaffordable for small farmers. Hence, the high cost of livestock monitoring solutions hampers the growth of the market to some extent.

Social Factor- The awareness regarding sustainability is a vital attribute for evaluating the demand for Electric Vehicles in the region. The manufacturers should focus on considering each and every social factor while framing any business strategies in the region. The manufacturers and suppliers should focus on the set of values, religions, cultures, attitudes, etc. present in the region; that governs the performance of the market in the region. Thus, the company has to maintain a balance to avoid any kind of discrimination in the organization. Thus, these factors should be identified well by the companies, and all other socially responsible factors should be taken into consideration before setting up or expanding the business in any regional market.

Technological Factors- The livestock monitoring solution based on the latest technologies enables farmers to check in on the health and location of each individual animal. In addition to health tracking, livestock monitoring solutions utilize GPS tracking to collect and store historical data about preferred grazing spots as well as use temperature tracking to understand the peak of the mating season. Such features associated with livestock monitoring as compared with traditional monitoring helps in keeping a check on the movement of the cattle.

Environmental Factors- According to various studies, livestock farming leads to about 13 to 15% of the man-made greenhouse gas emissions causing global warming. In addition, this type of farming causes biodiversity loss, water & land degradation, acid rain, deforestation, and coral reef degeneration. For instance, the livestock industry uses about 8% of the total available freshwater and more than 10% of the global agricultural land. This may be further responsible for biodiversity loss and deforestation. Hence, the aforementioned environmental concerns triggered by livestock farming may pose significant challenges to market growth.

Legal Factors- The multiple legislations and laws prevailing in the region must be followed by manufacturers. In order to set up a business, the manufacturer must require to pass the stringent regulations by regional agencies. Thus, companies should extensively focus on the legal factors of the country. Moreover, the laws related to employment laws, import and export, and labor laws must be taken care of. A lawful and legal organization can effectively survive in the long run. For instance, recently, an Oklahoma University found lung lesions and scarring in 37% of cattle that had never been diagnosed as sick. Such instances have led to the emergence of IoT-enabled livestock management solutions. This has become one of the leading revolutionary solutions developed and architected using advanced technologies such as sensors, GPS, and other IoT-enabled devices and integrating them with a network protocol for communication. Such systems are helping farmers to keep a check on their farm animals and track & monitor the health of livestock remotely.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porterβs Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Offering

- Market Attractiveness Analysis By Livestock Type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Demand for early disease detection and real-time monitoring

- Advantageous features associated with the associated with the livestock monitoring

- Restrains

- High implementation cost of livestock monitoring solutions

- Opportunities

- Upsurge in number of poultry, dairy, and swine farms

- Challenges

- Environmental concerns such as global warming

- Global Livestock Monitoring Market Analysis and Projection, By Offering

- Segment Overview

- Hardware

- Software

- Services

- Global Livestock Monitoring Market Analysis and Projection, By Livestock Type

- Segment Overview

- Cattle

- Poultry

- Swine

- Equine

- Others

- Global Livestock Monitoring Market Analysis and Projection, By Application

- Segment Overview

- Milk Harvesting Management

- Heat Detection Monitoring

- Feeding Management

- Heat Stress Management

- Health Monitoring Management

- Sorting and Weighing Management

- Global Livestock Monitoring Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Livestock Monitoring Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Livestock Monitoring Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Offering Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Allflex Livestock Intelligence

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- DeLaval

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Afimilk Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Nedap N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- BouMatic

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- ENGS Systems

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- CowManager B.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Dairymaster

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- HerdInsights

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Zoetis

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Offering Portfolio

- Recent Developments

- SWOT Analysis

- Allflex Livestock Intelligence

List of Table

- Global Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Global Hardware Market, By Region, 2021β2029(USD Billion)

- Global Software Market, By Region, 2021β2029(USD Billion)

- Global Services Market, By Region, 2021β2029(USD Billion)

- Global Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Global Cattle Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Poultry Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Swine Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Equine Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Others Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Global Milk Harvesting Management Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Heat Detection Monitoring Application Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Feeding Management Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Heat Stress Management Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Health Monitoring Management Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Sorting and Weighing Management Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Livestock Monitoring Market, By Region, 2021β2029(USD Billion)

- Global Livestock Monitoring Market, By North America, 2021β2029(USD Billion)

- North America Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- North America Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- North America Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- USA Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- USA Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- USA Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Canada Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Canada Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Canada Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Mexico Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Mexico Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Mexico Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Europe Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Europe Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Europe Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Germany Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Germany Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Germany Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- France Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- France Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- France Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- UK Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- UK Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- UK Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Italy Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Italy Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Italy Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Spain Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Spain Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Spain Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Asia Pacific Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Asia Pacific Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Asia Pacific Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Japan Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Japan Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Japan Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- China Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- China Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- China Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- India Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- India Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- India Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- South America Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- South America Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- South America Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Brazil Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Brazil Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Brazil Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- Middle East and Africa Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- Middle East and Africa Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- Middle East and Africa Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- UAE Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- UAE Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- UAE Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

- South Africa Livestock Monitoring Market, By Offering, 2021β2029(USD Billion)

- South Africa Livestock Monitoring Market, By Livestock Type, 2021β2029(USD Billion)

- South Africa Livestock Monitoring Market, By Application, 2021β2029(USD Billion)

List of Figures

- Global Livestock Monitoring Market Segmentation

- Livestock Monitoring Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porterβs Five Forces Analysis

- Value Chain Analysis

- Global Livestock Monitoring Market Attractiveness Analysis By Offering

- Global Livestock Monitoring Market Attractiveness Analysis By Livestock Type

- Global Livestock Monitoring Market Attractiveness Analysis By Application

- Global Livestock Monitoring Market Attractiveness Analysis By Region

- Global Livestock Monitoring Market: Dynamics

- Global Livestock Monitoring Market Share By Offering(2021 & 2029)

- Global Livestock Monitoring Market Share By Livestock Type(2021 & 2029)

- Global Livestock Monitoring Market Share By Application(2021 & 2029)

- Global Livestock Monitoring Market Share by Regions (2021 & 2029)

- Global Livestock Monitoring Market Share by Company (2020)