Maleic Anhydride Market Size by Source (N-Butane and Benzene), Application (Unsaturated Polyester Resins, Lubricating Oil Additives, Food Additives, Copolymers, 1,4-BDO, Plasticizers, and Others), End-users (Building and Construction, Automotive, Food and Beverages, Electronics, Pharmaceutical, Personal Care, Agriculture, and Others), Distribution Channel (Direct and Indirect) Regions, Segmentation, and Projection till 2029

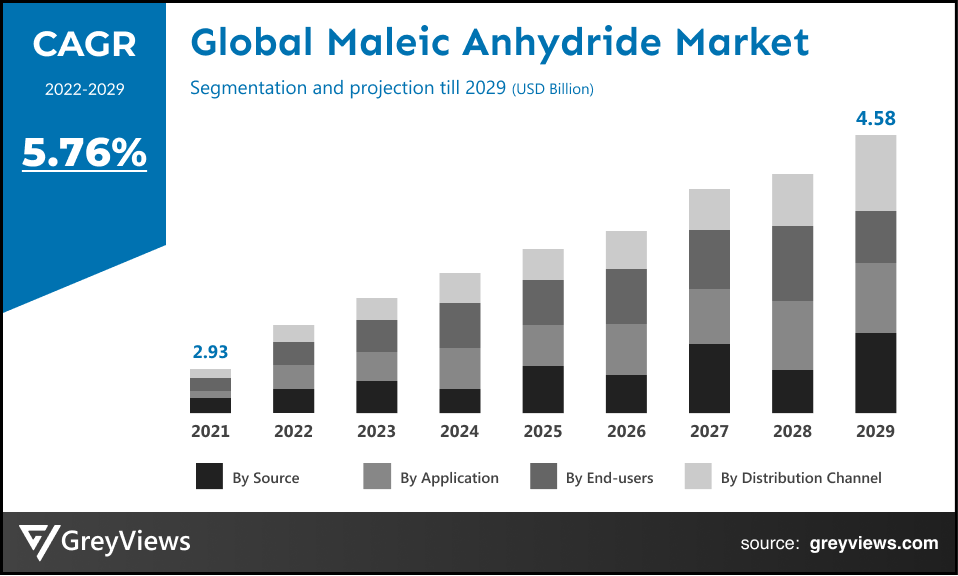

CAGR: 5.76%Current Market Size: USD 2.93 billionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Maleic Anhydride- Market Overview

The global maleic anhydride market is expected to grow from USD 2.93 billion in 2021 to USD 4.58 billion by 2029, at a CAGR of 5.76% during the Projection period 2022-2029. This growth of the maleic anhydride market is significantly driven by the rising use of such materials in the manufacturing of automotive and construction industry. The increasing demand for bio-based maleic anhydride in several applications has led to high sales in the past few years. The developing countries are the major end-users of maleic anhydride owing to the expansion of the construction industry.

Maleic anhydride is known by the formula of C2H2(CO)2O and is the widely used acid anhydride. Maleic anhydride has no color and has a white solid appearance. Maleic anhydride is manufactured industrially on large scale for different applications. Traditionally, maleic anhydride was formed by benzene oxidation. There is a limited number of manufacturers that use this technique. There are several benefits of using maleic anhydride in different end-users such as pharmaceutical, automotive, agriculture, cosmetics, etc. There are limited environmental risks of maleic anhydride. The bonds of maleic anhydride consist of high strength and are readily available.

Request Sample:- Global Maleic Anhydride Market

Market Dynamics:

Drivers:

- Increasing demand for unsaturated polyester resins

The increase in unsaturated polyester resins has led to the high use of maleic anhydride. The developing countries have a high demand for unsaturated polyester resins which can help in decreasing the weight of the automobile bodies. Unsaturated polyester resins are the most used body filler for automobiles. The unsaturated polyester resins are manufactured at a much lower cost and thus it is preferred in many industries. They are used in the development processes for the plastics used in automobiles, construction, etc. applications. Maleic anhydride is used for the manufacturing of large-scale unsaturated polyester resins.

- Increasing demand for construction and wind energy

The increase in construction activities has led to the high use of maleic anhydride. The developing countries have a high demand for advanced construction materials which can help in decreasing the weight of the infrastructure. Due to the expansion of urbanization and industrialization, the construction industry is keen on using materials that can help in the manufacturing of plastics. The maleic anhydride provides freedom of design and effective processing in wind energy infrastructure installments.

Restraints:

- Fluctuating prices of raw materials

The maleic anhydride market's expansion is being hampered by the variable cost of raw materials necessary for product development. The total costs are influenced by the raw material prices connected with the development of maleic anhydride. The upstream price of raw materials has an impact on the production's final price. As a result, the shifting cost of raw materials has an impact on the market expansion of maleic anhydride companies.

Opportunities:

- Commercialization of sustainable maleic anhydride

Maleic anhydride has been produced for a longer period of time. The manufacturers are involved in the continuous development of alternative sources used for maleic anhydride manufacturing. The awareness regarding toxic attributes of aromatic compounds and benzene. There are alternative materials used for the development of maleic anhydride which will reduce the environmental pressure. Bio-based maleic anhydride has been replaced with petroleum maleic anhydride. The bio-based raw materials are fermented and used in the production of mixtures that can be purified and oxidized in order to derive the required amount of maleic anhydride

Challenges

- Higher demand for electronic vehicles

Hybrid vehicles runs on electric motor and internal combustion engine and thus these do not require engine oils. The technology of electric vehicles is constantly developing and thus it is impacting the sales of fuel-based vehicles. The consumption of engine oil has drastically reduced and thus the overall demand for lubricating additives has decreased, thus hampering the growth of the maleic anhydride market.

Segmentation Analysis:

The global maleic anhydride market has been segmented based on source, application, end-users, distribution channel, and regions.

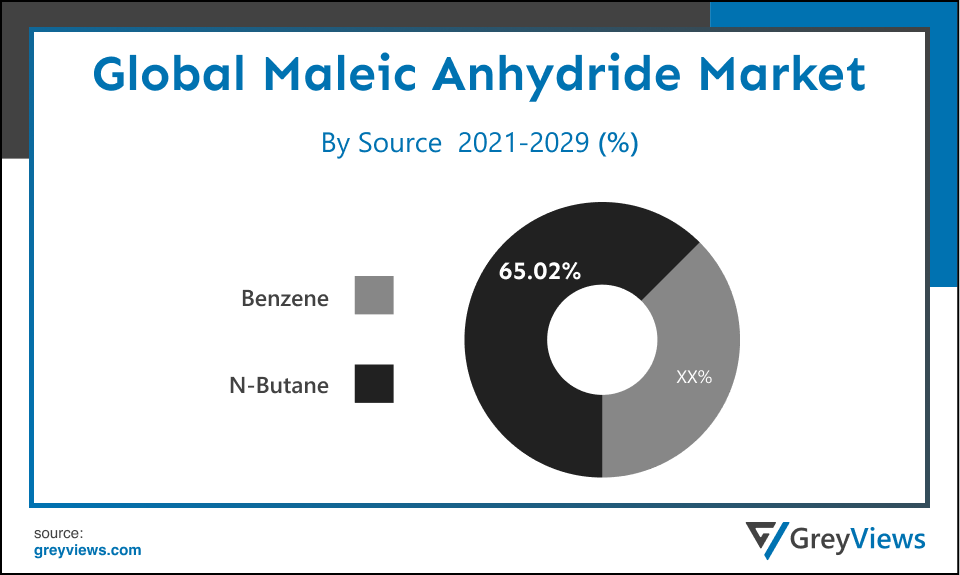

By Source

The source segment includes N-Butane and benzene. The N-butane segment led the maleic anhydride market with a market share of around 65.02% in 2021. N-butane is the most used source in the production of maleic anhydride. The production cost of n-butane is low and is thus mostly used in different end-user industries such as automobile, construction and wind energy, pharmaceuticals, etc. There are multiple advantages of n-butane over benzene and thus contribute to the total revenue of the market.

By Application

The application segment includes unsaturated polyester resins, lubricating oil additives, food additives, copolymers, 1,4-BDO, plasticizers, and others. The unsaturated polyester resins segment led the maleic anhydride market with a market share of around 32.10% in 2021. Maleic anhydride is mostly used for the manufacturing of unsaturated polyester resins. Unsaturated polyester resins are widely used in large volume applications. UPRs are milestone materials used in the development of plastics used in numerous industries such as automobiles and construction.

By End-users

The end-user segment includes building and construction, automotive, food and beverages, electronics, pharmaceutical, personal care, agriculture, and others. The automotive segment led the maleic anhydride market with a market share of around 31.11% in 2021. Automotive requires the use of a lightweight and durable raw material for the manufacturing of different components. Further, maleic anhydride is used in the production of lubricating oil additives that are used in engine oil. It is even used in corrosion inhibitors and crank oil as dispersants.

By Distribution Channel

The end-user segment includes direct and indirect. The direct segment led the maleic anhydride market with a market share of around 76.43% in 2021. Maleic anhydrides are majorly used by the end-users of construction, electric and electronics, automotive, pharmaceutical, and other industries. Thus, the end-users usually buy the product in bulk quantity, as it is used in the manufacturing of various equipment and component. Manufacturers would prefer to check the quality in accordance with their requirements and thus they will prefer to buy direct from the wholesalers.

By Regional Analysis

The regions analyzed for the maleic anhydride market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the maleic anhydride market and held the 33.19% share of the market revenue in 2021.

- The Asia-Pacific region has registered the highest value for the year 2021. The increasing growth rate of the automobile and construction industry has led to a rise in demand for maleic anhydride. The countries such as China, India, Japan, Malaysia, and Singapore are the major end-users of maleic anhydride. The increasing industrialization and urbanization, are providing lucrative opportunities for the market growth of maleic anhydride. Further, the presence of multiple manufacturers in the regional countries have increased the supply of product.

- North America is likely to register substantial growth during the Projection period due to the use of maleic anhydride in the automobile industry. The increasing use of maleic anhydride in the manufacturing of automobile bodies has led to the high demand for products. Moreover, USA and Canada are some of the key countries for the maleic anhydride market in the North American region. Further, the rising chemical spending is fueling up the market growth.

Global Maleic Anhydride Market- Country Analysis:

- China

China is the largest maleic anhydride market across the globe with an estimated market share of 34.91% across the Asia region by 2022. There are many manufacturers in the country and also there are high numbers of maleic anhydride raw material suppliers. The high sales of unsaturated polyester resins and lubricating oil indicate a significant market growth opportunity for the maleic anhydride.

- USA

In the North American region, the USA is the largest market shareholder in the maleic anhydride market with an estimated market share of around 46.02% by the end of 2022. The extensive applications of lubricating oil and copolymers in the chemical industry are anticipated to drive the market growth of maleic anhydride in the USA.

Key Industry Players Analysis:

To increase their market position in the global maleic anhydride business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Huntsman Corporation

- Shanxi Qiaoyou Chemical Co., Ltd.

- Changzhou Yabang Chemical Co., Ltd.

- Polynt-Reichhold Group

- Mitsubishi Chemical Corporation

- Zibo Qixiang Tengda Chemical Co., Ltd.

- Nippon Shokubai Co., Ltd.

- Gulf Advanced Chemical Industries Co., Ltd.

- LANXESS AG

- China Bluestar Harbin Petrochemical Co, Ltd.

- Ningbo Jiangning Chemical Co., Ltd.

- Nan Ya Plastics

- Shijiazhuang Bailong Chemical Co., Ltd.

- IG Petrochemicals Ltd.

- MOL Plc.

- Yongsan Chemical Co., Ltd.

- Global Ispat Koksna Industrija d.o.o. Lukavac

- PT Justus Sakti Raya

- Cepsa

- Tianjin Bohai Chemical Industry Group Co., Ltd.

- Yunnan Yunwei Company Limited

- Ruse Chemicals

- Huanghua Hongcheng Business Corp., Ltd.

- Shanxi Taiming Chemical Industry Co., Ltd.

- Gurit Holdings AG

- Aekyung Petrochemical Co., Ltd.

Latest Development:

In July 2020, a known global manufacturer, Polynt Reichhold Group., had announced the construction of fifty thousand tons capacity maleic anhydride. The construction site is located at Illinois.

Report Attribute

|

Report Metric |

Deatils |

|

Study Period |

2018-2029 |

|

Base Year |

2021 |

|

Projection Period |

2022-2029 |

|

Market Share Unit |

USD Billion |

|

Segments Covered |

Source, Application, End-users and Distribution Channel |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle-East and Africa |

|

Major Players |

Huntsman Corporation, Shanxi Qiaoyou Chemical Co., Ltd., Changzhou Yabang Chemical Co., Ltd., Polynt-Reichhold Group, Mitsubishi Chemical Corporation, Zibo Qixiang Tengda Chemical Co., Ltd., Nippon Shokubai Co., Ltd., Gulf Advanced Chemical Industries Co., Ltd., LANXESS AG, China Bluestar Harbin Petrochemical Co, Ltd., Ningbo Jiangning Chemical Co., Ltd., Nan Ya Plastics, Shijiazhuang Bailong Chemical Co., Ltd., IG Petrochemicals Ltd., MOL Plc., Yongsan Chemical Co., Ltd., Global Ispat Koksna Industrija d.o.o. Lukavac, PT Justus Sakti Raya, Cepsa, Tianjin Bohai Chemical Industry Group Co., Ltd., Yunnan Yunwei Company Limited, Ruse Chemicals, Huanghua Hongcheng Business Corp., Ltd., Shanxi Taiming Chemical Industry Co., Ltd., Gurit Holdings AG and Aekyung Petrochemical Co., Ltd. |

Scope of the Report

Global Maleic Anhydride Market by Source:

- N-Butane

- Benzene

Global Maleic Anhydride Market by Application:

- Unsaturated Polyester Resins

- Lubricating Oil Additives

- Food Additives

- Copolymers

- 1,4-BDO

- Plasticizers

- Others

Global Maleic Anhydride Market by End-users:

- Building and Construction

- Automotive

- Food and Beverages

- Electronics

- Pharmaceutical

- Personal Care

- Agriculture

- Others

Global Maleic Anhydride Market by Distribution Channel:

- Direct

- Indirect

Global Maleic Anhydride Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the Current market size of the Global Maleic Anhydride Market?

The current market size of Global maleic anhydride market is USD 2.93 billion in 2021 and it is expected to reach USD 4.58 billion by 2029, at a CAGR of 5.76%

Which region dominate the global Maleic Anhydride Market?

Asia-Pacific region dominated the maleic anhydride market and held the 33.19% share of the market revenue in 2021

Which country is the largest market for Maleic Anhydride?

China is the largest maleic anhydride market across the globe with an estimated market share of 34.91% across the Asia region by 2022. There are many manufacturers in the country and also there are high numbers of maleic anhydride raw material suppliers

What is the uses of Maleic Anhydride?

Maleic anhydrides are majorly used by the end-users of construction, electric and electronics, automotive, pharmaceutical, and other industries. Thus, the end-users usually buy the product in bulk quantity, as it is used in the manufacturing of various equipment and component

What are the technological factor in Maleic Anhydride Market?

The manufacturers are involved in the continuous development of alternative sources used for maleic anhydride manufacturing. The awareness regarding toxic attributes of aromatic compounds and benzene. There are alternative materials used for the development of maleic anhydride which will reduce the environmental pressure. Bio-based maleic anhydride has been replaced with petroleum maleic anhydride. The bio-based raw materials are fermented and used in the production of mixtures that can be purified and oxidized in order to derive the required amount of maleic anhydride

What are the Economic Factor in Maleic Anhydride Market?

The maleic anhydride market's expansion is being hampered by the variable cost of raw materials necessary for product development. The total costs are influenced by the raw material prices connected with the development of maleic anhydride. The upstream price of raw materials has an impact on the production's final price. As a result, the shifting cost of raw materials has an impact on the market expansion of maleic anhydride companies

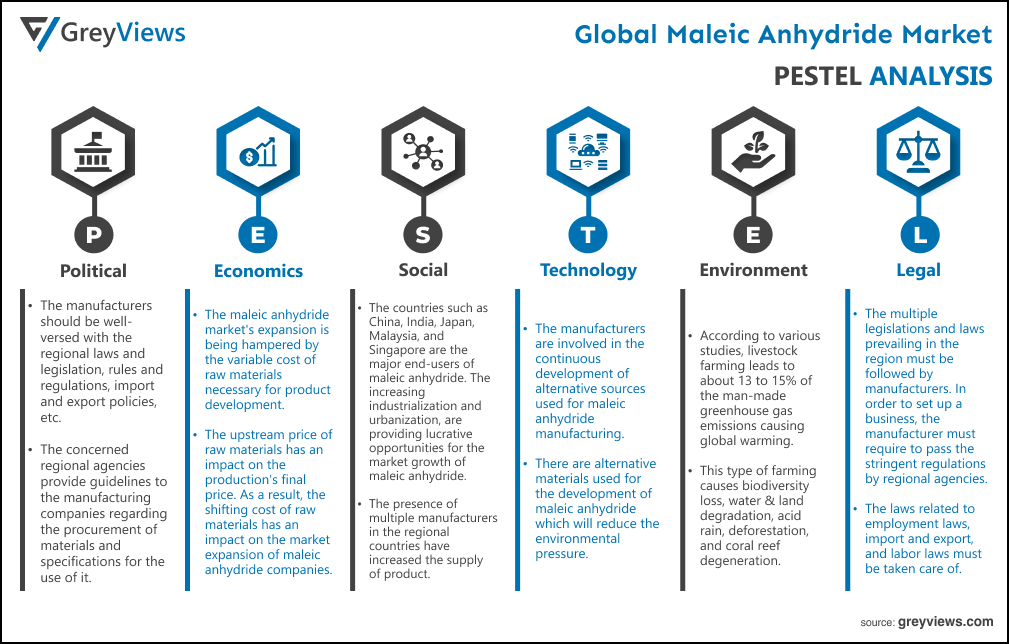

Political Factors- Political factors are one of the significant factors that largely affect the operations of the organization in the livestock monitoring market. The manufacturers should be well-versed with the regional laws and legislation, rules and regulations, import and export policies, etc. The concerned regional agencies provide guidelines to the manufacturing companies regarding the procurement of materials and specifications for the use of it.

Economic Factors- The maleic anhydride market's expansion is being hampered by the variable cost of raw materials necessary for product development. The total costs are influenced by the raw material prices connected with the development of maleic anhydride. The upstream price of raw materials has an impact on the production's final price. As a result, the shifting cost of raw materials has an impact on the market expansion of maleic anhydride companies.

Social Factor- The increasing growth rate of the automobile and construction industry has led to a rise in demand for maleic anhydride. The countries such as China, India, Japan, Malaysia, and Singapore are the major end-users of maleic anhydride. The increasing industrialization and urbanization, are providing lucrative opportunities for the market growth of maleic anhydride. Further, the presence of multiple manufacturers in the regional countries have increased the supply of product. North America is likely to register substantial growth during the Projection period due to the use of maleic anhydride in the automobile industry. The increasing use of maleic anhydride in the manufacturing of automobile bodies has led to the high demand for products. Moreover, USA and Canada are some of the key countries for the maleic anhydride market in the North American region. Further, the rising chemical spending is fueling up the market growth.

Technological Factors- The manufacturers are involved in the continuous development of alternative sources used for maleic anhydride manufacturing. The awareness regarding toxic attributes of aromatic compounds and benzene. There are alternative materials used for the development of maleic anhydride which will reduce the environmental pressure. Bio-based maleic anhydride has been replaced with petroleum maleic anhydride. The bio-based raw materials are fermented and used in the production of mixtures that can be purified and oxidized in order to derive the required amount of maleic anhydride

Environmental Factors- According to various studies, livestock farming leads to about 13 to 15% of the man-made greenhouse gas emissions causing global warming. In addition, this type of farming causes biodiversity loss, water & land degradation, acid rain, deforestation, and coral reef degeneration. The production of harmful chemicals also causes damage to the environment and loss of natural resources.

Legal Factors- The multiple legislations and laws prevailing in the region must be followed by manufacturers. In order to set up a business, the manufacturer must require to pass the stringent regulations by regional agencies. Thus, companies should extensively focus on the legal factors of the country. Moreover, the laws related to employment laws, import and export, and labor laws must be taken care of. A lawful and legal organization can effectively survive in the long run. For instance, Polynt Reichhold Group., had announced the construction of fifty thousand tons capacity maleic anhydride. The construction site is located at Illinois.

- Introduction

- Objective Of The Study

- Overview Of Maleic Anhydride Market

- Markets Covered

- Geographic Scope

- Years Considered For The Study

- Currency And Pricing

- Executive Summary

- Premium Insights

- Market Attractiveness Analysis

- Market Attractiveness Analysis By Source

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By End-user

- Market Attractiveness Analysis By Distribution Channel

- Market Attractiveness Analysis By Region

- Industry SWOT

- Industry Trends

- Porter’s Five Forces Analysis

- Country Level Analysis

- Factors Considered For The Study

- Pointers Covered At Macro Level

- Pointers Covered At Micro Level

- Year On Year Growth Rate

- Technology Road Map

- Market Attractiveness Analysis

- Market Overview and Key Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Maleic Anhydride Market Analysis and Projection, By Source

- Segment Overview

- N-Butane

- Benzene

- Global Maleic Anhydride Market Analysis and Projection, By Application

- Segment Overview

- Unsaturated Polyester Resins

- Lubricating Oil Additives

- Food Additives

- Copolymers

- 1,4-BDO

- Plasticizers

- Others

- Global Maleic Anhydride Market Analysis and Projection, By End-user

- Segment Overview

- Building and Construction

- Automotive

- Food and Beverages

- Electronics

- Pharmaceutical

- Personal Care

- Agriculture

- Others

- Global Maleic Anhydride Market Analysis and Projection, By Distribution Channel

- Segment Overview

- Direct

- Indirect

- Global Maleic Anhydride Market Analysis and Projection, By Regional Analysis

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- North America

- Global Maleic Anhydride Market-Competitive Landscape

- Overview

- Market Share of Key Players in Global Maleic Anhydride Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Huntsman Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Shanxi Qiaoyou Chemical Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Changzhou Yabang Chemical Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Polynt-Reichhold Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Mitsubishi Chemical Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Zibo Qixiang Tengda Chemical Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Nippon Shokubai Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Gulf Advanced Chemical Industries Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- LANXESS AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- China Bluestar Harbin Petrochemical Co, Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Ningbo Jiangning Chemical Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Nan Ya Plastics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Shijiazhuang Bailong Chemical Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- IG Petrochemicals Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- MOL Plc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Yongsan Chemical Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Global Ispat Koksna Industrija d.o.o. Lukavac

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- PT Justus Sakti Raya

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Cepsa

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Tianjin Bohai Chemical Industry Group Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Yunnan Yunwei Company Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Ruse Chemicals, Co.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Huanghua Hongcheng Business Corp., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Shanxi Taiming Chemical Industry Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Gurit Holdings AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Aekyung Petrochemical Co., Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Huntsman Corporation

List of Table

- Global Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Global N-Butane, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Benzene, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Global Unsaturated Polyester Resins, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Lubricating Oil Additives, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Food Additives, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Copolymers, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global 1,4-BDO, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Plasticizers, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Others, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Global Building and Construction, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Automotive, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Food and Beverages, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Electronics, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Pharmaceutical, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Personal Care, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Agriculture, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Others, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Global Direct, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- Global Indirect, Maleic Anhydride Market, By Region, 2021-2029 (USD Billion)

- North America Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- North America Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- North America Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- North America Maleic Anhydride Market, By Distribution Channel 2021-2029 (USD Billion)

- US Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- US Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- US Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- US Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Canada Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Canada Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Canada Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Canada Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Mexico Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Mexico Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Mexico Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Mexico Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Europe Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Europe Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Europe Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Europe Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Germany Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Germany Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Germany Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Germany Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- France Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- France Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- France Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- France Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- UK Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- UK Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- UK Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- UK Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Italy Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Italy Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Italy Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Italy Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Spain Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Spain Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Spain Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Spain Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Asia Pacific Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Asia Pacific Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Asia Pacific Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Asia Pacific Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Japan Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Japan Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Japan Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Japan Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- China Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- China Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- China Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- China Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- India Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- India Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- India Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- India Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- South America Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- South America Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- South America Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- South America Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Brazil Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Brazil Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Brazil Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Brazil Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- Middle East and Africa Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- Middle East and Africa Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- Middle East and Africa Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- Middle East and Africa Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- UAE Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- UAE Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- UAE Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- UAE Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

- South Africa Maleic Anhydride Market, By Source, 2021-2029 (USD Billion)

- South Africa Maleic Anhydride Market, By Application, 2021-2029 (USD Billion)

- South Africa Maleic Anhydride Market, By End-user, 2021-2029 (USD Billion)

- South Africa Maleic Anhydride Market, By Distribution Channel, 2021-2029 (USD Billion)

List of Figures

- Global Maleic Anhydride Market Segmentation

- Global Maleic Anhydride Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Maleic Anhydride Market Attractiveness Analysis By Source

- Global Maleic Anhydride Market Attractiveness Analysis By Application

- Global Maleic Anhydride Market Attractiveness Analysis By End-user

- Global Maleic Anhydride Market Attractiveness Analysis By Distribution Channel

- Global Maleic Anhydride Market Attractiveness Analysis By Region

- Global Maleic Anhydride Market: Dynamics

- Global Maleic Anhydride Market Share By Source (2021 & 2029)

- Global Maleic Anhydride Market Share By Application (2021 & 2029)

- Global Maleic Anhydride Market Share By End-user (2021 & 2029)

- Global Maleic Anhydride Market Share By Distribution Channel (2021 & 2029)

- Global Maleic Anhydride Market Share By Regions (2021 & 2029)

- Global Maleic Anhydride Market Share By Company (2021)