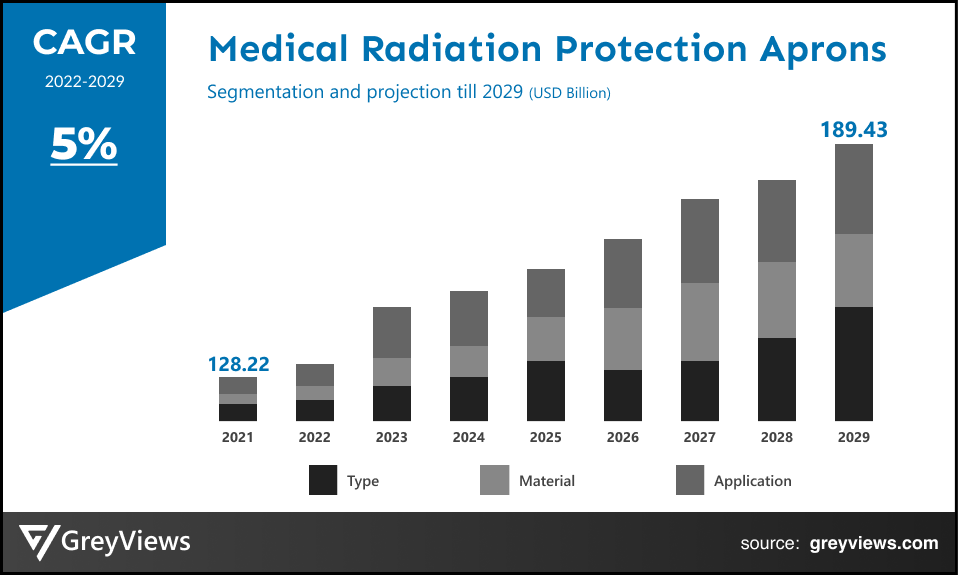

Medical Radiation Protection Aprons Market Size By Type (Vest and Skirt Aprons, Front Protection Aprons, and Other Aprons), By Material (Light Lead Composite Aprons, Lead-Free Aprons, and Lead Aprons), By Application (Hospitals, Research Laboratories, and Clinics & Radiology Centers), Regions, Segmentation, and Projection till 2029

CAGR: 5%Current Market Size: USD 128.22 MillionFastest Growing Region: Europe

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Medical Radiation Protection Aprons Market- Market Overview:

The Global Medical Radiation Protection Aprons market is expected to grow from USD 128.22 million in 2021 to USD 189.43 million by 2029, at a CAGR of 5% during the Projection period 2022-2029. The growth of this market is mainly driven owing to increasing development in end-user applications worldwide.

Employees who use radiation equipment in radiology departments and other healthcare facilities must wear radiation protection aprons to shield themselves from the hazardous radiation they are exposed to regularly. To meet the standards of state X-ray boards and other healthcare regulatory organizations, regularly inspect such aprons for any damage. The World Health Organization (WHO) suggested that exposure to ionizing radiation may result in skin and blood damage, cataract, infertility, birth abnormalities, and cancer in its January 2022 notice on Occupational hazards in the health industry. The extent of the health issues is inversely correlated with the radiation dose. The use of suitable play shielding, protective barriers, safety interlocks, warning signs, and signals are only a few of the protective, preventive measures against radiation that the WHO has highlighted. To guard against the damaging effects of radiation, it is crucial to wear radiation protective gear like aprons and vests. Around 34.9 million imaging tests were recorded in England for the calendar year ending in March 2021, according to the National Health Services England Diagnostic Imaging Data Set Annual Statistics 2021. With around 16.8 million imaging procedures, X-rays were the most popular imaging method, followed by Diagnostic Ultrasonography (8.2 million), Computerized Axial Tomography (5.6 million), and Magnetic Resonance Imaging (3 million).

Sample Request: - Global Medical Radiation Protection Aprons Market

Market Dynamics:

Drivers:

- Rising number of expert radiologists

Medical imaging equipment, such as X-ray and computed tomography (CT), which is commonly used for diagnostic and treatment applications in hospitals and other healthcare institutions, must be operated by trained radiologic technologists. When using this medical imaging equipment, radiologic technologists must utilize personal protection equipment (PPE), such as clothing or other specialized equipment (including aprons), to shield themselves from ionizing radiation exposure. As a result, the market for medical radiation protection aprons is anticipated to be directly impacted by the rise in the number of radiologic technologists.

Restraints:

- No mandate for using lead aprons during dental X-ray procedures

In dental clinics across the US, lead aprons were mandated for patients to protect themselves from excessive radiation during dental X-ray procedures. However, according to the Center for Health Protection, Radiation Protection Services (RPS), as of 2016, lead aprons in dental are not mandatory for adult patients. Though the RPS has recommended providing lead aprons for patients who want to wear them during treatment procedures voluntarily, this policy change is expected to affect the demand for medical radiation protection aprons in dental clinics. The benefits of lead aprons for patients in dental radiography are also negligible, according to a report from the American Academy of Oral and Maxillofacial Radiology, as compared to the advantages provided by E-speed films and rectangular collimation (rectangular collimation is used in dental clinics to reduce radiation doses for patients). The demand for adult medical radiation protection aprons among these end users is anticipated to decline throughout the projected period as alternatives to lead aprons to become more readily available in dental clinics.

Opportunities:

- Screening recommendations for cancer

Governments in developed nations and primary care physicians advise individuals to undergo cancer screening tests to identify cancer in its earliest stages and lower the death rate. To reduce disease occurrence and ensure early-stage treatment, the US Preventive Services Task Force (USPSTF) advises colorectal cancer screening in the US starting at age 50 and continuing until age 75. Canada has also made recommendations for adults 50 to 74 years old about screening for colorectal cancer every two years. The number of tests performed in diagnostic labs is anticipated to grow due to these guidelines. In the upcoming years, this will fuel demand for products with radiation protection aprons.

Challenges

- High and rising lead prices

Lead is the main basic material needed to make radiation safety gear, including gloves, aprons, and glasses. But it is also widely utilized for other things, like making lead storage batteries and fighting fires. Its cost is anticipated to rise soon due to its expanding application in other industries. This highlights the necessity for the creation of novel raw materials. As a result, the market for North American radiation protection aprons will face challenges from the rising cost of lead during the Projection period.

Segmentation Analysis:

The global medical radiation protection aprons market has been segmented based on type, material, application, and region.

By Type

The type segment is vest and skirt aprons, front protection aprons, and other aprons. The vest and skirt aprons segment led the medical radiation protection aprons market with a market share of around 38% in 2021. The demand for vest and skirt aprons is increasing as they create a distribution of weight between the hips and shoulders that helps eradicate stress on the back. Moreover, the segment is expanding as the number of X-ray procedures increases. Also, major players in the market manufacture vest and skirt aprons that fuels the market.

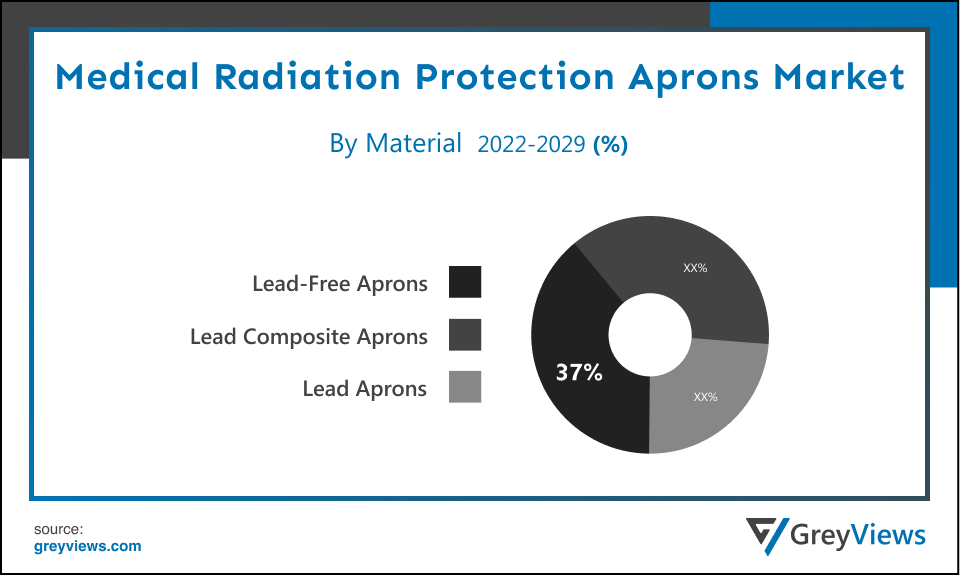

By Material

The material includes light lead composite aprons, lead-free aprons, and lead aprons. The lead-free aprons segment led the medical radiation protection aprons market with a market share of around 37% in 2021. As lead-free apron is lighter and less harmful than lead-based clothing, their use is growing. A combination of attenuating heavy metals other than lead is used to create lead-free materials (Pb). Typically, one or more metals make up these alloys: titanium, tungsten, tin, antimony, barium, aluminium, and bismuth. Other metals besides lead can shield a person from dangerous radiation. A recent study, as reported by the Mayo Clinic, reveals that many radiology practitioners experience musculoskeletal pain due to the weight of lead materials. 62% of technicians, 60% of nurses, and 44% of attending physicians who participated in the poll all mentioned having pain at work. Women, workers who were exposed to radiation more frequently, and people who were wearing lead aprons experienced the pain more frequently.

By Application

The application includes hospitals, research laboratories, and clinics & radiology centers. The hospital segment led the medical radiation protection aprons market with a market share of around 33% in 2021. This is because medical imaging techniques like MRI, X-rays, ultrasound and CT scans are used more frequently in hospital settings for precise diagnosis during therapeutic operations. In addition, the presence of cutting-edge medical imaging equipment and a solid infrastructure contribute to the segmental growth of hospitals. Similarly, the availability of qualified healthcare workers in hospitals increases the demand for medical imaging at those facilities. The progression of the medical imaging industry will also be accelerated by increased chronic disease instances and a rise in hospital admissions which fuels the demand for medical radiation protection aprons.

By Regional Analysis:

The regions analyzed for the medical radiation protection aprons market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the medical radiation protection aprons market and held a 38% share of the market revenue in 2021.

- North American region witnessed a major share. The market in the region is expanding owing to surging awareness of radiation safety, the rising number of nuclear power plants, the increasing occurrence of cancer, and advantageous initiatives by the government. In addition to an increase in cancer treatments across North America, nuclear medicine and radiation therapy are being used increasingly to detect and cure ailments. More diagnostic tests and radiation therapy increase the demand for radiology specialists. In the United States, there were about 250,000 radiologic and MRI technologists in 2018, according to the Bureau of Labor Statistics (BLS). The number of radiologic technologists is anticipated to increase by 9%, while the number of MRI technologists is anticipated to increase by 11% by 2028. These professionals place a high priority on their safety and the safety of their patients. This region's market may benefit from the availability of cutting-edge products, which would help explain its impressive market share during the predicted period.

- Europe is anticipated to experience significant growth during the predicted period. The region's market is growing due to rising health awareness among those who work in radiation-prone environments, an increase in the number of trained radiologic technicians, an increase in the number of orthopedic and spine surgeries, and a rise in the prevalence of cancer.

Global Medical Radiation Protection Aprons Market- Country Analysis:

- Germany

Germany's Medical Radiation Protection Aprons market size was valued at USD 16.07 million in 2021 and is expected to reach USD 21.99 million by 2029, at a CAGR of 4% from 2022 to 2029. The market in the country is expanding owing to the increasing demand for radiation protection aprons owing to their efficiency and durability in safeguarding the body and blocking radiation. Moreover, the increasing geriatric population and the presence of key key players in the country drive the market.

- China

China Medical Radiation Protection Aprons’ market size was valued at USD 13.02 million in 2021 and is expected to reach USD 16.49 million by 2029, at a CAGR of 3% from 2022 to 2029. China's market for medical radiation protection aprons has grown due to rising cancer prevalence, rising cancer screening demand, and rising medical imaging procedures. Additionally, the market expansion supported a rise in the demand for protective radiation aprons and an increase in the number of orthopaedic procedures. Future opportunities will be made possible by the rapid technological improvements in the healthcare industry.

- India

India's Medical Radiation Protection Aprons market size was valued at USD 11 million in 2021 and is expected to reach USD 13.40 million by 2029, at a CAGR of 2.5% from 2022 to 2029. The rise in research and development investment for the healthcare industry boosts the market in the region. Moreover, advancements in healthcare technologies fuel the market in the region.

Key Application Players Analysis:

To increase their market position in the global medical radiation protection aprons business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- AADCO Medical, Inc.

- BLOXR Solutions

- Burlington Medical

- AliMed Inc.

- Amray Radiation Protection

- barrier technologies

- Trivitron Healthcare

- infab corporation

- Kiran

- Lite Tech, Inc.

- Kemper Medical Inc.

- Protech Medical.

- Shielding Intl.

- Techo-Aide

- Velcro BVBA

Latest Development:

- In February 2022, In the creation of radiation protection aprons with the highest level of space-grade, Trivitron Healthcare introduced a ground-breaking technique. For medical workers who would have to spend a lot of time in operating rooms and imaging labs, the SpaceD Radioprotection Apron was created specifically for them.

- In September 20220, Biodex Medical Systems, Inc. advances medical imaging, nuclear medicine, and physical medicine via the use of science and technology. Its headquarters are in Shirley, New York (USA). To increase its presence in the medical industry, Mirion Technologies, Inc. purchased Biodex Medical Systems, Inc.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5% |

|

Market Size |

128.22 million in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Material, By Application, and Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

AADCO Medical, Inc., BLOXR Solutions, Burlington Medical, AliMed Inc., Amray Radiation Protection, barrier technologies, Trivitron Healthcare, infab corporation, Kiran, Lite Tech, Inc., Kemper Medical Inc., Protech Medical, Shielding Intl., Techo-Aide, Velcro BVBA, among others |

|

By Type |

|

|

By Material |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Medical Radiation Protection Aprons Market by Type:

- Vest and Skirt Aprons

- Front Protection Aprons

- Other Aprons

Global Medical Radiation Protection Aprons Market by Material:

- Light Lead Composite Aprons

- Lead-Free Aprons

- Lead Aprons

Global Medical Radiation Protection Aprons Market by Application:

- Hospitals

- Research Laboratories

- Clinics & Radiology Centers

Global Medical Radiation Protection Aprons Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the market size and growth rate of medical radiation protection aprons market?

Global medical radiation protection aprons market is expected to reach USD 189.43 million by 2029, at a CAGR of 5% from 2022 to 2029.

Which region dominate the medical radiation protection aprons market?

North American region dominated the medical radiation protection aprons market and held a 38% share of the market revenue in 2021.

Which are the market players in medical radiation protection aprons market?

Leading market players active in the global medical radiation protection aprons market are AADCO Medical, Inc., BLOXR Solutions, Burlington Medical, AliMed Inc., Amray Radiation Protection, barrier technologies, Trivitron Healthcare, infab corporation, Kiran, Lite Tech, Inc., Kemper Medical Inc., Protech Medical, Shielding Intl., Techo-Aide, Velcro BVBA.

What are the top 5 exporter countries of medical radiation protection aprons?

United States, Germany, China, India, United Kingdom.

What is the key threats to the medical radiation protection aprons market?

High cost of lead aprons is primarily impeding the growth of the medical radiation protection aprons market.

Political Factors- Political factors directly impact healthcare costs in this area. These include insurance policies and healthcare changes. Take into account the Medicare and Medicaid programmes, government spending and personnel policies. The political environment's influence on the functioning of the healthcare sector is always changing, primarily due to shifting government laws which impact the medical radiation protection aprons. Around the world, numerous economies have implemented measures to reduce spending in the health sector. The healthcare sector may be impacted by political considerations such as shifting tax laws, employment restrictions, consumer protection laws, and insurance obligations. Further, changes in medicine import regulations and strikes by medical professionals over pay inequities are fundamentally political problems that impact healthcare providers. The amount of money the government spends on healthcare is significantly impacted by changes in tax law.

Economical Factors- Consider how unemployment and inflation affect people's ability to afford insurance and healthcare costs when focusing on economic implications. Therefore, these characteristics directly impact how well healthcare organisations and other businesses operating in the field operate, affecting the medical radiation protection aprons industry. Economic issues that affect the performance and operation of technology in the healthcare sector include unemployment, interest rates, loan availability, and inflation. These economic climate changes can significantly impact businesses' spending decisions and consumer purchasing habits. For instance, rising interest rates can let down a lot of investors in the healthcare industry. Similarly, rising unemployment or declining customer purchasing power would indicate that they would not use the goods or services provided by healthcare manufacturers. Identifying infrastructures that enhance medical services and boost industrial investment is a good idea.

Social Factor- A person's involvement in health tech services is strongly impacted by their cultural ideas and values. Some cultures, in particular, favour conventional methods. Others turn to natural remedies or alternative medical care. Socio-cultural aspects concentrate on a specific client segment's views, attitudes, and norms as well as topics like gender preference, population ageing, and decreasing fertility. To avoid compromising values and beliefs, businesses must understand the culture of their customers. For instance, people increasingly use natural medicines to treat illnesses like fever, the flu, and headaches. Healthcare experts can better serve these sufferers by comprehending the rationale behind this method.

Technological Factors- Medical radiation protection aprons businesses may incur costs to develop innovative technological solutions. The price of healthcare is directly impacted, impacting medical radiation protection aprons. Additionally, healthcare facilities must concentrate on instructing staff members on how to use new technologies. Healthcare distribution and technological solutions are two activities in that medical corporations are involved. For instance, a power wheelchair enables people with disabilities to travel easily around their homes, places of employment, and communities. Technology advancements can also be used as marketing techniques to promote adopting technological healthcare solutions. In actuality, technological elements offer significant growth prospects for healthcare businesses. Computer application advancements may make it possible for patients to receive therapy or care more quickly than in the past. Several healthcare businesses are now providing apps to connect doctors with their patients. Furthermore, numerous healthcare companies permit making an email or live chat to doctors for their illnesses.

Environmental Factors- Medical radiation protection aprons facilities should constantly enhance their waste disposal procedures. The goal is to address the population's environmental concerns in particular. As a result, they ought to incorporate such actions into their strategic planning. The basic goal of health care is being undermined by how the health care system damages the environment in ways that also impair health. For instance, the healthcare industry is responsible for a sizeable portion of the global emissions of air pollutants and greenhouse gases, including 4.4% of greenhouse gases, 2.8% of hazardous particulate matter (air particles), 3.4% of nitrogen oxides, and 3.6% of sulphur dioxide.

Legal Factors- Finally, it is important to discuss tax regulations relating to medical radiation protection aprons companies in this section. In particular, the latter should adhere to the relevant rules that regulate the sector. The following significant topics are covered: labour legislation, consumer protection, organ transplantation, health insurance, medical abortion, pre-conception, and prenatal diagnosis. Healthcare law aims to protect patients from errors, fraud, and system abuse. Additionally, it defends their legal rights, including their privacy rights. Inform one of their rights and obligations: Laws governing healthcare define one's position's boundaries.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Material

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising number of expert radiologists

- 3. Restraints

- 3.1. No mandate for using lead aprons during dental X-ray procedures

- 4. Opportunities

- 4.1. Screening recommendations for cancer

- 5. Challenges

- 5.1. High Prices of lead

- Global Medical Radiation Protection Aprons Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Vest and Skirt Aprons

- 3. Front Protection Aprons

- 4. Other Aprons

- Global Medical Radiation Protection Aprons Market Analysis and Projection, By Material

- 1. Segment Overview

- 2. Light Lead Composite Aprons

- 3. Lead-Free Aprons

- 4. Lead Aprons

- Global Medical Radiation Protection Aprons Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Hospitals

- 3. Research Laboratories

- 4. Clinics & Radiology Centers

- Global Medical Radiation Protection Aprons Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Medical Radiation Protection Aprons Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Medical Radiation Protection Aprons Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- AADCO Medical, Inc.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- BLOXR Solutions

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Burlington Medical

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- AliMed Inc.

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Amray Radiation Protection

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Barrier technologies

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Trivitron Healthcare

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Infab corporation

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Kiran

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Lite Tech, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- AADCO Medical, Inc.

List of Table

- Global Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Global Vest and Skirt Aprons, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Front Protection Aprons, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Other Aprons, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Global Light Lead Composite Aprons, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Lead-Free Aprons, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Lead Aprons, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Global Hospitals, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Research Laboratories, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Clinics & Radiology Centers, Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- Global Medical Radiation Protection Aprons Market, By Region, 2021–2029 (USD Million)

- North America Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- North America Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- North America Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- USA Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- USA Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- USA Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Canada Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Canada Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Canada Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Mexico Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Mexico Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Mexico Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Europe Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Europe Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Europe Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Germany Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Germany Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Germany Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- France Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- France Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- France Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- UK Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- UK Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- UK Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Italy Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Italy Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Italy Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Spain Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Spain Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Spain Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Asia Pacific Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Asia Pacific Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Asia Pacific Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Japan Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Japan Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Japan Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- China Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- China Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- China Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- India Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- India Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- India Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- South America Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- South America Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- South America Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Brazil Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Brazil Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Brazil Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- Middle East and Africa Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- Middle East and Africa Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- Middle East and Africa Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- UAE Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- UAE Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- UAE Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

- South Africa Medical Radiation Protection Aprons Market, By Type, 2021–2029 (USD Million)

- South Africa Medical Radiation Protection Aprons Market, By Material, 2021–2029 (USD Million)

- South Africa Medical Radiation Protection Aprons Market, By Application, 2021–2029 (USD Million)

List of Figures

- Global Medical Radiation Protection Aprons Market Segmentation

- Medical Radiation Protection Aprons Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Medical Radiation Protection Aprons Market Attractiveness Analysis By Type

- Global Medical Radiation Protection Aprons Market Attractiveness Analysis By Material

- Global Medical Radiation Protection Aprons Market Attractiveness Analysis By Application

- Global Medical Radiation Protection Aprons Market Attractiveness Analysis By Region

- Global Medical Radiation Protection Aprons Market: Dynamics

- Global Medical Radiation Protection Aprons Market Share By Type (2021 & 2029)

- Global Medical Radiation Protection Aprons Market Share By Material (2021 & 2029)

- Global Medical Radiation Protection Aprons Market Share By Application (2021 & 2029)

- Global Medical Radiation Protection Aprons Market Share by Regions (2021 & 2029)

- Global Medical Radiation Protection Aprons Market Share by Company (2020)