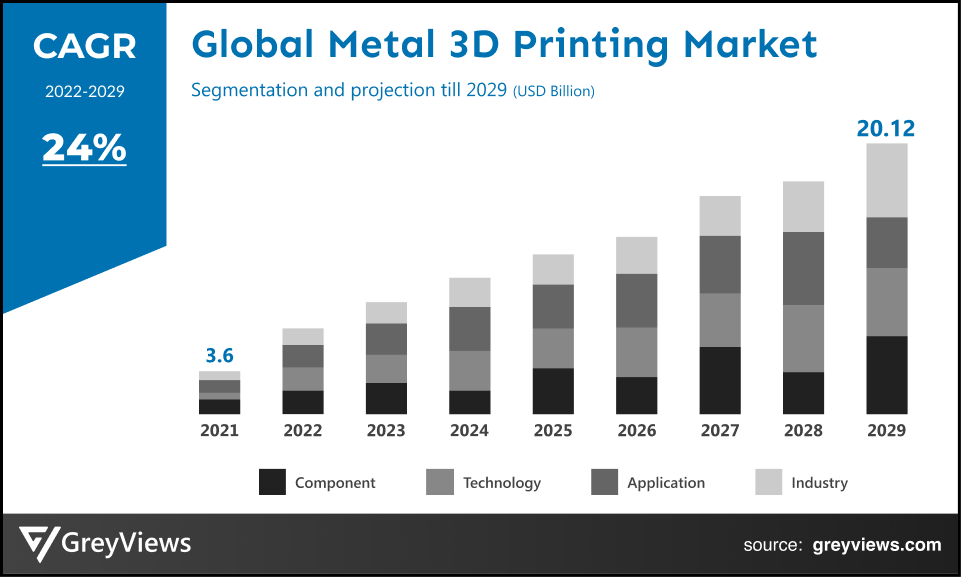

Metal 3D Printing Market Size By Component (Software, Hardware, and Services), By Technology (Selective Laser Sintering, Direct Metal Laser Sintering, Laser Metal Deposition, Laminated Object Manufacturing, Selective Laser Melting, and Others), By Application (Prototyping, Functional Parts, and Tooling), By Industry (Aerospace & Defense, Healthcare, Automotive, Power & Energy, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 24%Current Market Size: USD 3.6 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Metal 3D Printing Market- Market Overview:

The Global Metal 3D Printing market is expected to grow from USD 3.6 billion in 2021 to USD 20.12 billion by 2029, at a CAGR of 24% during the Projection period 2022-2029. The growth of this market is mainly driven owing to increasing development in the end-user industry around the world.

The powder bed fusion 3D printing family includes the metal additive manufacturing technologies Selective Laser Melting (SLM) and Direct Metal Laser Sintering (DMLS). Both methods use lasers to scan and selectively fuse (or melt) metal powder particles, fusing them and creating a part layer by layer. This is only one example of how the two technologies are comparable. Additionally, metals in the form of granules are used in both processes. The foundations of the particle bonding process (as well as patents) differentiate SLM and DMLS: While DMLS employs a powder made of elements with varying melting points that fuse at high temperatures, SLM uses metal powders with a single melting temperature and melts the particles. SLM creates components out of a single metal, whereas DMLS creates components out of metal alloys. High-strength materials like nickel or cobalt-chrome superalloys, which are extremely difficult to handle with conventional manufacturing techniques, are compatible with metal 3D printing, which is one of its primary advantages. By employing metal 3D printing to produce a nearly net-shape item that can later be post-processed to a very high surface polish, significant time and cost savings can be realized.

Sample Request: - Global Metal 3D Printing Market

Market Dynamics:

Drivers:

- Improved Government Investments

The usage of modern industrial techniques is being severely disrupted by digital technology in several countries throughout the world. The US is one potential use of 3D technology. As a crucial capability, the US Department of Defense budgeted money for this technology in 2018. Software industry leaders like Autodesk, Microsoft, and HP have introduced manufacturing solutions for additive and 3D printing. In a similar vein, China is making great efforts to maintain the manufacturing sector's competitiveness in the global market. Due to their perception that this technology presents both a risk and an opportunity for the Chinese industrial sector, Chinese businesses frequently invest in its research and development.

Restraints:

- The common misconceptions small and medium-sized enterprises have about the prototyping processes.

The adoption of additive manufacturing is hampered by the widespread misunderstandings small and medium-sized firms have about prototyping procedures. Instead of attempting to comprehend the advantages and benefits of prototyping, businesses engaged in the design, particularly small and medium-sized businesses, hesitate before considering prototyping expenditures as responsible investments. These businesses generally believe a prototype is only an expensive step before manufacturing. Such misconceptions about a prototype and a lack of technical expertise, and an impending lack of standardized process controls are anticipated to impede industry expansion.

Opportunities:

- Shifting away from Rapid Prototyping Opens Up Profitable Market Opportunities

For market players, the shift from rapid prototyping to production using 3D printing is anticipated to create new opportunities. More than half of businesses utilize 3D printing to create useful end goods, according to a recent survey of 3D hubs. The application of 3D printing has grown recently in the fields of biotechnology, power & energy, and automotive.

Challenges

- Privacy and security issues

A threat to client financial data may jeopardize the marketβs growth pace. It will be difficult for the market to experience a steady increase in market value due to a shortage of expert knowledge and technical expertise, particularly in developed and developing economies and among management-level people. Furthermore, the market growth rate will again be hampered by the lack of a sophisticated IT infrastructure.

Segmentation Analysis:

The global metal 3D printing market has been segmented based on component, technology, Application, industry, and region.

By Component

The component segment is software, hardware, and services. The services segment led the metal 3D printing market with a market share of around 33% in 2021. Metal 3D printing services enable firms to make intricate and delicate functional parts more easily and accurately thanks to the implementation of the methodology. Due to the benefits of the technology and improved prototyping, production costs are also being cut dramatically. As a result, participants in numerous industrial verticals are paying more attention to the advantages and benefits of 3D printing.

By Technology

The technology includes selective laser sintering, direct metal laser sintering, laser metal deposition, laminated object manufacturing, and selective laser melting. The selective laser melting segment led the metal 3D printing market with a market share of around 24% in 2021. The SLM technology is facilitating the adoption of this technology because to its many benefits and operational simplicity. Experts and researchers are expanding the market for selective laser melting technologies with technological developments and the industry's active R&D initiatives.

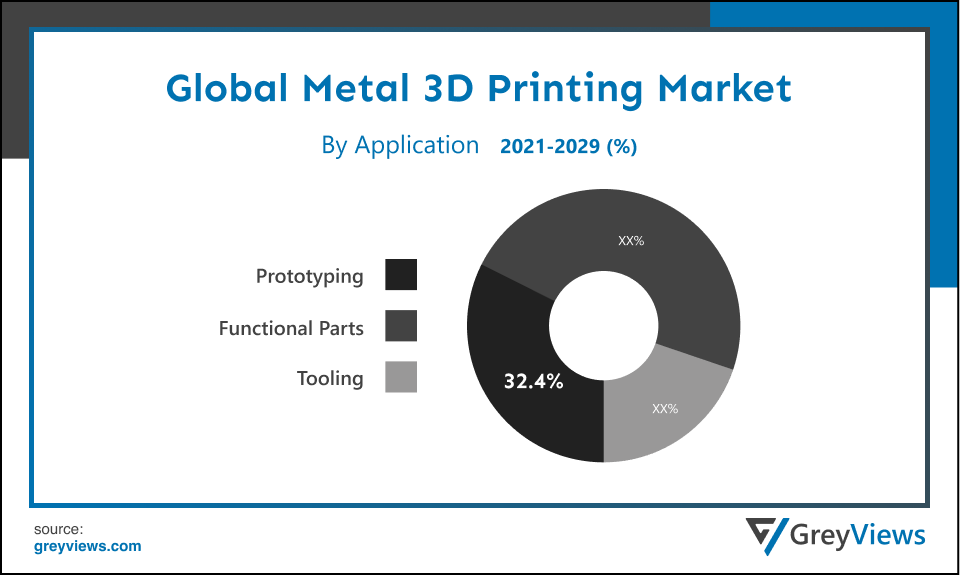

By Application

The application includes prototyping, functional parts, and tooling. The prototyping segment led the metal 3D printing market with a market share of around 324% in 2021. The segment is growing due to the widespread adoption of the prototyping process across numerous industrial verticals. Prototyping is used extensively in the automotive, aerospace, and defense industries to precisely design and build parts, components, and complex systems. Manufacturers can build trustworthy final goods and attain improved precision through prototyping. As a result, it is anticipated that the prototyping segment would continue to rule the market during the Projection period.

Smaller joints and other metallic hardware connecting elements are examples of functional pieces. While developing machinery and systems, the accuracy and accurate sizing of these functional pieces are of the utmost importance. With the rising demand for designing and producing functional components, the functional parts market is growing significantly.

By Industry

The industry includes aerospace & defense, healthcare, automotive, power & energy, and others. The automotive segment led the metal 3D printing market with a market share of around 24% in 2021. The market is growing as a result of technology being actively adopted in a number of automotive-related production processes. The automotive industry, one of the biggest and most significant sectors for the production of metal parts, spends trillions of dollars annually on components across the manufacturing lifecycle, from research and development to prototyping to mass production and long-term aftermarket parts maintenance. Metal 3D printing offers several new chances for automobile producers to produce vehicles more quickly, better, and more efficiently than ever before by meeting their needs at every point of that lifecycle.

By Regional Analysis:

The regions analyzed for the metal 3D printing market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the metal 3D printing market and held a 38% share of the market revenue in 2021.

- North American region witnessed a major share. Due to the widespread adoption of additive manufacturing in the region, the market is growing. The U.S. and Canada are two examples of North American nations that were among the leading and early users of these technologies in a variety of manufacturing processes. Metal 3D printing has profitable prospects in the regional market for a variety of uses.

- Asia Pacific is anticipated to experience significant growth during the predicted period. The advancements and improvements made in the region's manufacturing sector are the reason for the rapid uptake of metal 3D printing in the Asia Pacific. Additionally, metal 3D printing id developing as a manufacturing powerhouse for the healthcare and automotive sectors in the Asia Pacific area. The region's growing need for three-dimensional printing is also being fueled by a grip on the production of automobiles and increased urbanization.

Global Metal 3D Printing Market- Country Analysis:

- Germany

Germany's Metal 3D Printing market size was valued at USD 0.28 billion in 2021 and is expected to reach USD 1.20 billion by 2029, at a CAGR of 20% from 2022 to 2029. It is anticipated that Germany would create new Industry 4.0 strategies because of its developed Industry 4.0 infrastructure. Additionally, Germany has one of the greatest geographic footprints of any region. It is home to a number of industry participants in additive manufacturing that have extensive technical knowledge of the procedures.

- China

China Metal 3D Printingβs market size was valued at USD 0.57 billion in 2021 and is expected to reach USD 2.89 billion by 2029, at a CAGR of 22.5% from 2022 to 2029. China is making a lot of effort to maintain its manufacturing sector's competitiveness on the global market. Because they see it as both a risk and an opportunity for the Chinese industrial sector, which supports the metal 3D printing industry, Chinese businesses frequently participate in the research and development of this technology.

- India

India's Metal 3D Printing market size was valued at USD 0.43 billion in 2021 and is expected to reach USD 2.11 billion by 2029, at a CAGR of 22% from 2022 to 2029. The rising use of metal 3D printing across several domains is promoting market progress in India. Additionally, India is looking forward to this technology as an opportunity to strengthen its position as a worldwide competitor in the manufacturing industry. The Indian market is supported by active government initiatives like the "Make in India" Initiative.

Key Industry Players Analysis:

To increase their market position in the global metal 3D printing business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- 3D Systems Corporation

- General Electric Company

- Carpenter Technology Corporation

- GE Additive

- Stratasys Ltd.

- Renishaw plc

- Materialise NV

- Voxeljet AG

- Sandvik AB

- EOS GmbH Electro Optical Systems

- Autodesk Inc.

- Optomec, Inc.

- The ExOne Company, and Proto Labs, Inc.

Latest Development:

- In October 2022, SLM Solutions' metal 3D printing equipment will have full support thanks to a partnership by Dyndrite and SLM Solutions. SLM Solutions and Dyndrite have established a partnership to enable the SLM file format in Dyndrite's Application Development Kit (ADK).

- In October 2022, The fourth-generation metal 3D printer from Stargate, with horizontal printing capabilities, is unveiled by Relativity. For Relativity's Terran R launch vehicle, the Stargate 4th Generation metal 3D printers will be the main manufacturing facility. A fully reusable rocket called Terran R is intended to carry 20,000 kg into low-Earth orbit (LEO).

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 24% |

| Market Size | 3.6 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | By Component, Technology, Industry, Application, and Region. |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | 3D Systems Corporation, General Electric Company, Carpenter Technology Corporation, GE Additive, Stratasys Ltd., Renishaw plc, Materialise NV, Voxeljet AG, Sandvik AB, EOS GmbH Electro Optical Systems, Autodesk Inc., Optomec, Inc., The ExOne Company, and Proto Labs, Inc, among others |

| By Component |

|

| By Technology |

|

| By Industry |

|

| By Application |

|

Regional scope |

|

Scope of the Report

Global Metal 3D Printing Market by Component:

- Software

- Hardware

- Services

Global Metal 3D Printing Market by Technology:

- Selective Laser Sintering

- Direct Metal Laser Sintering

- Laser Metal Deposition

- Laminated Object Manufacturing

- Selective Laser Melting

- Others

Global Metal 3D Printing Market by Application:

- Prototyping

- Functional Parts

- Tooling

Global Metal 3D Printing Market by Industry:

- Aerospace & Defense

- Healthcare

- Automotive

- Power & Energy

- Others

Global Metal 3D Printing Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of the metal 3D printing market in 2021?

Global Metal 3D Printing market valuation was USD 3.6 billion in 2021

What are the challenges hampering the markets growth over the Projection period?

High cost of 3D printing challenges the markets growth over the Projection period.

How are the company profiles selected?

Company profiles are selected based on developments by prominent market players, such as mergers, acquisitions, product launches, and partnerships.

What are the key drivers of the metal 3D printing market?

Introducing metal 3D printing for prototyping products drives the metal 3D printing market.

Which top companies hold the largest share in the metal 3D printing market?

Leading market players active in the global metal 3D printing market are 3D Systems Corporation, General Electric Company, Carpenter Technology Corporation, GE Additive, Stratasys Ltd., Renishaw plc, Materialise NV, Voxeljet AG, Sandvik AB, EOS GmbH Electro Optical Systems, Autodesk Inc., Optomec, Inc., The ExOne Company, and Proto Labs, Inc.

Political Factors- More weight is placed on the political factor that affects the growth of the metal 3D printing market. The government can have an impact on the sector in several ways. With elections regarded as fair and transparent, the nations such as Russia, the USA, Canada, India, and Others have a robust democratic system and an efficient rule of law. For instance, in a presidential democracy like that of the USA, the people elect a single person to serve as both the head of state and the head of government. Numerous tech behemoths, including Microsoft, Amazon, Google, Apple, and others, call the USA home, which supports a robust economy. As a result, the government works to develop more business-friendly regulations. Numerous concerns are associated with the nation's political climate. Risks can include monetary controls, currency restrictions, and trade restrictions. To reduce political risks, businesses should take specific actions. For example, companies can avoid investments where this type of risk is greater. Large potential losses may be offset by political risk insurance. Therefore, the political environment directly impacts the success and income of each operating business.

Economical Factors- The software and information technology (IT) sector is one of the world's most developed and expanding sectors. And evidence of this may be found in the growth of the countries GDP contribution and the creation of numerous job opportunities. For instance, the sector generates 11.8 million jobs and $1.6 trillion of the US value-added GDP, or more than 8% of the US economy. With a per capita income of more than $65,112, the USA is a high-income nation. A slowdown in the economies of Europe or Asia has a greater impact on the overall economy. For instance, the Indian IT industry depends heavily on foreign clients, particularly the USA, for more than 70% of its revenue; therefore, changes in the exchange rate can have a significant impact on the performance of the IT industry as well as other sectors. The USA's inflation rate in 2019 was 2.3%, which is 0.4% higher than the inflation rate in 2018, which was 1.9%. The majority of the physical and human resources needed for the information and technology sector are readily available because the USA is a developed country. Infrastructure refers to all of the hardware and networking tools required to maintain an IT operation. The majority of empirical investigations have come to the conclusion that greater use of information and technology can boost GDP, productivity, and employment.

Social Factor- A social environment is made up of a group of people's values, beliefs, habits, and activities. A company is impacted by both its own internal social environment and the external social environment. There are other social issues that also have a strong impact on business. For instance, there is no official language in the United States. However, English is spoken by the majority of Americans, or close to 30 million people. English has been designated as an official language in 31 US states. There are 350 languages spoken in the USA besides English, some of which are Spanish, Chinese, French, etc. Given the variety of languages spoken there, communication in the nation is made simple. Additionally, the fact that English is a universal language makes it easier for IT companies to interact and collaborate with global businesses. For international corporations and businesses operating there, the task is fairly simple due to the high level of education in economies like India, China, Japan, France, and the United States. There are plenty of qualified workers readily available for IT organisations.

Technological Factors- Technological features including R&D effort, automation, technology incentives, and the pace of technological progress are examples of technological factors. They can establish entry barriers, the minimum effective production level, and have an impact on outsourcing choices. Additionally, changes in technology can have an impact on prices, quality, and innovation. A company should analyse the industry's technological state as well as how quickly it is being disrupted by technology. Slow technological disruption will allow more time, whereas rapid disruption may give a firm little time to adapt and be profitable.

Environmental Factors- Environmental considerations include ecological and environmental elements including weather, climate, and climate change, which may have a particularly negative impact on some sectors of the economy like tourism, agriculture, and insurance. Additionally, as people become more aware of the possible effects of climate change, it is changing how businesses run and the products they offer, creating new markets but also eroding or eliminating existing ones. Climate changes such as climate change, greenhouse gas emissions, and growing pollution, effectively by prominent market players. It should put more emphasis on waste management, recycling, renewable energy sources, and wastage that decomposes naturally or artifically. It should also be aware of how its resources and waste are being used up, as this could have a detrimental effect on its brand reputation and consumer loyalty.

Legal Factors- Legal considerations include those related to discrimination, consumers, antitrust, employment, and health and safety laws. These elements may have an impact on a company's operations, expenses, and product demand. The IT industry are subject to very strict legislative requirements. Market players to gain consumer loyalty and their faith in its brand products, it is crucial that it abide by all laws and binding rules and regulations. Nearly all nations now have laws that must be followed for consumer protection, data privacy, intellectual property rights (IPR), health and safety, employees and the workplace, and other topics. Therefore, it becomes essential for this business to conduct itself in a lawful and ethical manner in order to prevent any legal proceedings or penalties or punishments from a court of law. The law is derived from five sources, similar to the United States, including common law, treaties, statutory law, and administrative regulations (which includes case law). Information technology law is a transaction-based discipline that deals with problems that come up when businesses create, licence, buy, or sell products and services related to information technology and computers.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porterβs Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Component

- 3.2. Market Attractiveness Analysis By Technology

- 3.3. Market Attractiveness Analysis By Industry

- 3.4. Market Attractiveness Analysis By Application

- 3.5. Market Attractiveness Analysis By Region

- 4. Application Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increasing investments by the Government

- 3. Restraints

- 3.1. Data theft

- 4. Opportunities

- 4.1. Growing 3D printing Benefits

- 5. Challenges

- 5.1. High cost of 3D printing

- Global Metal 3D Printing Market Analysis and Projection, By Component

- 1. Segment Overview

- 2. Hardware

- 3. Software

- 4. Healthcare

- Global Metal 3D Printing Market Analysis and Projection, By Technology

- 1. Segment Overview

- 2. Selective Laser Sintering

- 3. Direct Metal Laser Sintering

- 4. Laser Metal Deposition

- 5. Laminated Object Manufacturing

- 6. Selective Laser Melting

- 7. Others

- Global Metal 3D Printing Market Analysis and Projection, By Industry

- 1. Segment Overview

- 2. Aerospace & Defense

- 3. Healthcare

- 4. Automotive

- 5. Power & Energy

- 6. Others

- Global Metal 3D Printing Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Prototyping

- 3. Functional Parts

- 4. Tooling

- Global Metal 3D Printing Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Metal 3D Printing Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Metal 3D Printing Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- 3D Systems Corporation

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- General Electric Company

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Carpenter Technology Corporation

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- GE Additive

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Stratasys Ltd.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Renishaw plc

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Materialise NV

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Voxeljet AG

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Sandvik AB

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Proto Labs, Inc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- 3D Systems Corporation

List of Table

- Global Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Global Hardware, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Software, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Services, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Global Selective Laser Sintering, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Direct Metal Laser Sintering, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Laser Metal Deposition, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Laminated Object Manufacturing, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Selective Laser Melting, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Others, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Global Aerospace & Defense, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Healthcare, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Automotive, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Power & Energy, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Others, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Global Prototyping, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Functional Parts Software, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Tooling, Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- Global Metal 3D Printing Market, By Region, 2021β2029 (USD Billion)

- North America Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- North America Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- North America Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- North America Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- USA Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- USA Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- USA Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- USA Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Canada Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Canada Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Canada Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Canada Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Mexico Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Mexico Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Mexico Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Mexico Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Europe Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Europe Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Europe Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Europe Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Germany Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Germany Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Germany Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Germany Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- France Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- France Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- France Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- France Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- UK Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- UK Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- UK Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- UK Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Italy Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Italy Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Italy Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Italy Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Spain Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Spain Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Spain Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Spain Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Asia Pacific Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Asia Pacific Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Asia Pacific Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Asia Pacific Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Japan Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Japan Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Japan Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Japan Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- China Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- China Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- China Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- China Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- India Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- India Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- India Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- India Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- South America Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- South America Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- South America Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- South America Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Brazil Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Brazil Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Brazil Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Brazil Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- Middle East and Africa Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- Middle East and Africa Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- Middle East and Africa Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- Middle East and Africa Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- UAE Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- UAE Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- UAE Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- UAE Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

- South Africa Metal 3D Printing Market, By Component, 2021β2029 (USD Billion)

- South Africa Metal 3D Printing Market, By Technology, 2021β2029 (USD Billion)

- South Africa Metal 3D Printing Market, By Industry, 2021β2029 (USD Billion)

- South Africa Metal 3D Printing Market, By Application, 2021β2029 (USD Billion)

List of Figures

- Global Metal 3D Printing Market Segmentation

- Metal 3D Printing Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porterβs Five Forces Analysis

- Value Chain Analysis

- Global Metal 3D Printing Market Attractiveness Analysis By Component

- Global Metal 3D Printing Market Attractiveness Analysis By Technology

- Global Metal 3D Printing Market Attractiveness Analysis By Industry

- Global Metal 3D Printing Market Attractiveness Analysis By Application

- Global Metal 3D Printing Market Attractiveness Analysis By Region

- Global Metal 3D Printing Market: Dynamics

- Global Metal 3D Printing Market Share By Component (2021 & 2029)

- Global Metal 3D Printing Market Share By Technology (2021 & 2029)

- Global Metal 3D Printing Market Share By Industry (2021 & 2029)

- Global Metal 3D Printing Market Share By Application (2021 & 2029)

- Global Metal 3D Printing Market Share by Regions (2021 & 2029)

- Global Metal 3D Printing Market Share by Company (2020)