Metal Forming Market Size, Application of Metal Forming, Types of Metal Forming, Types of Technique in Metal Forming, Which region dominate the metal forming market, what is the growth rate of metal forming market, players in Metal Forming Market, what will be the market size of metal forming in 2029, challenges in Metal Forming Market, Opportunities in Metal Forming Market

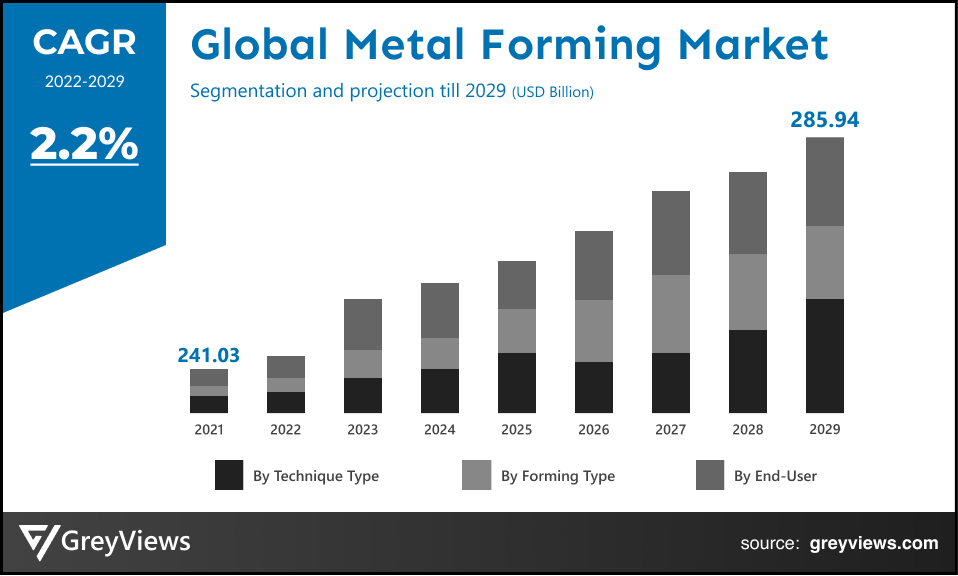

CAGR: 2.2%Current Market Size: USD 241.03 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Metal Forming- Market Overview:

The global metal forming market is expected to grow from USD 241.03 billion in 2021 to USD 285.94 billion by 2029, at a CAGR of 2.2% during the Projection period 2022-2029. This growth of the metal forming market is mainly driven by an upsurge in demand for high-performance and reliability to automobiles.

Metal forming is a large manufacturing process comprising drawing, forging, rolling, and bending. The metal forming process enables the bending or deforming of a metal workpiece into a desired geometric shape. As per the requirement of strength and mechanical properties for the application, commonly metals such as stainless steel, aluminum, brass, galvanized steel, and copper are used for metal forming. In the past few years, ultrasonic metal forming is seeing emerging popularity. It includes the application of ultrasonic vibrations to metal forming processes to improve performance through augmented production speeds, reduced forming forces, less tool wear, and improved surface finish.

The process of metal forming has been applicable in producing metallic parts used in various applications for industrial sectors, including automotive, aerospace, and durable goods such as appliances, agriculture, telecommunications, rail & marine, consumer and commercial electronics, and petrochemical industries.

Request Sample: - Global Metal Forming Market

Market Dynamics:

Drivers:

- Increased demand for metal forming in the automotive industry

Metal forming has become a prominent process in the automotive industry. It involves shaping or bending metal into a specific shape to create automotive parts. Hence, the growing number of vehicles across the globe creates demand for metal forming. For instance, rising preference for SUVs and commercial vehicles across the globe is expected to propel market growth. For instance, Mahindra & Mahindra Ltd, one of the leading Indian automotive companies, witnessed an overall auto sale of 54,643 vehicles for March 2022. The Passenger Vehicles segment (comprised of UVs, Vans, and Cars) sold 27,603 vehicles, witnessing a 65% increase compared to the sales in March 2021.

- Growth in industrialization across the developing and developed countries

The increased industrialization coupled with the infrastructure development in developing and developed nations has driven the growth of the global metal forming market. For instance, the industrialized economies in Asia-Pacific, such as Hong Kong, Singapore, South Korea, and Taiwan, are attracting worldwide attention with significant investment in the industrial manufacturing sector. This has significantly boosted the growth of the global metal forming market.

Restraints:

- Rising usage of composites in the automotive sector

The automotive industry is a prominent end-user in the global metal forming market. However, in the past few years, this industry has been focusing on weight reduction by replacing metal-formed components with plastics and composite materials. In addition, OEMs in the automotive sector are adopting novel materials for reducing the weight of their vehicles to attain enhanced fuel efficiency and comply with government regulations. This factor has led to the decline in demand for metal forming in the automotive sector, hampering the growth of the global metal forming market.

Opportunities:

- Upsurge in the application of metal forming in industrial equipment & machinery and aerospace engineering

The ongoing growth of the global industrial sector coupled with the demand for machines for energy production and distribution infrastructure and tools & heavy equipment for the food and beverage sector has fueled the need for metal forming. On the other hand, in the aerospace sector, metal forming has provided the manufacturers with the specialized expertise and equipment required for customized processes. Hence, the growth of the global industrial equipment & machinery and aerospace engineering sector creates lucrative growth opportunities for the market.

Challenges

- Impact of COVID-19 pandemic

The global COVID-19 pandemic has forced all industries to change the way of managing assets and workforces. In addition, the global automotive sector has disrupted supply chains due to large-scale manufacturing interruptions within Europe, the closure of assembly plants in the U.S., and disruption in Chinese parts exports. Hence, disruption in the supply chain during the pandemic has posed considerable challenges to the metal forming industry.

Segmentation Analysis:

The global metal forming market has been segmented based on technique, forming, end-user, and regions.

Global Metal Forming - By Technique Type

The components segment includes roll forming, stretch forming, stamping, deep drawing, hydroforming, and others. The roll forming segment led the metal forming market with a market share of around 27.9% in 2021. Roll forming has become a reliable approach to metal shaping that is perfect for modern applications. This metal forming process utilizes a constant bending operation in which the long metal strips, usually coiled steel, are passed through repeated rolls at room temperature. The benefits such as efficiency and flexibility, along with the precision, quality, and consistency associated with the roll forming, boost the growth of this segment.

Global Metal Forming - By Forming Type

The forming type segment includes cold forming, hot forming, and warm forming. The cold-forming segment led the Metal Forming market with a market share of around 46.7% in 2021. This is attributed to the fact that cold forming is one of the most conventional manufacturing processes. This forming occurs at room temperature and does not require additional carrying or handling. Due to the factors mentioned above, the cost of the cold forming process is comparatively lower than the hot forming process. Most of the OEMs across the globe are giving preference to cold forming due to its lower cost, thus fueling the growth of the cold forming segment.

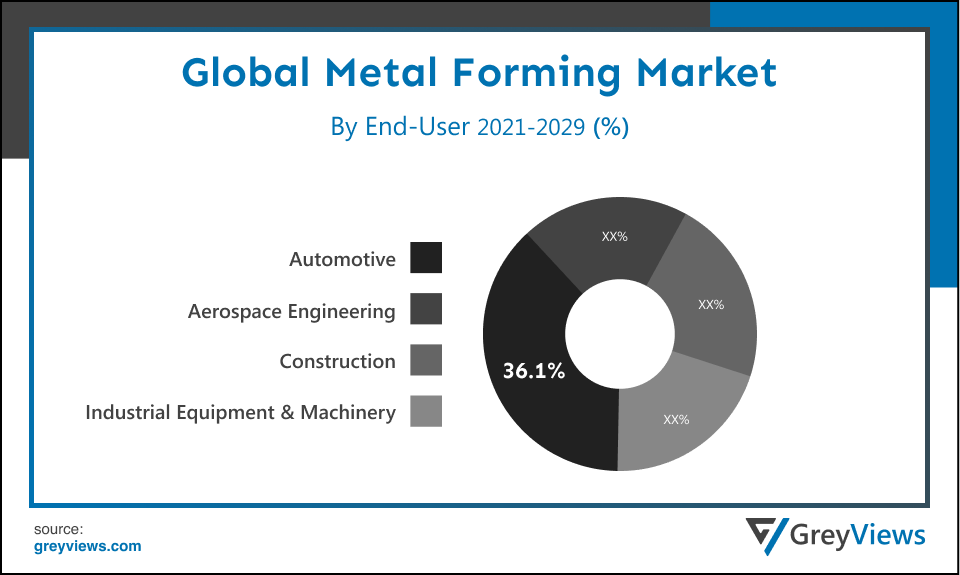

Global Metal Forming - By End User

The end-user segment includes automotive, aerospace engineering, construction, and industrial equipment & machinery. The automotive segment led the Metal Forming market with a market share of around 36.1% in 2021. In the automotive sector, metal forming is essential for shaping or bending metal into a specific shape to create automotive parts. The rising trend of vehicle light-weighting and the growing vehicle production have driven demand for metal forming in this sector. In addition, the demand for reliability and high performance of automobiles among consumers has further boosted the demand for metal forming.

Global Metal Forming Market- By Regional Analysis:

The regions analyzed for the metal forming market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. Asia-Pacific region dominated the Metal Forming market and held the 39.03% market revenue share in 2021.

- The Asia-Pacific region has registered the highest value for the year 2021. The factors such as increasing automotive sales, growing presence of manufacturing units, and presence of leading players operating in this region have primarily driven the growth of the Asia-Pacific metal forming market. In addition, several companies are shifting their manufacturing bases to the Asia-Pacific region, creating lucrative growth opportunities for the metal forming market.

- The North American region is anticipated to contribute considerably to the global metal forming market. The market growth in this region is mainly driven by the significant presence of major automotive manufacturers and growing construction and reconstruction activities. In addition, the easy availability of convenient financing options and the government's significant emphasis on ensuring in-house automotive production is projected to boost the metal forming market.

Global Metal Forming Market- Country Analysis:

- Germany

Germany's metal forming market size was valued at USD 31.33 billion in 2021 and is expected to reach USD 36.88 billion by 2029, at a CAGR of 2.1% from 2022 to 2029.

Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. For instance, according to the World Bank collection of development indicators, the manufacturing sector added an 18.17% GDP share in Germany in 2020. Germany's growth in the manufacturing sector is fueling the growth of the metal forming market.

On the other hand, significant automotive sector growth is opportunistic for the German metal forming market growth. For instance, according to the Capgemini “COVID -19 and the automotive consumer” study in 2020, the country's interest in car ownership amongst under 35-year-olds is on the rise. This trend of car ownership is creating demand for metal forming.

- China

China's metal forming market size was valued at USD 57.85 billion in 2021 and is expected to reach USD 67.56 billion by 2029, at a CAGR of 2.0% from 2022 to 2029. According to the World Bank data, China reported the manufacturing sector with the 26.18% of GDP share in 2020. In addition, according to the Fitch Solutions Infrastructure Report, China is the largest construction market globally and is expected to grow at an annual average of 8.6% between 2022 and 2030. Hence, the growth of the country's manufacturing and construction sector is fueling the market's growth.

Furthermore, China is the world’s largest light-vehicle manufacturer. In addition, the country has seen a growing demand for luxury electric cars in recent years as it is a vastly populous nation and attracts significant investments from worldwide carmakers. Such investments are opportunistic for the growth of the global market.

- India

India's metal forming market size was valued at USD 21.69 billion in 2021 and is expected to reach USD 25.94 billion by 2029, at a CAGR of 2.3% from 2022 to 2029.

India is one of the strongest growing economies in Asia. In addition, the emerging growth of the automotive sector in this country is expected to create lucrative growth opportunities for the metal forming market. In addition, the various factors such as the rising preference for pre-engineered buildings and components, surge in demand for metal forming in the manufacturing sector, and infrastructure development initiatives by the government are boosting the growth of the metal forming market.

Key Industry Players Analysis:

To increase their market position in the global metal forming business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Bradbury Group

- Formtek Moulding Solutions

- Mestek Machinery

- Avic Manufacturing Technology Institute

- VNT Automotive GmbH

- Westway Machinery

- Benteler International AG

- Toyota Boshoku Corporation

- Magna International Inc.

- Hirotec Corporation

Latest Development:

- In July 2021, BENTELER announced to sell Goshen and Kalamazoo, the automotive plants to Shiloh Industries, the provider of automotive solutions. This strategy has enabled BENTELER to enhance its focus on the strategic production sites in the North American region.

- In January 2020, Hirotec Group, A Japan-based firm, introduced a new facility at its plant in Keeranatham near Coimbatore. This facility is projected to produce stamping dyes for the automobile industry within India.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2020 |

|

CAGR (%) |

2.2% |

|

Market Size |

241.03 Billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Technique Type, Forming Type, End User, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Bradbury Group, Formtek Moulding Solutions, Mestek Machinery, Avic Manufacturing Technology Institute, VNT Automotive GmbH, Westway Machinery, Benteler International AG, Toyota Boshoku Corporation, Magna International Inc., and Hirotec Corporation among others |

|

By Technique Type |

|

|

By Forming Type |

|

|

By End User |

|

|

Regional scope |

|

Scope of the Report

Global Metal Forming Market by Technique Type:

- Roll Forming

- Stretch Forming

- Stamping

- Deep Drawing

- Hydroforming

- Others

Global Metal Forming Market by Forming Type:

- Cold Forming

- Hot Forming

- Warm Forming

Global Metal Forming Market by End User:

- Automotive

- Aerospace Engineering

- Construction

- Industrial Equipment & Machinery

Global Metal Forming Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size and growth rate of Global Metal Forming Market?

Global metal forming market Size Was USD 241.03 billion in 2021 and it will reach to USD 285.94 billion by 2029, at a CAGR of 2.2%

Who are the End User Of Forming Market?

End-users are automotive, aerospace engineering, construction, and industrial equipment & machinery. In the automotive sector, metal forming is essential for shaping or bending metal into a specific shape to create automotive parts. The rising trend of vehicle light-weighting and the growing vehicle production have driven demand for metal forming in this sector. In addition, the demand for reliability and high performance of automobiles among consumers has further boosted the demand for metal forming

Which Region Dominate the Global Metal Forming Market?

Asia-Pacific region dominated the Metal Forming market and held the 39.03% market revenue share in 2021

Which Country is largest Market in Metal Forming?

China's metal forming market size was valued at USD 57.85 billion in 2021 and is expected to reach USD 67.56 billion by 2029, at a CAGR of 2.0% from 2022 to 2029. According to the World Bank data, China reported the manufacturing sector with the 26.18% of GDP share in 2020. In addition, according to the Fitch Solutions Infrastructure Report, China is the largest construction market globally and is expected to grow at an annual average of 8.6% between 2022 and 2030. Hence, the growth of the country's manufacturing and construction sector is fueling the market's growth.

What are the Forming Type in Metal Forming?

Forming type includes cold forming, hot forming and warm forming.

What are the Challenges in Metal Forming Market?

The global automotive sector has disrupted supply chains due to large-scale manufacturing interruptions within Europe, the closure of assembly plants in the U.S., and disruption in Chinese parts exports. Hence, disruption in the supply chain during the pandemic has posed considerable challenges to the metal forming industry

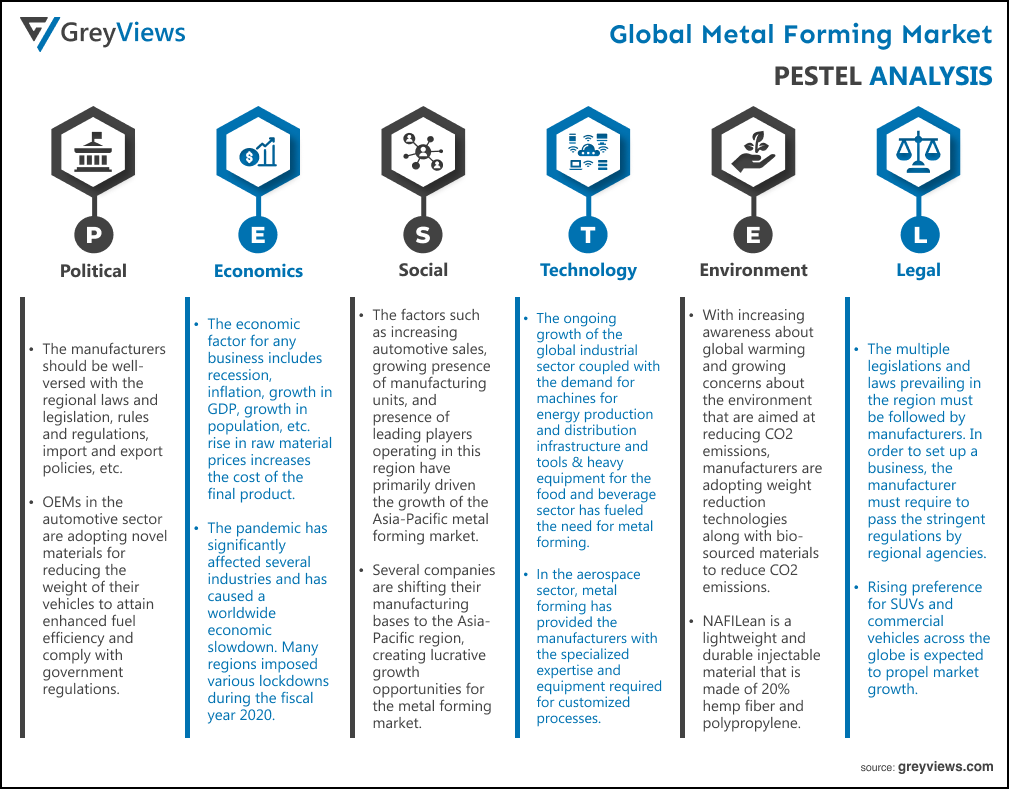

Political Factors- Political factors are one of the significant factors that largely affect the operations of the organization in the metal forming market. The manufacturers should be well-versed with the regional laws and legislation, rules and regulations, import and export policies, etc. The concerned regional agencies provide guidelines to the manufacturing companies regarding the procurement of materials and specifications for the use of it. OEMs in the automotive sector are adopting novel materials for reducing the weight of their vehicles to attain enhanced fuel efficiency and comply with government regulations.

Economical Factors- The economic factor for any business includes recession, inflation, growth in GDP, growth in population, etc. rise in raw material prices increases the cost of the final product, and to maintain profitability, the organization has to increase its prices. The organization can leverage this trend by expanding its product range and targeting new customers. For instance, the pandemic has significantly affected several industries and has caused a worldwide economic slowdown. Many regions imposed various lockdowns during the fiscal year 2020. These lockdowns led to the closure of the regional industries and all manufacturing facilities, leading to a supply shortage in the market. Additionally, all the end-users’ industries were temporarily closed during this period, which has decreased the sales of metal forming.

Social Factor- The factors such as increasing automotive sales, growing presence of manufacturing units, and presence of leading players operating in this region have primarily driven the growth of the Asia-Pacific metal forming market. In addition, several companies are shifting their manufacturing bases to the Asia-Pacific region, creating lucrative growth opportunities for the metal forming market. the easy availability of convenient financing options and the government's significant emphasis on ensuring in-house automotive production is projected to boost the metal forming market.

Technological Factors- The latest metal forming solution enables manufacturers to check the developments based on the latest technologies. The ongoing growth of the global industrial sector coupled with the demand for machines for energy production and distribution infrastructure and tools & heavy equipment for the food and beverage sector has fueled the need for metal forming. On the other hand, in the aerospace sector, metal forming has provided the manufacturers with the specialized expertise and equipment required for customized processes. Hence, the growth of the global industrial equipment & machinery and aerospace engineering sector creates lucrative growth opportunities for the market. The weight reduction technology can greatly reduce the weight of massive parts of automobiles such as door panels, dashboard bodies, and others. Such new technologies can potentially drive the growth of the metal forming market in the upcoming years.

Environmental Factors- With increasing awareness about global warming and growing concerns about the environment that are aimed at reducing CO2 emissions, manufacturers are adopting weight reduction technologies along with bio-sourced materials to reduce CO2 emissions. For instance, NAFILean is a lightweight and durable injectable material that is made of 20% hemp fiber and polypropylene.

Legal Factors- The multiple legislations and laws prevailing in the region must be followed by manufacturers. To set up a business, the manufacturer must pass the stringent regulations by regional agencies. Thus, companies should extensively focus on the legal factors of the country. Moreover, the laws related to employment laws, import and export, and labor laws must be taken care of. A lawful and legal organization can effectively survive in the long run. For instance, rising preference for SUVs and commercial vehicles across the globe is expected to propel market growth. For instance, Mahindra & Mahindra Ltd, one of the leading Indian automotive companies, witnessed an overall auto sale of 54,643 vehicles for March 2022. The Passenger Vehicles segment (comprised of UVs, Vans, and Cars) sold 27,603 vehicles, witnessing a 65% increase compared to the sales in March 2021.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Technique Type

- Market Attractiveness Analysis By Forming Type

- Market Attractiveness Analysis By End User

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increased demand for metal forming in automotive industry

- Growth in industrialization across the developing and developed countries

- Restrains

- Rising usage of composites in automotive sector

- Opportunities

- Upsurge in application of metal forming in industrial equipment & machinery and aerospace engineering

- Challenges

- Impact of COVID-19 pandemic

- Global Metal Forming Market Analysis and Projection, By Technique Type

- Segment Overview

- Roll Forming

- Stretch Forming

- Stamping

- Deep Drawing

- Hydroforming

- Others

- Global Metal Forming Market Analysis and Projection, By Forming Type

- Segment Overview

- Cold Forming

- Hot Forming

- Warm Forming

- Global Metal Forming Market Analysis and Projection, By End User

- Segment Overview

- Automotive

- Aerospace Engineering

- Construction

- Industrial Equipment & Machinery

- Global Metal Forming Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Metal Forming Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Metal Forming Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Technique Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Bradbury Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Formtek Moulding Solutions

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Mestek Machinery

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Avic Manufacturing Technology Institute

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- VNT Automotive GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Westway Machinery

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Benteler International AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Toyota Boshoku Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Magna International Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Hirotec Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Technique Type Portfolio

- Recent Developments

- SWOT Analysis

- Bradbury Group

List of Table

- Global Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Global Roll Forming Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Stretch Forming Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Stamping Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Deep Drawing Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Hydroforming Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Others Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Global Cold Forming Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Hot Forming Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Warm Forming Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Metal Forming Market, By End User, 2021–2029(USD Billion)

- Global Automotive Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Aerospace Engineering Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Construction Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Industrial Equipment & Machinery Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Metal Forming Market, By Region, 2021–2029(USD Billion)

- Global Metal Forming Market, By North America, 2021–2029(USD Billion)

- North America Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- North America Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- North America Metal Forming Market, By End User, 2021–2029(USD Billion)

- USA. Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- USA. Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- USA. Metal Forming Market, By End User, 2021–2029(USD Billion)

- Canada Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Canada Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Canada Metal Forming Market, By End User, 2021–2029(USD Billion)

- Mexico Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Mexico Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Mexico Metal Forming Market, By End User, 2021–2029(USD Billion)

- Europe Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Europe Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Europe Metal Forming Market, By End User, 2021–2029(USD Billion)

- Germany Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Germany Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Germany Metal Forming Market, By End User, 2021–2029(USD Billion)

- France Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- France Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- France Metal Forming Market, By End User, 2021–2029(USD Billion)

- UK. Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- UK. Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- UK. Metal Forming Market, By End User, 2021–2029(USD Billion)

- Italy Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Italy Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Italy Metal Forming Market, By End User, 2021–2029(USD Billion)

- Spain Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Spain Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Spain Metal Forming Market, By End User, 2021–2029(USD Billion)

- Asia Pacific Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Asia Pacific Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Asia Pacific Metal Forming Market, By End User, 2021–2029(USD Billion)

- Japan Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Japan Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Japan Metal Forming Market, By End User, 2021–2029(USD Billion)

- China Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- China Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- China Metal Forming Market, By End User, 2021–2029(USD Billion)

- India Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- India Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- India Metal Forming Market, By End User, 2021–2029(USD Billion)

- South America Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- South America Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- South America Metal Forming Market, By End User, 2021–2029(USD Billion)

- Brazil Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Brazil Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Brazil Metal Forming Market, By End User, 2021–2029(USD Billion)

- Middle East and Africa Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- Middle East and Africa Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- Middle East and Africa Metal Forming Market, By End User, 2021–2029(USD Billion)

- UAE Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- UAE Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- UAE Metal Forming Market, By End User, 2021–2029(USD Billion)

- South Africa Metal Forming Market, By Technique Type, 2021–2029(USD Billion)

- South Africa Metal Forming Market, By Forming Type, 2021–2029(USD Billion)

- South Africa Metal Forming Market, By End User, 2021–2029(USD Billion)

List of Figures

- Global Metal Forming Market Segmentation

- Metal Forming Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Metal Forming Market Attractiveness Analysis By Technique Type

- Global Metal Forming Market Attractiveness Analysis By Forming Type

- Global Metal Forming Market Attractiveness Analysis By End User

- Global Metal Forming Market Attractiveness Analysis By Region

- Global Metal Forming Market: Dynamics

- Global Metal Forming Market Share By Technique Type(2021 & 2028)

- Global Metal Forming Market Share By Forming Type(2021 & 2028)

- Global Metal Forming Market Share By End User (2021 & 2028)

- Global Metal Forming Market Share by Regions (2021 & 2028)

- Global Metal Forming Market Share by Company (2020)