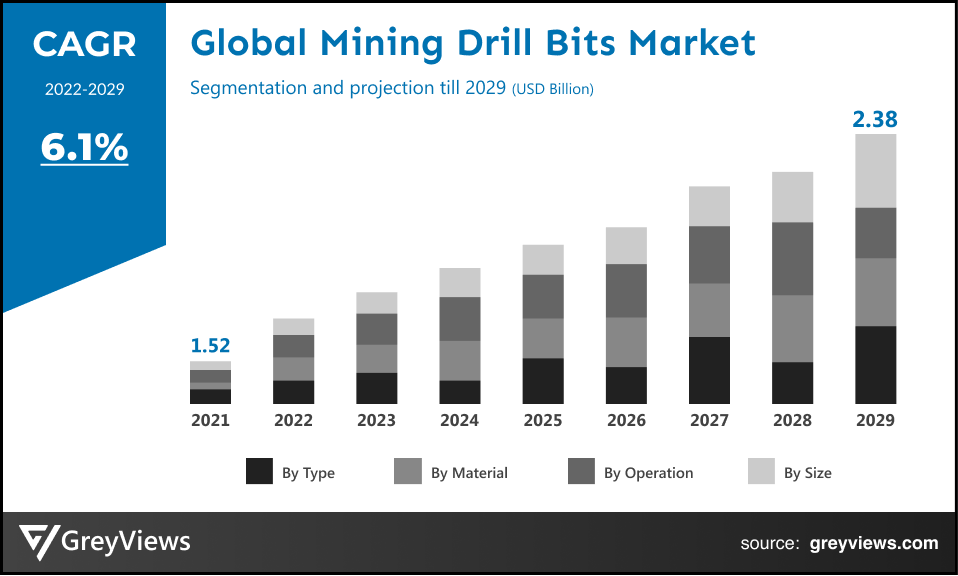

Mining Drill Bits Market Size by Type (Roller Bit, Fixed-Head Bit, Rotary Bit, DTH Bit, Others); Material (Steel, Diamond, Carbide, Others); Operation (Underground Drilling, Surface Drilling), and Size (Below 8 Inches, 8 Inches to 11 Inches, above 11 Inches) and Regions, Segmentation, and Projection till 2029

CAGR: 6.1%Current Market Size: USD 1.52 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Mining Drill Bits- Market Overview:

The global mining drill bits market is expected to grow from USD 1.52 billion in 2021 to USD 2.38 billion by 2029, at a CAGR of 6.1% during the Projection period 2022-2029. The ongoing growth of the mining industry and rapid industrialization across the regions have mainly driven the global market growth.

Mining drill bits are the tools used to dig or drill the earth's surface and rocks for mining operations. They are mainly designed to offer features such as high wear resistance, improved rock fragmentation, and greater penetration rates. In addition to the mining, these equipment are seeing drilling applications across the sectors, including quarrying, well drilling, construction, geological exploration, tunneling, and blasting.

Moreover, a growing number of industrial facilities around the globe are implementing Mining Drill Bits to improve production and manufacturing efficiency. In addition, the mining drill bits are helping mining companies address the growing wages and pressure to improve the working conditions of the employees as per the government regulations.

Request Sample: - Mining Drill Bits Market

Market Dynamics:

Drivers:

- The ongoing growth of the mining industry

The demand for raw materials, metals, and minerals to support the countries' economic growth has boosted the mining industry. The extraction of mineral resources has considerably increased in the past decade and is projected to witness higher growth in upcoming years. Furthermore, according to the UN Environment Program, the global population is anticipated to reach 8.5 billion by 2030 and 9.8 billion by 2050. This growth in population leads to the rise in demand for mineral resources, fuelling the global mining industry. This contributes to the growth of the mining drill bits market.

- Upsurge in demand for metals from the manufacturing and automotive sectors

An expanding population, coupled with the ascending disposable income, has pushed growth in automobile sales. This creates demand for metals in the automotive sector as most of the mechanical components, frames of vehicles, and even electronics in vehicles are made of metals. This demand for metals is fulfilled by the extraction of metal ores, such as iron, copper, lead, gold, silver, and zinc among others. Hence, growing mining activities due to demand for metals in the manufacturing and automotive sector boosts the growth of the global mining drill bits market.

Restraints:

- Stricter and costlier regulatory requirements for mining companies

The various governments across the globe impose policies and regulations on the mining sector to increase the benefits of natural resources. Such policies and regulations range from taxes, permitting fees, and export duties on mining companies' production. On the other hand, increased concerns over the adverse impact of extraction and processing operations on the environment further increase costs for companies to receive a social license. Such factors slowdowns mining activities and thus hampers the growth of the market.

Opportunities:

- The rise in investment for R&D in the mining drill sector

The companies operating in the global mining drill sector are significantly investing in improving the performance of their products and meeting customer requirements. For instance, in March 2022, Nabors Industries, the global drilling contractor, invested $8 million in developing plasma bit, an emerging drilling tool technology. On the other hand, in February 2021, Epiroc launched two innovative drill bit products, the Omega S rotary and Epsilon² tritone. These products were manufactured in a way to boost drilling performance as well as longevity in mining. Such innovations and investment in R&D are opportunistic for market’s growth.

Challenges

- Concern about environmental impacts of mining

Mining and drilling practices significantly impact local water sources, natural resources, and biological life through degradation, pollution, and direct damage. Further, along with the hazards of moving parts and handling, drilling operations generate considerable dust. Such factors may pose challenges to the mining drilling bits manufacturers and mining companies.

Segmentation Analysis:

The global mining drill bits market has been segmented based on type, material, operation, Size, and regions.

By Type

The type offering segment includes roller bit, fixed-head bit, rotary bit, DTH bit, and others. The rotary drilling bits segment led the Mining Drill Bits market with a market share of around 36.01% in 2021. Increased usage of rotary drilling bits for underground mining operations primarily drives the growth of this segment. This type of drilling involves a rotary cutting head on the end of a shaft, which is driven into the ground as it rotates. The increasing applications of such drilling bits to drill big holes in large quarries, petroleum extraction, open-pit mines, and other fields boost the segment's growth.

By Material

The material segment includes steel, diamond, carbide, and others. The diamond segment led the Mining Drill Bits market with a market share of around 43.17% in 2021. This is attributed to the rapid usage of industrial-grade diamonds for oil and geothermal well drilling. In addition, the diamond material offers excellent wear resistance, increased efficiency, and high penetration rates. Such features associated with the diamond further fuelling the growth of this segment.

By Operation

The operation segment includes underground drilling and surface drilling. The surface mining segment led the Mining Drill Bits market with a market share of around 67.02% in 2021. In this type of mining, the soil and rock covering the mineral deposits are removed. However, the segment's growth is mainly attributed to the fact that the surface mining method is preferred for mining nearly all non-metallic minerals, most metallic minerals, and a large fraction of coal.

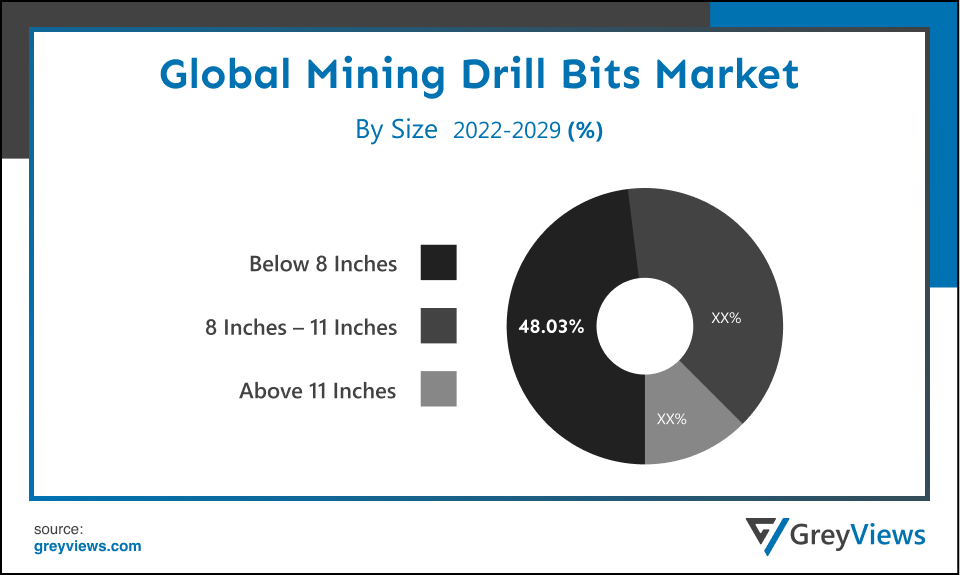

By Size

The Size segment includes d into below 8 inches, 8 – 11 inches, and above 11 inches. The 8 – 11 inches segment led the Mining Drill Bits market with a market share of around 48.03% in 2021. The 8- to 11 inches bit size is the most extensively used drill for production drilling. Hence, an upsurge in developing oil or gas production wells in fields boosts demand for 8- to 11 inches drill bit sizes. In addition, increasing underground production drilling services such as long-hole drill, cable bolt drilling, and blast further drives the growth of this segment.

By Regional Analysis:

The regions analyzed for the mining drill bits market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. Asia-Pacific region dominated the Mining Drill Bits market and held the 43.02% share of the market revenue in 2021.

- The Asia-Pacific region witnessed a major share. The growth of this region is mainly driven by an upsurge in oil and gas exploration activities, and rising infrastructure development supports the growth of the mining drill bits market in the region. On the other hand, Asia-Pacific is the largest coal mining market. China, India, Indonesia, and Australia are the leaders in the region's coal production for applications, including steel production and power Hence, increasing underground mining projects for coal production in the region boosts demand for mining drill bits.

- North America and the Middle East region, followed by Africa, are expected to witness a significant growth rate during the Projection period. In North America, Mexico is a large exporter of mining ores and minerals, with total Mexican exports of ores and minerals totaling about $15.6 billion in 2020. This significance of Mexico in the mining sector creates demand for mining drill bits in the country. On the other hand, in June 2021, Ma’aden, the Saudi Arabian Mining Company, awarded an $880 million contract to Jac Rijk Al-Rushaid Contracting at its Mansourah-Massarah gold mines. This is the largest-ever investment by the company in the gold sector. Such developments in the Middle East are opportunistic for the growth of the mining drill bits market.

Global Mining Drill Bits Market- Country Analysis:

- Germany

Germany's mining drill bits market size was valued at USD 0.15 billion in 2021 and is expected to reach USD 0.24 billion by 2029, at a CAGR of 6.0% from 2022 to 2029.

Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. In addition, the country is a crucial mining country within Europe. The major mineral resources mined across Germany are lignite, hard coal, and, in minor quantities, crude oil and natural gas. Moreover, the country is seeing huge demand for raw materials such as lithium for electric cars, potash salts for fertilizers, quartz & quartz sands, graphite, magnesium, and refractory clays. This factor is projected to increase mining activities in the country, creating demand for mining drill bits.

- China

China's mining drill bits market size was valued at USD 0.33 billion in 2021 and is expected to reach USD 0.52 billion by 2029, at a CAGR of 5.9% from 2022 to 2029. China is the world’s largest light-vehicle manufacturer and is the leading automotive producer, consumer, and exporter. Hence, the country is seeing huge demand for metals in the automotive sector, which fuels growth in mining activities across the country. On the other hand, the huge mining sector in the country has led to the considerable growth of the mining drill bits market. Also, the country is substantially involved in foreign mining projects, including 52 copper projects across Europe and Africa. For instance, in May 2022, Zhejiang Huayou Cobalt, a Shanghai-listed mining company, announced to the investment of about $300 million into its Arcadia lithium mine near Harare, Zimbabwe. Such foreign mining projects of the China-based mining companies are further contributing to the market growth.

- India

India's mining drill bits market size was valued at USD 0.12 billion in 2021 and is expected to reach USD 0.19 billion by 2029, at a CAGR of 6.2% from 2022 to 2029. India is one of the strongest growing economies in Asia. This country's market growth is driven by factors such as an upsurge in infrastructure development, growing automotive production, demand from cement and power industries, and demand for steel and iron across the commercial and residential building industry. On the other hand, in June 2020, the country launched an auction for 41 coal mines for commercial mining. This commercialization of coal mining in the country is opportunistic for the growth of the mining drill bits market.

Key Industry Players Analysis:

To increase their market position in the global Mining Drill Bits business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Brunner and Lay

- Caterpillar Inc.

- Changsha Heijingang Industrial Co., Ltd

- Epiroc AB

- Rockmore International, Sandvik

- Western Drilling Tools Inc

- Mitsubishi Materials Corporation

- Robit Plc

- Xiamen Prodrill Equipment Co., Ltd.

Latest Development:

- In May 2022, Epiroc AB launched Powerbit X with diamond-protected buttons. Powerbit is the wide range of tophammer drill bits offered by Epiroc for surface drilling. This new launch of Powerbit X enables lesser exposure to danger for operators, lower CO2 emissions, and more uptime.

- In March 2021, Sandvik launched the SH69 PowerCarbide. The PowerCarbide offering by Sandvik combination features such as strength, toughness, hardness, and wear resistance. SH69 PowerCarbide is an advanced-grade product developed for down-the-hole drilling applications.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

6.1% |

|

Market Size |

1.52 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Type, material, operation, bit size , and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Brunner and Lay, Caterpillar Inc., Changsha Heijingang Industrial Co., Ltd, Epiroc AB, Rockmore International, Sandvik, Western Drilling Tools Inc., Mitsubishi Materials Corporation, Robit Plc, Xiamen Prodrill Equipment Co., Ltd. among others |

|

By Type |

|

|

By Material

|

|

|

By Operation

|

|

|

By Size

|

|

|

Regional scope |

|

Scope of the Report

Global Mining Drill Bits Market by Type:

- Roller Bit

- Fixed-Head Bit

- Rotary Bit

- DTH Bit

- Others

Global Mining Drill Bits Market by Material:

- Steel

- Diamond

- Carbide

- Others

Global Mining Drill Bits Market by Operation:

- Underground Drilling

- Surface Drilling

Global Mining Drill Bits Market by Size:

- Below 8 Inches

- 8 Inches – 11 Inches

- Above 11 Inches

Global Mining Drill Bits Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Mining Drill Bits Market?

The global mining drill bits market is expected to grow from USD 1.52 billion in 2021 to USD 2.38 billion by 2029, at a CAGR of 6.1% during the Projection period 2022-2029.

Which region dominate the Global Mining Drill Bits Market?

Asia-Pacific region dominated the Mining Drill Bits market and held the 43.02% share of the market revenue in 2021

What are the opportunities in Mining Drill Bits Market?

The companies operating in the global mining drill sector are significantly investing in improving the performance of their products and meeting customer requirements. For instance, in March 2022, Nabors Industries, the global drilling contractor, invested $8 million in developing plasma bit, an emerging drilling tool technology. On the other hand, in February 2021, Epiroc launched two innovative drill bit products, the Omega S rotary and Epsilon² tritone. These products were manufactured in a way to boost drilling performance as well as longevity in mining. Such innovations and investment in R&D are opportunistic for market’s growth.

Which are the leading market players active in the Mining Drill Bits Market?

Leading market players active in the Brunner and Lay, Caterpillar Inc., Changsha Heijingang Industrial Co., Ltd, Epiroc AB, Rockmore International, Sandvik, Western Drilling Tools Inc., Mitsubishi Materials Corporation, Robit Plc, and Xiamen Prodrill Equipment Co., Ltd. among others.

Which regions have been studied for the regional analysis of the global Mining Drill Bits Market?

The regions analyzed for the mining drill bits market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

What is the segmentation considered for analyzing the global Mining Drill Bits Market?

The global mining drill bits market has been segmented based on type, material, operation, Size, and regions.

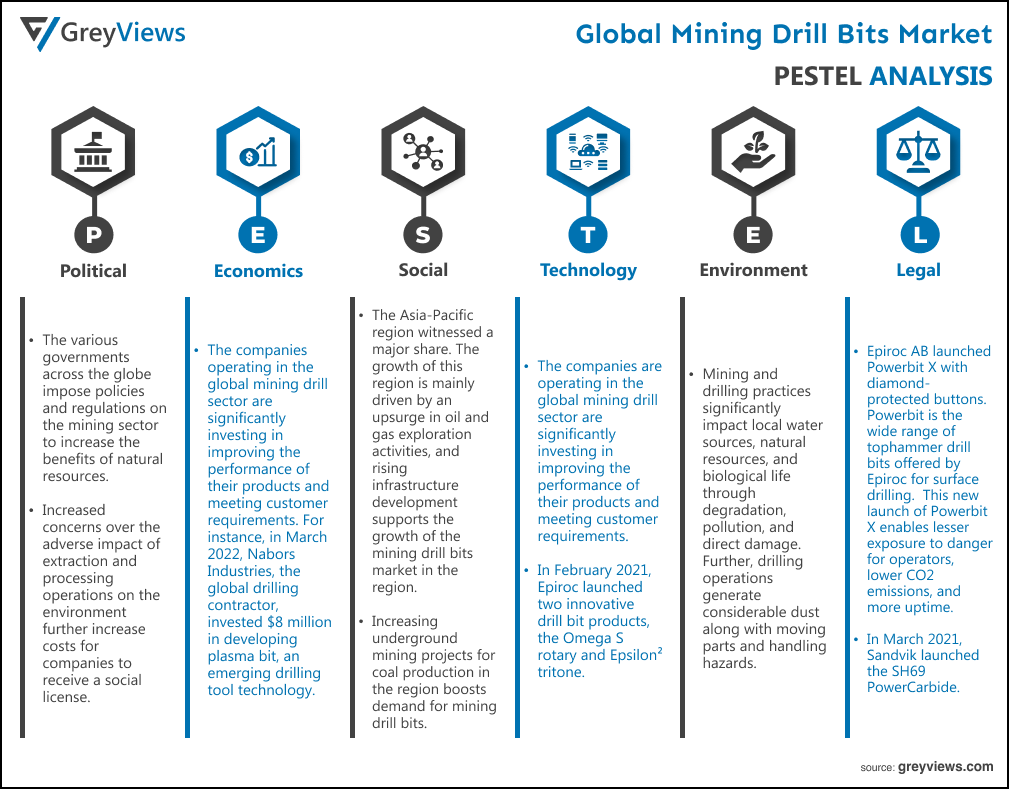

Political Factors- The various governments across the globe impose policies and regulations on the mining sector to increase the benefits of natural resources. Such policies and regulations range from taxes, permitting fees, and export duties on mining companies' production. On the other hand, increased concerns over the adverse impact of extraction and processing operations on the environment further increase costs for companies to receive a social license. Such factors slowdowns mining activities and thus hampers the growth of the market.

Economic Factors- The companies operating in the global mining drill sector are significantly investing in improving the performance of their products and meeting customer requirements. For instance, in March 2022, Nabors Industries, the global drilling contractor, invested $8 million in developing plasma bit, an emerging drilling tool technology. On the other hand, in February 2021, Epiroc launched two innovative drill bit products, the Omega S rotary and Epsilon² tritone. These products were manufactured in a way to boost drilling performance as well as longevity in mining. Such innovations and investment in R&D are opportunistic for market’s growth. For instance, in May 2022, Zhejiang Huayou Cobalt, a Shanghai-listed mining company, announced investing about $300 million into its Arcadia lithium mine near Harare, Zimbabwe. Such foreign mining projects of the China-based mining companies are further contributing to the market growth.

Social Factor-The Asia-Pacific region witnessed a major share. The growth of this region is mainly driven by an upsurge in oil and gas exploration activities, and rising infrastructure development supports the growth of the mining drill bits market in the region. On the other hand, Asia-Pacific is the largest coal mining market. China, India, Indonesia, and Australia are the leaders in the region's coal production for applications, including steel production and power generation. Hence, increasing underground mining projects for coal production in the region boosts demand for mining drill bits.

Technological Factors- The companies are operating in the global mining drill sector are significantly investing in improving the performance of their products and meeting customer requirements. For instance, in March 2022, Nabors Industries, the global drilling contractor, invested $8 million in developing plasma bit, an emerging drilling tool technology. On the other hand, in February 2021, Epiroc launched two innovative drill bit products, the Omega S rotary and Epsilon² tritone. These products were manufactured in a way to boost drilling performance as well as longevity in mining. Such innovations and investment in R&D are opportunistic for market’s growth.

Environmental Factors- Mining and drilling practices significantly impact local water sources, natural resources, and biological life through degradation, pollution, and direct damage. Further, drilling operations generate considerable dust along with moving parts and handling hazards. Such factors may pose challenges to the mining drilling bits manufacturers and companies.

Legal Factors- Epiroc AB launched Powerbit X with diamond-protected buttons. Powerbit is the wide range of tophammer drill bits offered by Epiroc for surface drilling. This new launch of Powerbit X enables lesser exposure to danger for operators, lower CO2 emissions, and more uptime. In March 2021, Sandvik launched the SH69 PowerCarbide. The PowerCarbide offering by Sandvik combination features such as strength, toughness, hardness, and wear resistance. SH69 PowerCarbide is an advanced-grade product developed for down-the-hole drilling applications.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Material

- Market Attractiveness Analysis By Operation

- Market Attractiveness Analysis By Size

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Ongoing growth of the mining industry

- Upsurge in demand for metals from the manufacturing and automotive sectors

- Restrains

- Stricter and costlier regulatory requirements for mining companies

- Opportunities

- Rise in investment for R&D in mining drill sector

- Challenges

- Concern about environmental impacts of mining

- Global Mining Drill Bits Market Analysis and Projection, By Type

- Segment Overview

- Roller Bit

- Fixed-Head Bit

- Rotary Bit

- DTH Bit

- Others

- Global Mining Drill Bits Market Analysis and Projection, By Material

- Segment Overview

- Steel

- Diamond

- Carbide

- Others

- Global Mining Drill Bits Market Analysis and Projection, By Operation

- Segment Overview

- Underground Drilling

- Surface Drilling

- Global Mining Drill Bits Market Analysis and Projection, By Size

- Segment Overview

- Below 8 Inches

- 8 Inches – 11 Inches

- Above 11 Inches

- Global Mining Drill Bits Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Mining Drill Bits Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Mining Drill Bits Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Brunner and Lay

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Caterpillar Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Changsha Heijingang Industrial Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Epiroc AB

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Rockmore International

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Sandvik

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Western Drilling Tools Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Mitsubishi Materials Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Robit Plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Xiamen Prodrill Equipment Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Brunner and Lay

List of Table

- Global Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Global Roller Bit Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Shipside Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Fixed-Head Bit Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Rotary Bit Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global DTH Bit Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Others Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Global Steel Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Diamond Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Carbide Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Others Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Global Underground Drilling Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Surface Drilling Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Global Below 8 Inches Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global 8 Inches – 11 Inches Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Above 11 Inches Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Mining Drill Bits Market, By Region, 2021–2029(USD Billion)

- Global Mining Drill Bits Market, By North America, 2021–2029(USD Billion)

- North America Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- North America Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- North America Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- North America Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- USA. Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- USA. Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- USA. Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- USA. Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Canada Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Canada Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Canada Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Canada Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Mexico Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Mexico Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Mexico Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Mexico Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Europe Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Europe Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Europe Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Europe Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Germany Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Germany Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Germany Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Germany Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- France Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- France Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- France Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- France Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- UK. Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- UK. Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- UK. Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- UK. Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Italy Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Italy Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Italy Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Italy Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Spain Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Spain Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Spain Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Spain Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Asia Pacific Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Asia Pacific Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Asia Pacific Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Japan Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Japan Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Japan Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Japan Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- China Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- China Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- China Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- China Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- India Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- India Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- India Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- India Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- South America Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- South America Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- South America Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- South America Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Brazil Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Brazil Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Brazil Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Brazil Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- Middle East and Africa Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- Middle East and Africa Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- Middle East and Africa Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- UAE Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- UAE Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- UAE Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- UAE Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

- South Africa Mining Drill Bits Market, By Type, 2021–2029(USD Billion)

- South Africa Mining Drill Bits Market, By Material, 2021–2029(USD Billion)

- South Africa Mining Drill Bits Market, By Operation, 2021–2029(USD Billion)

- South Africa Mining Drill Bits Market, By Size, 2021–2029(USD Billion)

List of Figures

- Global Mining Drill Bits Market Segmentation

- Mining Drill Bits Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Mining Drill Bits Market Attractiveness Analysis By Type

- Global Mining Drill Bits Market Attractiveness Analysis By Material

- Global Mining Drill Bits Market Attractiveness Analysis By Operation

- Global Mining Drill Bits Market Attractiveness Analysis By Size

- Global Mining Drill Bits Market Attractiveness Analysis By Region

- Global Mining Drill Bits Market: Dynamics

- Global Mining Drill Bits Market Share By Type(2021 & 2029)

- Global Mining Drill Bits Market Share By Material(2021 & 2029)

- Global Mining Drill Bits Market Share By Operation(2021 & 2029)

- Global Mining Drill Bits Market Share By Size (2021 & 2029)

- Global Mining Drill Bits Market Share by Regions (2021 & 2029)

- Global Mining Drill Bits Market Share by Company (2020)