Orthopedic Devices Market Size By Application (Spine, Cranio-Maxillofacial, Dental, Hip, Knee, and SET), By End-User (Hospital and Orthopedic Clinic), Regions, Segmentation, and Projection till 2029

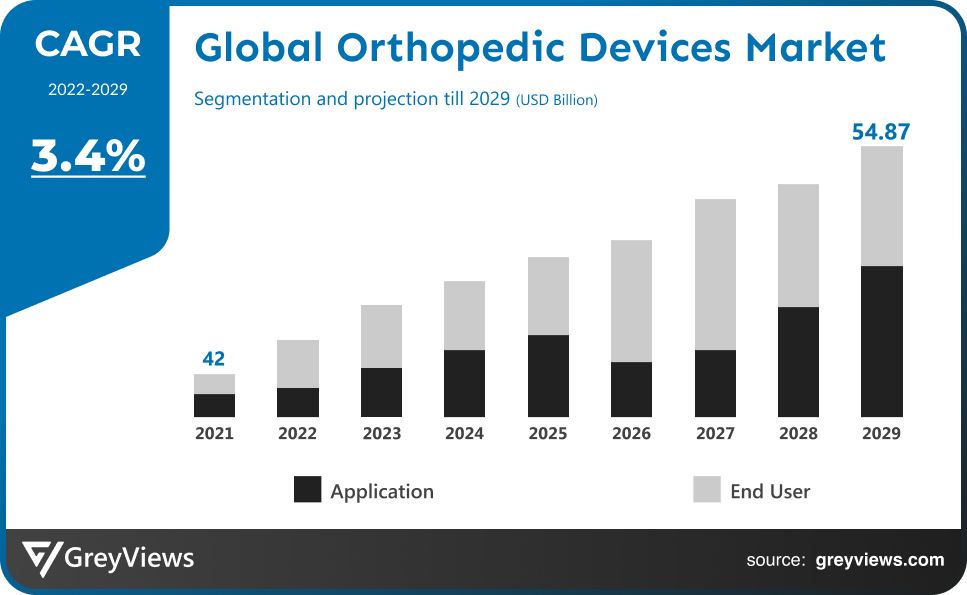

CAGR: 3.4%Current Market Size: USD 42 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Orthopedic Devices Market- Market Overview:

The Global Orthopedic devices market is expected to grow from USD 42 billion in 2021 to USD 54.87 billion by 2029, at a CAGR of 3.4% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the rising population of patients.

Orthopedic devices are used to support broken bones, restore missing joints, or replace missing bones. For strength, titanium alloys and stainless steel are used in the fabrication of the devices, and the plastic coating serves as synthetic cartilage. Internal fixation is an orthopedic procedure in which implants are used to heal broken bones. Rods, pins, plates, and screws are the most used orthopedic medical devices used to stabilize broken bones while they recover. The field of orthopedics is constantly changing. Osteoarthritis, bone fractures, joint dislocations, and scoliosis are only a few examples of the wide range of musculoskeletal illnesses that include degenerative conditions, injuries, and deformities. Without limiting the list, common medical devices utilized in orthopedic applications include: total hip arthroplasty and finger joint replacement are two examples of joint replacement implants, spinal stabilization devices, such as fixation plates, screws, and rods, and implants that are reparative and/or regenerative, like cartilage scaffolds and bone morphogenetic proteins. Instruments used in conjunction with implants, including drivers, inserters, and surgical instruments. The FDA uses a range of characterization techniques to assess applications for orthopedic medical devices. But since new technology and data are discovered and patient demands are always changing, regulatory knowledge gaps are swiftly created.

Sample Request: - Global Orthopedic Devices Market

Market Dynamics:

Drivers:

- Increasing technological advancement

The sector has benefited from ongoing scientific advancements in orthopedic devices, innovations in design, and improvements in efficiency. Innovative End-Users including patient-specific, personalized implants and 3D-printed implants have been released to the market as a result of extensive research and development in the machinery used for hip, spinal, and knee replacement. Robotics and novel automation technologies are being used in corporate operations, which will assist produce high-quality devices even more. The use of robotics in orthopedic surgery also makes procedures less invasive and more precise, which speeds up recovery and reduces hospital stays. The da Vinci Surgical System, the first robotic surgery system, has received approval from the US FDA. For assistance during operations or to obtain 3D scans that help in the creation of custom joints, more players are sponsoring research projects in surgical robots. In conjunction with patient-specific implants, virtual surgical planning will result in greater levels of customization, precision, and improved efficiency. The development of 3D bio-printing in orthopedics and the advancement of new materials will greatly increase demand for these medical items.

Restraints:

- Stringent government regulations

Orthopedic devices fall under the strict restrictions and compliances of class III medical devices. As a result, the U.S. FDA oversees the regulation of these devices. Before being distributed commercially, class III devices require premarket authorization (PMA). Section 515 of the act, which includes FDA approval of the device's premarket approval (PMA) application, mandates that the maker obtain approval. A redesigned medical device regulation that replaces the current medical device directive was also created by the European Union Commission.

Opportunities:

- Rising Geriatric Populations

In the older population around the world, knee problems are frequent. Chronic knee problems are more common in adults 60 and older, especially those residing in long-term care facilities. The prevalence of knee diseases in the elderly population may rise with age, opening the door for the development of drugs and implants in crucial diagnostic and preventative measures for the treatment of knee disorders in older persons. The likelihood of developing knee problems and other risk factors rises with age. Knee osteoarthritis may run in the family for some people, but it can also be brought on by trauma, infection, or even being overweight. The rise in the number of elderly people is anticipated to fuel market expansion as more procedures are performed with orthopedic devices. These devices were developed to provide for the physical and medicinal requirements of elderly individuals. Additionally, the fact that chronic diseases have a significant impact on the senior population may contribute to the expansion of the market for orthopedic devices globally.

Challenges

- Shortage of skilled professionals

The pace of recovery and progress in one area would be hampered by a lack or scarcity of trained knowledge. People who are unemployed in one area frequently possess abilities that are in demand in another. Furthermore, this industry is experiencing a scarcity of knowledge due to the rapid growth of technology. The number of podiatrists and several residency training programs is unknown despite calls for expansion. Some orthopedic and medical professionals in other parts of Europe have not yet begun to address the issue of CME and related obligations, despite the fact that the revalidation process for orthopedic surgeons has started in Switzerland, the United Kingdom, and other nations. Retaining and managing skill-specific specialists has become difficult due to the excessively high skill expectations. The development of technology is another factor that contributes to the rise in demand for skilled workers. Only a small number of podiatrists rate themselves as successfully delivering supportive treatment, and they report major unmet supportive care needs and impediments in their clinics.

Segmentation Analysis:

The global orthopedic devices market has been segmented based on application, End-User, and region.

By Application

The application segment is the spine, cranio-maxillofacial, dental, hip, knee, and SET. The knee segment led the largest share of the orthopedic devices market with a market share of around 23.3% in 2021. The segment is growing as a result of an increase in knee surgery. However, high expenses and extended follow-up times are two significant barriers to segment expansion. Furthermore, the approval of class III medical equipment is being slowed down by strict regulatory requirements.

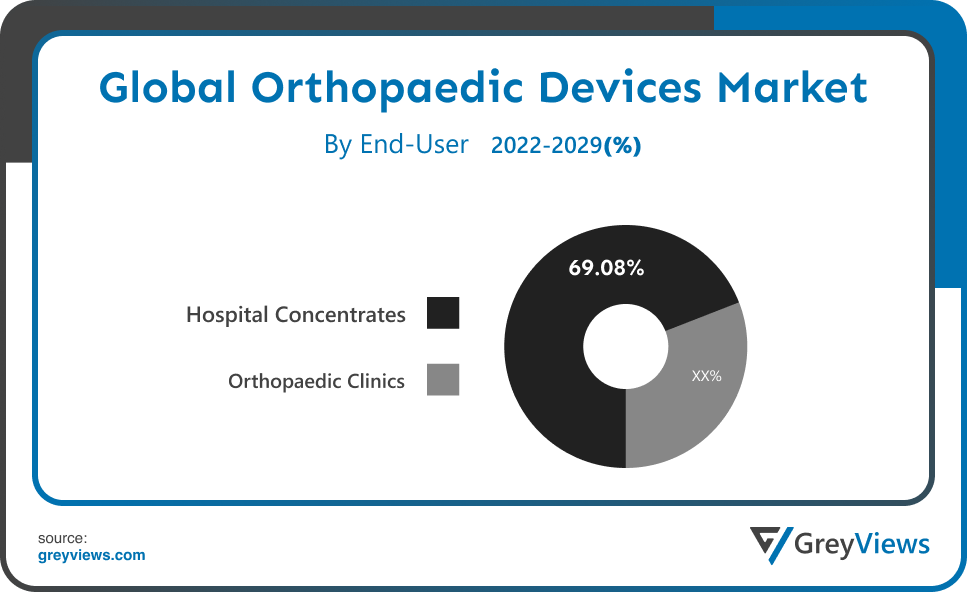

By End-User

The end-user includes hospitals and orthopedic clinics. The hospital concentrates segment led the orthopedic devices market with a market share of around 69.08% in 2021. Patients with orthopedic injuries are frequently treated in hospitals. In addition to therapy, hospitals' efficient reimbursement practices play a critical role in the rising number of patients receiving care in hospitals. But it's anticipated that as the usage of minimally invasive procedures increases, outpatient surgical facilities will become more popular.

Global Orthopedic devices Market- Sales Analysis.

The sale of Orthopedic devices types expanded at a CAGR of 3.2% from 2015 to 2021.

The illnesses that are most likely to increase demand for orthopaedic trauma fixation devices are osteoarthritis and rheumatoid arthritis. Over the next few years, it is anticipated that the frequency of traffic accidents, fractures, and sports injuries will continue to rise, driving up demand for orthopaedic trauma medical devices. The industry is now seeing a major boost from an expanding senior population as well as an increasing number of orthopedic illness cases. The strong presence of top local players in each region's market is a crucial factor in the sales of orthopedic devices.

As 3D printing technology develops, the industry is finding new uses in orthopaedics, and as a result, 3D printed orthopedic devices are quickly gaining popularity throughout the globe. In the market, a more effective reverse shoulder arthroplasty is also popular. Leading producers of orthopedic devices are likely to come across a number of lucrative opportunities in the near future, including a rise in the demand for orthopedic and trauma surgeries, increased funding for providing state-of-the-art trauma care, and ongoing development of novel, effective, and efficient orthopedic trauma care products. The emergence of digital orthpedics is predicted to have a profoundly positive impact on the overall landscape of the market for orthopedic trauma solutions worldwide.

Thus, owing to the aforementioned factors, the global Orthopedic devices Market is expected to grow at a CAGR of 3.4% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the orthopedic devices market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the orthopedic devices market and held the 22% share of the market revenue in 2021.

- North America region witnessed a major share. The presence of industry titans, a well-developed healthcare infrastructure, and payment coverage are projected to fuel the area market's high demand for sophisticated healthcare services. The target patient population is continuously growing as a result of ageing and an increase in traffic accidents, which is further boosting the number of orthopaedic surgeries performed in the area. The high frequency of orthopaedic diseases and widespread use of cutting-edge treatment methods are expected to drive market expansion in the United States.

- Asia Pacific is anticipated to experience significant growth during the predicted period. The greatest elderly population pools in the world are anticipated to be in China and India. Therefore, it is anticipated that these nations' demand would increase greatly in the near future. In addition, the expanding medical tourism sector is anticipated to draw more patients from the target patient group due to the affordable availability of cutting-edge medical treatments. Japan has more implant makers than the majority of other nations in its region, and it spends more on healthcare. Furthermore, it is anticipated that the widespread use of new technology would support regional market expansion.

Global Orthopedic Devices Market- Country Analysis:

- Germany

Germany's Orthopedic devices market size was valued at USD 3.29 billion in 2021 and is expected to reach USD 3.91 billion by 2029, at a CAGR of 2.2% from 2022 to 2029. Regarding the acceptance and invention of medical technology, Germany is regarded as a leader. Additionally, the national government budgeted €3 billion to support hospitals' digitization in 2020. Through the installation of Versius at Klinikum Chemnitz, a cutting-edge teaching and public hospital renowned for its digitally integrated healthcare solutions, the SMR subsequently moved into a potentially lucrative market in 2021. Therefore, throughout the upcoming years, these variables are expected to fuel the growth of the German market.

- China

China Orthopedic devices’s market size was valued at USD 4.8 billion in 2021 and is expected to reach USD 6.08 billion by 2029, at a CAGR of 3% from 2022 to 2029. The region's healthcare infrastructure and strategic alliances amongst major industry participants are expected to stimulate demand. One of the main factors driving the growth of the nation's orthopedic devices market is the rising prevalence of chronic diseases brought on by the rise in the geriatric population, the development of surgery devices, particularly for lung cancer and thymus-thymoma, and the rising acceptance of devices for orthopedic.

- India

India's Orthopedic devices market size was valued at USD 4 billion in 2021 and is expected to reach USD 4.98 billion by 2029, at a CAGR of 2.8% from 2022 to 2029. The market in the region is growing as a result of rising R&D expenditures and the availability of a robust healthcare infrastructure. Orthopedic devices are being adopted more frequently in developing nations. In addition, increased surgical procedures and healthcare costs in developing nations are anticipated to fuel market expansion over the next years.

Key Industry Players Analysis:

To increase their market position in the global Orthopedic Devices business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, End-User developments, collaborations, partnerships, joint ventures, etc.

- Medtronic PLC

- Aesculap Implant Systems, LLC

- Conmed Corporation

- Zimmer-Biomet Holdings, Inc.

- DePuy Synthes

- Smith and Nephew PLC

- MicroPort Scientific Corporation

- Stryker Corporation

- Donjoy, Inc.

- NuVasive, Inc.

Latest Development:

- In September 2020, Smith & Nephew announced that it would purchase the extremities orthopaedics division of Integra LifeSciences for USD 240 million. This acquisition helped the business strengthen and diversify its product line.

- In June 2019, MicroPort's Evolution NitrX Medial-Pivot Knee System went on sale. This approach makes it easier to use, recuperate quickly, and experience less pain. This product introduction helped the business offer cutting-edge products in the market, giving it a competitive edge.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

3.4% |

|

Market Size |

42 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Application, By End-User, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Medtronic PLC, Aesculap Implant Systems, LLC, Conmed Corporation, Zimmer-Biomet Holdings, Inc., DePuy Synthes, Smith and Nephew PLC, MicroPort Scientific Corporation, Stryker Corporation, Donjoy, Inc., and NuVasive, Inc. |

|

By Application |

|

|

By End-User |

|

|

Regional scope |

|

Scope of the Report

Global Orthopedic Devices Market by Application:

- Spine

- Cranio-Maxillofacial

- Dental

- Hip

- Knee

- SET

Global Orthopedic Devices Market by End-User:

- Hospital

- Orthopedic Clinic

Global Orthopedic Devices Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What are the ongoing trends that are projected to influence the market in the upcoming years?

Advancements in the healthcare sector and an increasing number of surgeries around the globe are projected to influence the market in the upcoming years.

What is the key driver of the Orthopedic devices market?

Increasing adoption of orthopedic devices in developing economies is primarily driving the growth of the orthopedic devices market.

Which are the leading market players active in the Orthopedic devices market?

Leading market players active in the global orthopedic devices market are Medtronic PLC, Aesculap Implant Systems, LLC, Conmed Corporation, Zimmer-Biomet Holdings, Inc., DePuy Synthes, Smith and Nephew PLC, MicroPort Scientific Corporation, Stryker Corporation, Donjoy, Inc., NuVasive, Inc.

Which regions have been studied for the regional analysis of the global Orthopedic devices market?

The regions analyzed for the Orthopedic devices market include North America, Europe, South America, Asia Pacific, and the Middle East and Africa.

What is the segmentation considered for the analysis of the global Orthopedic devices market?

The global orthopedic devices market has been segmented based on application, End-User, and regions.

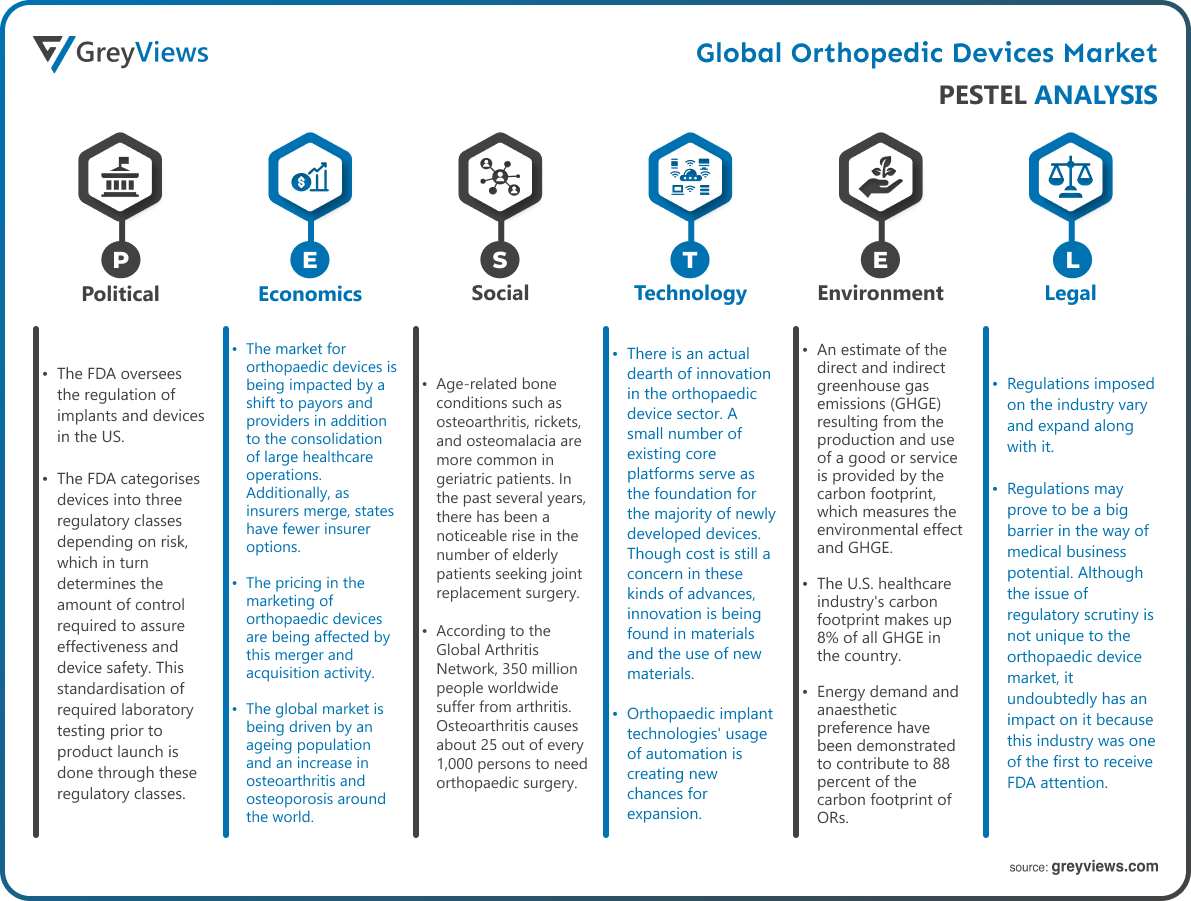

Political Factors- The FDA oversees the regulation of implants and devices in the US. The FDA categorises devices into three regulatory classes depending on risk, which in turn determines the amount of control required to assure effectiveness and device safety. This standardisation of required laboratory testing prior to product launch is done through these regulatory classes. The least regulated class is Class I, and the most regulated class is Class III. An arthroscope, an endoscopic device used to view an internal joint, is described as Class II, but a non-powered goniometer, a purely exterior device, is listed as Class I. Implantable devices can be Class II, like an intramedullary nail, or Class III, if they are thought to pose a higher risk, like an artificial intervertebral disc. The European regulatory framework, which is now undergoing renovation, also makes use of a tier-based system for designating device classes in addition to the Conformité Européenne (CE) mark. When a product bears the CE mark, it means that it complies with all regulatory criteria for health, safety, and the environment and can be sold and distributed within the European Economic Area (EEA).

Economical Factors- The market for orthopaedic devices is being impacted by a shift to payors and providers in addition to the consolidation of large healthcare operations. Additionally, as insurers merge, states have fewer insurer options. The pricing in the marketing of orthopaedic devices are being affected by this merger and acquisition activity. The global market is being driven by an ageing population and an increase in osteoarthritis and osteoporosis around the world. The global market has grown significantly as a result of increased medical tourism and technical advancements. Increased geriatric population, greater risk of osteoporosis and osteoarthritis, as well as a rise in joint replacement and sports injuries globally, are some of the factors driving the orthopaedic devices market. The market for orthopaedic devices is also anticipated to grow as a result of fracture and trauma cases.

Social Factor- Age-related bone conditions such as osteoarthritis, rickets, and osteomalacia are more common in geriatric patients. In the past several years, there has been a noticeable rise in the number of elderly patients seeking joint replacement surgery. According to the Global Arthritis Network, 350 million people worldwide suffer from arthritis. Osteoarthritis causes about 25 out of every 1,000 persons to need orthopaedic surgery. The World Health Organization (WHO) estimates that by 2050, there will be 2 billion people worldwide who are 60 years of age or older. Over the past few years, the demand for orthopaedic devices from lower socioeconomic levels has increased, which has impacted the industry. For the sector to survive and thrive, it is imperative to find a means to meet this demand while keeping costs down.

Technological Factors- There is an actual dearth of innovation in the orthopaedic device sector. A small number of existing core platforms serve as the foundation for the majority of newly developed devices. Though cost is still a concern in these kinds of advances, innovation is being found in materials and the use of new materials. Orthopaedic implant technologies' usage of automation is creating new chances for expansion. Additionally, using robots makes the procedure simpler. Surgery performed by robots is more likely to be successful than by human surgeons. It enhances the market for orthopaedic devices' utilisation of robots. It is an essential element that encourages quick growth. Growing research and development is another element that offers growth potential. The best local businesses in the market are spending millions on orthopaedic implants.

Environmental Factors- An estimate of the direct and indirect greenhouse gas emissions (GHGE) resulting from the production and use of a good or service is provided by the carbon footprint, which measures the environmental effect and GHGE. The U.S. healthcare industry's carbon footprint makes up 8% of all GHGE in the country. Hospitals are the major contributors to acidification, smog, air pollutants, and ecotoxicity in the industry, accounting for one-third of the sector's environmental effect. The average carbon footprint per OR per year was determined to be 146 kg to 232 kg CO2 equivalents (CO2e) per case. Energy demand and anaesthetic preference have been demonstrated to contribute to 88 percent of the carbon footprint of ORs.

Legal Factors- Regulations imposed on the industry vary and expand along with it. Regulations may prove to be a big barrier in the way of medical business potential. Although the issue of regulatory scrutiny is not unique to the orthopaedic device market, it undoubtedly has an impact on it because this industry was one of the first to receive FDA attention. The market for orthopaedic devices is being impacted by a shift to payors and providers in addition to the consolidation of large healthcare operations. Additionally, as insurers merge, states have fewer insurer options. The pricing in the marketing of orthopaedic devices is being affected by this merger and acquisition activity.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Application

- 3.2. Market Attractiveness Analysis By End-User

- 3.3. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increasing technological advancement

- 3. Restraints

- 3.1. Stringent government regulations

- 4. Opportunities

- 4.1. Rising Geriatric Populations

- 5. Challenges

- 5.1. Shortage of skilled professionals

- Global Orthopedic Devices Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Spine

- 3. Cranio-Maxillofacial

- 4. Dental

- 5. Hip

- 6. Knee

- 7. SET

- Global Orthopedic Devices Market Analysis and Projection, By End-User

- 1. Segment Overview

- 2. Hospital

- 3. Orthopedic Clinic

- Global Orthopedic Devices Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Orthopedic Devices Market-Competitive Landscape

- 1. Overview

- 2. Market Share of Key Players in the Orthopedic Devices Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- 3. Competitive Situations and Trends

- 3.1. Application Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Medtronic PLC

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Application Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Aesculap Implant Systems, LLC

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Application Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Conmed Corporation

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Application Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Zimmer-Biomet Holdings, Inc.

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Application Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- DePuy Synthes

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Application Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Smith and Nephew PLC

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Application Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- MicroPort Scientific Corporation

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Application Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Stryker Corporation

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Application Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Donjoy, Inc.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Application Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- NuVasive, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Application Portfolio

- Recent Developments

- SWOT Analysis

- Medtronic PLC

List of Table

- Global Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Global Spine, Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- Global Cranio-Maxillofacial, Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- Global Dental, Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- Global Hip, Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- Global Knee, Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- Global SET, Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- Global Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Global Hospital, Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- Global Orthopedic Clinic, Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- Global Orthopedic Devices Market, By Region, 2021–2029 (USD Billion)

- North America Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- North America Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- USA Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- USA Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Canada Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Canada Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Mexico Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Mexico Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Europe Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Europe Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Germany Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Germany Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- France Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- France Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- UK Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- UK Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Italy Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Italy Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Spain Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Spain Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Asia Pacific Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Japan Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Japan Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- China Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- China Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- India Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- India Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- South America Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- South America Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Brazil Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Brazil Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- Middle East and Africa Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- UAE Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- UAE Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

- South Africa Orthopedic Devices Market, By Application, 2021–2029 (USD Billion)

- South Africa Orthopedic Devices Market, By End-User, 2021–2029 (USD Billion)

List of Figures

- Global Orthopedic Devices Market Segmentation

- Orthopedic Devices Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Orthopedic Devices Market Attractiveness Analysis By Application

- Global Orthopedic Devices Market Attractiveness Analysis By End-User

- Global Orthopedic Devices Market Attractiveness Analysis By Region

- Global Orthopedic Devices Market: Dynamics

- Global Orthopedic Devices Market Share By Application (2021 & 2029)

- Global Orthopedic Devices Market Share By End-User (2021 & 2029)

- Global Orthopedic Devices Market Share by Regions (2021 & 2029)

- Global Orthopedic Devices Market Share by Company (2020)