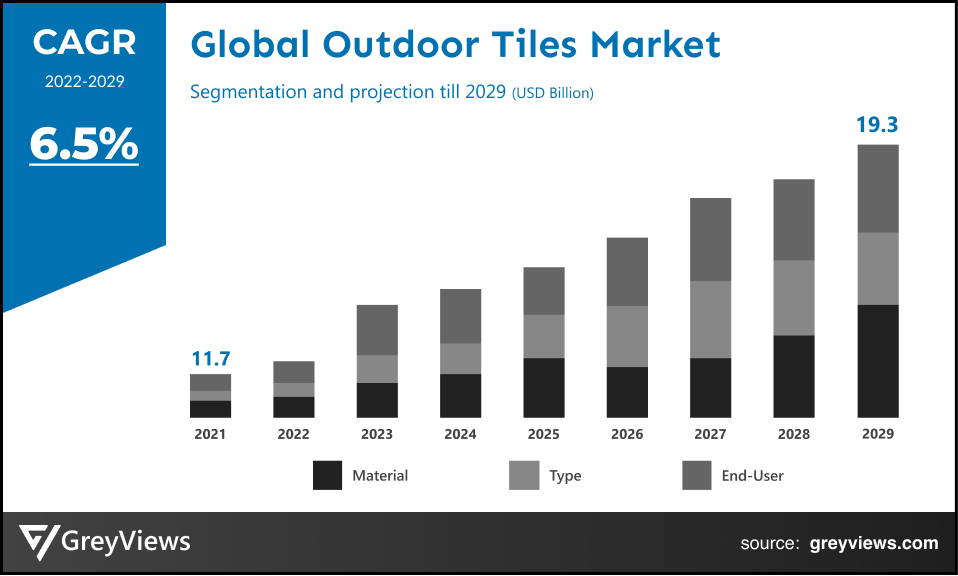

Outdoor Tiles Market Size By Material (Wood, Ceramics, Concrete, and Others), By Type (Tile, Decking, and Others), By End User (Residential, Commercial, Public Sector, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 6.5%Current Market Size: USD 11.7 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Outdoor Tiles Market- Market Overview:

Global Outdoor Tiles market is expected to grow from USD 11.7 billion in 2021 to USD 19.3 billion by 2029, at a CAGR of 6.5% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the growth and increasing development in the construction industry.

Granite, slate, limestone, and travertine tiles are all referred to as natural stones. These materials make for seamless outdoor use, which makes them suitable for use in tiles. Outside tiles frequently mimic stones, concrete, decking, pavement, or other outdoor features. In addition, the outdoor tile's surface is more textured than the indoor tile. This produces a surface that won't slide and will provide traction for users. Additionally, outdoor tile is far more resilient than indoor tile. They can endure harsh weather and direct sunlight without suffering damage. Increased demand from end users and governments around the world, rising urbanization levels that will raise demand for homes and offices, etc., are the main forces behind this expansion and technological developments in outdoor flooring options, such as ceramic tiles, which offer excellent durability and resistance against a variety of extreme weather situations, like floods or hot summers. Man's flooring options frequently include tiles for the outdoors. People today want to reside nearby public transportation hubs or workplaces due to changing lifestyles and increased urbanization, which allows them to commute less frequently. In addition to being comfortable, outdoor flooring improves lung health by absorbing the moisture that would otherwise be discharged into the air due to humidity or dew formation.

Sample Request- Global Outdoor Tiles Market

Market Dynamics:

Drivers:

- Population growth and urbanization

One of the primary drivers of demand for the outdoor tile market is the growing population. Additionally, the global population movement from rural to urban areas has further accelerated development rates. According to the United Nations Population Division, the overall population is anticipated to reach 9.5 billion by 2050, with metropolitan areas accounting for roughly 66.4% of the total. Further enhanced sanitation and disinfection are necessary for a favorable shift in the standards for basic comforts. APAC has recently made tremendous strides in the market for outdoor tiles, which mostly includes growing nations like China and India. By 2050, it is anticipated that urban regions in Asia would account for 52.3% of all metropolitan areas worldwide, creating the largest workforce ever.

Restraints:

- The price of volatile natural substances

Tile manufacturing is a highly energy-intensive assembly process; power, gas, and transportation costs are major expense-related issues that have an impact on the industry. For the outdoor tile business to grow, reliable availability of power and fuel at affordable prices is crucial. Unpredictable and unstable marketplaces have significant negative effects, which manufacturing associations fundamentally consider. Additionally, there is a greater degree of uncertainty in the pricing of raw materials used to make ceramic tiles. Unrefined materials including silica sand, kaolin, feldspar, and bentonite have unpredictable costs. Unstable, unprocessed materials increase the cost of the entire tile-assembling process. The stock chains are weakened by growing costs and unexpected variations in raw material cost levels, making it difficult for manufacturers to compete in the serious outdoor tiles market.

Opportunities:

- The integrated retail area's expansion

The entry of coordinated merchants increases the availability of diverse types of ceramic tiles, hence boosting this market's capacity for growth. A tremendous number of retail sites, including hypermarkets, supermarkets, and specialized stores, are being divided up in the rapidly expanding global retail market. Accommodation and comfort are increasingly important to customers due to their disorganized lifestyles and work schedules. As a result, large-scale coordinated retail sites focus on putting more brands and varieties of ceramic tiles under one roof in order to give customers more options. Ceramic tiles are also made available to customers through dedicated shop spaces for home décor goods. The importance of coordinated shops supplying brand-named ceramic products and other home furnishing items has increased along with the rise in brand awareness among consumers. Customers are empowered by coordinated retailing to gather information on various brands, assess the price, quality, and layout of a few things, and then make a purchasing decision. Therefore, the market for ceramic tiles is anticipated to be significantly impacted in the coming years by the growth of the coordinated retailing area.

Challenges

- Stringent governmental regulations

The growth of the market is hampered by the strict government laws regarding the carbon emissions produced when making tiles. Due to their longevity and capacity to resist cracking, outdoor tiles are frequently used in both residential and commercial structures. The manufacturer's testing and manufacturing capabilities may limit the license's scope, which is anticipated to restrain the market's expansion over the Projection period.

Segmentation Analysis:

The global outdoor tiles market has been segmented based on material, type, end-user, and regions.

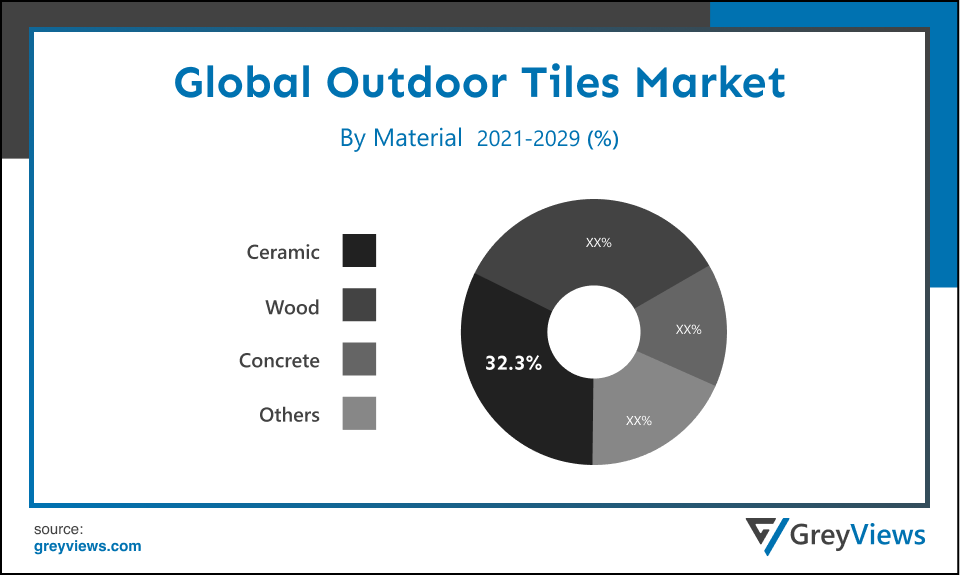

By Material

The material segment is wood, ceramics, concrete, and others. The ceramic segment led the largest share of the outdoor tiles market with a market share of around 32.3% in 2021. During the Projection period, an increase in the building of office buildings, shopping centers, hotels, and other utility areas around the world is projected to drive up demand for goods. The increase in the population, rise in disposable income, growth in remodeling and construction projects, and expansion of interests in the private and business sectors have all contributed to the growth of the ceramic outdoor tile market. A coordinated retail area's growth and the expanding popularity of emerging economies paved the way for market expansion.

By Type

The type segment includes tile, decking, and others. The tile segment led the outdoor tiles market with a market share of around 44.8% in 2021. The global housing crisis is fueling an increase in construction activity, which is boosting the tile market throughout the Projection period. Due to their longevity and crack resistance, tiles are frequently used in both residential and commercial structures. Additionally, the protective coatings on tiles provide the tile surface with superior water resistance, stain protection, and cleanliness.

By End-User

The end-user segment includes residential, commercial, public sector, and others. The commercial segment led the outdoor tiles market with a market share of around 33% in 2021. Increasing demand for porcelain flooring that is both cost-effective and extremely durable is anticipated to fuel market expansion over the course of the Projection period. The creation of innovative materials and simple installation methods have significantly fueled the expansion of the commercial flooring sector. Due to the product's antibacterial, anti-slip, and water-resistant qualities, ceramic flooring is becoming a popular choice for institutions and other sectors, including the healthcare industry.

By Regional Analysis:

The regions analyzed for the outdoor tiles market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the outdoor tiles market and held a 39.1% share of the market revenue in 2021.

- Asia Pacific region witnessed a major share. High product demand from the residential and non-residential building sectors in Asia Pacific's developing nations, particularly China and India, is anticipated to create market expansion prospects. Due to the region's rising per capita income, fast urbanization, and growing population, the construction sector is predicted to rise. Because of the region's sustained economic growth, the expansion of the residential, commercial, and industrial sectors is anticipated to spur building activity, which will ultimately fuel product demand over the projected period.

- North America is anticipated to experience significant growth during the Projection period. The expansion of residential and commercial building construction in the area contributes to the region's overall economic growth. Due to the region's accessibility to raw materials and sizable untapped market, several Italian tile manufacturers are also establishing their production facilities there. In North America, the demand for the product in residential and commercial replacement applications is anticipated to increase due to the need to upgrade current infrastructure. Commercial construction, which includes offices, hotels, and other lodging facilities, has demonstrated a consistent increase in 2020, which is anticipated to support future product demand in the area.

Global Outdoor Tiles Market- Country Analysis:

- Germany

Germany's outdoor tiles market size was valued at USD 1.0 billion in 2021 and is expected to reach USD 1.5 billion by 2029, at a CAGR of 5.7% from 2022 to 2029.

One of the key markets for tiles in the European region is Germany. The nation benefits from having access to highly developed and cutting-edge goods like roof tiles, bricks, sanitary ware, etc. Another aspect that encourages market expansion is the significant consumer spending on residential and housing buildings.

- China

China’s outdoor tiles market size was valued at USD 1.75 billion in 2021 and is expected to reach USD 3.0 billion by 2029, at a CAGR of 7.2% from 2022 to 2029. State investments and low lending rates are responsible for the building industry's bright future. The main driver of market expansion for outdoor tiles in China is the increased demand for new residential infrastructure.

- India

India's outdoor tiles market size was valued at USD 1.2 billion in 2021 and is expected to reach USD 2.0 billion by 2029, at a CAGR of 6.8% from 2022 to 2029. India is rapidly urbanizing, with a population proportion of 35% living in cities by 2020. Additionally, it is anticipated to reach 40% by 2030, or roughly 600 million people living in cities. The growth of cities and population migration are the main causes of urbanization in India. Housing, the road system, urban transportation, the water supply, infrastructures for generating electricity, smart cities, and other aspects of urban administration are all subject to investment. Urbanization increases the need for residential and commercial buildings, which has propelled the market for outdoor tiles in India's rapid expansion.

Key Industry Players Analysis:

To increase their market position in the global outdoor tiles business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Armstrong floorings Inc

- Beaulieu international group N.V

- Citadel floors

- Ecore International

- Mohawk industries

- Mats Inc

- Fiberon

- ATLAS CONCORDE S.P.A.

- Mohawk Industries, Inc.

- Guangdong Monalisa Industry Co., Ltd.

- Crossville Inc.

- Florida Tile, Inc.

- Porcelanosa Group

- Ricchetti Group

- Florim Ceramiche S.p.A.

Latest Development:

- In April 2021, The approximately 100 Q Premium Natural Quartz products now offered by M S International Inc (MSI), the top provider of flooring, wall tiles, countertops, and hardscaping goods in North America, have been added to. Five of the newest, in-demand quartz colors with a marbled appearance were introduced, offering lighter and darker tones to match any style.

- In August 2020, In order to enhance SCG CBM's digital technology and software development efforts to deliver benefits to customers and maximize growth potential, SCG CBM entered into a share purchase agreement to acquire all of the shares of Oitolabs Technologies Private Limited in India.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

6.5% |

|

Market Size |

11.7 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Material, By Type, By End-User |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Armstrong floorings Inc, Beaulieu international group N.V, Citadel floors, Ecore International, Mohawk industries, Mats Inc, Fiberon, ATLAS CONCORDE S.P.A., Mohawk Industries, Inc., Guangdong Monalisa Industry Co., Ltd., Crossville Inc., Florida Tile, Inc., Porcelanosa Group, Ricchetti Group, Florim Ceramiche S.p.A., and among others. |

|

By Material |

|

|

By Type |

|

|

By End User |

|

|

Regional scope |

|

Scope of the Report

Global Outdoor Tiles Market, By Material:

- Wood

- Ceramics

- Concrete

- Others

Global Outdoor Tiles Market, By Type:

- Tile

- Decking

- Others

Global Outdoor Tiles Market, By End-User:

- Residential

- Commercial

- Public Sector

- Others

Global Outdoor Tiles Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the market size of the Outdoor Tiles market in 2029?

Global outdoor tiles market is expected to reach USD 19.3 billion by 2029, at a CAGR of 6.5% from 2022 to 2029.

Which Region Dominate the Outdoor Tiles Market?

Asia Pacific region dominated the outdoor tiles market and held a 39.1% share of the market revenue in 2021.

In APAC which Country Dominate the APAC Outdoor Tiles Market?

China’s outdoor tiles market size was valued at USD 1.75 billion in 2021 and is expected to reach USD 3.0 billion by 2029, at a CAGR of 7.2% from 2022 to 2029 The main driver of market expansion for outdoor tiles in China is the increased demand for new residential infrastructure.

What are the top 5 exporter countries of Outdoor Tiles?

United States, Germany, United Kingdom, China, and France.

Which are the leading market players active in the Outdoor Tiles market?

Leading market players active in the global outdoor tiles market are Armstrong floorings Inc, Beaulieu international group N.V, Citadel floors, Ecore International, Mohawk industries, Mats Inc, Fiberon, ATLAS CONCORDE S.P.A., Mohawk Industries, Inc., Guangdong Monalisa Industry Co., Ltd., Crossville Inc., Florida Tile, Inc., Porcelanosa Group, Ricchetti Group, Florim Ceramiche S.p.A., and among others.

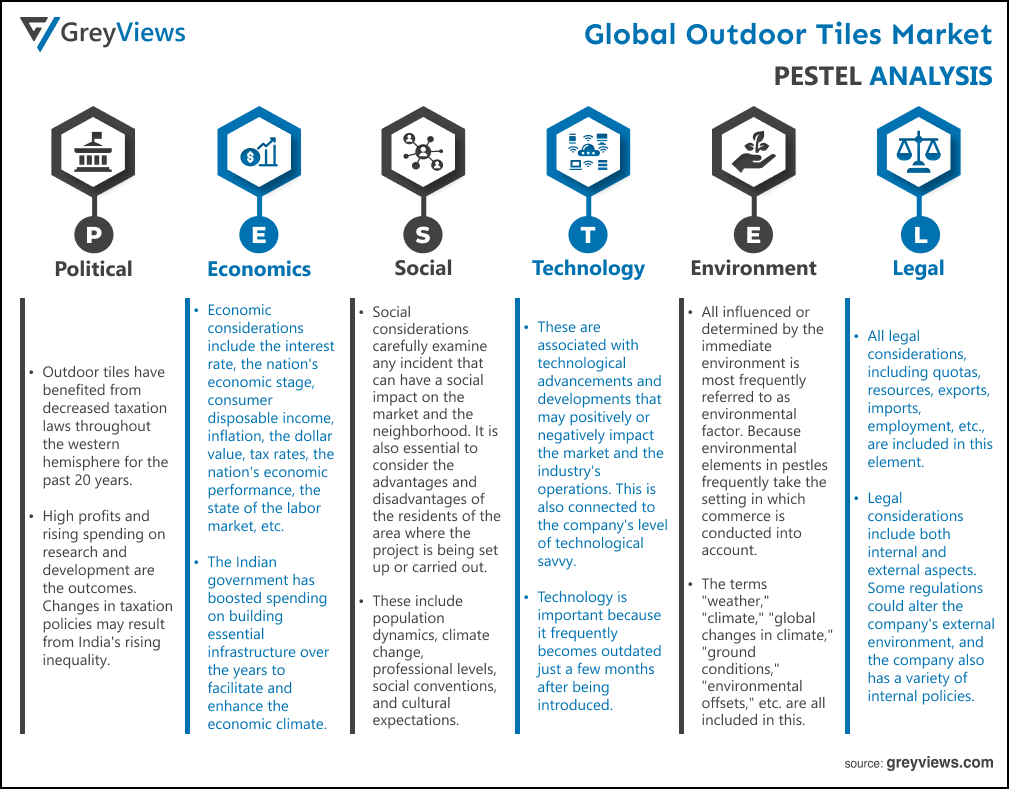

Political Factors- Outdoor tiles have benefited from decreased taxation laws throughout the western region for the past 20 years. High profits and rising spending on research and development are the reasons for the development of outdoor tiles. Changes in taxation policies may result from India's rising inequality. To reduce the carbon footprint of the capital goods industry, local governments are also looking into taxation schemes that are unique to construction supplies and fixtures. Other parties interested in the issue, such as non-governmental organizations, pressure and protest groups, and activist movements, are quite important in India. To support corporate and community goals more effectively, outdoor tiles should work closely with these groups.

Economical Factors- Economic considerations include the interest rate, the nation's economic state, consumer disposable income, inflation, the dollar value, tax rates, the nation's economic performance, the state of the labor market, etc. The Indian government has boosted spending on building essential infrastructure over the years to facilitate and enhance the economic climate. Outdoor tiles can use the available infrastructure to encourage the expansion of the capital goods market in India. The main economic factor is how the economy runs and how it affects the operation of the businesses. The way the business sets the pricing of its items may be impacted by a rise in the economy's inflation rate. The models used to predict supply and demand in the economy will also get altered due to changes in the economic condition of the country.

Social Factor- Social considerations carefully examine any incident that can have a social impact on the market and the neighborhood. It is also essential to consider the advantages and disadvantages for the residents of the area where the project is being set up or carried out. These include population dynamics, climate change, professional levels, social conventions, and cultural expectations. These aspects determine or measure the determinants such as demographics, cultural trends, population analytics, etc., while considering the prominent social context in the market.

Technological Factors- Technological advancement and innovation in the tiles market affect the technological aspect of the market. These technological advancements and developments may positively or negatively impact the market and the industry's operations. Technology is important because it frequently becomes outdated just a few months after being introduced. So, the market players must use the technology for outdoor tiles wisely and get the best results. The latest designs and cuttings must be done on the outdoor tiles to enhance the look.

Environmental Factors- Organizations are under pressure to reduce environmental harm due to strict environmental legislation in many countries. As a result, outdoor tile manufacturers should adopt ethical production methods, promote ethical consumption among their target market, work to enhance their brand's sustainability reputation, and ensure full compliance with local and international environmental laws because failure to do so may result in severe, reputation-damaging criticism from relevant stakeholders. Renewable technology development to lessen reliance on natural resources has become a strong trend in many industries.

Legal Factors- All legal considerations, including quotas, resources, exports, imports, employment, etc., are included in the legal factors. Legal considerations include both internal and external aspects. Some regulations could alter the company's external environment, and the company also has a variety of internal policies. These two factors are considered in the legal analysis, which then develops specific methods by considering these laws. Legal factors offer more information about various rules and regulations, mainly concerning employment laws, health and safety laws, intellectual property laws, and consumer protection laws. In contrast, political factors offer a broader perspective.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Material

- 3.2. Market Attractiveness Analysis By Type

- 3.3. Market Attractiveness Analysis By End User

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Population growth and urbanization

- 3. Restraints

- 3.1. The price of volatile natural substances

- 4. Opportunities

- 4.1. The integrated retail area's expansion

- 5. Challenges

- 5.1. Stringent governmental regulations

- Global Outdoor Tiles Market Analysis and Projection, By Material

- 1. Segment Overview

- 2. Wood

- 3. Ceramics

- 4. Concrete

- 5. Others

- Global Outdoor Tiles Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Tile

- 3. Decking

- 4. Others

- Global Outdoor Tiles Market Analysis and Projection, By End User

- 1. Segment Overview

- 2. Residential

- 3. Commercial

- 4. Public Sector

- 5. Others

- Global Outdoor Tiles Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Outdoor Tiles Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Outdoor Tiles Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Armstrong floorings Inc

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Beaulieu international group N.V

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Citadel floors

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Ecore International

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Mohawk industries

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Mats Inc

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Fiberon

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- ATLAS CONCORDE S.P.A.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Mohawk Industries, Inc.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Guangdong Monalisa Industry Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Armstrong floorings Inc

List of Table

- Global Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Global Wood, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Ceramics, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Concrete, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Others, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Global Tile, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Decking, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Others, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Global Residential, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Commercial, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Public Sector, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Others, Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- Global Outdoor Tiles Market, By Region, 2021–2029(USD Billion)

- North America Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- North America Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- North America Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- USA Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- USA Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- USA Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Canada Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Canada Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Canada Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Mexico Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Mexico Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Mexico Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Europe Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Europe Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Europe Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Germany Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Germany Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Germany Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- France Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- France Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- France Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- UK Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- UK Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- UK Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Italy Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Italy Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Italy Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Spain Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Spain Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Spain Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Asia Pacific Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Asia Pacific Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Japan Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Japan Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Japan Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- China Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- China Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- China Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- India Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- India Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- India Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- South America Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- South America Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- South America Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Brazil Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Brazil Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Brazil Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- Middle East and Africa Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- Middle East and Africa Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- UAE Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- UAE Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- UAE Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

- South Africa Outdoor Tiles Market, By Material, 2021–2029(USD Billion)

- South Africa Outdoor Tiles Market, By Type, 2021–2029(USD Billion)

- South Africa Outdoor Tiles Market, By End User, 2021–2029(USD Billion)

List of Figures

- Global Outdoor Tiles Market Segmentation

- Outdoor Tiles Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Outdoor Tiles Market Attractiveness Analysis By Material

- Global Outdoor Tiles Market Attractiveness Analysis By Type

- Global Outdoor Tiles Market Attractiveness Analysis By End User

- Global Outdoor Tiles Market Attractiveness Analysis By Region

- Global Outdoor Tiles Market: Dynamics

- Global Outdoor Tiles Market Share By Material (2021 & 2029)

- Global Outdoor Tiles Market Share By Type (2021 & 2029)

- Global Outdoor Tiles Market Share By End User (2021 & 2029)

- Global Outdoor Tiles Market Share by Regions (2021 & 2029)

- Global Outdoor Tiles Market Share by Company (2020)