Personal Care Ingredients Market Size by Ingredient Type (Emollients, Surfactants, Emulsifiers, Rheology Modifiers, Conditioning Polymers, and Others), Application (Skin Care, Hair Care, Oral Care, Make-up, and Others), Regions, Segmentation, and Projection till 2029

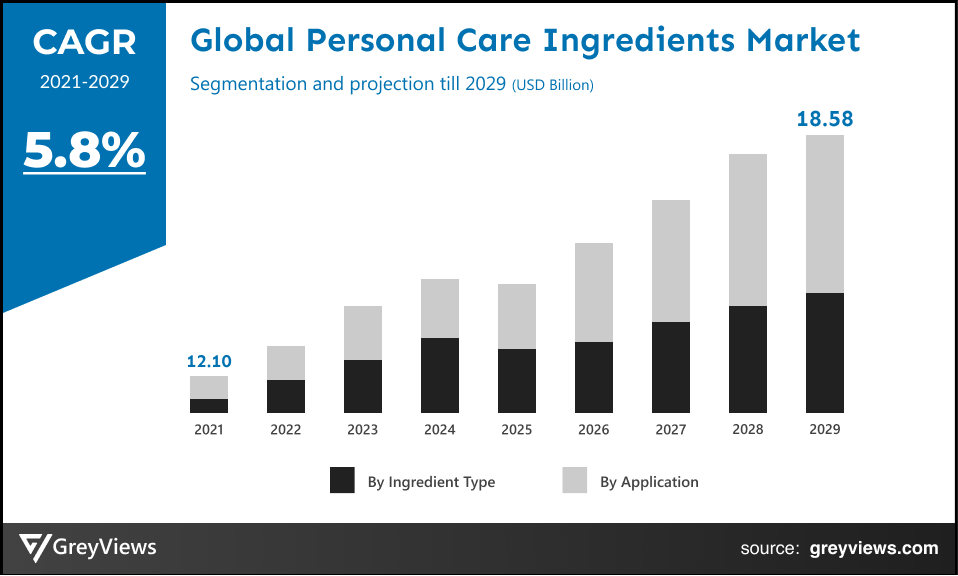

CAGR: 5.8%Current Market Size: USD 12.10 billionFastest Growing Region: APAC

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Personal Care Ingredients- Market Overview

The global personal care ingredients market is expected to grow from USD 12.10 billion in 2021 to USD 18.58 billion by 2029, at a CAGR of 5.8% during the Projection period 2022-2029. This growth is mainly driven by a significant rise in population and a surge in purchasing power of consumers across the developing countries.

Personal care ingredients are the vital raw materials involved in the manufacture of skin care products such as skin moisturizers, lipsticks, fingernail polishes, perfumes, eye, and facial makeup preparations, shampoos, and hair colors, permanent waves, and deodorants among others. The prominent ingredients include emollients, preservatives, emulsifiers, mild surfactants, actives, and pearlized. In the past few years, personal care ingredients are seeing the emergence of trending natural beauty ingredients including sea buckthorn oil, pearl powder, and ceramides. The desire for more authentic and socially-responsible ways of living has led to the rise in the adoption of personal care products, fueling market growth.

On the other hand, ready access to information has enabled people to set their own personal health goals with skincare being a vital part of the process. People are looking for high-quality cosmetics products that work and make them feel good about their looks.

Request Sample:- Global Personal Care Ingredients

Market Dynamics

Drivers:

- Growing disposable income coupled with the rise in purchasing power of consumers

Over the past few years, spending on personal care products has increased exponentially with the media penetration and rising consciousness about global fashion trends. For instance, according to the survey in July 2020 by Picodi.com, an international e-commerce company, British women spend on average $490.60 on cosmetics every year and own at least 24 products at one time. While 41% of women in the UK would purchase more premium cosmetics “occasionally” and 28% always buy them. This growth in spending on personal care products boosts demand for personal care ingredients.

- Increasing demand for milder ingredients

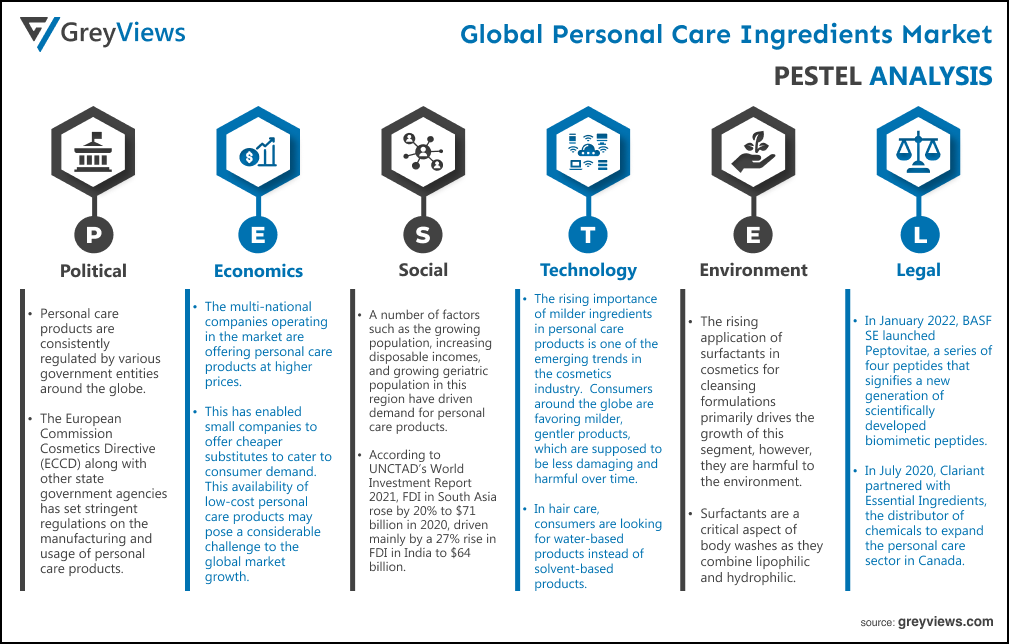

The rising importance of milder ingredients in personal care products is one of the emerging trends in the cosmetics industry. Consumers around the globe are favoring milder, gentler products, which are supposed to be less damaging and harmful over time. For instance, in hair care, consumers are looking for water-based products instead of solvent-based products. Water-based hair care products are easy to use and comparatively less damaging or harmful to hair. In addition, the market players are actively developing mild ingredient products. For instance, in March 2022, BASF Care Creations, a provider of ingredients for personal care developed Plantapon Soy, a bio-based mild anionic surfactant derived from soy protein that provides sustainability benefits.

Restraints:

- Stringent regulations related to the cosmetic products

Personal care products are consistently regulated by various government entities around the globe. For instance, the European Commission Cosmetics Directive (ECCD) along with other state government agencies has set stringent regulations on the manufacturing and usage of personal care products. The EU Cosmetics Regulation specifies that all cosmetics products must be manufactured in compliance with the harmonized standards laid out in Good Manufacturing Practices (GMP). On the other hand, the usage of new unregistered ingredients is not allowed by regulations set by the China Food and Drugs Administration (CFDA). Such regulations may hamper the growth of the market to some extent.

Opportunities:

- Upsurge in demand for personal care products in developing countries

Developing nations such as China, India, and Indonesia have seen an enormous demand for personal care products. An aging population along with the rise in disposable incomes in such countries if further leads to the growth of the market. For instance, in 2021, people aged 60 and over made up approximately one-fifth of the Chinese population.

Moreover, according to a monthly India Consumer Sentiment Index (CSI) survey by Axis My India, consumers in India showed steady improvement in purchases across essential and discretionary products in May 2022. This demand for personal care products in developing countries is opportunistic for the growth of the market.

Challenges

- The expensiveness of cosmetic products

The multi-national companies operating in the market are offering personal care products at higher prices. This has enabled small companies to offer cheaper substitutes to cater to consumer demand. This availability of low-cost personal care products may pose a considerable challenge to the global market growth.

Segmentation Analysis:

The global personal care ingredients market has been segmented based on ingredient type, application, and regions.

By Ingredient Type

The ingredient type segment includes emollients, surfactants, emulsifiers, rheology modifiers, conditioning polymers, and others. The surfactants segment led the personal care ingredients market with a market share of around 25.43% in 2021. The rising application of surfactants in cosmetics for cleansing formulations primarily drives the growth of this segment. In addition, surfactants are a critical aspect of body washes as they combine lipophilic and hydrophilic. Moreover, the surge in demand for anti-aging formulations due to the increasing middle-aged and geriatric population coupled with changing beauty trends boosted the need for surfactants.

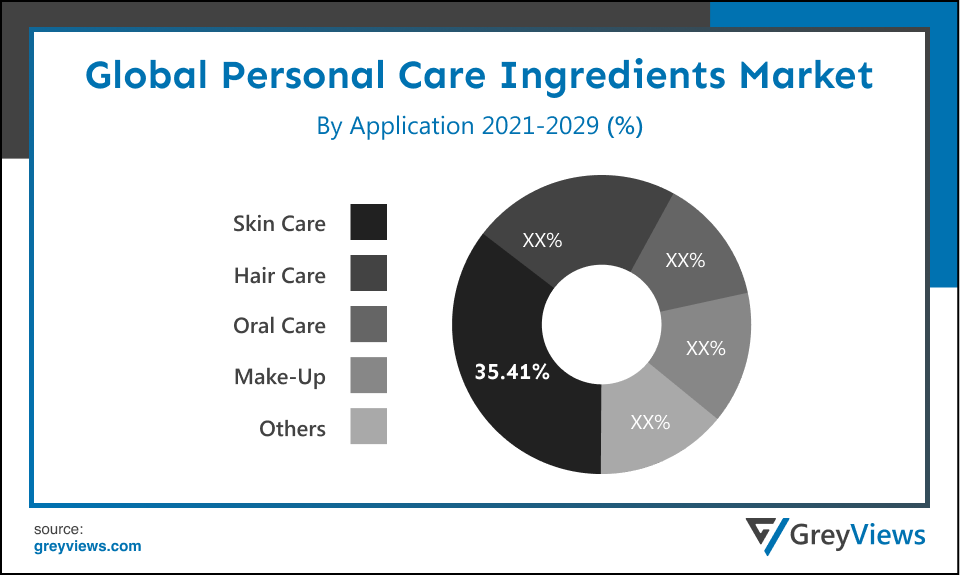

By Application

The application segment includes Skin Care, Hair Care, Oral Care, Make-up, and Others. The skincare segment led the personal care ingredients market with a market share of around 35.41% in 2021. The main layers of the skin include the epidermis, dermis, and hypodermis and are prone to numerous problems, such as skin cancer, wrinkles, acne, and rashes. Skincare deals with practices that support skin integrity, cure skin conditions and enhance its appearance. Hence, the need for personal care products for different skin-related requirements such as anti-acne, anti-aging, and sun protection primarily drives the growth of this segment.

By Regional Analysis:

The regions analyzed for the personal care ingredients market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Europe region dominated the personal care ingredients market and held a 36.38% share of the market revenue in 2021.

- Europe region witnessed a major share as the region is a leader in the cosmetics industry with dominant cosmetics exports in past few years. In addition, the vast majority of consumers in Europe use personal care and cosmetics products every day to protect their health, boost their self-esteem, and enhance their well-being. Moreover, the region is home to research and development (R&D) in the cosmetics industry with at least 77 scientific innovation facilities in 2018 that carry out research associated with cosmetics and personal care. Such factors have fueled the growth of the Europe personal care ingredients market.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. A number of factors such as the growing population, increasing disposable incomes, and growing geriatric population in this region have driven demand for personal care products. Moreover, a significant rise in foreign direct investment (FDI) for the economic development of Asia is expected to create lucrative growth opportunities for the market in upcoming years. For instance, according to UNCTAD’s World Investment Report 2021, FDI in South Asia rose by 20% to $71 billion in 2020, driven mainly by a 27% rise in FDI in India to $64 billio

Global Personal Care Ingredients Market- Country Analysis

- Germany

In Germany, the high consumer interest in premium cosmetics has driven the growth of the personal care ingredients market. Germany's personal care ingredients market size was valued at USD 1.09 billion in 2021, at a CAGR of 4.78% from 2022 to 2029.

Further, this is one of the major countries with the most rapidly aging population in the world, hence, the need for skincare solutions in boosts the growth of the market in the country. Also, the country is seeing new product innovations in the skincare industry. For instance, in April 2022, Beiersdorf, a German multinational company announced to launch the world’s first skincare product with recycled CO2

- China

China's personal care ingredients market size was valued at USD 0.94 billion in 2021 and is expected to reach USD 1.42 billion by 2029, at a CAGR of 5.5% from 2022 to 2029. Growing disposable income, considerable growth in urbanization, and social media influence have boosted the growth of the personal care ingredients market in China. In addition, increasing imports of personal care products in the country are projected to boost the growth of the market. For instance, according to the U.S. Department of Commerce data in 2020, the U.S. exported about $838 million of personal care and cosmetic products to China, up 2.2% from the previous year.

- India

India's personal care ingredients market size was valued at USD 0.69 billion in 2021 and is expected to reach USD 1.04 billion by 2029, at a CAGR of 5.6% from 2022 to 2029. India is one of the strongest growing economies in Asia. Increasing focus on personal hygiene and health, improving consumer living standards, and demand for men's grooming products has driven the growth of the Indian personal care ingredients market. In addition, the personal care brands in this country are targeting niche audiences with the proposition of sustainable and natural products. This factor is further projected to create lucrative growth opportunities for the market.

Key Industry Players Analysis:

To increase their market position in the global personal care ingredients business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- ASHLAND GLOBAL HOLDINGS INC.

- BASF SE

- BERKSHIRE HATHAWAY INC.

- CLARIANT

- CRODA INTERNATIONAL PLC.

- DOW INC.

- EVONIK INDUSTRIES

- M. HUBER CORPORATION

- KCC CORPORATION

- SOLVAY S.A.

Latest Development:

- In January 2022, BASF SE launched Peptovitae, a series of four peptides that signifies a new generation of scientifically developed biomimetic peptides. These new bioactive address personal care skin benefits related to combatting the signs of aging, enhancing the brightness of the skin, calming and moisturizing skin, and soothing skin prone to dryness and itching.

- In July 2020, Clariant partnered with Essential Ingredients, the distributor of chemicals to expand the personal care sector in Canada. Through this partnership, Essential Ingredients will be the exclusive Canadian distributor for Clariant in the personal care and hygiene markets.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year considered |

2021 |

|

CAGR (%) |

5.8% |

|

Market Size |

12.10 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Ingredient type and application, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Ashland Global Holdings Inc., BASF SE, Berkshire Hathaway Inc., Clariant AG, Croda International Plc, DOW, Inc., Evonik Industries AG, J.M. Huber Corporation, KCC Corporation, and Solvay S.A. among others |

|

By Ingredient Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Personal Care Ingredients Market by Ingredient Type:

- Emollients

- Surfactants

- Emulsifiers

- Rheology Modifiers

- Conditioning Polymers

- Others

Global Personal Care Ingredients Market by Application:

- Skin Care

- Hair Care

- Oral Care

- Make-up

- Others

Global Personal Care Ingredients Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the current market size of Global Personal Care Ingredients Market?

Global personal care ingredients market is USD 12.10 billion in 2021 and Expected to reach USD 18.58 billion by 2029, at a CAGR of 5.8% during the Projection period 2022-2029

Which Region Dominate the Global Personal Care Ingredients Market?

Europe region dominated the personal care ingredients market and held a 36.38% share of the market revenue in 2021

What is the valuation of Germany Personal Care Ingredients Market?

Germany's personal care ingredients market size was valued at USD 1.09 billion in 2021

What are the Segments Covered in Global Personal Care Ingredients Market?

There are Two Segments covered in Personal Care Ingredients Market By Ingredient Type, By Application

What are the political factor in Personal Care Ingredients Market?

Personal care products are consistently regulated by various government entities around the globe. For instance, the European Commission Cosmetics Directive (ECCD) along with other state government agencies has set stringent regulations on the manufacturing and usage of personal care products. The EU Cosmetics Regulation specifies that all cosmetics products must be manufactured in compliance with the harmonized standards laid out in Good Manufacturing Practices (GMP). On the other hand, the usage of new unregistered ingredients is not allowed by regulations set by the China Food and Drugs Administration (CFDA). Such regulations may hamper the growth of the market to some extent.

What are the Technological Factors in Personal Care Ingredients Market?

The rising importance of milder ingredients in personal care products is one of the emerging trends in the cosmetics industry. Consumers around the globe are favoring milder, gentler products, which are supposed to be less damaging and harmful over time. For instance, in hair care, consumers are looking for water-based products instead of solvent-based products. Water-based hair care products are easy to use and comparatively less damaging or harmful to hair. In addition, the market players are actively developing mild ingredient products. For instance, in March 2022, BASF Care Creations, a provider of ingredients for personal care developed Plantapon Soy, a bio-based mild anionic surfactant derived from soy protein that provides sustainability benefits.

What are the Environmental Factors in Personal Care Ingredients Market?

The rising application of surfactants in cosmetics for cleansing formulations primarily drives the growth of this segment, however, they are harmful to the environment. In addition, surfactants are a critical aspect of body washes as they combine lipophilic and hydrophilic. Moreover, the surge in demand for anti-aging formulations due to the increasing middle-aged and geriatric population coupled with changing beauty trends boosted the need for surfactants. Penetration of technology caused global warming in addition to biodiversity loss, water & land degradation, acid rain, deforestation, and coral reef degeneration. Hence, the aforementioned environmental concerns triggered by the automotive industry may pose significant challenges to market growth

Political Factors- Personal care products are consistently regulated by various government entities around the globe. For instance, the European Commission Cosmetics Directive (ECCD) along with other state government agencies has set stringent regulations on the manufacturing and usage of personal care products. The EU Cosmetics Regulation specifies that all cosmetics products must be manufactured in compliance with the harmonized standards laid out in Good Manufacturing Practices (GMP). On the other hand, the usage of new unregistered ingredients is not allowed by regulations set by the China Food and Drugs Administration (CFDA). Such regulations may hamper the growth of the market to some extent.

Economic Factors- The multi-national companies operating in the market are offering personal care products at higher prices. This has enabled small companies to offer cheaper substitutes to cater to consumer demand. This availability of low-cost personal care products may pose a considerable challenge to the global market growth. For instance, according to the survey in July 2020 by Picodi.com, an international e-commerce company, British women spend on average $490.60 on cosmetics every year and own at least 24 products at one time. While 41% of women in the UK would purchase more premium cosmetics “occasionally” and 28% always buy them. This growth in spending on personal care products boosts demand for personal care ingredients.

Social Factor- Asia-Pacific is expected to witness the highest growth rate during the Projection period. A number of factors such as the growing population, increasing disposable incomes, and growing geriatric population in this region have driven demand for personal care products. Moreover, a significant rise in foreign direct investment (FDI) for the economic development of Asia is expected to create lucrative growth opportunities for the market in the upcoming years. For instance, according to UNCTAD’s World Investment Report 2021, FDI in South Asia rose by 20% to $71 billion in 2020, driven mainly by a 27% rise in FDI in India to $64 billion.

Technological Factors- The rising importance of milder ingredients in personal care products is one of the emerging trends in the cosmetics industry. Consumers around the globe are favoring milder, gentler products, which are supposed to be less damaging and harmful over time. For instance, in hair care, consumers are looking for water-based products instead of solvent-based products. Water-based hair care products are easy to use and comparatively less damaging or harmful to hair. In addition, the market players are actively developing mild ingredient products. For instance, in March 2022, BASF Care Creations, a provider of ingredients for personal care developed Plantapon Soy, a bio-based mild anionic surfactant derived from soy protein that provides sustainability benefits.

Environmental Factors- The rising application of surfactants in cosmetics for cleansing formulations primarily drives the growth of this segment, however, they are harmful to the environment. In addition, surfactants are a critical aspect of body washes as they combine lipophilic and hydrophilic. Moreover, the surge in demand for anti-aging formulations due to the increasing middle-aged and geriatric population coupled with changing beauty trends boosted the need for surfactants. Penetration of technology caused global warming in addition to biodiversity loss, water & land degradation, acid rain, deforestation, and coral reef degeneration. Hence, the aforementioned environmental concerns triggered by the automotive industry may pose significant challenges to market growth.

Legal Factors- In January 2022, BASF SE launched Peptovitae, a series of four peptides that signifies a new generation of scientifically developed biomimetic peptides. These new bioactive address personal care skin benefits related to combatting the signs of aging, enhancing the brightness of the skin, calming and moisturizing skin, and soothing skin prone to dryness and itching. In July 2020, Clariant partnered with Essential Ingredients, the distributor of chemicals to expand the personal care sector in Canada. Through this partnership, Essential Ingredients will be the exclusive Canadian distributor for Clariant in the personal care and hygiene markets.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Ingredient Type

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growing disposable income coupled with the rise in purchasing power of consumers

- Increasing demand for milder ingredients

- Restrains

- Stringent regulations related to the cosmetic products

- Opportunities

- Upsurge in demand for personal care products in developing countries

- Challenges

- Expensiveness of cosmetic products

- Global Personal Care Ingredients Market Analysis and Projection, By Ingredient Type

- Segment Overview

- Emollients

- Surfactants

- Emuslifiers

- Rheology Modifiers

- Conditioning Polymers

- Others

- Global Personal Care Ingredients Market Analysis and Projection, By Application

- Segment Overview

- Skin Care

- Hair Care

- Oral Care

- Make-up

- Others

- Global Personal Care Ingredients Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Personal Care Ingredients Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Personal Care Ingredients Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Ingredient Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Ashland Global Holdings Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- BASF SE

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Berkshire Hathaway Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Clariant AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Croda International Plc

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- DOW, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Evonik Industries AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- M. Huber Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- KCC Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Solvay S.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Ingredient Type Portfolio

- Recent Developments

- SWOT Analysis

- Ashland Global Holdings Inc.

List of Table

- Global Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Global Emollients Market, By Region, 2021–2029(USD Billion)

- Global Surfactants Market, By Region, 2021–2029(USD Billion)

- Global Emuslifiers Market, By Region, 2021–2029(USD Billion)

- Global Rheology Modifiers Market, By Region, 2021–2029(USD Billion)

- Global Conditioning Polymers Market, By Region, 2021–2029(USD Billion)

- Global Others Market, By Region, 2021–2029(USD Billion)

- Global Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Global Skin Care Personal Care Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Hair Care Application Personal Care Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Oral Care Personal Care Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Make-up Personal Care Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Others Personal Care Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Personal Care Ingredients Market, By Region, 2021–2029(USD Billion)

- Global Personal Care Ingredients Market, By North America, 2021–2029(USD Billion)

- North America Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- North America Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- USA Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- USA Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Canada Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Canada Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Mexico Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Mexico Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Europe Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Europe Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Germany Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Germany Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- France Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- France Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- UK Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- UK Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Italy Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Italy Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Spain Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Spain Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Asia Pacific Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Japan Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Japan Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- China Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- China Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- India Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- India Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- South America Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- South America Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Brazil Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Brazil Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- Middle East and Africa Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- UAE Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- UAE Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

- South Africa Personal Care Ingredients Market, By Ingredient Type, 2021–2029(USD Billion)

- South Africa Personal Care Ingredients Market, By Application, 2021–2029(USD Billion)

List of Figures

- Global Personal Care Ingredients Market Segmentation

- Personal Care Ingredients Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Personal Care Ingredients Market Attractiveness Analysis By Ingredient Type

- Global Personal Care Ingredients Market Attractiveness Analysis By Application

- Global Personal Care Ingredients Market Attractiveness Analysis By Region

- Global Personal Care Ingredients Market: Dynamics

- Global Personal Care Ingredients Market Share By Ingredient Type(2021 & 2029)

- Global Personal Care Ingredients Market Share By Application(2021 & 2029)

- Global Personal Care Ingredients Market Share by Regions (2021 & 2029)

- Global Personal Care Ingredients Market Share by Company (2020)