Prepreg Market Size by Type of Fiber Reinforcement (Carbon Fiber Prepreg, Glass Fiber Prepreg, and Others), Resin Type (Thermoset Prepreg and Thermoplastic Prepreg), Form (Tow Prepreg and Fabric Prepreg), Manufacturing Process (Hot-Melt Process and Solvent Dip Process), Application (Aerospace & Defense, Wind Energy, Automotive, Sporting Goods, Electronics (PCB), and Others), Regions, Segmentation, and Projection till 2029

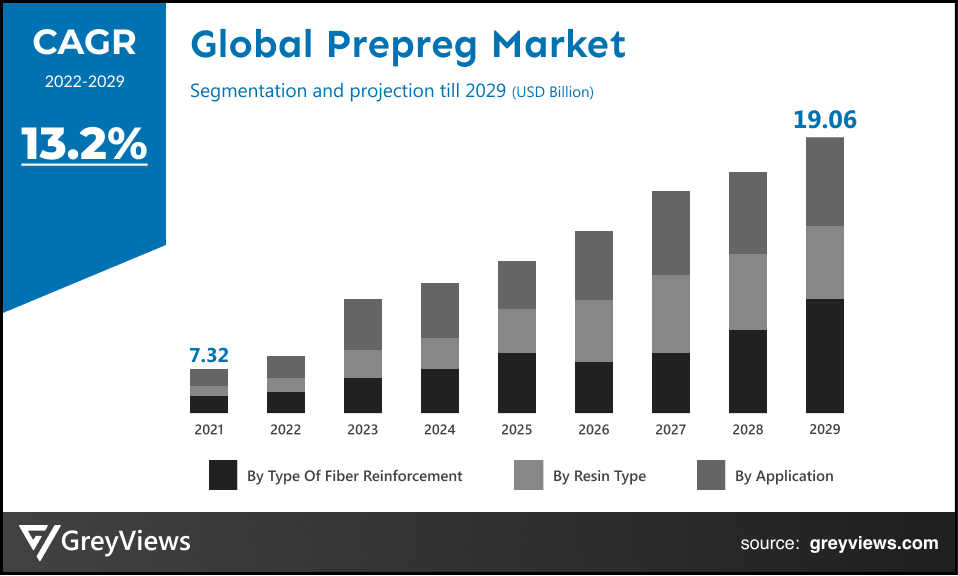

CAGR: 13.2%Current Market Size: USD 7.32 billion Fastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Prepreg- Market Overview

The global prepreg market is expected to grow from USD 7.32 billion in 2021 to USD 19.06 billion by 2029, at a CAGR of 13.2% during the Projection period 2022-2029. This growth of the market is driven by rapid demand for prepreg in end-user industries such as aerospace & defense, wind energy, electronics, automotive, and sporting goods.

Prepregs is the composite material that comprises a high-strength reinforcement fiber pre-impregnated with a thermoset or a thermoplastic resin. The process of resin impregnation accurately controls the fiber to resin ratio. It offers several benefits such as maximum strength properties, part uniformity and repeatability, less waste, and less curing time. However, the prepregs are pricey and can be stored for about six months at room temperature.

Prepregs are generally used for high-performance applications where weight and mechanical properties take precedence over the cost in industries such as aerospace, sports, military, automotive, and wind energy. For instance, prepreg fibers with greater strength and light weight are essential for the aircraft manufacturing industry. There is a significant trend of replacing traditional materials with lightweight composites for producing lightweight aircraft to decrease emissions, increase fuel efficiency, and reduce material usage, creating the demand for prepregs.

Request Sample:- Global Prepreg Market

Market Dynamics:

Drivers:

- The surge in demand for lightweight materials from the automotive industry

Significant research and development into lightweight materials are going on in the global automotive industry for lowering the cost, increase the ability of the materials to be recycled, maximize the fuel economy, and enabling materials integration into vehicles. Hence, in current times, carbon fiber-reinforced polymer (CFRP) and glass fiber-reinforced polymer (GFRP) is being used as a substitute for aluminum and steel in the automotive sector. The glass fiber and carbon fiber prepregs are lighter than steel by about 15–20%, and 50–70% respectively. Also, the weight of a vehicle can be reduced by about 60% by using such prepreg parts. Hence, demand for lightweight materials from the automotive industry drives the growth of the global prepreg market.

- Increasing usage of prepreg materials in the wind energy industry

In the wind energy sector, carbon fiber composites have seen high-potential applications such as turbine blades. This is mainly attributed to the high tensile and compressive strength of prepreg materials. For instance, recently, Hexcel Corporation, an American public industrial materials company expanded its supply agreement with Vestas Wind Systems A/S, a Danish manufacturer, seller, installer, and servicer of wind turbines to provide composite materials for new generation wind blades. Such agreements among wind energy industry players and prepreg materials companies are fueling the growth of the global market.

Restraints:

- High cost of processing and manufacturing

At present, prepregs are seeing a dramatic surge in applications across aerospace, wind, and other industries. However, its usage is restricted due to its high material and manufacturing costs. For instance, carbon fiber prepregs are presently being used only in the manufacture of racing cars as well as some high-end sports cars owing to their significantly high cost.

Opportunities:

- The emergence of innovative software tools for prepreg product development

In June 2021, Rassini, a Mexico-based technology company in composite vehicle suspension systems adopted the HexPly M901 prepreg system by Hexcel, a global provider of advanced composites technologies to accelerate prototype and new product development cycles. This has helped Rassini to decrease the total time to market with an easy to process material solution and enable an effective early-stage design screening and cost-effective production. The emergence of innovative software tools such as the HexPly M901 prepreg system for prepreg product development is expected to create lucrative growth opportunities for the market in upcoming years.

Challenges

- The declining economy and slow market recovery from COVID-19

The global COVID-19 pandemic has forced all industries to change the way of managing assets and workforces. In addition, the global automotive sector has seen disruption in supply chains due to large-scale manufacturing interruptions within Europe, the closure of assembly plants in the U.S., and disruption in Chinese parts exports. This situation has led to drastic changes in demand for prepreg materials across the globe due to a decreased demand from the aerospace & defense and automotive industries. However, the aforementioned industries are seeing a slow recovery rate; this factor may pose challenges to the growth of the market.

Segmentation Analysis:

The global prepreg market has been segmented based on the type of fiber reinforcement, resin type, form, manufacturing process, application, and regions.

By type of fiber reinforcement

The type of fiber reinforcement segment includes carbon fiber prepreg, glass fiber prepreg, and others. The carbon fiber prepreg segment led the prepreg market with a market share of around 78.32% in 2021. This is attributed to the rising usage of carbon fiber composite materials as alternatives for metal components by automotive parts manufacturers due to concerns about fuel consumption and CO2 emissions. In addition, as compared with the traditional forms of composites manufacturing, carbon fiber prepreg enables improved production performance and reduced manufacturing costs. The aforementioned factors are fueling the growth of this segment.

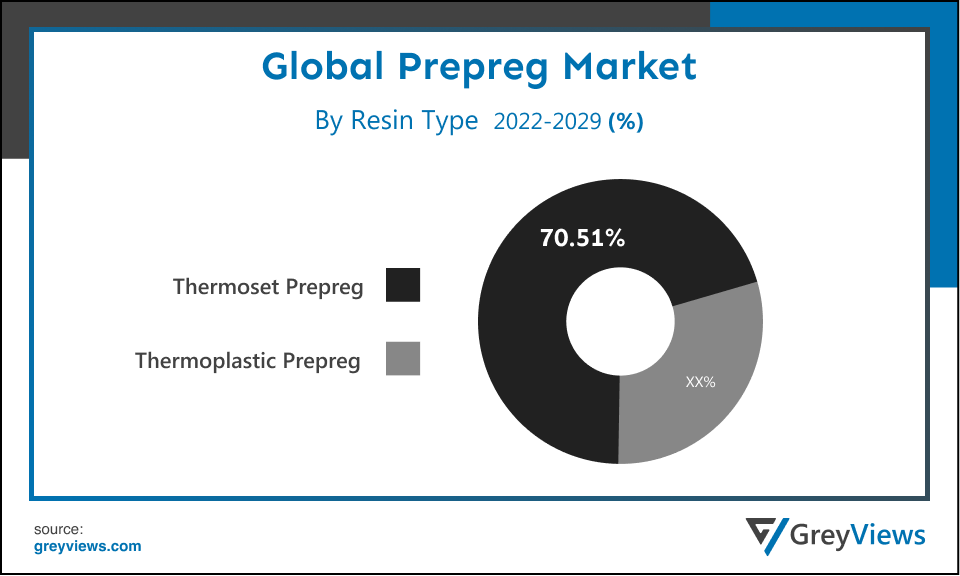

By Resin Type

The resin type segment includes thermoset prepreg and thermoplastic prepreg. The thermoset prepreg segment led the prepreg market with a market share of around 70.51% in 2021. These prepregs are the synthetic polymer-reinforced fibers pre-impregnated with high-grade resins. Such materials turn into exceptionally strong and durable after heating, while being exceptionally lightweight as compared with the traditional metallic solutions. Such features of thermoset prepreg are the primary factor contributing to the growth of this segment.

By Application

The application segment includes aerospace & defense, wind energy, automotive, sporting goods, electronics (PCB), and others. The aerospace & defense segment led the prepreg market with a market share of around 39.04% in 2021. The upsurge in demand for highly lightweight and durable aircraft parts has primarily driven the growth of this segment. In addition, the market players are developing innovative prepreg solutions for the aerospace industry, creating lucrative growth opportunities for the segment. For instance, in March 2021, Toray Industries Inc. announced the development of carbon-fiber-reinforced plastic (CFRP) prepreg for advanced aerospace applications.

By Regional Analysis

The regions analyzed for the prepreg market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. North America region dominated the prepreg market and held the 41.03% share of the market revenue in 2021.

- The North American region has registered the highest value for the year 2021. The growth of this region is mainly driven by the rapid expansion of the aerospace and defense industry coupled with the upsurge in the production of airframe and aircraft parts. In addition, the new product development trend in this region is opportunistic for the growth of the market. For instance, in July 2021, Toray Composite Materials America, Inc., a supplier of carbon fiber materials and advanced composite prepreg launched Toray 2700, an Epoxy-based high-performance, patented resin technology mainly focused on applications in emerging aerospace programs.

- Asia-Pacific is expected to witness the highest growth rate during the Projection period. The growth of this region is driven by the increasing application of prepreg across the highest growing industries such as automotive and renewable energy. In addition, the factors such as the significant presence of tire one manufacturers and growing wind installation capacities in the region are expected to create lucrative growth opportunities for the market.

Global Prepreg Market - Country Analysis

- Germany

Germany's prepreg market size was valued at USD 0.93 billion in 2021 and is expected to reach USD 2.39 billion by 2029, at a CAGR of 12.9% from 2022 to 2029. Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. Growing demand for prepreg material in wind energy system installation across Germany has primarily driven the growth of the market. In addition, the expansion of global industry players in the country is opportunistic for the growth of the market. For instance, in January 2020, Mitsubishi Chemical Corporation, a Japanese company announced to the acquisition of c-m-p GmbH, a German carbon fiber prepreg manufacturer to strengthen its presence in the carbon fiber composite material business.

- China

China's prepreg market size was valued at USD 1.06 billion in 2021 and is expected to reach USD 2.73 billion by 2029, at a CAGR of 13.0% from 2022 to 2029. China is a leading automotive producer, consumer, and exporter. For instance, the country continues to be the largest vehicle market by both manufacturing output and annual sales, with domestic production anticipated to reach 35 million vehicles by 2025. Hence, the huge demand for prepreg materials from the automotive sector in China drives the growth of the market.

- India

India's prepreg market size was valued at USD 0.55 billion in 2021 and is expected to reach USD 1.46 billion by 2029, at a CAGR of 13.4% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the emerging popularity of prepreg in this country is expected to create lucrative growth opportunities for the market.

The demand for prepreg from wind energy applications in the country is opportunistic for the growth of the market. The Government of India is promoting wind power projects around the country through private sector investments by providing different financial and fiscal incentives.

Key Industry Players Analysis:

To increase their market position in the global Prepreg business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Solvay Group

- Hexcel Corporation

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Holdings Corporation

- SGL Group

- Axiom Materials

- Gurit Holding AG

- Park Aerospace Corp.

- Plastic Reinforcement Fabrics Ltd.

Latest Development

- In May 2022, Solvay Group introduced SolvaLite 714 Prepregs, an essential addition to its wide portfolio of composite materials for the automotive industry. This offering is the new generation of unidirectional carbon-fiber and woven-fabric products pre-impregnated with SolvaLite 714 epoxy resin.

- In October 2021, Renegade Materials Corporation, the carbon fiber subsidiary of Teijin Limited and a leading U.S.-based supplier of highly heat-resistant thermoset prepregs for the aerospace industry announced the expansion of its prepreg production by 2.5 times approximately.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year considered |

2021 |

|

CAGR (%) |

13.2% |

|

Market Size |

7.32 billion in 2021 |

|

Projection period |

2021-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Type of Fiber Reinforcement, Resin Type, Form, Manufacturing Process, Application, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Solvay Group, Hexcel Corporation, Toray Industries, Inc., Teijin Limited, Mitsubishi Chemical Holdings Corporation, SGL Group, Axiom Materials, Gurit Holding AG, Park Aerospace Corp., Plastic Reinforcement Fabrics Ltd. among others |

|

By Type of Fiber Reinforcement |

|

|

By Resin Type |

|

|

By Form |

|

|

By Manufacturing Process |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Prepreg Market by Type of Fiber Reinforcement:

- Carbon Fiber Prepreg

- Glass Fiber Prepreg

- Others

Global Prepreg Market by Resin Type:

- Thermoset Prepreg

- Thermoplastic Prepreg

Global Prepreg Market by Form:

- Tow Prepreg

- Fabric Prepreg

Global Prepreg Market by Manufacturing Process:

- Hot-Melt Process

- Solvent Dip Process

Global Prepreg Market by Application:

- Aerospace & Defense

- Wind Energy

- Automotive

- Sporting Goods

- Electronics (PCB)

- Others

Global Prepreg Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

Which Region dominate the Global Prepreg Market?

North America region dominated the prepreg market and held the 41.03% share of the market revenue in 2021

What are the Application of Prepreg?

The application segment includes aerospace & defense, wind energy, automotive, sporting goods, electronics (PCB), and others. The aerospace & defense segment led the prepreg market with a market share of around 39.04% in 2021. The upsurge in demand for highly lightweight and durable aircraft parts has primarily driven the growth of this segment. In addition, the market players are developing innovative prepreg solutions for the aerospace industry, creating lucrative growth opportunities for the segment. For instance, in March 2021, Toray Industries Inc. announced the development of carbon-fiber-reinforced plastic (CFRP) prepreg for advanced aerospace applications.

What are the Opportunities in Prepreg Market?

In June 2021, Rassini, a Mexico-based technology company in composite vehicle suspension systems adopted the HexPly M901 prepreg system by Hexcel, a global provider of advanced composites technologies to accelerate prototype and new product development cycles. This has helped Rassini to decrease the total time to market with an easy to process material solution and enable an effective early-stage design screening and cost-effective production. The emergence of innovative software tools such as the HexPly M901 prepreg system for prepreg product development is expected to create lucrative growth opportunities for the market in upcoming years.

What will be the effect of Prepreg on Environment?

The rising usage of carbon fiber composite materials as alternatives for metal components by automotive parts manufacturers due to concerns about fuel consumption and CO2 emissions. In addition, as compared with the traditional forms of composites manufacturing, carbon fiber prepreg enables improved production performance and reduced manufacturing costs

Which Country in APAC hold the large market Share in Prepreg Market?

China's prepreg market size was valued at USD 1.06 billion in 2021 and is expected to reach USD 2.73 billion by 2029, at a CAGR of 13.0% from 2022 to 2029. China is a leading automotive producer, consumer, and exporter. For instance, the country continues to be the largest vehicle market by both manufacturing output and annual sales, with domestic production anticipated to reach 35 million vehicles by 2025. Hence, the huge demand for prepreg materials from the automotive sector in China drives the growth of the market.

What are the latest Development in Prepreg Market?

In May 2022, Solvay Group introduced SolvaLite 714 Prepregs, an essential addition to its wide portfolio of composite materials for the automotive industry. This offering is the new generation of unidirectional carbon-fiber and woven-fabric products pre-impregnated with SolvaLite 714 epoxy resin.

What will be market valuation of Global Prepreg market in 2029?

Global prepreg market is expected to grow from USD 7.32 billion in 2021 to USD 19.06 billion by 2029, at a CAGR of 13.2% during the Projection period 2022-2029

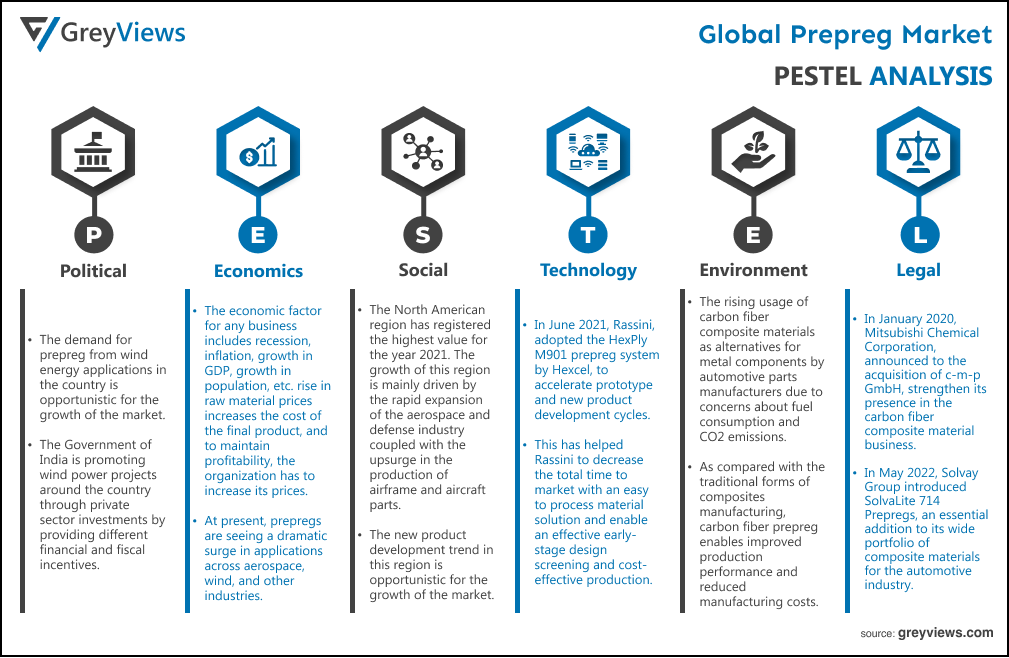

Political Factors- The demand for prepreg from wind energy applications in the country is opportunistic for the growth of the market. The Government of India is promoting wind power projects around the country through private sector investments by providing different financial and fiscal incentives.

Economical Factors- The economic factor for any business includes recession, inflation, growth in GDP, growth in population, etc. rise in raw material prices increases the cost of the final product, and to maintain profitability, the organization has to increase its prices. The organization can leverage this trend by expanding its product range and targeting new customers. At present, prepregs are seeing a dramatic surge in applications across aerospace, wind, and other industries. However, its usage is restricted due to its high material and manufacturing costs. For instance, carbon fiber prepregs are presently being used only in the manufacture of racing cars as well as some high-end sports cars owing to their significantly high cost.

Social Factor- The North American region has registered the highest value for the year 2021. The growth of this region is mainly driven by the rapid expansion of the aerospace and defense industry coupled with the upsurge in the production of airframe and aircraft parts. In addition, the new product development trend in this region is opportunistic for the growth of the market. For instance, in July 2021, Toray Composite Materials America, Inc., a supplier of carbon fiber materials and advanced composite prepreg launched Toray 2700, an Epoxy-based high-performance, patented resin technology mainly focused on applications in emerging aerospace programs.

Technological Factors- In June 2021, Rassini, a Mexico-based technology company in composite vehicle suspension systems adopted the HexPly M901 prepreg system by Hexcel, a global provider of advanced composites technologies to accelerate prototype and new product development cycles. This has helped Rassini to decrease the total time to market with an easy to process material solution and enable an effective early-stage design screening and cost-effective production. The emergence of innovative software tools such as the HexPly M901 prepreg system for prepreg product development is expected to create lucrative growth opportunities for the market in upcoming years.

Environmental Factors- The rising usage of carbon fiber composite materials as alternatives for metal components by automotive parts manufacturers due to concerns about fuel consumption and CO2 emissions. In addition, as compared with the traditional forms of composites manufacturing, carbon fiber prepreg enables improved production performance and reduced manufacturing costs.

Legal Factors- In January 2020, Mitsubishi Chemical Corporation, a Japanese company announced to the acquisition of c-m-p GmbH, a German carbon fiber prepreg manufacturer to strengthen its presence in the carbon fiber composite material business. Furthermore, in May 2022, Solvay Group introduced SolvaLite 714 Prepregs, an essential addition to its wide portfolio of composite materials for the automotive industry. This offering is the new generation of unidirectional carbon-fiber and woven-fabric products pre-impregnated with SolvaLite 714 epoxy resin.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type of Fiber Reinforcement

- Market Attractiveness Analysis By Resin Type

- Market Attractiveness Analysis By Form

- Market Attractiveness Analysis By Manufacturing Process

- Market Attractiveness Analysis By Application

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Surge in demand for lightweight materials from automotive industry

- Increasing usage of prepreg materials in wind energy industry

- Restrains

- High cost of processing and manufacturing

- Opportunities

- Emergence of innovative software tools for prepreg product development

- Challenges

- Declining economy and slow market recovery from COVID-19

- Global Prepreg Market Analysis and Projection, By Type of Fiber Reinforcement

- Segment Overview

- Carbon Fiber Prepreg

- Glass Fiber Prepreg

- Others

- Global Prepreg Market Analysis and Projection, By Resin Type

- Segment Overview

- Thermoset Prepreg

- Thermoplastic Prepreg

- Global Prepreg Market Analysis and Projection, By Form

- Segment Overview

- Tow Prepreg

- Fabric Prepreg

- Global Prepreg Market Analysis and Projection, By Manufacturing Process

- Segment Overview

- Hot-Melt Process

- Solvent Dip Process

- Global Prepreg Market Analysis and Projection, By Application

- Segment Overview

- Aerospace & Defense

- Wind Energy

- Automotive

- Sporting Goods

- Electronics (PCB)

- Others

- Global Prepreg Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Prepreg Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Prepreg Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type of Fiber Reinforcement Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Solvay Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Hexcel Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Toray Industries, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Teijin Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Mitsubishi Chemical Holdings Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- SGL Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Axiom Materials

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Gurit Holding AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Park Aerospace Corp.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Plastic Reinforcement Fabrics Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type of Fiber Reinforcement Portfolio

- Recent Developments

- SWOT Analysis

- Solvay Group

List of Table

- Global Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Global Carbon Fiber Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Glass Fiber Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Others Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Global Thermoset Prepreg Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Thermoplastic Prepreg Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Prepreg Market, By Form, 2021–2029(USD Billion)

- Global Tow Prepreg Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Fabric Prepreg Form Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Global Hot-Melt Process Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Solvent Dip Process Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Prepreg Market, By Application, 2021–2029(USD Billion)

- Global Aerospace & Defense Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Wind Energy Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Automotive Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Sporting Goods Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Electronics (PCB) Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Others Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Prepreg Market, By Region, 2021–2029(USD Billion)

- Global Prepreg Market, By North America, 2021–2029(USD Billion)

- North America Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- North America Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- North America Prepreg Market, By Form, 2021–2029(USD Billion)

- North America Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- North America Prepreg Market, By Application, 2021–2029(USD Billion)

- USA Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- USA Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- USA Prepreg Market, By Form, 2021–2029(USD Billion)

- USA Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- USA Prepreg Market, By Application, 2021–2029(USD Billion)

- Canada Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Canada Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Canada Prepreg Market, By Form, 2021–2029(USD Billion)

- Canada Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Canada Prepreg Market, By Application, 2021–2029(USD Billion)

- Mexico Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Mexico Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Mexico Prepreg Market, By Form, 2021–2029(USD Billion)

- Mexico Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Mexico Prepreg Market, By Application, 2021–2029(USD Billion)

- Europe Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Europe Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Europe Prepreg Market, By Form, 2021–2029(USD Billion)

- Europe Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Europe Prepreg Market, By Application, 2021–2029(USD Billion)

- Germany Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Germany Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Germany Prepreg Market, By Form, 2021–2029(USD Billion)

- Germany Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Germany Prepreg Market, By Application, 2021–2029(USD Billion)

- France Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- France Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- France Prepreg Market, By Form, 2021–2029(USD Billion)

- France Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- France Prepreg Market, By Application, 2021–2029(USD Billion)

- UK Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- UK Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- UK Prepreg Market, By Form, 2021–2029(USD Billion)

- UK Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- UK Prepreg Market, By Application, 2021–2029(USD Billion)

- Italy Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Italy Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Italy Prepreg Market, By Form, 2021–2029(USD Billion)

- Italy Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Italy Prepreg Market, By Application, 2021–2029(USD Billion)

- Spain Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Spain Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Spain Prepreg Market, By Form, 2021–2029(USD Billion)

- Spain Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Spain Prepreg Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Asia Pacific Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Asia Pacific Prepreg Market, By Form, 2021–2029(USD Billion)

- Asia Pacific Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Asia Pacific Prepreg Market, By Application, 2021–2029(USD Billion)

- Japan Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Japan Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Japan Prepreg Market, By Form, 2021–2029(USD Billion)

- Japan Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Japan Prepreg Market, By Application, 2021–2029(USD Billion)

- China Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- China Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- China Prepreg Market, By Form, 2021–2029(USD Billion)

- China Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- China Prepreg Market, By Application, 2021–2029(USD Billion)

- India Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- India Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- India Prepreg Market, By Form, 2021–2029(USD Billion)

- India Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- India Prepreg Market, By Application, 2021–2029(USD Billion)

- South America Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- South America Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- South America Prepreg Market, By Form, 2021–2029(USD Billion)

- South America Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- South America Prepreg Market, By Application, 2021–2029(USD Billion)

- Brazil Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Brazil Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Brazil Prepreg Market, By Form, 2021–2029(USD Billion)

- Brazil Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Brazil Prepreg Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- Middle East and Africa Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- Middle East and Africa Prepreg Market, By Form, 2021–2029(USD Billion)

- Middle East and Africa Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- Middle East and Africa Prepreg Market, By Application, 2021–2029(USD Billion)

- UAE Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- UAE Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- UAE Prepreg Market, By Form, 2021–2029(USD Billion)

- UAE Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- UAE Prepreg Market, By Application, 2021–2029(USD Billion)

- South Africa Prepreg Market, By Type of Fiber Reinforcement, 2021–2029(USD Billion)

- South Africa Prepreg Market, By Resin Type, 2021–2029(USD Billion)

- South Africa Prepreg Market, By Form, 2021–2029(USD Billion)

- South Africa Prepreg Market, By Manufacturing Process, 2021–2029(USD Billion)

- South Africa Prepreg Market, By Application, 2021–2029(USD Billion)

List of Figures

- Global Prepreg Market Segmentation

- Prepreg Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Prepreg Market Attractiveness Analysis By Type of Fiber Reinforcement

- Global Prepreg Market Attractiveness Analysis By Resin Type

- Global Prepreg Market Attractiveness Analysis By Form

- Global Prepreg Market Attractiveness Analysis By Manufacturing Process

- Global Prepreg Market Attractiveness Analysis By Application

- Global Prepreg Market Attractiveness Analysis By Region

- Global Prepreg Market: Dynamics

- Global Prepreg Market Share By Type of Fiber Reinforcement(2021 & 2028)

- Global Prepreg Market Share By Resin Type(2021 & 2028)

- Global Prepreg Market Share By Form(2021 & 2028)

- Global Prepreg Market Share By Manufacturing Process(2021 & 2028)

- Global Prepreg Market Share By Application (2021 & 2028)

- Global Prepreg Market Share by Regions (2021 & 2028)

- Global Prepreg Market Share by Company (2020)