Printed Electronics Market Size By Material (Ink and substrate), Technology (Inkjet Printing, Screen Printing, Flexographic Printing, Gravure Printing, and Other), Applications (Displays, RFID Tags, Batteries, Photovoltaic Cells, Lighting, and Others), End-Use Industry (Automotive & Transportation, Healthcare, Consumer Electronics, Aerospace & Defense, Construction & Architecture, Retail & Packaging, and Others) and Regions, Segmentation, and Projection till 2029

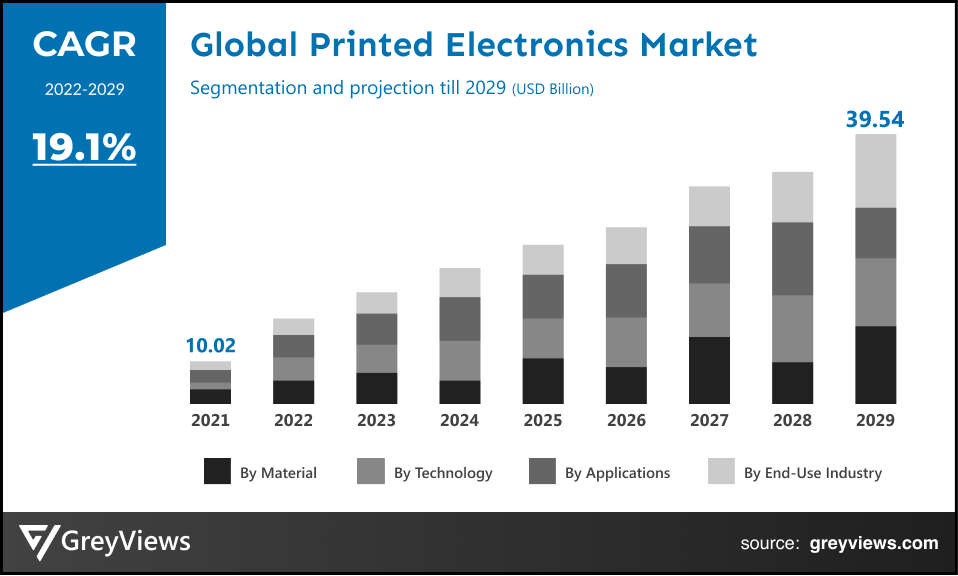

CAGR: 19.1%Current Market Size: USD 10.02 BillionFastest Growing Region: Europe

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Printed Electronics- Market Overview:

The global printed electronics market is expected to grow from USD 10.02 billion in 2021 to USD 39.54 billion by 2029, at a CAGR of 19.1% during the Projection period 2022-2029. Upsurge in the adoption of IoT across the end-use industries along with the significant growth of the consumer electronics sector has primarily driven the growth of the global printed electronics market.

Printed electronics involves a process of using printing technology for the production of different types of electronic goods, including electronic circuits, sensors, displays, and RFID. It is the process of printing circuits on different flexible substrates to create electronic solutions. The various electronic printing techniques includes screen printing, rotogravure printing, vacuum evaporation, offset, roll-to-roll, flexographic, spin-coating, and inkjet printing.

Printed electrics is an innovative term in the global electronics sector with several benefits. For instance, it replaces bulky electronics components and makes the final product more innovative and thinner. In addition, it is easier to incorporate into various applications and components and offers advantageous features such as attractive and customizable design, Cost-effectiveness, and lightweight.

Request Sample: - Global Printed Electronics Market

Market Dynamics:

Drivers:

- Growth of the global consumer electronics sector

The demand for the latest consumer electronic devices has been trending for past years and is expected to grow substantially in the upcoming years. In addition, the growth of global economies has fueled demand for consumer electronics due to the increased disposable income of the population. However, the consumer electronics sector is looking for faster, lighter, thinner, and more flexible electronics solutions. Hence, the growth of the global consumer electronics sector boosts the growth of the printed electrics market.

- Lucrative benefits and applications associated with the printed electronics

The features, including security, flexibility, and cost-effectiveness, make printed electronics appealing to an extensive range of industries. In addition, printed electronics have the potential to reduce technical constraints and costs related to the mass production of electronics. Moreover, it facilitates wide-ranging development of non-conventional functional electronic devices such as flexible displays, active clothing, smart labels, and animated posters, among others. All of the factors mentioned above contribute to the global market growth.

Restraints:

- Product lifecycle and performance issues

Printed electronics offer low performance as compared with conventional electronics. In addition, the product life cycle of products manufactured by integration of printed electronics is short in comparison to long life cycle of products manufactured with the help of conventional electronics techniques. Such factors may hamper the growth of the printed electronics market to some extent.

Opportunities:

- The emergence of 5G and Electric Vehicles

Emerging interest and inevitable move towards 5G technology created new material opportunities in the electronics sector for the printed electronics market. On the other hand, electric vehicle (EV) battery capacity significantly depends on temperature. Hence, there is a huge demand for printed arrays of temperature sensors to enable local monitoring. Therefore, the rising move toward more connectivity and weight reduction in autonomous vehicles and EVs opens lucrative growth opportunities for printed electronics.

Challenges

- Increased competition among the market players

The global electronics manufacturing industry has become significantly competitive. This has made companies operating in the printed electronics industry compete for market share; however, the new entrants are continuously entering the market. Due to this competition, market players are under pressure to reduce the prices of electronics products impacting their margins and profitability. This is a prominent challenge in the global printed electronics market.

Segmentation Analysis:

The global printed electronics market has been segmented based on material, technology, applications, end-use industry, and regions.

By Material

The material offering segment includes ink and substrate. The inked segment led the printed electronics market with a market share of around 72.34% in 2021. Upsurge in the application of printed electronics across different industries has enabled the significant adoption of inks. In addition, the market players are introducing innovative inks for printed electronics applications, fueling the growth of the segment. For instance, in August 2020, Kunal Enterprise, the solution provider in Printing/ Packaging Industry in collaboration with Saralon GmbH introduced Saral, the brand name of innovative Ink for Printed Electronics.

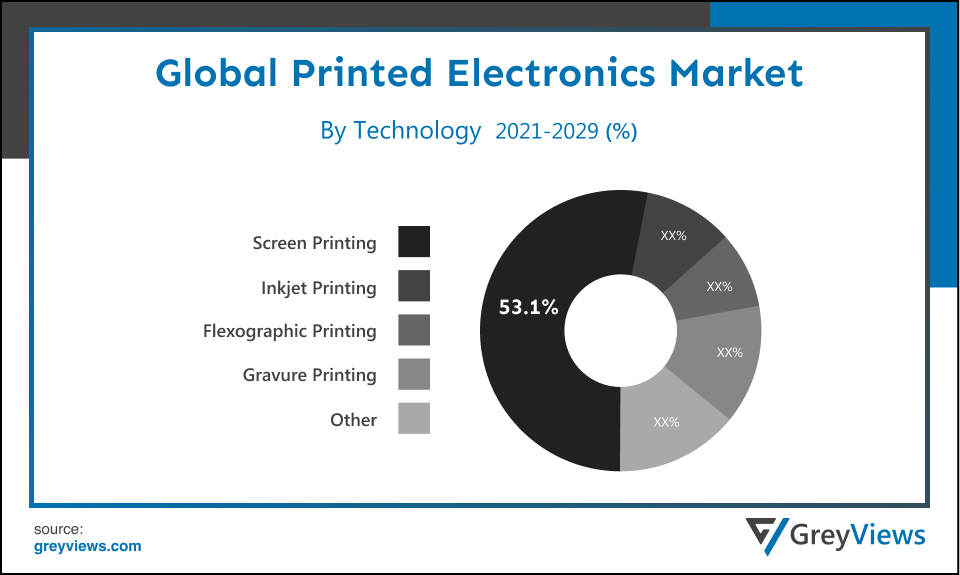

By Technology

The technology segment includes inkjet printing, screen printing, flexographic printing, gravure printing, and others. The screen-printing technology segment led the Printed electronics market with a market share of around 53.1% in 2021. The durable outputs and high quality associated with the screen-printing technology is the major factor contributing to the growth of this segment. In addition, screen printing is compatible with an extensive range of material viscosities as compared with inkjet printing technologies. This advantage, among others, has further led to the rising preference for screen printing technology.

By End User Industry

The end-use industry segment includes automotive & transportation, healthcare, consumer electronics, aerospace & defense, construction & architecture, retail & packaging, and others. The consumer electronics segment led the Printed electronics market with a market share of around 32.4% in 2021. The rising shift among the consumers preference toward printed electronics in wearable devices. In addition, rising demand for improving the functionality and improved electrical performance of consumer electronics devices is projected to boost the growth of this segment.

Global Printed Electronics Market- By Regional Analysis:

The regions analyzed for the Printed Electronics market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. Asia-Pacific region dominated the Printed electronics market and held the 40.76% share of the market revenue in 2021.

- The Asia-Pacific region witnessed a major share. This is mainly attributed to the fact that the Asia-Pacific region has become a manufacturing hub for electronic components and devices. In addition, the countries such as China, India, Japan, and South Korea are seeing increased investments in the electronics sector along with the large-scale production of electronic components.

- North America and Europe region are expected to witness a considerable growth rate during the Projection period. The growth of these regions is mainly driven by significant R&D investment in the printed electronics market, the proliferation of electric vehicles, and demand for advanced consumer electronics products.

Global Printed Electronics Market- Country Analysis:

- Germany

Germany printed electronics market size was valued at USD 1.10 billion in 2021 and is expected to reach USD 4.32 billion by 2029, at a CAGR of 19.0% from 2022 to 2029.

Germany is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries. In Europe, Germany is the leading electronics market in production and sales. In addition, the country is recognized as the leader in research and innovation in microelectronics production. For instance, in November 2020, Merck KGaA officially launched its new Research Center for electronic applications at the headquarters in Darmstadt, Germany. The company has invested about $52.34 million in this research hub to further advance the innovation for the display and semiconductor sectors.

- China

China printed electronics market size was valued at USD 2.10 billion in 2021 and is expected to reach USD 8.19 billion by 2029, at a CAGR of 18.9% from 2022 to 2029. China is the electronics manufacturing hub across the globe. In addition, the Chinese government is introducing innovative plans to expand its domestic electronics manufacturing sector. For instance, in January 2021, the Chinese government introduced expansion plans for the domestic electronic components market to $327 billion by 2023. Such plans are opportunistic for the growth of the China printed electronics market.

- India

India's Printed electronics market size was valued at USD 0.78 billion in 2021 and is expected to reach USD 3.11 billion by 2029, at a CAGR of 19.2% from 2022 to 2029. In India, the electronics sector contributes about 3.4% of the country's Gross Domestic Product (GDP). On the other hand, in January 2022, the Ministry of Electronics and Information Technology and the India Cellular and Electronics Association (ICEA) released a five-year roadmap and vision for the electronics sector in the country. As per this roadmap, electronics manufacturing in the country is expected to reach $300 Billion by 2026. This huge market of electronics manufacturing is opportunistic for the growth of the Indian printed electronics market.

Key Industry Players Analysis:

To increase their market position in the global Printed electronics business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Samsung Electronics Co., Ltd.

- LG Display Co., Ltd.

- Molex, LLC

- Agfa-Gevaert Group

- Palo Alto Research Center Incorporated

- DuPont de Nemours, Inc.

- Nissha Co., Ltd.

- BASF

- NovaCentrix

- E Ink Holdings Inc.

Latest Development:

- In November 2021, DuPont acquired Rogers Corporation, a engineered materials and components provider. This acquisition has strengthened the advanced technology solutions offering DuPont competitive advantages.

- In April 2021, E Ink Holdings, the innovator of electronic ink technology, signed an agreement with DATA MODUL, the provider of the display, embedded, touch, monitor, and panel PC solutions. Through this agreement, the DATA MODUL is projected to become a reseller, focusing on the European and the U.S. markets.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 19.1% |

| Market Size | 10.02 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | Material, Technology, Applications, End Use Industry, and Regions |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Samsung Electronics Co., Ltd., LG Display Co., Ltd., Molex, LLC, Agfa-Gevaert Group, Palo Alto Research Center Incorporated, DuPont de Nemours, Inc., Nissha Co., Ltd., BASF, NovaCentrix, and E Ink Holdings Inc. among others |

By Material

|

|

By Technology

|

|

By Applications

|

|

By End Use Industry

|

|

Regional scope |

|

Scope of the Report

Global Printed Electronics Market by Material:

- Ink

- Substrate

Global Printed Electronics Market by Technology:

- Inkjet Printing

- Screen Printing

- Flexographic Printing

- Gravure Printing

- Other

Global Printed Electronics Market by Applications:

- Displays

- RFID Tags

- Batteries

- Photovoltaic Cells

- Lighting

- Others

Global Printed Electronics Market by End-Use Industry:

- Automotive & Transportation

- Healthcare

- Consumer Electronics

- Aerospace & Defense

- Construction & Architecture

- Retail & Packaging

- Others

Global Printed Electronics Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Printed electronics market?

The global printed electronics market is expected to grow from USD 10.02 billion in 2021 to USD 39.54 billion by 2029, at a CAGR of 19.1% during the Projection period 2022-2029.

Who is the end user of Printed electronics?

End-use industries are automotive & transportation, healthcare, consumer electronics, aerospace & defense, construction & architecture, retail & packaging, and others. The consumer electronics segment led the Printed electronics market with a market share of around 32.4% in 2021. The rising shift among the consumers preference toward printed electronics in wearable devices. In addition, rising demand for improving the functionality and improved electrical performance of consumer electronics devices is projected to boost the growth of this segment

What is the key driver of the Printed electronics market?

Upsurge in the adoption of IoT across the end-use industries along with the significant growth of the consumer electronics sector is primarily driving the growth of the printed electronics market.

Why China plays important role in Printed electronics market?

China is the electronics manufacturing hub across the globe. In addition, the Chinese government is introducing innovative plans to expand its domestic electronics manufacturing sector. For instance, in January 2021, the Chinese government introduced expansion plans for the domestic electronic components market to $327 billion by 2023. Such plans are opportunistic for the growth of the China printed electronics market

Which are the leading market players active in the Printed electronics market?

Leading market players active in the Samsung Electronics Co., Ltd., LG Display Co., Ltd., Molex, LLC, Agfa-Gevaert Group, Palo Alto Research Center Incorporated, DuPont de Nemours, Inc., Nissha Co., Ltd., BASF, NovaCentrix, and E Ink Holdings Inc. among others.

What is the segmentation considered for the analysis of the global Printed electronics market?

The global printed electronics market has been segmented based on material, technology, applications, end-use industry, and regions.

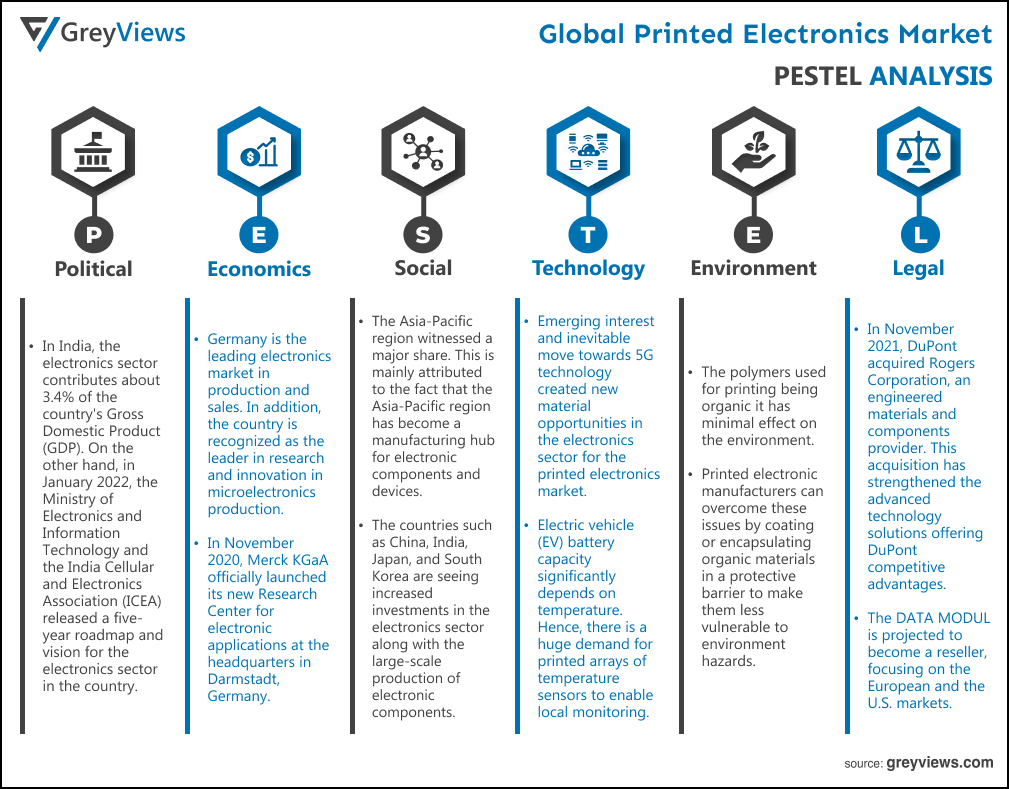

Political Factors- In India, the electronics sector contributes about 3.4% of the country's Gross Domestic Product (GDP). On the other hand, in January 2022, the Ministry of Electronics and Information Technology and the India Cellular and Electronics Association (ICEA) released a five-year roadmap and vision for the electronics sector in the country. As per this roadmap, electronics manufacturing in the country is expected to reach $300 Billion by 2026. This huge market of electronics manufacturing is opportunistic for the growth of the Indian printed electronics market.

Economic Factors- Germany is the leading electronics market in production and sales. In addition, the country is recognized as the leader in research and innovation in microelectronics production. For instance, in November 2020, Merck KGaA officially launched its new Research Center for electronic applications at the headquarters in Darmstadt, Germany. The company has invested about $52.34 million in this research hub to further advance the innovation for the display and semiconductor sectors. In January 2021, the Chinese government introduced expansion plans for the domestic electronic components market to $327 billion by 2023. Such plans are opportunistic for the growth of the China printed electronics market.

Social Factor- The Asia-Pacific region witnessed a major share. This is mainly attributed to the fact that the Asia-Pacific region has become a manufacturing hub for electronic components and devices. In addition, the countries such as China, India, Japan, and South Korea are seeing increased investments in the electronics sector along with the large-scale production of electronic components.

Technological Factors- Emerging interest and inevitable move towards 5G technology created new material opportunities in the electronics sector for the printed electronics market. On the other hand, electric vehicle (EV) battery capacity significantly depends on temperature. Hence, there is a huge demand for printed arrays of temperature sensors to enable local monitoring. Therefore, the rising move toward more connectivity and weight reduction in autonomous vehicles and EVs opens lucrative growth opportunities for printed electronics.

Environmental Factors- The polymers used for printing being organic it has minimal effect on the environment. New techniques still do not have an established method for replicating lab processes while experimenting on press. "Printed electronic manufacturers can overcome these issues by coating or encapsulating organic materials in a protective barrier to make them less vulnerable to environment hazards.

Legal Factors- In November 2021, DuPont acquired Rogers Corporation, an engineered materials and components provider. This acquisition has strengthened the advanced technology solutions offering DuPont competitive advantages. In April 2021, E Ink Holdings, the innovator of electronic ink technology, signed an agreement with DATA MODUL, the provider of the display, embedded, touch, monitor, and panel PC solutions. Through this agreement, the DATA MODUL is projected to become a reseller, focusing on the European and the U.S. markets.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Material

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By Applications

- Market Attractiveness Analysis By End Use Industry

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growth of the global consumer electronics sector

- Lucrative benefits and applications associated with the printed electronics

- Restrains

- Product lifecycle and performance issues

- Opportunities

- Emergence of 5G and Electric Vehicles

- Challenges

- Increased competition among the market players

- Global Printed Electronics Market Analysis and Projection, By Material

- Segment Overview

- Ink

- substrate

- Global Printed Electronics Market Analysis and Projection, By Technology

- Segment Overview

- Inkjet Printing

- Screen Printing

- Flexographic Printing

- Gravure Printing

- Other

- Global Printed Electronics Market Analysis and Projection, By Applications

- Segment Overview

- Displays

- RFID Tags

- Batteries

- Photovoltaic Cells

- Lighting

- Others

- Global Printed Electronics Market Analysis and Projection, By End Use Industry

- Segment Overview

- Automotive & Transportation

- Healthcare

- Consumer Electronics

- Aerospace & Defense

- Construction & Architecture

- Retail & Packaging

- Others

- Global Printed Electronics Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Printed Electronics Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Printed Electronics Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Material Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Samsung Electronics Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- LG Display Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Molex, LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Agfa-Gevaert Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Palo Alto Research Center Incorporated

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- DuPont de Nemours, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Nissha Co., Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- BASF

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- NovaCentrix

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- E Ink Holdings Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Material Portfolio

- Recent Developments

- SWOT Analysis

- Samsung Electronics Co., Ltd.

List of Table

- Global Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Global Ink Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Substrate Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Global Inkjet Printing Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Screen Printing Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Flexographic Printing Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Gravure Printing Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Other Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Global Displays Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global RFID Tags Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Batteries Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Photovoltaic Cells Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Lighting Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Others Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Global Automotive & Transportation Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Healthcare Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Consumer Electronics Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Aerospace & Defense Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Construction & Architecture Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Retail & Packaging Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Others Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Printed Electronics Market, By Region, 2021–2029(USD Billion)

- Global Printed Electronics Market, By North America, 2021–2029(USD Billion)

- North America Printed Electronics Market, By Material, 2021–2029(USD Billion)

- North America Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- North America Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- North America Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- USA Printed Electronics Market, By Material, 2021–2029(USD Billion)

- USA Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- USA Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- USA Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Canada Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Canada Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Canada Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Canada Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Mexico Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Mexico Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Mexico Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Mexico Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Europe Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Europe Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Europe Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Europe Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Germany Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Germany Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Germany Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Germany Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- France Printed Electronics Market, By Material, 2021–2029(USD Billion)

- France Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- France Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- France Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- UK Printed Electronics Market, By Material, 2021–2029(USD Billion)

- UK Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- UK Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- UK Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Italy Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Italy Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Italy Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Italy Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Spain Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Spain Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Spain Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Spain Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Asia Pacific Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Asia Pacific Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Asia Pacific Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Asia Pacific Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Japan Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Japan Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Japan Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Japan Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- China Printed Electronics Market, By Material, 2021–2029(USD Billion)

- China Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- China Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- China Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- India Printed Electronics Market, By Material, 2021–2029(USD Billion)

- India Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- India Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- India Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- South America Printed Electronics Market, By Material, 2021–2029(USD Billion)

- South America Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- South America Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- South America Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Brazil Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Brazil Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Brazil Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Brazil Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- Middle East and Africa Printed Electronics Market, By Material, 2021–2029(USD Billion)

- Middle East and Africa Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- Middle East and Africa Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- Middle East and Africa Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- UAE Printed Electronics Market, By Material, 2021–2029(USD Billion)

- UAE Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- UAE Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- UAE Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

- South Africa Printed Electronics Market, By Material, 2021–2029(USD Billion)

- South Africa Printed Electronics Market, By Technology, 2021–2029(USD Billion)

- South Africa Printed Electronics Market, By Applications, 2021–2029(USD Billion)

- South Africa Printed Electronics Market, By End Use Industry, 2021–2029(USD Billion)

List of Figures

- Global Printed Electronics Market Segmentation

- Printed Electronics Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Printed Electronics Market Attractiveness Analysis By Material

- Global Printed Electronics Market Attractiveness Analysis By Technology

- Global Printed Electronics Market Attractiveness Analysis By Applications

- Global Printed Electronics Market Attractiveness Analysis By End Use Industry

- Global Printed Electronics Market Attractiveness Analysis By Region

- Global Printed Electronics Market: Dynamics

- Global Printed Electronics Market Share By Material(2021 & 2029)

- Global Printed Electronics Market Share By Technology(2021 & 2029)

- Global Printed Electronics Market Share By Applications(2021 & 2029)

- Global Printed Electronics Market Share By End Use Industry (2021 & 2029)

- Global Printed Electronics Market Share by Regions (2021 & 2029)

- Global Printed Electronics Market Share by Company (2020)