PVC Stabilizers Market Size By Type (Calcium-based, Tin-based, Barium-based, Lead-based, and Others), By End-user (Automotive, Electrical and Electronics, Packaging, Building and Construction, Footwear, and Others), Regions, Segmentation, and Projection till 2029

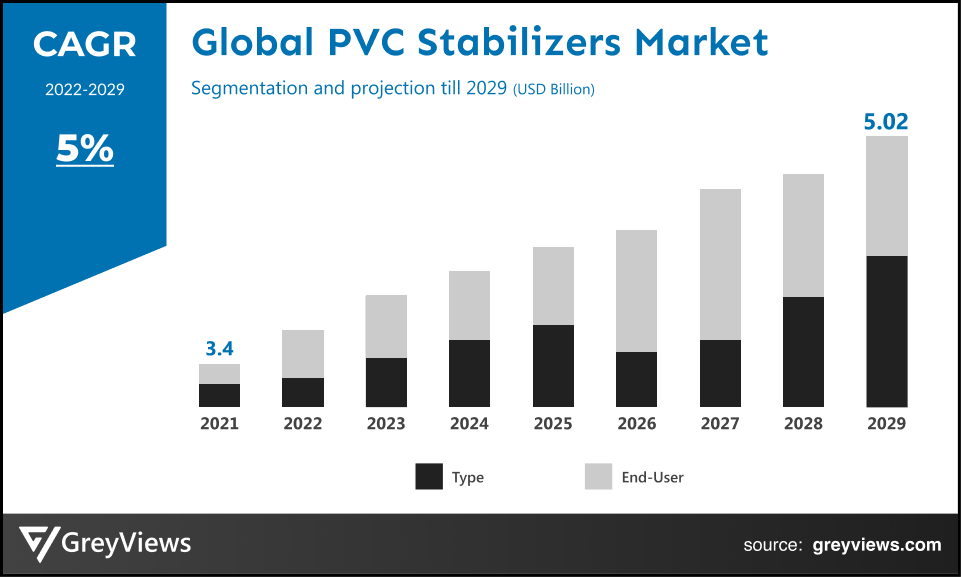

CAGR: 5%Current Market Size: USD 3.4 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global PVC Stabilizers Market- Market Overview:

The Global PVC Stabilizers market is expected to grow from USD 3.4 billion in 2021 to USD 5.02 billion by 2029, at a CAGR of 5% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the increasing usage of PVC stabilizers by end-user industries.

The most popular material across industries is polyvinyl chloride (PVC). It is very delicate and has a natural white tint. It is a synthetic resin created through the polymerization of vinyl chloride. PVC is created by polymerizing the vinyl chloride monomer. The majority of the manufacture is done by suspension polymerization. PVC is stabilized to improve its functional qualities, prevent degradation, enable processing, and boost resilience, especially in outdoor applications, weathering, and heat ageing, which substantially impact the physical qualities of PVC-finished items. PVC is used in packaging because it is clear, lightweight, flexible, affordable, and safe. Compared to other packaging materials like glass and metal, PVC also uses less energy to manufacture and transport. By halting the spread of germs throughout production, distribution, and display, it guards against contamination. PVC is frequently used in applications like electrical cables for residential buildings, vehicles, home appliances, cable coverings, insulating tapes, switch boxes, wire coverings, and protective tubes for power and telecommunications cables because of its excellent electrical insulation qualities and higher fire resistance.

Sample Request: - Global PVC Stabilizers Market

Market Dynamics:

Drivers:

- Increasing Awareness of PVC’s Benefits

Its flooring solutions are very effective and affordable in various private and public sectors, including homes, enterprises, hotels, schools, and commercial places. PVC flooring is durable, has many attractive aesthetic elements, is easy to install, is available in several thicknesses, and is readily recycled. Its beneficial qualities are becoming more widely known, which will accelerate the market for polyvinyl chloride (PVC) stabilizers. Additionally, factors including rising demand for electric vehicles, an expansion of the automobile industry, and an increase in the use of plastic film and sheets will all contribute to market value growth. The market is expected to expand due to the expansion of the building and construction industry and the rising demand for medical devices.

Restraints:

- Prohibition of PVC in Green Buildings

The market for PVC stabilizers will suffer from the increasing emphasis on PVC prohibition in the construction of green buildings. The plastic that harms the environment the most is PVC. There is a release of hazardous, chlorine-based chemicals as a result of the PVC lifecycle, which includes production, use, and disposal. In the water, air, and food chain, these toxins accumulate.

Opportunities:

- Increased Usage and Applications

PVC stabilizers are being used more frequently in detergent, Fittings and pipelines, including window profiles, rigid and semi-rigid films, wires and cables, coatings, and floors, which is good news for the market. PVC applications are replacing traditional and antiquated polymers, and as a result, the market for PVC stabilizers is expanding exponentially. According to estimates, this will pave the path for market expansion.

Challenges

- Fluctuating Costs and Volatility of Crude Materials

The market for polyvinyl chloride (PVC) stabilizers will face challenges due to the high volatility of raw materials and shifts in the price of raw materials. Global PVC prices have increased in all regions because to the huge supply-demand imbalance, which is impeding the market.

Segmentation Analysis:

The global PVC stabilizers market has been segmented based on type, end-user, and regions.

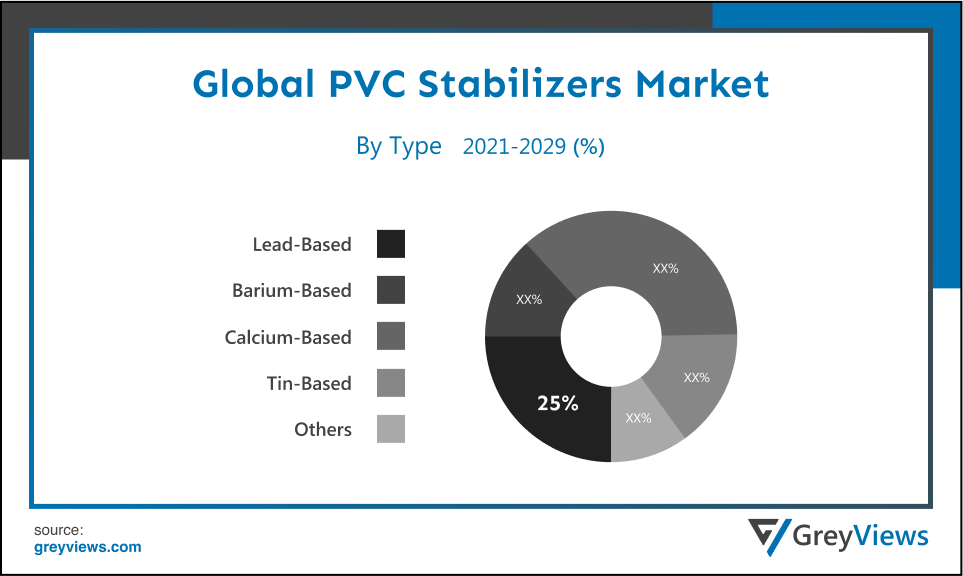

By Type

The type segment is calcium-based, tin-based, barium-based, lead-based, and others. The lead stabilizer segment led the largest share of the PVC stabilizers market with a market share of around 25% in 2021. The longest use of lead as a PVC stabilizer is evident. Particularly for PVC products with extended service lives and the need for longer fabrication (heating) times, lead compounds are very cost-effective and their stabilizing performances are good. The temperature at which PVC decomposes in lead-based stabilizers is also substantially lower than the temperature at which it is processed. Thus, heat stabilizers that prevent HCl molecules from leaving the polymer chain and raise the breakdown temperature are needed when processing PVC. Excellent heat and light stability is offered by lead-based heat stabilizers. Additionally, they have excellent mechanical and electrical qualities and a very broad processing range.

By End-User

The end-user includes automotive, electrical and electronics, packaging, building and construction, footwear, and others. The building and construction segment led the PVC stabilizers market with a market share of around 19.08% in 2021. PVC is a sturdy and lightweight material that resists abrasion, chemical corrosion, and the elements. It offers resistance to fire. In the architecture and construction sector, PVC is frequently utilized for a variety of purposes, including pipelines, windows, flooring, roofing, and lightweight buildings. Stabilizers made of calcium, lead, and tin are widely used in construction.

By Regional Analysis:

The regions analyzed for the PVC stabilizers market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the PVC stabilizers market and held a 38% share of the market revenue in 2021.

- Asia Pacific region witnessed a major share. This can be attributed to the expansion of the gasoline industry in the region's growing nations, including China and India. Due to ongoing advancements in the agricultural sector, China currently generates the most revenue from the PVC stabilizer market, while India is fending off an increase in demand for PVC applications. These elements drive up demand in the area. The development of end-user sectors in the region, including the construction and automotive industries, is another factor driving the demand for PVC stabilizers.

- North America is anticipated to experience significant growth during the predicted period. The region has recently been the fastest at embracing new technologies in the construction business because of the huge corporations in countries like the USA, Canada, and others. PVC is increasingly in demand across a wide range of industry sectors, including construction, automotive, packaging, and electrical & electronics, which is driving the market.

Global PVC Stabilizers Market- Country Analysis:

- Germany

Germany's PVC Stabilizers market size was valued at USD 0.26 billion in 2021 and is expected to reach USD 2.39 billion by 2029, at a CAGR of 3.2% from 2022 to 2029.

Germany has one of the most developed automotive industries. It is home to many prominent players. The automotive sector makes extensive use of PVC. Due to its thermoplastic characteristics, it is lighter and less expensive to manufacture. Because of this, the country's market for PVC stabilizers is anticipated to expand throughout the Projection period.

- China

China PVC Stabilizers market size was valued at USD 0.41 billion in 2021 and is expected to reach USD 6.7 billion by 2029, at a CAGR of 4.2% from 2022 to 2029. Building is one of the main industries in China and plays a significant part in the development of the national economy. Even in the midst of the current economic crisis, this industry saw tremendous development. This is because the government thinks infrastructure spending could help to spur economic development amid a slump. In order to boost the economy, similar investments are anticipated in the building sector. Across April, construction work in the nation picked back up. With an anticipated investment of USD 142 billion, 26 infrastructure projects were approved by the Chinese government in 2019. According to the National Development and Reform Commission, these projects should be finished by 2023. With such developments, the demand for PVC stabilizers is increasing in the country.

- India

India's PVC Stabilizers market size was valued at USD 0.31 billion in 2021 and is expected to reach USD 4 billion by 2029, at a CAGR of 3.8% from 2022 to 2029. PVC is widely used in the building and construction industry for a variety of applications, including pipes, windows, flooring, roofing, and lighter structures. As a result of the growth of the construction and packaging industries, as well as other factors, India is predicted to gain a sizable market share over the course of the Projection period.

Key Industry Players Analysis:

To increase their market position in the global PVC stabilizers business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Pau Tai Industrial Corporation

- Clariant AG

- Arkema SA

- BASF SE

- Baerlocher GmbH

- Clariant AG

- Addivant

- Valtris Specialty Chemicals

- Addivant USA LLC

- Songwon Industrial Co. Ltd.

- AkzoNobel N.V.

- PATCHAM(FZC)

- Sun Ace Kakoh (Pte.) Ltd.

- Chemcon Speciality Chemicals Ltd.

Latest Development:

- In January 2021, BASF SE purchased the polyamide (PA 6.6) business of Solvay. Technyl®, a brand-new product from BASF, is one example of how the company has broadened its polyamide offerings. As a result, BASF will be able to offer its customers even better-designed plastics solutions, such as those for electric and driverless vehicles. Additionally, the agreement improves the company's access to Asia's and North and South America's emerging markets.

- In July 2020, Penn Color offers a UV Enhancer that extends weathering performance by up to 60% for PVC compounds and extruded profiles.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5% |

|

Market Size |

3.4 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By End-User, and Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Pau Tai Industrial Corporation, Clariant AG, Arkema SA, BASF SE, Baerlocher GmbH, Clariant AG, Addivant, Valtris Specialty Chemicals, Addivant USA LLC, Songwon Industrial Co. Ltd., AkzoNobel N.V., PATCHAM(FZC), Sun Ace Kakoh (Pte.) Ltd., Chemcon Speciality Chemicals Ltd., among others |

|

By Type |

|

|

By End-User |

|

|

Regional scope |

|

Scope of the Report

Global PVC Stabilizers Market by Type:

- Calcium-based

- Tin-based

- Barium-based

- Lead-based

- Others

Global PVC Stabilizers Market by End-User:

- Automotive

- Electrical and Electronics

- Packaging

- Building and Construction

- Footwear

- Others

Global PVC Stabilizers Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was market size of PVC stabilizers market in 2021?

Global PVC Stabilizers market size was USD 3.4 billion in 2021.

Which segment hold large share in PVC stabilizers market?

The lead stabilizer segment led the largest share of the PVC stabilizers market with a market share of around 25% in 2021

What will be the market size of the PVC stabilizers market?

Global PVC stabilizers market is expected to reach USD 5.02 billion by 2029, at a CAGR of 5% from 2022 to 2029.

Which are the leading market players active in the PVC stabilizers market?

Leading market players active in the global PVC stabilizers market are Pau Tai Industrial Corporation, Clariant AG, Arkema SA, BASF SE, Baerlocher GmbH, Clariant AG, Addivant, Valtris Specialty Chemicals, Addivant USA LLC, Songwon Industrial Co. Ltd., AkzoNobel N.V., PATCHAM(FZC), Sun Ace Kakoh (Pte.) Ltd., Chemcon Speciality Chemicals Ltd..

What is the key opportunity of the PVC stabilizers market?

Surging investment in construction sector is primarily driving the growth of the PVC stabilizers market.

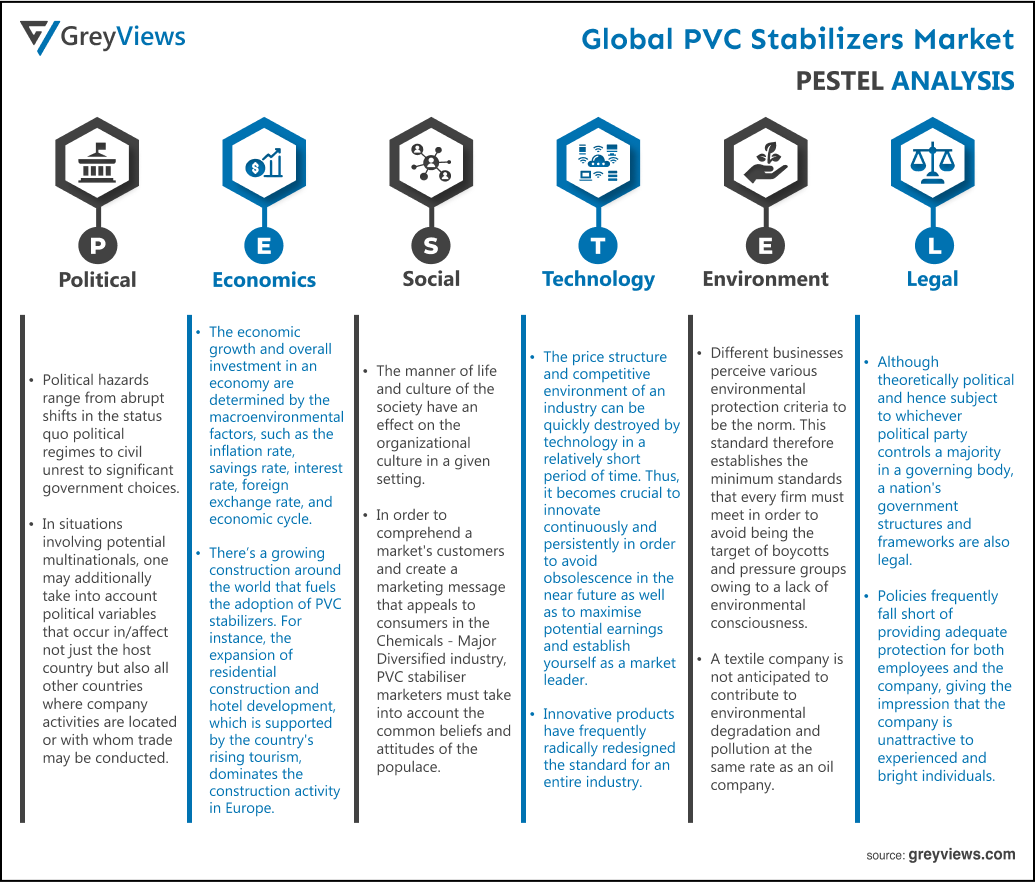

Political Factors- There are several different political issues that could affect the PVC Stabilizer industry's profitability or prospects of survival. Political hazards range from abrupt shifts in the status quo political regimes to civil unrest to significant government choices. In situations involving potential multinationals, one may additionally take into account political variables that occur in/affect not just the host country but also all other countries where company activities are located or with whom trade may be conducted. The integrity of the politicians and their propensity to engage in acts of corruption can be evaluated in order to accurately assess the scope of the overall systematic political risk that may be present, as the fallout could result in the impeachment or resignation of high-ranking government officials.

Economical Factors- The economic growth and overall investment in an economy are determined by the macroenvironmental factors, such as the inflation rate, savings rate, interest rate, foreign exchange rate, and economic cycle. There’s a growing construction around the world that fuels the adoption of PVC stabilizers. For instance, the expansion of residential construction and hotel development, which is supported by the country's rising tourism, dominates the construction activity in Europe. Approximately 270 new hotels opened in 2019, and more than 700 projects are planned, many of which are currently under development and will be operational by the end of 2022. As a result of a tremendous increase in international travel, Germany and the United Kingdom are the top two nations for building new hotels. Over 100,000 rooms will be available at approximately 390 new hotels that are currently under construction in the UK and 353 new hotels that are currently under construction in Germany. ?These factors impact the PVC stabilizer sector.

Social Factor- The manner of life and culture of the society have an effect on the organizational culture in a given setting. In order to comprehend a market's customers and create a marketing message that appeals to consumers in the Chemicals - Major Diversified industry, PVC stabiliser marketers must take into account the common beliefs and attitudes of the populace. The population's demographics and skill level, social class, hierarchy, power structures, culture, social norms, the spirit of entrepreneurship, and the overall makeup of society are all elements that have an impact on the PVC stabilizer market.

Technological Factors- The price structure and competitive environment of an industry can be quickly destroyed by technology in a relatively short period of time. Thus, it becomes crucial to innovate continuously and persistently in order to avoid obsolescence in the near future as well as to maximise potential earnings and establish yourself as a market leader. Innovative products have frequently radically redesigned the standard for an entire industry. A number of technological factors, including current technology advancements and competitive technological advances, may have an impact. It is crucial to keep an eye on a new technology's level of acceptance as well as how quickly it is expanding and displacing revenues from rivals in the industry in question.

Environmental Factors- Different businesses perceive various environmental protection criteria to be the norm. This standard therefore establishes the minimum standards that every firm must meet in order to avoid being the target of boycotts and pressure groups owing to a lack of environmental consciousness. For instance, a textile company is not anticipated to contribute to environmental degradation and pollution at the same rate as an oil company. With the interest and knowledge, it possesses, the new customer prefers to patronize businesses it believes to be more ethical, particularly in light of climate change and the environment. The capacity to handle the movement of materials and the finished product may be considerably impacted by the current weather conditions. This affects the dates of delivery of the final product.

Legal Factors- Although theoretically political and hence subject to whichever political party controls a majority in a governing body, a nation's government structures and frameworks are also legal. Policies frequently fall short of providing adequate protection for both employees and the company, giving the impression that the company is unattractive to experienced and bright individuals. Health and safety legislation, which were developed in response to the appalling conditions that workers were compelled to work in during and immediately following the industrial revolution, are regarded to have an impact on PVC stabilizer. Although putting in place the right laws can be expensive, it is necessary not only under the law but also out of a sense of moral obligation to other people.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By End-User

- 3.3. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increasing Awareness of PVC’s Benefits

- 3. Restraints

- 3.1. Prohibition of PVC in Green Buildings

- 4. Opportunities

- 4.1. Increased usage and applications of PVC stabilizers

- 5. Challenges

- 5.1. Volatile crude oil prices

- Global PVC Stabilizers Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Calcium-based

- 3. Tin-based

- 4. Barium-based

- 5. Lead-based

- 6. Others

- Global PVC Stabilizers Market Analysis and Projection, By End-User

- 1. Segment Overview

- 2. Automotive

- 3. Electrical and Electronics

- 4. Packaging

- 5. Building and Construction

- 6. Footwear

- 7. Others

- Global PVC Stabilizers Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global PVC Stabilizers Market-Competitive Landscape

- 1. Overview

- 2. Market Share of Key Players in the PVC Stabilizers Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- 3. Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Pau Tai Industrial Corporation

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Clariant AG

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Arkema SA

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- BASF SE

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Baerlocher GmbH

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Clariant AG

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Addivant

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Valtris Specialty Chemicals

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Songwon Industrial Co. Ltd.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- AkzoNobel N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Pau Tai Industrial Corporation

List of Table

- Global PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Global Calcium-based, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Tin-based, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Barium-based, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Lead-based, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Others, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Global Automotive, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Electrical and Electronics, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Packaging, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Building and Construction, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Footwear, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global Others, PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- Global PVC Stabilizers Market, By Region, 2021–2029 (USD Billion)

- North America PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- North America PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- USA PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- USA PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Canada PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Canada PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Mexico PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Mexico PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Europe PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Europe PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Germany PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Germany PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- France PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- France PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- UK PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- UK PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Italy PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Italy PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Spain PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Spain PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Asia Pacific PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Japan PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Japan PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- China PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- China PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- India PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- India PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- South America PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- South America PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Brazil PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Brazil PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- Middle East and Africa PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- UAE PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- UAE PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

- South Africa PVC Stabilizers Market, By Type, 2021–2029 (USD Billion)

- South Africa PVC Stabilizers Market, By End-User, 2021–2029 (USD Billion)

List of Figures

- Global PVC Stabilizers Market Segmentation

- PVC Stabilizers Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global PVC Stabilizers Market Attractiveness Analysis By Type

- Global PVC Stabilizers Market Attractiveness Analysis By End-User

- Global PVC Stabilizers Market Attractiveness Analysis By Region

- Global PVC Stabilizers Market: Dynamics

- Global PVC Stabilizers Market Share By Type (2021 & 2029)

- Global PVC Stabilizers Market Share By End-User (2021 & 2029)

- Global PVC Stabilizers Market Share by Regions (2021 & 2029)

- Global PVC Stabilizers Market Share by Company (2020)