Rolled Ring Market Size By Type (Stainless Rolled Rings, Alloy Rolled Rings, and Carbon Rolled Rings), By Application (Automotive, Aerospace, Agriculture, General Industrial, and Others), Regions, Segmentation, and Projection till 2029

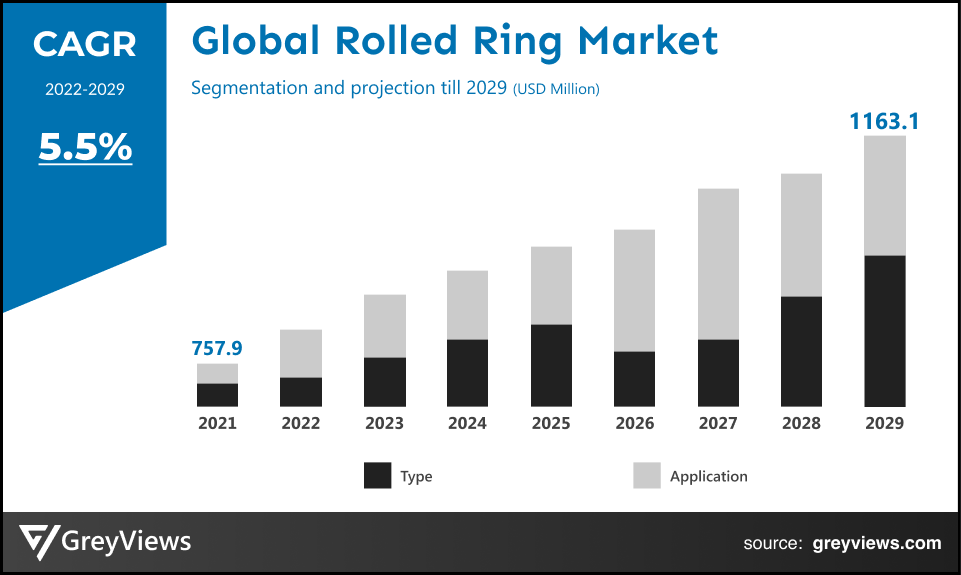

CAGR: 5.5%Current Market Size: USD 757.9 MillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Rolled Ring Market- Market Overview:

The Global Rolled Ring market is expected to grow from USD 757.9 million in 2021 to USD 1163.1 million by 2029, at a CAGR of 5.5% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the rise in demand for ring rollers.

Donut- or toroidally-shaped metal components known as rolled rings can be used in a variety of applications. They can be as little as a washer or as large as 110 inches in diameter, and they can be made out of a wide variety of materials, including carbon, stainless steel, alloy steels, Haynes, Incoloy, Inconel, super alloys, and many more. Rolled rings are the product of a manufacturing technique known as ring rolling, which involves shaping a circular preform of metal into the required shape, size, and weight until the desired result is attained. Rolling ring are utilized for a wide variety of purposes as a result of their many advantageous properties, which include their high level of strength, cost-effectiveness, resistance to heat, and adaptability. For instance, rolled rings are frequently utilized for applications such as bearings, clutches, couplings, drives, ring gaskets, high-pressure pipelines, flanges, gears, glass-lined reactors, machines, robotics, and valves, to name just a few of its many possible applications. Forgings of rolled rings are an excellent type of metal component. Some of the Rolled Ring uses are; Automobile Manufacturing Industry- In the automotive sector, almost every key structural or rising component in trucks and cars are made of rolled rings., Petroleum and Natural Gas Business- Rolled rings are well known for their application in the oil and gas industry, where they are used as pipe connections as well as a range of flanges and pressure vessel ring connectors for pipelines.

Sample Request:- Rolled Ring Market

Market Dynamics:

Drivers:

? Increasing Number of Manufacturing Plants

It is anticipated that the rising demand for goods and services across a variety of industries in India, along with the fact that global manufacturing companies focus to diversify their production by setting up low-cost plants in countries like China and India, will drive the growth of the manufacturing sector in India. In addition, it is anticipated that by the year 2025, the value of the manufacturing industry in India will have increased by more than six times its current level, reaching a total of one trillion US dollars. This expansion in the manufacturing sector in India is predicted to, in turn, lead to an increase in the number of manufacturing facilities located inside the country. As a result, it is anticipated that this will drive demand within the market that was researched.

Restraints:

- Inadequate Number of Professionals

The expansion market has been hampered both by a shortage of competent individuals and by advancements in additive building technologies.

- Expensive

A further factor that will work to the market's disadvantage is the volatility of the cost of the raw materials used in metal manufacture. These rolled rings need an excessive amount of energy, workers, equipment, and raw materials, which makes the manufacturing process a little bit expensive. As a result, this will present a barrier to the growth rate of the metal fabrication market.

Opportunities:

Altering Patterns and Developing Technologies

- In addition, shifting tendencies in the financial and manufacturing sectors, as well as the deployment of automated fabrication methods, further expand product applications and extend profitable prospects to market players in the projected period of 2022 to 2029. In addition, the progress that has been made in the areas of automation tools and robotics will contribute significantly to the market expansion that will occur in the near future for metal fabrication.

Challenges

- Financial setback

The rolled ring market experienced a decline as a direct result of the current outbreak of coronavirus. The implementation of numerous rules and precautionary lockdowns, social distance standards, and import/export bans imposed by governments to curb the spread of the disease has hampered the market as there have been severe disruptions in various manufacturing as well as the top of the cross-border supply chain of raw materials. This is because of the implementation of numerous rules and precautionary lockdowns, social distance standards, and import/export bans to curb the spread of disease. Because of this, the market experienced a significant and devastating financial setback. The revenue trajectory of the market will be weighed over the Projection period by the aforementioned determinants, which will take place throughout the Projection period.

Segmentation Analysis:

The global Rolled Ring market has been segmented based on type, application and regions.

By Type

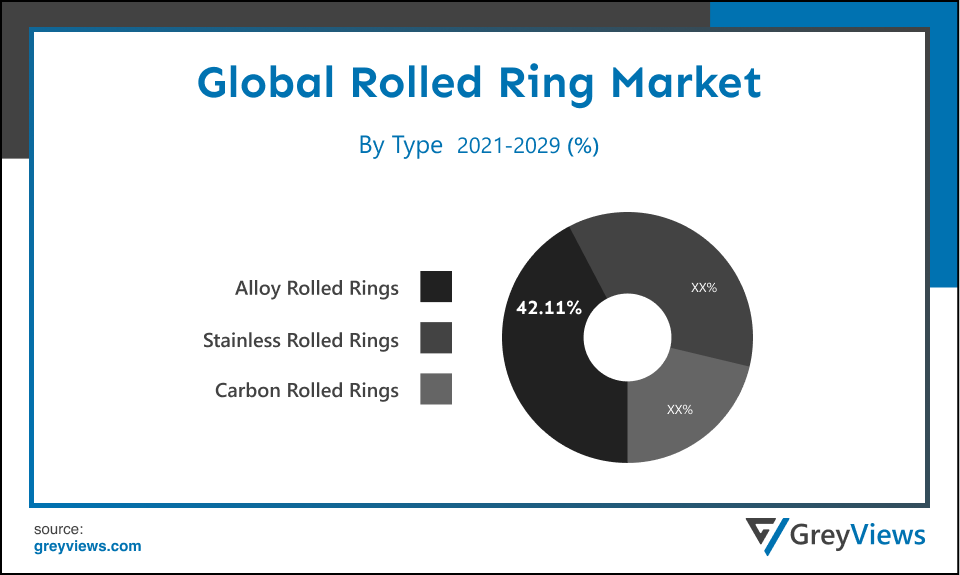

The type segment includes Stainless Rolled Rings, Alloy Rolled Rings, and Carbon Rolled Rings. The alloy rolled rings segment led the largest share of Rolled Ring market with a market share of around 42.11% in 2021. Titanium, aluminium, and stainless steel are some of the metals that are utilised in the manufacturing process of alloy rolled rings. These different metals are alloyed together so that the resulting metal will have a special quality that cannot be achieved by just combining the individual metals. For instance, titanium possesses a very high corrosion resistance but very poor ductility, whereas aluminium possesses a high corrosion resistance but extremely low ductility.

By Application

The application segment includes Automotive, Aerospace, General Industries, Agriculture and Others. The aerospace segment led the Rolled Ring market with a market share of around 30.1% in 2021. Components used in aerospace vehicles are frequently subjected to high temperatures, which, if they are not made properly, can lead to their failure or a decline in performance. This has resulted in an increase in the demand for rolled rings from a variety of aerospace applications, such as engine nacelles/pylons, turbine blades and vanes, space vehicles (fuselage), aircraft fuselages (wing root), and airframe structure (floor beams), as well as other metal fatigue critical parts such as fasteners and rivets, amongst others.

By Regional Analysis:

The regions analyzed for the Rolled Ring market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia - Pacific region dominated the Rolled Ring market and held the 39.1% share of the market revenue in 2021.

- The Asia-Pacific region held a dominant share of the worldwide rolled ring market in 2021, and it is anticipated that this region would maintain its preeminence during the Projection period. The expansion of this region can be due to the increased demand from end-use sectors such as the automotive industry, the aerospace industry, the construction industry, and others. In addition, over the next eight years, significant industrialisation in India and China, together with rising levels of foreign investment in both countries, are predicted to be the primary drivers of regional growth. The Asia-Pacific region has the potential to become a lucrative source for rolled rings due to the high production volumes of various types of steel products along with the growing exports from key countries such as Japan and South Korea. This will likely cause the region to emerge as a lucrative source for rolled rings.

- North America is expected to witness a considerable growth rate during the Projection period. The region has experienced rapid expansion in the automotive industry, the aerospace industry, the construction industry, and others. Increasing vehicle production in the region is also expected to add to the growth of Rolled Ring demand.

Global Rolled Ring Market- Country Analysis:

- Germany

Germany's Rolled Ring market size was valued at USD 9.93 million in 2021 and is expected to reach USD 14.55 million by 2029, at a CAGR of 4.9% from 2022 to 2029.

Germany has one of the leading Rolled Ring industries in Europe. In addition, Germany's automotive sector is the country's most innovative industry sector, which boosts the demand for metal products, including Rolled Ring.

- China

China Rolled Ring market size was valued at USD 22.88 million in 2021 and is expected to reach USD 37.58 million by 2029, at a CAGR of 6.4% from 2022 to 2029. China's growing population and improved standard of living have boosted the demand for Rolled Ring. China's rising per capita disposable income also contributes to rising per capita spending on metal parts manufacturing.

- India

India's Rolled Ring market size was valued at USD 21.09 million in 2021 and is expected to reach USD 33.36 million by 2029, at a CAGR of 5.9% from 2022 to 2029. India is one of the strongest growing economies in Asia. The expansion of this region can be due to the increased demand from end-use sectors such as the automotive industry, the aerospace industry, the construction industry, and others.

Key Industry Players Analysis:

To increase their market position in the global Rolled Ring business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Precision Castparts Corp

- Arconic

- Nippon Steel & Sumitomo Metal

- KOBELCO

- Thyssenkrupp

- Aichi Steel

- Eramet Group

- American Axle & Manufacturing Holdings

- Ferroalloy

- McInnes Rolled Rings

Latest Development:

- In March 2022, Aptec Ltd. was a sheet metal fabrication company that specialized in metal forming, bending, and laser cutting. This company was acquired by Vulcan Industries plc.

- In February 2022, CGI Automated Manufacturing completed the acquisition of Richland Metal Fabricators. Richland Metal Fabricators was a provider of quality sheet metal fabrication and machining services.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.5% |

|

Market Size |

757.9 million 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Application and Region |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Precision Castparts Corp, Arconic, Nippon Steel & Sumitomo Metal, KOBELCO, Thyssenkrupp, Aichi Steel, Eramet Group, American Axle & Manufacturing Holdings, Ferralloy, McInnes Rolled Ringsand among others. |

|

By Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Rolled Ring Market by Type:

- Stainless Rolled Rings

- Alloy Rolled Rings

- Carbon Rolled Rings

Global Rolled Ring Market by Application:

- Automotive

- Aerospace

- Agriculture

- General Industrial

- Others

Global Rolled Ring Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the market size of the Rolled Ring market in 2029?

Global Rolled Ring market is expected to reach USD 1163.1 million by 2029, at a CAGR of 5.5% from 2022 to 2029.

Which are the leading market players active in the Rolled Ring market?

Leading market players active in the global Rolled Ring market are Precision Castparts Corp, Arconic, Nippon Steel & Sumitomo Metal, KOBELCO, Thyssenkrupp, Aichi Steel, Eramet Group, American Axle & Manufacturing Holdings, Ferralloy, McInnes Rolled Ringsand among others.

What is the most significant sales channel for Rolled Ring?

Alloy Rolled Rings segment witnessed a significant share in the Rolled Ring market with a market share of around 42.11% in 2021

What are the upcoming trends in Rolled Ring Market?

The high production volumes of various types of steel products along with the growing exports from key countries around the globe are projected to influence the market in the upcoming years.

What are the top 5 exporter countries of Rolled Ring?

United States, Germany, United Kingdom, China, and France.

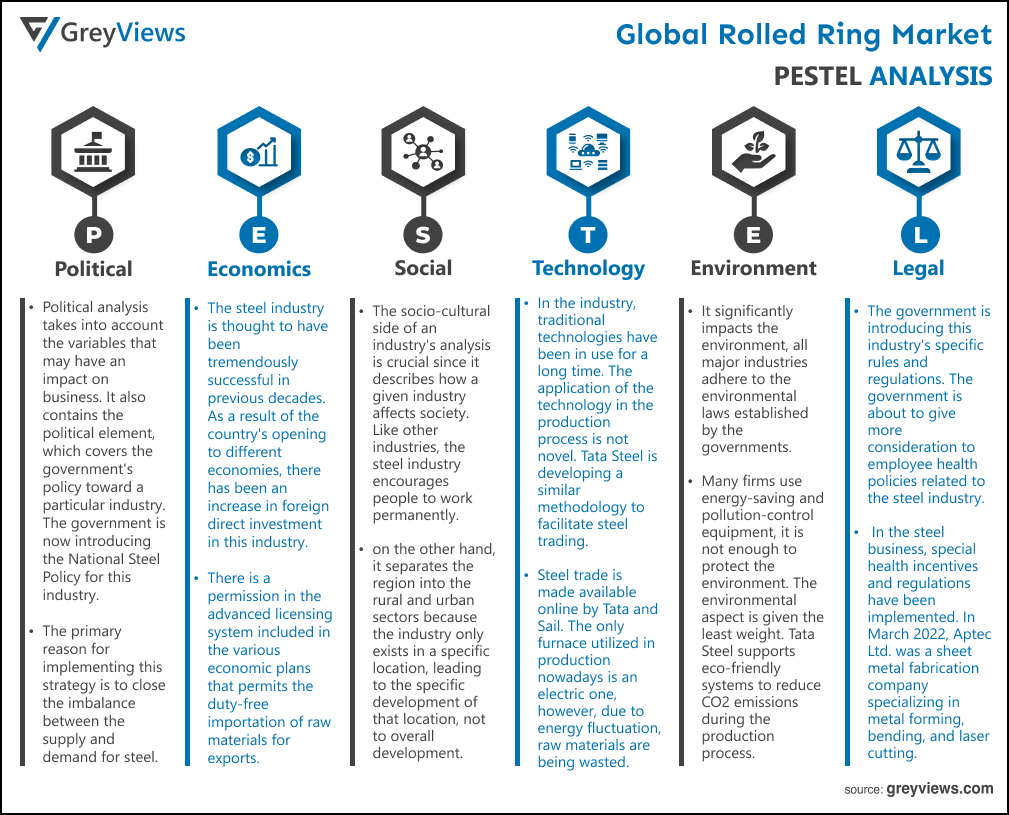

Political Factors- Political analysis takes into account the variables that may have an impact on business. It also contains the political element, which covers the government's policy toward a particular industry. The government is now introducing the National Steel Policy for this industry. The primary reason for implementing this strategy is to close the imbalance between the supply and demand for steel. The fundamental objective of this approach is also to maximize productivity. The primary goal of the policy is also to raise production to one million tonnes. Special incentives are created for the steel industry under this strategy. For the steel industry, incentives are offered in the form of reduced taxes, no import duties, the availability of land, and other infrastructure improvements.

Economical Factors- The steel industry is thought to have been tremendously successful in previous decades. As a result of the country's opening to different economies, there has been an increase in foreign direct investment in this industry. There is a permission in the advanced licensing system included in the various economic plans that permits the duty-free importation of raw materials for exports. However, despite the industry's expansion, the GDP is growing relatively slowly. The American subprime crisis is causing problems for the steel industry as well. The automobile sector, infrastructure, and other businesses connected to the steel industry are all suffering due to the subprime crisis. The supply and demand of steel in society are vastly out of balance.

Social Factor- The socio-cultural side of an industry's analysis is crucial since it describes how a given industry affects society. Like other industries, the steel industry encourages people to work permanently. Still, on the other hand, it separates the region into the rural and urban sectors because the industry only exists in a specific location, leading to the specific development of that location, not to overall development. Many industries do not pay attention to the employees' health because of the working circumstances that cause many health issues among those employed in the steel sector, which is inherently incurable. Employees are not granted any form of allowance. The development of the rural economy, which raises people's living standards, is also a result of the steel industry.

Technological Factors- In the industry, traditional technologies have been in use for a long time. The application of the technology in the production process is not novel. Tata Steel is developing a similar methodology to facilitate steel trading. Steel trade is made available online by Tata and Sail. The only furnace utilized in production nowadays is an electric one, however, due to energy fluctuation, raw materials are being wasted. Three outmoded technologies used in the production process are the basic arc, induction furnace, and electric furnace.

Environmental Factors- Even if the steel industry supports a variety of industries and promotes growth, it is also causing an adverse environment in the natural world. Although it significantly impacts the environment, all major industries adhere to the environmental laws established by the governments. Although many firms use energy-saving and pollution-control equipment, it is not enough to protect the environment. The environmental aspect is given the least weight. Tata Steel supports eco-friendly systems to reduce CO2 emissions during the production process. Tata is advancing the production of ultra-low carbon steel, reducing environmental damage.

Legal Factors- The government is introducing this industry's specific rules and regulations. The government is about to give more consideration to employee health policies related to the steel industry. In the steel business, special health incentives and regulations have been implemented. In March 2022, Aptec Ltd. was a sheet metal fabrication company specializing in metal forming, bending, and laser cutting. This company was acquired by Vulcan Industries plc. In February 2022, CGI Automated Manufacturing completed the acquisition of Richland Metal Fabricators. Richland Metal Fabricators was a provider of quality sheet metal fabrication and machining services.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increasing Number of Manufacturing Plants

- Restraints

- Inadequate Number of Professionals

- Expensive

- Opportunities

- Altering Patterns and Developing Technologies

- Challenges

- Financial setback

- Global Rolled Ring Market Analysis and Projection, By Type

- Segment Overview

- Stainless Rolled Rings

- Alloy Rolled Rings

- Carbon Rolled Rings

- Global Rolled Ring Market Analysis and Projection, By Application

- Segment Overview

- Automotive

- Aerospace

- Agriculture

- General Industrial

- Others

- Global Rolled Ring Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Rolled Ring Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Rolled Ring Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Precision Castparts Corp

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Arconic

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Nippon Steel & Sumitomo Metal

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- KOBELCO

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Thyssenkrupp

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Aichi Steel

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Eramet Group

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- American Axle & Manufacturing Holdings

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Ferroalloy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- McInnes Rolled Rings

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Precision Castparts Corp

List of Table

- Global Rolled Ring Market, By Type, 2021–2029(USD Million)

- Global Stainless Rolled Rings, Rolled Ring Market, By Region, 2021–2029(USD Million)

- Global Alloy Rolled Rings, Rolled Ring Market, By Region, 2021–2029(USD Million)

- Global Carbon Rolled Rings, Rolled Ring Market, By Region, 2021–2029(USD Million)

- Global Rolled Ring Market, By Application, 2021–2029(USD Million)

- Global Automotive, Rolled Ring Market, By Region, 2021–2029(USD Million)

- Global Aerospace, Rolled Ring Market, By Region, 2021–2029(USD Million)

- Global Agriculture, Rolled Ring Market, By Region, 2021–2029(USD Million)

- Global General Industrial, Rolled Ring Market, By Region, 2021–2029(USD Million)

- Global Others, Rolled Ring Market, By Region, 2021–2029(USD Million)

- Global Rolled Ring Market, By Region, 2021–2029(USD Million)

- North America Rolled Ring Market, By Type, 2021–2029(USD Million)

- North America Rolled Ring Market, By Application, 2021–2029(USD Million)

- USA Rolled Ring Market, By Type, 2021–2029(USD Million)

- USA Rolled Ring Market, By Application, 2021–2029(USD Million)

- Canada Rolled Ring Market, By Type, 2021–2029(USD Million)

- Canada Rolled Ring Market, By Application, 2021–2029(USD Million)

- Mexico Rolled Ring Market, By Type, 2021–2029(USD Million)

- Mexico Rolled Ring Market, By Application, 2021–2029(USD Million)

- Europe Rolled Ring Market, By Type, 2021–2029(USD Million)

- Europe Rolled Ring Market, By Application, 2021–2029(USD Million)

- Germany Rolled Ring Market, By Type, 2021–2029(USD Million)

- Germany Rolled Ring Market, By Application, 2021–2029(USD Million)

- France Rolled Ring Market, By Type, 2021–2029(USD Million)

- France Rolled Ring Market, By Application, 2021–2029(USD Million)

- UK Rolled Ring Market, By Type, 2021–2029(USD Million)

- UK Rolled Ring Market, By Application, 2021–2029(USD Million)

- Italy Rolled Ring Market, By Type, 2021–2029(USD Million)

- Italy Rolled Ring Market, By Application, 2021–2029(USD Million)

- Spain Rolled Ring Market, By Type, 2021–2029(USD Million)

- Spain Rolled Ring Market, By Application, 2021–2029(USD Million)

- Asia Pacific Rolled Ring Market, By Type, 2021–2029(USD Million)

- Asia Pacific Rolled Ring Market, By Application, 2021–2029(USD Million)

- Japan Rolled Ring Market, By Type, 2021–2029(USD Million)

- Japan Rolled Ring Market, By Application, 2021–2029(USD Million)

- China Rolled Ring Market, By Type, 2021–2029(USD Million)

- China Rolled Ring Market, By Application, 2021–2029(USD Million)

- India Rolled Ring Market, By Type, 2021–2029(USD Million)

- India Rolled Ring Market, By Application, 2021–2029(USD Million)

- South America Rolled Ring Market, By Type, 2021–2029(USD Million)

- South America Rolled Ring Market, By Application, 2021–2029(USD Million)

- Brazil Rolled Ring Market, By Type, 2021–2029(USD Million)

- Brazil Rolled Ring Market, By Application, 2021–2029(USD Million)

- Middle East and Africa Rolled Ring Market, By Type, 2021–2029(USD Million)

- Middle East and Africa Rolled Ring Market, By Application, 2021–2029(USD Million)

- UAE Rolled Ring Market, By Type, 2021–2029(USD Million)

- UAE Rolled Ring Market, By Application, 2021–2029(USD Million)

- South Africa Rolled Ring Market, By Type, 2021–2029(USD Million)

- South Africa Rolled Ring Market, By Application, 2021–2029(USD Million)

List of Figures

- Global Rolled Ring Market Segmentation

- Rolled Ring Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Rolled Ring Market Attractiveness Analysis By Type

- Global Rolled Ring Market Attractiveness Analysis By Application

- Global Rolled Ring Market Attractiveness Analysis By Region

- Global Rolled Ring Market: Dynamics

- Global Rolled Ring Market Share By Type (2021 & 2029)

- Global Rolled Ring Market Share By Application (2021 & 2029)

- Global Rolled Ring Market Share by Regions (2021 & 2029)

- Global Rolled Ring Market Share by Company (2020)