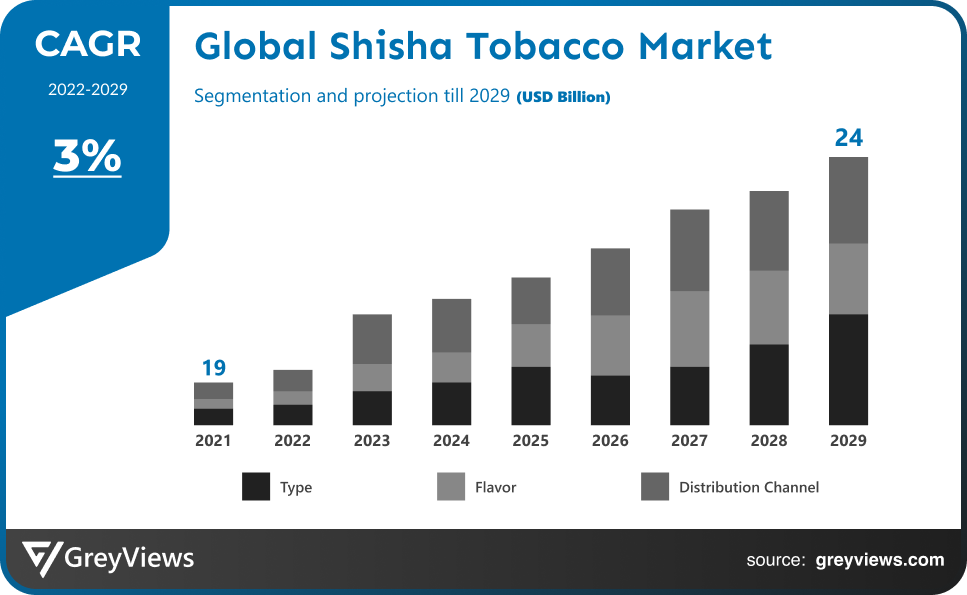

Shisha Tobacco Market Size By Type (Strong, Mild and Light), By Flavor (Fruit Flavor, Confectionary Flavor, Spices, Beverages, Single and Others), By Distribution Channel (Direct Channel and Indirect Channel), Regions, Segmentation, and Projection till 2029

CAGR: 3%Current Market Size: USD 19 BillionFastest Growing Region: MEA

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Shisha Tobacco Market- Market Overview:

The Global shisha tobacco market is expected to grow from USD 19 billion in 2021 to USD 24 billion by 2029, at a CAGR of 3% during the Projection period 2022-2029. The growth of this market is mainly driven by the rising popularity of hookah tobacco and the rising acceptance of it in a variety of theme-based restaurants, lounges, and cafes.

In Arabic, hookah is another name for a water pipe or shisha, and it is used to smoke marijuana. It consists of a water pipe and a water basin via which tobacco smoke is inhaled. At the top of the water pipe, burning charcoal is used to heat the tobacco used in hookahs. Hookahs were previously prevalent in Middle Eastern culture, but they are now widely used throughout the world. The availability of hookah tobacco in a variety of tastes is a key factor in the popularity of the device. The hookah tobacco's sweet, fruity, and candy-like smells and scents have won over users. The popularity of hookah cafes and rising young hookah tobacco smoking are major market drivers. However, increasing governmental engagement because of the health dangers associated with hookah usage may impede market expansion during the projected timeframe. Nevertheless, the market may have an opportunity with the introduction of new flavors of hookah tobacco. Young people now frequently congregate, socialize, and party at hookah cafés and lounges. This opportunity has been seized by cafes and restaurants, which has increased younger adults' use of hookah tobacco. The social, enjoyable, and relaxing atmosphere of these locations has been successful in luring young people to try hookah tobacco while mingling with friends.

Sample Request: - Global Shisha Tobacco Market

Market Dynamics:

Drivers:

- Surge In Misconception

Many people are switching to water pipe smoking as a way to cut back on cigarette smoking. Despite the fact that smoking shisha tobacco through water pipes is more damaging to health than smoking cigarettes, the majority of customers are unaware of its negative effects. The majority of smokers and non-smokers share this misunderstanding. The most prevalent argument in favor of this fallacy is the idea that smoking shisha tobacco is safer than smoking cigarettes since most of the nicotine is absorbed by water. This fallacy is the main cause of shisha tobacco's global rise, despite the decline of the tobacco business.

Restraints:

- Adverse Effect

The market for shisha tobacco will face challenges as a result of growing public knowledge of the health risks associated with cigarette use. Rising rates of various cancers and heart failure may further slow the market's expansion for tobacco products. Rigid laws in developing nations will also slow the expansion of the market as a whole.

Opportunities:

- Research and Development

Additionally, in order to provide more lucrative prospects to market participants during the Projection period, tobacco product makers invested in the development of a number of low-risk tobacco products. The expansion of creative marketing strategies used by participants to draw in and target potential customers will also contribute to the continued expansion of the shisha tobacco market.

Challenges:

- Stringent Regulations

To lessen these consequences and negative impacts related to the use and sale of shisha tobacco, the government has stepped in and implemented tough laws and bans. The shisha tobacco market would suffer as a result of the governments of several global actors creating strict laws. As a result, it is projected that this factor will slow the rate of expansion of the shisha tobacco market.

Segmentation Analysis:

The global shisha tobacco market has been segmented based on type, flavor, distribution channel, and region.

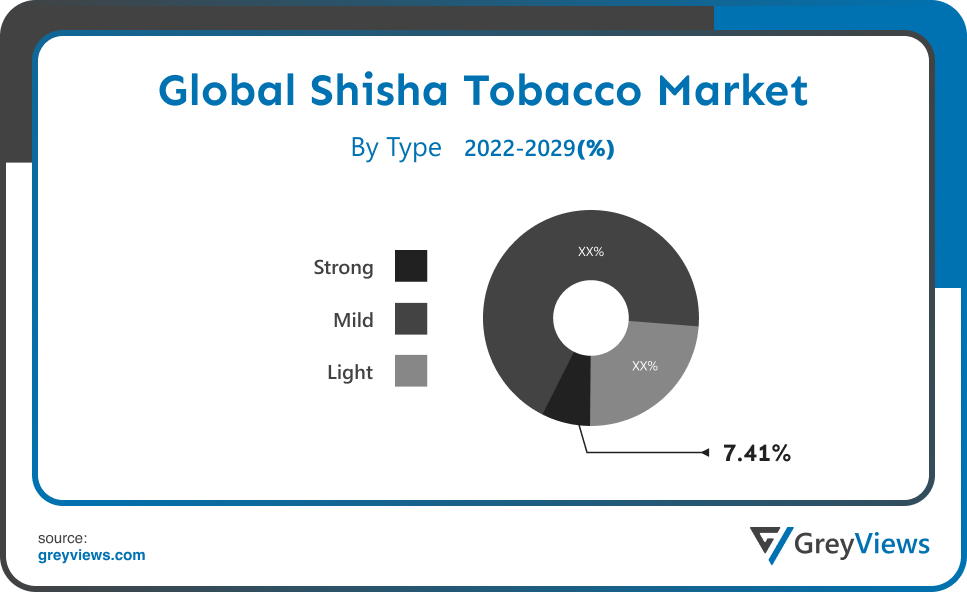

By Type

The type segment is strong, mild, and light. The strong segment led the largest share of the shisha tobacco market with a market share of around 7.41% in 2021. Given that more people are choosing to smoke shisha instead of cigarettes, strong shisha tobacco is likely to hold a large portion of the market. The demand for the product is increasing as companies in the sector innovate the product line and offer new flavors and essence within the robust shisha tobacco range.

By Flavor

The flavor segment includes Fruit Flavor, Confectionary Flavor, Spices, Beverages, Single, and Others. The single segment led the shisha tobacco market with a market share of around 5.89% in 2021. Single flavors Shisha tobacco is any tobacco product with an additional flavor, typically a smoke flavor. The most popular single-flavored shishas are apple, watermelon, and mint, and they are primarily used for hookah smoking. One individual typically uses this type of shisha tobacco for personal usage solely.

By Distribution Channel

The distribution channel segment includes Direct Channel and Indirect Channel. The direct channel acid segment led the Shisha Tobacco Market with a market share of around 11.21% in 2021. A variety of direct channel, including specialist parlors, eateries, bars, and cafés that allow hookah smoking, can be used to distribute hookah tobacco. It has been common practice to share hookah tobacco, especially among young people. Due to this, hookah cafes and restaurants have benefited by adding it to their list of offerings. As the focal point of these settings, hookah tobacco helped to legalize its usage during social events. Around the world, there are an increasing number of establishments that serve hookah tobacco, encouraging this type of tobacco use. Despite the broad passage of smoke-free workplace regulations in many states and localities, tobacco shops and hookah lounges still exist.

Global Shisha Tobacco Market- Sales Analysis.

The sale of dermal fillers type, flavor, and distribution channel expanded at a CAGR of 1.3% from 2015 to 2021.

Shisha tobacco is a concoction of tobacco, water, glycerin, flavorings, and aromatics that is smoked using a hookah device. The majority of people smoke this flavorful and aromatic tobacco because it has calming properties. Due to the product's widespread usage and variety of flavor options, the market is anticipated to experience moderate growth during the Projection period. In many parts of the world, shisha is also known as waterpipe tobacco, argileh, maassel, hookah, or narghile. It is enjoyed for its calming and stimulating effects. The molasses-syrupy shisha tobacco, which comes in a variety of flavors, is smoked using a hookah or water pipe.

The demand has been maintained by the rising smoking rates in Asia and Africa's developing nations. The major corporations' massive marketing operations have also played a big role in keeping the sector alive. The market is growing as a result of a trend of new product launches that entice customers to consume tobacco. Tobacco use has been significantly impacted by the COVID-19 outbreak. Given that COVID-19 is a respiratory disease and smoking only makes things worse, smoking is thought to be particularly dangerous. Global patterns, however, showed that stress brought on by lockdowns merely increased spending. During this time, the number of new smokers continued to be relatively modest.

Thus, owing to the aforementioned factors, the global shisha tobacco market is expected to grow at a CAGR of 3% during the Projection period from 2022 to 2029.

Global Shisha Tobacco Market- By Regional Analysis:

The regions analyzed for the Shisha Tobacco Market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Shisha Tobacco Market and held a 38% share of the market revenue in 2021.

- The Asia Pacific region witnessed a major share. Market expansion in this region is projected to be supported by offline infrastructure upgrades and large brand marketing initiatives by well-known corporations in important markets including India, Bangladesh, China, and the Philippines. Additionally, businesses are putting greater emphasis on their clients by providing flavored cigarettes, which are very well-liked by the younger generation. In developing nations in Asia, the number of smokers is increasing. For instance, the results of the National Family Health Survey, which was carried out by the Government of India in 2019–20, show that India has a relatively high absolute number of customers, mostly as a result of its enormous population.

- Middle East Asia and Africa are anticipated to experience significant growth during the Projection period. The sixth edition of The Tobacco Atlas, which includes statistics from the American Cancer Society and Vital Strategies, estimates that 400 billion cigarettes are consumed annually in the Middle East. According to the report, product usage has significantly increased in Bahrain, Lebanon, Egypt, Oman, and Saudi Arabia.

Global Shisha Tobacco Market- Country Analysis:

- Germany

Germany's Shisha Tobacco Market size was valued at USD 0.09 billion in 2021 and is expected to reach USD 0.10 billion by 2029, at a CAGR of 1.8% from 2022 to 2029.

The introduction of a new line of tobacco products indicates a little rise in both the population of smokers and the proportion of persons who try the new goods. Interesting advertising tactics have been used successfully to achieve notable achievements, maintain market dominance, and stay competitive. For instance, certain racial or demographic groups receive more aggressive marketing and advertising of certain products.

- China

China’s Shisha Tobacco Market size was valued at USD 0.19 billion in 2021 and is expected to reach USD 0.23 billion by 2029, at a CAGR of 2.7% from 2022 to 2029. Since the country's highly established tourist industry draws a sizable number of visitors each year, cafés and restaurants are expected to dominate the market. In addition, the nation's harsh rules prohibiting smoking in public places may encourage the sale of hookah equipment for both home and commercial uses (cafés, bars, and restaurants), expanding the shisha tobacco industry.

- India

India's Shisha Tobacco Market size was valued at USD 0.15 billion in 2021 and is expected to reach USD 0.17 billion by 2029, at a CAGR of 2.1% from 2022 to 2029. With peers, hookah tobacco is frequently used in social situations. Peer influence on hookah initiation and use has increased along with the social acceptance of hookah tobacco use among college and university students. According to polls, students believe they may stop using hookah tobacco at any moment and that it is not as addictive as cigarettes, which increased hookah tobacco use by more than five times. One of the main reasons why the younger generation has chosen to use hookah tobacco is their insatiable eagerness to try out new smoking habits.

Key Industry Players Analysis:

To increase their market position in the global shisha tobacco business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- FUMARI

- Haze Tobacco

- Al Fakher Tobacco Factory

- SOCIALSMOKE

- Japan Tobacco Inc.

- Prince Molasses

- Romman Shisha

- Mazaya

- Ugly Hookah

- Cloud Tobacco

- Flavors of Americas S.A.

- Al Amir Tobacco

- Nakhla

- MujeebSons

- Godfrey Phillips India Ltd.

- The Eastern Company

- ALWAHA-TOBACCO.

Latest Development:

- In November 2021, The purchase of a controlling stake in Moderno Opificio del Sigaro Italiano, or MOSI, an Italian cigar manufacturer with about 40 employees and production facilities in Orsago, in northern Italy, was announced by the Scandinavian Tobacco Group. With majority ownership in MOSI, the business obtained cutting-edge cigar-making expertise, a premium brand, and more consumer options, giving it the chance to further enhance its revenue share.

- In September 2021, The business announced commercial testing of its heated tobacco products through a widespread rollout in Greece. The testing is a component of the business's new approach to creating a focused and long-lasting Next Generation Product (NGP) business.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

3% |

|

Market Size |

19 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Flavor, By Distribution Channel And By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

FUMARI, Haze Tobacco, Al Fakher Tobacco Factory, SOCIALSMOKE, Japan Tobacco Inc., SOEX, Prince Molasses, Romman Shisha, Mazaya, Ugly Hookah, Cloud Tobacco, Flavors of Americas S.A., Al Amir Tobacco, STARBUZZTOBACCO., Nakhla, MujeebSons, Godfrey Phillips India Ltd., The Eastern Company, ALWAHA-TOBACCO., among others. |

|

By Type |

|

|

By Flavor |

|

|

By Distribution Channel |

|

|

Regional scope |

|

Scope of the Report

Global Shisha Tobacco Market By Type:

- Strong

- Mild

- Light

Global Shisha Tobacco Market By Flavor:

- Fruit Flavor

- Confectionary Flavor

- Spices

- Beverages

- Single

- Others

Global Shisha Tobacco Market By Distribution Channel:

- Direct Channel

- Indirect Channel

Global Shisha Tobacco Market By Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Shisha Tobacco Market in 2029?

Global Shisha Tobacco Market is expected to reach USD 24 billion by 2029.

What is the CAGR of the Shisha Tobacco Market?

The Shisha Tobacco Market is projected to have a CAGR of 3%.

What are the key factors for the growth of the shisha tobacco market?

The market for shisha tobacco will expand at a faster rate due to people's rising propensity for using it to relieve boredom and daily stress. The expansion of the entire market is further aided by the rise in disposable income, fast urbanization, rise in online retailing, and quick development of the e-commerce sector.

What is the breakup of the global shisha tobacco market based on the distribution channel?

Based on distribution channel, the global shisha tobacco market has been segmented into direct channel and indirect channel.

Which are the leading market players active in the Shisha Tobacco Market?

Leading market players active in the global shisha tobacco market are FUMARI (U.S.), Haze Tobacco (U.S.), Al Fakher Tobacco Factory (UAE), SOCIALSMOKE (U.S.), Japan Tobacco Inc. (Japan), SOEX (Germany), Prince Molasses (Morocco), Romman Shisha (U.S.), Mazaya (Kuwait), Ugly Hookah (U.S.), Cloud Tobacco (U.S.), Flavors of Americas S.A. (Paraguay), Al Amir Tobacco (UAE), STARBUZZTOBACCO. (U.S.), Nakhla (Iraq), MujeebSons (India), Godfrey Phillips India Ltd. (India), The Eastern Company (U.S.), ALWAHA-TOBACCO. (U.S.) among others.

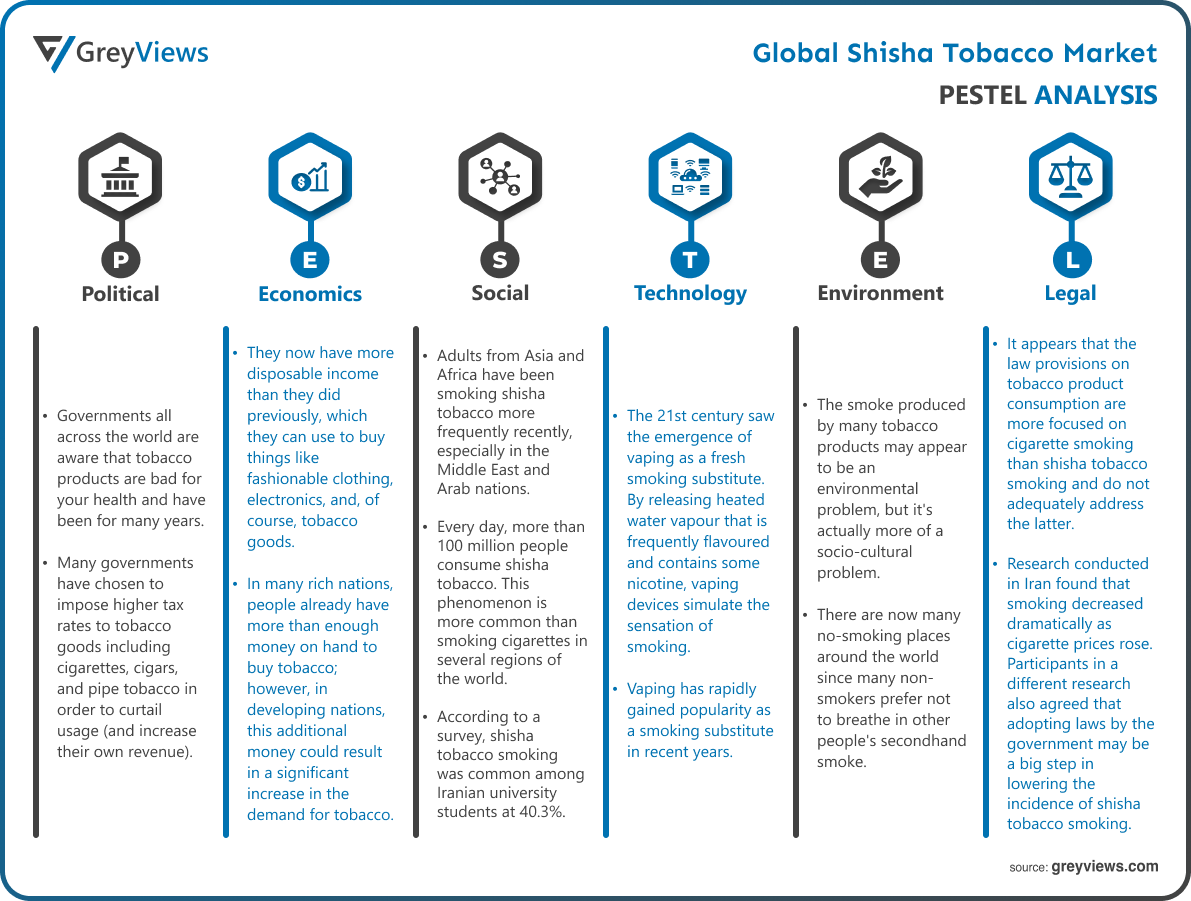

Political Factors- Governments all across the world are aware that tobacco products are bad for your health and have been for many years. Many governments have chosen to impose higher tax rates to tobacco goods including cigarettes, cigars, and pipe tobacco in order to curtail usage (and increase their own revenue). These decisions are mostly political and made by the governing authorities, but there is a definite trend towards governments making it more difficult for people to buy tobacco products. This is undoubtedly bad for the industry as a whole.

Economical Factors- Globally speaking, wealth is increasing for most individuals. They now have more disposable income than they did previously, which they can use to buy things like fashionable clothing, electronics, and, of course, tobacco goods. In many rich nations, people already have more than enough money on hand to buy tobacco; however, in developing nations, this additional money could result in a significant increase in the demand for tobacco.

Social Factor- Adults from Asia and Africa have been smoking shisha tobacco more frequently recently, especially in the Middle East and Arab nations. Every day, more than 100 million people consume shisha tobacco. This phenomenon is more common than smoking cigarettes in several regions of the world. According to a survey, shisha tobacco smoking was common among Iranian university students at 40.3%. Another survey found that students at higher education institutions in Khorramabad, Iran, smoked shisha tobacco at a rate of 29.7%. In a different study conducted in Syria by Almerie et al., shisha tobacco smoking was prevalent in 23.5% of medical science students. Similar to this, Fielder et alcohort .'s study from 2009–2010 showed that students were more likely to smoke shisha tobacco following their first year of college, rising from 29.0% to 45.0%.

Technological Factors- The 21st century saw the emergence of vaping as a fresh smoking substitute. By releasing heated water vapour that is frequently flavoured and contains some nicotine, vaping devices simulate the sensation of smoking. Vaping doesn't entail inhaling any smoke, therefore even though it contains nicotine, the same addictive ingredient found in tobacco products, it has significantly fewer bad health impacts. Vaping has rapidly gained popularity as a smoking substitute in recent years. Vaping can also be used to wean oneself off other tobacco products gradually. Overall, traditional tobacco is losing popularity as more people turn to vape.

Environmental Factors- The smoke produced by many tobacco products may appear to be an environmental problem, but it's actually more of a socio-cultural problem. There are now many no-smoking places around the world since many non-smokers prefer not to breathe in other people's secondhand smoke. Smokers will have nowhere to use tobacco goods as more people quit smoking and start to protest secondhand smoke. The number of people who use tobacco is surely declining as people become more aware of its harmful effects.

Legal Factors- It appears that the law provisions on tobacco product consumption are more focused on cigarette smoking than shisha tobacco smoking and do not adequately address the latter. The studies revealed that price variation was an influential element on demand for tobacco goods, even though state restrictions have a decisive role in the consumption of tobacco products (e.g., impacts of price on demand for tobacco products). For instance, research conducted in Iran found that smoking decreased dramatically as cigarette prices rose. Participants in a different research also agreed that adopting laws by the government may be a big step in lowering the incidence of shisha tobacco smoking.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Flavor

- 3.3. Market Attractiveness Analysis By Distribution Channel

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Surge In Misconception

- 3. Restraints

- 3.1. Adverse Effect

- 4. Opportunities

- 4.1. Research and Development

- 5. Challenges

- 5.1. Stringent Regulations

- Global Shisha Tobacco Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Strong

- 3. Mild

- 4. Light

- Global Shisha Tobacco Market Analysis and Projection, By Flavor

- 1. Segment Overview

- 2. Fruit Flavor

- 3. Confectionary Flavor

- 4. Spices

- Global Shisha Tobacco Market Analysis and Projection, By Distribution Channel

- 1. Segment Overview

- 2. Direct Channel

- 3. Indirect Channel

- Global Shisha Tobacco Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Shisha Tobacco Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Shisha Tobacco Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- FUMARI

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Haze Tobacco

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Al Fakher Tobacco Factory

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- SOCIALSMOKE

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Japan Tobacco Inc.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Prince Molasses

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Romman Shisha

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Mazaya

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Ugly Hookah

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Cloud Tobacco

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Flavors of Americas S.A.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- FUMARI

- Al Amir Tobacco

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

-

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Global Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Global Strong, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Mild, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Light, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Global Fruit Flavor, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Confectionary Flavor, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Spices, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Beverages, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Single, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Others, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Global Direct Channel, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- Global Indirect Channel, Shisha Tobacco Market, By Region, 2021–2029 (USD Billion)

- North America Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- North America Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- North America Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- USA Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- USA Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- USA Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Canada Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Canada Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Canada Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Mexico Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Mexico Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Mexico Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Europe Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Europe Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Europe Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Germany Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Germany Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Germany Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- France Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- France Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- France Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- UK Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- UK Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- UK Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Italy Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Italy Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Italy Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Spain Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Spain Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Spain Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Asia Pacific Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Asia Pacific Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Japan Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Japan Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Japan Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- China Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- China Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- China Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- India Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- India Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- India Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- South America Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- South America Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- South America Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Brazil Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Brazil Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Brazil Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- Middle East and Africa Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- Middle East and Africa Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- UAE Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- UAE Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- UAE Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

- South Africa Shisha Tobacco Market, By Type, 2021–2029 (USD Billion)

- South Africa Shisha Tobacco Market, By Flavor, 2021–2029 (USD Billion)

- South Africa Shisha Tobacco Market, By Distribution Channel, 2021–2029 (USD Billion)

List of Figures

- Global Shisha Tobacco Market Segmentation

- Shisha Tobacco Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Shisha Tobacco Market Attractiveness Analysis By Type

- Global Shisha Tobacco Market Attractiveness Analysis By Flavor

- Global Shisha Tobacco Market Attractiveness Analysis By Distribution Channel

- Global Shisha Tobacco Market Attractiveness Analysis By Region

- Global Shisha Tobacco Market: Dynamics

- Global Shisha Tobacco Market Share By Type (2021 & 2029)

- Global Shisha Tobacco Market Share By Flavor (2021 & 2029)

- Global Shisha Tobacco Market Share By Distribution Channel (2021 & 2029)

- Global Shisha Tobacco Market Share by Regions (2021 & 2029)

- Global Shisha Tobacco Market Share by Company (2020)