Single-use Assemblies Market Size By Product (Filtration Assemblies, Bottle Assemblies, Bag Assemblies, Tubing Assemblies, and Others), By End-Use (Biopharmaceutical & Pharmaceutical Companies, Academic & Research Institutes, and CROs & CMOs), By Application (Filtration, Storage, Cell Culture & Mixing, Sampling, and Others), Regions, Segmentation, and Projection till 2029

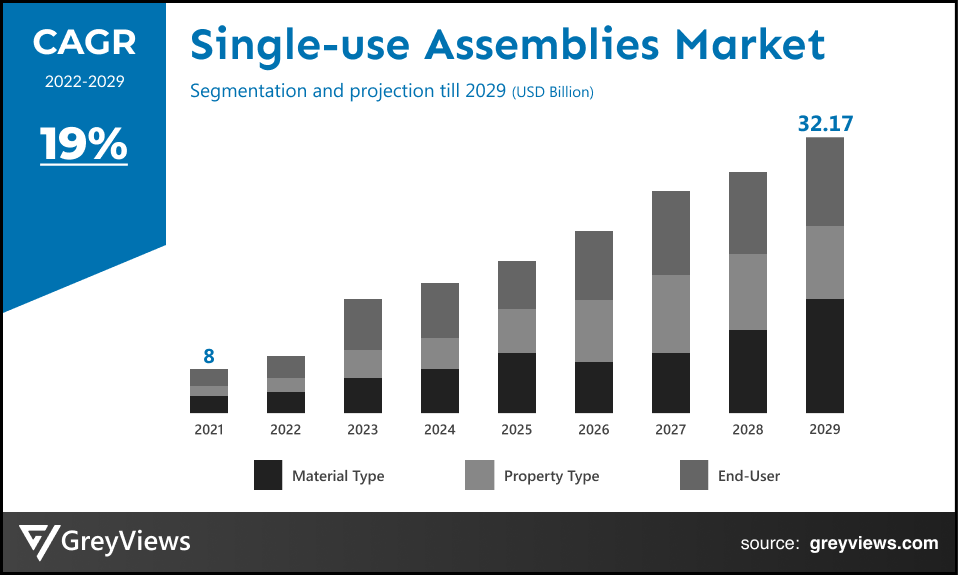

CAGR: 19%Current Market Size: USD 8 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Single-use Assemblies Market- Market Overview:

The Global Single-use Assemblies market is expected to grow from USD 8 billion in 2021 to USD 32.17 billion by 2029, at a CAGR of 19% during the Projection period 2022-2029. The growth of this market is mainly driven owing to increasing development in the biologics market around the world.

Preassembled plastic fluid channels and self-contained goods are considered single-use assemblies. They are often ready-to-use and gamma irradiated to assure sterility. They are constructed using a combination of several standard components. Sampling bottles, filters, tubing, check valves, clamps, sterile connectors, fittings, and seals are some of the often-used industrial products. A single-use assembly is an all-in-one, customer-specific, ready-to-use solution composed of various plastic parts that are put together into a single unit. Sometimes businesses in the (bio)pharmaceutical and life science sectors put together their own single-use process systems. This must take place safely. Leakage or cross-contamination might occur if the connection between the components is improper. By doing this, the production process may be delayed and the safety and quality of the final product may be compromised. The last ten years have witnessed widespread adoption of single-use assembly and technologies, with practically every sterile industry switching at least some of their manufacturing equipment to a single-use alternative to conventional stainless steel. Single-use equipment lessens cross-product/batch contamination hazards, boosts product integrity, saves downtime, lowers cleaning costs, decreases facility set-up charges, provides a smaller manufacturing footprint, and promotes facility flexibility and adaptability.

Sample Request: - Global Single-use Assemblies Market

Market Dynamics:

Drivers:

- Growing biopharmaceutical R&D is Projection market expansion

The development and commercialization of technologically cutting-edge single-use assembly solutions that offer simplified workflows, simple operation, and quick deployment are increasingly in the attention of major players in the global single-use assemblies’ market. High market growth of single-use assemblies is attributable to the fact that they play a significant role in both small- and large-scale biopharmaceutical manufacturing, which has led to increased spending in biopharmaceutical R&D for product development. The market for single-use assembly is expanding because of benefits such as low product cross-contamination risk and removal of unnecessary sterilization procedures. For instance, in 2021, R&D spending by the 15 biggest pharmaceutical corporations reached a record high of USD 133 billion.

Restraints:

- Extractables and leachable related problems

The majority of end users, including big research centers and pharmaceutical firms, need a lot of single-use assemblies to run several production processes and research investigations at once. High temperature and ambient conditions are used for these experiments and processes. single-use assemblies consisting of plastics and other materials with a variety of preservatives that are likely to deteriorate in small amounts as extractable and leachable. This raises the possibility of material cross-contamination. Therefore, the market expansion of single-use assemblies is being constrained by substantial concerns about extractable and leachable.

Opportunities:

- Emerging Economies

Single-use assemblies have been increasingly popular over the past ten years due to their benefits. Many pharmaceutical and biopharmaceutical companies anticipate expanding their single-use manufacturing facilities in emerging nations like China, India, and South Korea in order to turn these nations into a hub for outsourcing bioprocesses. These nations also offer favorable regulatory environments and cost advantages. The growing amount of investments made by major market participants in developing nations also supports this. For instance, Cytiva strengthened its supply chain in the APAC region by partnering with Wego Pharmaceutical to increase its manufacturing capacity in China.

Challenges

- Stringent trade policies

Future trade policies may be a problem for the pharmaceutical sector, which would then affect the single-use assemblies industry, given the global changes in government policies currently underway. Trade between industrialized nations like the US and Europe, which are the leading markets in the industry, and developing nations that are regarded as pharmerging nations, like China, India, and Brazil, could be negatively impacted. Another urgent concern in this sector is BREXIT. Even though it's still unknown how Brexit will affect the pharmaceutical sector, firms like Novartis, Astra Zeneca, and Roche have already moved their manufacturing facilities to lower the risk.

Segmentation Analysis:

The global single-use assemblies market has been segmented based on product, end-use, application, and region.

By Product

The product segment is filtration assemblies, bottle assemblies, bag assemblies, tubing assemblies, and others. The filtration assemblies segment led the single-use assemblies market with a market share of around 29% in 2021. Filtration assemblies have been encouraged to be used for bulk and final fill processes due to increased regulatory opportunities and the need to reduce the risk of contamination. Because they do away with sterilising procedures and the associated validation procedures, single-use filtration assemblies offer a versatile and effective replacement for stainless-steel systems.

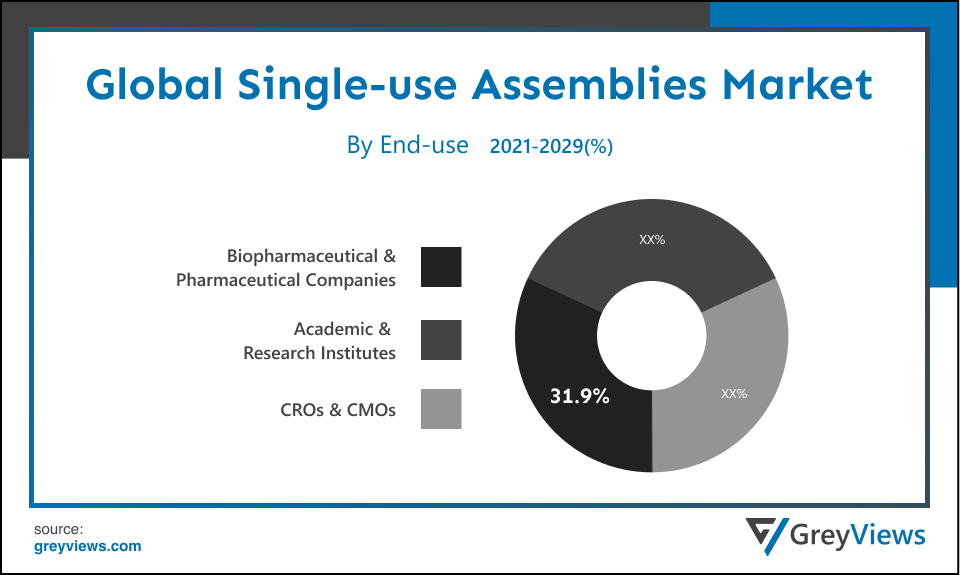

By End-use

The end-use includes biopharmaceutical & pharmaceutical companies, academic & research institutes, and CROs & CMOs. The biopharmaceutical & pharmaceutical companies segment led the single-use assemblies market with a market share of around 319% in 2021. The expansion of the present biopharmaceutical manufacturing facilities fuels the demand for single-use assemblies. For instance, in order to improve Alexion's manufacturing in Ireland, the company invested USD 70 million in new medication production facilities, equipment, and warehousing facilities in June 2022. The portfolio of biological medication substances is to be expanded by the expansion. Similarly, Upperton Pharma Solutions stated in May 2022 that it would invest USD 16 million in a facility expansion that might help improve R&D space and boost GMP manufacturing space by ten times.

By Application

The application includes filtration, storage, cell culture & mixing, sampling, and others. The filtration segment led the single-use assemblies market with a market share of around 23% in 2021. Due to their advantages, the usage of single-use assemblies for filtration is expanding quickly. In addition to saving money and time, SUTs also reduce the need for 90% of sterile connections, 90% of integrity testing, and up to 90% of tubing time. Single-use flirting systems, which are ready to use, unlike traditional filtration systems, also reduce process time. Several manufacturing facilities will be needed to fulfil the growing market demand and ensure the economic success of biopharmaceuticals.

By Regional Analysis:

The regions analyzed for the Single-use Assemblies market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the single-use assemblies market and held a 40% share of the market revenue in 2021.

- North American region witnessed a major share. This significant increase in market share can be attributed to the expansion of the biotechnology and pharmaceutical sectors, improvements in goods, rising rates of diseases like cancer, and investments and funding in drug development research. For instance, Thermo Fisher Scientific Inc. built its manufacturing facility for single-use technologies in Greater Nashville in August 2022. The company can fulfil the rising demand for the bioprocessing components needed to create ground-breaking treatments and vaccines for cancer and other diseases thanks to the 400,000 square foot, USD 105 million facilities.

- Asia Pacific is anticipated to experience significant growth during the predicted period. Due to strategic actions taken by major players, the market in the region is growing. For instance, Sartorius made significant investments in Beijing, China, and China in 2021, where more cleanroom space was built to manufacture bags and single-use filters. Additionally, Cytiva stated in September 2021 that it will invest USD 52.5 million in the construction of a disposable manufacturing facility in South Korea.

Global Single-use Assemblies Market- Country Analysis:

- Germany

Germany's single-use assemblies market size was valued at USD 0.62 billion in 2021 and is expected to reach USD 2.17 billion by 2029, at a CAGR of 17% from 2022 to 2029. Germany is both the largest market in Europe and the third-largest market in the world for medical technology. The market in the region is being driven by factors like quick and simple deployment, reduced danger of cross-contamination, and an increase in R&D spending by biopharmaceutical businesses.

- China

China single-use assemblies market size was valued at USD 0.9 billion in 2021 and is expected to reach USD 3.42 billion by 2029, at a CAGR of 18.2% from 2022 to 2029. The market in China is anticipated to experience rapid growth during the Projection period due to favorable government regulations, an increase in the number of companies establishing manufacturing facilities there, an increase in the outsourcing of drug production to specialized contract manufacturing organizations (CMOS), and low labor and manufacturing costs.

- India

India's single-use assemblies market size was valued at USD 0.75 billion in 2021 and is expected to reach USD 2.74 billion by 2029, at a CAGR of 17.6% from 2022 to 2029. The global pharmaceutical market is significantly influenced by the Indian pharmaceutical industry. India ranks third globally in terms of output by volume and fifteenth globally in terms of value, according to the National Investment Promotion and Facilitation Agency. The country is the world's top maker of vaccines and the largest supplier of generic drugs, making up 20% of the global supply by volume. With a strong network of more than 10,500 production facilities and a pool of highly trained workers, India is home to more than 3,000 pharmaceutical companies. These elements have an impact on the regional market.

Key Industry Players Analysis:

To increase their market position in the global single-use assemblies business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Thermo Fisher Scientific

- Danaher Corp.

- Sartorius AG

- Merck KGaA

- Entegris

- KUHNER AG

- Avantor

- Lonza

- Saint-Gobain

- Corning Inc.

- GE Healthcare

- Parker Hannifin

Latest Development:

- In June 2021, RIM Bio, a Chinese manufacturer of single-use bioprocess bags and parts for biopharmaceutical production, was purchased by Avantor. With this acquisition, Avantor will have access to RIM's facility in Changzhou, China, making it its first single-use manufacturing facility in the AMEA region. Avantor plans to exploit RIM's unique technologies and quick lead times to differentiate its services for single-use clients.

- In March 2021, The joint venture (JV) established by Pall and Austar, Pall-Austar Lifesciences Limited, was fully acquired by Pall Corporation. This acquisition will boost production capability to meet China's supply chain need for single-use technology driven by COVID-19.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

19% |

|

Market Size |

8 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Product, By End-Use, By Application, and Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Thermo Fisher Scientific, Danaher Corp., Sartorius AG, Merck KGaA, Entegris, KUHNER AG, Avantor, Lonza, Saint-Gobain, Corning Inc., GE Healthcare, and Parker Hannifin, among others |

|

By Product |

|

|

By End-Use |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Single-use Assemblies Market by Product:

- Filtration Assemblies

- Bottle Assemblies

- Bag Assemblies

- Tubing Assemblies

- Others

Global Single-use Assemblies Market by End-use:

- Biopharmaceutical & Pharmaceutical Companies

- Academic & Research Institutes

- CROs & CMOs

Global Single-use Assemblies Market by Application:

- Filtration

- Storage

- Cell Culture & Mixing

- Sampling

- Others

Global Single-use Assemblies Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Single-use Assemblies market?

Global Single-use Assemblies market is expected to reach USD 32.17 billion by 2029, at a CAGR of 19% from 2022 to 2029.

Which region dominates the global single-use assemblies market?

North America dominates the global single-use assemblies market.

What are the drivers that are projected to influence the Single-use Assemblies market?

Initiatives and investments done by the regional government around the globe are projected to influence the market in the Projection years.

What is the key challenges to the Single-use Assemblies market?

Unpredictable trade practices are primarily impeding the growth of the Single-use Assemblies market.

Which are the leading market players active in the Single-use Assemblies market?

Leading market players active in the global Single-use Assemblies market are Thermo Fisher Scientific, Danaher Corp., Sartorius AG, Merck KGaA, Entegris, KUHNER AG, Avantor, Lonza, Saint-Gobain, Corning Inc., GE Healthcare, and Parker Hannifin.

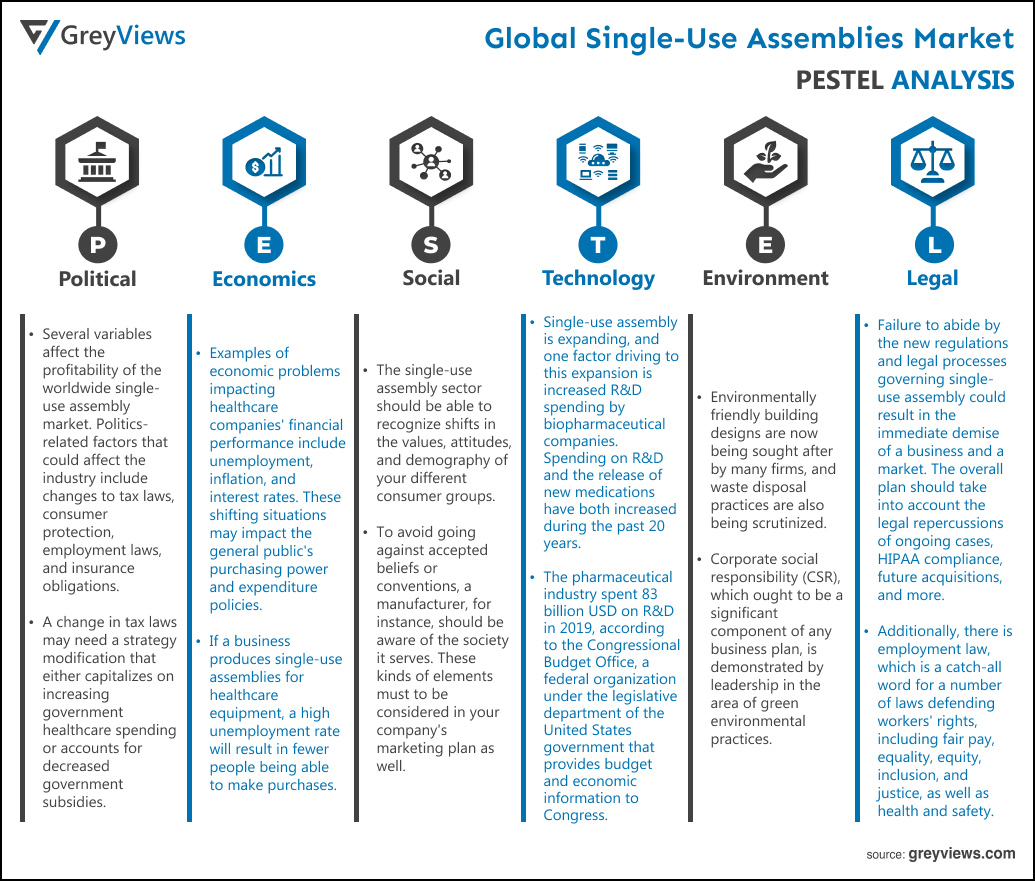

Political Factors- Several variables affect the profitability of the worldwide single-use assembly market. Politics-related factors that could affect the industry include changes to tax laws, consumer protection, employment laws, and insurance obligations. For instance, a change in tax laws may need a strategy modification that either capitalizes on increasing government healthcare spending or accounts for decreased government subsidies. A significant shift in the workforce and overtime requirements may also result from changes in employment law, such as the 2016 legislation that affected employee overtime requirements.

Economical Factors- Examples of economic problems impacting healthcare companies' financial performance include unemployment, inflation, and interest rates. These shifting situations may impact the general public's purchasing power and expenditure policies. For instance, if a business produces single-use assemblies for healthcare equipment, a high unemployment rate will result in fewer people being able to make purchases. Additionally, if fewer people can work, they will not be eligible for employment benefits, such as healthcare.

Social Factor- The single-use assembly sector should be able to recognize shifts in the values, attitudes, and demography of your different consumer groups. To avoid going against accepted beliefs or conventions, a manufacturer, for instance, should be aware of the society it serves. These kinds of elements must to be considered in your company's marketing plan as well. The effectiveness of marketing will increase, and it will have a positive effect on performance if you use content that demonstrates your alignment with a particular sociocultural set of beliefs/values.

Technological Factors- Single-use assembly is expanding, and one factor driving to this expansion is increased R&D spending by biopharmaceutical companies. Spending on R&D and the release of new medications have both increased during the past 20 years. For instance, the pharmaceutical industry spent 83 billion USD on R&D in 2019, according to the Congressional Budget Office, a federal organization under the legislative department of the United States government that provides budget and economic information to Congress. As a result, the benefits of single-use assembly over conventional procedures as well as enhanced biopharmaceutical R&D activities are fueling market expansion. A few technological characteristics are the speed of technological advancement, automation, R&D initiatives, and technology incentives. Today, technology is all around us and the development of new technologies is likely to affect the industry.

Environmental Factors- For firms that assemble single-use products, environmental sustainability measures have both financial and environmental advantages. Environmentally friendly building designs are now being sought after by many firms, and waste disposal practices are also being scrutinized. Corporate social responsibility (CSR), which ought to be a significant component of any business plan, is demonstrated by leadership in the area of green environmental practices. The implementation of the closed-loop, circular economy approach is starting to become the standard in several nations. Industries with enabling institutional frameworks facilitate material recycling and reuse.

Legal Factors- Laws pertaining to consumer protection, antitrust, employment, and health and safety regulations are only a few of them. These factors could affect a business' operations, costs, and product demand. Failure to abide by the new regulations and legal processes governing single-use assembly could result in the immediate demise of a business and a market. The overall plan should take into account the legal repercussions of ongoing cases, HIPAA compliance, future acquisitions, and more. Additionally, there is employment law, which is a catch-all word for a number of laws defending workers' rights, including fair pay, equality, equity, inclusion, and justice, as well as health and safety. While some nations lack efficient enforcement of employment laws, others have harsh penalties for violating any of the specified rights of employees. Therefore, breaking these regulations could result in severe consequences.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Product

- 3.2. Market Attractiveness Analysis By End-Use

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increasing R&D spending

- 3. Restraints

- 3.1. Extractables and leachable related problems

- 4. Opportunities

- 4.1. Emerging economies

- 5. Challenges

- 5.1. Strict trade policies

- Global Single-use Assemblies Market Analysis and Projection, By Product

- 1. Segment Overview

- 2. Filtration Assemblies

- 3. Bottle Assemblies

- 4. Bag Assemblies

- 5. Tubing Assemblies

- 6. Others

- Global Single-use Assemblies Market Analysis and Projection, By End-Use

- 1. Segment Overview

- 2. Biopharmaceutical & Pharmaceutical Companies

- 3. Academic & Research Institutes

- 4. CROs & CMOs

- Global Single-use Assemblies Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Filtration

- 3. Storage

- 4. Cell Culture & Mixing

- 5. Sampling

- 6. Others

- Global Single-use Assemblies Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Single-use Assemblies Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Single-use Assemblies Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Thermo Fisher Scientific

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Danaher Corp.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Sartorius AG

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Merck KGaA

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Entegris

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- KUHNER AG

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Avantor

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Lonza

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Parker Hannifin

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- GE Healthcare

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Thermo Fisher Scientific

List of Table

- Global Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Global Filtration Assemblies, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Bottle Assemblies, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Bag Assemblies, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Tubing Assemblies, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Others, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Global Biopharmaceutical & Pharmaceutical Companies, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Academic & Research Institutes, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global CROs & CMOs, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Global Filtration, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Storage, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Cell Culture & Mixing, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Sampling, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Others, Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- Global Single-use Assemblies Market, By Region, 2021–2029 (USD Billion)

- North America Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- North America Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- North America Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- USA Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- USA Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- USA Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Canada Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Canada Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Canada Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Mexico Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Mexico Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Mexico Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Europe Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Europe Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Europe Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Germany Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Germany Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Germany Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- France Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- France Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- France Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- UK Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- UK Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- UK Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Italy Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Italy Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Italy Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Spain Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Spain Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Spain Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Asia Pacific Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Asia Pacific Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Japan Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Japan Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Japan Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- China Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- China Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- China Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- India Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- India Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- India Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- South America Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- South America Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- South America Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Brazil Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Brazil Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Brazil Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- Middle East and Africa Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- Middle East and Africa Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- UAE Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- UAE Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- UAE Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

- South Africa Single-use Assemblies Market, By Product, 2021–2029 (USD Billion)

- South Africa Single-use Assemblies Market, By End-Use, 2021–2029 (USD Billion)

- South Africa Single-use Assemblies Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Single-use Assemblies Market Segmentation

- Single-use Assemblies Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Single-use Assemblies Market Attractiveness Analysis By Product

- Global Single-use Assemblies Market Attractiveness Analysis By End-Use

- Global Single-use Assemblies Market Attractiveness Analysis By Application

- Global Single-use Assemblies Market Attractiveness Analysis By Region

- Global Single-use Assemblies Market: Dynamics

- Global Single-use Assemblies Market Share By Product (2021 & 2029)

- Global Single-use Assemblies Market Share By End-Use (2021 & 2029)

- Global Single-use Assemblies Market Share By Application (2021 & 2029)

- Global Single-use Assemblies Market Share by Regions (2021 & 2029)

- Global Single-use Assemblies Market Share by Company (2020)