Solid Oxide Fuel Cell Market Size by Type (Planar and Tubular), Application (Portable, Stationary, and Transport), End User (Commercial & Industrial, Data Centers, Military & Defense, and Residential), Regions, Segmentation, and Projection till 2029

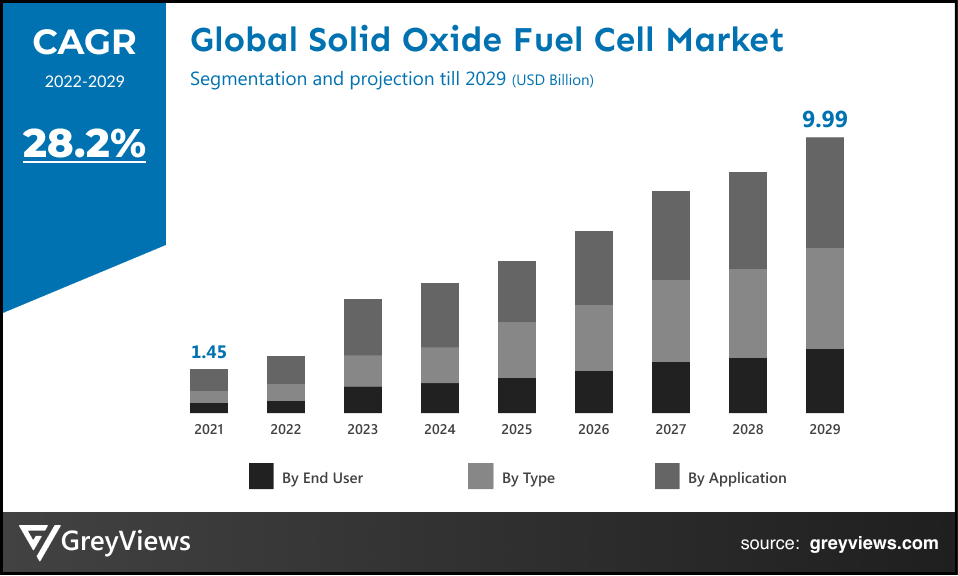

CAGR: 28.2%Current Market Size: 1.45 billionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Solid Oxide Fuel Cell- Market Overview

The global Solid Oxide Fuel Cell market is expected to grow from USD 1.45 billion in 2021 to USD 9.99 billion by 2029, at a CAGR of 28.2% during the Projection period 2022-2029. This growth is mainly attributed to the upsurge in demand for clean energy and the ongoing growth of the power and energy sectors.

Solid oxide fuel cells are among the different types of fuel cells that utilize a solid oxide material as the electrolyte. The solid oxide electrolyte is used to conduct negative oxygen ions from the cathode to the anode. These types of fuel cells can operate at very high temperatures of about 500 - 1,000°C without the need for an expensive platinum catalyst. It has a wide range of applications such as supplementary power units in vehicles to stationary power generation with outputs from 100W to 2MW.

On the other hand, the higher operating temperatures of solid oxide fuel cells make them suitable for application in heat engine energy recovery devices. Also, in the past few years, solid oxide fuel cells are being considered to hold significant potential due to their low operating costs and high electrical efficiencies.

Request Sample:- Solid Oxide Fuel Cell market

Market Dynamics:

Drivers:

- Upsurge in R&D on fuel cell programs

In the U.S., the Hydrogen and Fuel Cell Technologies Office (HFTO) is the premier R&D program at the Department of Energy. The office most traditionally offers funding in the form of competitive grants to conduct R&D in fuel cells and their end uses across industrial, transportation, and stationary power applications. In the financial year 2021, the Consolidated Appropriations Act provided $150 million to HFTO. Such investments by worldwide governments in fuel cell programs have significantly driven the global solid oxide fuel cells market.

- The rise in demand for clean energy

The regions such as Europe and North America have stringent emission norms. For instance, Euro 7 emission norms were implemented in 2020, with a CO2 emission target of 95 grams per kilometer. Such clean energy norms create demand for Solid Oxide Fuel Cells (SOFC) that plays a major role in energy decentralization by producing quiet, clean, and efficient energy, particularly in stationary power generation. In addition, the SOFCs are the most efficient fuel cell with fuel to electricity conversion efficiencies of over 60%. Such features of SOFCs make them a prominent choice to meet requirements by stringent emission norms, boosting market growth.

Restraints:

- High manufacturing and installation cost

The manufacturing of a fuel cell stack is the most expensive part of solid oxide fuel cell manufacturing. In addition, the manufacturers are innovating their products to maintain higher operational efficiency at high temperatures. For instance, the yttria-stabilized zirconia (YSZ) is being used as an electrolyte. However, Zirconium has titanium-like properties and an extremely high melting temperature of 1,852°C. The cost of this material is significantly higher as compared with the traditional ceramic-based electrolytes. Hence, the use of such materials in the manufacture of solid oxide fuel cells hampers the growth of the market to some extent due to increased manufacturing costs.

Opportunities:

- The rise in demand for portable and noiseless SOFCs for military applications

The innovative solid oxide fuel cells are extensively being used to operate military robots, unmanned aerial vehicles (UAVs), and communications devices. For instance, the U.S. Department of Defense (DoD) has been experimenting with SOFC technology to develop lightweight logistic fuel compatible systems for applications such as silent watch auxiliary power units, range extenders for electric vehicles, power generation for battery charging, and power for unmanned underwater and aerial vehicles. In the upcoming years, the U.S. military is projected to significantly increase its usage of unmanned aerial systems for wide-ranging functions, such as surveillance, reconnaissance, and targeting/acquisition. Hence, demand for portable and noiseless SOFCs in such military applications is opportunistic for the growth of the market.

Challenges

- Development of alternative types of fuel cells

There is an extensive range of fuel cells differentiated on the basis of the type of electrolyte being employed. In addition, there are numerous types of fuel cells presently under development, each with its own limitations, advantages, and potential applications. For instance, among the various fuel cell types, Alkaline Fuel Cells (AFCs) are the most efficient type of fuel cell, reaching up to 60% efficiency. Hence, the availability and development of more efficient and cost-effective fuel cells may pose a considerable challenge to the market players.

Segmentation Analysis:

The global solid oxide fuel cell market has been segmented based on type, application, end-user, and regions.

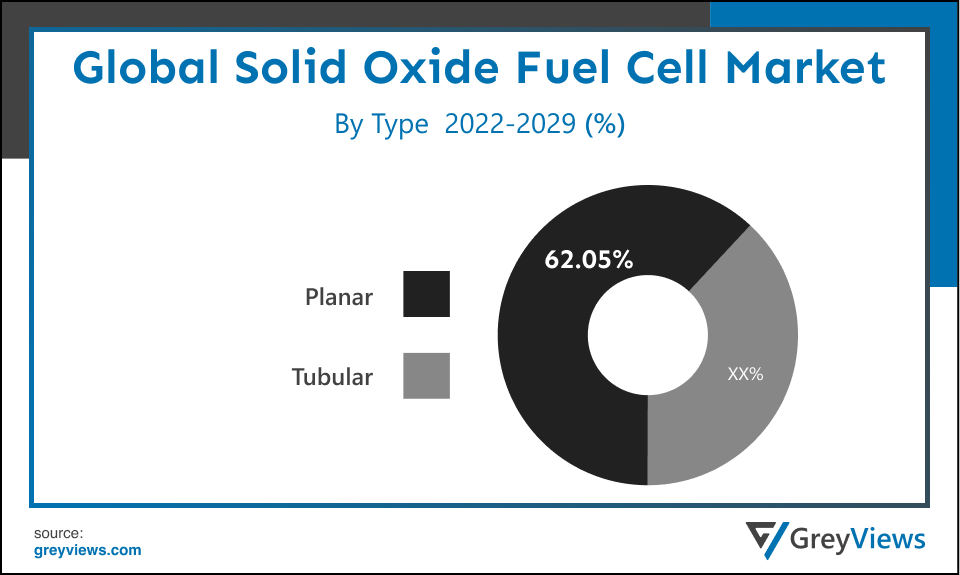

By Type

The type segment includes planar and tubular. The planar segment led the Solid Oxide Fuel Cell market with a market share of around 62.05% in 2021. A relatively easier construction process, high power density, and simple geometry have primarily driven the growth of this segment. A planar design offers the simplest configuration where the cell components are configured as thin flat layers or plates. In addition, planar design has a higher energy density and a lower manufacturing cost. Such factors drive the growth of this segment.

By Application

The application type segment includes portable, stationary, and transport. The stationary segment led the solid oxide fuel cell market with a market share of around 73.41% in 2021. This is attributed to the fact that stationary solid oxide fuel cell is one of the most efficient and cleanest heat and electricity generation technologies. In addition, the growing focus on hydrogen-powered fuel cells for backup power has boosted the demand for stationary fuel cells. On the other hand, nowadays, the stationary solid oxide fuel cell systems adoption has increased significantly for distributed power generation, backup power, and cogeneration along with supplying power at remote locations.

By End User

The end-user segment includes commercial & industrial, data centers, military & defense, and residential. The commercial & industrial segment led the Solid Oxide Fuel Cell market with a market share of around 37.81% in 2021. The rise in demand for fuel cells in portable electronics, motor vehicles, and industrial stationary/motive power applications has primarily driven the growth of this segment. In addition, the commercial & industrial end-users are adopting various strategies to curb GHG emissions. This has further boosted demand for solid oxide fuel cells in commercial & industrial applications.

By Regional Analysis

The regions analyzed for the Solid Oxide Fuel Cell market include North America, Europe, South America, Asia Pacific, and the Middle East, and Africa. The Asia-Pacific region dominated the Solid Oxide Fuel Cell market and held a 39.4% share of the market revenue in 2021.

- The Asia-Pacific region witnessed a major share. The growth of this region is mainly driven by wide-scale applications of solid oxide fuel cells in the stationary segments in the Asia Pacific. In addition, the countries such as Singapore, India, and Malaysia are actively framing regulations to support the alternative energy sector. Moreover, the factors such as increasing demand for clean electrical energy and rising environmental concerns are projected to be the major drivers of the market.

- North America is expected to witness a considerable growth rate during the Projection period as the policymakers and regulators in this region have introduced long- and medium-term goals to decarbonize the economy and boost the deployment of advanced zero-emission technologies. This factor has primarily driven the growth of the solid oxide fuel cells market in the region.

Global Solid Oxide Fuel Cell Market- Country Analysis:

- Germany

Germany solid oxide fuel cell market size was valued at USD 0.23 billion in 2021 and is expected to reach USD 1.49 billion by 2029, at a CAGR of 27.2% from 2022 to 2029. In the Europe region, Germany is the largest market shareholder in the solid oxide fuel cell market with an estimated market share of around 26.71% by the end of 2022. This is attributed to the fact that it is one of the leading nations in the mechanical engineering, manufacturing, automotive, and electrical industries.

In this country, the solid oxide fuel cell has become a prominent energy conversion technology owing to its higher efficiency. For instance, in October 2020, Mitsubishi Power supplies the first solid oxide fuel cell in Europe. This highly efficient hybrid system was projected to be put into operation at the Gas- und Wärme-Institut Essen e.v. (GWI) in Essen, Germany by March 2022.

- China

China's Solid Oxide Fuel Cell market size was valued at USD 0.30 billion in 2021 and is expected to reach USD 2.23 billion by 2029, at a CAGR of 29.2% from 2022 to 2029. The growth of the market in this region is mainly driven by the rising number of fuel cell vehicles along with the favorable government policies to use fuel cell technology. On the other hand, in February 2022, Ceres Power, the UK-based fuel cell technology developer signed an agreement with Bosch and Weichai for two stationary fuel cell joint ventures in China. Such business development strategies by key players further boost the growth of the market in this country.

- India

India's Solid Oxide Fuel Cell market size was valued at USD 0.16 billion in 2021 and is expected to reach USD 1.32 billion by 2029, at a CAGR of 31.2% from 2022 to 2029. India is one of the strongest growing economies in Asia. In this country, the government has introduced various regulations to reduce the dependency on fossil fuels; therefore, creating the demand for low carbon technologies, such as fuel cells. In addition, the energy consumption in this country is expected to be the fastest among all significant economies by 2040; hence, growing energy demand in this country is opportunistic for the growth of the market.

Key Industry Players Analysis:

To increase their market position in the global solid oxide fuel cell business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Bloom Energy

- Mitsubishi Power

- Aisin Seiki

- Hitachi Zosen Corporation

- Ceres Power

- Adelan

- Adaptive Energy

- Solid Power

- Watt fuel cell corporation

- Upstart power

Latest Development:

- In August 2021, Daroga Power, an emerging leader in sustainable infrastructure announced to deploy 32.5MW of Bloom Energy hydrogen solid oxide fuel cells (SOFC) for the production of renewable, clean power at customer sites in California, Connecticut, New York, Massachusetts, New Jersey, and Maryland.

- In December 2020, the collaboration of Bosch with Ceres progresses to the mass production of SOFC systems. This collaboration among the companies is aimed at an initial 200MW capacity in 2024.

Report Metrics

|

Report Attribute |

Details |

|

Market size available for years |

2021-2029 |

|

Base year considered |

2021 |

|

CAGR (%) |

28.2% |

|

Market Size |

1.45 billion in 2021 |

|

Projection period |

2021-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Type, application, end user, and regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Bloom Energy, Mitsubishi Power, Aisin Seiki, Hitachi Zosen Corporation, Ceres Power, Adela, Adaptive Energy, Solid Power, Watt Fuel Cell Corporation, Upstart Power among others |

|

By Type |

|

|

By Application |

|

|

By End User |

|

|

Regional scope |

|

Scope of the Report

Global Solid Oxide Fuel Cell Market by Type:

- Planar

- Tubular

Global Solid Oxide Fuel Cell Market by Application:

- Portable

- Stationary

- Transport

Global Solid Oxide Fuel Cell Market by End User:

- Commercial & Industrial

- Data Centers

- Military & Defense

- Residential

Global Solid Oxide Fuel Cell Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of Solid Exide Fuel Cell Market in 2021?

The Solid Exide Fuel Cell Market size was 1.45 billion in 2021

Which Region dominate the Solid Oxide Fuel Cell Market?

Asia-Pacific region dominated the Solid Oxide Fuel Cell market and held a 39.4% share of the market revenue in 2021

What is the Application of Solid Oxide Fuel Cell?

The application type segment includes portable, stationary, and transport. The stationary segment led the solid oxide fuel cell market with a market share of around 73.41% in 2021. This is attributed to the fact that stationary solid oxide fuel cell is one of the most efficient and cleanest heat and electricity generation technologies. In addition, the growing focus on hydrogen-powered fuel cells for backup power has boosted the demand for stationary fuel cells. On the other hand, nowadays, the stationary solid oxide fuel cell systems adoption has increased significantly for distributed power generation, backup power, and cogeneration along with supplying power at remote locations

What are the Challenges in Solid Oxide Fuel Cell Market?

There is an extensive range of fuel cells differentiated on the basis of the type of electrolyte being employed. In addition, there are numerous types of fuel cells presently under development, each with its own limitations, advantages, and potential applications. For instance, among the various fuel cell types, Alkaline Fuel Cells (AFCs) are the most efficient type of fuel cell, reaching up to 60% efficiency. Hence, the availability and development of more efficient and cost-effective fuel cells may pose a considerable challenge to the market players

Where India Stands in Solid Oxide Fuel Cell Market?

India's Solid Oxide Fuel Cell market size was valued at USD 0.16 billion in 2021 and is expected to reach USD 1.32 billion by 2029, at a CAGR of 31.2% from 2022 to 2029. India is one of the strongest growing economies in Asia. In this country, the government has introduced various regulations to reduce the dependency on fossil fuels; therefore, creating the demand for low carbon technologies, such as fuel cells. In addition, the energy consumption in this country is expected to be the fastest among all significant economies by 2040; hence, growing energy demand in this country is opportunistic for the growth of the market

Major Players in Solid Oxide Fuel Cell Market?

Bloom Energy, Mitsubishi Power, Aisin Seiki, Hitachi Zosen Corporation, Ceres Power, Adela, Adaptive Energy, Solid Power, Watt Fuel Cell Corporation, Upstart Power among others

What are the environmental Impact because of Solid Oxide Fuel Cell?

The regions such as Europe and North America have stringent emission norms. For instance, Euro 7 emission norms were implemented in 2020, with a CO2 emission target of 95 grams per kilometer. Such clean energy norms create demand for Solid Oxide Fuel Cells (SOFC) that plays a major role in energy decentralization by producing quiet, clean, and efficient energy, particularly in stationary power generation. In addition, the SOFCs are the most efficient fuel cell with fuel to electricity conversion efficiencies of over 60%. Such features of SOFCs make them a prominent choice to meet requirements by stringent emission norms, boosting market growth

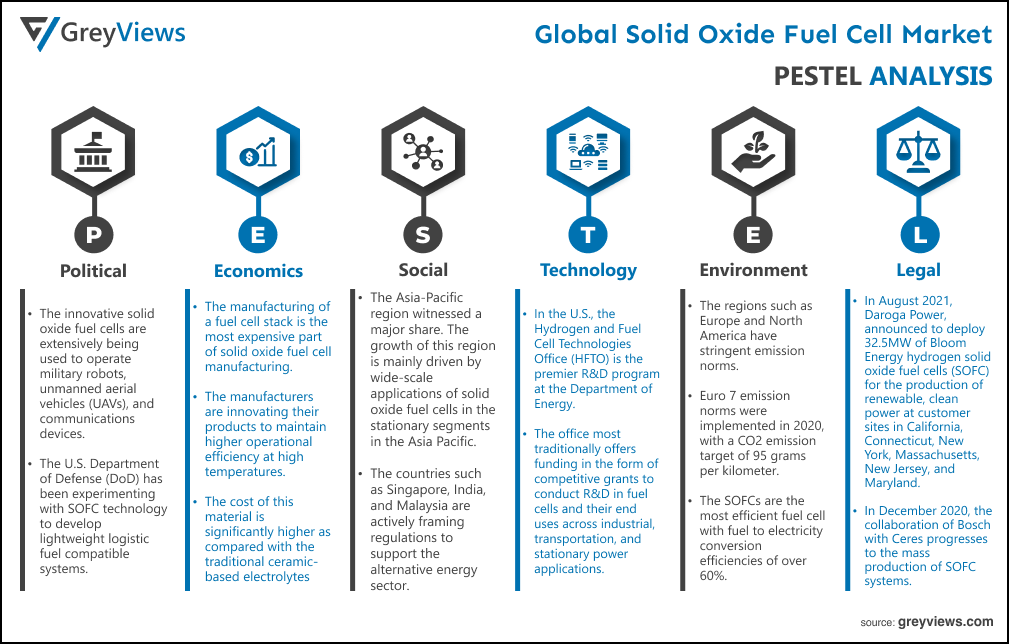

Political Factors- The innovative solid oxide fuel cells are extensively being used to operate military robots, unmanned aerial vehicles (UAVs), and communications devices. For instance, the U.S. Department of Defense (DoD) has been experimenting with SOFC technology to develop lightweight logistic fuel compatible systems for applications such as silent watch auxiliary power units, range extenders for electric vehicles, power generation for battery charging, and power for unmanned underwater and aerial vehicles. In the upcoming years, the U.S. military is projected to significantly increase its usage of unmanned aerial systems for wide-ranging functions, such as surveillance, reconnaissance, and targeting/acquisition. Hence, demand for portable and noiseless SOFCs in such military applications is opportunistic for the growth of the market.

Economic Factors- The manufacturing of a fuel cell stack is the most expensive part of solid oxide fuel cell manufacturing. In addition, the manufacturers are innovating their products to maintain higher operational efficiency at high temperatures. For instance, the yttria-stabilized zirconia (YSZ) is being used as an electrolyte. However, Zirconium has titanium-like properties and an extremely high melting temperature of 1,852°C. The cost of this material is significantly higher as compared with the traditional ceramic-based electrolytes. Hence, the use of such materials in the manufacture of solid oxide fuel cells hampers the growth of the market to some extent due to increased manufacturing costs.

Social Factor- The Asia-Pacific region witnessed a major share. The growth of this region is mainly driven by wide-scale applications of solid oxide fuel cells in the stationary segments in the Asia Pacific. In addition, the countries such as Singapore, India, and Malaysia are actively framing regulations to support the alternative energy sector. Moreover, the factors such as increasing demand for clean electrical energy and rising environmental concerns are projected to be the major drivers of the market.

Technological Factors- In the U.S., the Hydrogen and Fuel Cell Technologies Office (HFTO) is the premier R&D program at the Department of Energy. The office most traditionally offers funding in the form of competitive grants to conduct R&D in fuel cells and their end uses across industrial, transportation, and stationary power applications. In the financial year 2021, the Consolidated Appropriations Act provided $150 million to HFTO. Such investments by worldwide governments in fuel cell programs have significantly driven the global solid oxide fuel cells market.

Environmental Factors- The regions such as Europe and North America have stringent emission norms. For instance, Euro 7 emission norms were implemented in 2020, with a CO2 emission target of 95 grams per kilometer. Such clean energy norms create demand for Solid Oxide Fuel Cells (SOFC) that plays a major role in energy decentralization by producing quiet, clean, and efficient energy, particularly in stationary power generation. In addition, the SOFCs are the most efficient fuel cell with fuel to electricity conversion efficiencies of over 60%. Such features of SOFCs make them a prominent choice to meet requirements by stringent emission norms, boosting market growth.

Legal Factors- In August 2021, Daroga Power, an emerging leader in sustainable infrastructure announced to deploy 32.5MW of Bloom Energy hydrogen solid oxide fuel cells (SOFC) for the production of renewable, clean power at customer sites in California, Connecticut, New York, Massachusetts, New Jersey, and Maryland. In December 2020, the collaboration of Bosch with Ceres progresses to the mass production of SOFC systems. This collaboration among the companies is aimed at an initial 200MW capacity in 2024.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Type

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By End User

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Upsurge in R&D on fuel cell programs

- Rise in demand for clean energy

- Restrains

- High manufacturing and installation cost

- Opportunities

- Rise in demand for portable and noiseless SOFCs for military applications

- Challenges

- Development of alternative types of fuel cells

- Global Solid Oxide Fuel Cell Market Analysis and Projection, By Type

- Segment Overview

- Planar

- Tubular

- Global Solid Oxide Fuel Cell Market Analysis and Projection, By Application

- Segment Overview

- Portable

- Stationary

- Transport

- Global Solid Oxide Fuel Cell Market Analysis and Projection, By End User

- Segment Overview

- Commercial & Industrial

- Data Centers

- Military & Defense

- Residential

- Global Solid Oxide Fuel Cell Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Solid Oxide Fuel Cell Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Solid Oxide Fuel Cell Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Type Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Bloom Energy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Mitsubishi Power

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Aisin Seiki

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Hitachi Zosen Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Ceres Power

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Adela

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Adaptive Energy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Solid Power

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Watt Fuel Cell Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Upstart Power

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Type Portfolio

- Recent Developments

- SWOT Analysis

- Bloom Energy

List of Table

- Global Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Global Planar Market, By Region, 2021–2029(USD Billion)

- Global Tubular Market, By Region, 2021–2029(USD Billion)

- Global Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Global Portable Solid Oxide Fuel Cell Market, By Region, 2021–2029(USD Billion)

- Global Stationary Solid Oxide Fuel Cell Market, By Region, 2021–2029(USD Billion)

- Global Transport Solid Oxide Fuel Cell Market, By Region, 2021–2029(USD Billion)

- Global Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Global Commercial & Industrial Solid Oxide Fuel Cell Market, By Region, 2021–2029(USD Billion)

- Global Data Centers End User Solid Oxide Fuel Cell Market, By Region, 2021–2029(USD Billion)

- Global Military & Defense Solid Oxide Fuel Cell Market, By Region, 2021–2029(USD Billion)

- Global Residential Solid Oxide Fuel Cell Market, By Region, 2021–2029(USD Billion)

- Global Solid Oxide Fuel Cell Market, By Region, 2021–2029(USD Billion)

- Global Solid Oxide Fuel Cell Market, By North America, 2021–2029(USD Billion)

- North America Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- North America Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- North America Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- USA Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- USA Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- USA Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Canada Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Canada Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Canada Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Mexico Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Mexico Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Mexico Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Europe Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Europe Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Europe Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Germany Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Germany Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Germany Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- France Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- France Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- France Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- UK Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- UK Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- UK Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Italy Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Italy Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Italy Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Spain Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Spain Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Spain Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Asia Pacific Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Asia Pacific Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Japan Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Japan Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Japan Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- China Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- China Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- China Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- India Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- India Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- India Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- South America Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- South America Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- South America Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Brazil Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Brazil Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Brazil Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- Middle East and Africa Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- Middle East and Africa Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- UAE Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- UAE Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- UAE Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

- South Africa Solid Oxide Fuel Cell Market, By Type, 2021–2029(USD Billion)

- South Africa Solid Oxide Fuel Cell Market, By Application, 2021–2029(USD Billion)

- South Africa Solid Oxide Fuel Cell Market, By End User, 2021–2029(USD Billion)

List of Figures

- Global Solid Oxide Fuel Cell Market Segmentation

- Solid Oxide Fuel Cell Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Solid Oxide Fuel Cell Market Attractiveness Analysis By Type

- Global Solid Oxide Fuel Cell Market Attractiveness Analysis By Application

- Global Solid Oxide Fuel Cell Market Attractiveness Analysis By End User

- Global Solid Oxide Fuel Cell Market Attractiveness Analysis By Region

- Global Solid Oxide Fuel Cell Market: Dynamics

- Global Solid Oxide Fuel Cell Market Share By Type(2021 & 2029)

- Global Solid Oxide Fuel Cell Market Share By Application(2021 & 2029)

- Global Solid Oxide Fuel Cell Market Share By End User(2021 & 2029)

- Global Solid Oxide Fuel Cell Market Share by Regions (2021 & 2029)

- Global Solid Oxide Fuel Cell Market Share by Company (2020)