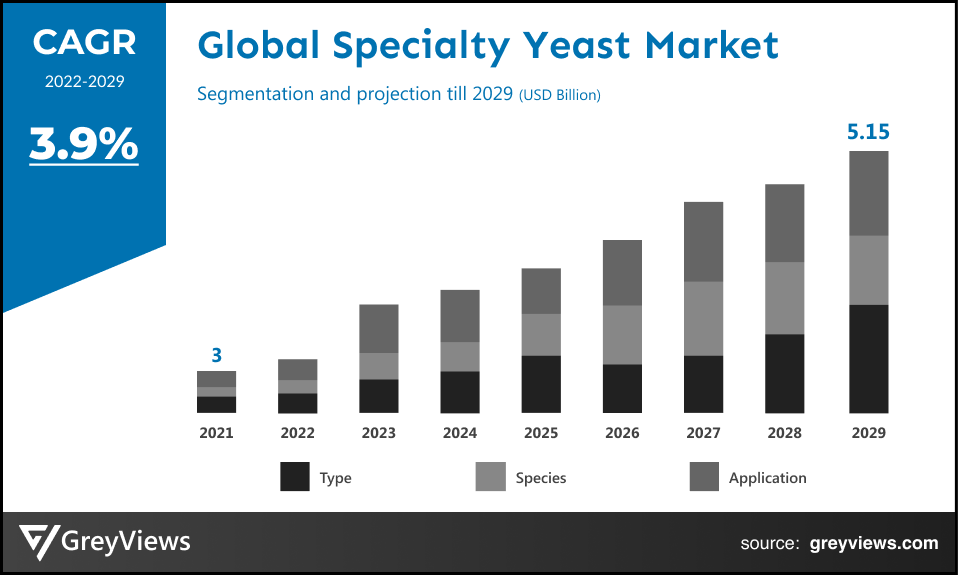

Specialty Yeast Market Size By Type (Yeast Extracts, Yeast Beta-Glucan, Yeast Autolysates, and Others), By Species (Pichia Pastoris, Saccharomyces Cerevisiae, Kluyveromyces, and Others), By Application (Feed, Food & Beverages, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 7%Current Market Size: USD 3 BillionFastest Growing Region: APAC

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Specialty Yeast Market- Market Overview:

The Global Specialty Yeast market is expected to grow from USD 3 billion in 2021 to USD 5.15 billion by 2029, at a CAGR of 7% during the Projection period 2022-2029. The growth of this market is mainly driven owing to increasing development in the food & beverage industry around the world.

Specialty yeasts are all-natural additives that enhance the nutritional profiles of food and feed products while also giving them a richer taste character. They are useful for a range of uses in the food and beverage sectors because of their high nutritional values and antioxidant qualities, which are thought to provide health advantages. Specialty yeast is extracted using fresh yeast. Typically, there are three phases involved in producing specialty yeast: fermentation (yeast development), disruption (cell breaking), and separation (to keep the soluble part). The enzymes dismantle the yeast shell and degrade the proteins, resulting in the production of the unique yeast products. Yeast is a single-celled fungus and a type of microorganism. Around 1,500 distinct varieties of yeast are used in the food and beverage industries. Saccharomyces cerevisiae is the most common species of yeast used for fermentation. It is also used to create alcoholic beverages, including beer and bread. Specialty yeast has different technical requirements than fresh yeast and is made up of proteins, amino acids, vitamins, and carbohydrates. The food industry frequently uses specialized yeast because of its particular flavor. Specialty yeast comes in a wide range of variants nowadays. However, the two most popular variants are still the unfortified and fortified ones. No additional vitamins or minerals are present in the unfortified variety. It solely contains the minerals and vitamins that yeast cells naturally produce as they grow. In the fortified form, nutrients are increased through the use of chemicals such synthetic vitamins.

Sample Request: - Global Specialty Yeast Market

Market Dynamics:

Drivers:

- Increasing Specialty Yeast Use in the Food and Beverage Industry

Specialty yeast is becoming more and more popular. This is mostly due to the fruitful results of several studies that have been conducted on yeasts as a whole. In reality, the majority of specialist yeasts were developed after their effects were recognised. Specialty yeast products, such as yeast extracts, yeast autolysates, and other yeast derivatives, are used in food and beverage goods because they can improve flavour. Specialty yeast applications are even expanding to include dietary supplements and other functional food categories.

Restraints:

- Negative Effects Of Yeast And Yeast Varieties On Health

Due to inaccurate measurements caused by fortification, the majority of speciality yeast variants include an excess of some nutrients. Even just 2 tablespoons of nutritional yeast flakes can provide close to the recommended daily dose of dietary fibre. If a person is not accustomed to consuming high-fiber meals, introducing too much fibre too quickly could result in cramps or even diarrhoea. Despite the fact that nutritional yeast is a great source of many vitamins and minerals, such as zinc and vitamin B-12, some yeast products also contain ingredients like tyramine, which in some people can lead to migraine attacks.

Opportunities:

- Developing Nations Are Seeing Increasing Demand For Low-Salt, No-Msg, and Clean-Label Products

Specialty yeasts are one of the rapidly growing food additives, eventually replacing synthetic flavours like MSG to reduce the glutamic acid and salt content of food. Over the past ten years, there has been an upsurge in demand for meals that are low in salt and MSG. Salt and MSG are regularly swapped out with yeast extracts, which have the properties of food flavouring agents, in processed food products. The fact that unique yeast components may keep a decent flavour under extremely low-salt settings is further evidence that this trend has been expanding as a result of rising consumer demand for food security and increased consumer awareness of consumer health.

Challenges

- Strict government guidelines

The usage of specialty yeast is anticipated to be constrained by strict regulatory regulations for speciality yeast and specialty yeast derivative goods. Despite the fact that eating organic food is good for consumers' general health, one of the main barriers to purchase is the high cost of organic goods. Due to the high cost of agricultural cultivation and processing, organic food is typically pricey. The requirement for legal compliance and laws in a particular nation also adds to the product's high price, which inhibits market expansion.

Segmentation Analysis:

The global specialty yeast market has been segmented based on type, species, application, and region.

By Type

The type segment is yeast extracts, yeast beta-glucan, yeast autolysates, and others. The yeast autolysates segment led the specialty yeast market with a market share of around 27% in 2021. Yeast autolysates are rapidly growing in popularity as a result of the growth in customer desire for natural and clean-label ingredients in recent years.

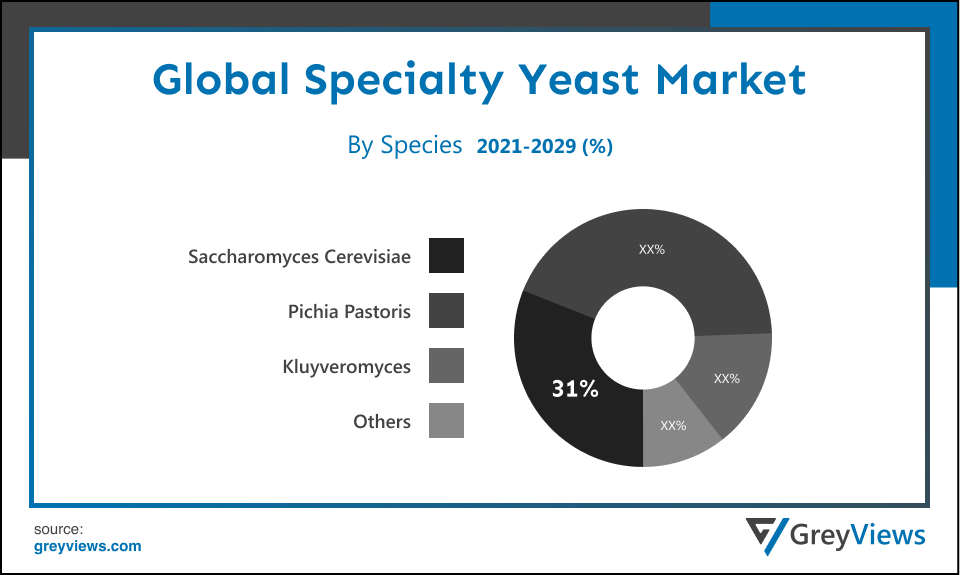

By Species

The species includes pichia pastoris, saccharomyces cerevisiae, kluyveromyces, and others. The saccharomyces cerevisiae segment led the specialty yeast market with a market share of around 31% in 2021. This kind of species is a frequently utilized component in a variety of food and beverage industry applications. The rise of the saccharomyces cerevisiae market will also be fueled by the rising demand for flavors like pepper and smokiness as well as rising health consciousness.

By Application

The application includes feed, food & beverages, and others. The large enterprise segment led the specialty yeast market with a market share of around 57% in 2021. Due to the extensive use of specialty yeast in numerous food applications, including snack spices, sauces, bread goods, and ready-to-eat meat products, the market is expanding. Additionally, the food processing sector uses a variety of specialist yeasts, including yeast autolysates, dried yeast, and yeast extracts, because these are thought of as nutritious ingredients. In the upcoming years, this element will help the food & beverage segment's market expansion.

By Regional Analysis:

The regions analyzed for the specialty yeast market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Europe region dominated the specialty yeast market and held a 40% share of the market revenue in 2021.

- Europe region witnessed a major share. Due to the increasing use of alcoholic beverages and savory goods in the region, the market is growing. Expanding urbanization will stimulate market expansion by making convenience foods more widely available. Specialty yeast is increasingly employed in feed products as a source of protein. Feed, bioethanol, biotechnology, cosmetics, and personal care items are all made with specialty yeasts. The creation of customized yeast involves the application of cutting-edge technical methods. The creation of specialized yeast involves a number of significant stakeholders. Several institutions, groups, and associations are attempting to increase public knowledge of specialized yeast products.

- Asia Pacific is anticipated to experience significant growth during the predicted period. During the Projection period, Asia Pacific is expected to increase significantly. Over the past few years, the region has experienced tremendous urbanization and an increase in the demand for fast food items. Other important drivers for the expansion of the specialized yeast sector in the region are rising demand for natural, pure, and fresh goods as well as more awareness of health and wellbeing. China, Japan, and India are important global markets for sauces, wine, dairy, and bakery goods, which considerably supports the expansion of the specialty yeast industry in the region.

Global Specialty Yeast Market- Country Analysis:

- Germany

Germany's Specialty Yeast market size was valued at USD 0.38 billion in 2021 and is expected to reach USD 0.61 billion by 2029, at a CAGR of 6.2% from 2022 to 2029. The country's bread and brewers industries are using more yeast components as a result of the big mass of baking items and their strong demand. The growing demand for alcohol and the enrichment of animal feed products are significant drivers of this market's expansion. Growing pet adoption rates and improved awareness of livestock health are driving industry expansion.

- China

China Specialty Yeast’s market size was valued at USD 0.30 billion in 2021 and is expected to reach USD 0.47 billion by 2029, at a CAGR of 5.7% from 2022 to 2029. In recent years, the region has experienced tremendous urbanization and a rise in the demand for fast food items. The demand for natural, pure, and fresh products has substantially expanded, and this has had a big positive impact on the expansion of the specialty yeast business in the region.

- India

India's Specialty Yeast market size was valued at USD 0.24 billion in 2021 and is expected to reach USD 0.36 billion by 2029, at a CAGR of 5.5% from 2022 to 2029. India's market expansion is also being aided by the country's booming food and beverage sector. The current change is significant, as evidenced by the trend toward decreasing sugar consumption. After years in which obesity became a significant health issue, Indian consumers are pushing back against products that are deemed to contribute to the issue. Products with less sugar and those that replace sugar are now required as a result of this. As a result, speciality yeast is expanding exponentially here.

Key Industry Players Analysis:

To increase their market position in the global specialty yeast business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- ADM

- AEB Group S.p.A.

- Leiber

- DSM

- Lesaffre

- Levex

- Biorigin

- Jeevan Biotech

- Angelyeast Co. Ltd.

- Hansen Holding A/S

- Foodchem International Corporation

- Halcyon Proteins Pty. Ltd.

- Agrano GmbH & Co. KG

- Aria Ingredients

- Associated British Foods PLC

- Kemin Industries, Inc.

- Kerry Group PLC

- Kohjin Life Sciences Co. Ltd.

- Lallemand Inc.

- Titan Biotech

Latest Development:

- In July 2022, An agreement was signed between Bejing PhaBuilder Biotechnology and Angel Yeast. The parties to this agreement sought to establish a sizable polyhydroxyalkanoate (PHA) production facility in the Hubei province of Yichang. The agreement also included plans for a future joint venture that would investigate how synthetic biology might be used in the biotechnology sector.

- In January 2022, A division of Associated British Foods Plc (UK), OHLY (Germany) introduced the yeast-based chicken flavor enhancer OHLY SAV-R-MEAT PBD. This product aims to satisfy consumer demand for a good-tasting chicken product with a lingering umami flavor.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

7% |

|

Market Size |

3 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Species, By Application, and Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

ADM, AEB Group S.p.A., Leiber, DSM, Lesaffre, Levex, Biorigin, Jeevan Biotech, Angelyeast Co. Ltd., Chr. Hansen Holding A/S, Foodchem International Corporation, Halcyon Proteins Pty. Ltd., Agrano GmbH & Co. KG, Aria Ingredients, Associated British Foods PLC, Kemin Industries, Inc., Kerry Group PLC, Kohjin Life Sciences Co. Ltd., Lallemand Inc., Titan Biotech, among others |

|

By Type |

|

|

By Species |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Specialty Yeast Market by Type:

- Yeast Extracts

- Yeast Beta-Glucan

- Yeast Autolysates

- Others

Global Specialty Yeast Market by Species:

- Pichia Pastoris

- Saccharomyces Cerevisiae

- Kluyveromyces

- Others

Global Specialty Yeast Market by Application:

- Feed

- Food & Beverages

- Others

Global Specialty Yeast Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of specialty yeast market in 2021?

Global Specialty Yeast market size was USD 3 billion in 2021

What will be the market size of the specialty yeast market?

Global specialty yeast market is expected to reach USD 5.15 billion by 2029, at a CAGR of 7% from 2022 to 2029.

Which are the leading market players active in the specialty yeast market?

Leading market players active in the global specialty yeast market are ADM, AEB Group S.p.A., Leiber, DSM, Lesaffre, Levex, Biorigin, Jeevan Biotech, Angelyeast Co. Ltd., Chr. Hansen Holding A/S, Foodchem International Corporation, Halcyon Proteins Pty. Ltd., Agrano GmbH & Co. KG, Aria Ingredients, Associated British Foods PLC, Kemin Industries, Inc., Kerry Group PLC, Kohjin Life Sciences Co. Ltd., Lallemand Inc., Titan Biotech.

What are the key threats to the specialty yeast market?

The possibility of side effects of yeast is primarily impeding the growth of the specialty yeast market.

What opportunities are projected to influence the market in the upcoming years?

Development in the food & beverage industry around the globe is projected to influence the market in the Projection years.

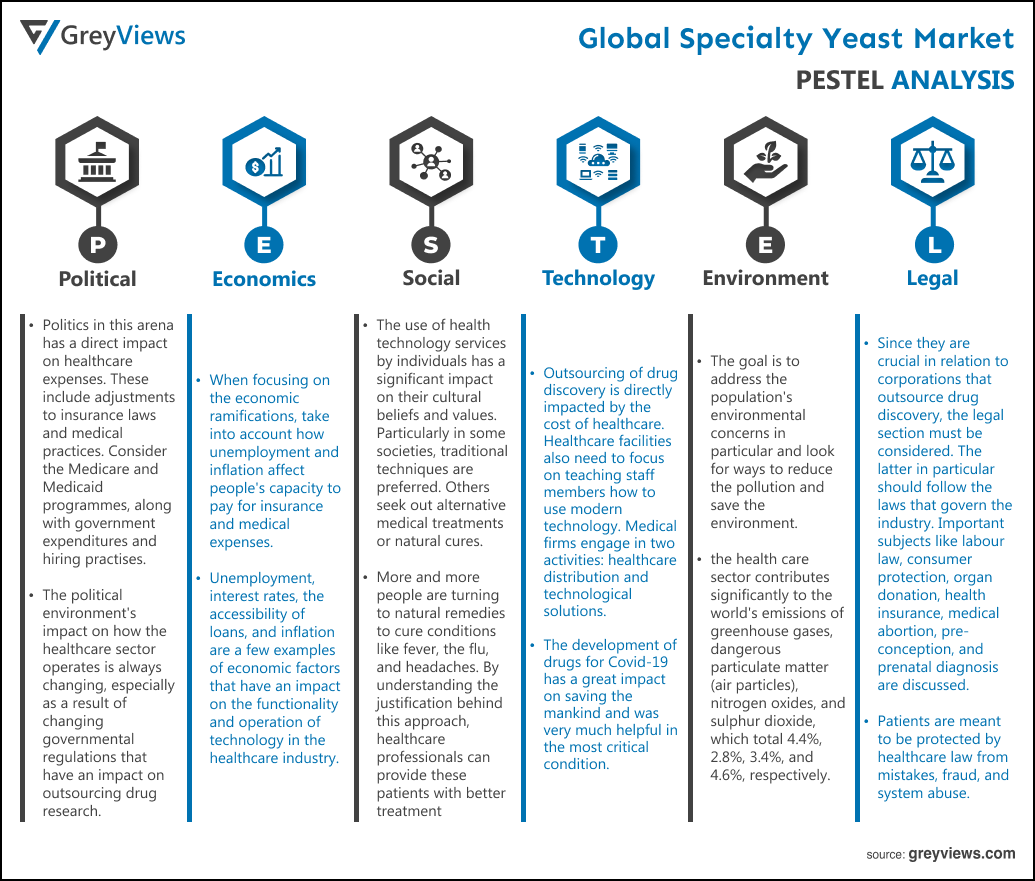

Political Factors- Operating in the food industry exposes the market players to a variety of political systems and environmental concerns. There are organizations like PETA that can raise their voice against the animal-based food industry. Diversifying the systemic risk management of the political environment is necessary to succeed in such a dynamic industry as food across numerous nations. Political stability and the importance of Food in the country's economy play a huge role. Trade regulations & tariffs related to Consumer Goods and the Food industry also affect the market’s growth.

Economical Factors- While microenvironmental elements like industry norms have an impact on the firm's competitive edge. The food industry can forecast not only the growth trajectory of the specialty yeast sector but also that of the market players by using country-level economic factors like growth rate, inflation, and industry-level economic indicators like food industry growth rate, consumer spending, etc. Exchange rates impact an economy's supply and price of imported commodities as well as the costs associated with exporting goods.

Social Factor- The specialty yeast market should create a marketing message for consumers in the industry, shared beliefs and attitudes of the populace play a significant influence in how marketers at that company comprehend the clients of a specific market. Education level as well as education standards in the Food industry also affects the market’s growth. In addition to cultural features, social variables also take into account age distribution, career attitudes, health consciousness, and emphasis on safety. Social trends have an impact on a company's operations and the demand for its products. An aging population, for instance, can indicate a smaller and less willing workforce (thus increasing the cost of labor). In addition, businesses may alter their management tactics to reflect these social trends (such as recruiting older workers).

Technological Factors- Examples of technological aspects include R&D work, automation, technology incentives, and the rate of technological advancement. They can set entrance barriers, determine the minimal effective level of output, and influence outsourcing decisions. Prices, quality, and innovation may also be impacted by technological advancements. A business should assess the technological state of the sector and the speed of technological disruption. Rapid technological disruption may provide a firm little time to adapt and be successful, but slow technological disruption will give more time.

Environmental Factors- As people become more aware of the possible effects of climate change, it changes how businesses run and the products they offer, creating new markets and eroding or eliminating existing ones. Climate changes such as climate change, greenhouse gas emissions, and growing pollution, are effectively by prominent market players. It should emphasise waste management, recycling, renewable energy sources, and food wastage that decomposes naturally. It should also be aware of how its resources and waste are being used up, as this could negatively affect its brand reputation and consumer loyalty.

Legal Factors- The food industry is subject to very strict legislative requirements. Market players, to gain consumer loyalty and their faith in their brand products, must abide by all laws and binding rules and regulations. Nearly all nations now have laws that must be followed for consumer protection, data privacy, intellectual property rights (IPR), health and safety, employees and the workplace, and other topics. Therefore, it becomes essential for this business to conduct itself lawfully and ethically to prevent any legal proceedings or penalties, or punishments from a court of law. Like in India, FSSAI is in charge of monitoring food product adulteration, safety, and standards. All food businesses are required by law to comply with this requirement. Similarly in the USA, there is FDA that regulates the food environment.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Species

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Increasing preference for MSG free, less sugar food

- 3. Restraints

- 3.1. Related side-effects

- 4. Opportunities

- 4.1. Increasing Specialty Yeast Use in the Food and Beverage Industry

- 5. Challenges

- 5.1. Stringent government regulations

- Global Specialty Yeast Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Yeast Extracts

- 3. Yeast Beta-Glucan

- 4. Yeast Autolysates

- 5. Others

- Global Specialty Yeast Market Analysis and Projection, By Species

- 1. Segment Overview

- 2. Pichia Pastoris

- 3. Saccharomyces Cerevisiae

- 4. Kluyveromyces

- 5. Others

- Global Specialty Yeast Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Feed

- 3. Food & Beverages

- 4. Others

- Global Specialty Yeast Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Specialty Yeast Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Specialty Yeast Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- ADM

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- AEB Group S.p.A.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Leiber

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- DSM

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Lesaffre

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Levex

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Biorigin

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Jeevan Biotech

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Angelyeast Co. Ltd.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Hansen Holding A/S

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- ADM

List of Table

- Global Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Global Yeast Extracts, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Yeast Beta-Glucan, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Yeast Autolysates, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Others, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Global Pichia Pastoris, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Saccharomyces Cerevisiae, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Kluyveromyces, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Others, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Global Feed, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Food & Beverages, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Others, Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- Global Specialty Yeast Market, By Region, 2021–2029 (USD Billion)

- North America Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- North America Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- North America Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- USA Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- USA Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- USA Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Canada Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Canada Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Canada Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Mexico Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Mexico Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Mexico Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Europe Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Europe Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Europe Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Germany Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Germany Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Germany Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- France Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- France Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- France Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- UK Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- UK Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- UK Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Italy Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Italy Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Italy Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Spain Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Spain Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Spain Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Asia Pacific Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Japan Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Japan Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Japan Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- China Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- China Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- China Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- India Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- India Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- India Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- South America Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- South America Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- South America Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Brazil Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Brazil Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Brazil Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- Middle East and Africa Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- UAE Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- UAE Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- UAE Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

- South Africa Specialty Yeast Market, By Type, 2021–2029 (USD Billion)

- South Africa Specialty Yeast Market, By Species, 2021–2029 (USD Billion)

- South Africa Specialty Yeast Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Specialty Yeast Market Segmentation

- Specialty Yeast Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Specialty Yeast Market Attractiveness Analysis By Type

- Global Specialty Yeast Market Attractiveness Analysis By Species

- Global Specialty Yeast Market Attractiveness Analysis By Application

- Global Specialty Yeast Market Attractiveness Analysis By Region

- Global Specialty Yeast Market: Dynamics

- Global Specialty Yeast Market Share By Type (2021 & 2029)

- Global Specialty Yeast Market Share By Species (2021 & 2029)

- Global Specialty Yeast Market Share By Application (2021 & 2029)

- Global Specialty Yeast Market Share by Regions (2021 & 2029)

- Global Specialty Yeast Market Share by Company (2020)