Sports Equipment Market Size by Product Type (Ball Games, Ball Over Net Games, Athletic Training Equipment, Fitness/Strength Equipment), By Distribution Channel (Online retail, Specialty & sports shops, Department & discount stores), End-User, Regions, Segmentation, and Projection till 2029

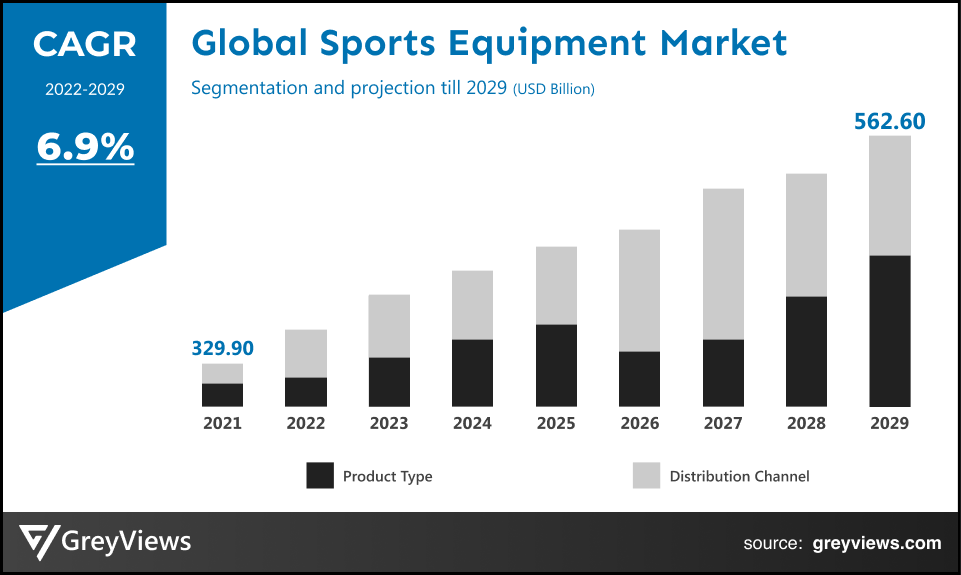

CAGR: 6.9%Current Market Size: USD 329.90 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Sports Equipment Market- Market Overview:

The Global Sports Equipment market is expected to grow from USD 329.90 billion in 2021 to USD 562.60 billion by 2029, at a CAGR of 6.9% during the Projection period 2022-2029. Rapid technological advancements and continuous innovation drive this market growth to keep pace with the preferences of dynamic consumers.

Sports equipment, also known as sporting goods, includes sports apparel, tools, gear, and materials widely used to compete in a sports activity to keep a person healthy and fit. Sports equipment is also used as protective gear or tools to assist the sportsperson in playing the sport. Sports equipment is also used to protect and prevent injuries while playing any sports. This equipment can be found online or in any special sporting equipment shop or department store. The market for sports equipment has witnessed a high demand in recent years owing to the increasing importance of sports and fitness activities and awareness about the benefits of a healthy lifestyle. Furthermore, the growing popularity of national and international events, such as the Olympic Games, Soccer World Cup, and Cricket World Cup, provide impetus to the market’s growth.

Request Sample: - Global Sports Equipment Market

Market Dynamics:

Drivers:

- Increasing awareness regarding the health benefits of sports activities

Playing sports has several advantages for the human body as it helps reduce fat and keep a person healthy by controlling the body weight. Hence, an increasing number of people are participating in sports activities to improve fitness and health. In addition, the rising number of national and international events also increases the demand for sports equipment among consumers driving the market’s growth. Several sports activities, when played regularly, helps decrease the risk of diabetes, reduce blood pressure, improve heart function, and reduce stress levels.

Moreover, consumer interest has increased in health and wellness due to the COVID-19 pandemic. This was attributed to the extensive studies which linked obesity to the higher incidence of death and serious illness from COVID-19. Such factors contributed to the growth of the global Sports Equipment market.

Restraints:

- Increasing preferences for indoor sports

The increasing preferences for indoor activities, such as playing video games, board games, mobile phone games, etc., are restraining the market’s growth. The rapid penetration of the internet adversely affects the market growth as the youth and children as continuously glued to their mobile screens and hardly go out to play any sports. In addition, the rising demand for watching movies, virtual reality gaming, live music shows, and others restrains the growth of the sports equipment market.

Opportunities:

- Upsurge in investment in the sports industry

The sports sector has attracted significant investment capital over the past few years. More than half of the deals have been acquisitions of teams, leagues, or media partnerships; the rest have focused on related aspects of the sports ecosystem, such as online betting, fitness hardware and software, and technology that supports digitally enhanced fan experiences. In addition, governments are also putting laws into place that support the development of sports infrastructure and Sports Equipment which will be expected to present a market expansion potential for the sports equipment market.

Challenges

- Impact of COVID-19 pandemic

The COVID-19 pandemic has posed significant challenges in the global Sports Equipment industry. This has forced everyone associated with the sports industry to work from home, and players were compelled to follow quarantine restrictions imposed by government orders. Moreover, the factories manufacturing sports equipment were temporarily closed to stop the spread of the disease, which challenged the market’s growth. There was also disruption in the raw material supply chain as most of the raw materials used for making sports equipment were received from China, which completely stopped during the Covid-19 pandemic.

Segmentation Analysis:

The global Sports Equipment market has been segmented based on product type, distribution channel, and region.

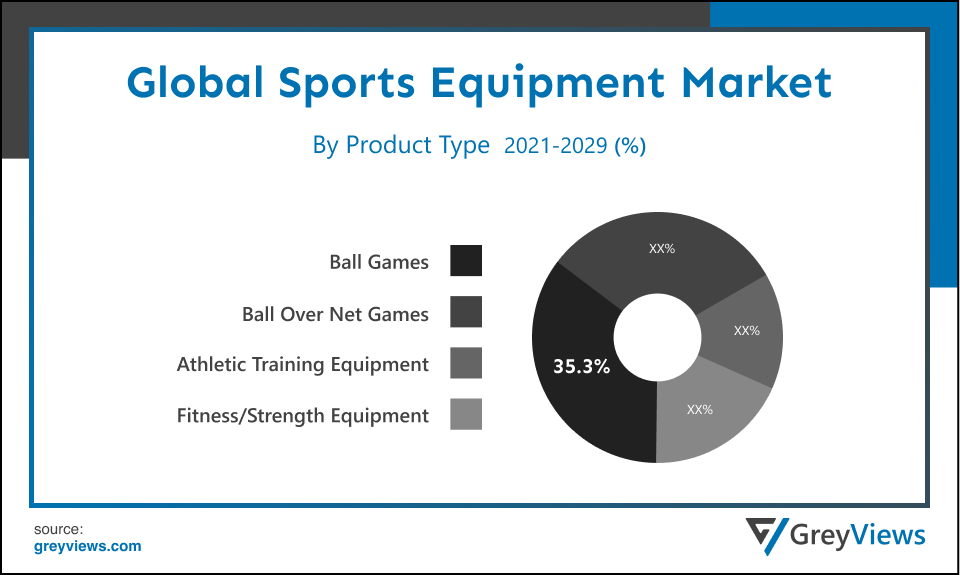

By Product Type

The product type segment includes ball games, ball over net games, athletic training equipment, and fitness/strength equipment. The Ball Games segment led the Sports Equipment market with a market share of around 35.6% in 2021. The increasing popularity of ball games such as cricket, football, basketball, volleyball, tennis, etc., propels the demand for the segment. Furthermore, these games are easy to play, and the equipment is also cheaper when compared to other sports equipment, supplementing the segment’s growth.

By Distribution Channel

The distribution Channel segment includes online retail, specialty & sports shops, and department & discount stores. The specialty & sports shops segment led the Sports Equipment market with a market share of around 45.8% in 2021. The specialty & sports shops have various options of branded sports equipment and provide consumers with the required information and support. Moreover, these shops also arrange for the equipment ordered by the consumer on short notice, and the products can also be replaced easily in case of any defect, supplementing the growth of this segment.

By Regional Analysis:

The regions analyzed for the Sports Equipment market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the Sports Equipment market and held a 36.05% share of the market revenue in 2021.

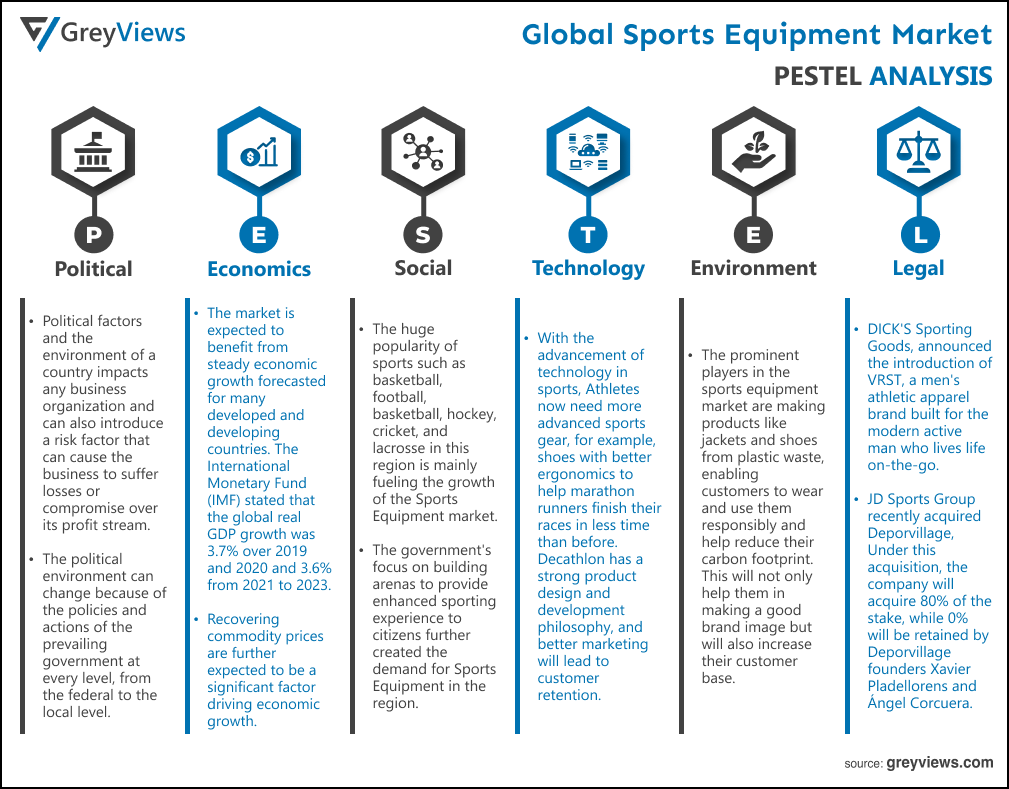

- The north American region has registered the highest value for the year 2021. The huge popularity of sports such as basketball, football, basketball, hockey, cricket, and lacrosse in this region is mainly fueling the growth of the Sports Equipment market. In addition, the government's focus on building arenas to provide enhanced sporting experience to citizens further created the demand for Sports Equipment in the region.

- Asia-Pacific is expected to witness a considerable growth rate during the Projection period. The ongoing political, social, and economic significance of the sports industry in the Asia-Pacific has mainly boosted demand for Sports Equipment in countries such as China, India, and Japan, among others. In addition, major global sports mega-events are repeatedly being hosted in Asia-Pacific countries propelling the market’s growth.

Global Sports Equipment Market- Country Analysis

- Germany

Germany's Sports Equipment market size was valued at USD 11.6 billion in 2021 and is expected to reach USD 22.77 billion by 2029, at a CAGR of 8.8% from 2022 to 2029. Germany is one of the leading nations in the Europe Sports Equipment market. The factors such as huge participation and spectatorship of football, economic growth, and increasing focus on health and wellness among the population are fueling the growth of the Germany Sports Equipment market.

In addition, the popularity of the NBA (National Basketball Association) has increased the fan base for sports in Germany. There is also an increase in the European sports fan base, driving the market’s growth in the region. For instance, in July 2021, Fanatics, in association with NBA, announced the opening of the first NBA store in the United Kingdom. This store is located in London’s shopping area at 14-16 Foubert’s Place.

- China

China's Sports Equipment market was valued at USD 2.05 billion in 2021 and is expected to reach USD 3.05 billion by 2029, at a CAGR of 5.1% from 2022 to 2029. China is one of the largest Sports Equipment markets. This is mainly attributed to the introduction of several key initiatives that are aimed at boosting the sports industry. For instance, in August 2021, the government of China announced its ambitious plan to make a 5 trillion-yuan sports industry by 2025. This size of the sports industry is about 69.5% higher than the size in 2019. Such government funding and policy assistance are expected to fuel the growth of the overall Sports Equipment industry in the country.

- India

India's Sports Equipment market size was valued at USD 3.9 billion in 2021 and is expected to reach USD 7.7 billion by 2029, at a CAGR of 8.9% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the emerging popularity of cricket and other sports in this country is expected to create lucrative growth opportunities for the market. The rising need for sports equipment and apparel to use while playing sports to prevent injuries is expected to drive the market’s growth in the region.

Key Industry Players Analysis:

To increase their market position in the global Sports Equipment business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Adidas AG

- Amer Sports

- Callaway Golf Co.

- Sumitomo Rubber Industries Limited

- Nike, Inc.

- Puma SE

- Mizuno Corporation

- Sports Direct International PLC

- Under Armour

- Yonex Co., Ltd

Latest Development:

- In March 2021, DICK'S Sporting Goods, the largest U.S.-based, omni-channel sporting goods retailer, announced the introduction of VRST, a men's athletic apparel brand built for the modern active man who lives life on-the-go.

- In June 2021, JD Sports Group recently acquired Deporvillage, an online-only retailer of outdoor sporting equipment. Under this acquisition, the company will acquire 80% of the stake, while 0% will be retained by Deporvillage founders Xavier Pladellorens and Ángel Corcuera.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

6.9% |

|

Market Size |

329.90 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Product type, distribution channel, facility of use, and Regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Adidas AG, Amer Sports, Callaway Golf Co., Sumitomo Rubber Industries Limited, Nike, Inc., Puma SE, Mizuno Corporation, Sports Direct International PLC, Under Armour, Yonex Co., Ltd. among others |

|

By Product Type |

? Ball over net games ? Ball games ? Fitness/Strength equipment ? Athletic training equipment |

|

By Distribution Channel |

? Online retail ? Specialty & sports shops ? Department & discount stores |

|

Regional scope |

? North America ? Europe ? Asia-Pacific ? South America ? Middle East and Africa |

Scope of the Report

Global Sports Equipment Market by Product Type:

- Ball over net games

- Ball games

- Fitness/Strength equipment

- Athletic training equipment

Global Sports Equipment Market by Distribution Channel:

- Online retail

- Specialty & sports shops

- Department & discount stores

Global Sports Equipment Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of the Sports Equipment market?

Global Sports Equipment market is expected to reach USD 329.90 billion in 2021 to USD 562.60 billion by 2029, at a CAGR of 6.9% from 2022 to 2029.

Which is leading region for the global sports equipment market?

North America is the leading Region for the sports equipment market.

What is the most significant medium to sell Sports Equipment?

Specialty & sports shops segment witnessed a significant share in the Sports Equipment market, with a market share of around 45.8% in 2021.

Which are the leading market players active in the Sports Equipment market?

Leading market players active in the global Sports Equipment market are Adidas AG, Amer Sports, Callaway Golf Co., Sumitomo Rubber Industries Limited, Nike, Inc., Puma SE, Mizuno Corporation, Sports Direct International PLC, Under Armour, Yonex Co., Ltd among others.

What are the driving factors for the market’s growth during the Projection period?

Upsurge in investment in sports industry, supportive government initiatives, and growth potential of developing countries are projected to influence the market during the Projection period.

Political Factors- Governments are also putting laws into place that support the development of sports infrastructure and sports training which will be expected to present a market expansion potential. For instance, in February 2022, National Development and Reform Commission (NDRC) in China announced an investment of about $331 million to build 185 sports venues, including national fitness centers, sports parks, and public facilities for outdoor sports. Such investments are opportunistic for the growth of the global sports training market.

Economical Factors- Increased disposable income of the population has led to higher purchasing power, further expanding and enabling more people to afford sports training services. For instance, according to the L.E.K. Consulting, as of the year 2018, recreation spending in the U.S. increased by 24% in the last five years, while U.K. spending on leisure activities was up to 17%. This increase in the disposable income of the population is fueling demand for sports training services.

Social Factor- Huge popularity of sports such as basketball, ice hockey, gridiron football, charrería/rodeo, jaripeo/bull riding, and lacrosse in this region is mainly fueling growth of the sports training market. In addition, American football is seeing an increased interest among the population in terms of broadcast viewership, audience, and players. This has further created the demand for sports training in the region.

Technological Factors- More than half of the deals have been acquisitions of teams, leagues, or media partnerships; the rest have focused on related aspects of the sports ecosystem, such as online betting, fitness hardware and software, and technology that supports digitally enhanced fan experiences. Moreover, the Covid-19 situation has led to significant needs and challenges in front of the sports training sector to increase the adoption of advanced technologies to manage and train athletes or sportsmen without affecting their or trainers’ health and continue the practice.

Environmental Factors- There are environmental considerations that impact on the way that the sports marketer creates, implements, and analyses their marketing campaigns. This chapter will investigate the environmental forces that surround and permeate sports organisations and the sports marketer within them. The first part of this chapter will discuss the key principles of environmental analysis which, is that these external forces impact on all organisations, sport and non-sport, that operate within the same environment

Legal Factors- The government of China announced its ambitious plan to make a 5 trillion-yuan sports industry by 2025. This size of the sports industry is about 69.5% higher than the size in 2019. Such government funding and policy assistance is expected to fuel growth of the overall sports training industry in the country. According to GroupM ESP, a media investment company, the estimated size of the Indian Sports Industry is about $796 million. Also, the size of the Indian sports industry is expected to grow rapidly in the upcoming years. In addition, the country is seeing emerging awareness and interest in various sports. US Sports Camps, the provider of Nike Sports Camps, launched Nike KIDS Camps. These camps are focused on development of foundational athletic skills for 5- to 8-year-old kids. The training offered through this launch is expected to help campers build confidence and competence through practicing sports as well as athletic fundamentals

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Form

- Market Attractiveness Analysis By Sports Type

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By Medium

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increased rate of participation in sports for health benefits

- Increase in disposable income

- Restrains

- Underdevelopment of sports industry in developing countries

- Opportunities

- Upsurge in investment in sports industry

- Challenges

- Impact of COVID-19 pandemic on global sports training industry

- Global Sports Training Market Analysis and Projection, By Form

- Segment Overview

- Academy/Coaching

- Therapy

- Sports Analytics

- Global Sports Training Market Analysis and Projection, By Sports Type

- Segment Overview

- Soccer

- Cricket

- Baseball

- Volleyball

- Global Sports Training Market Analysis and Projection, By Application

- Segment Overview

- Men

- Women

- Kids

- Global Sports Training Market Analysis and Projection, By Medium

- Segment Overview

- Online

- Offline

- Global Sports Training Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Sports Training Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Sports Training Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Form Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Challenger Sports

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- CMT Learning Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- Coach Sport LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- Elle Football Academy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- ESM Academies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- Ignite Sport UK Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- School Sports Coaching

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- TENVIC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- United States Sports Academy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- US Sports Camps Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- Challenger Sports

List of Table

- Global Sports Training Market, By Form, 2021–2029(USD Billion)

- Global Academy/Coaching Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Therapy Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Analytics Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Global Soccer Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Cricket Training Market, By Region, 2021–2029(USD Billion)

- Global Baseball Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Volleyball Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By Application, 2021–2029(USD Billion)

- Global Men Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Women Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Kids Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By Medium, 2021–2029(USD Billion)

- Global Online Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Offline Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By North America, 2021–2029(USD Billion)

- North America Sports Training Market, By Form, 2021–2029(USD Billion)

- North America Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- North America Sports Training Market, By Application, 2021–2029(USD Billion)

- North America Sports Training Market, By Medium, 2021–2029(USD Billion)

- USA Sports Training Market, By Form, 2021–2029(USD Billion)

- USA Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- USA Sports Training Market, By Application, 2021–2029(USD Billion)

- USA Sports Training Market, By Medium, 2021–2029(USD Billion)

- Canada Sports Training Market, By Form, 2021–2029(USD Billion)

- Canada Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Canada Sports Training Market, By Application, 2021–2029(USD Billion)

- Canada Sports Training Market, By Medium, 2021–2029(USD Billion)

- Mexico Sports Training Market, By Form, 2021–2029(USD Billion)

- Mexico Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Mexico Sports Training Market, By Application, 2021–2029(USD Billion)

- Mexico Sports Training Market, By Medium, 2021–2029(USD Billion)

- Europe Sports Training Market, By Form, 2021–2029(USD Billion)

- Europe Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Europe Sports Training Market, By Application, 2021–2029(USD Billion)

- Europe Sports Training Market, By Medium, 2021–2029(USD Billion)

- Germany Sports Training Market, By Form, 2021–2029(USD Billion)

- Germany Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Germany Sports Training Market, By Application, 2021–2029(USD Billion)

- Germany Sports Training Market, By Medium, 2021–2029(USD Billion)

- France Sports Training Market, By Form, 2021–2029(USD Billion)

- France Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- France Sports Training Market, By Application, 2021–2029(USD Billion)

- France Sports Training Market, By Medium, 2021–2029(USD Billion)

- UK Sports Training Market, By Form, 2021–2029(USD Billion)

- UK Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- UK Sports Training Market, By Application, 2021–2029(USD Billion)

- UK Sports Training Market, By Medium, 2021–2029(USD Billion)

- Italy Sports Training Market, By Form, 2021–2029(USD Billion)

- Italy Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Italy Sports Training Market, By Application, 2021–2029(USD Billion)

- Italy Sports Training Market, By Medium, 2021–2029(USD Billion)

- Spain Sports Training Market, By Form, 2021–2029(USD Billion)

- Spain Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Spain Sports Training Market, By Application, 2021–2029(USD Billion)

- Spain Sports Training Market, By Medium, 2021–2029(USD Billion)

- Asia Pacific Sports Training Market, By Form, 2021–2029(USD Billion)

- Asia Pacific Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Asia Pacific Sports Training Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Sports Training Market, By Medium, 2021–2029(USD Billion)

- Japan Sports Training Market, By Form, 2021–2029(USD Billion)

- Japan Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Japan Sports Training Market, By Application, 2021–2029(USD Billion)

- Japan Sports Training Market, By Medium, 2021–2029(USD Billion)

- China Sports Training Market, By Form, 2021–2029(USD Billion)

- China Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- China Sports Training Market, By Application, 2021–2029(USD Billion)

- China Sports Training Market, By Medium, 2021–2029(USD Billion)

- India Sports Training Market, By Form, 2021–2029(USD Billion)

- India Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- India Sports Training Market, By Application, 2021–2029(USD Billion)

- India Sports Training Market, By Medium, 2021–2029(USD Billion)

- South America Sports Training Market, By Form, 2021–2029(USD Billion)

- South America Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- South America Sports Training Market, By Application, 2021–2029(USD Billion)

- South America Sports Training Market, By Medium, 2021–2029(USD Billion)

- Brazil Sports Training Market, By Form, 2021–2029(USD Billion)

- Brazil Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Brazil Sports Training Market, By Application, 2021–2029(USD Billion)

- Brazil Sports Training Market, By Medium, 2021–2029(USD Billion)

- Middle East and Africa Sports Training Market, By Form, 2021–2029(USD Billion)

- Middle East and Africa Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Middle East and Africa Sports Training Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Sports Training Market, By Medium, 2021–2029(USD Billion)

- UAE Sports Training Market, By Form, 2021–2029(USD Billion)

- UAE Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- UAE Sports Training Market, By Application, 2021–2029(USD Billion)

- UAE Sports Training Market, By Medium, 2021–2029(USD Billion)

- South Africa Sports Training Market, By Form, 2021–2029(USD Billion)

- South Africa Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- South Africa Sports Training Market, By Application, 2021–2029(USD Billion)

- South Africa Sports Training Market, By Medium, 2021–2029(USD Billion)

List of Figures

- Global Sports Training Market Segmentation

- Sports Training Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Sports Training Market Attractiveness Analysis By Form

- Global Sports Training Market Attractiveness Analysis By Sports Type

- Global Sports Training Market Attractiveness Analysis By Application

- Global Sports Training Market Attractiveness Analysis By Medium

- Global Sports Training Market Attractiveness Analysis By Region

- Global Sports Training Market: Dynamics

- Global Sports Training Market Share By Form(2021 & 2028)

- Global Sports Training Market Share By Sports Type(2021 & 2028)

- Global Sports Training Market Share By Application(2021 & 2028)

- Global Sports Training Market Share By Medium(2021 & 2028)

- Global Sports Training Market Share by Regions (2021 & 2028)

- Global Sports Training Market Share by Company (2020)