Sports Training Market Size by Form (Academy/Coaching, Therapy, and Sports Analytics), Sports Type (Soccer, Cricket, Baseball, and Volleyball), Application (Men, Women, and Kids), Medium (Online and Offline), Regions, Segmentation, and Projection till 2029

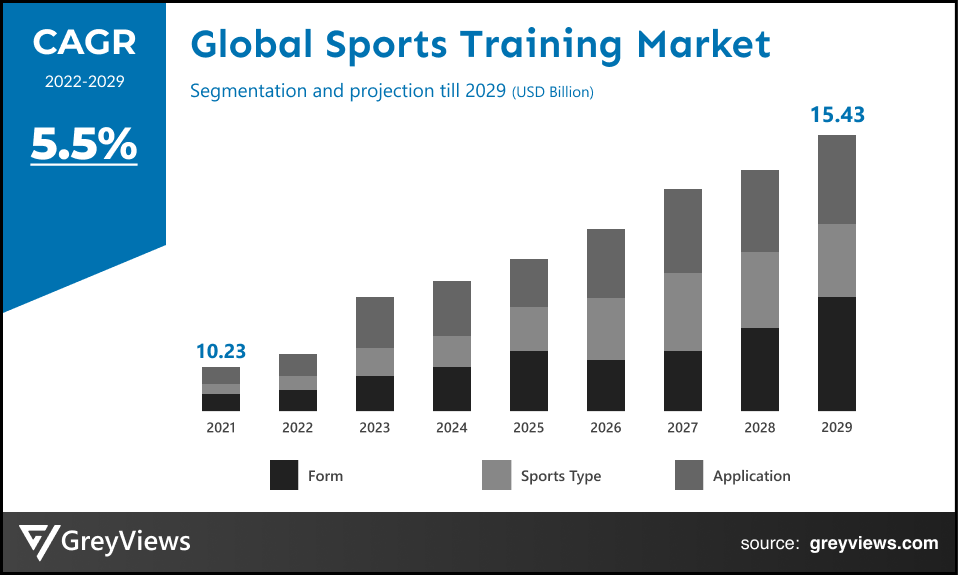

CAGR: 5.5%Current Market Size: USD 10.23 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Sports Training Market- Market Overview:

The Global Sports Training market is expected to grow from USD 10.23 billion in 2021 to USD 15.43 billion by 2029, at a CAGR of 5.5% during the Projection period 2022-2029. This market growth is driven by the population's growing per capita disposable income and an increased participation rate in sports for health benefits.

Sports training is a special preparation process aimed at enabling the sportsman to ensure the highest possible performance in a particular event/sport. Such trainings allow the body of a sportsman to gradually build up endurance and strength along with improved skill levels, motivation, and confidence. Hence, the need to reach extreme efficiency in motor abilities associated with a certain sports discipline mainly creates a demand for effective sports training. This training also enables athletes to gain additional knowledge about their sport and to learn the importance of a healthy body and mind.

Around the world, sports trainers and coaches are guiding people to support them in achieving specific sports performance objectives. These trainers work carefully with athletes across elementary schools, colleges & universities, high schools, and professional sports teams.

Request Sample:- Global Sports Training Market

Market Dynamics:

Drivers:

- Increased rate of participation in sports for health benefits

Playing sports supports reducing body fat and controlling body weight. Hence, there is an increased rate of participation in sports to improve fitness and health. In addition, the intense physical activity involved in several sports helps improve heart function, reduce blood pressure, decrease the risk of diabetes, and reduce stress levels.

Moreover, consumer interest has increased in health and wellness due to the COVID-19 pandemic. This was attributed to the extensive studies which linked obesity to the higher incidence of death and serious illness from COVID-19. Such factors contributed to the growth of the global sports training market.

- Increase in disposable income

Increased disposable income of the population has led to higher purchasing power, further expanding and enabling more people to afford sports training services. For instance, according to the L.E.K. Consulting, as of the year 2018, recreation spending in the U.S. increased by 24% in the last five years, while U.K. spending on leisure activities was up to 17%. This increase in the disposable income of the population is fueling demand for sports training services.

Moreover, in Asia-Pacific, Latin America, and the Middle East, per capita income has increased considerably over a decade, which is expected to rapidly boost the demand for sports training services in upcoming years.

Restraints:

- Underdevelopment of sports industry in developing countries

According to various research, the sports infrastructure investment in several developing countries is comparatively less than in developed countries. This is attributed to the fact that the development of the sports sector is usually not a top priority in the education system or national budget of such countries. Also, owing to the reasons mentioned above, there are fewer prospects for athletes in developing countries to continue sports training or follow professional sports careers. Such factors are expected to hamper the growth of the global sports training market to some extent during the Projection period.

Opportunities:

- Upsurge in investment in the sports industry

The sports sector has attracted significant investment capital over the past few years. More than half of the deals have been acquisitions of teams, leagues, or media partnerships; the rest have focused on related aspects of the sports ecosystem, such as online betting, fitness hardware and software, and technology that supports digitally enhanced fan experiences.

In addition, governments are also putting laws into place that support the development of sports infrastructure and sports training which will be expected to present a market expansion potential. For instance, in February 2022, National Development and Reform Commission (NDRC) in China announced an investment of about $331 million to build 185 sports venues, including national fitness centers, sports parks, and public facilities for outdoor sports. Such investments are opportunistic for the growth of the global sports training market.

Challenges

- Impact of COVID-19 pandemic on the global sports training industry

The COVID-19 pandemic has posed significant challenges in the global sports training industry. This has forced everyone associated with the sports industry to work from home, and players were compelled to follow quarantine restrictions imposed by government orders. Moreover, this situation has led to significant needs and challenges in front of the sports training sector to increase the adoption of advanced technologies to manage and train athletes or sportsmen without affecting their or trainers’ health and continue the practice.

Segmentation Analysis:

The global sports training market has been segmented based on form, sports type, application, medium, and region.

By Form

The form segment includes academy/coaching, therapy, and sports analytics. The Academy/Coaching segment led the sports training market with a market share of around 51.6% in 2021. Sports has been helping and benefiting both adults and children in having an enhanced quality of life. This has led to the rising trend among people to join sports academy/coaching. Sports academies around the globe are offering services that ensure a comprehensive approach to an athlete's training, teaching, and all-inclusive development.

By Sports Type

The sports type segment includes soccer, cricket, baseball, and volleyball. The soccer segment led the Sports Training market with a market share of around 45.2% in 2021. This growth is mainly driven by the need for training associated with fitness components including speed, agility and endurance. Also, in past few years, Soccer has earned the status of the most prevalent sport around the globe with more than 250 million people likes playing soccer. For instance, the recent World Cup hosted by Russia bragged a viewership of about 4 billion people. This huge popularity of soccer across the globe has mainly contributed to the demand for sports training associated with soccer.

By Medium

The medium segment includes online and offline. The offline segment led the Sports Training market with a market share of around 65.8% in 2021. This is the traditional medium of sports training. Higher effectiveness of offline training in ensuring the student/athlete/sportsman is paying attention to the training is mainly driving growth of this segment.

By Regional Analysis:

The regions analyzed for the sports training market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. North America region dominated the Sports Training market and held the 36.05% share of the market revenue in 2021.

- North American region has registered highest value for the year 2021. Huge popularity of sports such as basketball, ice hockey, gridiron football, charrería/rodeo, jaripeo/bull riding, and lacrosse in this region is mainly fueling growth of the sports training market. In addition, American football is seeing an increased interest among the population in terms of broadcast viewership, audience, and players. This has further created the demand for sports training in the region.

- Asia-Pacific is expected to witness a considerable growth rate during the Projection period. The ongoing political, social, and economic significance of sports industry in the Asia-Pacific has mainly boosted demand for sports training in countries such as China, India, and Japan among others. In addition, major global sports mega-events are repeatedly being hosted in Asia-Pacific countries.

Global Sports Training Market- Country Analysis

- Germany

Germany sports training market size was valued at USD 1.02 billion in 2021 and is expected to reach USD 1.52 billion by 2029, at a CAGR of 5.3% from 2022 to 2029. Germany is one of the leading nations in the Europe sports training market. The factors such as huge participation and spectatorship of football, economic growth, and increasing focus on health and wellness among the population are fueling growth of the Germany sports training market.

In addition, the strong winter sports market in the country is further creating lucrative growth opportunities for the sports training market. For instance, the country is seeing huge popularity in winter sports, including alpine skiing, sledding/tobogganing, winter hiking, cross-country skiing, snowboarding, snowshoeing, and ski touring.

- China

China's Sports Training market was valued at USD 2.05 billion in 2021 and is expected to reach USD 2.99 billion by 2029, at a CAGR of 5.1% from 2022 to 2029. China is one of the largest sports training market. This is mainly attributed to the introduction of several key initiatives that are aimed at boosting the sports industry. For instance, in August 2021, the government of China announced its ambitious plan to make a 5 trillion yuan sports industry by 2025. This size of the sports industry is about 69.5% higher than the size in 2019. Such government funding and policy assistance is expected to fuel growth of the overall sports training industry in the country.

On the other hand, the 2022 Winter Olympics is further slated for Beijing, China. This trend of major global sports mega-events to be hosted in the country is projected to create lucrative growth opportunities for the sports training market.

- India

India's Sports Training market size was valued at USD 0.41 billion in 2021 and is expected to reach USD 0.63 billion by 2029, at a CAGR of 5.7% from 2022 to 2029. India is one of the strongest growing economies in Asia. In addition, the emerging popularity of cricket and other sports in this country is expected to create lucrative growth opportunities for market.

On the other hand, according to GroupM ESP, a media investment company, the estimated size of the Indian Sports Industry is about $796 million. Also, the size of the Indian sports industry is expected to grow rapidly in the upcoming years. In addition, the country is seeing emerging awareness and interest in various sports. Such factors are expected to create lucrative growth opportunities for the sports training market.

Key Industry Players Analysis:

To increase their market position in the global Sports Training business, top companies are focusing on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, and partnerships, joint ventures, etc.

- Challenger Sports

- CMT Learning Ltd.

- Coach Sport LLC

- Elle Football Academy

- ESM Academies

- Ignite Sport UK Ltd.

- School Sports Coaching

- TENVIC

- United States Sports Academy

- US Sports Camps Inc.

Latest Development:

- In April 2022, CD Leganés, a football club based in Leganés, Community of Madrid, Spain partnered with the Football Science Institute, a private football science and training school. The partnership agreement is aimed at generating and coordinating on sports training activities among both institutions.

- In April 2021, US Sports Camps, the provider of Nike Sports Camps, launched Nike KIDS Camps. These camps are focused on development of foundational athletic skills for 5- to 8-year-old kids. The training offered through this launch is expected to help campers build confidence and competence through practicing sports as well as athletic fundamentals.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.5% |

|

Market Size |

10.23 billion in 2021 |

|

Projection period |

2021-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

Form, sports type, application, medium, and regions |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Challenger Sports, CMT Learning Ltd., Coach Sport LLC, Elle Football Academy, ESM Academies, Ignite Sport UK Ltd., School Sports Coaching, TENVIC, United States Sports Academy, and US Sports Camps Inc. among others |

|

By Form |

|

|

By Sports Type |

|

|

By Application |

|

|

By Medium |

|

|

Regional scope |

|

Scope of the Report

Global Sports Training Market by Form:

- Academy/Coaching

- Therapy

- Sports Analytics

Global Sports Training Market by Sports Type:

- Soccer

- Cricket

- Baseball

- Volleyball

Global Sports Training Market by Application:

- Men

- Women

- Kids

Global Sports Training Market by Medium:

- Online

- Offline

Global Sports Training Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the total market size of the Sports Training Market?

Global Sports Training market size was USD 10.23 billion in 2021 expected to reach USD 15.43 billion by 2029, at a CAGR of 5.5% from 2022 to 2029.

What will be the growth rate of Sport Training Market?

Global Sports Training Market will grow at the rate of CAGR 5.5% and it will accommodate USD 15.43 Billion by 2029

Which are the leading market players active in the Sports Training market?

Leading market players active in the global Sports Training market are Challenger Sports, CMT Learning Ltd., Coach Sports LLC, Elle Football Academy, ESM Academies, Ignite Sport UK Ltd., School Sports Coaching, TENVIC, United States Sports Academy, and US Sports Camps Inc. among others.

What are the top 5 importers countries in Sports Goods Sector?

United States, Germany, China, the UK, and France.

What is the most significant medium of Sports Training?

Offline segment witnessed a significant share in the Sports Training market, with a market share of around 65.8% in 2021.

What is the driving factor of Sports Training market?

Consumer interest has increased in health and wellness due to the COVID-19 pandemic. This was attributed to the extensive studies which linked obesity to the higher incidence of death and serious illness from COVID-19. Such factors contributed to the growth of the global sports training market.

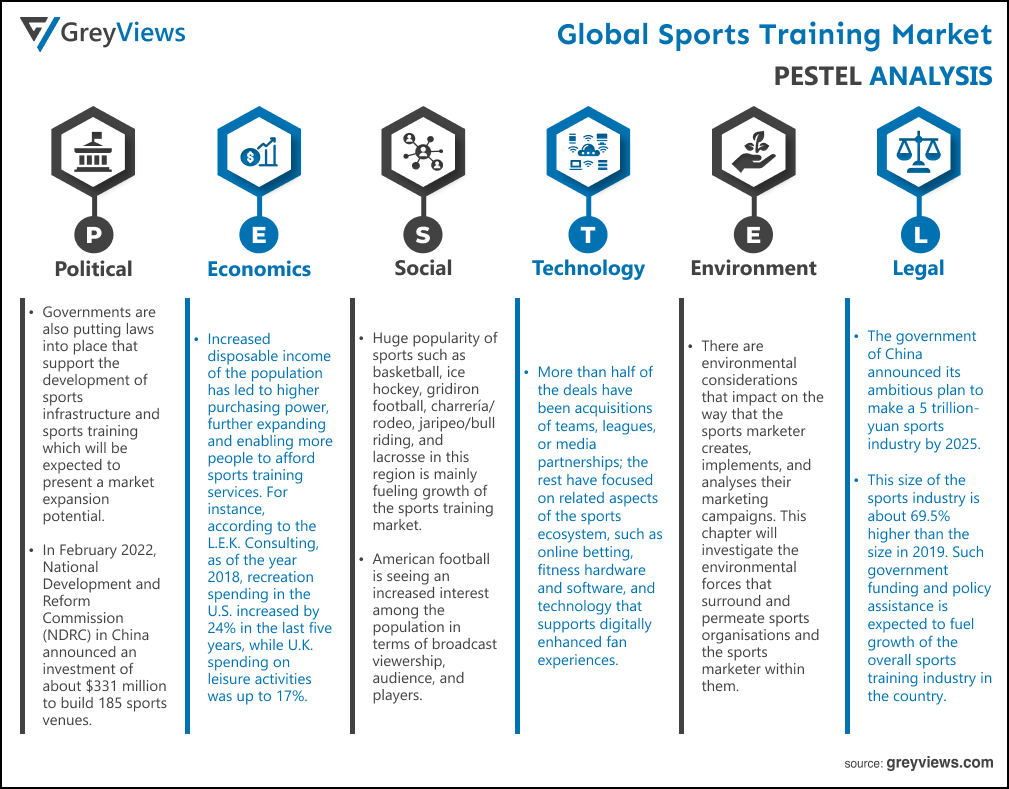

Political Factors- Governments are also putting laws into place that support the development of sports infrastructure and sports training which will be expected to present a market expansion potential. For instance, in February 2022, National Development and Reform Commission (NDRC) in China announced an investment of about $331 million to build 185 sports venues, including national fitness centers, sports parks, and public facilities for outdoor sports. Such investments are opportunistic for the growth of the global sports training market.

Economical Factors- Increased disposable income of the population has led to higher purchasing power, further expanding and enabling more people to afford sports training services. For instance, according to the L.E.K. Consulting, as of the year 2018, recreation spending in the U.S. increased by 24% in the last five years, while U.K. spending on leisure activities was up to 17%. This increase in the disposable income of the population is fueling demand for sports training services.

Social Factor- Huge popularity of sports such as basketball, ice hockey, gridiron football, charrería/rodeo, jaripeo/bull riding, and lacrosse in this region is mainly fueling growth of the sports training market. In addition, American football is seeing an increased interest among the population in terms of broadcast viewership, audience, and players. This has further created the demand for sports training in the region.

Technological Factors- More than half of the deals have been acquisitions of teams, leagues, or media partnerships; the rest have focused on related aspects of the sports ecosystem, such as online betting, fitness hardware and software, and technology that supports digitally enhanced fan experiences. Moreover, the Covid-19 situation has led to significant needs and challenges in front of the sports training sector to increase the adoption of advanced technologies to manage and train athletes or sportsmen without affecting their or trainers’ health and continue the practice.

Environmental Factors- There are environmental considerations that impact on the way that the sports marketer creates, implements, and analyses their marketing campaigns. This chapter will investigate the environmental forces that surround and permeate sports organisations and the sports marketer within them. The first part of this chapter will discuss the key principles of environmental analysis which, is that these external forces impact on all organisations, sport and non-sport, that operate within the same environment

Legal Factors- The government of China announced its ambitious plan to make a 5 trillion yuan sports industry by 2025. This size of the sports industry is about 69.5% higher than the size in 2019. Such government funding and policy assistance is expected to fuel growth of the overall sports training industry in the country. According to GroupM ESP, a media investment company, the estimated size of the Indian Sports Industry is about $796 million. Also, the size of the Indian sports industry is expected to grow rapidly in the upcoming years. In addition, the country is seeing emerging awareness and interest in various sports. US Sports Camps, the provider of Nike Sports Camps, launched Nike KIDS Camps. These camps are focused on development of foundational athletic skills for 5- to 8-year-old kids. The training offered through this launch is expected to help campers build confidence and competence through practicing sports as well as athletic fundamentals

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Form

- Market Attractiveness Analysis By Sports Type

- Market Attractiveness Analysis By Application

- Market Attractiveness Analysis By Medium

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Increased rate of participation in sports for health benefits

- Increase in disposable income

- Restrains

- Underdevelopment of sports industry in developing countries

- Opportunities

- Upsurge in investment in sports industry

- Challenges

- Impact of COVID-19 pandemic on global sports training industry

- Global Sports Training Market Analysis and Projection, By Form

- Segment Overview

- Academy/Coaching

- Therapy

- Sports Analytics

- Global Sports Training Market Analysis and Projection, By Sports Type

- Segment Overview

- Soccer

- Cricket

- Baseball

- Volleyball

- Global Sports Training Market Analysis and Projection, By Application

- Segment Overview

- Men

- Women

- Kids

- Global Sports Training Market Analysis and Projection, By Medium

- Segment Overview

- Online

- Offline

- Global Sports Training Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Sports Training Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Sports Training Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Form Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Challenger Sports

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- CMT Learning Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- Coach Sport LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- Elle Football Academy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- ESM Academies

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- Ignite Sport UK Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- School Sports Coaching

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- TENVIC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- United States Sports Academy

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- US Sports Camps Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Form Portfolio

- Recent Developments

- SWOT Analysis

- Challenger Sports

List of Table

- Global Sports Training Market, By Form, 2021–2029(USD Billion)

- Global Academy/Coaching Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Therapy Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Analytics Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Global Soccer Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Cricket Training Market, By Region, 2021–2029(USD Billion)

- Global Baseball Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Volleyball Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By Application, 2021–2029(USD Billion)

- Global Men Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Women Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Kids Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By Medium, 2021–2029(USD Billion)

- Global Online Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Offline Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By Region, 2021–2029(USD Billion)

- Global Sports Training Market, By North America, 2021–2029(USD Billion)

- North America Sports Training Market, By Form, 2021–2029(USD Billion)

- North America Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- North America Sports Training Market, By Application, 2021–2029(USD Billion)

- North America Sports Training Market, By Medium, 2021–2029(USD Billion)

- USA Sports Training Market, By Form, 2021–2029(USD Billion)

- USA Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- USA Sports Training Market, By Application, 2021–2029(USD Billion)

- USA Sports Training Market, By Medium, 2021–2029(USD Billion)

- Canada Sports Training Market, By Form, 2021–2029(USD Billion)

- Canada Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Canada Sports Training Market, By Application, 2021–2029(USD Billion)

- Canada Sports Training Market, By Medium, 2021–2029(USD Billion)

- Mexico Sports Training Market, By Form, 2021–2029(USD Billion)

- Mexico Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Mexico Sports Training Market, By Application, 2021–2029(USD Billion)

- Mexico Sports Training Market, By Medium, 2021–2029(USD Billion)

- Europe Sports Training Market, By Form, 2021–2029(USD Billion)

- Europe Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Europe Sports Training Market, By Application, 2021–2029(USD Billion)

- Europe Sports Training Market, By Medium, 2021–2029(USD Billion)

- Germany Sports Training Market, By Form, 2021–2029(USD Billion)

- Germany Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Germany Sports Training Market, By Application, 2021–2029(USD Billion)

- Germany Sports Training Market, By Medium, 2021–2029(USD Billion)

- France Sports Training Market, By Form, 2021–2029(USD Billion)

- France Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- France Sports Training Market, By Application, 2021–2029(USD Billion)

- France Sports Training Market, By Medium, 2021–2029(USD Billion)

- UK Sports Training Market, By Form, 2021–2029(USD Billion)

- UK Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- UK Sports Training Market, By Application, 2021–2029(USD Billion)

- UK Sports Training Market, By Medium, 2021–2029(USD Billion)

- Italy Sports Training Market, By Form, 2021–2029(USD Billion)

- Italy Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Italy Sports Training Market, By Application, 2021–2029(USD Billion)

- Italy Sports Training Market, By Medium, 2021–2029(USD Billion)

- Spain Sports Training Market, By Form, 2021–2029(USD Billion)

- Spain Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Spain Sports Training Market, By Application, 2021–2029(USD Billion)

- Spain Sports Training Market, By Medium, 2021–2029(USD Billion)

- Asia Pacific Sports Training Market, By Form, 2021–2029(USD Billion)

- Asia Pacific Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Asia Pacific Sports Training Market, By Application, 2021–2029(USD Billion)

- Asia Pacific Sports Training Market, By Medium, 2021–2029(USD Billion)

- Japan Sports Training Market, By Form, 2021–2029(USD Billion)

- Japan Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Japan Sports Training Market, By Application, 2021–2029(USD Billion)

- Japan Sports Training Market, By Medium, 2021–2029(USD Billion)

- China Sports Training Market, By Form, 2021–2029(USD Billion)

- China Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- China Sports Training Market, By Application, 2021–2029(USD Billion)

- China Sports Training Market, By Medium, 2021–2029(USD Billion)

- India Sports Training Market, By Form, 2021–2029(USD Billion)

- India Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- India Sports Training Market, By Application, 2021–2029(USD Billion)

- India Sports Training Market, By Medium, 2021–2029(USD Billion)

- South America Sports Training Market, By Form, 2021–2029(USD Billion)

- South America Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- South America Sports Training Market, By Application, 2021–2029(USD Billion)

- South America Sports Training Market, By Medium, 2021–2029(USD Billion)

- Brazil Sports Training Market, By Form, 2021–2029(USD Billion)

- Brazil Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Brazil Sports Training Market, By Application, 2021–2029(USD Billion)

- Brazil Sports Training Market, By Medium, 2021–2029(USD Billion)

- Middle East and Africa Sports Training Market, By Form, 2021–2029(USD Billion)

- Middle East and Africa Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- Middle East and Africa Sports Training Market, By Application, 2021–2029(USD Billion)

- Middle East and Africa Sports Training Market, By Medium, 2021–2029(USD Billion)

- UAE Sports Training Market, By Form, 2021–2029(USD Billion)

- UAE Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- UAE Sports Training Market, By Application, 2021–2029(USD Billion)

- UAE Sports Training Market, By Medium, 2021–2029(USD Billion)

- South Africa Sports Training Market, By Form, 2021–2029(USD Billion)

- South Africa Sports Training Market, By Sports Type, 2021–2029(USD Billion)

- South Africa Sports Training Market, By Application, 2021–2029(USD Billion)

- South Africa Sports Training Market, By Medium, 2021–2029(USD Billion)

List of Figures

- Global Sports Training Market Segmentation

- Sports Training Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Sports Training Market Attractiveness Analysis By Form

- Global Sports Training Market Attractiveness Analysis By Sports Type

- Global Sports Training Market Attractiveness Analysis By Application

- Global Sports Training Market Attractiveness Analysis By Medium

- Global Sports Training Market Attractiveness Analysis By Region

- Global Sports Training Market: Dynamics

- Global Sports Training Market Share By Form(2021 & 2028)

- Global Sports Training Market Share By Sports Type(2021 & 2028)

- Global Sports Training Market Share By Application(2021 & 2028)

- Global Sports Training Market Share By Medium(2021 & 2028)

- Global Sports Training Market Share by Regions (2021 & 2028)

- Global Sports Training Market Share by Company (2020)