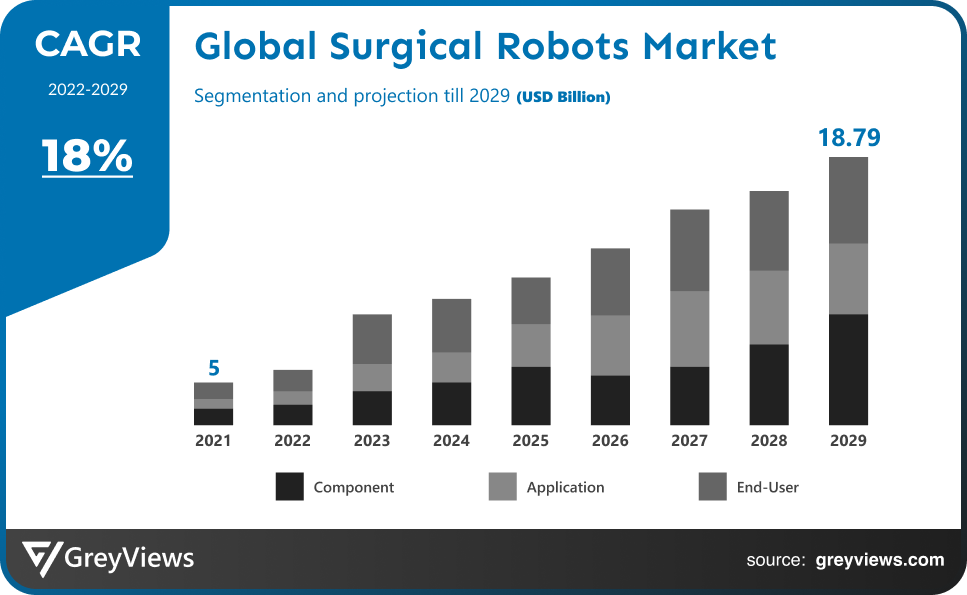

Surgical Robots Market Size By Component (Instruments & Accessories and Robot Systems), By Application (Neurosurgery, General Surgery, Orthopedic Surgery, Gynecology Surgery, and Urologic Surgery), By End-user (Hospitals and Ambulatory Surgical Centers), Regions, Segmentation, and Projection till 2029

CAGR: 18%Current Market Size: USD 5 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Surgical Robots Market- Market Overview:

The Global Surgical Robots market is expected to grow from USD 5 billion in 2021 to USD 18.79 billion by 2029, at a CAGR of 18% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the rising population of patients.

Advanced medical gadgets with robotic arms and instruments are known as surgical robots. As they enable doctors or healthcare professionals to carry out difficult treatments with greater precision when compared to conventional or traditional techniques, they are crucial to hospitals and ambulatory surgical centers. The capacity of surgical robots to precisely manipulate surgical equipment in a tiny operating room beyond the capabilities of humans makes them helpful for minimally invasive surgery. In this method, micromanipulators are being created for minimally invasive neurosurgery. A stiff neuro endoscope, two tiny grasping manipulators, a suction tube, and a perfusion tube make up the micromanipulator. Surgical robots provide assistance during operations. Their use dates back to the middle of the 1980s. The majority of prostatectomies performed in the United States today use robotic assistance because the likelihood of a successful procedure is higher with robotic assistance than without. Robotic procedures have been minimally invasive for a very long time prior to the invention of robots. A wide range of common procedures, including laparoscopic cholecystectomy and gall bladder excisions, are included in this broad concept. The term "procedure" refers to a technique that operates on the body through a brief (often 1 cm) entry incisions, avoiding the need for lengthy cuts. Long-handled instruments are used by surgeons to work on bodily tissue. Endoscopes are the viewing devices used to direct these procedures. These are tiny tubes that have cameras on the ends that the surgeon uses to examine three-dimensional, greatly magnified images of the surgery site in real-time on a display.

Sample Request: - Global Surgical Robots Market

Market Dynamics:

Drivers:

- Rising Adoption of Surgical Robots

Systems for several surgeries such as orthopedics, urology, neurology, and others have proven useful for surgical procedures generally. The use of surgical robots over time, particularly in developed countries, has fueled the market expansion. In hospitals all across the world, surgical robots are being widely used and are well-liked. There is also strong support for the lower risk of infection associated with using disposables during procedures. The availability of appropriate reimbursement policies for these surgical robots across various nations is another important aspect that favorably affects the growth of the market for surgical robots.

Restraints:

- High Price of Surgical Robots

Minimally invasive procedures are less expensive than robotic-assisted procedures. The adoption of robotic surgical techniques for all hysterectomies (the surgical removal of the uterus, ovaries, cervix, and Fallopian tubes) would increase hysterectomy costs in the United States of America by about USD 960 million annually, according to the American Congress of Obstetricians & Gynecologists. Along with the expenditures associated with implementing robotic surgical techniques, maintenance expenses and shrinking hospital budgets have hampered the market growth for surgical robots.

Opportunities:

- Growing Involvement of Surgical Robots in ASCs

Ambulatory surgical centres (ASCs) are independent medical clinics that focus on non-hospital admission diagnostic, surgical, and preventative procedures. According to a Healthcare BlueBook and HealthSmart report, ASCs reduce the cost of outpatient surgery by USD 38 billion annually because they provide a more affordable care setting than a traditional hospital's outpatient department. A survey found that there are currently over 9000 ambulatory surgery centres functioning in the US. The adoption of surgical robots will increase as there are more ASCs, promoting industry growth globally.

Challenges:

- Shortage of skilled professional

Retaining and managing skill-specific specialists has become difficult due to the excessively high skill expectations. The development of technology is another factor that contributes to the rise in demand for skilled workers. Only a small number of podiatrists rate themselves as successfully delivering supportive treatment, and they report major unmet supportive care needs and impediments in their clinics. For instance, to treat chronic knee conditions and obtain the necessary supportive care resources, podiatrists and other experts are urgently needed. The employability prospects and access to high-quality jobs are restricted by a lack of qualified and experienced professionals and ongoing skill gaps. This indicates that a barrier to the expansion of the global surgical robots market is a shortage of qualified specialists.

Segmentation Analysis:

The global surgical robot market has been segmented based on component, application, end-user, and regions.

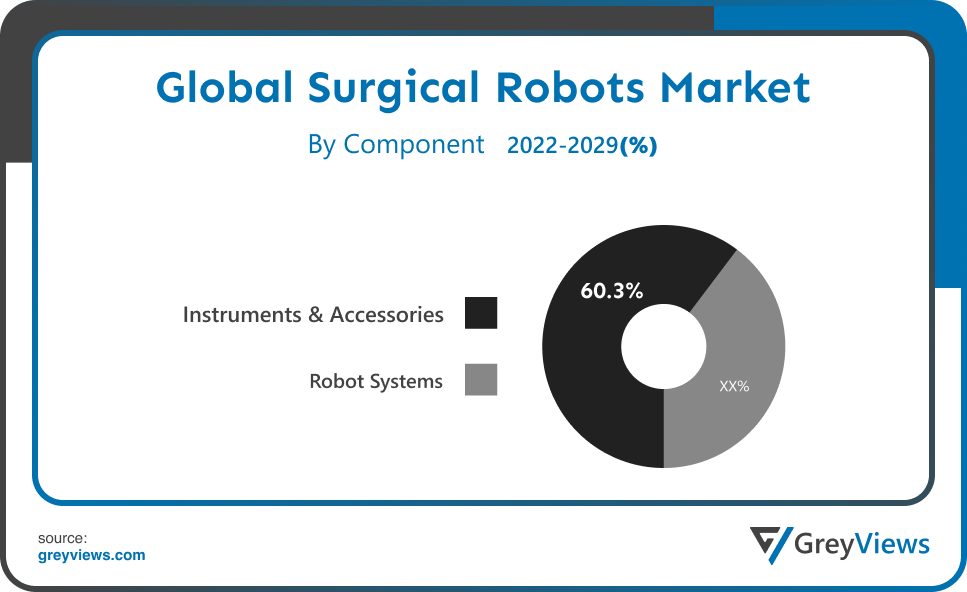

By Component

The component segment is instruments & accessories and robot systems. The instruments & accessories segment led the largest share of the surgical robots market with a market share of around 60.3% in 2021. This is attributable to the use of modern, high-tech instruments and accessories. For instance, Da Vinci surgical system by Intuitive Surgical features interactive robotic arms and Endowrist surgical devices. The company unveiled a number of tools, including robotic clip applicators, robotic needle holders, robotic atraumatic graspers, and robotic scissors and bipolar dissectors. Consequently, with new accessories and instruments in high demand, the market as a whole is expected to grow over the Projection period.

By Application

The application segment includes neurosurgery, general surgery, orthopedic surgery, gynecology surgery, and urologic surgery. The neurosurgery segment led the surgical robots market with a market share of around 25.08% in 2021. The increasing use of surgical robots in neurosurgeries as a result of the advantages they offer over conventional surgical techniques is expected to significantly accelerate the segment's growth. Moreover, it is anticipated that technological developments will support the segment's growth over time, especially in light of robotic neurosurgery's positive results. The category is also anticipated to be driven by the expanding use of automated robotic tools in brain procedures. For instance, brain surgery was performed in 2019 using 5G technology and robotic aid, according to an article in Robotics Industries Association (RIA). Such activity suggests that the neurosurgery market is expanding.

By End-User

The end-user segment is hospitals and ambulatory surgical centers. The hospital segment led the largest share of the surgical robots market with a market share of around 66.3% in 2021. The segment is growing as a result of rising healthcare costs in various economies. Modern surgical robots are available in hospitals to enhance the standard of treatment and patient outcomes. Nowadays, during many surgical operations, doctors or surgeons choose robot-assisted systems in hospital settings. For instance, a study indicated that from 1.8% in 2012 to 15.1% in 2018, the utilisation of robot-assisted operations for general surgical procedures increased by a factor of more than two. Therefore, during the Projection period, the aforementioned factors will facilitate market expansion.

Global Surgical Robots Market- Sales Analysis.

The sale of synthetic biology products expanded at a CAGR of 14.9% from 2015 to 2021.

The market expansion is also being positively impacted by the rising investments made by regional and international companies in the introduction of new and cutting-edge surgical robots. In addition, the rising incidence of osteoporosis and arthritis cases, as well as the rising demand for hip and knee replacement procedures, are key drivers predicted to drive the market's expansion. For instance, approximately 4,50,000 hip replacement procedures are carried out annually in the United States, according to a data from the Agency for Healthcare Research and Quality. Furthermore, according to figures from the Australian Institute of Health and Welfare (AIHW), the rate of total knee replacements for osteoarthritis grew by around 38% between 2005–2006 and 2017–2018.

One of the key reasons supporting market expansion is the rise in regulatory approvals for surgical robots. For instance, the Ion robotic surgical system from Intuitive Surgical Inc. was granted 510(k) FDA clearance in 2019. Additionally, the market is being supported by an increase in the use of assisted operations such hysterectomies, the number of robotic systems used for surgical interventions, and manufacturers' ongoing expenditures in and R&D efforts related to automated robotic systems.

The market for surgical robots is expected to grow over the coming years as a result of technological developments in this area. Examples include the integration of cameras, high-definition 3D imaging, computing technology, sensors, remote navigation technology systems, robotic controlled catheters, and other accessories used in surgical procedures.

Thus, owing to the aforementioned factors, the global Surgical Robots Market is expected to grow at a CAGR of 18% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the surgical robots market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the surgical robots market and held a 39.1% share of the market revenue in 2021.

- The North American region witnessed a major share The market in this region is being driven by an increase in next-generation healthcare facilities in the U.S. and a rise in the use of automated surgical tools. Additionally, the U.S. patient population’s dearth of doctors and surgeons is anticipated to fuel regional market growth. A further factor pushing the market in this region is the rising prevalence of chronic diseases including cancer, diabetes, and cardiovascular diseases in the U.S. These conditions are also hastening the use of automated surgical equipment.

- Asia Pacific is anticipated to experience significant growth during the predicted period. The region's market is developing as a result of an increase in the number of patients and the use of sophisticated automated surgical instruments. Additionally, it is projected that increasing modern healthcare facilities and rising awareness of the benefits of adopting new medical technology will promote market expansion in the region. Additionally, growing government initiatives to create cutting-edge healthcare infrastructure draw international investors to participate in the development of automated instruments, which is predicted to drive market expansion in this region over the Projection years.

Global Surgical Robots Market- Country Analysis:

- Germany

Germany's surgical robots market size was valued at USD 0.39 billion in 2021 and is expected to reach USD 1.19 billion by 2029, at a CAGR of 15% from 2022 to 2029.

Regarding the acceptance and invention of medical technology, Germany is regarded as a leader in the surgical robot market. Additionally, the national government budgeted €3 billion to support hospitals' digitization in 2020. Through the installation of Versius at Klinikum Chemnitz, a cutting-edge teaching and public hospital renowned for its digitally integrated healthcare solutions, the SMR subsequently moved into a potentially lucrative market in 2021. Therefore, throughout the Projection years, these variables are expected to fuel the growth of the German market.

- China

China’s surgical robots’ market size was valued at USD 0.6 billion in 2021 and is expected to reach USD 2.06 billion by 2029, at a CAGR of 16.7% from 2022 to 2029. The region's healthcare infrastructure and strategic alliances amongst major industry participants are expected to stimulate demand. One of the main factors driving the growth of the nation's surgical robotics market is the rising prevalence of chronic diseases brought on by the rise in the geriatric population, the development of robotic surgery, particularly for lung cancer and thymus-thymoma, and the rising acceptance of robotic surgical procedures.

- India

India's surgical robots market size was valued at USD 0.49 billion in 2021 and is expected to reach USD 1.60 billion by 2029, at a CAGR of 16% from 2022 to 2029. The market in the region is growing as a result of rising R&D expenditures and the availability of a robust healthcare infrastructure. Surgical robots are being adopted more frequently in developing nations. In addition, increased surgical procedures and healthcare costs in developing nations are anticipated to fuel market expansion over the Projection period.

Key Industry Players Analysis:

To increase their market position in the global surgical robots business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Stryker Corporation

- Medrobotics

- Smith & Nephew

- Zimmer Biomet

- Amplitude Surgical

- Intuitive Surgical

- Digital Surgery

- TransEnterix Surgical, Inc.

- Renishaw plc.

- Medtronic

- THINK Surgical, Inc.

Latest Development:

- In February 2021, Digital Surgery, a privately held surgical AI startup that specializes in digital education, data analytics, and training, was bought by Medtronic. With the acquisition, Medtronic hopes to improve its platform for robotic surgery and add a new robot dubbed Hugo to its lineup of robotic systems.

- In May 2022, Excelsius3D, an intelligent intraoperative 3-in-1 imaging device with less invasive procedures, was used in surgeries, according to Globus Medical. The company will be able to enhance its surgical outcomes product line as a result.

- In April 2022, A long-term collaboration between crucial Robotics and Amplitude Surgical has been launched to create a combined robotic knee surgery solution.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

18% |

|

Market Size |

5 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Component, By Application, By End-user, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Stryker Corporation, Medrobotics, Smith & Nephew, Zimmer Biomet, Amplitude Surgical, Intuitive Surgical, Digital Surgery, TransEnterix Surgical, Inc., Renishaw plc., Medtronic, and THINK Surgical, Inc. |

|

By Component |

|

|

By Application |

|

|

By End-user |

|

|

Regional scope |

|

Scope of the Report

Global Surgical Robots Market by Component:

- Instruments & Accessories

- Robot Systems

Global Surgical Robots Market by Application:

- Neurosurgery

- General Surgery

- Orthopedic Surgery

- Gynecology Surgery

- Urologic Surgery

Global Surgical Robots Market by End-User:

- Hospitals

- Ambulatory Surgical Centers

Global Surgical Robots Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of the surgical robots market in 2021?

Global surgical robots market’s size in 2021 was USD 5 billion.

What are some factors that cause a threat to the surgical robots market?

The high price of surgeries, lack of knowledge, and lack of skilled professionals are some of the factors hampering the market growth.

What is the key driving factor for the surgical robots market?

The market is being driven as the geriatric population is increasing owing to which chronic illness that requires surgeries is also increasing.

What are the opportunities for the market’s growth over the Projection period?

Growing Involvement of Surgical Robots in ASCs is expected to provide an opportunity for the market’s growth over the Projection period.

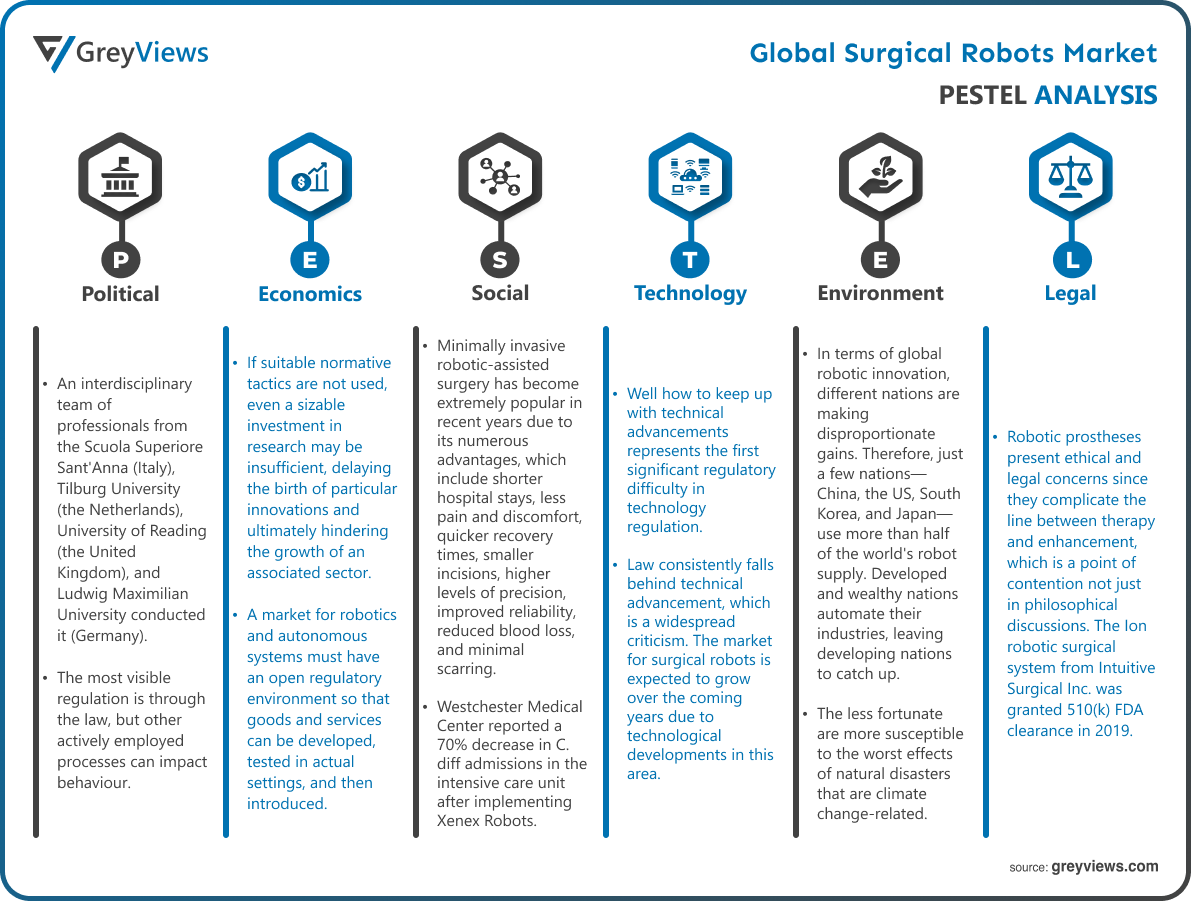

Political Factors- The efforts have been focused on the RoboLaw project, which was the first study exclusively devoted to law and robotic technology to receive funding from the European Commission research framework programmes to map the major regulatory difficulties of robots. An interdisciplinary team of professionals from the Scuola Superiore Sant'Anna (Italy), Tilburg University (the Netherlands), University of Reading (the United Kingdom), and Ludwig Maximilian University conducted it (Germany). The most visible regulation is through the law, but other actively employed processes can impact behaviour. Law, social norms, markets, and architecture are the four tools Lessig names in the regulatory toolbox (i.e. technology as a regulatory tool).

Economical Factors- If suitable normative tactics are not used, even a sizable investment in research may be insufficient, delaying the birth of particular innovations and ultimately hindering the growth of an associated sector. A market for robotics and autonomous systems must have an open regulatory environment so that goods and services can be developed, tested in actual settings, and then introduced. The revenue reduction is somewhat attributable to economic issues because Intuitive Surgical's robots are expensive, but it will also be affected by claims that the systems' capabilities allow for outcomes no better than those often attained by real doctors.

Social Factor- Minimally invasive robotic-assisted surgery has become extremely popular in recent years due to its numerous advantages, which include shorter hospital stays, less pain and discomfort, quicker recovery times, smaller incisions, higher levels of precision, improved reliability, reduced blood loss, and minimal scarring. Westchester Medical Center reported a 70% decrease in C. diff admissions in the intensive care unit after implementing Xenex Robots. Additionally, it provides surgeons with better visualisation, improved dexterity, and increased precision. As a result, end users are increasingly choosing minimally invasive procedures, and this trend is expected to continue during the Projection period.

Technological Factors- Well how to keep up with technical advancements represents the first significant regulatory difficulty in technology regulation. Law consistently falls behind technical advancement, which is a widespread criticism. The market for surgical robots is expected to grow over the coming years due to technological developments in this area. Examples include integrating cameras, high-definition 3D imaging, computing technology, sensors, remote navigation technology systems, robotic controlled catheters, and other accessories used in surgical procedures. Moreover, it is projected that the use of surgical robots will increase over time due to improvements in medical technology and the growing adoption of automated surgical equipment in healthcare facilities. One ground-breaking element that is anticipated to drive the acceptance and implementation of surgical robots, consequently fueling growth, is the rising occurrence of a number of malignancies, tumours, and spine problem disorders.

Environmental Factors- In terms of global robotic innovation, different nations are making disproportionate gains. Therefore, just a few nations—China, the US, South Korea, and Japan—use more than half of the world's robot supply. Developed and wealthy nations automate their industries, leaving developing nations to catch up. The less fortunate are more susceptible to the worst effects of natural disasters that are climate change-related. One of the main causes of environmental degradation is inequality, which is either directly or indirectly brought on by the wealthy nations' increased use of automation and robotics.

Legal Factors- Robotic prostheses present ethical and legal concerns since they complicate the line between therapy and enhancement, which is a point of contention not just in philosophical discussions. The Ion robotic surgical system from Intuitive Surgical Inc. was granted 510(k) FDA clearance in 2019. Additionally, the market is being supported by an increase in the use of assisted surgeries like hysterectomies, an increase in the number of robotic surgical systems, and ongoing manufacturer R&D efforts related to automated robotic systems. Robotic prostheses present ethical and legal concerns since they complicate the line between therapy and enhancement, which is a point of contention not just in philosophical discussions.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Component

- 3.2. Market Attractiveness Analysis By Application

- 3.3. Market Attractiveness Analysis By End-user

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising Adoption of Surgical Robots

- 3. Restraints

- 3.1. High Price of Surgical Robots

- 4. Opportunities

- 4.1. Growing Involvement of Surgical Robots in ASCs

- 5. Challenges

- 5.1. Shortage of skilled professional

- Global Surgical Robots Market Analysis and Projection, By Component

- 1. Segment Overview

- 2. Instruments & Accessories

- 3. Robot Systems

- Global Surgical Robots Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Neurosurgery

- 3. General Surgery

- 4. Orthopedic Surgery

- 5. Gynecology Surgery

- 6. Urologic Surgery

- Global Surgical Robots Market Analysis and Projection, By End-user

- 1. Segment Overview

- 2. Hospitals

- 3. Ambulatory Surgical Centers

- Global Surgical Robots Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Surgical Robots Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Surgical Robots Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Stryker Corporation

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Medrobotics

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Smith & Nephew

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Zimmer Biomet

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Amplitude Surgical

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Intuitive Surgical

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Digital Surgery

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- TransEnterix Surgical, Inc.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Renishaw plc.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Medtronic

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- THINK Surgical, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Stryker Corporation

List of Table

- Global Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Global Instruments & Accessories, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global Robot Systems, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Global Neurosurgery, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global General Surgery, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global Orthopedic Surgery, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global Gynecology Surgery, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global Urologic Surgery, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Global Hospitals, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global Ambulatory Surgical Centers, Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- Global Surgical Robots Market, By Region, 2021–2029 (USD Billion)

- North America Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- North America Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- North America Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- USA Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- USA Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- USA Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Canada Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Canada Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Canada Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Mexico Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Mexico Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Mexico Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Europe Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Europe Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Europe Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Germany Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Germany Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Germany Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- France Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- France Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- France Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- UK Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- UK Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- UK Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Italy Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Italy Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Italy Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Spain Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Spain Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Spain Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Asia Pacific Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Asia Pacific Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Japan Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Japan Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Japan Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- China Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- China Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- China Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- India Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- India Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- India Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- South America Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- South America Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- South America Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Brazil Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Brazil Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Brazil Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- Middle East and Africa Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- Middle East and Africa Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- UAE Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- UAE Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- UAE Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

- South Africa Surgical Robots Market, By Component, 2021–2029 (USD Billion)

- South Africa Surgical Robots Market, By Application, 2021–2029 (USD Billion)

- South Africa Surgical Robots Market, By End-user, 2021–2029 (USD Billion)

List of Figures

- Global Surgical Robots Market Segmentation

- Surgical Robots Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Surgical Robots Market Attractiveness Analysis By Component

- Global Surgical Robots Market Attractiveness Analysis By Application

- Global Surgical Robots Market Attractiveness Analysis By End-user

- Global Surgical Robots Market Attractiveness Analysis By Region

- Global Surgical Robots Market: Dynamics

- Global Surgical Robots Market Share By Component (2021 & 2029)

- Global Surgical Robots Market Share By Application (2021 & 2029)

- Global Surgical Robots Market Share By End-user (2021 & 2029)

- Global Surgical Robots Market Share by Regions (2021 & 2029)

- Global Surgical Robots Market Share by Company (2020)