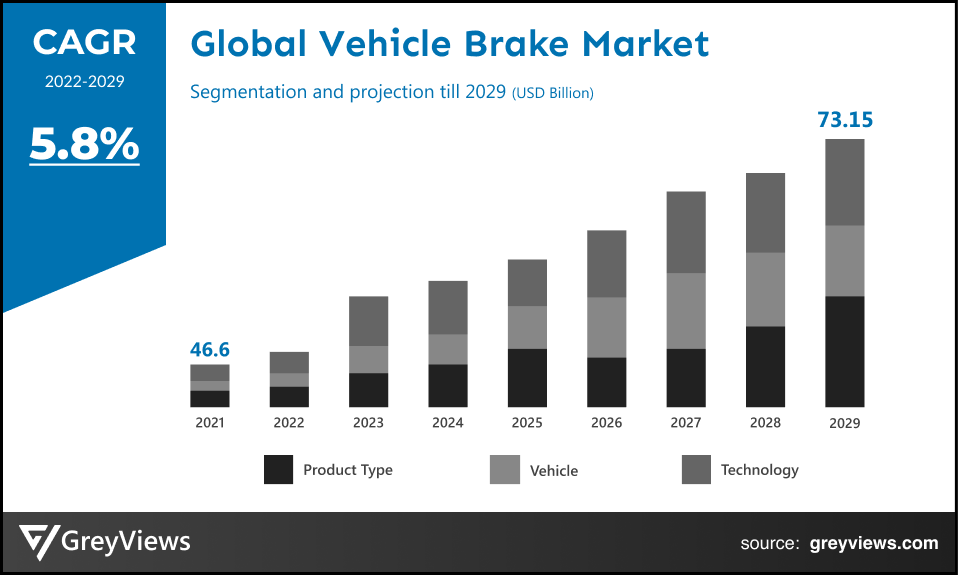

Vehicle Brake Market Size By Product Type (Drum Brake and Disc Brake), By Vehicle (Passenger Vehicle and Commercial Vehicle), By Technology (Traction Control System (TCS), Electronic Brake-force Distribution (EBD), Anti-lock Brake System (ABS), and Electronic Stability Control (ESC)) Regions, Segmentation, and Projection till 2029

CAGR: 5.8%Current Market Size: USD 46.6 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Vehicle Brake Market- Market Overview:

The Global Vehicle Brake market is expected to grow from USD 46.6 billion in 2021 to USD 73.15 billion by 2029, at a CAGR of 5.8% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the increasing number of automobiles around the world.

The car's braking mechanism stops or slows down, enabling the driver to prevent collisions and save lives. The pieces of the brake system include the master cylinder, brake pedal, brake calipers, brake shoes, brake disc, brake rotor, drum, brake lining, and hoses. Vehicles used in agriculture, mining, construction, and manufacturing are all dependent on the growth of the brake systems sector. Every braking system relies on frictional force to function. The relative motion of the bodies in touch with each other is resisted by friction. As the friction force presses the surface materials together to provide a braking action, the friction force relies on the type of surface materials in contact. As the demand for passenger and commercial vehicles rises in nations like China and India, the market for vehicle brake is anticipated to grow dramatically. The acceptance of luxury cars, the adoption of severe safety regulations, and the rising use of disc brakes in commercial vehicles contribute to the market's expansion. Additionally, only a certain number of kilometers can be covered by brake components before they need to be replaced, which is driving up the replacement market.

Sample Request:- Vehicle Brake Market

Market Dynamics:

Drivers:

- Addition of cutting-edge braking systems like ABS and EBD to improve vehicle safety

The stopping distance can be decreased by using electronic braking systems as Anti-lock Brake Systems (ABS), Brake Assist (BA), and Electronic Brakeforce Distribution (EBD). ABS helps shorten stopping distances when braking forcefully by enabling vehicle stability and directional control. This is only one of the many benefits ABS has over traditional braking systems. The Royal Society for the Prevention of Accidents (ROSPA) claims that ABS guarantees the achievement of the smallest distance at which a vehicle can come to a stop. BA is typically used in conjunction with ABS and is dependent on the vehicle's ABS technology. BA contributes to a 45% reduction in stopping distance. As a result, the regulatory standards for vehicle safety are likely to lead to an increase in the deployment of ABS and BA in the upcoming years. EBD, which functions as an extension of the ABS, is in charge of applying the same amount of force to each wheel. EBD has benefits like increased stability, shorter stopping distances, better grip on the road, and increased braking effectiveness. Given these benefits, developing nations like Mexico and India have declared their intention to use electronic stability control (ESC) and electronic brake distribution (EBD) in their new car braking systems. The Indian vehicle industry has already embraced ESC, and starting in 2023, EBD will be required. The Mexican government revealed its intention to equip some vehicles made starting in 2022 with ESC and EBD in 2021.

Restraints:

- Growing Usage of Modern Vehicles

Scalability, adaptability, serviceability, simplification, standardization, and management are all characteristics of high-performance electronic brakes. Different braking techniques aim to provide high-quality products while lowering the overall operating cost of an electric brake. Braking systems today are more sophisticated than they were in the past. Since there is a significant growth in demand for electric automobiles in the passenger, commercial, and agricultural industries, problems are unavoidable when modern vehicle technology transitions to the production of electric vehicles. Extreme temperature and humidity swings can harm the braking system, impair the performance, and reduce the lifespan of the brake shoes and pads on these cars. Because of the high installation and maintenance costs, which are added to the overall cost of vehicle brakes, market growth is anticipated to be constrained.

Opportunities:

- New technologies are being introduced to increase market opportunities

The brake pedal and other mechanical and hydraulic components of traditional brake systems are replaced by electronic sensors and controllers in the brake-by-wire approach. Numerous advantages of wire brake systems include their lighter weight, smaller size, lower working noise and vibration, and quicker response times, which lead to shorter stopping distances. Since this technology is still in its early stages, it can only be used commercially. Wire-based brake systems that rely on Sensotronic and Electronically Controlled Brake (ECB) technology are available on the Mercedes-Benz E-Class, SL, and Toyota Estima. Additionally, BMW and Nissan plan to enter the market soon.

Challenges:

- Freezing of the air brakes

In heavy-duty vehicles, such as trucks and trailers, the air brakes might freeze. Moisture in the brake shoes or lines is the most frequent reason for trailer brakes to freeze. Winter is when air brake freeze-ups most frequently happen, and fixing them requires serious work. Additionally, moisture may pose a greater threat to the brake system's functionality if the car has ABS. In the presence of moisture, the ABS valves may collect moisture, freeze, and result in brake problems. Managing moisture in the trailer brake lines is crucial because stability control is now a requirement for new trucks in developed Europe and North America. As a result, air brake freeze-ups in the winter can be a pain, especially for heavy-duty automobiles.

Segmentation Analysis:

The global Vehicle Brake market has been segmented based on product type, vehicle type, technology, and regions.

By Product Type

The product type segment includes drum brakes and disc brakes. The disc brake segment led the largest share of the vehicle brake market, with a market share of around 64.3% in 2021. Disc brakes have seen a significant increase in use recently. The ability of disc brakes to operate in bad weather without overheating or fading is credited with their expansion. The disc brake market is growing even faster thanks to its connectivity with other cutting-edge systems.

By Vehicle

The vehicle segment includes passenger vehicles and commercial vehicles. The Passenger vehicle segment led the vehicle brake market with a market share of around 59.08% in 2021. Due to rising populations, more disposable income, and urbanization, the number of passenger cars is rising. Manufacturers frequently create more effective braking systems to add more safety features. ADAS most significantly influence the principal market share and growth of passenger cars. Due to a growth in the demand for electromagnetic induction braking systems in cars, motorcycles, and other vehicles throughout the Projection period, rising ADAS spending is also anticipated to impact the brake systems market.

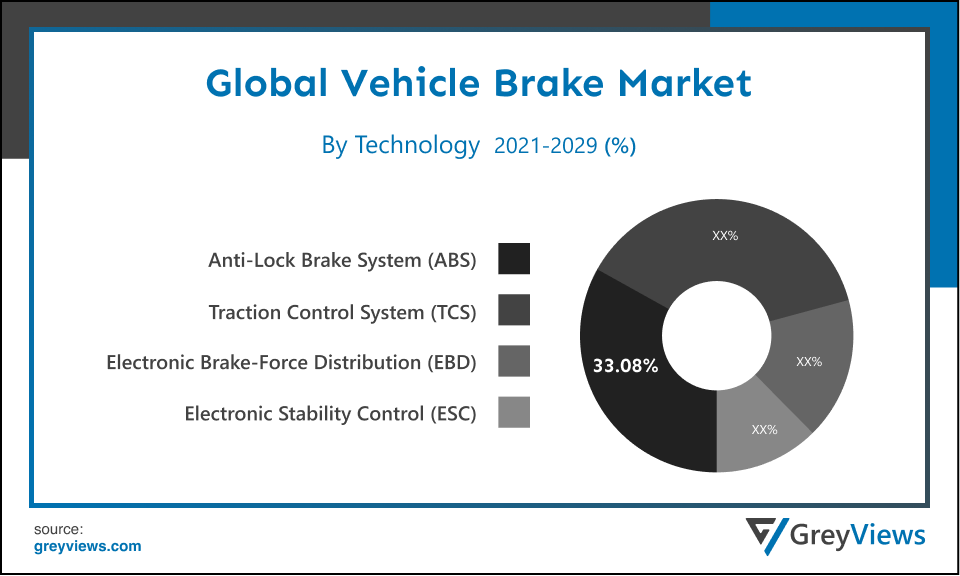

By Technology

The technology segment includes Traction Control System (TCS), Electronic Brake-force Distribution (EBD), Anti-lock Brake System (ABS), and Electronic Stability Control (ESC). The ABS segment led the vehicle brake market with a market share of around 33.08% in 2021. The vigorous push by numerous auto industry groups to compel the deployment of ABS in strategic areas is what has led to the evolution of ABS technology. Similarly, electronic stability control technology is gaining popularity due to perceptions of its advantages in regaining vehicle control in an emergency. As a result, it is anticipated to fuel the market for automobile brake systems throughout the anticipated timeframe.

By Regional Analysis:

The regions analyzed for the vehicle brake market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the vehicle brake market and held the 37.8% share of the market revenue in 2021.

- Asia Pacific region witnessed a major share. The Asia-Pacific region is expanding as a result of the region's capacity to provide businesses with significant cost savings on labor and raw materials. Additionally, the center of the car manufacturing industry is located in nations like China and India. The market is anticipated to develop due to the increased popularity of automotive brake systems and increased sales of luxury and premium vehicles. Additionally, the rise in automotive ownership and the rising accident rate contribute to the market's expansion.

- North America is anticipated to experience significant growth during the predicted period. The expansion of the market in this area has been fueled by the growing demand for vehicles that perform better in poor weather conditions, the presence of major automakers, and the growth in the supply of light commercial vehicles and passenger automobiles. Additionally, the compulsory installation of ESC technology in all light cars starting in 2018 has fueled the expansion of the regional market.

Global Vehicle Brake Market- Country Analysis:

- Germany

Germany's Vehicle Brake market size was valued at USD 3.5 billion in 2021 and is expected to reach USD 5.2 billion by 2029, at a CAGR of 5.1% from 2022 to 2029.

31.8% of the European market for car brakes is under German control. Industry giants including Robert Bosch, Continental AG, and ZF Friedrichshafen are based in Europe's Germany. Since automatic emergency braking will be required in all vehicles in the EU starting in May 2022, the automobile air disc brake market is developing quickly.

- China

China’s Vehicle Brake market size was valued at USD 6.6 billion in 2021 and is expected to reach USD 10.75 billion by 2029, at a CAGR of 6.3% from 2022 to 2029. The market for vehicle brakes in China has expanded significantly in recent years because of the tremendous untapped potential in the region. Furthermore, because of the region's pro-industry government initiatives and increasing production of passenger cars and light commercial vehicles (LCVs), the region's need for vehicle brakes is expected to rise.

- India

India's Vehicle Brake market size was valued at USD 4.2 billion in 2021 and is expected to reach USD 6.4 billion by 2029, at a CAGR of 5.6% from 2022 to 2029. Factors including the implementation of strict safety rules, the acceptance of luxury and high-end automobiles, and the expanding use of air disc brakes in commercial vehicles fuel the market in the region.

Key Industry Players Analysis:

To increase their market position in the global vehicle brake business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Advics Co. Ltd.

- ZF Friedrichshafen AG

- Continental AG

- Akebono Brake Industry Co.

- Hitachi Automotive System

- Brembo SpA

- Robert Bosch GmbH

- Aisin Seiki Co.Ltd.

- Haldex

- Web co

- Nissin Kogyo Co. Ltd.

Latest Development:

- In April 2020, Veoneer announced an initial agreement to transfer its US braking control business to ZF Friedrichshafen AG for international market expansion.

- In March 2021, Brembo unveiled its brand-new Brembo Sport | T3 brake disc. The use of Type3 slotting and engraving the Brembo emblem on the braking surface set apart the new Brembo Sport | T3 disc from the previous model. It is a direct replacement for original equipment discs. These innovative techniques and characteristics in a road disc are

Report Metrics

| Report Attribute | Details |

|---|---|

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 5.8% |

| Market Size | USD 46.6 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | Product Type, Vehicle, Technology, and Regions |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Advics Co. Ltd., ZF Friedrichshafen AG, Continental AG, Akebono Brake Industry Co., Hitachi Automotive System, Brembo SpA, Robert Bosch GmbH, Aisin Seiki Co.Ltd., Haldex, Web co, Nissin Kogyo Co. Ltd., and among others. |

| By Product Type |

|

| By Vehicle |

|

| By Technology |

|

Regional scope |

|

Scope of the Report

Global Vehicle Brake Market by Product Type:

- Drum Brake

- Disc Brake

Global Vehicle Brake Market by Vehicle:

- Passenger Vehicle

- Commercial Vehicle

Global Vehicle Brake Market by Technology:

- Traction Control System (TCS)

- Electronic Brake-force Distribution (EBD)

- Anti-lock Brake System (ABS)

- Electronic Stability Control (ESC)

Global Vehicle Brake Market by Region:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What are the top 5 exporter countries of Vehicle brakes?

United States, Germany, United Kingdom, China, and France.

What was the market size of Vehicle Brake market in 2021?

Global Vehicle Brake market size was USD 46.6 billion in 2021.

What will be the market size of the Vehicle Brake market in 2029?

Global Vehicle Brake market is expected to reach USD 73.15 billion by 2029, at a CAGR of 5.8% from 2022 to 2029.

What are the opportunities in Vehicle Brake Market?

New technologies are being introduced to increase market opportunities

Which are the leading market players active in the Vehicle Brake market?

Leading market players active in the global Vehicle Brake market are Advics Co. Ltd., ZF Friedrichshafen AG, Continental AG, Akebono Brake Industry Co., Hitachi Automotive System, Brembo SpA, Robert Bosch GmbH, Aisin Seiki Co.Ltd., Haldex, Web co, Nissin Kogyo Co. Ltd., and among others.

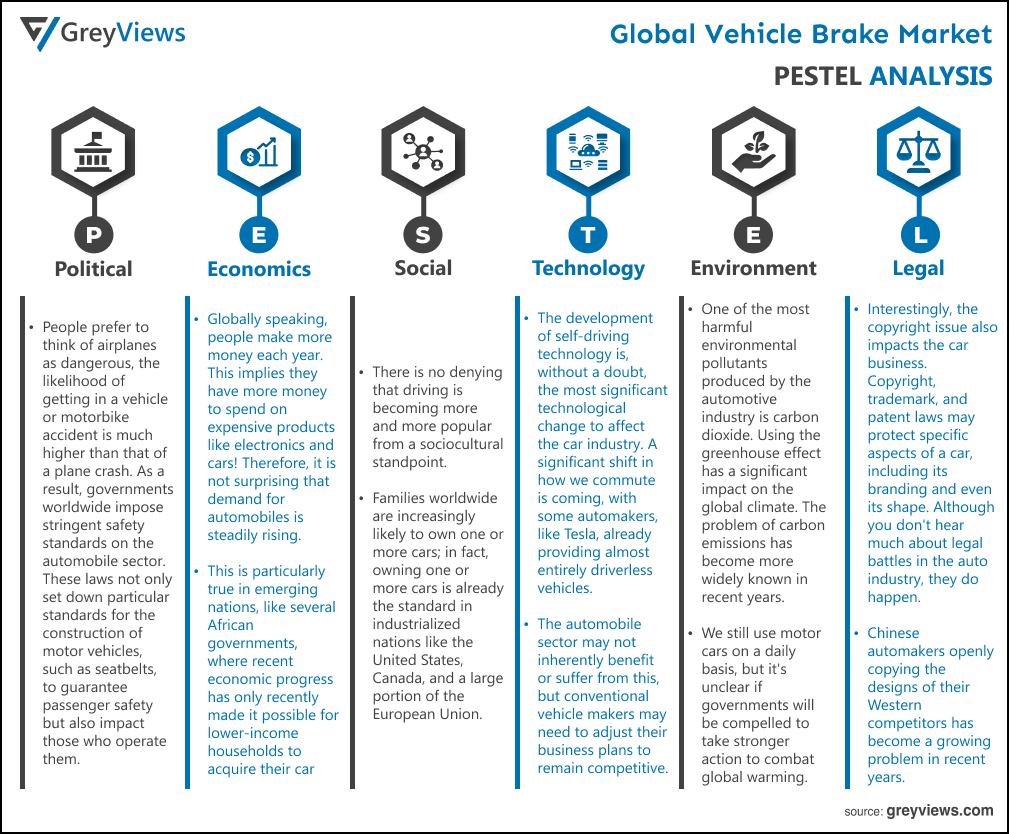

Political Factors- Driving a car can be incredibly risky. Although people prefer to think of airplanes as dangerous, the likelihood of getting in a vehicle or motorbike accident is much higher than that of a plane crash. As a result, governments worldwide impose stringent safety standards on the automobile sector. These laws not only set down particular standards for the construction of motor vehicles, such as seatbelts, to guarantee passenger safety but also impact those who operate them. The amount of carbon dioxide created by driving a car, or carbon emissions, is a serious issue with motor vehicles. Governments are very interested in the emissions data for new and used automobiles. This is just another legal hurdle that automakers must clear in addition to other environmental worries.

Economical Factors- Globally speaking, people make more money each year. This implies they have more money to spend on expensive products like electronics and cars! Therefore, it is not surprising that demand for automobiles is steadily rising. This is particularly true in emerging nations, like several African governments, where recent economic progress has only recently made it possible for lower-income households to acquire their car. In the end, more cars will be sold due to the rising demand for motor vehicles, boosting profits for those working in the sector.

Social Factor- There is no denying that driving is becoming more and more popular from a sociocultural standpoint. Families worldwide are increasingly likely to own one or more cars; in fact, owning one or more cars is already the standard in industrialized nations like the United States, Canada, and a large portion of the European Union. It's not like most of us can't get by on bicycles and buses; rather, we choose to drive motor cars just because that's what is expected of us, and that's part of the problem.

Technological Factors- The development of self-driving technology is, without a doubt, the most significant technological change to affect the car industry. A significant shift in how we commute is coming, with some automakers, like Tesla, already providing almost entirely driverless vehicles. The automobile sector may not inherently benefit or suffer from this, but conventional vehicle makers may need to adjust their business plans to remain competitive. Aside from the introduction of self-driving automobiles, a significant technological development in the automotive sector is the safety of motor vehicles in general. Wearing seat belts wasn't mandatory until the 1980s, and lower-end automakers didn't start installing airbags in all of their vehicles until the early 2000s.

Environmental Factors- One of the most harmful environmental pollutants produced by the automotive industry is carbon dioxide. Using the greenhouse effect has a significant impact on the global climate. The problem of carbon emissions has become more widely known in recent years. We still use motor cars on a daily basis, but it's unclear if governments will be compelled to take stronger action to combat global warming. This could mean outlawing the use or production of all motor vehicles or, at the very least, shifting to electric ones.

Legal Factors- Interestingly, the copyright issue also impacts the car business. Copyright, trademark, and patent laws may protect specific aspects of a car, including its branding and even its shape. Although you don't hear much about legal battles in the auto industry, they do happen. Chinese automakers openly copying the designs of their Western competitors has become a growing problem in recent years. For instance, there has been significant contention over some suspiciously similar Rolls Royce Phantom replicas made by the Chinese company Geely. Although the overall impact of this copying on the sector is unknown, it is undoubtedly a problem.

- Introduction

- Objectives of the Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Product Type

- Market Attractiveness Analysis By Vehicle

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- The rise in the prevalence of chronic diseases

- The rapid development and Government investments in the healthcare industry

- Restraints

- The initial cost of setup

- Opportunities

- Increasing geriatric population

- Challenges

- Penetration in underdeveloped regions

- Global Vehicle Brake Market Analysis and Projection, By Product Type

- Segment Overview

- Drum Brake

- Disc Brake

- Global Vehicle Brake Market Analysis and Projection, By Vehicle

- Segment Overview

- Passenger Vehicle

- Commercial Vehicle

- Global Vehicle Brake Market Analysis and Projection, By Technology

- Segment Overview

- Traction Control System (TCS)

- Electronic Brake-force Distribution (EBD)

- Anti-lock Brake System (ABS)

- Electronic Stability Control (ESC)

- Global Vehicle Brake Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Vehicle Brake Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Vehicle Brake Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- Advics Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- ZF Friedrichshafen AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Continental AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Akebono Brake Industry Co.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Hitachi Automotive System

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Brembo SpA

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Robert Bosch GmbH

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Aisin Seiki Co.Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Haldex

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Web co

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Nissin Kogyo Co. Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Advics Co. Ltd.

List of Table

- Global Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Global Drum Brake Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- Global Disc Brake Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- Global Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Global Passenger Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- Global Commercial Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- Global Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Global Traction Control System (TCS) Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- Global Electronic Brake-force Distribution (EBD) Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- Global Anti-lock Brake System (ABS) Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- Global Electronic Stability Control (ESC) Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- Global Vehicle Brake Market, By Region, 2021–2029(USD Billion)

- North America Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- North America Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- North America Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- USA Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- USA Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- USA Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- USA Vehicle Brake Market, By Usage, 2021–2029(USD Billion)

- USA Vehicle Brake Market, By End-User, 2021–2029(USD Billion)

- Canada Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Canada Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Canada Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Mexico Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Mexico Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Mexico Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Europe Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Europe Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Europe Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Germany Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Germany Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Germany Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- France Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- France Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- France Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- UK Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- UK Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- UK Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Italy Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Italy Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Italy Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Spain Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Spain Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Spain Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Asia Pacific Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Asia Pacific Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Ashi Pacific Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Japan Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Japan Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Japan Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- China Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- China Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- China Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- India Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- India Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- India Mexico Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- South America Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- South America Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- South America Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Brazil Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Brazil Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Brazil Mexico Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- Middle East and Africa Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- Middle East and Africa Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- Middle East Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- UAE Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- UAE Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- UAE Mexico Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

- South Africa Vehicle Brake Market, By Product Type, 2021–2029(USD Billion)

- South Africa Vehicle Brake Market, By Vehicle, 2021–2029(USD Billion)

- South Africa Vehicle Brake Market, By Technology, 2021–2029(USD Billion)

List of Figures

- Global Vehicle Brake Market Segmentation

- Vehicle Brake Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Vehicle Brake Market Attractiveness Analysis By Product Type

- Global Vehicle Brake Market Attractiveness Analysis By Vehicle

- Global Vehicle Brake Market Attractiveness Analysis By Technology

- Global Vehicle Brake Market Attractiveness Analysis By Region

- Global Vehicle Brake Market: Dynamics

- Global Vehicle Brake Market Share By Product Type (2021 & 2029)

- Global Vehicle Brake Market Share By Vehicle (2021 & 2029)

- Global Vehicle Brake Market Share By Technology (2021 & 2029)

- Global Vehicle Brake Market Share by Regions (2021 & 2029)

- Global Vehicle Brake Market Share by Company (2020)