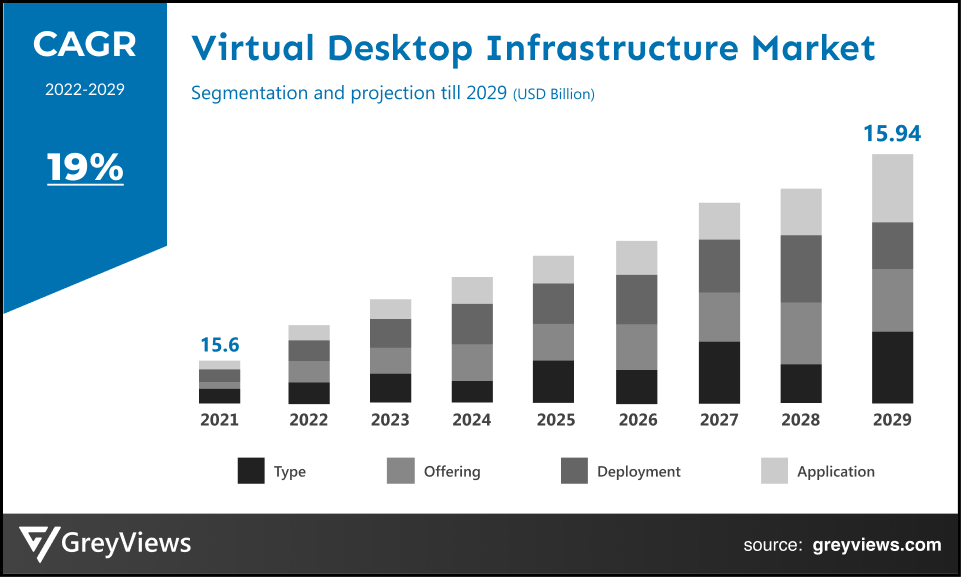

Virtual Desktop Infrastructure Market Size By Type (Persistent and Non-persistent), By Offering (Solution and Services), By Deployment (On-premise and Cloud), By Application (BFSI, Aerospace & Defense, IT & Telecom, Manufacturing, Healthcare, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 9%Current Market Size: USD 15.6 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Virtual Desktop Infrastructure Market- Market Overview:

The Global Virtual Desktop Infrastructure market is expected to grow from USD 15.6 billion in 2021 to USD 15.94 billion by 2029, at a CAGR of 19% during the Projection period 2022-2029. The growth of this market is mainly driven owing to increasing development in end-user application around the world.

A technology known as virtual desktop infrastructure (VDI) describes the use of virtual machines to create and maintain virtual desktops. On a centralized server, VDI hosts desktop environments and makes them available to end users upon request. In virtual desktop infrastructure (VDI), a hypervisor divides servers into virtual machines, which in turn host virtual desktops that users can access remotely from their devices. These virtual desktops are accessible to users from any location or device, and the host server handles all processing. A connection broker, a Services-based gateway that stands between the user and the server, is how users connect to their desktop instances. VDI has a lot of benefits, including increased security, flexibility, and user mobility. Its high-performance requirements in the past rendered it expensive and difficult to implement on legacy systems, which presented a hurdle for many enterprises. However, the increased use of hyperconverged infrastructure in businesses offers cost-effective solutions that enable scalability and excellent performance. Even though VDI can be utilized in a variety of settings, there are a few use cases that are particularly well suited for VDI, such as shift or remote work, BYOD, and remote work. Any technology that separates the desktop environment from the solution used to access it is referred to as desktop virtualization. Desktop virtualization, which includes VDI, can also be done in other ways, such as remote desktop services (RDS), which allows users to access shared desktops that are hosted remotely.

Sample Request: - Global Virtual Desktop Infrastructure Market

Market Dynamics:

Drivers:

- Corporate-owned personally enabled devices and bring your own device to drive market

The use of virtual desktop infrastructure in the IT and telecom sectors is being driven by bring-your-own-device policies and corporate-owned, personally-enabled devices. Furthermore, as the mobile workforce expands, so does the demand for virtual desktop infrastructure. Businesses are increasingly using virtual desktop infrastructure (VDI) to handle IT consumerization and cost management. Advanced virtualized desktop infrastructure is being developed by businesses. Due to mobility, Bring Your Own Device policies, and the consumerization of IT, businesses are under pressure to adopt cutting-edge virtual technologies. Because of the increased security, control, and compliance, desktop virtualization is becoming more and more popular. Switching to a DaaS platform may improve a company's security strategy because security is one of its main concerns.

Restraints:

- Security for virtual desktops is required which limit market expansion

Security-wise, virtual desktops are identical to their physical counterparts. Virtual desktop infrastructure is fundamentally incompatible with EDRs, while VR desktops lack endpoint security and have shoddy defenses. Significant obstacles to market expansion are posed by the excessive network traffic between the central interrogation server and endpoint detection and response (EDR) agents of each virtual instance. When hackers migrate laterally from the virtual session into the server without endpoint defenses, the harm can be catastrophic.

Opportunities:

- Growing Virtual Desktop Infrastructure Benefits to Promote Market Growth

Different Desktop-as-a-service providers offer transitional assistance for organizations moving to newer, intrinsically safer equipment as well as security services. A DaaS service also allows user data to be stored and accessed from almost any client device. The DaaS environment assures data security by combining encryption in transit and encryption at rest. As endpoint vulnerabilities become more widespread, businesses are also switching to virtualized systems, which decrease the perimeter of exposure by keeping data in a secure data center rather than on a hard drive on a traditional end-user device. As a result, some VDI advantages are fostering market expansion.

Challenges

- The market is likely to be hindered by issues including high deployment costs, endpoint security concerns, and others

Both in terms of technology and labor, deployment costs are considerable. A VDI project lasts for a number of months and involves significant changes for both the IT team and the users. But you must also take into account long-term exploitation costs and contrast them with those of a decentralized desktop architecture. In the case of a VDI architecture, data center hacking is also a possibility but is still uncommon. Although data security has been strengthened centrally, local workstations are still vulnerable to attacks. Consider using a thin client workstation to secure data access via the local workstation.

Segmentation Analysis:

The global virtual desktop infrastructure market has been segmented based on type, offering, deployment, application, and region.

By Type

The type segment is persistent and non-persistent. The persistent segment led the virtual desktop infrastructure market with a market share of around 53% in 2021. The actual user data is kept on the desktop while the persistent VDI's storage is kept on a separate logical drive, which allows it to be integrated with the underlying virtual machine. The transition in the IT sector toward desktop virtualization has created new possibilities for the leading companies in the persistent market.

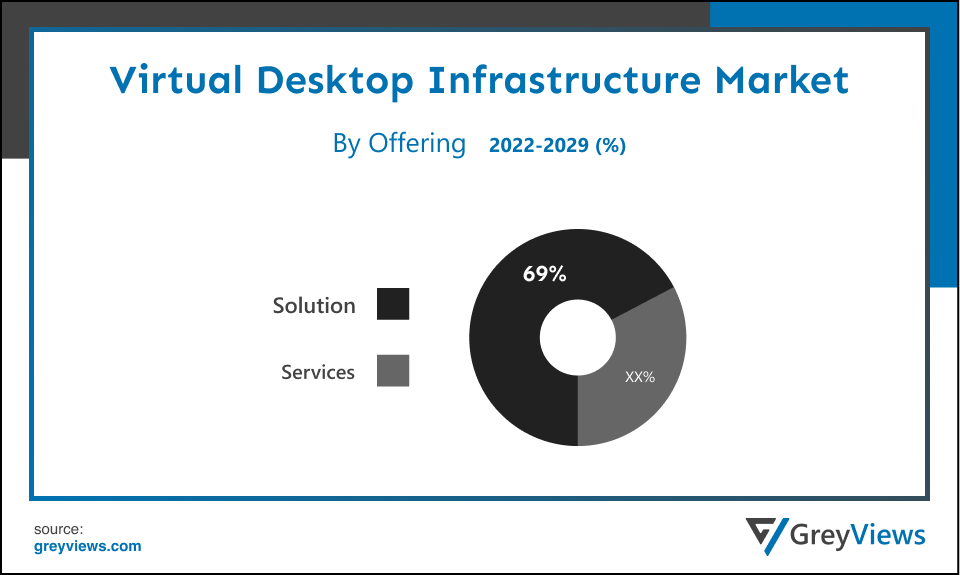

By Offering

The offering includes solution and services. The solution segment led the virtual desktop infrastructure market with a market share of around 69% in 2021. The market is growing as a result of the use of virtual desktop infrastructure solutions by several enterprises, which fuels demand among SMEs. All economies, especially those that are developing, depend heavily on small enterprises. According to the World Bank, SMEs in emerging economies account for 40% of GDP and 60% of all employment. As a result, the market is growing as virtual desktop infrastructure solutions are increasingly used by SME's.

By Deployment

The deployment includes on-premise and cloud. The cloud segment led the virtual desktop infrastructure market with a market share of around 59% in 2021. As VDI is relatively less expensive and has a robust network infrastructure in industrialized nations, the cloud sector drives the majority of demand. In order to completely eliminate the risk of a cyberattack, the cloud-based virtual desktop infrastructure manufacturers are also putting a lot of effort into producing a high-level security patch. This factor is also significantly increasing end-user demand, which is propelling the market for virtual desktop infrastructure.

By Application

The application includes BFSI, aerospace & defense, IT & telecom, manufacturing, healthcare, and others. The IT and telecom segment led the virtual desktop infrastructure market with a market share of around 59% in 2021. VDI solutions are being adopted by telecommunication and communication service providers to make it easier for their distant employees to access internal resources. Similar to this, VDI assists businesses in lowering the expense and maintenance costs related to physical network equipment.

By Regional Analysis:

The regions analyzed for the virtual desktop infrastructure market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the virtual desktop infrastructure market and held a 38% share of the market revenue in 2021.

- North America region witnessed a major share. Due to increased security (centralization of IT functions) and businesses concentrating on boosting employee productivity, the market in the region is growing, which suggests future expansion of the virtual desktop infrastructure market in the area. VDI technology are helping American businesses to guarantee the safety of their workers while delivering better remote connectivity, accelerating segment advancement.

- Asia Pacific is anticipated to experience significant growth during the predicted period. As more people use the internet, more people use social media, and more end-user industries are adopting virtual desktop infrastructure, the market is growing. Additionally, the region's widespread use of BYOD and cloud-based technology is a major driver of market expansion. Businesses across the nation are implementing BYOD to increase operational effectiveness and give employees flexibility. The industry will expand as there is more emphasis on lowering infrastructure costs and boosting performance.

Global Virtual Desktop Infrastructure Market- Country Analysis:

- Germany

Germany's Virtual Desktop Infrastructure market size was valued at USD 0.62 billion in 2021 and is expected to reach USD 1.06 billion by 2029, at a CAGR of 7% from 2022 to 2029.

When compared to non-persistent virtual desktops, the region's market is primarily driven by the high level of personalization and desktop customization features. The actual user data is kept on the desktop while the persistent VDI's storage is kept on a separate logical drive, which allows it to be integrated with the underlying virtual machine. Additionally, the market is growing as a result of the rising popularity of BYOD policies across the board in businesses. The majority of VDI providers are broadening their product lines to attract more customers in the area.

- China

China Virtual Desktop Infrastructure’s market size was valued at USD 0.81 billion in 2021 and is expected to reach USD 1.56 billion by 2029, at a CAGR of 8.6% from 2022 to 2029. Due to the region's educational institutions moving toward digitization during the pandemic outbreak, the industry is expanding. Virtualized desktops are supporting educational institutions in bridging the gap between students and instructors by providing remote access, thereby elevating the product demand across the education industry since students are facing significant pauses in learning and instruction. Furthermore, the market expansion potential will expand as colleges use Desktop-as-a-Service (DaaS) to set up new virtual teaching labs.

- India

India's Virtual Desktop Infrastructure market size was valued at USD 0.61 billion in 2021 and is expected to reach USD 1.12 billion by 2029, at a CAGR of 8% from 2022 to 2029. The market expansion in India is increasing rapidly as a result of falling solution prices, particularly those for GPUs, storage, and flash memory. On their VDI platforms, Desktop-as-a-Service (DaaS) providers can now offer users a near-zero latency experience thanks to fast solid-state drives and powerful GPUs. Virtual desktop solutions are predicted to equal the performance of actual PCs as network performance improves quickly with the advent of Services-defined networking and 5G networks, opening up new growth prospects for the industry in the region.

Key Application Players Analysis:

To increase their market position in the global virtual desktop infrastructure business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Neverfail, Inc.

- Parallels International GmbH

- RedHat, Inc.

- Amazon Web Services, Inc.

- Citrix Systems, Inc.

- HP Enterprise Co.

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- IBM Corporation

- IGEL Technology

- Intel Corporation

- Microsoft Corporation

- NComputing Co.

- Nutanix, Inc.

- Ericom Software, Inc.

- Evolve IP, LLC.

- NVIDIA Corporation

- Vagrant

- VMware, Inc.

Latest Development:

- In November 2021, In Belgium, Microsoft unveiled its "Digital AmBEtion" strategy. The development of the nation's digital infrastructure, including the installation of data centres and high-speed internet, was part of this plan.

- In September 2019, Horizon 7 Version 7.10, CART 5.2, App Volumes 2.18, and DEM 9.9 have all been made available by VMware. The version includes a number of improvements, including the inclusion of additional functionality to the HTML5-based Horizon Console, improvements to the capabilities of Remote Desktop Services Hosts (RDSH), and troubleshooting tools in Horizon 7.10.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 19% |

| Market Size | 15.6 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | By Type, Offering, Deployment, Application, and Region. |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | Neverfail, Inc., Parallels International GmbH, RedHat, Inc., Amazon Web Services, Inc., Citrix Systems, Inc., HP Enterprise Co., Huawei Technologies Co., Ltd., Cisco Systems, Inc., IBM Corporation, IGEL Technology, Intel Corporation, Microsoft Corporation, NComputing Co., Nutanix, Inc., Ericom Software, Inc., Evolve IP, LLC., NVIDIA Corporation, Vagrant (HashiCorp, Inc.), and VMware, Inc., among others |

| By Type |

|

| By Offering |

|

| By Deployment |

|

| By Application |

|

Regional scope |

|

Scope of the Report

Global Virtual Desktop Infrastructure Market by Type:

- Persistent

- Non-Persistent

Global Virtual Desktop Infrastructure Market by Offering:

- Solution

- Services

Global Virtual Desktop Infrastructure Market by Deployment:

- On-premise

- Cloud

Global Virtual Desktop Infrastructure Market by Application:

- BFSI

- Aerospace & Defense

- IT & Telecom

- Manufacturing

- Healthcare

- Others

Global Virtual Desktop Infrastructure Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What is the market size of ViRtual Desktop Infrastructure Market in 2021?

Global Virtual Desktop Infrastructure market size was USD 15.6 billion in 2021

What is the CAGR for the ViRtual Desktop Infrastructure Market?

The CAGR for the ViRtual Desktop Infrastructure Market is 9%.

What will be the market size of the virtual desktop infrastructure market?

Global virtual desktop infrastructure market is expected to reach USD 15.94 billion by 2029.

Which are the leading market players active in the virtual desktop infrastructure market?

Leading market players active in the global virtual desktop infrastructure market are Neverfail, Inc., Parallels International GmbH, RedHat, Inc., Amazon Web Services, Inc., Citrix Systems, Inc., HP Enterprise Co., Huawei Technologies Co., Ltd., Cisco Systems, Inc., IBM Corporation, IGEL Technology, Intel Corporation, Microsoft Corporation, NComputing Co., Nutanix, Inc., Ericom Software, Inc., Evolve IP, LLC., NVIDIA Corporation, Vagrant (HashiCorp, Inc.), and VMware, Inc.

What are the latest trends that are projected to influence the market in the upcoming years?

Introduction of advanced technologies around the globe is projected to influence the market in the Projection years.

What is the key threats to the virtual desktop infrastructure market?

The possibility of data theft is primarily impeding the growth of the virtual desktop infrastructure market.

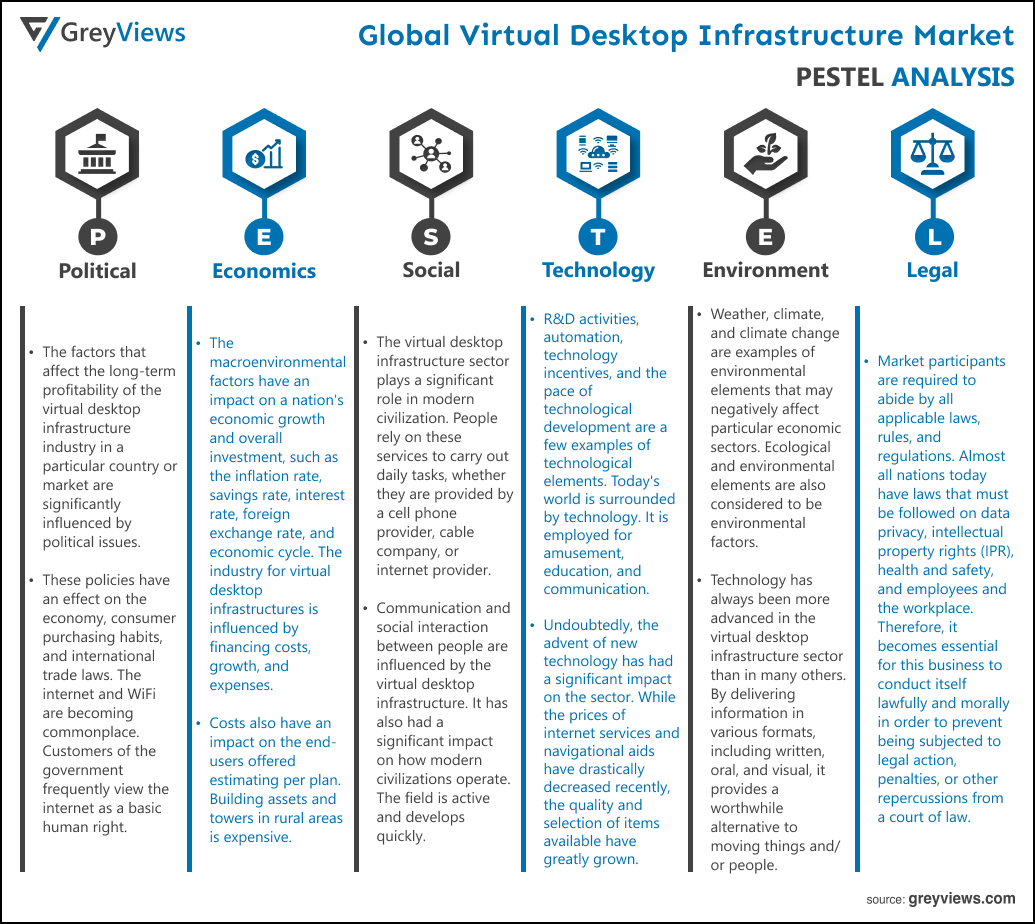

Political Factors- The factors that affect the long-term profitability of the virtual desktop infrastructure industry in a particular country or market are significantly influenced by political issues. These policies have an effect on the economy, consumer purchasing habits, and international trade laws. The internet and WiFi are becoming commonplace. Customers of the government frequently view the internet as a basic human right. It is necessary for training in many different vocations. Even if applying for jobs online is a common practice, leaving a company website and uploading a resume to servers is essential. The debate over unrestricted internet is raging. Customers trust the internet, so professional organizations and the administration should treat it the same. Unrestricted internet would prevent, for example, specialized businesses from slowing down web and information speeds.

Economical Factors- The macroenvironmental factors have an impact on a nation's economic growth and overall investment, such as the inflation rate, savings rate, interest rate, foreign exchange rate, and economic cycle. The industry for virtual desktop infrastructures is influenced by financing costs, growth, and expenses. Costs also have an impact on the end-users offered estimating per plan. Building assets and towers in rural areas is expensive. Customers who don't reside in large urban areas are affected. The demand for assets used by virtual desktop infrastructures rises as militaries grow more. Depending on the location, the number of clients in the area, and the demand for telecommunication services, this may result in rising expenses (along with income).

Social Factor- The virtual desktop infrastructure sector plays a significant role in modern civilization. People rely on these services to carry out daily tasks, whether they are provided by a cell phone provider, cable company, or internet provider. Communication and social interaction between people are influenced by the virtual desktop infrastructure. It has also had a significant impact on how modern civilizations operate. The field is active and develops quickly. Rapid technological advancements require ongoing industrial adaptation in order to maintain competitiveness. The way cell phones have transformed the globe in only a few short years is a good illustration of this phenomenon. They are now more common than laptops, cost significantly less than laptops did a few years ago, and have given rise to totally new industries that did not exist before the widespread adoption of smartphones, such as ride-sharing apps or online shopping.

Technological Factors- R&D activities, automation, technology incentives, and the pace of technological development are a few examples of technological elements. Today's world is surrounded by technology. It is employed for amusement, education, and communication. Undoubtedly, the advent of new technology has had a significant impact on the sector. While the prices of internet services and navigational aids have drastically decreased recently, the quality and selection of items available have greatly grown. According to Jablonski (2021), the advent of 5G will significantly alter society. It makes use of all contemporary infrastructure, technology, and mobile connectivity. Not only is it altering how quickly individuals communicate, but it is also altering their capacity to convey information.

Environmental Factors- Weather, climate, and climate change are examples of environmental elements that may negatively affect particular economic sectors. Ecological and environmental elements are also considered to be environmental factors. Technology has always been more advanced in the virtual desktop infrastructure sector than in many others. By delivering information in various formats, including written, oral, and visual, it provides a worthwhile alternative to moving things and/or people. However, there are also additional risks associated with highly enhanced goods and services. According to ETNO (2021), the worldwide carbon dioxide (CO2) emissions in 2020 were contributed by the telecommunications sector at a rate of 2.6%. Companies must therefore increase the sustainability of their products and services.

Legal Factors- Companies that manufacture virtual desktop infrastructures are subject to very tight legislative requirements. Market participants are required to abide by all applicable laws, rules, and regulations. Almost all nations today have laws that must be followed on data privacy, intellectual property rights (IPR), health and safety, and employees and the workplace. Therefore, it becomes essential for this business to conduct itself lawfully and morally in order to prevent being subjected to legal action, penalties, or other repercussions from a court of law. Each industry has a number of significant legislative requirements that must be met. The sector that deals with virtual desktop infrastructures should observe all legal requirements without breaking any of them.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Deployment

- 3.3. Market Attractiveness Analysis By Offering

- 3.4. Market Attractiveness Analysis By Application

- 3.5. Market Attractiveness Analysis By Region

- 4. Application Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. More preference for bringing your own device

- 3. Restraints

- 3.1. Data theft

- 4. Opportunities

- 4.1. Growing Virtual Desktop Infrastructure Benefits

- 5. Challenges

- 5.1. High deployment costs

- Global Virtual Desktop Infrastructure Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Persistent

- 3. Non-Persistent

- Global Virtual Desktop Infrastructure Market Analysis and Projection, By Deployment

- 1. Segment Overview

- 2. On-Premise

- 3. Cloud

- Global Virtual Desktop Infrastructure Market Analysis and Projection, By Offering

- 1. Segment Overview

- 2. Solution

- 3. Services

- Global Virtual Desktop Infrastructure Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. BFSI

- 3. Aerospace & Defense

- 4. IT & Telecom

- 5. Manufacturing

- 6. Healthcare

- 7. Others

- Global Virtual Desktop Infrastructure Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Virtual Desktop Infrastructure Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Virtual Desktop Infrastructure Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Neverfail, Inc.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Parallels International GmbH

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- RedHat, Inc.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Amazon Web Services, Inc.

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Citrix Systems, Inc.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- HP Enterprise Co.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Huawei Technologies Co., Ltd.

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Cisco Systems, Inc.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- IBM Corporation

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- IGEL Technology

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Neverfail, Inc.

List of Table

- Global Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Global Persistent, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Non-Persistent, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Global On-Premise, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Cloud, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Global Solution, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Services, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Global BFSI, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Aerospace & Defense Non-Persistent, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global IT & Telecom, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Manufacturing, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Healthcare, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Others, Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- Global Virtual Desktop Infrastructure Market, By Region, 2021–2029 (USD Billion)

- North America Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- North America Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- North America Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- North America Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- USA Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- USA Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- USA Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- USA Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Canada Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Canada Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Canada Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Canada Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Mexico Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Mexico Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Mexico Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Mexico Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Europe Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Europe Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Europe Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Europe Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Germany Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Germany Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Germany Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Germany Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- France Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- France Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- France Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- France Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- UK Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- UK Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- UK Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- UK Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Italy Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Italy Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Italy Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Italy Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Spain Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Spain Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Spain Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Spain Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Asia Pacific Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Asia Pacific Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Japan Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Japan Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Japan Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Japan Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- China Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- China Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- China Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- China Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- India Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- India Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- India Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- India Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- South America Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- South America Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- South America Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- South America Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Brazil Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Brazil Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Brazil Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Brazil Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- Middle East and Africa Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- Middle East and Africa Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- UAE Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- UAE Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- UAE Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- UAE Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

- South Africa Virtual Desktop Infrastructure Market, By Type, 2021–2029 (USD Billion)

- South Africa Virtual Desktop Infrastructure Market, By Deployment, 2021–2029 (USD Billion)

- South Africa Virtual Desktop Infrastructure Market, By Offering, 2021–2029 (USD Billion)

- South Africa Virtual Desktop Infrastructure Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Virtual Desktop Infrastructure Market Segmentation

- Virtual Desktop Infrastructure Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Virtual Desktop Infrastructure Market Attractiveness Analysis By Type

- Global Virtual Desktop Infrastructure Market Attractiveness Analysis By Deployment

- Global Virtual Desktop Infrastructure Market Attractiveness Analysis By Offering

- Global Virtual Desktop Infrastructure Market Attractiveness Analysis By Application

- Global Virtual Desktop Infrastructure Market Attractiveness Analysis By Region

- Global Virtual Desktop Infrastructure Market: Dynamics

- Global Virtual Desktop Infrastructure Market Share By Type (2021 & 2029)

- Global Virtual Desktop Infrastructure Market Share By Deployment (2021 & 2029)

- Global Virtual Desktop Infrastructure Market Share By Offering (2021 & 2029)

- Global Virtual Desktop Infrastructure Market Share By Application (2021 & 2029)

- Global Virtual Desktop Infrastructure Market Share by Regions (2021 & 2029)

- Global Virtual Desktop Infrastructure Market Share by Company (2020)