Warehouse Automation Equipment Market Size, By Technology (Automatic Identification and Data Capture, Overhead Systems, Automated Storage and Retrieval Systems (ASRS), Conveyors, Order Picking, AGV/AMR, MRO Outbounds, Gantry Robots, Palletizing & Depalletizing, Sortation, and WMS/WES/WCS), By End-User (E-commerce, 3PL, Apparel, Pharma, Grocery, Food & Beverage, and General Merchandise), Regions, Segmentation, and Projection till 2029

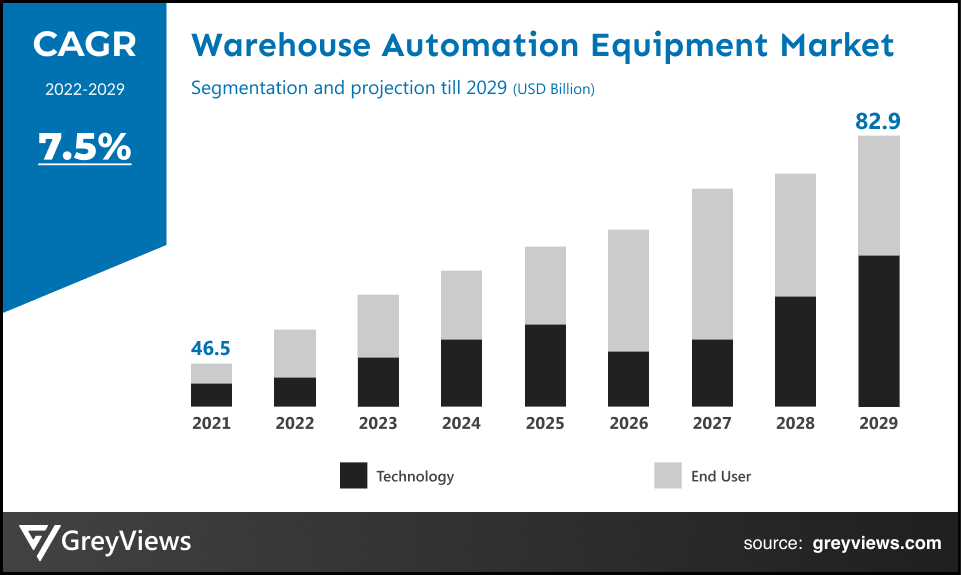

CAGR: 7.5%Current Market Size: USD 46.5 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Warehouse Automation Equipment Market- Market Overview:

The Global Warehouse Automation Equipment market is expected to grow from USD 46.5 billion in 2021 to USD 82.9 billion by 2029, at a CAGR of 7.5% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the exponential growth of the e-commerce industry

Most contemporary warehouse changes fall under the broad category of warehouse automation equipment. To boost efficiency, warehouse automation uses equipment and technology to automate labour-intensive, repetitive processes. The complete set of tools, personnel, procedures and systems required to automate warehouse jobs for improved accuracy and efficiency is called warehouse automation. This could involve labelling inventory items, data collection from warehouses, automated item storage and retrieval, and back-office report creation. Any work that requires repetitive labour can benefit from automation. Drones and machine learning, two examples of contemporary technology, open the door for warehouse automation systems to undertake more difficult, non-repetitive work and finish many tasks. Due to the increase in e-commerce and rising labour expenses associated with warehousing, the market for warehouse automation is anticipated to experience exceptional growth in the upcoming years. IoT, AI, machine learning, and big data analytics are being adopted more widely, generating buzz for the industry and successfully running the automation business. Additionally, the growing use of robotics in warehouse operations has created new economic prospects. However, a few factors preventing the market from expanding are a lack of skilled workers and mechanical issues related to warehouse automation. Nevertheless, the market is projected to continue to rise in the years to come due to the growing advantages of automation and the increase in R&D efforts.

Sample Request: - Warehouse Automation Equipment Market

Market Dynamics:

Drivers:

- Growing Use of 3D Printing

In important industries like healthcare, 3D printing is swiftly taking over as the innovation front line. For patient care, research, and storage, the 3D printing technique aims to replace human organs with artificial ones. Waiting periods for organs like kidneys can last up to a year. Furthermore, despite the long wait times, the high cost of these organs keeps them out of most people's reach. In addition to making organ transfers possible, 3D printing allows pharmacies, hospitals, research centres, and warehouses to keep organs safely. This process has already begun in the case of dental models, tissues, surgical instruments, and caskets for fractures. The requirement for internal warehousing at many sites will also rise due to 3D printing.

Restraints:

- Mechanical Challenges of Warehouse Automation

Computer system errors in warehouses might result in problems that spread swiftly. However, mechanical problems in an automated system can spread just as quickly and might even be harder to fix. For instance, promptly locating replacement parts for a custom-built ASRS won't be easy. Because of this, safeguarding against damage to the ASRS, palletizers, and other equipment is the greatest persistent difficulty in warehouse automation. The wood shipment pallets common throughout most of the supply chain frequently cause physical damage to an automated warehouse system.

Opportunities:

- Positive Impact of E-commerce

United Nations Conference on Trade and Development estimates that in 2018, global e-commerce sales were USD25.6 trillion. This was a notable 8% increase from 2017. Additionally, according to UNCTAD, B2B and B2C sales made up 30% of the world's GDP in the same year. Players in the market for warehouse automation will benefit greatly from this. The fastest operations and a global delivery infrastructure are required for e-commerce. Digitalization, automation, and global networking are required for such efficiency and connectedness. Additionally, B2C sales, a significant force behind global e-commerce, increased by 7.05 percent by 2018 to reach $404 billion. Technological developments in automation, declining shipping costs for international shipments, and increasing e-commerce demand will propel the market for warehouse automation equipment players to experience rapid expansion.

Challenges

- Lack of skilled workforce

The market's expansion is being constrained by a lack of skilled labour. Automation in warehouses operates by automating operations using software and technology such as robotics and sensors. To meet the demand for the work, these technologies require people with knowledge and skills. People in poor or impoverished countries are not up to par, which hurts the market. The entire cost of the project might also go up since users of specialist warehouse automation technology would need to undergo training, which will probably limit the market.

Segmentation Analysis:

The global warehouse automation equipment market has been segmented based on technology, end-user, and regions.

By Technology

The technology segment is automatic identification and data capture, overhead systems, Automated Storage and Retrieval Systems (ASRS), conveyors, order picking, AGV/AMR, MRO Outbounds, gantry robots, palletizing & depalletizing, sortation, and WMS/WES/WCS. The AGV/AMR segment led the largest share of the warehouse automation equipment market with a market share of around 12.3% in 2021. A type of mechanized automation called automatic guided vehicles (AGV) has a little amount of computing power on board. These vehicles use magnetic strips, wires, or sensors to move along a predetermined path across the warehouse. This navigation technique limits the deployment of AGVs to large, straightforward warehouse settings. The more versatile autonomous mobile robots (AMRs), as opposed to AGVs, use GPS systems to calculate effective routes across a warehouse. AMRs use cutting-edge laser guidance systems to identify obstructions, allowing them to manoeuvre safely in busy, dynamic environments.

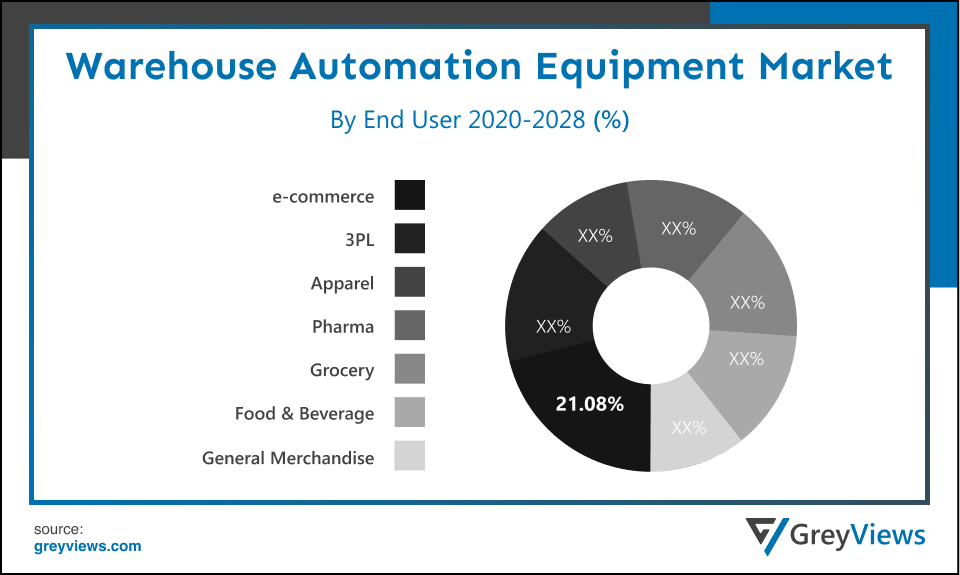

By End-User

The material segment is E-commerce, 3PL, Apparel, Pharma, Grocery, Food & Beverage, and General Merchandise. The e-commerce segment led the warehouse automation equipment market with a market share of around 21.08% in 2021. The warehouse of the future will need to accommodate both margin gains and the anticipated increase in e-commerce. E-commerce, as it did for brick-and-mortar retail, is changing warehouse space in a way that goes beyond merely extending existing structures.

By Regional Analysis:

The regions analyzed for the warehouse automation equipment market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the warehouse automation equipment market and held a 32.2% share of the market revenue in 2021.

- North America region witnessed a major share. The existence of well-established retail businesses, the e-commerce sector, and various other industry verticals is attributed to contributing to the region's dominance's strong potential in the end-user sector. The North American warehouse automation market is also driven by favorable government assistance and an increasing focus among warehouse businesses to automate their operations due to many benefits.

- The Asia Pacific is anticipated to experience significant growth during the predicted period. The existence of numerous manufacturing industries supports the general economic growth of the area. The Asia-Pacific warehouse automation market is expanding rapidly due to a number of factors, including rising production capacity, an increase in the population, and expanding e-commerce and packaging sectors in nations like China and India.

Global Warehouse Automation Equipment Market- Country Analysis:

- Germany

Germany's warehouse automation equipment market size was valued at USD 4.09 billion in 2021 and is expected to reach USD 7.0 billion by 2029, at a CAGR of 7.1% from 2022 to 2029.

The market is expanding in the nation as a result of many market participants' soaring investment chances in new technologies. Also, the vigorous demand from the infrastructure and e-commerce industries fuels the market growth in the country.

- China

China warehouse automation equipment’s market size was valued at USD 4.7 billion in 2021 and is expected to reach USD 9.1 billion by 2029, at a CAGR of 8.7% from 2022 to 2029. The warehousing industry has seen tremendous growth as a result of China's adoption of e-commerce. The challenges brought on by this rapid growth are numerous. Transport delays, a shortage of experienced labour, etc. forced the stakeholders to explore beyond traditional adoption strategies for robotics-enabled automation solutions. The warehousing sector is quickly evolving from basic godowns or shelters made of brick and mortar to highly complex stockrooms. Because of this, the participants in the warehousing industry continually assess and adapt new technology to provide their businesses a competitive edge.

- India

India's warehouse automation equipment market size was valued at USD 5.96 billion in 2021 and is expected to reach USD 9.32 billion by 2029, at a CAGR of 6.0% from 2022 to 2029. There is a rising need for industrial automation solutions in India due to the expansion of the manufacturing, retail, and FMCG industries. Strong growth is being seen in the markets for mobile robot platforms, automated storage, and shuttle retrieval systems. Additionally, there are several industrial and freight routes springing up all across the nation, which is predicted to lead to an expansion in organised players in the warehousing and industrial parks. It is anticipated that these players will implement automation so they may gain from increased returns on their investments. India's warehouse automation landscape will be significantly impacted by the developing field of AI (Automatic Identification) in robotics and other industry 4.0 solutions.

Key Industry Players Analysis:

To increase their market position in the global warehouse automation equipment business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- ABB Ltd.

- Automation Tooling Systems

- Amazon Robotics

- Fetch Robotics, Inc.

- FANUC Corporation

- Kuka AG

- Locus Robotics

- Honeywell International, Inc.

- SSI Schaefer AG

- Omron Corporation

- Yaskawa Electric Corporation, Inc.

Latest Development:

- June 2022 - Vacuum Picker, a new device from Schmalz India that can be used in warehouses, was introduced at IMTEX 2022 in Bangalore, India. The new vacuum pickers are made to pick up and move items from warehouses.

- March 2022 - The strategic cooperation between Addverb Technologies, based in India, and Numina Group will enable Addverb to expand the use of its cutting-edge mobile robots for automation solutions in North American warehouses.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 7.5% |

| Market Size | 46.5 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | By Technology, By End User |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | ABB Ltd., Automation Tooling Systems, Amazon Robotics, Fetch Robotics, Inc., FANUC Corporation, Kuka AG, Locus Robotics, Honeywell International, Inc., SSI Schaefer AG, Omron Corporation, Yaskawa Electric Corporation, Inc., and among, others. |

| By Technology |

|

| By End Use |

|

Regional scope |

|

Scope of the Report

Global Warehouse Automation Equipment Market by Technology:

- Automatic Identification and Data Capture

- Overhead Systems

- Automated Storage and Retrieval Systems (ASRS)

- Conveyors

- Order Picking

- AGV/AMR

- MRO Outbounds

- Gantry Robots

- Palletizing & Depalletizing

- Sortation

- WMS/WES/WCS

Global Warehouse Automation Equipment Market by End User:

- E-commerce

- 3PL

- Apparel

- Pharma

- Grocery

- Food & Beverage

- General Merchandise

Global Warehouse Automation Equipment Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What was the market size of Warehouse Automation Equipment market in 2021?

Global Warehouse Automation Equipment market size was USD 46.5 billion in 2021

Which region dominate the Warehouse Automation Equipment market?

North America region dominated the warehouse automation equipment market and held a 32.2% share of the market revenue in 2021.

What could be the market size of Warehouse Automation Equipment market in 2029?

Global warehouse automation equipment market is expected to reach USD 82.9 billion by 2029, at a CAGR of 7.5% from 2022 to 2029.

Who are leading players in Warehouse Automation Equipment market?

Leading market players active in the global warehouse automation equipment market are ABB Ltd., Automation Tooling Systems, Amazon Robotics, Fetch Robotics, Inc., FANUC Corporation, Kuka AG, Locus Robotics, Honeywell International, Inc., SSI Schaefer AG, Omron Corporation, Yaskawa Electric Corporation, Inc., and among, others.

Political Factors- By gaining powerful partners in the media, pressure groups can have an impact on the business climate. These groups exert pressure on the organizations by planning protests and organizing marketing efforts. The activities of these pressure organizations need to be monitored by Warehouse automation equipment because they have the potential to modify government policies, which could then have an impact on the general business climate. To gain the trust of these organizations, Warehouse automation equipment should work closely with them. It should also make investments in moral and charitable causes.

Economical Factors- High financial market efficiency facilitates capital accumulation and the production of goods and services by sharing a strong positive relationship with overall economic growth. So that it may quickly amass financial and human capital, Warehouse automation equipment must select nations with extremely efficient financial markets. Warehouse automation equipment can stay one step ahead of the competition by keeping an eye on the efficiency of the financial market. When deciding whether to expand internationally, market players should consider the economic growth rate of the various nations. More options to pursue long-term growth goals exist in nations with high economic growth rates. Consumer spending becomes more conservative when the economy is growing slowly, directly impacting Raymond Design of Warehouse Operations' revenue growth.

Social Factor- Respect for hierarchy and social class stratification are two significant social characteristics that may impact warehouse automation equipment commercial, marketing, and human resource management tactics. Warehouse automation equipment best suits a hierarchical structure and formal work culture when entering nations with a high power distance. The requirement for appropriate market segmentation techniques is also indicated by increased social stratification, as warehouse automation equipment cannot target several segments from various social classes using the same marketing mix.

Technological Factors- It is crucial for market players in warehouse automation equipment to research. It foresees the current and future technological trends to ensure the long-term viability of the business in today's competitive business environment, where business organizations are heavily investing in emerging technologies to stay ahead of the competition. The technological analysis lists a few technological developments that significantly affect the Warehouse automation equipment market. A well-developed technological infrastructure also shows that it will be more difficult for warehouse automation equipment to employ technology to gain a sustained competitive advantage because rivals might easily duplicate it.

Environmental Factors- Businesses are under pressure to lessen environmental harm due to strict environmental legislation in many different countries. In response, warehouse automation equipment market players should adopt ethical production methods, promote ethical consumption among their target market, work to enhance their brand's sustainability reputation, and ensure full compliance with local and international environmental laws because failure to do so could result in severe, reputation-damaging criticism from relevant stakeholders.

Legal Factors- Owners and operators of warehouses are required to treat your items with the same level of care as a "prudent person" would. This generally means that operators should use caution when storing their products and always protect their inventory. After all, it is the responsibility of your warehouse provider to perform background checks on employees, provide the necessary training, and guarantee a clean, climate-controlled environment. Policyholders are insured from loss resulting from negligence or negligent handling. However, losses from hail, fire, windstorms, and other common causes are typically not covered.

- Introduction

- Objectives of Study

- Market Definition

- Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Top Investment Pockets

- Market Attractiveness Analysis By Technology

- Market Attractiveness Analysis By End User

- Market Attractiveness Analysis By Region

- Industry Trends

- Market Dynamics

- Market Evaluation

- Drivers

- Growing Use of 3D Printing

- Restraints

- Mechanical Challenges of Warehouse Automation

- Opportunities

- Positive Impact of E-commerce

- Challenges

- Lack of skilled workforce

- Global Warehouse automation equipment Market Analysis and Projection, By Technology

- Segment Overview

- Automatic Identification and Data Capture

- Overhead Systems

- Automated Storage and Retrieval Systems (ASRS)

- Conveyors

- Order Picking

- AGV/AMR

- MRO Outbounds

- Gantry Robots

- Palletizing & Depalletizing

- Sortation

- WMS/WES/WCS

- Global Warehouse automation equipment Market Analysis and Projection, By End User

- Segment Overview

- E-commerce

- 3PL

- Apparel

- Pharma

- Grocery

- Food & Beverage

- General Merchandise

- Global Warehouse automation equipment Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South America

- Brazil

- Middle East and Africa

- UAE

- South Africa

- Global Warehouse automation equipment Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Warehouse automation equipment Market

- Global Company Market Share

- North America Company Market Share

- Europe Company Market Share

- APAC Company Market Share

- Competitive Situations and Trends

- Product Launches and Developments

- Partnerships, Collaborations, and Agreements

- Mergers & Acquisitions

- Expansions

- Company Profiles

- ABB Ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Automation Tooling Systems

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Amazon Robotics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Fetch Robotics, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- FANUC Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Kuka AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Locus Robotics

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Honeywell International, Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- SSI Schaefer AG

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Omron Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- ABB Ltd.

List of Table

- Global Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Global Automatic Identification and Data Capture, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Overhead Systems, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- GlobalAutomated Storage and Retrieval Systems (ASRS), Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Conveyors, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Order Picking, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global AGV/AMR, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global MRO Outbounds, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Gantry Robots, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Palletizing & Depalletizing, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Sortation, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global WMS/WES/WCS, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Global E-commerce, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global 3PL, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Apparel, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Pharma , Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Grocery, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Food & Beverage, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global General Merchandise, Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- Global Warehouse automation equipment Market, By Region, 2021–2029(USD Billion)

- North America Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- North America Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- USA Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- USA Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Canada Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Canada Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Mexico Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Mexico Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Europe Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Europe Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Germany Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Germany Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- France Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- France Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- UK Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- UK Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Italy Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Italy Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Spain Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Spain Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Asia Pacific Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Asia Pacific Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Japan Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Japan Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- China Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- China Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- India Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- India Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- South America Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- South America Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Brazil Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Brazil Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- Middle East and Africa Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- Middle East and Africa Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- UAE Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- UAE Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

- South Africa Warehouse automation equipment Market, By Technology, 2021–2029(USD Billion)

- South Africa Warehouse automation equipment Market, By End User, 2021–2029(USD Billion)

List of Figures

- Global Warehouse automation equipment Market Segmentation

- Warehouse automation equipment Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Warehouse automation equipment Market Attractiveness Analysis By Technology

- Global Warehouse automation equipment Market Attractiveness Analysis By End User

- Global Warehouse automation equipment Market Attractiveness Analysis By Region

- Global Warehouse automation equipment Market: Dynamics

- Global Warehouse automation equipment Market Share By Technology (2021 & 2029)

- Global Warehouse automation equipment Market Share By End User (2021 & 2029)

- Global Warehouse automation equipment Market Share by Regions (2021 & 2029)

- Global Warehouse automation equipment Market Share by Company (2020)