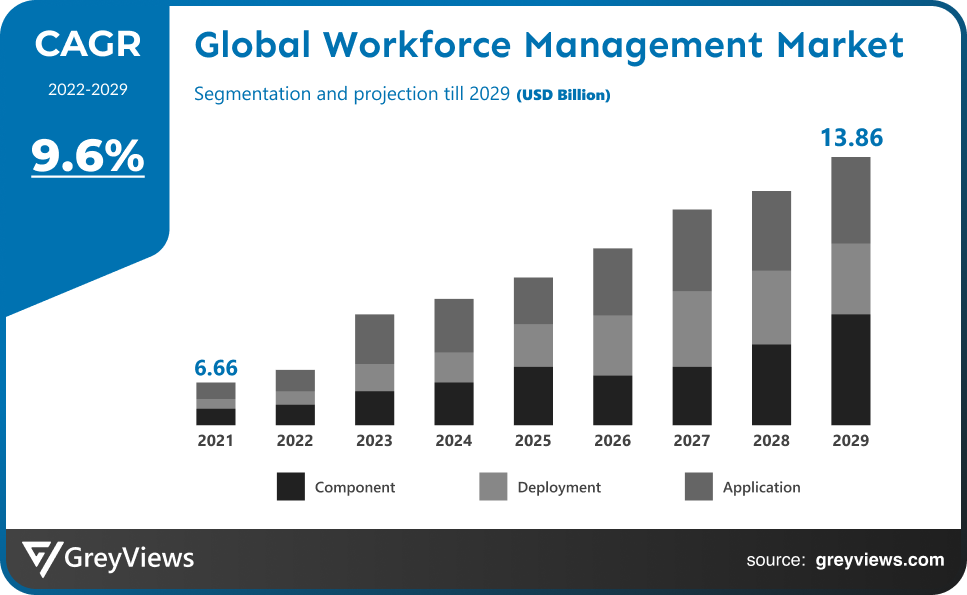

Workforce Management Market Size by Component (Software and Service), By Deployment (Cloud and On-Premise), By Applications (Attendance Management, Workforce Analytics, Workforce Scheduling and Others), Regions, Segmentation, and Projection till 2029

CAGR: 9.6%Current Market Size: USD 6.66 BillionFastest Growing Region: APAC

Largest Market: EuropeProjection Time: 2022-2029Base Year: 2021

Global Workforce Management Market- Market Overview:

The Global Workforce Management market is expected to grow from USD 6.66 billion in 2021 to USD 13.86 billion by 2029, at a CAGR of 9.6% during the Projection period 2022-2029. The growth of this market is mainly driven owing to the increasing demand to balance work balance and track the work efficiency of employees.

In workforce management, employers track attendance, follow constantly changing workplace laws and regulations, and allocate people and resources strategically. The ability to engage with customers through a variety of channels is enabled by workforce management, and it also automates many tasks associated with the employee-employer relationship, in turn improving communication and saving time. In order to benefit from more efficient decision-making processes and protect data integrity, companies use workforce management to create custom workflows. For effective control of the workforce, organizations are increasingly using remote workforce management software, as well as embedded workforce management software with features such as marketing automation, workforce optimization, and corporate analysis. Data-driven strategic decisions are being made by companies using workforce management systems to analyze massive quantities of data generated by them to identify patterns and insights, which helps them to create plans and drive the company's competitiveness. Software solutions on the market include workforce time and attendance management, task management, and other solutions, including workforce analytics which allows businesses to better manage their workforce. The COVID-19 outbreak had a positive impact on the growth of the market. In response to the pandemic, businesses around the world have launched remote working operations and implemented effective work management systems.

Sample Request: - Global Workforce Management Market

Market Dynamics:

Drivers:

- Rising mobile-based workforce applications

Workforce management solutions are becoming increasingly important because of the popularity of remote working and the widespread use of mobile devices in businesses today. With smartphone penetration rising globally and organizations focusing more on human resource analytics, the workforce management market will see increased growth opportunities. Key players keep on working more on workforce management applications to make them more user-friendly and efficient.

Restraints:

- Lack of technical knowledge

Lack of technical knowledge and skills is hampering the growth of the market. It is necessary to have knowledge about the software and services used in workforce management systems to have a good experience. Lack of understanding and knowledge will create problems in the implementation and installation of the system, which will affect the work as well as work life. Moreover, if the consumer is not aware of the benefits and limits of the system, then they might not get comfortable with the system, and as a result of this, they will start looking for alternative options, which will affect the market growth of workforce management.

Opportunities:

- Advanced technologies implementation

Due to the vast workforce, large enterprises typically adopt workforce management software at a much greater pace than small businesses because they have invested heavily in advanced technologies. More technical advancements in the workforce management system will expand the market and attracts more consumers, which will help the market to attain a stable position in the market. Using IoT and AI technologies in the workforce management system is boosting the growth of the market because these technologies provide more innovative ways to keep track of employees and their work.

Challenges:

- Privacy and Security

As every little detail of the employer and employees are stored digitally on the company’s work platform, privacy and security concerns generally rise. Because nowadays, cyber crimes are at their peak, making it difficult for the company to provide a safe and secure platform to their employees even after so many safety measures. Due to of this some companies are not willing to switch to workforce management systems as they are comfortable with their traditional working systems which they find safe and secure.

Segmentation Analysis:

The global workforce management market has been segmented based on component, deployment, applications, and regions.

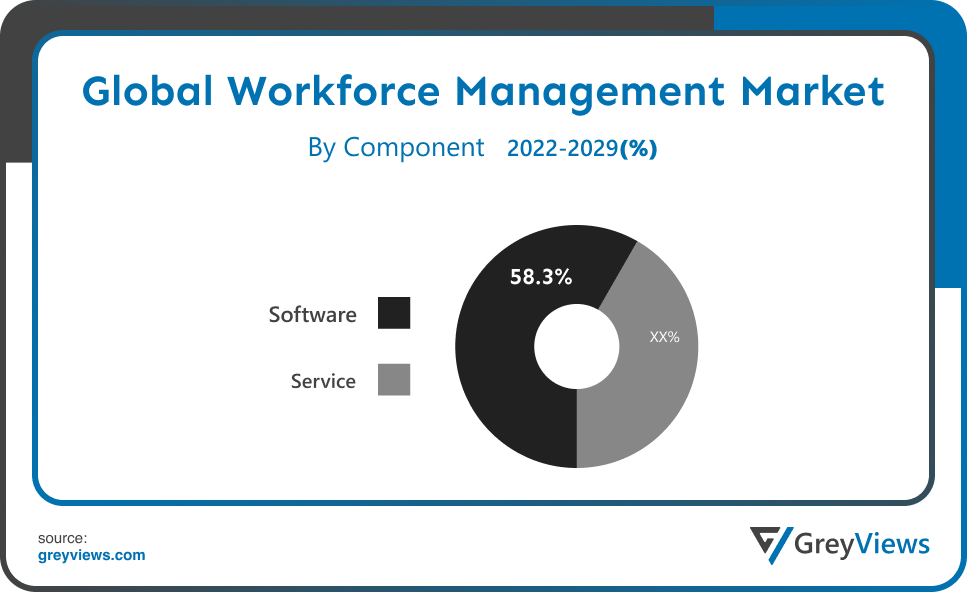

By Component

The component segment includes software and service. The software segment led the largest share of the workforce management market with a market share of around 58.3% in 2021. Various enterprises are seeking enhanced racking real-time data, data management and gaining insights regarding business performance as some of the factors driving the growth of the software segment. Software help in easy maintenance and tracking, safely and securely.

By Deployment

The solution segment includes cloud and on-premise. The cloud segment led the workforce management market with a market share of around 57.8% in 2021. The advantages of cloud-based systems include greater flexibility and mobile accessibility. Unlike other business technologies, cloud-based workforce management allows firms to simplify and improve their resource management functions, which will significantly impact market growth throughout the Projection period.

By Applications

The applications segment includes time and attendance management, workforce analytics, workforce scheduling and others. The time and attendance management segment led the largest share of the workforce management market with a market share of around 35.8% in 2021. Online time and attendance software help companies track and monitor their employees' working hours, enabling better insight into potential productivity problems. Therefore, workforce management will continue to grow during the Projection period as a result of this growing demand.

Global Workforce Management Market- Sales Analysis.

The sale of workforce management expanded at a CAGR of 10.1% from 2015 to 2021.

The approaches for corporate operations optimization have been simpler with the introduction of cloud computing, mobile technology, and big data. The technologies employed by businesses tend to greatly improve both the experience of their customers and employees, whether it be a CRM system like Salesforce, marketing automation software, inbound marketing software, or workforce management software. For instance, by automating routine labour-intensive tasks, cloud-based workforce management tools contribute to time utilisation optimization. Additionally, it facilitates immediate communication via a dedicated mobile application, enabling users to receive rapid notifications of relevant events like approved leave requests or schedule changes.

The need to schedule workforces, analyze workforce data, and monitor employee performance is likely to drive the demand for workforce management systems in large enterprises. Implementation of a cloud-based solution for handling workforce management For businesses that are under pressure to save costs, increase workplace efficiency, and boost their bottom line, WFM has been increasingly important. Workforce management solutions are essential for properly managing personnel across many business sites due to the popularity of remote working and the wide use of mobile devices. The best solutions include tools that respond to the needs of the adaptable modern employee, such as analytics, reporting, employee scheduling, and metrics for resolving inquiries. Enterprises can scale up their flexibility and agility thanks to cloud-based deployment.

By utilizing workforce management, companies can improve their decision-making processes' efficiency and protect their data's integrity. Moreover, the COVID-19 pandemic creates more opportunities for the workforce management market. Businesses worldwide have launched remote working operations and adopted an effective work management system due to the pandemic.

Thus, owing to the aforementioned factors, the global Workforce Management Market is expected to grow at a CAGR of 9.6% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the gloves market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The European region dominated the smart farming market and held a 36.4% share of the market revenue in 2021.

- The European region witnessed a major share. Workforce management solutions are becoming increasingly important in European organizations due to the growing need for increased productivity to maintain a competitive edge. Moreover, a growing number of businesses is also increasing employment in the region, which drives the demand for efficient workforce management, which will propel the growth of the workforce management market in the region.

- Asia Pacific is anticipated to experience significant growth during the predicted period. With a high concentration of SMEs, which are heavily involved in developing and using workforce software and management solutions, the region is enjoying rapid growth. Additionally, investments by small and medium-sized businesses will also contribute to market growth in the region.

Global Smart Farming Market- Country Analysis:

- Germany

Germany's smart farming market size was valued at USD 0.77 billion in 2021 and is expected to reach USD 1.62 billion by 2029, at a CAGR of 9.8% from 2022 to 2029. By implementing workforce management software, businesses are enhancing productivity and automating their operations. In response, many companies and industries are adopting workforce management software, which will benefit the market for workforce management software.

- China

China’s smart farming market size was valued at USD 0.18 billion in 2021 and is expected to reach USD 0.38 billion by 2029, at a CAGR of 9.9% from 2022 to 2029. Market growth is driven primarily by the increase in cloud-based workforce management solutions adoption, the use of artificial intelligence technology in workforce management systems and the demand for workforce optimization boosting the growth of the market in the country.

- India

India's smart farming market size was valued at USD 0.13 billion in 2021 and is expected to reach USD 0.27 billion by 2029, at a CAGR of 10% from 2022 to 2029. Using its rapidly growing digital economy, India has embraced workforce management solutions in the private and public sectors to promote its workforce strategy and has emerged as one of the fastest-emerging countries in the South Asia Pacific region.

Key Industry Players Analysis:

To increase their market position in the global workforce management business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- SAP SE

- Mitrefinch Ltd.

- ServiceMax Inc.

- 7shifts

- IBM Corporation

- Workday Inc.

- Oracle Corporation

- Reflexis System Inc.

- Clicksoftware Technologies Ltd.

- SISQUAL

- Blue Yonder Group Inc.

- Crown Workforce Management System

- Infor Global Solutions

- Kronos Incorporated

- Automatic Data Processing

- NICE Systems Ltd.

- ADP LLC

- Kirona Solutions Limited

- Roubler UK Limited Company

- Atoss Software AG

Latest Development:

- In January 2019, With the introduction of the Workforce Dimensions, Kronos Inc.'s next-generation cloud suite, Kronos announced advanced improvements. The new workforce dimension features provide comprehensive human capital management solutions for organizations, as well as predictive scheduling, task management, and labour volume Projectioning.

- In June 2022, in order to bolster operations with high caseloads and high compliance scenarios, ActiveOps PLC launched CaseworkiQ, a workforce management solution. Moreover, this product allows customers to plan resources in line with caseload demand and service level agreements (SLAs), resulting in optimized performance, reduced risk, and lower costs.

Report Metrics

| Report Attribute | Details |

| Study Period | 2021-2029 |

| Base year | 2021 |

| CAGR (%) | 9.6 % |

| Market Size | 6.66 billion in 2021 |

| Projection period | 2022-2029 |

| Projection unit | Value (USD) |

| Segments covered | By Component, By Deployment, By Applications And By Region. |

| Report Scope | Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

Companies covered | SAP SE, Mitrefinch Ltd., ServiceMax Inc., 7shifts, IBM Corporation, Workday Inc., Oracle Corporation, Reflexis System Inc., Click software Technologies Ltd., SISQUAL among others. |

| By Component |

|

| By Deployment |

|

| By Applications |

|

| Regional scope |

|

Scope of the Report

Global Workforce Management Market by Component:

- Software

- Service

Global Workforce Management Market by Deployment:

- Cloud

- On-Premise

Global Workforce Management Market by Applications:

- Attendance Management

- Workforce Analytics

- Workforce Scheduling

- Others

Global Workforce Management Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Workforce Management Market in 2029?

Global Workforce Management Market is expected to reach USD 6.66 billion in 2021 to USD 13.86 billion by 2029, at a CAGR of 9.6% from 2022 to 2029.

What was the CAGR of the Workforce Management Market in 2015-2021?

The Workforce Management Market is projected to have a CAGR of 10.1%.

What is the component segment of the Workforce Management Market?

On the basis of components, the Workforce Management Market is segmented into software and service.

What are the key factors for the growth of the Workforce Management Market?

The Workforce management market is anticipated to be driven by Rising mobile-based workforce applications.

What is the breakup of the global Workforce Management Market based on the solutions?

Based on solutions, the global Workforce Management Market has been segmented into cloud and on-premise

Which are the leading market players active in the Workforce Management Market?

Leading market players active in the global SAP SE, Mitrefinch Ltd., ServiceMax Inc., 7shifts, IBM Corporation, Workday Inc., Oracle Corporation, Reflexis System Inc., Clicksoftware Technologies Ltd., SISQUAL among others.

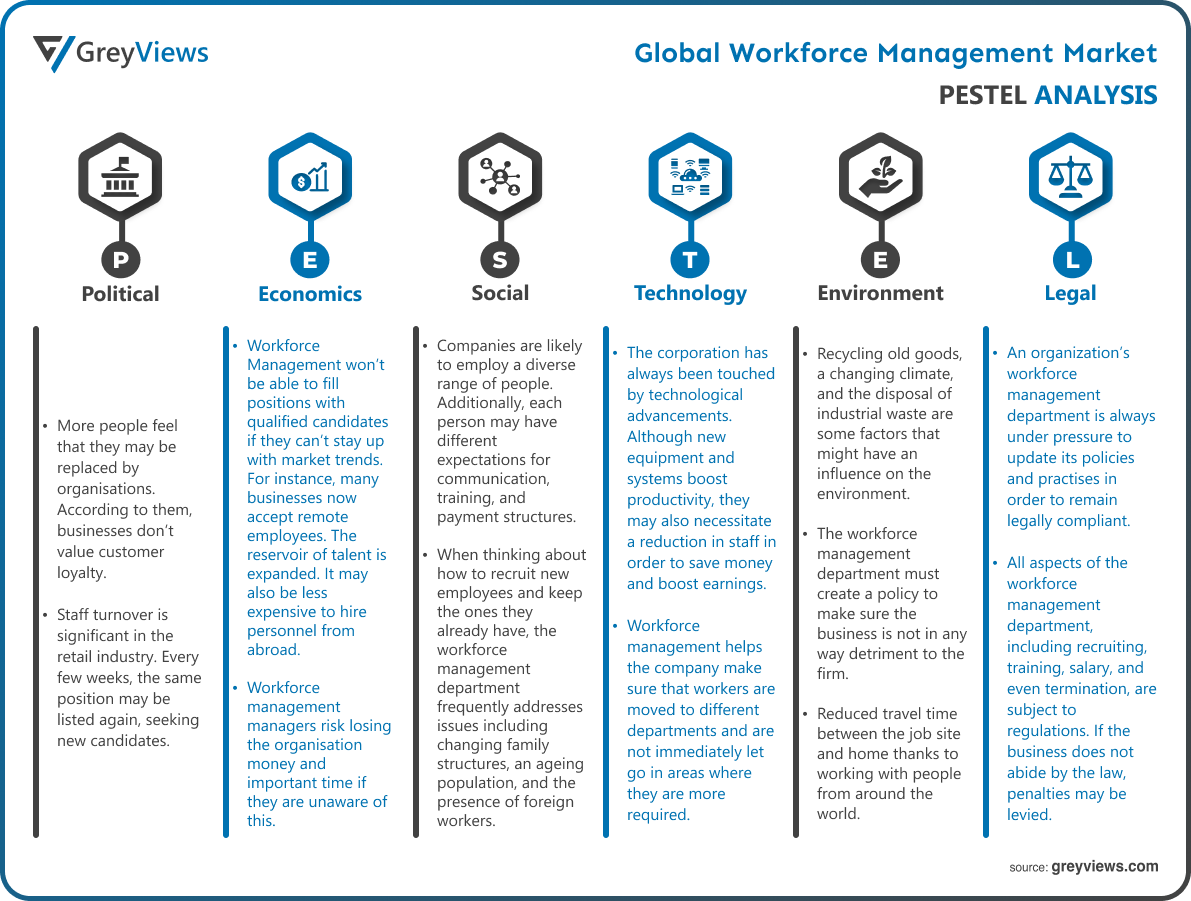

Political Factors- More people feel that they may be replaced by organisations. According to them, businesses don’t value customer loyalty. workforce management and employers are looking for fresh talent. In fact, although this is more common in certain industries than others, workforce management keeps an eye out for fresh talent even when they don’t need to replace someone. For example, staff turnover is significant in the retail industry. Every few weeks, the same position may be listed again, seeking new candidates. Retail workforce management uses recruiting as the primary approach for business expansion rather than adopting measures to maintain current personnel.

Economical Factors- Workforce Management won’t be able to fill positions with qualified candidates if they can’t stay up with market trends. For instance, many businesses now accept remote employees. The reservoir of talent is expanded. It may also be less expensive to hire personnel from abroad. workforce management managers risk losing the organisation money and important time if they are unaware of this. If you do want to deal with foreign firms, workforce management can find it challenging to educate these new hires. When everyone shares an office, arrives at the same time each day, and is accessible for weekly face-to-face meetings, it is much simpler to keep everyone on the same things.

Social Factor- This elements are crucial to every organization's staff. When thinking about how to recruit new employees and keep the ones they already have, the workforce management department frequently addresses issues including changing family structures, an ageing population, and the presence of foreign workers. Companies are likely to employ a diverse range of people. Additionally, each person may have different expectations for communication, training, and payment structures. All of these workers need to be taken care of by workforce management, who must make sure they have appropriate access to information, training, salary, benefits (where applicable), and more.

Technological Factors- The corporation has always been touched by technological advancements. Although new equipment and systems boost productivity, they may also necessitate a reduction in staff in order to save money and boost earnings. Workforce management helps the company make sure that workers are moved to different departments and are not immediately let go in areas where they are more required. Both finding and communicating with talent are straightforward processes. Within minutes, Workforce Management may post a job listing. They may then utilise the database to narrow down the pool of candidates until only the top candidates remain. Workforce Management can look for new recruits via forums, websites, and social media.

Environmental Factors- Recycling old goods, a changing climate, and the disposal of industrial waste are some factors that might have an influence on the environment. The workforce management department must create a policy to make sure the business is not in any way detriment to the firm. Reduced travel time between the job site and home thanks to working with people from around the world. Since everyone can work from a computer or smartphone, there will be less carbon dioxide released into the atmosphere. The internet has reduced the amount of documentation required by workforce management. Many (if not all) of these documents, such as handbooks, contracts, and other paperwork, are managed digitally as opposed to being printed out. To keep all the information organized, businesses only need a digital storage system.

Legal Factors- Every company is required to abide by legal legislation, rules, and regulations. An organization’s workforce management department is always under pressure to update its policies and practises in order to remain legally compliant. All aspects of the workforce management department, including recruiting, training, salary, and even termination, are subject to regulations. If the business does not abide by the law, penalties may be levied. The most significant legal need for workforce management is confidentiality. both legally and ethically, workforce management must fulfil this obligation. Workforce Management personnel may be fired if rules are not upheld. In the worst-case scenario, managers might go to jail.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Component

- 3.2. Market Attractiveness Analysis By Deployment

- 3.3. Market Attractiveness Analysis By Applications

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising mobile-based workforce applications

- 3. Restraints

- 3.1. Lack of technical knowledge

- 4. Opportunities

- 4.1. Advanced technologies implementation

- 5. Challenges

- 5.1. Privacy and Security

- Global Workforce Management Market Analysis and Projection, By Component

- 1. Segment Overview

- 2. Software

- 3. Service

- Global Workforce Management Market Analysis and Projection, By Deployment

- 1. Segment Overview

- 2. Cloud

- 3. On-Premise

- Global Workforce Management Market Analysis and Projection, By Applications

- 1. Segment Overview

- 2. Attendance Management

- 3. Workforce Analytics

- 4. Workforce Scheduling

- 5. Others

- Global Workforce Management Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Workforce Management Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Workforce Management Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- SAP SE

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Mitrefinch Ltd.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- ServiceMax Inc.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- 7shifts

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- IBM Corporation

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Workday Inc.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Oracle Corporation

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Reflexis System Inc.

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- SAP SE

- Clicksoftware Technologies Ltd.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- SISQUAL

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

List of Table

- Global Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Global Software, Workforce Management Market, By Region, 2021–2029 (USD Billion)

- Global Service, Workforce Management Market, By Region, 2021–2029 (USD Billion)

- Global Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Global Cloud, Workforce Management Market, By Region, 2021–2029 (USD Billion)

- Global On-Premise, Workforce Management Market, By Region, 2021–2029 (USD Billion)

- Global Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Global Attendance Management, Workforce Management Market, By Region, 2021–2029 (USD Billion)

- Global Workforce Analytics, Workforce Management Market, By Region, 2021–2029 (USD Billion)

- Global Workforce Scheduling, Workforce Management Market, By Region, 2021–2029 (USD Billion)

- Global Others, Workforce Management Market, By Region, 2021–2029 (USD Billion)

- North America Workforce Management Market, By Component, 2021–2029 (USD Billion)

- North America Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- North America Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- USA Workforce Management Market, By Component, 2021–2029 (USD Billion)

- USA Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- USA Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Canada Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Canada Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Canada Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Mexico Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Mexico Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Mexico Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Europe Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Europe Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Europe Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Germany Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Germany Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Germany Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- France Workforce Management Market, By Component, 2021–2029 (USD Billion)

- France Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- France Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- UK Workforce Management Market, By Component, 2021–2029 (USD Billion)

- UK Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- UK Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Italy Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Italy Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Italy Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Spain Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Spain Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Spain Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Asia Pacific Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Asia Pacific Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Asia Pacific Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Japan Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Japan Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Japan Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- China Workforce Management Market, By Component, 2021–2029 (USD Billion)

- China Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- China Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- India Workforce Management Market, By Component, 2021–2029 (USD Billion)

- India Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- India Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- South America Workforce Management Market, By Component, 2021–2029 (USD Billion)

- South America Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- South America Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Brazil Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Brazil Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Brazil Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- Middle East and Africa Workforce Management Market, By Component, 2021–2029 (USD Billion)

- Middle East and Africa Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- Middle East and Africa Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- UAE Workforce Management Market, By Component, 2021–2029 (USD Billion)

- UAE Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- UAE Workforce Management Market, By Applications, 2021–2029 (USD Billion)

- South Africa Workforce Management Market, By Component, 2021–2029 (USD Billion)

- South Africa Workforce Management Market, By Deployment, 2021–2029 (USD Billion)

- South Africa Workforce Management Market, By Applications, 2021–2029 (USD Billion)

List of Figures

- Global Workforce Management Market Segmentation

- Workforce Management Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Workforce Management Market Attractiveness Analysis By Component

- Global Workforce Management Market Attractiveness Analysis By Deployment

- Global Workforce Management Market Attractiveness Analysis By Applications

- Global Workforce Management Market Attractiveness Analysis By Region

- Global Workforce Management Market: Dynamics

- Global Workforce Management Market Share By Component (2021 & 2029)

- Global Workforce Management Market Share By Deployment (2021 & 2029)

- Global Workforce Management Market Share By Applications (2021 & 2029)

- Global Workforce Management Market Share by Regions (2021 & 2029)

- Global Workforce Management Market Share by Company (2020)