Anesthesia and Respiratory Devices Market Size By Product (Anaesthesia Monitoring Devices, Anaesthesia Delivery Systems, and Respiratory Devices), By End User (Hospitals, Ambulatory Service Centres, Homecare, and Clinics), Regions, Segmentation, and Projection till 2029

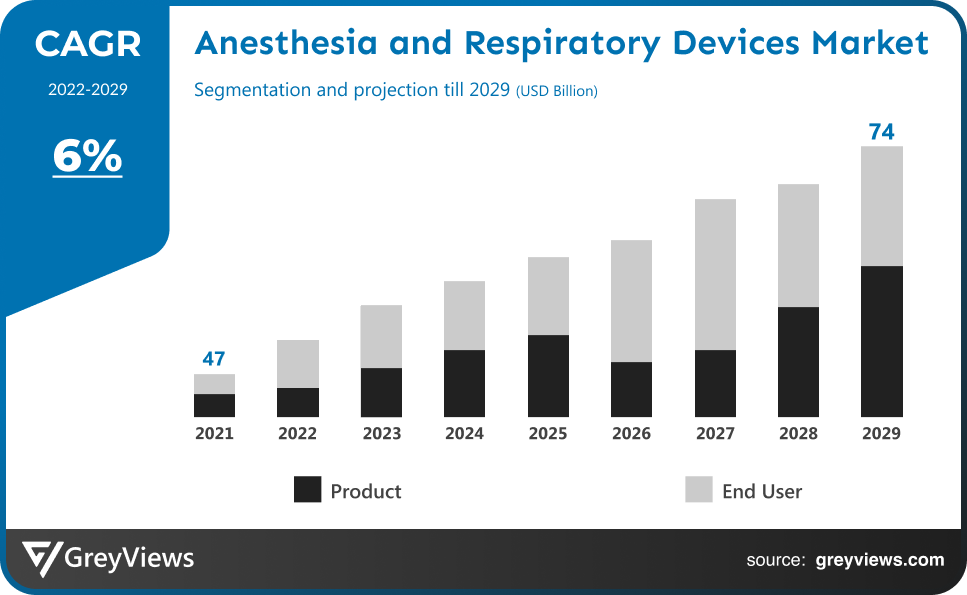

CAGR: 6%Current Market Size: USD 47 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Anesthesia and Respiratory Devices Market- Market Overview:

The global anesthesia and respiratory devices market is expected to grow from USD 47 billion in 2021 to USD 74 billion by 2029, at a CAGR of 6% during the Projection period 2022-2029. The growth of this market is mainly driven due to the rising prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD) and obstructive sleep apnoea (OSA).

Patients with injured respiratory organs are given the necessary amount of oxygen via respiratory devices. Devices for anesthesia are used to alleviate pain, regulate respiration and blood pressure, and track the heart rate and blood flow. Devices for anesthesia aid in creating a momentary absence of sensation. As a result, surgical treatments can be carried out more precisely. Hospitals, ambulatory service providers, homecare providers, and clinics all use anesthesia and respiratory equipment. Worldwide demand for medical devices such as ventilators and other vital sign monitoring equipment has increased because of the COVID-19 pandemic. As a result, in certain situations, certain devices would need to be adjusted to treat seriously ill patients. For instance, to provide patients with long-term ventilation, it could be essential to alter anesthetic and transport ventilators. In addition, businesses invested in the development of new products during the COVID-19 pandemic to meet the rising demand for medical equipment. For instance, InnAccel Technologies introduced a non-invasive ventilation system for COVID-19 patients in the intensive care unit (ICU) in April 2020. These reasons caused the pandemic to positively affect the ventilators market. The market for capnography equipment also suffered severely. Devices that measure end-tidal carbon dioxide (ETCO2) or capnography have been an effective adjuvant for evaluating patients with COVID-19 analgesia/sedation and breathing. The pandemic presented substantial problems and opportunities for Masimo, a creator, manufacturer, and marketer of noninvasive monitoring devices, including capnography systems. To meet the rising demand for its goods, the company increased its production capacity. It also continued to introduce new products, such as Masimo SafetyNet, a remote patient management system, to help fight the pandemic.

Sample Request: - Global Anesthesia and Respiratory Devices Market

Market Dynamics:

Drivers:

- Rising Expenditure

The demand for anesthetic and respiratory devices will increase due to rising spending on the construction of healthcare facilities in developing nations. The market value for anesthesia and respiratory devices will continue to increase due to increased rates of respiratory disorders and traffic accidents. Long-term market expansion will also be aided by the leading important players placing more emphasis on technical developments.

Restraints:

- Lack of Technological Resources

The expansion of the anesthetic and respiratory equipment market will be slowed down by a lack of technological resources in low- and middle-income countries. Additionally, a low adoption rate of new technology by healthcare professionals would hinder market expansion. Another obstacle to the expansion of the business will be the shortage of professional or educated healthcare personnel in these areas. Increased growth obstacles will result from strict regulations imposed on the approval of medical equipment.

Opportunities:

- Growing Demand

As a result, there is an increase in demand for respiratory equipment, which is encouraging industry growth. Over 480,000 deaths in the United States occur each year as a result of smoking cigarettes, according to data released by the CDC in June 2021. Out of them, 41,000 deaths were caused by exposure to secondhand smoke. The rising costs of building healthcare facilities in emerging countries are predicted to lead to an increase in the demand for anesthetic and respiratory equipment. Due to the growing prevalence of respiratory illnesses and traffic accidents, the market value for anesthesia and respiratory equipment will keep rising. The key players will be able to expand the market over the long run by putting more of an emphasis on technology developments.

Challenges:

- Low Adoption Rate

Low acceptance of new technologies by healthcare workers would limit the growth of the sector. The lack of qualified or educated healthcare workers in these places will be another barrier to the company's growth. Strict guidelines for medical device approval would further impede development. It is expected that as technology develops, the demand for anesthetic and respiratory equipment would rise. Manufacturers' involvement in patient care innovation, including the introduction of enhanced patient monitors, novel metrics, wireless devices, procedures, and integrated IT solutions, is further escalating the demand. These innovations enabled various anesthesiologists and physicians to offer individualized services to end users.

Segmentation Analysis:

The global anesthesia and respiratory devices market has been segmented based on product, end user, and regions.

By Product

The product segment includes Anaesthesia Monitoring Devices, Anaesthesia Delivery Systems, and Respiratory Devices. The respiratory devices segment led the anesthesia and respiratory devices market with a market share of around 18.8% in 2021. The main drivers of segment growth over the coming years are predicted to be the rising prevalence of respiratory disorders, the accessibility of cutting-edge respiratory devices, an increase in the number of operations performed, and rising healthcare costs. A respiratory device is a piece of medical equipment used to assist a patient who is having trouble breathing. Acute respiratory distress syndrome, COPD, fibrosis, and asthma are just a few of the illnesses that are managed and treated with the use of these devices. Anesthesia machines and anesthesia disposables are subcategories of the anesthesia devices segment.

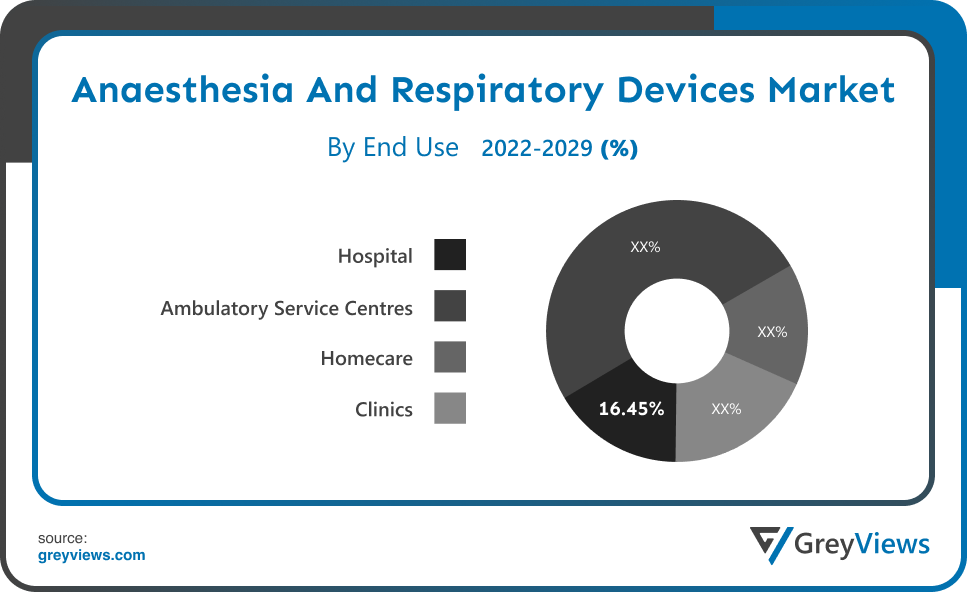

By End User

The end user segment includes Hospitals, Ambulatory Service Centres, Homecare, and Clinics. The hospital’s segment led the anesthesia and respiratory devices market with a market share of around 16.45% in 2021. With the rising incidences of respiratory diseases, the hospital segment is dominating.

Global Anesthesia and Respiratory Devices Market- Sales Analysis.

The sale of anesthesia and respiratory devices market design, product, and distribution channels expanded at a CAGR of 3.2% from 2015 to 2021.

Obstructive sleep apnea (OSA) and chronic obstructive pulmonary disease (COPD), fast urbanization, an increase in the number of surgical procedures, rising pollution levels, and a rise in the elderly population are all factors contributing to this trend. For instance, more than 15.0 million Americans suffered from COPD in 2021, according to the Centers for Disease Control & Prevention (CDC). Furthermore, 1.17 million patients in England were given a COPD diagnosis in 2020–2021, according to the National Health Service (NHS) U.K.

These reasons caused the pandemic to positively affect the ventilators market. The market for capnography equipment also suffered severely. Devices that measure end-tidal carbon dioxide (ETCO2) or capnography have been an effective adjuvant for evaluating patients with COVID-19 analgesia/sedation and breathing. The pandemic presented substantial problems and opportunities for Masimo, a creator, manufacturer, and marketer of noninvasive monitoring devices, including capnography systems. In order to meet the rising demand for its goods, the company increased its production capacity. It also continued to introduce innovative products, such as Masimo SafetyNet, a remote patient care system, to assist fight the pandemic.

A low rate of new technology adoption by healthcare professionals would also impede industry growth. The lack of qualified or educated healthcare workers in these places will be another barrier to the company's growth. Strict guidelines for medical equipment approval would further impede development. It is expected that as technology develops, the demand for anesthetic and respiratory equipment will rise.

Thus, owing to the aforementioned factors, the global anesthesia and respiratory devices market is expected to grow at a CAGR of 6% during the Projection period from 2022 to 2029.

Global Anesthesia and respiratory devices market- By Regional Analysis:

The regions analyzed for the anesthesia and respiratory devices market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the anesthesia and respiratory devices market and held a 35.59% share of the market revenue in 2021.

- The North America region witnessed a major share. An increase in the number of procedures performed in the U.S. as a result of the country's aging population will help the sector develop even more. For instance, the U.S. Census Bureau estimates that more than 54 million persons 65 and older lived in the country in 2021. Additionally, the World Health Organization predicts that the proportion of the elderly population will increase from 12% in 2015 to 22% in 2050. Additionally, problems with healthcare cost control following the economic crisis have forced the government to implement fresh plans to shorten hospital stays and levy an excise tax on medical equipment.

- Asia-Pacific is anticipated to experience significant growth during the Projection period. According to the National Statistical Office Senior in India 2021 study, India's elderly population (those 60 and older) is expected to grow by 41% over the course of a decade, from 138 million in 2021 to 194 million in 2031.

Global Anesthesia and Respiratory Devices Market- Country Analysis:

- Germany

Germany's anesthesia and respiratory devices market size was valued at USD 0.60 billion in 2021 and is expected to reach USD 0.87 billion by 2029, at a CAGR of 4.8% from 2022 to 2029. The market for anesthetic and respiratory equipment is expected to expand more quickly as the number of older people with COPD and asthma rises. Therefore, it is projected that the increase in pulmonary disorders will accelerate market expansion.

- China

China’s anesthesia and respiratory devices market size was valued at USD 0.80 billion in 2021 and is expected to reach USD 1.2 billion by 2029, at a CAGR of 5.5% from 2022 to 2029. The rising cases of smoking are further leading to the rising incidence of respiratory diseases, such as emphysema, bronchitis, cancer, and other lung diseases.

- India

India's anesthesia and respiratory devices market size was valued at USD 0.74 billion in 2021 and is expected to reach USD 1.1 billion by 2029, at a CAGR of 5.1% from 2022 to 2029. Due to rising expenditure to develop healthcare infrastructure, rising prevalence of respiratory diseases, and rising geriatric population.

Key Industry Players Analysis:

To increase their market position in the global anesthesia and respiratory devices business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- General Electric Company

- Medtronic

- Teleflex Inc.

- Koninklijke Philips N.V.

- Drägerwerk AG & Co. KGaA

- Getinge AB.

- Smiths Group plc

- Fisher & Paykel Healthcare Ltd.

- Masimo

- Braun Melsungen AG

- ResMed

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Latest Development:

- In May 2021, on account of the COVID-19 crisis, inspired breathing circuits, inspiredTM respiratory filters, and SAVe II+TM ventilators were given to the Democratic Republic of Congo (DRC) by Vincent Medical Holdings Limited, a provider of respiratory medical devices, and AutoMedx, a manufacturer of mechanical ventilators in the United States.

- In August 2021, to enable the development and sale of user-centric respiratory systems, including full-face masks, reusable half masks, respirators, filtration devices, and different filters, Mackwell Health teamed with Corpro, the UK respiratory protection expert.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

6% |

|

Market Size |

47 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Product, By End User and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

General Electric Company, Medtronic, Teleflex Inc., Koninklijke Philips N.V., Drägerwerk AG & Co. KGaA, Getinge AB., Smiths Group plc,Fisher & Paykel Healthcare Ltd., Masimo, B. Braun Melsungen AG, ResMed, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. among others. |

|

By Product |

|

|

By End User |

|

|

Regional scope |

|

Scope of the Report

Global Anesthesia and Respiratory Devices Market By Product:

- Anaesthesia Monitoring Devices

- Anaesthesia Delivery Systems

- Respiratory Devices

Global Anesthesia and Respiratory Devices Market By End User:

- Hospitals

- Ambulatory Service Centres

- Homecare

- Clinics

Global Anesthesia and Respiratory Devices Market By Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the anesthesia and respiratory devices market in 2029?

Global anesthesia and respiratory devices market is expected to reach USD 74 billion by 2029, at a CAGR of 6% from 2022 to 2029.

What is the CAGR of the anesthesia and respiratory devices market?

The anesthesia and respiratory devices market is projected to have a CAGR of 6%.

What is the end user of anesthesia and respiratory devices market based on the product?

Based on end user, the global anesthesia and respiratory devices market has been segmented into Hospitals, Ambulatory Service Centres, Homecare, and Clinics.

What are the key factors for the growth of the anesthesia and respiratory devices market?

Device manufacturers are benefiting from the emergence of advanced manufacturing processes. To meet the demands of the healthcare industry, producers in the global anesthesia and respiratory devices market are expanding their product lines.

Which are the leading market players active in the anesthesia and respiratory devices market?

Leading market players active in the global anesthesia and respiratory devices market are General Electric Company, Medtronic, Teleflex Inc., Koninklijke Philips N.V.,Drägerwerk AG & Co. KGaA, Getinge AB., Smiths Group plc, Fisher & Paykel Healthcare Ltd., Masimo, B. Braun Melsungen AG, ResMed, Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

What is the product segment of the anesthesia and respiratory devices market?

Based on product, the anesthesia and respiratory devices market is segmented into Anaesthesia Monitoring Devices, Anaesthesia Delivery Systems, and Respiratory Devices.

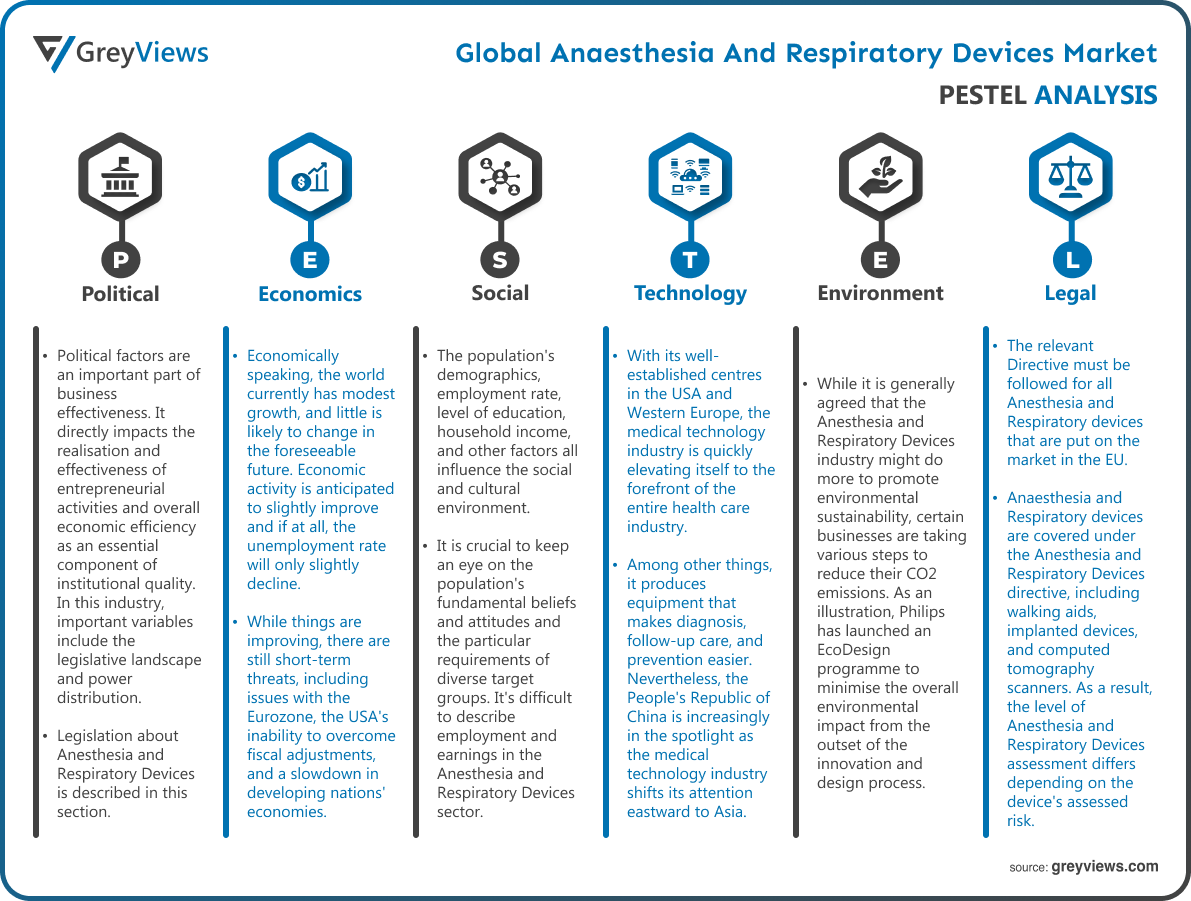

Political Analysis- Political factors are an important part of business effectiveness. It directly impacts the realisation and effectiveness of entrepreneurial activities and overall economic efficiency as an essential component of institutional quality. In this industry, important variables include the legislative landscape and power distribution. The actions of the government and other state institutions may substantially impact entrepreneurship in different sorts of markets. Legislation about Anesthesia and Respiratory Devices is described in this section. Global market regulations are based on the US FDA and similar to those in the People's Republic of China, Europe, and Canada. Classes, I, II, and III are used to categorise Anesthesia and Respiratory devices. From Class I to Class III, regulatory oversight is more stringent. The regulatory specifications for a generic device type are specified in the device categorization regulation.

Economic Analysis- Economically speaking, the world currently has modest growth, and little is likely to change in the foreseeable future. Economic activity is anticipated to slightly improve and if at all, the unemployment rate will only slightly decline. While things are improving, there are still short-term threats, including issues with the Eurozone, the USA's inability to overcome fiscal adjustments, and a slowdown in developing nations' economies. Some developed economies implemented risky and unorthodox monetary policies regarding medium-term risks to enhance global financial stability. In terms of the Anesthesia and Respiratory Devices sector, it is possible to see that nations like the People's Republic of China, India, Latin America, the Middle East, and other emerging markets with rising GDPs and growing middle classes present the industry with hitherto unheard-of potential. The demand for medical products and services should increase significantly as the population and disposable income increase.

Social Analysis- The population's demographics, employment rate, level of education, household income, and other factors all influence the social and cultural environment. It is crucial to keep an eye on the population's fundamental beliefs and attitudes and the particular requirements of diverse target groups. It's difficult to describe employment and earnings in the Anesthesia and Respiratory Devices sector. The manufacture of Anesthesia and Respiratory devices falls under the manufacturing industry category, hence it is not specifically under international surveillance. 15,400 industry experts work in the Anesthesia and Respiratory Devices sector, according to Eurostat and the OECD. The median wage increased by 5% between 2012 and 2013, reaching $105,000. Earnings also reflect the growing need for personnel in the quality assurance and regulatory affairs fields. Professionals working in quality assurance and quality control saw salary growth of more than 3% in 2013.

Technological Analysis- With its well-established centres in the USA and Western Europe, the medical technology industry is quickly elevating itself to the forefront of the entire health care industry. Among other things, it produces equipment that makes diagnosis, follow-up care, and prevention easier. Nevertheless, the People's Republic of China is increasingly in the spotlight as the medical technology industry shifts its attention eastward to Asia. This trend is likely to continue in the near future. With around 50% of the global market, the USA currently leads the globe in both Anesthesia and Respiratory Devices production and use. Japan, the EU, Canada, and Australia are the next largest and most stable markets for Anesthesia and Respiratory Devices after the US. 10 In general, the manufacture and use of medical equipment have increased significantly in all developed nations.

Environmental Analysis- While it is generally agreed that the Anesthesia and Respiratory Devices industry might do more to promote environmental sustainability, certain businesses are taking various steps to reduce their CO2 emissions. As an illustration, Philips has launched an EcoDesign programme to minimise the overall environmental impact from the outset of the innovation and design process. By using fewer resources and more recycled material, avoiding hazardous materials, designing for circularity, and making its packaging simple to recycle and reuse, Philips aims to increase the energy efficiency of its products. The CO2 emissions from Anesthesia and Respiratory devices could be lowered if additional businesses in the sector can create programmes like Philips' EcoDesign programme. The importance of environmental sustainability is growing every day, and Anesthesia and Respiratory Devices companies must take action quickly to cut waste and CO2 emissions.

Legal Analysis- The relevant Directive must be followed for all Anesthesia and Respiratory devices that are put on the market in the EU. Anaesthesia and Respiratory devices are covered under the Anesthesia and Respiratory Devices directive, including walking aids, implanted devices, and computed tomography scanners. As a result, the level of Anesthesia and Respiratory Devices assessment differs depending on the device's assessed risk. Before their products may be put on the market, businesses must have notified bodies to assess their quality procedures and technical documentation for medium- and high-risk devices. Before issuing a certification, the notified body is responsible for confirming that the pertinent standards are met. Manufacturers can then display their products' regulatory conformity by applying the European Conformity (CE) label. Since the CE marking is accepted throughout the European Union, the European Economic Area, and Switzerland, these products may be sold in a very large geographic area.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Product

- 3.2. Market Attractiveness Analysis By End User

- 3.3. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising Expenditure

- 3. Restraints

- 3.1. Lack of Technological Resources

- 4. Opportunities

- 4.1. Growing Demand

- 5. Challenges

- 5.1. Low Adoption Rate

- Global Anesthesia and Respiratory Devices Market Analysis and Projection, By Product

- 1. Segment Overview

- 2. Anaesthesia Monitoring Devices

- 3. Anaesthesia Delivery Systems

- 4. Respiratory Devices

- Global Anesthesia and Respiratory Devices Market Analysis and Projection, By End User

- 1. Segment Overview

- 2. Hospitals

- 3. Ambulatory Service Centres

- 4. Homecare

- 5. Clinics

- Global Anesthesia and Respiratory Devices Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Anesthesia and Respiratory Devices Market-Competitive Landscape

- 1. Overview

- 2. Market Share of Key Players in the Anesthesia and Respiratory Devices Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- 3. Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Lesaffre Group

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Lallemand, Inc.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Kerry Group

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Angel Yeast

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Thai Foods International Co., Ltd.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Leiber GmBH

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Biospringer

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- DSM

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Alltech

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Comar, LLC

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Synergy Flavors

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Biorigin

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Titan Biotech Limited Company

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Halcyon Proteins

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Specialty Biotech

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Lesaffre Group

List of Table

- Global Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Global Anaesthesia Monitoring Devices, Anesthesia and Respiratory Devices Market, By Region, 2021–2029 (USD Billion)

- Global Anaesthesia Delivery Systems, Anesthesia and Respiratory Devices Market, By Region, 2021–2029 (USD Billion)

- Global Respiratory Devices, Anesthesia and Respiratory Devices Market, By Region, 2021–2029 (USD Billion)

- Global Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Global Hospitals, Anesthesia and Respiratory Devices Market, By Region, 2021–2029 (USD Billion)

- Global Ambulatory Service Centres, Anesthesia and Respiratory Devices Market, By Region, 2021–2029 (USD Billion)

- Global Homecare, Anesthesia and Respiratory Devices Market, By Region, 2021–2029 (USD Billion)

- Global Clinics, Anesthesia and Respiratory Devices Market, By Region, 2021–2029 (USD Billion)

- North America Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- North America Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- USA Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- USA Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Canada Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Canada Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Mexico Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Mexico Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Europe Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Europe Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Germany Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Germany Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- France Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- France Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- UK Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- UK Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Italy Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Italy Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Spain Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Spain Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Asia Pacific Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Asia Pacific Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Japan Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Japan Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- China Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- China Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- India Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- India Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- South America Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- South America Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Brazil Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Brazil Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- Middle East and Africa Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- Middle East and Africa Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- UAE Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- UAE Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

- South Africa Anesthesia and Respiratory Devices Market, By Product, 2021–2029 (USD Billion)

- South Africa Anesthesia and Respiratory Devices Market, By End User, 2021–2029 (USD Billion)

List of Figures

- Global Anesthesia and Respiratory Devices Market Segmentation

- Anesthesia and Respiratory Devices Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Anesthesia and Respiratory Devices Market Attractiveness Analysis By Product

- Global Anesthesia and Respiratory Devices Market Attractiveness Analysis By End User

- Global Anesthesia and Respiratory Devices Market Attractiveness Analysis By Region

- Global Anesthesia and Respiratory Devices Market: Dynamics

- Global Anesthesia and Respiratory Devices Market Share By Product (2021 & 2029)

- Global Anesthesia and Respiratory Devices Market Share By End User (2021 & 2029)

- Global Anesthesia and Respiratory Devices Market Share by Regions (2021 & 2029)

- Global Anesthesia and Respiratory Devices Market Share by Company (2020)