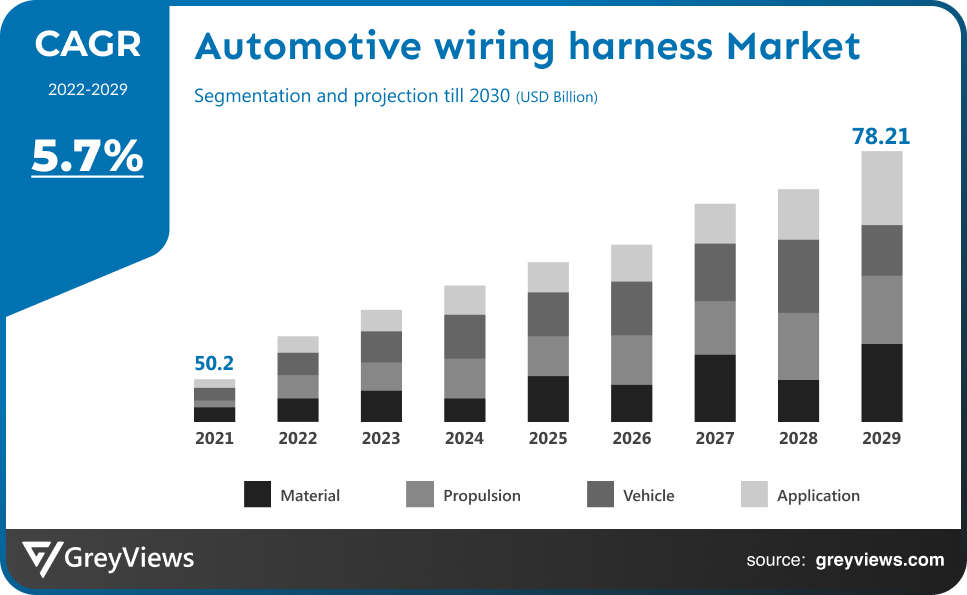

Automotive wiring harness Market Size By Material (Copper and Aluminum), By Propulsion (ICE Vehicles and Electric Vehicles), By Vehicle (Passenger Cars and Light Commercial Vehicles), By Application (Engine Harness, Chassis Harness, Battery Harness, Airbag Harness, Seat Harness, Door Harness, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 5.7%Current Market Size: USD 50.2 BillionFastest Growing Region: North America

Largest Market: APACProjection Time: 2022-2029Base Year: 2021

Global Automotive Wiring Harness Market- Market Overview:

The Global Automotive wiring harness market is expected to grow from USD 50.2 billion in 2021 to USD 78.21 billion by 2029, at a CAGR of 5.7% during the Projection period 2022-2029. The key driver of the growth of the automotive wiring harness market is the trend toward integrating cutting-edge technology to enhance driving enjoyment and vehicle performance.

A well-organized system of wires, terminals, and connections that runs throughout the car and transmits power and data is known as a wiring harness. In order to connect a multitude of components, wire harnesses are crucial. The progress of autos means that more and more of its component parts need electronics to fulfil other criteria. It has been demonstrated that wiring harnesses considerably aid in the growth and evolution of automobile manufacturers all around the world. The nerve center of a car is made up of tightly packed wires and data circuits called wiring harnesses. Automobiles have a number of electronic systems that maintain safety, perform fundamental operations (such as moving, turning, and stopping), and offer comfort and convenience. These systems need control signals and electrical power from the battery to work. These signals and electrical power are sent through the vehicle's wiring harness. The automotive cable harness is integrated to link various vehicle components, including the engine, body, dashboard, chassis, and others. It is developed to meet the dimensional requirements of vehicles. All electrical parts and gadgets, including wipers, the ignition, and lights, are powered by connectors, Ethernet cables, and wires that are included in car wiring loom kits. The wiring harness is essential to the functioning of the complete electrical system since wires are what make the car's electrical components work. The rapidly expanding electrification trend in the worldwide automotive industry and significant expenditures in cutting-edge vehicle safety features are two factors that have contributed to an increase in the size of the global automotive wire harness market. The industry is also being driven by an increase in the demand for in-car entertainment systems and improvements in automotive technology. Government rules that are strict regarding battery cells, onboard chargers, battery pack designs, and thermal propagation are predicted to provide the automotive wire harness industry with a considerable growth potential.

Sample Request: - Automotive wiring harness Market

Market Dynamics:

Drivers:

- Less installation time

One of the main benefits of using an automobile wire harness is that installation takes hardly any time at all. In the age of rapid gratification, this is extremely crucial. Customer satisfaction is always increased by on-time delivery.

Restraints:

- Continuous growing risk of wiring harness failures

The car has a number of electrical issues, including a battery problem, light problems, alternator problems, front and rear light malfunctions, and ignition problems, which are occasionally caused by wiring harness problems. The wire harness can occasionally flex as a result of quickly varying surroundings, such as sudden swings from extremely cold to extremely hot temperatures. These issues can significantly reduce the lifespan of the wire harness and cause it to deteriorate.

Opportunities:

- Growth of automotive motor market

To provide correct communication among the many electrical components included in automobile motors, the automotive wire harness is widely employed in these vehicles. Future demand for vehicle wire harness is anticipated to rise as a result.

Challenges:

- High chances of bundle getting worn

The chassis electrical harness might be damaged, just like it would be in any unplanned accident or jolt. This results in lashings, which compromise the electrical stability system. Due to the problems created in the wire harness construction, this raises concerns regarding the durability of automobile wiring harnesses.

Segmentation Analysis:

The global Automotive wiring harness market has been segmented based on Material, Propulsion, Vehicle, Application and regions.

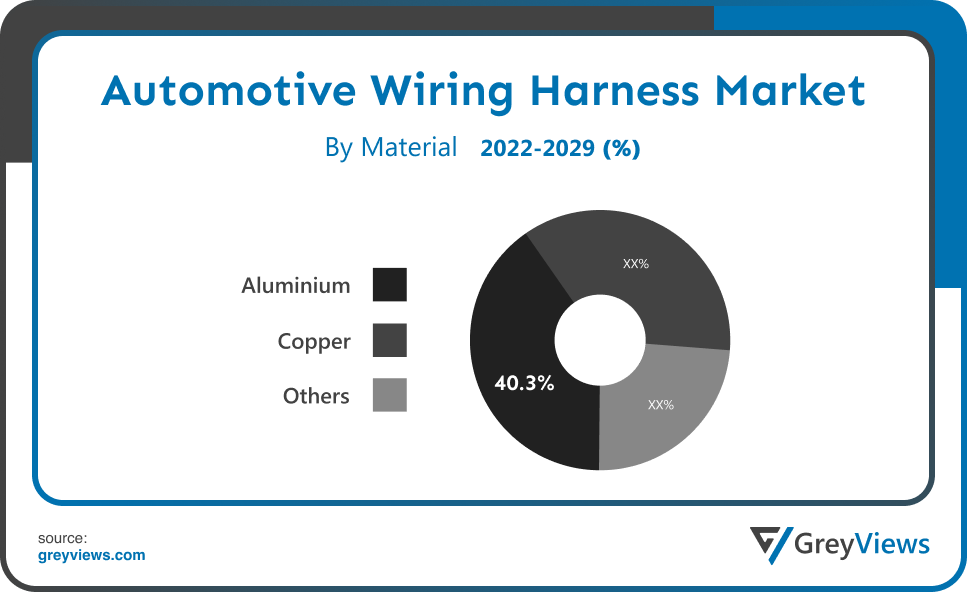

By Material

The Material segment includes Copper, Aluminum, and Others. The Aluminum segment led the largest share of the Automotive wiring harness market with a market share of around 40.3% in 2021. Over the projected period, aluminium is anticipated to increase quickly because it is replacing heavier copper conductors in the automotive wire harness market. Its ability to reduce overall weight and facilitate vehicle electrification, which can increase fuel economy, is what gives it its weight-saving qualities. Excellent copper substitute material is aluminium. Manufacturers have been interested in aluminium because of its low price, light weight, and wide availability. Wiring harness weight is reduced by 15% to 20% thanks to the usage of aluminium alloy by a number of OEMs as a conductor material (depending on the application or the extent of the implementation).

By Propulsion

The Propulsion segment includes ICE Vehicles and Electric Vehicles. The Electric Vehicles segment led the Automotive wiring harness market with a market share of around 53.08% in 2021. During the projected period, the electric vehicle category is anticipated to increase more quickly. Increased government incentives, declining battery costs, and growing infrastructure for charging are the causes of this rise. Some wire and cable producers are spending considerably in expanding manufacturing capacity to keep up with escalating demand as the use of electric vehicles throughout the globe increases. As an illustration, LS Cable and System declared in September 2020 that it has started producing aluminium wires in large quantities for electric automobiles. The business added that it established a plant in Korea specifically for the manufacture of aluminium wire. The business provides aluminium wires to well-known automakers including Hyundai and Kia Motors.

By Vehicle

The Vehicle segment includes Passenger Cars and Light Commercial Vehicles. The Passenger Cars segment led the Automotive wiring harness market with a market share of around 60.08% in 2021. The market was led by the passenger car sector, which is predicted to expand at a quicker CAGR. This is due to the fact that passenger cars are the most often produced vehicles, and as a result, demand in this market category is higher. In terms of sales, it is the most significant vehicle segment. based on Statista. The increased global sales of passenger vehicles, which are directly influencing the segment's growth, may be ascribed to the segment's rise.

By Application

The Application segment includes Engine Harness, Chassis Harness, Battery Harness, Airbag Harness, Seat Harness, Door Harness, and Others. The Chassis Harness segment led the Automotive wiring harness market with a market share of around 21.08% in 2021. The front, rear, and main harnesses make up the wiring for the chassis. The components of the chassis that are assigned to the automotive wire harness include the headlights, entertainment systems, turn indicators, and fuel flaps.

Global Automotive wiring harness Market- Sales Analysis.

The market value for Chassis & Safety Segment is expected to lead. The automotive wiring harness is primarily used for air brake pump and frame in the chassis applications. According to the survey conducted, the chassis and safety segment had a market share of 27% in 2021.

The sale of automotive wiring harness expanded at a CAGR of 4.9% from 2015 to 2021.

Around the world, there has been a growth in automobile exploration activity. due to the massive amount of investments made in this market. The use of flexible wires in this application aids in improving power delivery. Future sales of automobile wire harness may increase as a result of all of these. Additionally, the integration of many electrical and electronic systems into a single system aids in the transmission of signals and the operation of various electrical appliances. Without a question, this has made it possible for businesses to minimise costs. Manufacturers in other industries have taken notice of this, which could enhance the outlook for the automotive wire harness market in the future.

Additionally, the use of autonomous vehicles has increased as a result of its ability to lower accident-related incidents. Governments from all across the world are also spending millions on these autonomous vehicles. Another crucial component of these autonomous vehicles is the automotive harness. Automotive wiring harness demand is anticipated to rise as a result.

Thus, owing to the aforementioned factors, the global Automotive wiring harness Market is expected to grow at a CAGR of 5.7% during the Projection period from 2022 to 2032.

By Regional Analysis:

The regions analyzed for the Automotive wiring harness market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The Asia Pacific region dominated the Automotive wiring harness market and held the 32.1% share of the market revenue in 2021.

- The automotive wiring harness market is expected to be dominated by Asia Pacific. China, India, Japan, and South Korea all have significant vehicle businesses that are based in this area. During the anticipated period, China is expected to lead the global market for automotive wire harnesses. Since 2009, China has dominated the global car manufacturing industry. It produces almost 30% of all vehicles made worldwide. China's manufacturing capacity has surpassed that of the European Union, the US, and Japan put together. Additionally, China is the world's largest producer and seller of electric automobiles. The automotive wire harness market in China is expected to have considerable growth during the projected period due to an increase in electrification of conventional cars and the rate of adoption of electrical vehicles.

- North America is anticipated to experience significant growth during the predicted period. Due to the substantial demand for passenger and commercial cars in the area, North America accounts for a sizeable portion of the worldwide market for automotive wire harnesses. The U.S. government has ambitious ambitions for achieving net zero carbon emissions and encouraging EV electrification and hybridization, which are expected to drive the region's market for automotive wire harnesses.

Global Automotive wiring harness Market- Country Analysis:

- Germany

Germany Automotive wiring harness market size was valued at USD 16.38 billion in 2021 and is expected to reach USD 24.29 billion by 2029, at a CAGR of 5.3% from 2022 to 2029.

According to a survey done in the EU, Germany was the EU country that purchased the most car wiring harnesses. In addition, Germany is intended for some of the key participants in the automotive industry. The market for automobile wire harnesses in the area is anticipated to boom as a result.

- China

China Automotive wiring harness’s market size was valued at USD 29.78 billion in 2021 and is expected to reach USD 43.50 billion by 2029, at a CAGR of 5.1% from 2022 to 2029.

China is the country with the largest automobile wire harness market worldwide. In 2018, China produced more cars than the whole European Union combined, accounting for over 30% of global vehicle production.

- India

India's Automotive wiring harness market size was valued at USD 5.96 billion in 2021 and is expected to reach USD 9.32 billion by 2029, at a CAGR of 6.0% from 2022 to 2029. The Indian India's automotive wire harness market has the advantage of the nation's rapid technical advancement. Additionally, according to polls, India has the seventh-largest vehicle sector in the world. This demonstrates the market's unrealized potential in India. As a result, the Indian market has attracted a lot of international investors, making India a competitive participant. The future looks promising for the Indian market for automotive wire harnesses as more automakers concentrate on producing battery-powered automobiles.

Key Industry Players Analysis:

To increase their market position in the global Automotive wiring harness business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Quingdao Sanyuan Group

- Samvardhana Motherson Group

- Delphi Automotive

- Furukawa Electric Company Ltd

- Sumitomo Electric Industries

- Kromberg & Schubert

- Fujikura Ltd

- Leoni AG

- PKC Group (Motherson Sumi Systems)

- THB Group (AmWINS Group Inc.)

- Nexans Auto electric

- Spark Minda

- Kyungship Corporation

- Yazaki Corporation

- Yura Corporation and Lear Corporation.

Latest Development:

- In April 2021, Samvardhana Motherson Group subsidiary Motherson Sumi Systems Ltd. (MSSL) reported that the company's public shareholders approved the reorganisation plan. The business would profit from MSSL's sustained parentage and Sumitomo Wiring Systems, Japan's expanded emphasis.

- In October 2021, Serbia is the location of Leoni AG's fourth manufacturing facility. In the construction and equipment for its new wiring harness production plant, the business spent more than EUR 50 million.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

5.7% |

|

Market Size |

50.2 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Material, By Propulsion, By Vehicle, By Application and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Quingdao Sanyuan Group, Samvardhana Motherson Group, Delphi Automotive, Furukawa Electric Company Ltd, Sumitomo Electric Industries, Kromberg & Schubert, Fujikura Ltd, Leoni AG, PKC Group (Motherson Sumi Systems), THB Group (AmWINS Group Inc.), Nexans Auto electric, Spark Minda, Kyungship Corporation, Yazaki Corporation, and Yura Corporation and Lear Corporation. |

|

By Material |

|

|

By Propulsion |

|

|

By Vehicle |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Automotive wiring harness Market by Material:

- Copper

- Aluminum

- Others

Global Automotive wiring harness Market by Propulsion:

- ICE Vehicles

- Electric Vehicles

Global Automotive wiring harness Market by Vehicle:

- Passenger Cars

- Light Commercial Vehicles

Global Automotive wiring harness Market by Application:

- Engine Harness

- Chassis Harness

- Battery Harness

- Airbag Harness

- Seat Harness

- Door Harness

- Others

Global Automotive wiring harness Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Automotive wiring harness market in 2029?

Global Automotive wiring harness market is expected to reach USD 78.21 billion by 2029, at a CAGR of 5.7% from 2022 to 2029.

What are the main factors driving the market’s growth?

Main drivers of the automotive wiring harness market are: improved fuel efficiency and reduced risk of shorting.

What are some of the restraints of the Automotive wiring harness market?

Some of the restraints of the automotive wiring harness market are wire harness fracture, and inability to handle corrosion.

Which are the leading market players active in the Automotive wiring harness market?

Leading market players active in the global Automotive wiring harness market are BW Group, Dorian LPG Ltd., EXMAR, Hyundai Heavy Industries Co., Ltd, Kawasaki Heavy Industries, Ltd, Mitsubishi Heavy Industries, Ltd., Namura Shipbuilding Co., Ltd., PT Pertamina (Persero), StealthGas Inc., The Great Eastern Shipping Co. Ltd., Teekay Corporation among others.

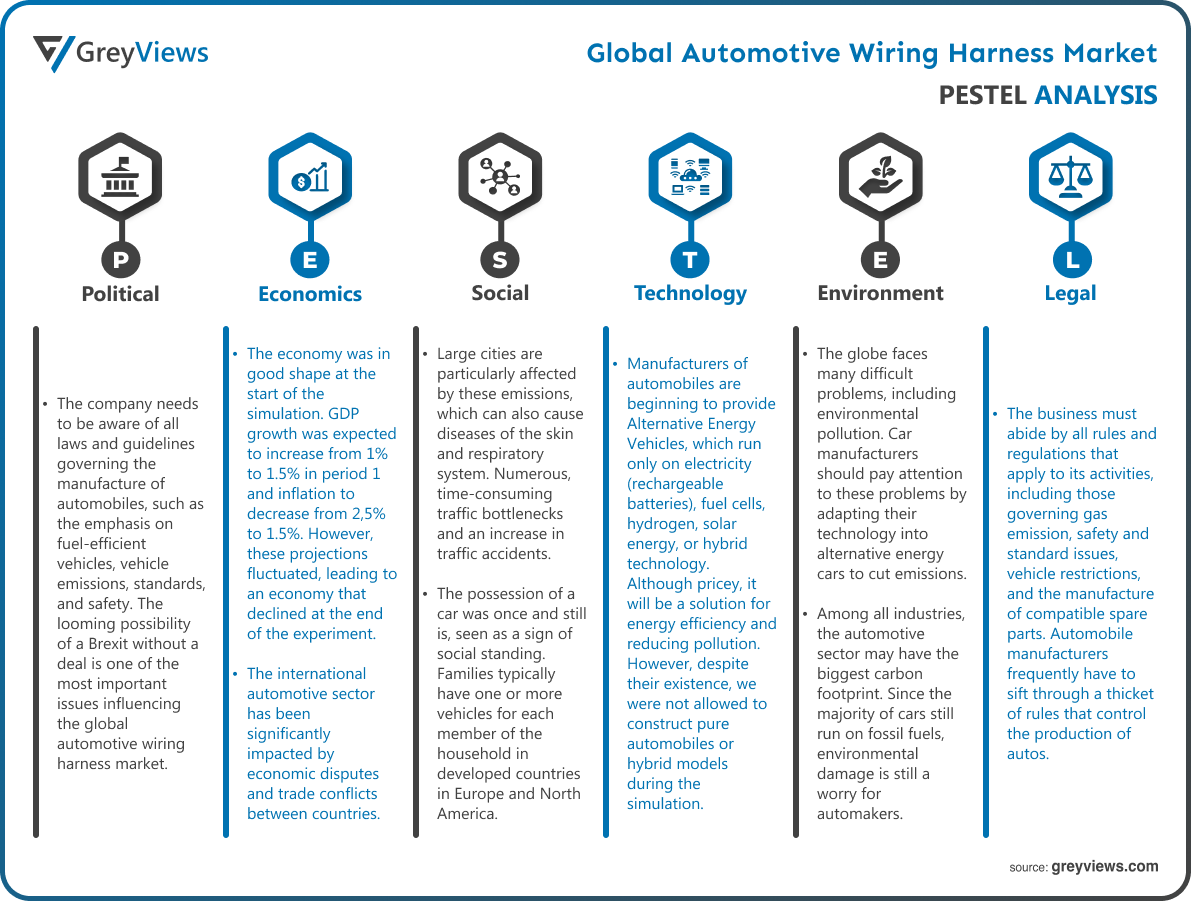

Political Factors- The company needs to be aware of all laws and guidelines governing the manufacture of automobiles, such as the emphasis on fuel-efficient vehicles, vehicle emissions, standards, and safety. The looming possibility of a Brexit without a deal is one of the most important issues influencing the global automotive wiring harness market. Automobile makers must contend with a market that is uncertain and the possibility of rising operational expenses as Britain moves closer to breaking ties with the European continent. As a result, investment in the European auto markets has drastically decreased. In addition to the aforementioned, the global automotive industry has been significantly impacted by complicated regulations and environmental legislation. New companies are therefore reluctant to enter the automotive industry.

Economical Factors- The economy was in good shape at the start of the simulation. GDP growth was expected to increase from 1% to 1.5% in period 1 and inflation to decrease from 2,5% to 1.5%. However, these projections fluctuated, leading to an economy that declined at the end of the experiment. The international automotive sector has been significantly impacted by economic disputes and trade conflicts between countries. Demand has decreased in the Chinese markets as the US and China head toward full-scale trade warfare. A decline in demand from China, which represents the single-largest portion of global vehicle sales, reverberates throughout the whole sector. However, there is excellent news coming from rising economies, including those in South American and African nations.

Social Factor- Due to their loudness and CO2 emissions, cars are one of the things that contaminate the environment. Large cities are particularly affected by these emissions, which can also cause diseases of the skin and respiratory system. Numerous, time-consuming traffic bottlenecks and an increase in traffic accidents. The possession of a car was once and still is, seen as a sign of social standing. Families typically have one or more vehicles for each member of the household in developed countries in Europe and North America. However, with the introduction of driverless cars and car-hailing services like Uber, things are starting to change. The trends appear to be moving away from ownership and towards ride-sharing and renting due to cheaper travel costs, the absence of maintenance headaches, and associated benefits.

Technological Factors- Manufacturers of automobiles are beginning to provide Alternative Energy Vehicles, which run only on electricity (rechargeable batteries), fuel cells, hydrogen, solar energy, or hybrid technology. Although pricey, it will be a solution for energy efficiency and reducing pollution. However, despite their existence, we were not allowed to construct pure automobiles or hybrid models during the simulation. Other innovations that boost productivity and reduce costs include synthetic materials, web-based technologies, JIT Management, sophisticated logistics, and computer-aided design software. The global automotive wiring harness market has been fueled by technology since its start. Traditional manufacturers are increasingly realizing the necessity to modify their current business models and procedures to accommodate the most recent advancements as AI and self-driving cars become a reality.

Environmental Factors- The globe faces many difficult problems, including environmental pollution. Car manufacturers should pay attention to these problems by adapting their technology into alternative energy cars to cut emissions. Among all industries, the automotive sector may have the biggest carbon footprint. Since the majority of cars still run on fossil fuels, environmental damage is still a worry for automakers. The global automotive wiring harness market is moving toward electric and hybrid vehicles because they are more environmentally friendly and appealing to customers who are environmentally conscious due to governments imposing stricter rules and tax norms.

Legal Factors- The business must abide by all rules and regulations that apply to its activities, including those governing gas emission, safety and standard issues, vehicle restrictions, and the manufacture of compatible spare parts. Automobile manufacturers frequently have to sift through a thicket of rules that control the production of autos. The automobile industry finds some solace in developing countries where favorable regulations and tax breaks are assisting automakers to provide consumers with newer models in light of new safety regulations and legislation being passed, changing copyright and patent laws, as well as legal difficulties resulting from competition.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Material

- 3.2. Market Attractiveness Analysis By Propulsion

- 3.3. Market Attractiveness Analysis By Vehicle

- 3.4. Market Attractiveness Analysis By Application

- 3.5. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Less installation time

- 3. Restraints

- 3.1. Continuous growing risk of wiring harness failures

- 4. Opportunities

- 4.1. Growth of automotive motor market

- 5. Challenges

- 5.1. High chances of bundle getting worn

- Global Automotive wiring harness Market Analysis and Projection, By Material

- 1. Segment Overview

- 2. Copper

- 3. Aluminum

- 4. Others

- Global Automotive wiring harness Market Analysis and Projection, By Propulsion

- 1. Segment Overview

- 2. ICE Vehicles

- 3. Electric Vehicles

- Global Automotive wiring harness Market Analysis and Projection, By Vehicle

- 1. Segment Overview

- 2. Passenger Cars

- 3. Light Commercial Vehicles

- Global Automotive wiring harness Market Analysis and Projection, By Application

9.1. Segment Overview

9.2 Engine Harness

9.3. Chassis Harness

9.4. Battery Harness

9.5. Airbag Harness

9.6. Seat Harness

9.7. Door Harness

9.8. Others

- Global Automotive wiring harness Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Automotive wiring harness Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Automotive wiring harness Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Quingdao Sanyuan Group

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Samvardhana Motherson Group

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Delphi Automotive

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Furukawa Electric Company Ltd

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Sumitomo Electric Industries

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Kromberg & Schubert

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Fujikura Ltd

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Leoni AG

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- PKC Group (Motherson Sumi Systems)

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- THB Group (AmWINS Group Inc.)

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Nexans Auto electric

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Spark Minda

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Kyungship Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Yazaki Corporation

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Yura Corporation and Lear Corporation.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Quingdao Sanyuan Group

List of Table

- Global Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Global Copper, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Aluminum, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Others, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Global ICE Vehicles, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Electric Vehicles, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Global Passenger Cars, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Light Commercial Vehicles, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Global Engine Harness, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Chassis Harness, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Battery Harness, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Airbag Harness, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Seat Harness, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Door Harness, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Others, Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- Global Automotive wiring harness Market, By Region, 2021–2029 (USD Billion)

- North America Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- North America Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- North America Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- North America Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- USA Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- USA Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- USA Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- USA Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Canada Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Canada Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Canada Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Canada Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Mexico Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Mexico Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Mexico Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Mexico Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Europe Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Europe Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Europe Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Europe Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Germany Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Germany Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Germany Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Germany Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- France Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- France Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- France Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- France Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- UK Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- UK Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- UK Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- UK Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Italy Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Italy Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Italy Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Italy Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Spain Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Spain Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Spain Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Spain Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Asia Pacific Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Asia Pacific Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Asia Pacific Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Japan Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Japan Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Japan Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Japan Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- China Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- China Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- China Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- China Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- India Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- India Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- India Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- India Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- South America Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- South America Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- South America Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- South America Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Brazil Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Brazil Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Brazil Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Brazil Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- Middle East and Africa Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- Middle East and Africa Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- Middle East and Africa Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- UAE Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- UAE Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- UAE Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- UAE Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

- South Africa Automotive wiring harness Market, By Material, 2021–2029 (USD Billion)

- South Africa Automotive wiring harness Market, By Propulsion, 2021–2029 (USD Billion)

- South Africa Automotive wiring harness Market, By Vehicle, 2021–2029 (USD Billion)

- South Africa Automotive wiring harness Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Automotive wiring harness Market Segmentation

- Automotive wiring harness Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Automotive wiring harness Market Attractiveness Analysis By Material

- Global Automotive wiring harness Market Attractiveness Analysis By Propulsion

- Global Automotive wiring harness Market Attractiveness Analysis By Vehicle

- Global Automotive wiring harness Market Attractiveness Analysis By Application

- Global Automotive wiring harness Market Attractiveness Analysis By Region

- Global Automotive wiring harness Market: Dynamics

- Global Automotive wiring harness Market Share By Material (2021 & 2029)

- Global Automotive wiring harness Market Share By Propulsion (2021 & 2029)

- Global Automotive wiring harness Market Share By Vehicle (2021 & 2029)

- Global Automotive wiring harness Market Share By Application (2021 & 2029)

- Global Automotive wiring harness Market Share by Regions (2021 & 2029)

- Global Automotive wiring harness Market Share by Company (2020)