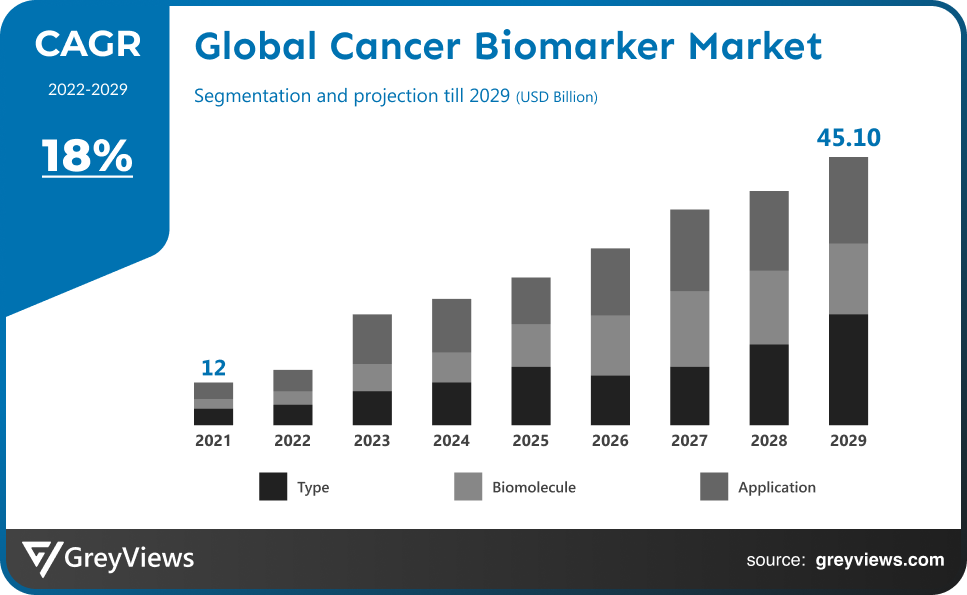

Cancer Biomarker Market Size By Type (Breast Cancer, Prostate Cancer, Liver Cancer, Lung Cancer, and Others), By Biomolecule (Genetic, Metabolic, Proteomic, Epigenetic, and Others), By Application (Personalized Medicine, Drug discovery and Development, Diagnostics, and Others), Regions, Segmentation, and Projection till 2029

CAGR: 18%Current Market Size: USD 12 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Cancer Biomarker Market- Market Overview:

The Global Cancer biomarker market is expected to grow from USD 12 billion in 2021 to USD 45.10 billion by 2029, at a CAGR of 18% during the Projection period 2022-2029. The growth of this market is mainly driven by increasing cases of cancer.

For therapeutic approaches to be beneficial and effective, early cancer identification is essential. Biomarkers are crucial for clinical applications and anticancer drug research, including prognosis assessment and monitoring therapeutic response. For routine screenings, conventional cancer screening methods are pricy, time-consuming, and inconvenient. On the other hand, one of the most promising methods for early detection, tracking the course of the disease, and ultimately treating cancer is biomarker-based cancer diagnostics. Biological markers also referred to as cancer biomarkers (CB), can be used to recognize the genetic characteristics of cancerous cells. Among the many types of biomarkers, proteins, nucleic acids, antibodies, and peptides are some of the most common. Additionally, a collection of proteomic, metabolic, and gene expression traits make up cancer biomarkers. Numerous genes and protein-based cancer biomarkers are now being used in patient care as a result of the advancement of clinical studies. These include BCR-ABL (Chronic Myeloid Leukemia), AFP (Liver Cancer), CA-125 (Ovarian Cancer), CA19.9 (Pancreatic Cancer), EGFR (Non-small-cell lung carcinoma), HER-2 (Breast Cancer), KIT (Gastrointestinal Stromal Tumor), CEA (Col Early cancer identification and diagnosis are crucial for extending the lives of cancer patients and ensuring improved health outcomes in such patients. This requires the ability to quickly and inexpensively detect low concentrations of specific target proteins in clinical specimens. In addition to early detection and diagnosis, biomarkers provide doctors with data and information about molecular pathway abnormalities in a particular type of cancer that enables evidence-based drug selection (predictive biomarkers) and improved and more precise disease prognosis (prognostic biomarkers).

Sample Request: - Global Cancer Biomarker Market

Market Dynamics:

Drivers:

- Rapid adoption of cutting-edge technologies for cancer biomarker development

Research on biomarkers has improved significantly as a result of the advent of innovative and reliable sophisticated technologies. This market's revenue growth is being driven by the adoption of novel, non-invasive, simpler, and less expensive processes and techniques for the detection of novel proteomic, genomic, or immunological biomarkers. Modern bioinformatics tools and the development of powerful proteomic and genomic technologies have made it possible to simultaneously evaluate thousands of biological markers. Due to the extensive use of genetic and molecular profiling technologies, biomarkers are becoming more important in the clinical diagnosis and treatment of cancer patients. Examples include the development of single gene, protein, or multi-gene-based signature assays to assess various molecular pathway modifications that aid in therapeutic decision-making.

Restraints:

- Lack of standardization and difficulties with biomarker validation are preventing the market from growing in terms of revenue

The finding of cancer biomarkers will be significantly hampered by the integration of proteomics, genomics, and metabolomics technologies in biomarker detection and functional interpretation in conjunction with clinical data and epidemiology. Their use in clinical practice has been limited by issues with analytical validation and a lack of data repeatability across diverse technology platforms. However, the development of this kind of technology has been slower than expected. The confirmation of recently discovered cancer biomarkers is the most challenging aspect of clinical proteomics. The validation studies must take into account the biomarker's specificity, reproducibility, experimental research design, and suitable controls, including clinical specimen and sample collection, experimental design, and data processing.

Opportunities:

- Development of Private Diagnostic Facilities to Support the Growth of the Cancer Diagnostics Market

As the need for diagnostic imaging procedures increases and the burden on public hospitals increases as a result of the limited number of imaging techniques accessible, the number of private diagnostic centers is growing all over the world. A cancer screening facility called NURA was created by the FUJIFILM Corporation in Bangalore, India, in January 2021. This medical screening facility is managed by Dr. Kutty's Healthcare and Fujifilm DKH LLP (FUJIFILM DKH) (DKH). A joint venture between FUJIFILM and Dr. Kutty's Healthcare (DKH), FUJIFILM DKH LLP (FUJIFILM DKH) runs hospitals and screening centers across India and the Middle East.

Challenges:

- Increased costs and poor reimbursement practices will limit market expansion

Market expansion is anticipated to be hampered by insufficient reimbursement laws. In terms of imaging technology, radiology has undergone a number of improvements recently. The majority of medical insurance organizations, however, do not pay for operations that involve computer-aided detection (CAD). Therefore, people opt for traditional diagnostic procedures like biopsies, pathology tests, or standard imaging procedures like mammography and MRI treatments. Additionally, it is anticipated that the high price of cancer detection software will restrain the market growth. Hospitals must renew their license for the computer-aided detection (CAD) program each year. Additionally, some insurance providers choose not to reimburse for CAD procedures because they believe that they are unnecessary and are not advised by senior radiologists.

Segmentation Analysis:

The global cancer biomarker market has been segmented based on type, biomolecule, application, and Regions.

By Type

The type segment is breast cancer, prostate cancer, liver cancer, lung cancer, and others. The breast cancer segment led the largest share of the cancer biomarker market with a market share of around 30% in 2021. The World Health Organization (WHO) and International Agency for Research on Cancer (IARC) estimate that in 2020, 2.3 million women will receive a breast cancer diagnosis, resulting in 685,000 deaths globally. By the end of 2020, there were 7.8 million women alive who had received a diagnosis of breast cancer within the previous five years, making it the most frequently diagnosed cancer type worldwide. Around 30% of female malignancies in the globe are caused by breast cancer, which also has a 15% mortality-incidence ratio. Breast cancer detection and treatment heavily rely on clinical indicators.

By Application

The application segment includes personalized medicine, drug discovery and development, diagnostics, and others. The drug discovery and development segment led the cancer biomarker market with a market share of around 32% in 2021. Clinical drug development, particularly for individualized anti-cancer therapies, has proven to require the use of biomarker-driven enrichment trials. By the end of 2018, more than 30 drugs had been created in conjunction with a biomarker test, and their usage had been supported by a regulator approved CDx assay.

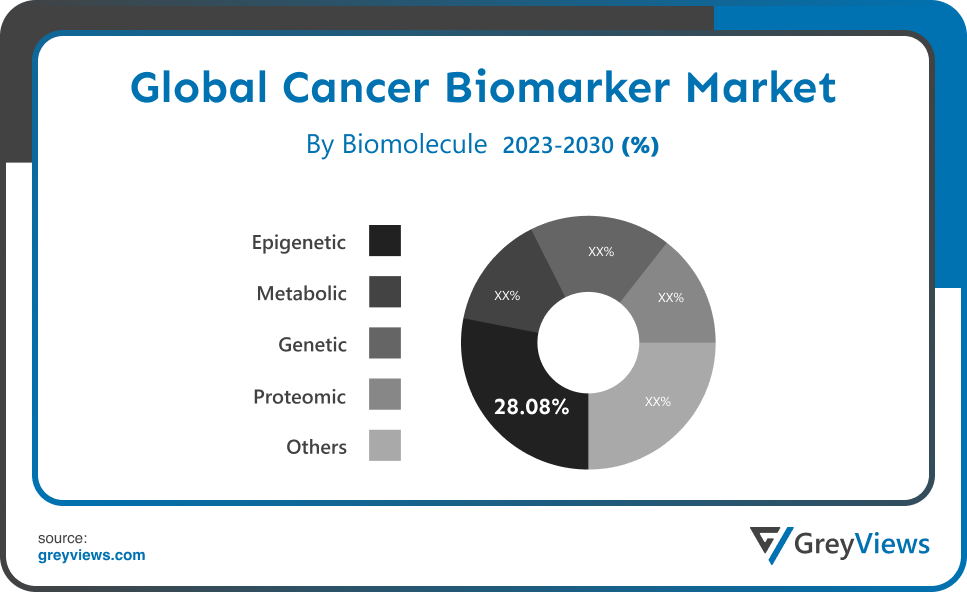

By Biomolecule

The biomolecule segment includes genetic, metabolic, proteomic, epigenetic, and others. The epigenetic segment led the cancer biomarker market with a market share of around 28.08% in 2021. Examples of epigenetic biomarkers, which are modifications to gene expression without a change in the DNA sequence, include promoter hypermethylation, chromatin remodeling, and histone modifications. Epigenetic biomarker research has made it easier to measure risk, diagnose cancer, and categorize diseases.

Global Cancer Biomarker Market- Sales Analysis

The sale of cancer biomarker types expanded at a CAGR of 11.2% from 2015 to 2021.

The incidence of cancer is rising alarmingly, making it one of the leading causes of death in the world. Therefore, in order to lower the incidence level, healthcare professionals are focusing on the creation of effective treatment and diagnosis solutions. Early detection increases the effectiveness of treatment plans. As a result, healthcare organizations and business organizations are promoting routine checks through various awareness campaigns. Over the Projection period, the market for cancer diagnostics will experience growth due to increases in the incidence and prevalence of various cancer types, including breast and lung cancer.

Over the Projection period, the market for cancer diagnostics will experience growth due to increases in the incidence and prevalence of various cancer types, including breast and lung cancer. Additionally, a surge in technological advancements supporting enhanced imaging of risky cells, innovations in tools for identifying the type of cancer, and an improvement in the accuracy of the outcome would help the cancer diagnostics market gain speed throughout the course of the projected period. In the coming years, the market expansion is anticipated to be driven by increased government efforts and other private organizations to raise awareness about early cancer detection and prevention.

The market is expected to grow in the next years as a result of developed countries' expanded diagnostics laboratory infrastructure. Yoga and other health-related practices will become increasingly popular throughout the anticipated time period, and there will be a noticeable increase in the emphasis on health and safety rules.

Thus, owing to the aforementioned factors, the global Cancer Biomarker Market is expected to grow at a CAGR of 18% during the Projection period from 2022 to 2029.

Global Cancer Biomarker Market- By Regional Analysis:

The regions analyzed for the cancer biomarker market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the cancer biomarker market and held a 39% share of the market revenue in 2021.

- The North America region witnessed a major share. The presence of pharmaceutical companies and research institutions in the United States and Canada, the expansion of government initiatives and programs relating to cancer drug therapy and treatment options, and the expansion of the healthcare industry globally are all contributing factors to the rising demand for cancer biomarkers. The Partnership for Accelerating Cancer Therapies (PACT), a five-year, USD 220 million public-private research partnership, was established by the National Institutes of Health, the FNIH, and 12 significant pharmaceutical companies. In order to advance novel cancer medications and treatments that harness the immune system to battle cancer, PACT is aiming to find, develop, and confirm trustworthy biomarkers. This is a key driver boosting the market in this area's revenue growth.

- Asia Pacific is anticipated to experience significant growth during the predicted period. The region's technological developments and breakthroughs in the field of cancer biomarker detection and development are some of the key reasons that are predicted to fuel the market revenue growth. Other important aspects include increased R&D investment from governments and commercial companies. Additionally, the demand for cancer biomarkers among numerous upcoming pharmaceutical and biotechnology industries and startups was significantly impacted by the improving healthcare system, the rapid development of infrastructure, and the rising economy. These factors are anticipated to propel the market's revenue growth in this region.

Global Cancer Biomarker Market- Country Analysis:

- Germany

Germany's cancer biomarker market size was valued at USD 1.41 billion in 2021 and is expected to reach USD 4.31 billion by 2029, at a CAGR of 15% from 2022 to 2029. A favorable environment for the adoption of cutting-edge cancer diagnostic technologies, such as imaging, has been created in Germany as a result of the country's desirable healthcare policies and high average per capita healthcare costs. Furthermore, the presence of significant players encourages regional expansion. These businesses' growth strategies, which include new releases, will support Germany's general expansion.

- China

China’s cancer biomarker’ market size was valued at USD 3.27 billion in 2021 and is expected to reach USD 11.48 billion by 2029, at a CAGR of 17% from 2022 to 2029. The region's cancer biomarker market is expected to be driven by factors such as rising cancer prevalence, a supportive environment for clinical trials, and rising government financing for drug research initiatives. Moreover, one of the major growth factors is the increasing attention that pharmaceutical companies are paying to this region, together with the growing acceptance of the biomarker-based diagnosis.

- India

India's cancer biomarker market size was valued at USD 2.67 billion in 2021 and is expected to reach USD 8.75 billion by 2029, at a CAGR of 16% from 2022 to 2029. In the upcoming decade, India's cancer biomarker market is expected to have strong growth due to rising demand for personalized medication and growing awareness among patients and healthcare professionals about the value of the early diagnosis of malignancies. Early diagnostic biomarkers let clinicians make better treatment decisions that result in a successful recovery in less time. According to estimates, the adoption rate will also rise as more innovative medications and diagnostics for cancer biomarkers receive regulatory approval.

Key Industry Players Analysis:

To increase their market position in the global cancer biomarker business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, type developments, collaborations, partnerships, joint ventures, etc.

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Bio Rad Laboratories Inc.

- Roche Holding AG

- GE Healthcare

- Illumina, Inc.

- Siemens AG

- Bristol-Myers Squibb

- Toshiba Medical Systems Corporation

- Koninklijke Philips N.V.

- Agilent Technologies Inc.

Latest Development:

- In March 2022, TruSight Oncology (TSO) Comprehensive, a single test that assesses a number of tumour genes and biomarkers to determine a unique molecular profile of a patient's cancer, was introduced by Illumina, Inc. In Vitro Diagnostic (IVD) kit will enhance cancer patients' access to precision treatment alternatives across Europe, where it will make its international premiere first.

- In December 2021, As a companion diagnostic (CDx) for the detection of non-small cell lung cancer (NSCLC) patients whose tumours carry epidermal growth factor receptor (EGFR) Exon20-insertion mutations for potential cancer treatment, the U.S. Food and Drug Administration granted premarket approval to Thermo Fisher Scientific's Oncomine Dx Target Test.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

18% |

|

Market Size |

12million in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Biomolecule, By Application, and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Abbott Laboratories, Thermo Fisher Scientific Inc., Bio Rad Laboratories Inc., Roche Holding AG, GE Healthcare, Illumina, Inc., Siemens AG, Bristol-Myers Squibb, Toshiba Medical Systems Corporation, Koninklijke Philips N.V., and Agilent Technologies Inc. |

|

By Type |

|

|

By Biomolecule |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Cancer Biomarker Market by Type:

- Breast Cancer

- Prostate Cancer

- Liver Cancer

- Lung Cancer

- Others

Global Cancer Biomarker Market by Biomolecule:

- Genetic

- Metabolic

- Proteomic

- Epigenetic

- Others

Global Cancer Biomarker Market by Application:

- Personalized Medicine

- Drug discovery and Development

- Diagnostics

- Others

Global Cancer Biomarker Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the growth rate of the global cancer biomarker market during the Projection period?

The global cancer biomarker market is expected to grow with a 18% CAGR during the Projection period.

How is the North American cancer biomarker market projected to grow?

The North American cancer biomarker market was projected to gain a global market share of 39% in 2021.

What are the biomolecule segments in the cancer biomarker market?

The biomolecule segment includes genetic, metabolic, proteomic, epigenetic, and others.

What is the market size of global cancer biomarker market?

Global cancer biomarker market’s size in 2021 was USD 12 billion.

What is the market size of global cancer biomarker market?

Global cancer biomarker market’s size in 2021 was USD 12 billion.

What is the major driving factor of the cancer biomarker market?

Global cancer biomarker key market players are Abbott Laboratories, Thermo Fisher Scientific Inc., Bio Rad Laboratories Inc., Roche Holding AG, GE Healthcare, Illumina, Inc., Siemens AG, Bristol-Myers Squibb, Toshiba Medical Systems Corporation, Koninklijke Philips N.V., and Agilent Technologies Inc.

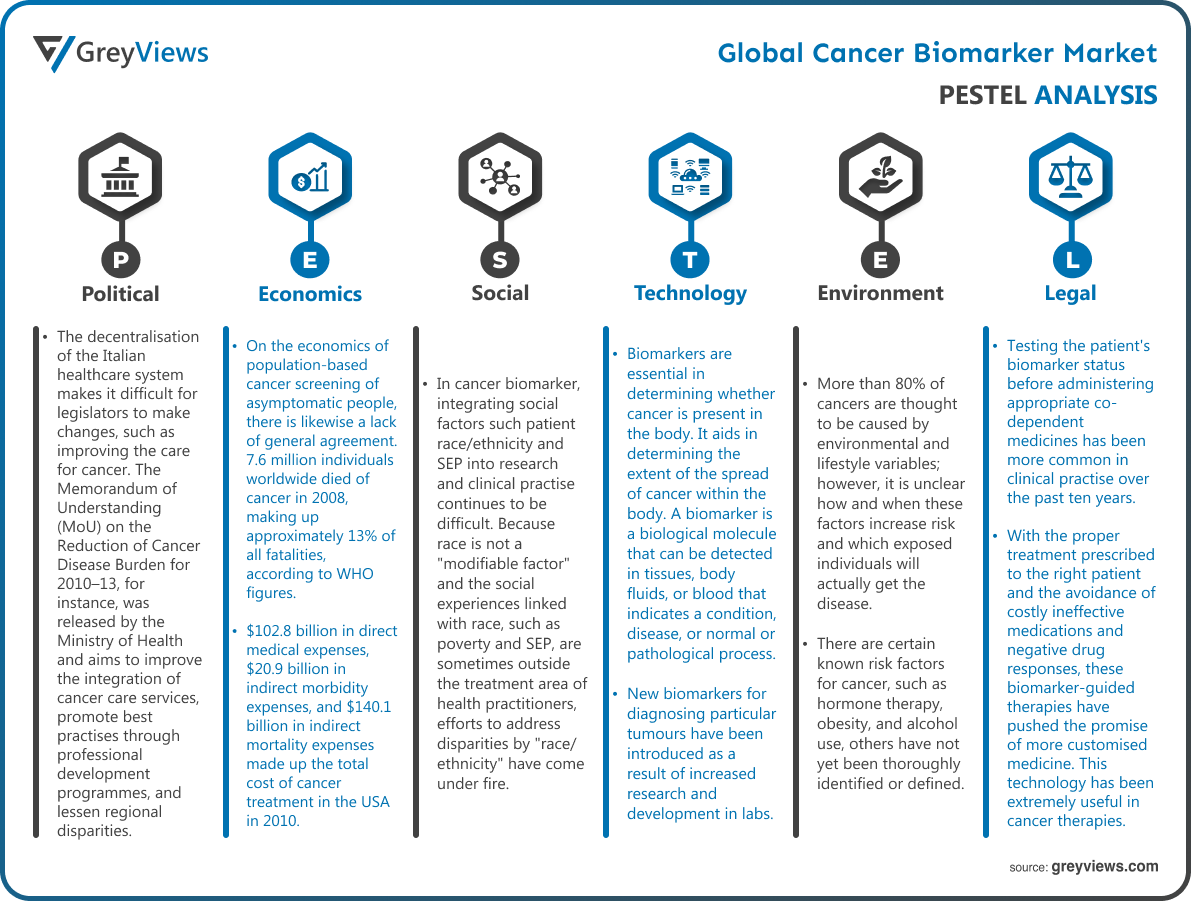

Political Factors- The decentralisation of the Italian healthcare system makes it difficult for legislators to make changes, such as improving the care for cancer. The Memorandum of Understanding (MoU) on the Reduction of Cancer Disease Burden for 2010–13, for instance, was released by the Ministry of Health and aims to improve the integration of cancer care services, promote best practises through professional development programmes, and lessen regional disparities. The government has placed a significant emphasis on cost management and control within the SSN because to the fact that public spending on healthcare was growing faster than the GDP (European Observatory on Health Systems and Policies 2018b). As part of this approach, the Ministry of Economics and Finance is now heavily involved in the healthcare system, keeping an eye on medical expenses and managing the budgets of debt-ridden districts.

Economical Factors- There are times when the costs of screening a wide population are higher than the costs of treating a group of people with the condition, even when screening has the potential to save resources through earlier identification and therapy. On the economics of population-based cancer screening of asymptomatic people, there is likewise a lack of general agreement. 7.6 million individuals worldwide died of cancer in 2008, making up approximately 13% of all fatalities, according to WHO figures. $102.8 billion in direct medical expenses, $20.9 billion in indirect morbidity expenses, and $140.1 billion in indirect mortality expenses made up the total cost of cancer treatment in the USA in 2010. Total healthcare costs in the USA rose from $7.14 billion in 1990 to $2.23 trillion in 2007. With overall national health spending estimated to reach $4.35 trillion by 2018, or 20.3% of expected gross domestic product, national health expenditure growth is predicted to continue to surpass income growth.

Social Factor- In cancer biomarker, integrating social factors such patient race/ethnicity and SEP into research and clinical practise continues to be difficult. Because race is not a "modifiable factor" and the social experiences linked with race, such as poverty and SEP, are sometimes outside the treatment area of health practitioners, efforts to address disparities by "race/ethnicity" have come under fire. However, across the spectrum of cancer control, race/ethnicity and SEP are linked to various social, political, cultural, and economic experiences that can be changed and have an impact on cancer risk and care. The modifications we suggest would make it possible to undertake interventions that are more successful by taking a variety of social risk factors into account. Additionally, they would take into account the social and environmental contexts in which cancer patients reside and receive treatment in order to really eliminate inequities.

Technological Factors- Biomarkers are essential in determining whether cancer is present in the body. It aids in determining the extent of the spread of cancer within the body. A biomarker is a biological molecule that can be detected in tissues, body fluids, or blood that indicates a condition, disease, or normal or pathological process. New biomarkers for diagnosing particular tumours have been introduced as a result of increased research and development in labs. Demand for new diagnostic methods has increased due to the rise of cancer patients worldwide. It is simpler for doctors to properly treat a patient if a cancer diagnosis is made early and is verified. Via various profiling technologies, biomarkers aid in the early detection of cancer. Increased demand for profiling technologies is also a result of increased awareness efforts for cancer early diagnosis.

Environmental Factors- More than 80% of cancers are thought to be caused by environmental and lifestyle variables; however, it is unclear how and when these factors increase risk and which exposed individuals will actually get the disease. While there are certain known risk factors for cancer, such as hormone therapy, obesity, and alcohol use, others have not yet been thoroughly identified or defined. In this study, it is suggested that the discovery of blood epigenetic markers for individual, foetal, and ancestor environmental exposures can aid in the development of personalised prevention strategies as well as a better understanding of the known and potential relationships between environmental exposures and cancer risk.

Legal Factors- Testing the patient's biomarker status before administering appropriate co-dependent medicines has been more common in clinical practise over the past ten years. With the proper treatment prescribed to the right patient and the avoidance of costly ineffective medications and negative drug responses, these biomarker-guided therapies have pushed the promise of more customised medicine. This technology has been extremely useful in cancer therapies. In this study, we examine the impact that the development of biomarker tests for cancer therapy has had on the early mortality and survival of cancer patients in Norway. Our findings imply that both biomarker testing and the availability of more cancer medications have generally benefitted cancer patients. Additionally, we discover that when the number of medications available rises, the overall impact of biomarker testing on 3-year survival declines, indicating that it is preferable to match patients with the right treatment when there are fewer options.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Biomolecule

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rapid adoption of cutting-edge technologies

- 3. Restraints

- 3.1. Lack of standardization and difficulties

- 4. Opportunities

- 4.1. Development of Private Diagnostic Facilities

- 5. Challenges

- 5.1. Increased costs and poor reimbursement practices will limit market expansion

- Global Cancer Biomarker Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Breast Cancer

- 3. Prostate Cancer

- 4. Liver Cancer

- 5. Lung Cancer

- 6. Others

- Global Cancer Biomarker Market Analysis and Projection, By Biomolecule

- 1. Segment Overview

- 2. Genetic

- 3. Metabolic

- 4. Proteomic

- 5. Epigenetic

- 6. Others

- Global Cancer Biomarker Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Personalized Medicine

- 3. Drug discovery and Development

- 4. Diagnostics

- 5. Others

- Global Cancer Biomarker Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Cancer Biomarker Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Cancer Biomarker Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Abbott Laboratories

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Thermo Fisher Scientific Inc.

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Bio Rad Laboratories Inc.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- Roche Holding AG

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- GE Healthcare

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Illumina, Inc.

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Siemens AG

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Bristol-Myers Squibb

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Toshiba Medical Systems Corporation

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Koninklijke Philips N.V.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Agilent Technologies Inc.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Abbott Laboratories

List of Table

- Global Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Global Breast Cancer, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Prostate Cancer, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Liver Cancer, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Lung Cancer, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Others, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Global Genetic, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Metabolic, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Proteomic, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Epigenetic, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Others, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Global Personalized Medicine, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Drug discovery and Development, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Diagnostics, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Others, Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- Global Cancer Biomarker Market, By Region, 2021–2029 (USD Billion)

- North America Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- North America Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- North America Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- USA Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- USA Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- USA Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Canada Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Canada Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Canada Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Mexico Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Mexico Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Mexico Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Europe Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Europe Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Europe Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Germany Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Germany Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Germany Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- France Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- France Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- France Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- UK Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- UK Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- UK Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Italy Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Italy Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Italy Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Spain Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Spain Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Spain Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Asia Pacific Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Japan Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Japan Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Japan Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- China Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- China Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- China Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- India Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- India Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- India Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- South America Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- South America Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- South America Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Brazil Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Brazil Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Brazil Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- Middle East and Africa Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- UAE Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- UAE Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- UAE Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

- South Africa Cancer Biomarker Market, By Type, 2021–2029 (USD Billion)

- South Africa Cancer Biomarker Market, By Biomolecule, 2021–2029 (USD Billion)

- South Africa Cancer Biomarker Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Cancer Biomarker Market Segmentation

- Cancer Biomarker Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Cancer Biomarker Market Attractiveness Analysis By Type

- Global Cancer Biomarker Market Attractiveness Analysis By Biomolecule

- Global Cancer Biomarker Market Attractiveness Analysis By Application

- Global Cancer Biomarker Market Attractiveness Analysis By Region

- Global Cancer Biomarker Market: Dynamics

- Global Cancer Biomarker Market Share By Type (2021 & 2029)

- Global Cancer Biomarker Market Share By Biomolecule (2021 & 2029)

- Global Cancer Biomarker Market Share By Application (2021 & 2029)

- Global Cancer Biomarker Market Share by Regions (2021 & 2029)

- Global Cancer Biomarker Market Share by Company (2020)