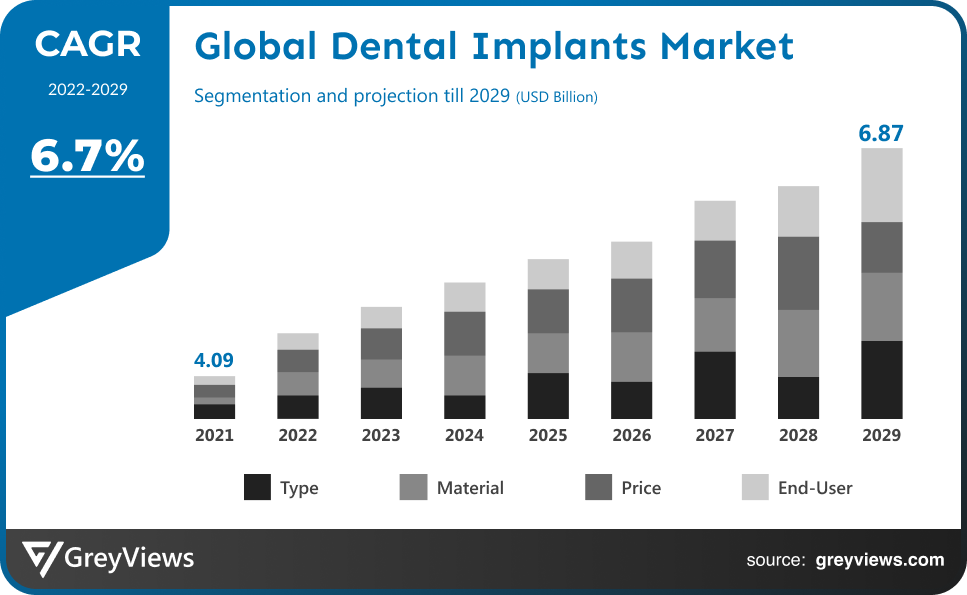

Dental Implants Market Size By Type (Endosteal, Subperiosteal, Intramucosal and Transosteal), By Material (Titanium and Zirconium), By Price (Premium and Non-premium), By End-user (Dental Clinics, Hospitals, Academics and Research Institutes), Regions, Segmentation, and Projection till 2029

CAGR: 6.7%Current Market Size: USD 4.09 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Dental Implants Market- Market Overview:

The Global Dental Implants market is expected to grow from USD 4.09 billion in 2021 to USD 6.87 billion by 2029, at a CAGR of 6.7% during the Projection period 2022-2029. The growth of this market is mainly driven by increasing cosmetic dentistry.

The term "dental implants" refers to prosthetic tooth roots that can be surgically placed into the jawbone. These dental implants include two main components: the fixture and the abutment, both of which are typically made of titanium and zirconium. These implants are widely utilised in the cosmetic business in North America and Europe. Growing demand for prostheses and expanding uses of dental implants in numerous therapeutic fields are some of the main reasons anticipated to propel industry expansion. Oral rehabilitation, which aids in restoring a patient's face shape and oral function, plays a significant role in driving the demand for these implants. Due to the drawbacks of detachable prosthesis, such as pain, an unnatural look, and care requirements, dental implants are becoming more and more popular among patients and dental surgeons. Additionally, the current focus in dentistry has been on dental inventions that combine engineering, art, science, and technology to promote oral health. Modern technological advancements, like CEREC crowns, utilise CAD and may be installed quickly. The market is being driven by the adoption of digital X-rays, non-mercury fillings, intraoral cameras, period protect, DIAGNOdent, laser dentistry, and isolates. Dental implants are an option for those who have lost one or more teeth due to an accident, decay, or any other reason. During the dental implant surgery, a metal post is placed underneath the gum line. An implant can be used to replace a missing tooth root. It also holds the bridge in place over the gap created by the missing tooth or teeth.

Sample Request: - Global Dental Implants Market

Market Dynamics:

Drivers:

- Changing lifestyle and unhealthy food habits

Oral hygiene quickly deteriorates, and the frequency of dental issues rises as a result of bad eating habits, changing lifestyles, and increased use of aerated beverages and high-sugar foods. The American Dental Hygienists' Association estimates that about 80% of Americans will have at least one cavity by the time they are 17 years old. This shows a rise in dental treatments being performed and a need for more dental supplies and tools. More than 40% of individuals’ report having had mouth discomfort in the last year (2020), and more than 80% of people will have experienced at least one cavity by the age of 34, according to the Centres for Disease Control and Prevention (CDC). Each year, the US spends around $124 billion on dental-related expenses.

Restraints:

- Dental Bridges Pose a Higher Risk of Tooth Loss

Dental bridges increase the risk of the bone surrounding the missing tooth or teeth deteriorating, which might impair the bone structure. This considerably increases the likelihood of dental plaque building up around the teeth, which in turn increases the risk of tooth decay and related gum illnesses. The International Journal of Dentistry reports that gum diseases (32.3% of the population), cavities/tooth decay (38.4% of the population), and prostheses (3.6% of the population) are the most prevalent causes of tooth loss. In the US, tooth loss is a big issue. The American College of Prosthodontists estimates that as many as 36 million Americans are missing all of their teeth as of 2019 and that at least 120 million Americans are missing one or more teeth.

Opportunities:

- Low Penetration Rate of Dental Implants in Developing Countries

Dental implants are rarely used in underdeveloped regions of the world and even in certain industrialised nations like the UK due to their expensive cost. However, the acceptability of dental implants is anticipated to increase quickly due to the expansion of clinics in these areas and the accessibility of high-quality dental care at affordable prices. Due to the increased emphasis on aesthetic dentistry, the dental implant markets in the UK and France are also anticipated to expand.

Challenges:

- Dearth of trained dental practitioners

Globally, there will likely be a greater need for dental care services as a result of shifting demographics, higher dental care knowledge, sedentary lifestyles, and an increase in dental illnesses. However, there is a serious problem with the global scarcity of dental specialists. By 2025, there will be 202,600 dentists practising in the US, up from the 198,517 dentists who were employed in 2017 according to the Health Resources and Services Administration (HRSA). In a similar vein, there is a lack of oral health professionals in places like Latin America, Asia, and Africa. Despite their enormous target patient populations, one of the main obstacles anticipated to slow down the adoption of dental technology in these nations is the lack of dentists.

Segmentation Analysis:

The global Dental Implants market has been segmented based on type, material, price, end user and Regions.

By Type

The type segment includes Endosteal, Subperiosteal, Intramucosal and Transosteal. The Endosteal segment led the largest share of the Dental Implants market with a market share of around 30% in 2021. Due to the high success rate of these implants compared to other types and the increased prevalence of dental caries, these types of implants are in high demand.

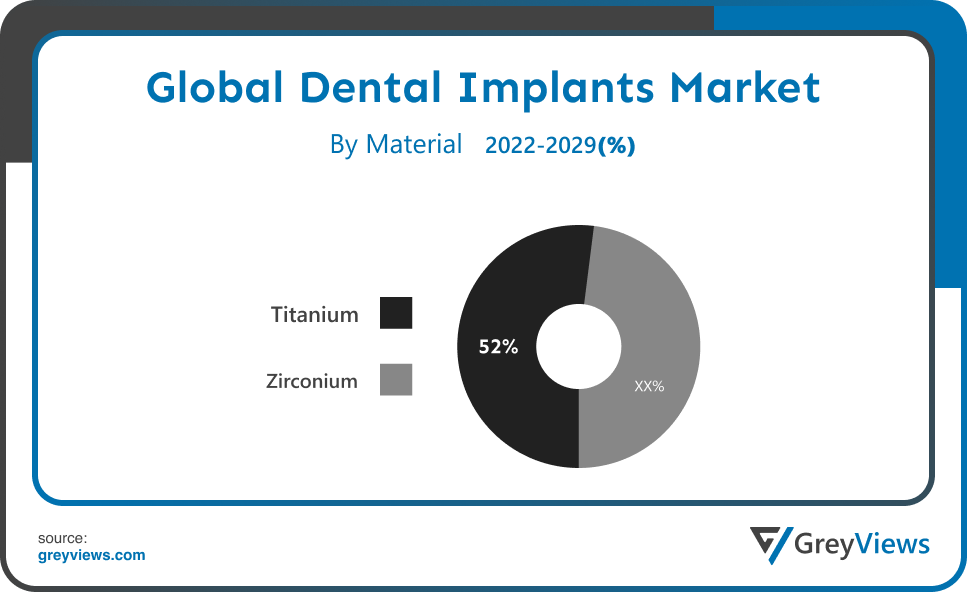

By Material

The application segment includes Titanium and Zirconium. The drug Titanium segment led the Dental Implants market with a market share of around 52% in 2021. Because titanium implants have such great strength and endurance, they have a substantial market share. Titanium implants also have a high degree of biocompatibility and are lightweight.

By Price

The price segment includes Premium and Non-premium. The Premium segment led the Dental Implants market with a market share of around 58.08% in 2021. This market's expansion is attributable to consumers' increased demand for high-quality dental implants, the introduction of new premium implants by significant market participants, consumers' rising disposable income, and consumers' growing knowledge of premium dental implants.

By End-user

The end user segment includes Dental Clinics, Hospitals, Academics and Research Institutes. The Dental Clinics segment led the Dental Implants market with a market share of around 28.08% in 2021. The primary site of care for all dental treatments is considered to be dental clinics. The need for specialised dental implant clinics and the accessibility of qualified dentists both contribute to the growth of this market.

Global Dental Implants Market- Sales Analysis

The sale of Dental Implants types expanded at a CAGR of 5.2% from 2015 to 2021.

The prosthetics and aesthetics sector has expanded over the past several years as people's desire for aesthetic perfection in all aspects of appearance has increased. Having excellent teeth is today considered to be a crucial component of face aesthetics, and dental implants have been instrumental in making this possible.

The market for dental implants has risen in popularity, but there have been some roadblocks. As a result, the dental implants market is pushing these limits by providing various advantages over traditional dental procedures, such as competitive cost. Future market trends are anticipated to be altered by new dental implants that are more sophisticated and created with the utmost care and effectiveness. The dentistry sector is developing quickly, and dental practises and other healthcare organisations are quickly adjusting and modifying their business strategies to take advantage of this in order to maximise earnings.

In the next three years, 400 clinic franchises will be opened throughout the United Kingdom, according to an announcement by YDS Group LTD. This initiative aims to reinvigorate and reform the dentistry business in the country so that it can take advantage of current developments.

Thus, owing to the aforementioned factors, the global Dental Implants Market is expected to grow at a CAGR of 6.7% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analysed for the Dental Implants market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North American region dominated the Dental Implants market and held a 39% share of the market revenue in 2021.

- The North America region witnessed a major share. The region's main growth drivers are its ageing population, which has a high frequency of dental diseases and a high level of public knowledge of oral preventative & restorative therapies. 3 million people currently have dental implants, according to the American Academy of Implant Dentistry. This number is typically higher in developed countries than in developing ones due to the wide availability of resources, the higher per capita income of the population, and the greater concern for aesthetics.

- Asia Pacific is anticipated to experience significant growth during the predicted period. Due to rising economic stability and disposable income, Asia Pacific is predicted to see the quickest growth throughout the projection period. Asian nations have dense populations and a rising senior demographic burden. These nations are favoured destinations for medical tourism since they are also well known for their affordable healthcare. One of the key reasons propelling the market is the increasing use of aesthetic dental implants. Additionally, it is anticipated that the advent of cutting-edge technology, including CAD/CAM-based dental restorations, and increasing knowledge of dental treatments would spur development throughout the projected period.

Global Dental Implants Market- Country Analysis:

- Germany

Germany Dental Implants market size was valued at USD 0.21 billion in 2021 and is expected to reach USD 0.64 billion by 2029, at a CAGR of 15% from 2022 to 2029. due to the country's growing periodontal disease incidence and advanced healthcare system. Additionally, the nation has created a national health care system that covers insurance for a range of dental operations, including prosthetic, restorative, and oral surgery.

- China

China’s Dental Implants’ market size was valued at USD 0.24 billion in 2021 and is expected to reach USD 0.74 billion by 2029, at a CAGR of 17% from 2022 to 2029. The population's increasing capacity to pay for aesthetic operations likewise increases demand for cosmetic dentistry. Additionally, the market will have prospects for expansion due to the availability of a sufficient dental workforce to meet the expanding demand for dental services.

- India

India's Dental Implants market size was valued at USD 0.27 billion in 2021 and is expected to reach USD 1.08 billion by 2029, at a CAGR of 19% from 2022 to 2029. One of the world's biggest dental implant markets is India. As they provide more functionality than other treatment alternatives, dental implants have gained popularity in the nation. In addition, a growth in the number of people seeking dental care has been brought about by rising disposable incomes and rising life expectancy.

Key Industry Players Analysis:

To increase their market position in the global Dental Implants business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, type developments, collaborations, partnerships, joint ventures, etc.

- BioHorizons IPH, Inc

- Nobel Biocare Services AG

- Zimmer Biomet Holdings, Inc

- OSSTEM IMPLANT

- Institut Straumann AG

- Bicon, LLC

- Leader Italy

- Anthogyr SAS

- DENTIS

- DENTSPLY Sirona

- DENTIUM Co., Ltd

- T-Plus Implant Tech. Co

- KYOCERA Medical Corp

Latest Development:

- In June 2022, T3 PRO Tapered Implant and Encode Emergence Healing Abutment, both approved by the Food and Drug Administration, were introduced in the US by ZimVie Inc. The T3 PRO, the newest member of ZimVie's family of dental implants, expands on the T3 Tapered Implant's tried-and-true solutions.

- In May 2022, Mini dental implants were developed by New Zealand scientists to replace missing teeth using the most advanced dental technology. These implants can be placed in a fraction of the time and with a lot less discomfort for the patient than conventional implants.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

6.7% |

|

Market Size |

4.09 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Type, By Material, By Price, By End-user and By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

BioHorizons IPH, Inc, Nobel Biocare Services AG, Zimmer Biomet Holdings, Inc, OSSTEM IMPLANT, Institut Straumann AG, Bicon, LLC, Leader Italy, Anthogyr SAS, DENTIS, DENTSPLY Sirona, DENTIUM Co., Ltd, T-Plus Implant Tech. Co, and KYOCERA Medical Corp. |

|

By Type |

|

|

By Material |

|

|

By Price |

|

|

By End-user |

|

|

Regional scope |

|

Scope of the Report

Global Dental Implants Market by Type:

- Endosteal

- Subperiosteal

- Intramucosal

- Transosteal

Global Dental Implants Market by Material:

- Titanium

- Zirconium

Global Dental Implants Market by Price:

- Premium

- Non-premium Implants

Global Dental Implants Market By End-user:

- Dental Clinics

- Hospitals

- Academics

- Research Institutes Global Dental

Global Dental Implants Market by Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the growth rate of the global Dental Implants market during the Projection period?

The global Dental Implants market is expected to grow with a 6.7% CAGR during the Projection period.

How is the North American Dental Implants market projected to grow?

The North American Dental Implants market was projected to gain a global market share of 39% in 2021.

What are the biomolecule segments in the Dental Implants market?

The biomolecule segment includes genetic, metabolic, proteomic, epigenetic, and others.

What was the market size of global Dental Implants market in 2021?

Global Dental Implants market’s size in 2021 was USD 12 billion.

What is the major driving factor of the Dental Implants market?

Global Dental Implants key market players are Abbott Laboratories, Thermo Fisher Scientific Inc., Bio Rad Laboratories Inc., Roche Holding AG, GE Healthcare, Illumina, Inc., Siemens AG, Bristol-Myers Squibb, Toshiba Medical Systems Corporation, Koninklijke Philips N.V., and Agilent Technologies Inc.

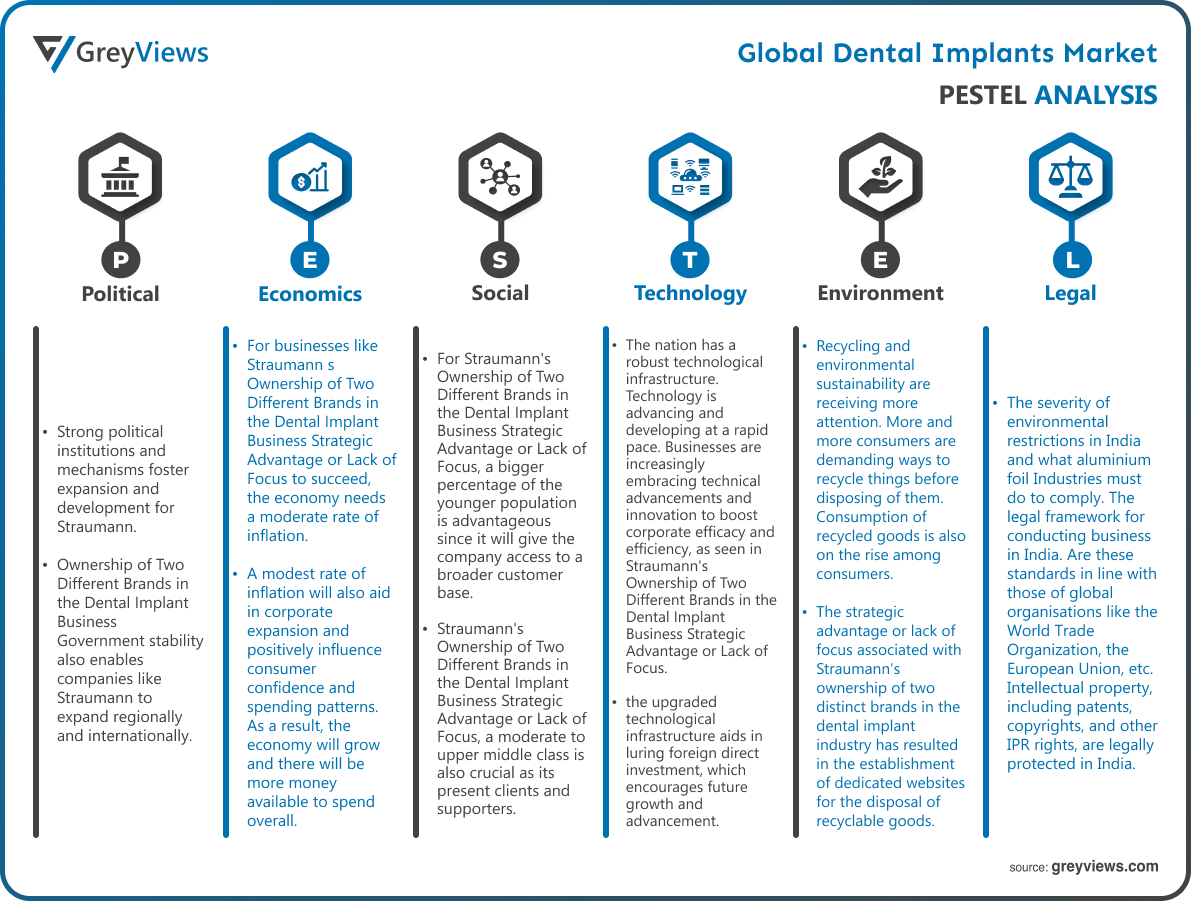

Political Factors- Strong political institutions and mechanisms foster expansion and development for Straumann. Ownership of Two Different Brands in the Dental Implant Business Government stability also enables companies like Straumann to expand regionally and internationally. Ownership of Two Different Brands in the Dental Implant Business: Strategic Advantage or Lack of Focus Due to the political power and stability of other nations, companies like Straumann's Ownership of Two Different Brands in the Dental Implant Commercial Strategic Advantage or Lack of Focus are able to effortlessly and smoothly maintain their offshore business ties.

Economical Factors- For businesses like Straumann s Ownership of Two Different Brands in the Dental Implant Business Strategic Advantage or Lack of Focus to succeed, the economy needs a moderate rate of inflation. A modest rate of inflation will also aid in corporate expansion and positively influence consumer confidence and spending patterns. As a result, the economy will grow and there will be more money available to spend overall. A greater inflation rate would result in fewer discretionary income, which might affect enterprises and companies and lower consumer confidence by reducing overall expansion.

Social Factor- For Straumann's Ownership of Two Different Brands in the Dental Implant Business Strategic Advantage or Lack of Focus, a bigger percentage of the younger population is advantageous since it will give the company access to a broader customer base. A younger population will also bring with it the promise of more educated, skilled, and human resources, broadening and deepening the talent pool. Straumann's Ownership of Two Different Brands in the Dental Implant Business. For Straumann's Ownership of Two Different Brands in the Dental Implant Business Strategic Advantage or Lack of Focus, a moderate to upper middle class is also crucial as its present clients and supporters.

Technological Factors- The nation has a robust technological infrastructure. Technology is advancing and developing at a rapid pace. Businesses are increasingly embracing technical advancements and innovation to boost corporate efficacy and efficiency, as seen in Straumann's Ownership of Two Different Brands in the Dental Implant Business Strategic Advantage or Lack of Focus. Every industry is seeing a tremendous rate of innovation, making organizations like Straumann's Ownership of Two Different Brands in the Dental Implant Business Strategic Advantage or Lack of Focus competitive and forward-thinking. Additionally, the upgraded technological infrastructure aids in luring foreign direct investment, which encourages future growth and advancement.

Environmental Factors- Recycling and environmental sustainability are receiving more attention. More and more consumers are demanding ways to recycle things before disposing of them. Consumption of recycled goods is also on the rise among consumers. The strategic advantage or lack of focus associated with Straumann's ownership of two distinct brands in the dental implant industry has resulted in the establishment of dedicated websites for the disposal of recyclable goods.

Legal Factors- Regarding the health and safety of employees at work, there are stringent rules. Respected associations and institutions conduct routine audits of businesses to determine whether safety nets, drills, and other preventative measures are being implemented. The safety and health of employees include not only their physical health but also their emotional and mental health. The safety and health of its employees is of utmost importance to Straumann, which continuously works to improve it.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Material

- 3.3. Market Attractiveness Analysis By Price

- 3.4. Market Attractiveness Analysis By End-user

- 3.5. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Changing lifestyle and unhealthy food habits

- 3. Restraints

- 3.1. Dental Bridges Pose a Higher Risk of Tooth Loss

- 4. Opportunities

- 4.1. Low Penetration Rate of Dental Implants in Developing Countries

- 5. Challenges

- 5.1. Dearth of trained dental practitioners

- Global Dental Implants Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Endosteal

- 3. Subperiosteal

- 4. Intramucosal

- 5. Transosteal

- Global Dental Implants Market Analysis and Projection, By Material

- 1. Segment Overview

- 2. Titanium

- 3. Zirconium

- Global Dental Implants Market Analysis and Projection, By Price

- 1. Segment Overview

- 2. Premium

- 3. Non-premium Implants

- Global Dental Implants Market Analysis and Projection, By End-user

- 1. Segment Overview

- 2. Dental Clinics

- 3. Hospitals

- 4. Academics

- 5. Research Institutes Global Dental

- Global Dental Implants Market Analysis and Projection, By Regional Analysis

- Segment Overview

- North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- South America

- 5.1. Brazil

- Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Dental Implants Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Dental Implants Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- BioHorizons IPH, Inc

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Nobel Biocare Services AG

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Zimmer Biomet Holdings, Inc

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- OSSTEM IMPLANT

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Institut Straumann AG

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Bicon, LLC

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- Leader Italy

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Anthogyr SAS

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- DENTIS

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- DENTSPLY Sirona

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- DENTIUM Co., Ltd

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- T-Plus Implant Tech. Co

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- KYOCERA Medical Corp

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- BioHorizons IPH, Inc

List of Table

- Global Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Global Endosteal, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Subperiosteal, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Intramucosal, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Transosteal, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Global Titanium, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Zirconium, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Global Premium, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Non-premium Implants, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Global Dental Clinics, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Hospitals, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Academics, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Research Institutes Global Dental, Dental Implants Market, By Region, 2021–2029 (USD Billion)

- Global Dental Implants Market, By Region, 2021–2029 (USD Billion)

- North America Dental Implants Market, By Type, 2021–2029 (USD Billion)

- North America Dental Implants Market, By Material, 2021–2029 (USD Billion)

- North America Dental Implants Market, By Price, 2021–2029 (USD Billion)

- North America Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- USA Dental Implants Market, By Type, 2021–2029 (USD Billion)

- USA Dental Implants Market, By Material, 2021–2029 (USD Billion)

- USA Dental Implants Market, By Price, 2021–2029 (USD Billion)

- USA Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Canada Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Canada Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Canada Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Canada Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Mexico Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Mexico Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Mexico Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Mexico Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Europe Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Europe Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Europe Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Europe Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Germany Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Germany Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Germany Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Germany Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- France Dental Implants Market, By Type, 2021–2029 (USD Billion)

- France Dental Implants Market, By Material, 2021–2029 (USD Billion)

- France Dental Implants Market, By Price, 2021–2029 (USD Billion)

- France Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- UK Dental Implants Market, By Type, 2021–2029 (USD Billion)

- UK Dental Implants Market, By Material, 2021–2029 (USD Billion)

- UK Dental Implants Market, By Price, 2021–2029 (USD Billion)

- UK Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Italy Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Italy Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Italy Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Italy Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Spain Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Spain Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Spain Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Spain Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Asia Pacific Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Asia Pacific Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Asia Pacific Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Japan Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Japan Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Japan Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Japan Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- China Dental Implants Market, By Type, 2021–2029 (USD Billion)

- China Dental Implants Market, By Material, 2021–2029 (USD Billion)

- China Dental Implants Market, By Price, 2021–2029 (USD Billion)

- China Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- India Dental Implants Market, By Type, 2021–2029 (USD Billion)

- India Dental Implants Market, By Material, 2021–2029 (USD Billion)

- India Dental Implants Market, By Price, 2021–2029 (USD Billion)

- India Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- South America Dental Implants Market, By Type, 2021–2029 (USD Billion)

- South America Dental Implants Market, By Material, 2021–2029 (USD Billion)

- South America Dental Implants Market, By Price, 2021–2029 (USD Billion)

- South America Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Brazil Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Brazil Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Brazil Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Brazil Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- Middle East and Africa Dental Implants Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Dental Implants Market, By Material, 2021–2029 (USD Billion)

- Middle East and Africa Dental Implants Market, By Price, 2021–2029 (USD Billion)

- Middle East and Africa Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- UAE Dental Implants Market, By Type, 2021–2029 (USD Billion)

- UAE Dental Implants Market, By Material, 2021–2029 (USD Billion)

- UAE Dental Implants Market, By Price, 2021–2029 (USD Billion)

- UAE Dental Implants Market, By End-user, 2021–2029 (USD Billion)

- South Africa Dental Implants Market, By Type, 2021–2029 (USD Billion)

- South Africa Dental Implants Market, By Material, 2021–2029 (USD Billion)

- South Africa Dental Implants Market, By Price, 2021–2029 (USD Billion)

- South Africa Dental Implants Market, By End-user, 2021–2029 (USD Billion)

List of Figures

- Global Dental Implants Market Segmentation

- Dental Implants Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Dental Implants Market Attractiveness Analysis By Type

- Global Dental Implants Market Attractiveness Analysis By Material

- Global Dental Implants Market Attractiveness Analysis By Price

- Global Dental Implants Market Attractiveness Analysis By End-user

- Global Dental Implants Market Attractiveness Analysis By Region

- Global Dental Implants Market: Dynamics

- Global Dental Implants Market Share By Type (2021 & 2029)

- Global Dental Implants Market Share By Material (2021 & 2029)

- Global Dental Implants Market Share By Price (2021 & 2029)

- Global Dental Implants Market Share By End-user (2021 & 2029)

- Global Dental Implants Market Share by Regions (2021 & 2029)

- Global Dental Implants Market Share by Company (2020)