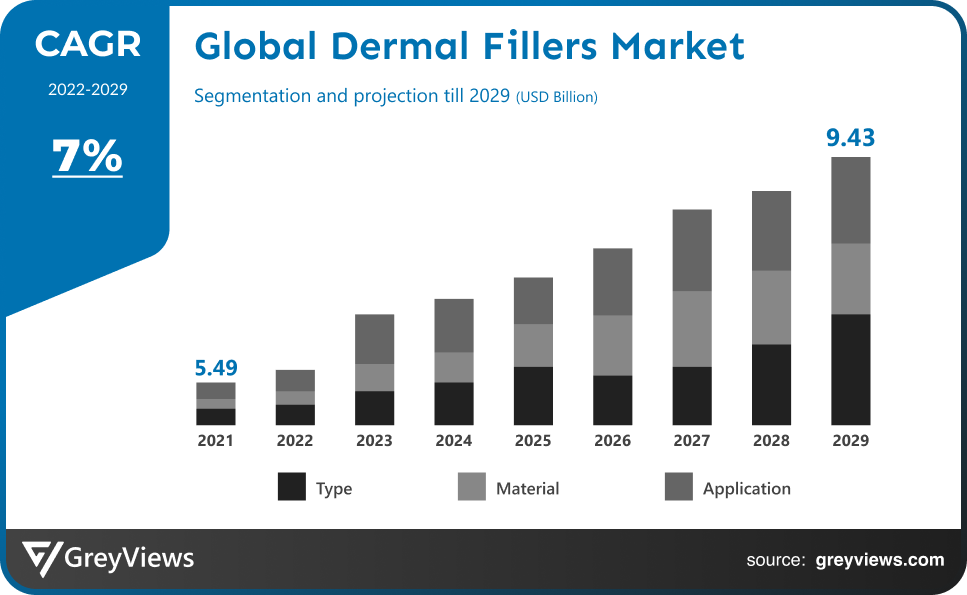

Dermal Fillers Market Size By Type (Biodegradable and Non-Biodegradable), By Material (CaHA, Fats, Hyaluronic Acid, Polymethyl-Methylacrlate Microspheres, and Poly-L Lactic Acid), By Application (Face Lift, Facial Line Correction and Lip Enhancement), Regions, Segmentation, and Projection till 2029

CAGR: 7%Current Market Size: USD 5.49 BillionFastest Growing Region: APAC

Largest Market: North AmericaProjection Time: 2022-2029Base Year: 2021

Global Dermal Fillers Market- Market Overview:

The global Dermal Fillers Market is expected to grow from USD 5.49 billion in 2021 to USD 9.43 billion by 2029, at a CAGR of 7% during the Projection period 2022-2029. The growth of this market is mainly driven by rising consumer demand for youthful, flawless skin that can be achieved through noninvasive, outpatient aesthetic dermatology procedures.

Injectable gel-like materials known as dermal fillers are used to fill in wrinkles, smooth out lines, and enhance the contours of the face. Because of different developments in the improving aesthetic and rejuvenating improvements that were previously only possible with surgeries, the use of dermal fillers has increased significantly in recent years. These techniques for face rejuvenation are rising in popularity. Dermal fillers exhibit immediate benefits in cosmetic volume replacement procedures due to their less invasive nature. These gadgets provide the face volume and boost and improve the skin's condition. For augmentation, a variety of techniques, including as injections, are performed. For aesthetic reasons, these fillers can produce larger, plumper lips. Depending on the substance utilised, there are numerous types of dermal fillers that can be injected into the lips and the area surrounding the mouth to maintain the volume of the lips. Some market participants are working on cutting-edge, new items, some of which are already in the pipeline. In the recent years, new, cutting-edge dermal filler treatments have been created in order to boost market growth, and industry participants are expanding their product lines. Dermal fillers are manufactured by a wide range of industry participants, and their developments open up new opportunities for market expansion.

Sample Request: - Global Dermal Fillers Market

Market Dynamics:

Drivers:

- Rising prevalence of minimally-invasive procedures

It reduces volume, shape, and undesirable fat while concentrating on the abnormalities of the face, such as wrinkles and fine lines. The use of minimally invasive techniques is becoming more popular because they have almost no risk of significant adverse outcomes and need few or no cuts with quick recovery. There is a huge demand worldwide for energy-based, minimally invasive procedures for skin tightening, wrinkle reduction, face contouring, and skin rejuvenation. Other factors driving demand for these operations include an aging population and an increase in the need for healthcare facilities, both of which can lessen the pressure on those facilities.

Restraints:

- High Cost

The cost of an elective operation is always taken into account. The type of dermal filler and the quantity utilized in the procedure determine the price. Additionally, the cost of the procedure depends on the training and experience of the individual administering the dermal fillers. Dermal filler cosmetic therapy is a popular and safe outpatient procedure for addressing some indications of aging and volume loss, but the high cost of the operations is anticipated to restrain market demand.

Opportunities:

- Advancement in Dermal Fillers

Dermal fillers are gel-like materials that are injected beneath the skin to replenish lost volume, smooth out wrinkles, and soften lines. More than a million people choose this well-known cosmetic transformation procedure each year to remove wrinkles and improve the appearance of facial lines in order to enhance facial features. Dermal fillers are a successful procedure that can make you seem younger without surgery or recovery time. Dermal fillers are medications that are injected beneath the skin to fill in face creases. Dermal filler medications come in a variety of forms, the most popular being calcium hydroxylapatite, hyaluronic acid, polyalkylimide, polylactic acid, and others. Dermal filler brand advancement will support increased market demand.

Challenges:

- Lack of Skilled Professionals

There are many different types of aesthetic treatment methods, including laser-based technology, energy-based technology, and powerful pulse light. For any of these strategies to be used effectively, the practitioner must possess strong interpersonal skills. Additionally, the field's rapid technological development has resulted in a shortage of qualified specialists. The handling of surgical instruments and performing procedures are both significantly hampered by a lack of competent experts.

Segmentation Analysis:

The global Dermal Fillers Market has been segmented based on material, type, application and regions.

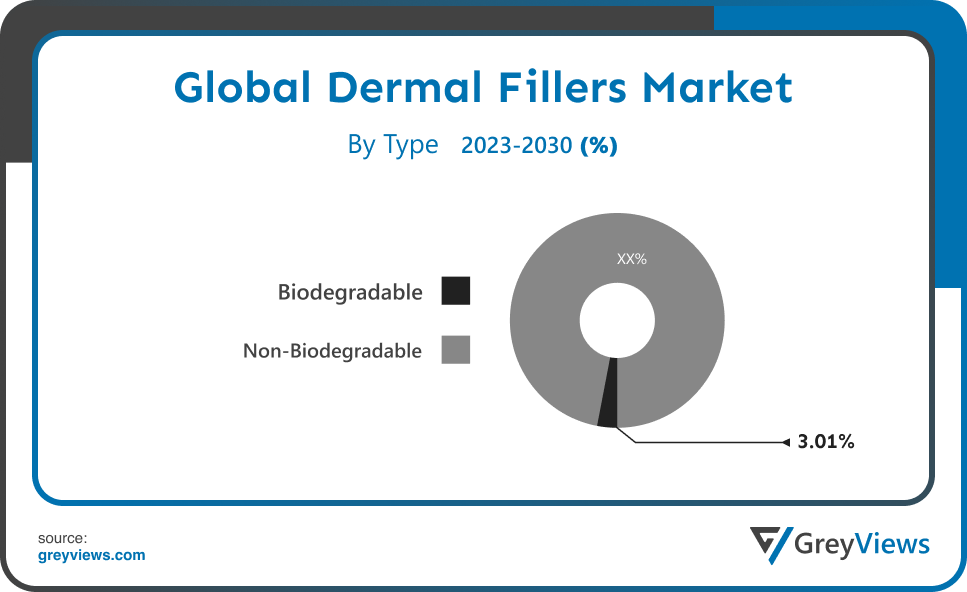

By Type

The type segment is Biodegradable and Non-Biodegradable. The biodegradable segment led the largest share of the Dermal Fillers Market with a market share of around 3.01% in 2021. Temporary and semi-permanent fillers for the skin are biodegradable. The market for biodegradable dermal fillers is predicted to account for the biggest proportion in 2021. Due to their increased effectiveness and safety, these injectable fillers are favored alternatives. Additionally, expanding biodegradable filler options will support market expansion.

By Materials

The materials segment includes CaHA, Fats, Hyaluronic Acid, Polymethyl-Methylacrlate Microspheres, and Poly-L Lactic Acid. The hyaluronic acid segment led the Dermal Fillers Market with a market share of around 1.7% in 2021. Dermatologists and patients alike are becoming more and more enamored with hyaluronic acid dermal fillers. They are employed for lip, cheek, and chin enlargement as well as the treatment of wrinkles, acne, and scars. Using hyaluronic acid fillers on the face can moisturize, volumize, encourage the production of new collagen, and reduce fine wrinkles. The demand for antiaging cosmetic and aesthetic procedures has expanded along with the global aging population. Hyaluronic acid products are recommended for the rising need for minimally invasive antiaging remedies because of their characteristic viscoelastic and moisturizing capabilities and reduced toxicity levels. The American Society for Aesthetic Plastic Surgery reported that 810,240 non-surgical hyaluronic acid procedures were carried out in 2018.

Global Dermal Fillers Market- Sales Analysis.

The sale of dermal fillers type, material, application expanded at a CAGR of 5.5% from 2015 to 2021.

Dermal fillers are less invasive procedures used to minimize facial wrinkles and restore firmness as anti-aging treatments. These dermal fillers, including hyaluronic acid, polymers and particles, and collagen, are soft tissue fillers that are injected into the skin to treat skin-related issues like scars and wrinkles and smooth the skin. Dermal filler operations are used to treat a variety of skin-related issues. Dermal filler techniques can be used to remove wrinkles, and scars, smooth skin, and perform other procedures. Dermal fillers are also the best option for enhancing the contours of the face, plumping the lips and cheeks, and filling in wrinkles and lines. With increasing age, the elderly population is more prone to physiological changes in the skin, such as wrinkles and drooping.

The growing inclination for minimally invasive aesthetic operations, the rise in the number of plastic surgeons practicing aesthetic procedures, and affordable alternatives to cosmetic surgery are key market drivers for dermal fillers. Additionally, the growth of the global dermal filler market is boosted by the rise in per capita disposable income. The global dermal filler market is seeing growth due to increased consumer awareness of these products in both developed and emerging countries, the introduction of new treatments, and the corresponding new indications. The Global Dermal Filler Market sales are also being boosted by this, along with leading players' growing efforts in R&D for novel dermal fillers.

Thus, owing to the aforementioned factors, the global Dermal Fillers Market is expected to grow at a CAGR of 7% during the Projection period from 2022 to 2029.

By Regional Analysis:

The regions analyzed for the Dermal Fillers Market include North America, Europe, South America, Asia Pacific, the Middle East, and Africa. The North America region dominated the Dermal Fillers Market and held a 39% share of the market revenue in 2021.

- The North America region witnessed a major share. North America is anticipated to dominate the market for dermal fillers based on hyaluronic acid. The expansion is brought on by elements including a solid healthcare infrastructure, supportive laws, an increase in plastic surgery operations, and an aging population in the area. For instance, Statistics Canada's population Projections from September 2021 indicate that there would be 96,88,677 people in Canada over the age of 60. Hyaluronic acid fillers play a part in reversing the unwelcome visible signs of aging and enhancing skin quality, according to a study titled "Treating Aging Changes of Facial Anatomical Layers with Hyaluronic Acid Fillers" that was published in August 2021.

- Asia Pacific is anticipated to experience significant growth during the Projection period. The increasing demand for cosmetic and aesthetic products from nations like Japan, China, South Korea, Thailand, Australia, and India is expected to cause the Asia Pacific region to grow at the highest rate in the Projection period. Due to the expanding social media influence and increased knowledge of minimally invasive procedures for cosmetic and aesthetic medical treatments, this demand is anticipated to rise. Additionally, the decreased price of these products is likely to boost the local market.

Global Dermal Fillers Market- Country Analysis:

- Germany

Germany's Dermal Fillers Market size was valued at USD 0.08 billion in 2021 and is expected to reach USD 0.13 billion by 2029, at a CAGR of 5.2% from 2022 to 2029.

Due to the rising aging population and growing public knowledge of cutting-edge aesthetic procedures. Another factor driving an increase in the use of dermal fillers in the region is an increase in the per capita income in nation. The European market offers more than 160 different hyaluronic acid fillers from more than 50 different manufacturers.

- China

China’s Dermal Fillers Market size was valued at USD 0.11 billion in 2021 and is expected to reach USD 0.19 billion by 2029, at a CAGR of 6.3% from 2022 to 2029. Due to the fast-growing elderly population, increasing per capita disposable income, increased demand for facial aesthetics goods, and growing knowledge of non-invasive cosmetic procedures offered in the market.

- India

India's Dermal Fillers Market size was valued at USD 0.11 billion in 2021 and is expected to reach USD 0.17 billion by 2029, at a CAGR of 5.9% from 2022 to 2029. Longer life expectancies are reported to have increased skin aging disorders in the geriatric population. In India, the rate of population aging is accelerating dramatically. Additionally, as people begin to age, their desire to look younger grows, which eventually sparks interest in using cosmetic procedures.

Key Industry Players Analysis:

To increase their market position in the global dermal fillers business, top companies focus on tactics such as adopting new technology, mergers & acquisitions, product developments, collaborations, partnerships, joint ventures, etc.

- Allergan (A Subsidiary of Abbvie, Inc.

- Prollenium Medical Technologies

- Suneva Medical, Revance Therapeutics, Inc.

- FillMed Laboratories

- Anika Therapeutics, Inc.

- Ipsen Pharma

- BIOXIS Pharmaceuticals

- Zimmer Aesthetic

- Zhejiang Jingjia Medical Technology Co. Ltd.

- Medytox, Contura International ltd.

- Shanghai Reyoungel Medical Technology Company Limited

- Humedix (A subsidiary of HUONS GLOBAL)

- Galderma Laboratories

Latest Development:

- In October 2021, Menarini intends to introduce a line of dermal fillers based on hyaluronic acid (HA) that are available with lidocaine. The product line would be created using Menarini's unique and exclusive XTR Technology, producing fillers with distinctive rheological properties to serve various clinical indications for facial volume restoration, hydration, and rejuvenation.

- In May 2021, Sinclair Pharma introduced MaiLi, a brand-new hyaluronic acid (HA) face filler. Long molecular HA chains are preserved by MaiLi, the first OxiFree technology to be patented in the world.

Report Metrics

|

Report Attribute |

Details |

|

Study Period |

2021-2029 |

|

Base year |

2021 |

|

CAGR (%) |

7% |

|

Market Size |

5.49 billion in 2021 |

|

Projection period |

2022-2029 |

|

Projection unit |

Value (USD) |

|

Segments covered |

By Materials, By Type, By Application And By Region. |

|

Report Scope |

Revenue Projection, competitive landscape, company ranking, growth factors, and trends |

|

Companies covered |

Allergan (A Subsidiary of Abbvie, Inc., Prollenium Medical Technologies, Suneva Medical, Revance Therapeutics, Inc., FillMed Laboratories, Anika Therapeutics, Inc., Ipsen Pharma, BIOXIS Pharmaceuticals, Zimmer Aesthetic, Zhejiang Jingjia Medical Technology Co. Ltd., Medytox, Contura International ltd., Shanghai Reyoungel Medical Technology, Company Limited, Humedix (A subsidiary of HUONS GLOBAL), Galderma Laboratories. |

|

By Materials |

|

|

By Type |

|

|

By Application |

|

|

Regional scope |

|

Scope of the Report

Global Dermal Fillers Market By Materials:

- CaHA

- Fats

- Hyaluronic Acid

- Polymethyl-Methylacrlate Microspheres

- Poly-L Lactic Acid

Global Dermal Fillers Market By Type:

- Biodegradable

- Non-Biodegradable

Global Dermal Fillers Market By Application:

- Face Lift

- Facial Line Correction

- Lip Enhancement

Global Dermal Fillers Market By Region:

- North America

- USA

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Asia-Pacific

- Japan

- China

- India

- Korea

- Southeast Asia

- South America

- Brazil

- Peru

- Middle East and Africa

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Questions

What will be the expected market size of the Dermal Fillers Market in 2029?

Global Dermal Fillers Market is expected to reach USD 9.43 billion by 2029, at a CAGR of 7% from 2022 to 2029.

What is the CAGR of the Dermal Fillers Market?

The Dermal Fillers Market is projected to have a CAGR of 7%.

What is the application segment of the Dermal Fillers Market?

On the basis of application, the dermal fillers market is segmented into Face Lift, Facial Line Correction and Lip Enhancement.

What are the key factors for the growth of the Dermal Fillers Market?

Dermal fillers' improved safety profiles and comparative longevity are the main factors behind the rising demand for them. The rise in the number of people who are getting older and the external environmental factors that accelerate skin ageing are some other factors that are fueling the growth of the global market.

What is the breakup of the global Dermal Fillers Market based on the material?

Based on material, the global Dermal Fillers Market has been segmented into CaHA, Fats, Hyaluronic Acid, Polymethyl-Methylacrlate Microspheres, and Poly-L Lactic Acid.

Which are the leading market players active in the Dermal Fillers Market?

Leading market players active in the global Allergan (A Subsidiary of Abbvie, Inc.), Prollenium Medical Technologies, Suneva Medical, Revance Therapeutics, Inc., FillMed Laboratories, Anika Therapeutics, Inc., Ipsen Pharma, BIOXIS Pharmaceuticals, Zimmer Aesthetic, Zhejiang Jingjia Medical Technology Co. Ltd., Medytox, Contura International ltd. among others.

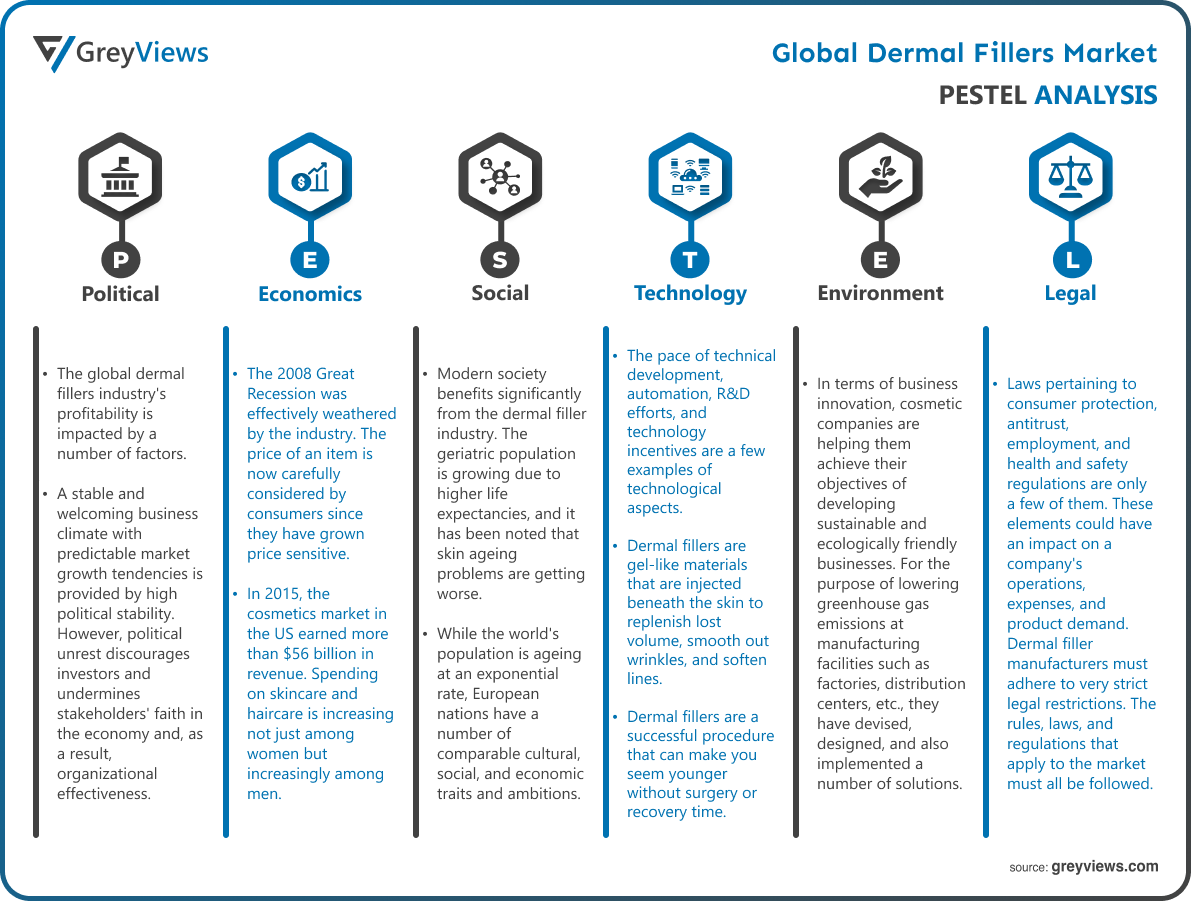

Political Factors- The global dermal fillers industry's profitability is impacted by a number of factors. A stable and welcoming business climate with predictable market growth tendencies is provided by high political stability. However, political unrest discourages investors and undermines stakeholders' faith in the economy and, as a result, organizational effectiveness. Dermal fillers are being used in all nations, each of which has its own political unrest. Dermal fillers' growth potential may be constrained by the increasing tensions and instability in the world's political climate. Because of the products' frequent skin-to-skin contact, product safety is one of the biggest issues in this market globally. The "Personal Care Product Safety Act" is a stringent US law that enables the FDA to consider even stricter rules and policies regarding the safety of products.

Economical Factors- Unlike other businesses, the dermal filler industry is very resilient to the economic downturn. The 2008 Great Recession was effectively weathered by the industry. The price of an item is now carefully considered by consumers since they have grown price sensitive. In 2015, the cosmetics market in the US earned more than $56 billion in revenue. Spending on skincare and haircare is increasing not just among women but increasingly among men. Additionally, the cosmetics sector accounts for more than 14% of the market. People are spending more money on cosmetics and skincare products today. In contrast to conventional methods for aesthetic and cosmetic surgery, including laser and other energy-based devices, the use of minimally invasive procedures has increased. Specially constructed devices have been created for minimally invasive surgical and non-surgical operations. By rejuvenating and tightening the skin, these anti-aging gadgets aid in minimizing the visible symptoms of skin ageing and impart a youthful appearance.

Social Factor- Modern society benefits significantly from the dermal filler industry. The geriatric population is growing due to higher life expectancies, and it has been noted that skin ageing problems are getting worse. While the world's population is ageing at an exponential rate, European nations have a number of comparable cultural, social, and economic traits and ambitions. As people begin to age, their desire to look younger grows, which eventually sparks interest in using aesthetic procedures. Better patient outcomes have been achieved as healthcare delivery has improved and the percentage of elderly people has increased in Middle Eastern nations.

Technological Factors- The pace of technical development, automation, R&D efforts, and technology incentives are a few examples of technological aspects. Technology is all around us today. Dermal fillers are gel-like materials that are injected beneath the skin to replenish lost volume, smooth out wrinkles, and soften lines. More than a million people choose this well-known cosmetic transformation procedure each year to remove wrinkles and improve the appearance of facial lines in order to enhance facial features. Dermal fillers are a successful procedure that can make you seem younger without surgery or recovery time. Dermal fillers are medications that are injected beneath the skin to fill in face creases. Dermal filler medications come in a variety of forms, the most popular being calcium hydroxylapatite, hyaluronic acid, polyalkylimide, polylactic acid, and others. Dermal filler brand advancement will support increased market demand.

Environmental Factors- In terms of business innovation, cosmetic companies are helping them achieve their objectives of developing sustainable and ecologically friendly businesses. For the purpose of lowering greenhouse gas emissions at manufacturing facilities such as factories, distribution centers, etc., they have devised, designed, and also implemented a number of solutions. The business community is concentrating more than ever on going "green." To reduce their impact on the environment, their packaging is becoming more environmentally friendly. For a period, the ingredient "microbeads" in skin care products dominated the news. These beads removed facial dead skin cells. However, they are terrible for the environment and made of plastic. The kind of substances used in things other than skin care, such fillers and surgery, can have a bad impact on the environment.

Legal Factors- Laws pertaining to consumer protection, antitrust, employment, and health and safety regulations are only a few of them. These elements could have an impact on a company's operations, expenses, and product demand. Dermal filler manufacturers must adhere to very strict legal restrictions. The rules, laws, and regulations that apply to the market must all be followed. As a result, it becomes crucial for this company to conduct itself morally and legally in order to avoid facing charges, fines, or other legal implications. The dermal filler industry uses complicated ingredients. The FDA can regulate them without also approving them. The Fair Packaging and Labeling Act (FPLA) and the Federal Food, Drug and Cosmetic Act (FD&C Act) are the main regulations that the cosmetics and beauty products sector must go by. The FD&C makes sure there is no false information branded on the items while also monitoring ingredients based on their use. The product might not make it to the shelves if there are problems. They might even need to be recalled.

- Introduction

- 1. Objectives of the Study

- 2. Market Definition

- 3. Research Scope

- Research Methodology and Assumptions

- Executive Summary

- Premium Insights

- 1. Porter’s Five Forces Analysis

- 2. Value Chain Analysis

- 3. Top Investment Pockets

- 3.1. Market Attractiveness Analysis By Type

- 3.2. Market Attractiveness Analysis By Material

- 3.3. Market Attractiveness Analysis By Application

- 3.4. Market Attractiveness Analysis By Region

- 4. Industry Trends

- Market Dynamics

- 1. Market Evaluation

- 2. Drivers

- 2.1. Rising prevalence of minimally-invasive procedures

- 3. Restraints

- 3.1. High Cost

- 4. Opportunities

- 4.1. Advancement in Dermal Fillers

- 5. Challenges

- 5.1. Lack of Skilled Professionals

- Global Dermal Fillers Market Analysis and Projection, By Type

- 1. Segment Overview

- 2. Biodegradable

- 3. Non-Biodegradable

- Global Dermal Fillers Market Analysis and Projection, By Material

- 1. Segment Overview

- 2. CaHA

- 3. Fats

- 4. Hyaluronic Acid

- 5. Polymethyl-Methylacrlate Microspheres

- 6. Poly-L Lactic Acid

- Global Dermal Fillers Market Analysis and Projection, By Application

- 1. Segment Overview

- 2. Face Lift

- 3. Facial Line Correction

- 4. Lip Enhancement

- Global Dermal Fillers Market Analysis and Projection, By Regional Analysis

- 1. Segment Overview

- 2. North America

- 2.1. U.S.

- 2.2. Canada

- 2.3. Mexico

- 3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. U.K.

- 3.4. Italy

- 3.5. Spain

- 4. Asia-Pacific

- 4.1. Japan

- 4.2. China

- 4.3. India

- 5. South America

- 5.1. Brazil

- 6. Middle East and Africa

- 6.1. UAE

- 6.2. South Africa

- Global Dermal Fillers Market-Competitive Landscape

- Overview

- Market Share of Key Players in the Dermal Fillers Market

- 2.1. Global Company Market Share

- 2.2. North America Company Market Share

- 2.3. Europe Company Market Share

- 2.4. APAC Company Market Share

- Competitive Situations and Trends

- 3.1. Product Launches and Developments

- 3.2. Partnerships, Collaborations, and Agreements

- 3.3. Mergers & Acquisitions

- 3.4. Expansions

- Company Profiles

- Allergan (A Subsidiary of Abbvie, Inc.

- 1.1. Business Overview

- 1.2. Company Snapshot

- 1.3. Company Market Share Analysis

- 1.4. Company Product Portfolio

- 1.5. Recent Developments

- 1.6. SWOT Analysis

- Prollenium Medical Technologies

- 2.1. Business Overview

- 2.2. Company Snapshot

- 2.3. Company Market Share Analysis

- 2.4. Company Product Portfolio

- 2.5. Recent Developments

- 2.6. SWOT Analysis

- Suneva Medical, Revance Therapeutics, Inc.

- 3.1. Business Overview

- 3.2. Company Snapshot

- 3.3. Company Market Share Analysis

- 3.4. Company Product Portfolio

- 3.5. Recent Developments

- 3.6. SWOT Analysis

- FillMed Laboratories

- 4.1. Business Overview

- 4.2. Company Snapshot

- 4.3. Company Market Share Analysis

- 4.4. Company Product Portfolio

- 4.5. Recent Developments

- 4.6. SWOT Analysis

- Anika Therapeutics, Inc.

- 5.1. Business Overview

- 5.2. Company Snapshot

- 5.3. Company Market Share Analysis

- 5.4. Company Product Portfolio

- 5.5. Recent Developments

- 5.6. SWOT Analysis

- Ipsen Pharma

- 6.1. Business Overview

- 6.2. Company Snapshot

- 6.3. Company Market Share Analysis

- 6.4. Company Product Portfolio

- 6.5. Recent Developments

- 6.6. SWOT Analysis

- BIOXIS Pharmaceuticals

- 7.1. Business Overview

- 7.2. Company Snapshot

- 7.3. Company Market Share Analysis

- 7.4. Company Product Portfolio

- 7.5. Recent Developments

- 7.6. SWOT Analysis

- Zimmer Aesthetic

- 8.1. Business Overview

- 8.2. Company Snapshot

- 8.3. Company Market Share Analysis

- 8.4. Company Product Portfolio

- 8.5. Recent Developments

- 8.6. SWOT Analysis

- Zhejiang Jingjia Medical Technology Co. Ltd.

- 9.1. Business Overview

- 9.2. Company Snapshot

- 9.3. Company Market Share Analysis

- 9.4. Company Product Portfolio

- 9.5. Recent Developments

- 9.6. SWOT Analysis

- Medytox, Contura International ltd.

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Shanghai Reyoungel Medical Technology Company Limited

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Humedix

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Galderma Laboratories

- Business Overview

- Company Snapshot

- Company Market Share Analysis

- Company Product Portfolio

- Recent Developments

- SWOT Analysis

- Allergan (A Subsidiary of Abbvie, Inc.

List of Table

- Global Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Global Biodegradable, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Non-Biodegradable, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Global CaHA, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Fats, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Hyaluronic Acid, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Polymethyl-Methylacrlate Microspheres, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Poly-L Lactic Acid, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Global Face Lift, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Facial Line Correction, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- Global Lip Enhancement, Dermal Fillers Market, By Region, 2021–2029 (USD Billion)

- North America Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- North America Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- North America Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- USA Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- USA Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- USA Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Canada Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Canada Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Canada Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Mexico Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Mexico Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Mexico Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Europe Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Europe Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Europe Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Germany Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Germany Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Germany Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- France Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- France Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- France Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- UK Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- UK Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- UK Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Italy Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Italy Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Italy Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Spain Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Spain Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Spain Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Asia Pacific Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Asia Pacific Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Asia Pacific Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Japan Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Japan Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Japan Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- China Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- China Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- China Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- India Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- India Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- India Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- South America Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- South America Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- South America Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Brazil Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Brazil Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Brazil Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- Middle East and Africa Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- Middle East and Africa Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- Middle East and Africa Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- UAE Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- UAE Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- UAE Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

- South Africa Dermal Fillers Market, By Type, 2021–2029 (USD Billion)

- South Africa Dermal Fillers Market, By Material, 2021–2029 (USD Billion)

- South Africa Dermal Fillers Market, By Application, 2021–2029 (USD Billion)

List of Figures

- Global Dermal Fillers Market Segmentation

- Dermal Fillers Market: Research Methodology

- Market Size Estimation Methodology: Bottom-Up Approach

- Market Size Estimation Methodology: Top-Down Approach

- Data Triangulation

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Global Dermal Fillers Market Attractiveness Analysis By Type

- Global Dermal Fillers Market Attractiveness Analysis By Material

- Global Dermal Fillers Market Attractiveness Analysis By Application

- Global Dermal Fillers Market Attractiveness Analysis By Region

- Global Dermal Fillers Market: Dynamics

- Global Dermal Fillers Market Share By Type (2021 & 2029)

- Global Dermal Fillers Market Share By Material (2021 & 2029)

- Global Dermal Fillers Market Share By Application (2021 & 2029)

- Global Dermal Fillers Market Share by Regions (2021 & 2029)

- Global Dermal Fillers Market Share by Company (2020)